Deck 14: Complex Financial Instruments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/101

العب

ملء الشاشة (f)

Deck 14: Complex Financial Instruments

1

What is speculation?

Speculation is purposefully taking on an identified risk with a view to making a profit.For instance,one can take a gamble that the exchange rate will move in his/her favour by entering into a forward exchange agreement.For example,a party could bet that the US dollar will weaken against the Canadian dollar.If the US$ weakens during the period,the speculator will make a profit,but if the US$ strengthens in the period,the speculator will lose money.

2

What is an option?

A)A contract that gives the holder the right to sell an instrument at a pre-specified price.

B)A contract that is derived from some other underlying quantity,index,asset or event.

C)A contract that gives the holder the right to acquire an instrument at a pre-specified price.

D)A contract that gives the holder the right to buy or sell something at a specified price.

A)A contract that gives the holder the right to sell an instrument at a pre-specified price.

B)A contract that is derived from some other underlying quantity,index,asset or event.

C)A contract that gives the holder the right to acquire an instrument at a pre-specified price.

D)A contract that gives the holder the right to buy or sell something at a specified price.

D

3

Which statement is correct about accounting for financial instruments?

A)All financial instruments are accounted for at fair value through profit or loss.

B)All are accounted for in accordance to their economic substance.

C)All financial instruments are accounted for at amortized cost.

D)All financial instruments are accounted for at fair value through OCI.

A)All financial instruments are accounted for at fair value through profit or loss.

B)All are accounted for in accordance to their economic substance.

C)All financial instruments are accounted for at amortized cost.

D)All financial instruments are accounted for at fair value through OCI.

B

4

Which of the following is correct about financial instruments?

A)Accounting for financial instruments has been consistent.

B)There is no economic substance to financial instruments.

C)They may be used in support of innovations designed to circumvent accounting standards.

D)All financial instruments are accounted for at fair value.

A)Accounting for financial instruments has been consistent.

B)There is no economic substance to financial instruments.

C)They may be used in support of innovations designed to circumvent accounting standards.

D)All financial instruments are accounted for at fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

5

What is a "forward"?

A)A contract in which two parties agree to exchange cash flows (e.g.interest cash flows).

B)A contract in which one party commits upfront to buy or sell commonly traded items at a defined price and maturity date.

C)A contract in which one party commits upfront to buy or sell something at a defined price at a defined future date.

D)A contact that gives the right,but not the obligation,to buy a share at a specified price over a specified period of time.

A)A contract in which two parties agree to exchange cash flows (e.g.interest cash flows).

B)A contract in which one party commits upfront to buy or sell commonly traded items at a defined price and maturity date.

C)A contract in which one party commits upfront to buy or sell something at a defined price at a defined future date.

D)A contact that gives the right,but not the obligation,to buy a share at a specified price over a specified period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is an example of a "forward"?

A)Right to buy 100 shares of CIBC over the next 5 years.

B)Commitment to buy 100 barrels of oil next month at $125/barrel.

C)Commitment to buy $100,000 US dollars in 120 days at US$=1.10.

D)Pay interest at prime +3% in exchange for receiving interest at 5%.

A)Right to buy 100 shares of CIBC over the next 5 years.

B)Commitment to buy 100 barrels of oil next month at $125/barrel.

C)Commitment to buy $100,000 US dollars in 120 days at US$=1.10.

D)Pay interest at prime +3% in exchange for receiving interest at 5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

7

What is a "swap"?

A)A contract in which two parties agree to exchange cash flows (e.g.interest cash flows).

B)A contract in which one party commits upfront to buy or sell commonly traded items at a defined price and maturity date.

C)A contract in which one party commits upfront to buy or sell something at a defined price at a defined future date.

D)A contact that gives the right,but not the obligation,to buy a share at a specified price over a specified period of time.

A)A contract in which two parties agree to exchange cash flows (e.g.interest cash flows).

B)A contract in which one party commits upfront to buy or sell commonly traded items at a defined price and maturity date.

C)A contract in which one party commits upfront to buy or sell something at a defined price at a defined future date.

D)A contact that gives the right,but not the obligation,to buy a share at a specified price over a specified period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is a "put" option?

A)A contract that gives the holder the right to sell an instrument at a pre-specified price.

B)A contract that is derived from some other underlying quantity,index,asset or event.

C)A contract that gives the holder the right to acquire an instrument at a pre-specified price.

D)A contract that gives the holder the right to buy or sell something at a specified price.

A)A contract that gives the holder the right to sell an instrument at a pre-specified price.

B)A contract that is derived from some other underlying quantity,index,asset or event.

C)A contract that gives the holder the right to acquire an instrument at a pre-specified price.

D)A contract that gives the holder the right to buy or sell something at a specified price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

9

Contrast options with warrants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is an example of a "future"?

A)Right to buy 100 shares of CIBC over the next 5 years.

B)Commitment to buy 100 barrels of oil next month at $125/barrel.

C)Commitment to buy $100,000 US dollars in 120 days at US$=1.10.

D)Pay interest at prime +3% in exchange for receiving interest at 5%.

A)Right to buy 100 shares of CIBC over the next 5 years.

B)Commitment to buy 100 barrels of oil next month at $125/barrel.

C)Commitment to buy $100,000 US dollars in 120 days at US$=1.10.

D)Pay interest at prime +3% in exchange for receiving interest at 5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

11

What is a derivative and what are two reasons why parties would enter into a derivative contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

12

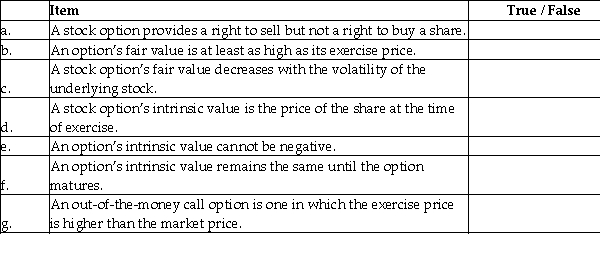

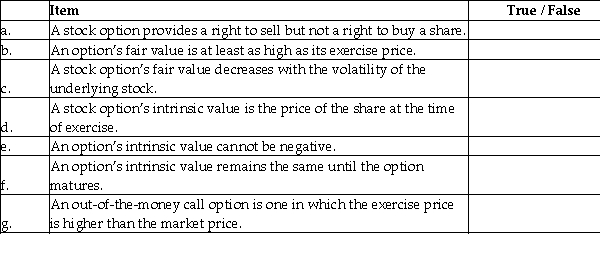

Indicate whether the following statements are true or false with respect to characteristics of stock options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is correct regarding a call option?

A)The intrinsic value of a call option is the greater of zero and (K- S),the difference between the market price and the strike price.

B)The time value of an option reflects the probability that the future market price of the underlying instrument will not exceed the strike price.

C)The time value decreases with the length of time to expiration and the volatility of the underlying instrument (such as the share price).

D)The time value is always positive until the option expires,so the total value of an unexpired option is always greater than the intrinsic value.

A)The intrinsic value of a call option is the greater of zero and (K- S),the difference between the market price and the strike price.

B)The time value of an option reflects the probability that the future market price of the underlying instrument will not exceed the strike price.

C)The time value decreases with the length of time to expiration and the volatility of the underlying instrument (such as the share price).

D)The time value is always positive until the option expires,so the total value of an unexpired option is always greater than the intrinsic value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is hedging?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

15

What is a "future"?

A)A contract in which two parties agree to exchange cash flows (e.g.interest cash flows).

B)A contract in which one party commits upfront to buy or sell commonly traded items at a defined price and maturity date.

C)A contract in which one party commits upfront to buy or sell something at a defined price at a defined future date.

D)A contact that gives the right,but not the obligation,to buy a share at a specified price over a specified period of time.

A)A contract in which two parties agree to exchange cash flows (e.g.interest cash flows).

B)A contract in which one party commits upfront to buy or sell commonly traded items at a defined price and maturity date.

C)A contract in which one party commits upfront to buy or sell something at a defined price at a defined future date.

D)A contact that gives the right,but not the obligation,to buy a share at a specified price over a specified period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is an example of a "swap"?

A)Right to buy 100 shares of CIBC over the next 5 years.

B)Commitment to buy 100 barrels of oil next month at $125/barrel.

C)Commitment to buy $100,000 US dollars in 4 months at US$=1.10.

D)Pay interest at prime +3% in exchange for receiving interest at 5%.

A)Right to buy 100 shares of CIBC over the next 5 years.

B)Commitment to buy 100 barrels of oil next month at $125/barrel.

C)Commitment to buy $100,000 US dollars in 4 months at US$=1.10.

D)Pay interest at prime +3% in exchange for receiving interest at 5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is a "warrant"?

A)A contract in which two parties agree to exchange cash flows (e.g.interest cash flows).

B)A contract in which one party commits upfront to buy or sell commonly traded items at a defined price and maturity date.

C)A contract in which one party commits upfront to buy or sell something at a defined price at a defined future date.

D)A contact that gives the right,but not the obligation,to buy a share at a specified price over a specified period of time.

A)A contract in which two parties agree to exchange cash flows (e.g.interest cash flows).

B)A contract in which one party commits upfront to buy or sell commonly traded items at a defined price and maturity date.

C)A contract in which one party commits upfront to buy or sell something at a defined price at a defined future date.

D)A contact that gives the right,but not the obligation,to buy a share at a specified price over a specified period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

18

Describe the underlying quantity that the derivative instrument derives its value from?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is an example of a "warrant"?

A)Right to buy 100 shares of CIBC at $50.00 per share over the next 5 years.

B)Commitment to buy 100 barrels of oil next month at $125/barrel.

C)Commitment to buy $100,000 US dollars in 4 months at US$=1.10.

D)Pay interest at prime +3% in exchange for receiving interest at 5%.

A)Right to buy 100 shares of CIBC at $50.00 per share over the next 5 years.

B)Commitment to buy 100 barrels of oil next month at $125/barrel.

C)Commitment to buy $100,000 US dollars in 4 months at US$=1.10.

D)Pay interest at prime +3% in exchange for receiving interest at 5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

20

What is a "call" option?

A)A contract that gives the holder the right to sell an instrument at a pre-specified price.

B)A contract that is derived from some other underlying quantity,index,asset or event.

C)A contract that gives the holder the right to acquire an instrument at a pre-specified price.

D)A contract that gives the holder the right to buy or sell something at a specified price.

A)A contract that gives the holder the right to sell an instrument at a pre-specified price.

B)A contract that is derived from some other underlying quantity,index,asset or event.

C)A contract that gives the holder the right to acquire an instrument at a pre-specified price.

D)A contract that gives the holder the right to buy or sell something at a specified price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

21

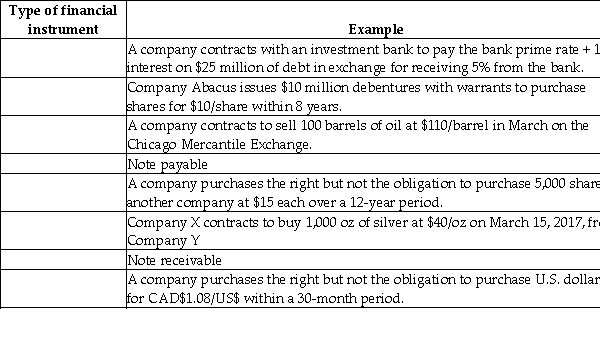

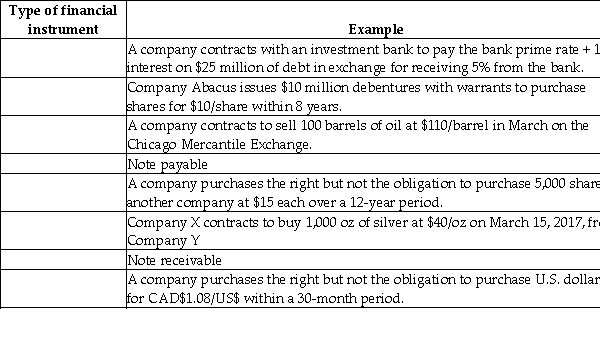

In the table below,choose the financial instrument that best explains the example on the right side.Types of financial instrument to select from: Financial asset,financial liability,equity,compound instrument,basic option,swap,forward,future,warrant,put option,or call option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

22

On September 30,2018,Pennsylvania Co.issued $3 million of 10%,10-year convertible bonds maturing on September 30,2028,with semi-annual coupon payments on March 31 and September 30.Each $1,000 bond can be converted into 80 no par value common shares.In addition,each bond included 20 detachable common stock warrants with an exercise price of $20 each.Immediately after issuance,the warrants traded at $5 each on the open market.Gross proceeds on issuance were $4.6 million (including accrued interest).From these proceeds,the company paid underwriting fees of $55,000.Without the warrants and conversion features the bond would be expected to yield 6% annually.Pennsylvania's year-end is December 31.

On February 22,2021,warrant holders exercised one-half of the warrants.The shares of Pennsylvania traded at $44 each on this day.

Required:

a)Determine how Niagara should allocate the $4,600,000 proceeds into its components.

b)Prepare all the journal entries for fiscal year 2018.

c)Record the journal entry for the exercise of stock warrants on February 22,2021.

On February 22,2021,warrant holders exercised one-half of the warrants.The shares of Pennsylvania traded at $44 each on this day.

Required:

a)Determine how Niagara should allocate the $4,600,000 proceeds into its components.

b)Prepare all the journal entries for fiscal year 2018.

c)Record the journal entry for the exercise of stock warrants on February 22,2021.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

23

How are derivative contracts generally accounted for?

A)Fair value.

B)Fair value with changes recorded through income.

C)Amortized cost.

D)Historical cost.

A)Fair value.

B)Fair value with changes recorded through income.

C)Amortized cost.

D)Historical cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

24

On December 15th,2018,Hammer paid $20,000 to purchase a futures contract that entitles the company to buy US$1 million at a cost of C$1.04 million on March 15,2019.On December 31,st ,Hammer's year end,the exchange rate is US$1:C$1.09.

Required:

Record the journal entry for (a)the purchase of the futures contract and (b)at year-end.

Required:

Record the journal entry for (a)the purchase of the futures contract and (b)at year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

25

Assume that Ariel agrees to purchase US$500,000 for C$550,000 on January 15,2013.The exchange rate at year end is US$1=C$0.95 and the January 15,2017 exchange rate is US$1=C$0.97.What journal entry is required when the contract is initiated?

A)0

B)$65,000 loss.

C)$75,000 gain.

D)$75,000 loss.

A)0

B)$65,000 loss.

C)$75,000 gain.

D)$75,000 loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

26

Explain how bonds issued with warrants alleviate adverse selection problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

27

On December 15,a company enters into a foreign currency forward to buy €100,000 at C$1.60 per euro in 30 days.The exchange rate on the day of the company's year-end of December 31 was C$1.55: €l.

Required:

Record the journal entries related to this forward contract.

Required:

Record the journal entries related to this forward contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

28

Naples Corporation issued call options on 20,000 shares of VESPUS Inc.on October 21,2019.These options give the holder the right to buy VESPUS shares at $35 per share until May 17,2020.For issuing these options,Naples received $60,000.On December 31,2020 (Naples's fiscal year-end),the options traded on the Montreal Exchange for $3.50 per option.On May 17,2020,VESPUS's share price increased to $40 and the option holders exercised their options.Naples had no holdings of VESPUS shares.

Required:

For Naples Corporation,record the journal entries related to these call options.

Required:

For Naples Corporation,record the journal entries related to these call options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

29

On December 15,a company enters into a foreign currency forward to buy €300,000 at C$1.60 per euro in 30 days.The exchange rate on the day of the company's year-end of December 31 was C$1.59: €l.

Required:

Record the journal entries related to this forward contract.

Required:

Record the journal entries related to this forward contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

30

A company pays $7,000 to purchase futures contracts to buy 200 oz of gold at $1,600/oz.At the company's year-end,the price of gold was $1,625 and the value of the company's futures contracts increased to $10,000.

Required:

Record the journal entries related to these futures.

Required:

Record the journal entries related to these futures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

31

Roman Corporation issued call options on 5,000 shares of POMPEI Inc.on October 21,2019.These options give the holder the right to buy POMPEI shares at $35 per share until May 17,2020.For issuing these options,Roman received $15,000.On December 31,2019 (Roman's fiscal year-end),the options traded on the Montreal Exchange for $3.50 per option.On May 17,2020,POMPEI's share price increased to $40 and the option holders exercised their options.Roman had no holdings of POMPEI shares.

Required:

For Roman Corporation,record the journal entries related to these call options.

Required:

For Roman Corporation,record the journal entries related to these call options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

32

How should warrants on the company's own common shares be accounted for?

A)Fair value.

B)Fair value through profit or loss.

C)Amortized cost.

D)Historical cost.

A)Fair value.

B)Fair value through profit or loss.

C)Amortized cost.

D)Historical cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

33

Sorrentino Corporation issued call options on 20,000 shares of BWC Inc.on October 21,2019.These options give the holder the right to buy BWC shares at $35 per share until May 17,2020.For issuing these options,Sorrentino received $20,000.On December 31,2019 (Sorrentino's fiscal year-end),the options traded on the Montreal Exchange for $2.00 per option.On May 17,2020,BWC's share price increased to $38 and the option holders exercised their options.Sorrentino had no holdings of BWC shares.

Required:

For Sorrentino Corporation,record the journal entries related to these call options.

Required:

For Sorrentino Corporation,record the journal entries related to these call options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

34

A company pays $5,000 to purchase futures contracts to buy 50 oz of silver at $40/oz.At the company's year-end,the price of silver rose and the value of the company's futures contracts increased to $6,000.

Required:

Record the journal entries related to these futures.

Required:

Record the journal entries related to these futures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

35

Becamel Company issued 100,000 preferred shares and received proceeds of $6,500,000.These shares have a par value of $60 per share and pay cumulative dividends of 8%.Buyers of the preferred shares also received a detachable warrant with each share purchased.Each warrant gives the holder the right to buy one common share at $30 per share within 10 years.The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $62 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $3 each.

Required:

Record the journal entry for the issuance of these shares and warrants.

Required:

Record the journal entry for the issuance of these shares and warrants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

36

Amel Company issues convertible bonds with face value of $7,000,000 and receives proceeds of $7,500,000.Each $1,000 bond can be converted,at the option of the holder,into 40 common shares.The underwriter estimated the market value of the bonds alone,excluding the conversion rights,to be approximately $7,200,000.

Required:

Record the journal entry for the issuance of these bonds.

Required:

Record the journal entry for the issuance of these bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

37

On August 15,2018,Madison Company issued 80,000 options on the shares of MVC (Middefield Valley Corporation).Each option gives the option holder the right to buy one share of MVC at $70 per share until March 16,2019.Madison received $800,000 for issuing these options.At the company's year-end of December 31,2018,the options contracts traded on the Montreal Exchange at $9.50 per contract.On March 16,2019,MVC shares closed at $63 per share,so none of the options was exercised.

Required:

Record the journal entries related to these call options.

Required:

Record the journal entries related to these call options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

38

On August 15,2018,Madison Company issued 10,000 options on the shares of MVC (Middefield Valley Corporation).Each option gives the option holder the right to buy one share of MVC at $70 per share until March 16,2019.Madison received $100,000 for issuing these options.At the company's year-end of December 31,2018,the options contracts traded on the Montreal Exchange at $9.50 per contract.On March 16,2019,MVC shares closed at $63 per share,so none of the options was exercised.

Required:

Record the journal entries related to these call options.

Required:

Record the journal entries related to these call options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

39

Explain how convertible bonds alleviate moral hazard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

40

Briefly describe a compound financial instrument and its advantages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

41

A company issued 105,000 preferred shares and received proceeds of $7,000,000.These shares have a par value of $50 per share and pay cumulative dividends of 6%.Buyers of the preferred shares also received a detachable warrant with each share purchased.Each warrant gives the holder the right to buy one common share at $35 per share within 10 years.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $55 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $5 each.

Required:

Record the journal entry for the issuance of these shares and warrants under IFRS.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $55 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $5 each.

Required:

Record the journal entry for the issuance of these shares and warrants under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

42

Assume that Barun agrees to purchase US$500,000 for C$550,000 on January 15,2018.The exchange rate at year end is US$1 = C$0.95 and the January 15,2018 exchange rate is US$1 = C$0.97.What journal entry is required at Jan 15,2018?

A)$10,000 gain.

B)$10,000 loss.

C)$75,000 gain.

D)$75,000 loss.

A)$10,000 gain.

B)$10,000 loss.

C)$75,000 gain.

D)$75,000 loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

43

Assume that Millan agrees to purchase US$100,000 for C$84,745 on January 15,2018.The exchange rate at year end is US$1 = C$1.20 and the January 15,2018 exchange rate is US$1 = C$1.19.What journal entry is required at year end?

A)$701 loss.

B)$701 gain.

C)$1,412 loss.

D)$1,412 gain.

A)$701 loss.

B)$701 gain.

C)$1,412 loss.

D)$1,412 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

44

A company issues convertible bonds with face value of $7,000,000 and receives proceeds of $8,500,000.Each $1,000 bond can be converted,at the option of the holder,into 100 common shares.The underwriter estimated the market value of the bonds alone,excluding the conversion rights,to be approximately $7,300,000.

Required:

Record the journal entry for the issuance of these bonds based on IFRS.

Required:

Record the journal entry for the issuance of these bonds based on IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which method is used under IFRS to account for compound instruments?

A)Fair value method.

B)Proportional method.

C)Incremental method.

D)Zero common equity method.

A)Fair value method.

B)Proportional method.

C)Incremental method.

D)Zero common equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

46

Assume that MAK agrees to purchase US$500,000 for C$550,000 on January 15,2018.The exchange rate at year end is US$1 = C$0.95 and the January 15,2018 exchange rate is US$1 = C$0.97.What journal entry is required at year end?

A)0

B)$65,000 loss.

C)$75,000 gain.

D)$75,000 loss.

A)0

B)$65,000 loss.

C)$75,000 gain.

D)$75,000 loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

47

A company issues convertible bonds with face value of $10,000,000 and receives proceeds of $10,500,000.Each $1,000 bond can be converted,at the option of the holder,into 800 common shares.The underwriter estimated the market value of the bonds alone,excluding the conversion rights,to be approximately $8,300,000.

Required:

Record the journal entry for the issuance of these bonds based on IFRS.

Required:

Record the journal entry for the issuance of these bonds based on IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

48

How would the liability portion of the compound instrument be recorded?

A)Once separated,this component is accounted for at fair value with changes recorded through income.

B)Once separated,this component is accounted for in accordance with its substance.

C)Once separated,this component is accounted for at amortized cost.

D)Once separated,this component is accounted for at historical cost.

A)Once separated,this component is accounted for at fair value with changes recorded through income.

B)Once separated,this component is accounted for in accordance with its substance.

C)Once separated,this component is accounted for at amortized cost.

D)Once separated,this component is accounted for at historical cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

49

A company issues convertible bonds with face value of $5,000,000 and receives proceeds of $6,500,000.Each $1,000 bond can be converted,at the option of the holder,into 80 common shares.The underwriter estimated the market value of the bonds alone,excluding the conversion rights,to be approximately $6,300,000.

Required:

Record the journal entry for the issuance of these bonds based on IFRS.

Required:

Record the journal entry for the issuance of these bonds based on IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

50

Assume that Aero agrees to purchase US$50,000 for C$52,000 on January 15,2018.The exchange rate at year end is US$1 = C$0.98 and the January 15,2018 exchange rate is US$1 = C$0.97.What journal entry is required at year end?

A)$3,000 loss.

B)$3,000 gain.

C)$3,500 loss.

D)$3,500 gain.

A)$3,000 loss.

B)$3,000 gain.

C)$3,500 loss.

D)$3,500 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

51

A company issued 75,000 preferred shares and received proceeds of $7,000,000.These shares have a par value of $50 per share and pay cumulative dividends of 6%.Buyers of the preferred shares also received a detachable warrant with each share purchased.Each warrant gives the holder the right to buy one common share at $35 per share within 10 years.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $55 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $5 each.

Required:

Record the journal entry for the issuance of these shares and warrants under IFRS.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $55 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $5 each.

Required:

Record the journal entry for the issuance of these shares and warrants under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which is a derivative on the company's own common shares?

A)Accounts payable.

B)Warrants on common shares.

C)Commodity futures contract.

D)Warranty provision.

A)Accounts payable.

B)Warrants on common shares.

C)Commodity futures contract.

D)Warranty provision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which statement best explains the accounting for compound instruments?

A)Once separated,each component is accounted for at fair value with changes recorded through income.

B)Once separated,each component is accounted for in accordance with its substance.

C)Once separated,each component is accounted for at amortized cost.

D)Once separated,each component is accounted for at historical cost.

A)Once separated,each component is accounted for at fair value with changes recorded through income.

B)Once separated,each component is accounted for in accordance with its substance.

C)Once separated,each component is accounted for at amortized cost.

D)Once separated,each component is accounted for at historical cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

54

Assume that Aero agrees to purchase US$50,000 for C$52,000 on January 15,2018.The exchange rate at year end is US$1 = C$0.98 and the January 15,2018 exchange rate is US$1 = C$0.97.What journal entry is required at Jan 15,2013?

A)$500 loss.

B)$500 gain.

C)$3,500 loss.

D)$3,500 gain.

A)$500 loss.

B)$500 gain.

C)$3,500 loss.

D)$3,500 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

55

Assume that Signh agrees to purchase US$100,000 for C$84,745 on January 15,2018.The exchange rate at year end is US$1 = C$1.20 and the January 15,2018 exchange rate is US$1 = C$1.19.What journal entry is required at January 15,2013?

A)$701 loss.

B)$701 gain.

C)$711 loss.

D)$711 gain.

A)$701 loss.

B)$701 gain.

C)$711 loss.

D)$711 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

56

Enterprises need to separate the components of a compound financial instrument and account for each component separately.(a)What are the three alterative methods of allocating the cost to the components? (b)Contrast the reporting requirements for compound financial instruments under IFRS and ASPE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which statement best describes the "zero common equity method"?

A)Under this method of accounting,for a convertible bond,all of the bond value would be counted as a liability.

B)Under this method of accounting,for a convertible bond,the issuing entity would record a liability for the estimated value of the bond without the conversion feature.

C)Under this method of accounting,for a convertible bond,an estimate would be made of the fair value of all components and allocated proportionally to all components.

D)Under this method of accounting,the common share component is considered the least reliably measured amount.

A)Under this method of accounting,for a convertible bond,all of the bond value would be counted as a liability.

B)Under this method of accounting,for a convertible bond,the issuing entity would record a liability for the estimated value of the bond without the conversion feature.

C)Under this method of accounting,for a convertible bond,an estimate would be made of the fair value of all components and allocated proportionally to all components.

D)Under this method of accounting,the common share component is considered the least reliably measured amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

58

How should employee stock options be accounted for?

A)Historical cost.

B)Fair value with changes recorded through income.

C)Amortized cost.

D)Fair value.

A)Historical cost.

B)Fair value with changes recorded through income.

C)Amortized cost.

D)Fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

59

A company issued 95,000 preferred shares and received proceeds of $6,000,000.These shares have a par value of $48 per share and pay cumulative dividends of 6%.Buyers of the preferred shares also received a detachable warrant with each share purchased.Each warrant gives the holder the right to buy one common share at $35 per share within 10 years.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $64 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $8 each.

Required:

Record the journal entry for the issuance of these shares and warrants under IFRS.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $64 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $8 each.

Required:

Record the journal entry for the issuance of these shares and warrants under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which is a derivative on the company's own common shares?

A)Interest rate swap contract.

B)Foreign exchange forward contract.

C)Employee stock option.

D)Commodity futures contract.

A)Interest rate swap contract.

B)Foreign exchange forward contract.

C)Employee stock option.

D)Commodity futures contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

61

List three common stock compensation plans and describe them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

62

A company had a debt-to-equity ratio of 1.64 before issuing convertible bonds.This ratio included $500,000 in equity.The company issued convertible bonds.The value reported for the bonds on the balance sheet is $180,000 and the conversion rights are valued at $22,000.

Required:

After the issuance of the convertible bonds,what is the value of the debt-to-equity ratio?

Required:

After the issuance of the convertible bonds,what is the value of the debt-to-equity ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which statement best describes the "proportional method"?

A)Under this method of accounting,for a convertible bond,all of the bond value would be counted as a liability.

B)Under this method of accounting,for a convertible bond,the issuing entity would record a liability for the estimated value of the bond without the conversion feature.

C)Under this method of accounting,for a convertible bond,estimate the fair value of all components and allocate proportionally to them.

D)Under this method of accounting,the common share component is considered the least reliably measured amount.

A)Under this method of accounting,for a convertible bond,all of the bond value would be counted as a liability.

B)Under this method of accounting,for a convertible bond,the issuing entity would record a liability for the estimated value of the bond without the conversion feature.

C)Under this method of accounting,for a convertible bond,estimate the fair value of all components and allocate proportionally to them.

D)Under this method of accounting,the common share component is considered the least reliably measured amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which method must be used under IFRS to account for employee stock options?

A)Intrinsic value of options.

B)Time value of options.

C)Market value of the shares.

D)Fair value on the grant date of the options.

A)Intrinsic value of options.

B)Time value of options.

C)Market value of the shares.

D)Fair value on the grant date of the options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which method is used under ASPE to account for compound instruments?

A)Fair value method.

B)Proportional method.

C)Book value method.

D)Zero common equity method.

A)Fair value method.

B)Proportional method.

C)Book value method.

D)Zero common equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which statement best describes the "incremental method"?

A)Under this method of accounting,for a convertible bond,all of the bond value would be counted as a liability.

B)Under this method of accounting,for a convertible bond,the issuing entity would record a liability for the estimated value of the bond without the conversion feature.

C)Under this method of accounting,for a convertible bond,an estimate would be made of the fair value of all components and allocated proportionally to all components.

D)Under this method of accounting,the common share component is considered the most reliably measured amount.

A)Under this method of accounting,for a convertible bond,all of the bond value would be counted as a liability.

B)Under this method of accounting,for a convertible bond,the issuing entity would record a liability for the estimated value of the bond without the conversion feature.

C)Under this method of accounting,for a convertible bond,an estimate would be made of the fair value of all components and allocated proportionally to all components.

D)Under this method of accounting,the common share component is considered the most reliably measured amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which method is used under ASPE to account for compound instruments?

A)Incremental method.

B)Fair value method.

C)Proportional method.

D)Book value method.

A)Incremental method.

B)Fair value method.

C)Proportional method.

D)Book value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

68

A company issued 100,000 preferred shares and received proceeds of $5,750,000.These shares have a par value of $50 per share and pay cumulative dividends of 6%.Buyers of the preferred shares also received a detachable warrant with each share purchased.Each warrant gives the holder the right to buy one common share at $35 per share within 10 years.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $55 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $5 each.

Required:

Record the journal entry for the issuance of these shares and warrants under IFRS.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $55 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $5 each.

Required:

Record the journal entry for the issuance of these shares and warrants under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

69

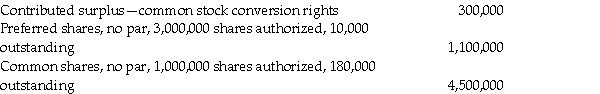

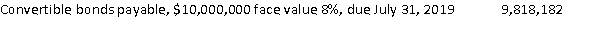

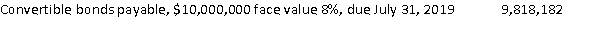

LMN Company reported the following amounts on its balance sheet at July 31,2018:

Liabilities

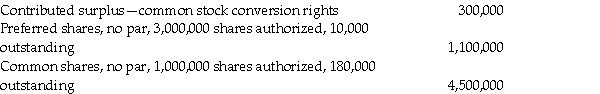

Convertible bonds payable,$10,000,000 face value 9%,due July 31,2019 9,909,091

Equity

Additional information

1.The bonds pay interest each July 31.Each $1,000 bond is convertible into 10 common shares.The bonds were originally issued to yield 10%.On July 31,2019,all the bonds were converted after the final interest payment was made.LMN uses the book value method to record bond conversions as recommended under IFRS.

2.No other share or bond transactions occurred during the year.

Required:

a.Prepare the journal entry to record the bond interest payment on July 31,2019.

b.Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2019.

c.Prepare the journal entry to record the bond conversion.

Liabilities

Convertible bonds payable,$10,000,000 face value 9%,due July 31,2019 9,909,091

Equity

Additional information

1.The bonds pay interest each July 31.Each $1,000 bond is convertible into 10 common shares.The bonds were originally issued to yield 10%.On July 31,2019,all the bonds were converted after the final interest payment was made.LMN uses the book value method to record bond conversions as recommended under IFRS.

2.No other share or bond transactions occurred during the year.

Required:

a.Prepare the journal entry to record the bond interest payment on July 31,2019.

b.Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2019.

c.Prepare the journal entry to record the bond conversion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

70

A company had a debt-to-equity ratio of 1.65 before issuing convertible bonds.This ratio included $450,000 in equity.The company issued convertible bonds.The value reported for the bonds on the balance sheet is $200,000 and the conversion rights are valued at $25,000.

Required:

After the issuance of the convertible bonds,what is the value of the debt-to-equity ratio?

Required:

After the issuance of the convertible bonds,what is the value of the debt-to-equity ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

71

What are the similarities and differences between forwards and futures?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

72

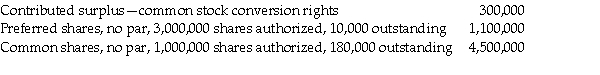

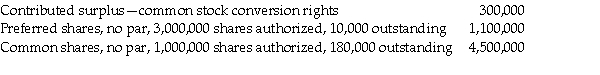

LMN Company reported the following amounts on its balance sheet at July 31,2019:

Liabilities

Equity

Additional information

1.The bonds pay interest each July 31.Each $1,000 bond is convertible into 5 common shares.The bonds were originally issued to yield 10%.On July 31,2019,all the bonds were converted after the final interest payment was made.LMN uses the book value method to record bond conversions as recommended under IFRS.

2.No other share or bond transactions occurred during the year.

Required:

a.Prepare the journal entry to record the bond interest payment on July 31,2019.

b.Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2019.

c.Prepare the journal entry to record the bond conversion.

Liabilities

Equity

Additional information

1.The bonds pay interest each July 31.Each $1,000 bond is convertible into 5 common shares.The bonds were originally issued to yield 10%.On July 31,2019,all the bonds were converted after the final interest payment was made.LMN uses the book value method to record bond conversions as recommended under IFRS.

2.No other share or bond transactions occurred during the year.

Required:

a.Prepare the journal entry to record the bond interest payment on July 31,2019.

b.Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2019.

c.Prepare the journal entry to record the bond conversion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

73

How would exercise of warrants that were part of an original compound instrument be recorded?

A)Common stock is recorded at an amount equal to the fair value of the options at date of conversion.

B)Common stock is recorded at an amount equal to the cash received plus the contributed surplus initially recorded

C)Common stock is recorded at an amount equal to the market price of the shares on conversion date.

D)Common stock is recorded at an amount equal to the price determined by the Black-Sholes model.

A)Common stock is recorded at an amount equal to the fair value of the options at date of conversion.

B)Common stock is recorded at an amount equal to the cash received plus the contributed surplus initially recorded

C)Common stock is recorded at an amount equal to the market price of the shares on conversion date.

D)Common stock is recorded at an amount equal to the price determined by the Black-Sholes model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

74

How would the exercise of an option,that was part of an initial compound instrument,be recorded?

A)Common stock is recorded at an amount equal to the fair value of the options at date of conversion.

B)Common stock is recorded at an amount equal to the price determined by the Black-Sholes model.

C)Common stock is recorded at an amount equal to the market price of the shares on conversion date.

D)Common stock is recorded at an amount equal to the cash received plus the contributed surplus initially recorded.

A)Common stock is recorded at an amount equal to the fair value of the options at date of conversion.

B)Common stock is recorded at an amount equal to the price determined by the Black-Sholes model.

C)Common stock is recorded at an amount equal to the market price of the shares on conversion date.

D)Common stock is recorded at an amount equal to the cash received plus the contributed surplus initially recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

75

A company had a debt-to-equity ratio of 1.55 before issuing convertible bonds.This ratio included $500,000 in equity.The company issued convertible bonds.The value reported for the bonds on the balance sheet is $180,000 and the conversion rights are valued at $22,000.

Required:

After the issuance of the convertible bonds,what is the value of the debt-to-equity ratio?

Required:

After the issuance of the convertible bonds,what is the value of the debt-to-equity ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

76

How would the equity portion of the compound instrument be recorded?

A)Once separated,this component is accounted for at fair value through profit or loss.

B)Once separated,this component is accounted for in accordance with its substance.

C)Once separated,this component is accounted for amortized cost.

D)Once separated,this component is accounted for at historical cost.

A)Once separated,this component is accounted for at fair value through profit or loss.

B)Once separated,this component is accounted for in accordance with its substance.

C)Once separated,this component is accounted for amortized cost.

D)Once separated,this component is accounted for at historical cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

77

Explain the conceptual meaning of the difference between the book value and market value methods of recording the conversion of bonds into common shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

78

On January 1,2019,Wayward Co.issued a $22 million,8%,6-year convertible bond with annual coupon payments.Each $1,000 bond was convertible into 35 shares of Wayward's common shares.Moonbeam Investments purchased the entire bond issue for $22.7 million on January 1,2019.Moonbeam estimated that without the conversion feature,the bonds would have sold for $21,013,098 (to yield 9%).

On January 1,2020,Moonbeam converted bonds with a par value of $8.8 million.At the time of conversion,the shares were selling at $30 each.

Required:

a.Prepare the journal entry to record the issuance of convertible bonds.

b.Prepare the journal entry to record the conversion according to IFRS (book value method).

c.Prepare the journal entry to record the conversion according ASPE (market value method).

On January 1,2020,Moonbeam converted bonds with a par value of $8.8 million.At the time of conversion,the shares were selling at $30 each.

Required:

a.Prepare the journal entry to record the issuance of convertible bonds.

b.Prepare the journal entry to record the conversion according to IFRS (book value method).

c.Prepare the journal entry to record the conversion according ASPE (market value method).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

79

A company issued 105,000 preferred shares and received proceeds of $6,100,000.These shares have a par value of $50 per share and pay cumulative dividends of 6%.Buyers of the preferred shares also received a detachable warrant with each share purchased.Each warrant gives the holder the right to buy one common share at $35 per share within 10 years.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $55 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $5 each.

Required:

Record the journal entry for the issuance of these shares and warrants under IFRS.

The underwriter estimated that the market value of the preferred shares alone,excluding the conversion rights,is approximately $55 per share.Shortly after the issuance of the preferred shares,the detachable warrants traded at $5 each.

Required:

Record the journal entry for the issuance of these shares and warrants under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

80

How is the subsequent conversion of bonds into common shares recorded under IFRS?

A)Book value.

B)Market value.

C)Fair value.

D)Historical value.

A)Book value.

B)Market value.

C)Fair value.

D)Historical value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck