Deck 1: Managerial Accounting and Cost Concepts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

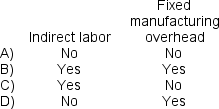

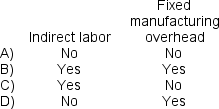

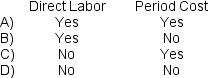

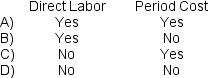

سؤال

سؤال

سؤال

سؤال

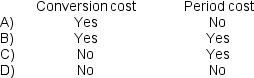

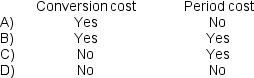

سؤال

سؤال

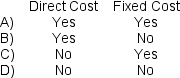

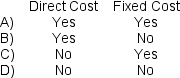

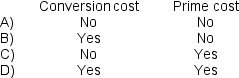

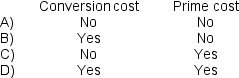

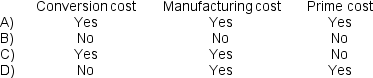

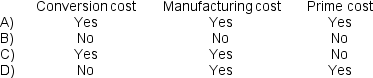

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/299

العب

ملء الشاشة (f)

Deck 1: Managerial Accounting and Cost Concepts

1

The three cost elements ordinarily included in product costs are direct materials,direct labor,and manufacturing overhead.

True

2

A direct cost is a cost that can be easily traced to the particular cost object under consideration.

True

3

A cost can be direct or indirect.The classification can change if the cost object changes.

True

4

Prime cost equals manufacturing overhead cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

5

Selling and administrative expenses are period costs under generally accepted accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

6

Prime cost is the sum of direct materials cost and direct labor cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

7

A factory supervisor's salary would be classified as an indirect cost with respect to a unit of product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

8

The sum of all manufacturing costs except for direct materials and direct labor is called manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

9

Wages paid to production supervisors would be classified as manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

10

The cost of shipping parts from a supplier is considered a period cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

11

Depreciation is always considered a period cost for external financial reporting purposes in a manufacturing company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

12

Conversion cost equals product cost less direct materials cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

13

Selling costs are indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

14

Conversion cost is the sum of direct labor cost and manufacturing overhead cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

15

Conversion cost is the same thing as manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

16

In a manufacturing company,all costs are period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

17

Advertising is not a considered a product cost even if it promotes a specific product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

18

Product costs are also known as inventoriable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

19

Administrative costs are indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

20

Opportunity costs at a manufacturing company are not part of manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

21

When operations are interrupted or cut back,committed fixed costs are cut in the short term because the costs of restoring them later are likely to be far less than the short-run savings that are realized

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

22

As activity decreases within the relevant range,fixed costs remain constant on a per unit basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

23

A fixed cost fluctuates in total as activity changes but remains constant on a per unit basis over the relevant range.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

24

A decrease in production will ordinarily result in a decrease in fixed production costs per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

25

Indirect costs,such as manufacturing overhead,are variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

26

The relevant range is the range of activity within which the assumption that cost behavior is strictly linear is reasonably valid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

27

Depreciation on equipment a company uses in its selling and administrative activities would be classified as a period cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

28

The cost of napkins put on each person's tray at a fast food restaurant is a variable cost with respect to how many persons are served.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

29

If the activity level increases,then one would expect the fixed cost per unit to increase as well.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

30

The variable cost per unit depends on how many units are produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

31

The concept of the relevant range does not apply to variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

32

In account analysis,an account is classified as either variable or fixed based on an analyst's prior knowledge of how the cost in the account behaves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

33

Committed fixed costs remain largely unchanged in the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

34

Fixed costs expressed on a per unit basis do not change with changes in activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

35

Cost behavior is considered curvilinear whenever a straight line is a reasonable approximation for the relation between cost and activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

36

A fixed cost is a cost whose cost per unit varies as the activity level rises and falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

37

If managers are reluctant to lay off direct labor employees when activity declines leads to a decrease in the ratio of variable to fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

38

A step-variable cost is a cost that is obtained in large chunks and that increases or decreases only in response to fairly wide changes in activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

39

A fixed cost is constant if expressed on a per unit basis but the total dollar amount changes as the number of units increases or decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

40

Within the relevant range,a change in activity results in a change in variable cost per unit and total fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

41

The contribution format income statement is used as an internal planning and decision-making tool.Its emphasis on cost behavior aids cost-volume-profit analysis,management performance appraisals,and budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

42

The relevant range concept is applicable to mixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

43

Although the traditional format income statement is useful for external reporting purposes,it has serious limitations when used for internal purposes because it does not distinguish between fixed and variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

44

In a traditional format income statement for a merchandising company,cost of goods sold is a variable cost that is included in the "Variable expenses" portion of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

45

Differential costs can only be variable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

46

The following costs are all examples of committed fixed costs:

depreciation on buildings,salaries of highly trained engineers,real estate taxes,and insurance expenses.

depreciation on buildings,salaries of highly trained engineers,real estate taxes,and insurance expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

47

In a traditional format income statement,the gross margin minus selling and administrative expenses equals net operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

48

The amount that a manufacturing company could earn by renting unused portions of its warehouse is an example of an opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

49

A contribution format income statement separates costs into fixed and variable categories,first deducting variable expenses from sales to obtain the contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

50

A fixed cost is not constant per unit of product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

51

Most companies use the contribution approach in preparing financial statements for external reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

52

The potential benefit that is given up when one alternative is selected over another is called a sunk cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

53

Committed fixed costs represent organizational investments with a one-year planning horizon.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

54

A variable cost remains constant if expressed on a unit basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

55

In a traditional format income statement,the gross margin is sales minus cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

56

In a contribution format income statement for a merchandising company,the cost of goods sold reports the product costs attached to the merchandise sold during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

57

Variable costs per unit are not affected by changes in activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

58

Contribution margin and gross margin mean the same thing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

59

A cost that differs from one month to another is known as a sunk cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

60

Contribution format income statements are prepared primarily for external reporting purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

61

A factory supervisor's wages are classified as:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

62

Wages paid to the factory warehouse foreman are considered an example of:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following would most likely NOT be included as manufacturing overhead in a furniture factory?

A) The cost of the glue in a chair.

B) The amount paid to the individual who stains a chair.

C) The workman's compensation insurance of the supervisor who oversees production.

D) The factory utilities of the department in which production takes place.

A) The cost of the glue in a chair.

B) The amount paid to the individual who stains a chair.

C) The workman's compensation insurance of the supervisor who oversees production.

D) The factory utilities of the department in which production takes place.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

64

Direct costs:

A) are incurred to benefit a particular accounting period.

B) are incurred due to a specific decision.

C) can be easily traced to a particular cost object.

D) are the variable costs of producing a product.

A) are incurred to benefit a particular accounting period.

B) are incurred due to a specific decision.

C) can be easily traced to a particular cost object.

D) are the variable costs of producing a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

65

Rotonga Manufacturing Company leases a vehicle to deliver its finished products to customers.Which of the following terms correctly describes the monthly lease payments made on the delivery vehicle?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

66

Manufacturing overhead includes:

A) all direct material, direct labor and administrative costs.

B) all manufacturing costs except direct labor.

C) all manufacturing costs except direct labor and direct materials.

D) all selling and administrative costs.

A) all direct material, direct labor and administrative costs.

B) all manufacturing costs except direct labor.

C) all manufacturing costs except direct labor and direct materials.

D) all selling and administrative costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

67

The cost of direct materials is classified as a:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

68

The costs of direct materials are classified as:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

69

Materials used in a factory that are not an integral part of the final product,such as cleaning supplies,should be classified as:

A) direct materials.

B) a period cost.

C) administrative expense.

D) manufacturing overhead.

A) direct materials.

B) a period cost.

C) administrative expense.

D) manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

70

Traditional format income statements are widely used for preparing external financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

71

The cost of lubricants used to grease a production machine in a manufacturing company is an example of a(n):

A) period cost.

B) direct material cost.

C) indirect material cost.

D) opportunity cost.

A) period cost.

B) direct material cost.

C) indirect material cost.

D) opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following costs is classified as both a prime cost and a conversion cost?

A) Direct materials.

B) Direct labor.

C) Variable overhead.

D) Fixed overhead.

A) Direct materials.

B) Direct labor.

C) Variable overhead.

D) Fixed overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is an example of a period cost in a company that makes clothing?

A) Fabric used to produce men's pants.

B) Advertising cost for a new line of clothing.

C) Factory supervisor's salary.

D) Monthly depreciation on production equipment.

A) Fabric used to produce men's pants.

B) Advertising cost for a new line of clothing.

C) Factory supervisor's salary.

D) Monthly depreciation on production equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following statements about product costs is true?

A) Product costs are deducted from revenue when the production process is completed.

B) Product costs are deducted from revenue as expenditures are made.

C) Product costs associated with unsold finished goods and work in process appear on the balance sheet as assets.

D) Product costs appear on financial statements only when products are sold.

A) Product costs are deducted from revenue when the production process is completed.

B) Product costs are deducted from revenue as expenditures are made.

C) Product costs associated with unsold finished goods and work in process appear on the balance sheet as assets.

D) Product costs appear on financial statements only when products are sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is NOT a period cost?

A) Depreciation of factory maintenance equipment.

B) Salary of a clerk who handles customer billing.

C) Insurance on a company showroom where customers can view new products.

D) Cost of a seminar concerning tax law updates that was attended by the company's controller.

A) Depreciation of factory maintenance equipment.

B) Salary of a clerk who handles customer billing.

C) Insurance on a company showroom where customers can view new products.

D) Cost of a seminar concerning tax law updates that was attended by the company's controller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following statements concerning direct and indirect costs is NOT true?

A) Whether a particular cost is classified as direct or indirect does not depend on the cost object.

B) A direct cost is one that can be easily traced to the particular cost object.

C) The factory manager's salary would be classified as an indirect cost of producing one unit of product.

D) A particular cost may be direct or indirect, depending on the cost object.

A) Whether a particular cost is classified as direct or indirect does not depend on the cost object.

B) A direct cost is one that can be easily traced to the particular cost object.

C) The factory manager's salary would be classified as an indirect cost of producing one unit of product.

D) A particular cost may be direct or indirect, depending on the cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

77

All of the following are examples of product costs except:

A) depreciation on the company's retail outlets.

B) salary of the plant manager.

C) insurance on the factory equipment.

D) rental costs of factory equipment.

A) depreciation on the company's retail outlets.

B) salary of the plant manager.

C) insurance on the factory equipment.

D) rental costs of factory equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

78

The salary paid to the president of a company would be classified on the income statement as a(n):

A) administrative expense.

B) direct labor cost.

C) manufacturing overhead cost.

D) selling expense.

A) administrative expense.

B) direct labor cost.

C) manufacturing overhead cost.

D) selling expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

79

The cost of electricity for running production equipment is classified as:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck

80

Product costs that have become expenses can be found in:

A) period costs.

B) selling expenses.

C) cost of goods sold.

D) administrative expenses.

A) period costs.

B) selling expenses.

C) cost of goods sold.

D) administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 299 في هذه المجموعة.

فتح الحزمة

k this deck