Deck 14: The Individual Tax Formula

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/113

العب

ملء الشاشة (f)

Deck 14: The Individual Tax Formula

1

An individual's taxable income equals adjusted gross income less the greater of the standard deduction or itemized deductions less the exemption amount.

True

2

Mr. Andrews is age 58, legally blind, and files as a single taxpayer. His standard deduction for 2015 is $6,300.

False

3

Mr. Lenz died on May 4, 2014. His widow, Mrs. Lenz, maintains a home for her three children, ages 4, 6, and 11. Mrs. Lenz must file as a head of household in 2015.

False

4

Adjusted gross income equals total income less itemized deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

5

Harry and Sally were married on December 23, 2014. Their income for the entire year is reported on a joint return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

6

The standard deduction for single individuals equals one-half of the standard deduction for married individuals filing jointly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

7

Mrs. Paley died on July 14, 2014. Her husband has not remarried. The Paleys' two children, ages 34 and 36, are financially independent. Mr. Paley may file as a surviving spouse in 2015 and 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

8

A taxpayer who knowingly signs a joint return on which his spouse has failed to report her income is liable for any tax assessments made by the IRS on that income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

9

In computing taxable income, an individual is allowed to deduct the lesser of itemized deductions or the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

10

Bill and Afton are married and file a joint tax return. Bill is 67 and Afton is 66, and neither is legally blind. Their standard deduction for 2015 is $15,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

11

An individual who files his own tax return but is claimed as a dependent on another individual's return is not allowed any standard deduction or personal exemption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

12

An itemized deduction doesn't result in any tax savings in a year in which an individual taxpayer takes the standard deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

13

A husband and wife are allowed only one exemption on a jointly filed return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

14

An individual's taxable income equals adjusted gross income less the exemption amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

15

An above-the-line deduction reduces both adjusted gross income and taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

16

In computing taxable income, an individual is allowed to deduct both the standard deduction and any itemized deduction for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

17

Charlie is single and provides 100% of the financial support for his dependent mother, Angela, who lives with Charlie. Charlie's filing status is head of household.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

18

Mr. Thomas is age 69, has perfect vision, and files as a single taxpayer. His standard deduction for 2015 is $7,850.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

19

For the taxable year in which a married person dies, the widow or widower can file a joint return with the deceased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

20

The majority of individual taxpayers take the standard deduction rather than itemizing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

21

An individual must pay the greater of her regular income tax or her alternative minimum tax (AMT) for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

22

Married individuals who elect to file separate tax returns may use the single rates to compute their tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

23

Mr. and Mrs. Kline file a joint return on which they claim the standard deduction and two exemptions. If the taxable income on their return is $55,300, they are not paying a marriage penalty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

24

The earned income credit offsets the burden of the federal payroll tax on low-income families and encourages individuals to seek employment rather than to depend on welfare.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

25

The earned income credit is available only to low-income taxpayers with dependent children.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

26

Mrs. Starling worked for Abbot Inc. from January 1 through September 19. Her salary from Abbot for this period totaled $122,000. Mrs. Starling worked for JJT Inc. from October 1 through December 31. Her salary from JJT for this period totaled $38,000. JJT is not required to withhold Social Security tax from Mrs. Starling's salary because Abbot Inc. already withheld the maximum tax for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

27

Jay Blount, 26-years old and a full time student, lives in his parents' home. Although Jay earned $8,400 from a part-time job, his parents provide at least 75% of his financial support. Jay's parents may claim him as a dependent this year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

28

Based on the 2015 tax rates, an individual is indifferent between filing as a single taxpayer or a head of household if he has $9,225 or less of taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

29

Every individual taxpayer is entitled to an AMT exemption, the amount of which varies with filing status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

30

The highest individual marginal rate for regular tax purposes is 39.6%, while the highest individual marginal rate for alternative minimum tax (AMT) purposes is only 28%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

31

Mr. and Mrs. Queen provide 90% of the financial support for Mrs. Queen's mother, Doreen, who lives in the couples' home. Doreen's only income this year is a $7,500 taxable pension from her former employer. Mr. and Mrs. Queen can't claim Doreen as a dependent this year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

32

Mr. and Mrs. Toliver's AGI on their jointly filed return is $339,000. Regardless of the number of their children, the Tolivers are not eligible for a child credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

33

Only natural and adopted children or stepchildren can be a qualifying child for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

34

Miss Blixen's regular income tax is $77,390, and her tentative minimum tax is $74,100. Consequently, Miss Blixen's alternative minimum tax (AMT) is zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

35

In order to be claimed as a dependent, an individual must be either a qualifying child or a qualifying relative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

36

Mr. and Mrs. Casey have two dependent children, ages 3 and 6. The Caseys spent $10,300 for child care this year. Mrs. Casey is employed full-time as an attorney. Mr. Casey is an unpublished novelist who has yet to earn any money from his writing. The Caseys are eligible for a dependent care credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

37

The tax rates for individuals who qualify as a head-of-household are lower than the tax rates for single individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

38

It is impossible for a progressive income tax system to be both marriage neutral and horizontally equitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

39

The standard deduction and exemption amount are not deductible in the computation of alternative minimum taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

40

An individual with $500,000 taxable income has the same marginal rate as a single taxpayer or as a head of household.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

41

Marie, an unmarried taxpayer, is 26 years old. This year, Marie earned $50,000 gross income. Her itemized deductions totaled $5,100. Marie maintained a home for her 12-year-old sister who qualifies as Marie's dependent. Compute Marie's taxable income.

A) $40,900

B) $32,750

C) $36,900

D) None of the above.

A) $40,900

B) $32,750

C) $36,900

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

42

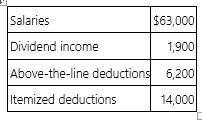

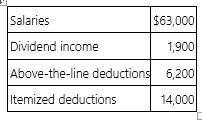

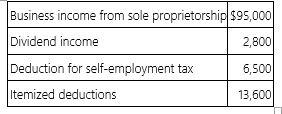

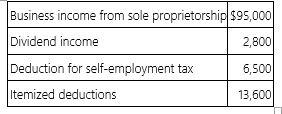

Mr. and Mrs. Dell, ages 29 and 26, file a joint return and have no dependents for the year. Here is their relevant information.  Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

A) AGI $64,900; taxable income $42,900

B) AGI $58,700; taxable income $36,700

C) AGI $58,700; taxable income $38,500

D) AGI $64,900; taxable income $36,700

Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.A) AGI $64,900; taxable income $42,900

B) AGI $58,700; taxable income $36,700

C) AGI $58,700; taxable income $38,500

D) AGI $64,900; taxable income $36,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

43

In determining the standard deduction, which of the following statements is true?

A) The standard deduction is a function of filing status.

B) An individual who is both blind and age 65 by the last day of the taxable year is entitled to one additional standard deduction amount.

C) An individual who is claimed as a dependent on another person's tax return is not allowed a standard deduction.

D) The standard deduction for a head of household is twice the standard deduction for a single individual.

A) The standard deduction is a function of filing status.

B) An individual who is both blind and age 65 by the last day of the taxable year is entitled to one additional standard deduction amount.

C) An individual who is claimed as a dependent on another person's tax return is not allowed a standard deduction.

D) The standard deduction for a head of household is twice the standard deduction for a single individual.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

44

An extension of the time to file an individual tax return also extends the time to pay any balance of tax due with the return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

45

Individual taxpayers can obtain an automatic extension of time to file a calendar year Form 1040 until October 15 of the following year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

46

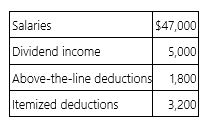

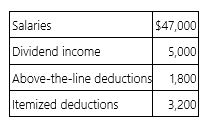

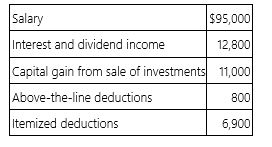

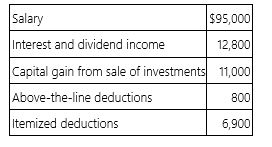

Mr. and Mrs. Liddy, ages 39 and 41, file a joint return and have no dependents for the year. Here is their relevant information.  Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

A) AGI $50,200; taxable income $29,600

B) AGI $52,000; taxable income $31,400

C) AGI $52,000; taxable income $39,000

D) AGI $50,200; taxable income $39,000

Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.A) AGI $50,200; taxable income $29,600

B) AGI $52,000; taxable income $31,400

C) AGI $52,000; taxable income $39,000

D) AGI $50,200; taxable income $39,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

47

Samantha died on January 18, 2014. Her husband Dave lived by himself until he remarried in 2016. What was Dave's filing status in 2014 and 2015?

A) Married filing jointly in 2014; surviving spouse in 2015.

B) Married filing jointly in 2014; single in 2015.

C) Surviving spouse in 2014 and 2015.

D) Surviving spouse in 2014; single in 2015.

A) Married filing jointly in 2014; surviving spouse in 2015.

B) Married filing jointly in 2014; single in 2015.

C) Surviving spouse in 2014 and 2015.

D) Surviving spouse in 2014; single in 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

48

Leon died on August 23, 2013, and his wife Mary has not remarried. Since her husband's death, Mary has maintained a home for her two dependent children, who were ages 7 and 4 when their father died. Which of the following describes Mary's filing status for 2014, 2015, and 2016?

A) Surviving spouse for 2014, 2015, and 2016.

B) Surviving spouse for 2014 and 2015; head of household for 2016.

C) Head of household for 2014, 2015, and 2016.

D) Surviving spouse for 2014; head of household for 2015 and 2016.

A) Surviving spouse for 2014, 2015, and 2016.

B) Surviving spouse for 2014 and 2015; head of household for 2016.

C) Head of household for 2014, 2015, and 2016.

D) Surviving spouse for 2014; head of household for 2015 and 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

49

Julie, an unmarried individual, lives in a home with her 13-year-old dependent son, Oscar. This year, Julie had the following tax information.  Compute Julie's adjusted gross income (AGI) and taxable income.

Compute Julie's adjusted gross income (AGI) and taxable income.

A) AGI $97,800; taxable income $69,700

B) AGI $97,800; taxable income $76,200

C) AGI $91,300; taxable income $66,900

D) AGI $91,300; taxable income $69,700

Compute Julie's adjusted gross income (AGI) and taxable income.

Compute Julie's adjusted gross income (AGI) and taxable income.A) AGI $97,800; taxable income $69,700

B) AGI $97,800; taxable income $76,200

C) AGI $91,300; taxable income $66,900

D) AGI $91,300; taxable income $69,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

50

The unextended due date for the individual tax return (Form 1040) is the 15th day of the third month following the close of the taxable year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

51

Mr. and Mrs. Warren's AGI last year was $90,300, and their total tax was $13,988. This year, the couple's total tax is $14,700. Unless the Warrens paid at least $13,988 in the form of withholding and quarterly estimated payments, they will incur an underpayment penalty this year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

52

Mr. Jones and his first wife were legally divorced on February 19, 2015. Mr. Jones remarried the second Mrs. Jones on December 20, 2015. Which of the following describes Mr. Jones' filing status in 2015?

A) Married filing jointly with the second Mrs. Jones

B) Married filing jointly with the first Mrs. Jones

C) Married filing separately (can't file jointly with either spouse)

D) None of the above.

A) Married filing jointly with the second Mrs. Jones

B) Married filing jointly with the first Mrs. Jones

C) Married filing separately (can't file jointly with either spouse)

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

53

Mr. Pearl's total income and self-employment tax on this year's Form 1040 is $72,610. If Mr. Pearl paid at least $65,349 of this tax in the form of withholding or quarterly estimated payments, he will not incur an underpayment penalty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

54

Mrs. Raines died on June 2, 2014. Mr. Raines has not remarried and has no children or other dependents. What is his filing status for 2014 and 2015?

A) Surviving spouse for 2014 and 2015.

B) Surviving spouse for 2014; single for 2015.

C) Married filing jointly for 2014; surviving spouse for 2015.

D) Married filing jointly for 2014; single for 2015.

A) Surviving spouse for 2014 and 2015.

B) Surviving spouse for 2014; single for 2015.

C) Married filing jointly for 2014; surviving spouse for 2015.

D) Married filing jointly for 2014; single for 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following statements regarding filing status is false?

A) A widow or widower maintaining a home for a dependent child qualifies as surviving spouse for two tax years following the year of the spouse's death.

B) Marital status for tax purposes is determined on the last day of the year.

C) Any unmarried individual with a dependent child qualifies as head of household.

D) An unmarried individual without children or other dependents files as a single taxpayer.

A) A widow or widower maintaining a home for a dependent child qualifies as surviving spouse for two tax years following the year of the spouse's death.

B) Marital status for tax purposes is determined on the last day of the year.

C) Any unmarried individual with a dependent child qualifies as head of household.

D) An unmarried individual without children or other dependents files as a single taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

56

Mr. and Mrs. Eller's AGI last year was $287,300, and their total tax was $70,268. The couple's safe-harbor estimate of current year tax is $77,295.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

57

Tamara and Todd Goble, ages 66 and 60, file a joint return. Todd is legally blind. Compute their standard deduction.

A) $15,700

B) $12,600

C) $13,850

D) $15,100

A) $15,700

B) $12,600

C) $13,850

D) $15,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following taxpayers can't use the tax rates for married filing jointly in 2015?

A) Mr. Lane died on August 10, 2015. Mrs. Lane has not remarried and has no dependent children.

B) Mrs. Holden died on January 15, 2014. Mr. Holden has not remarried and maintains a home for two dependent children.

C) Mr. and Mrs. West were legally divorced on December 21, 2015. Mrs. West has not remarried and maintains a home for three dependent children.

D) All of the above taxpayers qualify for married filing jointly filing status.

A) Mr. Lane died on August 10, 2015. Mrs. Lane has not remarried and has no dependent children.

B) Mrs. Holden died on January 15, 2014. Mr. Holden has not remarried and maintains a home for two dependent children.

C) Mr. and Mrs. West were legally divorced on December 21, 2015. Mrs. West has not remarried and maintains a home for three dependent children.

D) All of the above taxpayers qualify for married filing jointly filing status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

59

Julie, an unmarried individual, lives in a home with her 13-year-old dependent son, Oscar. This year, Julie had the following tax information.  Compute Julie's adjusted gross income (AGI) and taxable income.

Compute Julie's adjusted gross income (AGI) and taxable income.

A) AGI $118,000; taxable income $103,700

B) AGI $118,000; taxable income $93,850

C) AGI $118,000; taxable income $100,750

D) AGI $107,000; taxable income $89,750

Compute Julie's adjusted gross income (AGI) and taxable income.

Compute Julie's adjusted gross income (AGI) and taxable income.A) AGI $118,000; taxable income $103,700

B) AGI $118,000; taxable income $93,850

C) AGI $118,000; taxable income $100,750

D) AGI $107,000; taxable income $89,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following statements regarding the calculation of taxable income is false?

A) The first step in the calculation of taxable income is determining the taxpayer's total income.

B) Adjusted gross income is equal to total income less above-the-line deductions.

C) Adjusted gross income can be reduced by the greater of the standard deduction or itemized deductions.

D) Taxpayers are allowed to deduct the greater of itemized deductions or above-the-line deductions in calculating taxable income.

A) The first step in the calculation of taxable income is determining the taxpayer's total income.

B) Adjusted gross income is equal to total income less above-the-line deductions.

C) Adjusted gross income can be reduced by the greater of the standard deduction or itemized deductions.

D) Taxpayers are allowed to deduct the greater of itemized deductions or above-the-line deductions in calculating taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

61

Ms. Dolan, an unmarried individual, invited her elderly uncle, Martin, to move into her home in January of this year. Martin's only income item was $2,390 of taxable interest on a savings account. Ms. Dolan provides over 90% of her uncle's financial support. What is Ms. Dolan's filing status and number of exemptions for the year?

A) Single and one exemption

B) Single and two exemptions

C) Head of household and one exemption

D) Head of household and two exemptions

A) Single and one exemption

B) Single and two exemptions

C) Head of household and one exemption

D) Head of household and two exemptions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

62

Ms. Kilo is an unmarried individual. She has $219,344 taxable income in 2015. Compute Ms. Kilo's regular tax liability if she files as a single taxpayer and if she files as a surviving spouse.

A) Single $57,500; surviving spouse $61,924

B) Single $55,990; surviving spouse $54,174

C) Single $43,896; surviving spouse $48,468

D) None of the above.

A) Single $57,500; surviving spouse $61,924

B) Single $55,990; surviving spouse $54,174

C) Single $43,896; surviving spouse $48,468

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following statements regarding exemptions is false?

A) Taxpayers can claim a dependency exemption for a qualifying child or a qualifying relative.

B) A qualifying child must be the natural child, the adopted child, or the stepchild of the taxpayer.

C) A qualifying relative may include an unrelated individual who is a member of the taxpayer's household for the year.

D) There is no limit on the amount of gross income that a qualifying child may earn in a year.

A) Taxpayers can claim a dependency exemption for a qualifying child or a qualifying relative.

B) A qualifying child must be the natural child, the adopted child, or the stepchild of the taxpayer.

C) A qualifying relative may include an unrelated individual who is a member of the taxpayer's household for the year.

D) There is no limit on the amount of gross income that a qualifying child may earn in a year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

64

Mr. and Mrs. Steel, who file a joint return, have $513,200 taxable income in 2015. Compute their regular tax liability.

A) $105,062

B) $149,143

C) $179,620

D) None of the above.

A) $105,062

B) $149,143

C) $179,620

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

65

Mr. and Mrs. Kay, ages 68 and 66, file a joint return. Mrs. Kay is legally blind. Compute their standard deduction.

A) $12,600

B) $16,350

C) $15,100

D) $17,250

A) $12,600

B) $16,350

C) $15,100

D) $17,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following statements regarding the calculation of regular tax liability is false?

A) The rate schedule for calculating regular tax liability depends on the taxpayer's filing status.

B) All taxpayer, regardless of the amount of their taxable income, pay a 10% tax on their first bracket of income.

C) The individual tax rate schedules are adjusted annually for inflation.

D) The tax brackets in the single rate schedule are one-half of the brackets in the married-filing-jointly rate schedule.

A) The rate schedule for calculating regular tax liability depends on the taxpayer's filing status.

B) All taxpayer, regardless of the amount of their taxable income, pay a 10% tax on their first bracket of income.

C) The individual tax rate schedules are adjusted annually for inflation.

D) The tax brackets in the single rate schedule are one-half of the brackets in the married-filing-jointly rate schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

67

Melissa, age 16, is claimed as a dependent on her parents' tax return. This year, Melissa earned $2,000 from babysitting and $1,280 interest income from a savings account. Compute Melissa's standard deduction.

A) $2,000

B) $2,350

C) $0

D) $1,050

A) $2,000

B) $2,350

C) $0

D) $1,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

68

Alice is an unmarried individual. She has $182,340 taxable income in 2015. Compute Alice's regular tax liability if she files as a single taxpayer and if she files as a head of household.

A) Single $44,126; head of household $39,892

B) Single $60,172; head of household $51,055

C) Single $44,126; head of household $41,490

D) None of the above.

A) Single $44,126; head of household $39,892

B) Single $60,172; head of household $51,055

C) Single $44,126; head of household $41,490

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

69

Kent, an unmarried individual, invited his widowed father, Martin, to move into his home in January of this year. Martin's only income item was a $14,000 taxable pension from his former employer. Kent provides about 75% of his father's financial support. What is Kent's filing status and number of exemptions for the year?

A) Single and one exemption

B) Single and two exemptions

C) Head of household and one exemption

D) Head of household and two exemptions

A) Single and one exemption

B) Single and two exemptions

C) Head of household and one exemption

D) Head of household and two exemptions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

70

Mr. and Mrs. Upton's marginal tax rate on their joint return is 33%. This year, their itemized deductions totaled $13,800, and their standard deduction (MFJ) was $12,600. Compute their incremental tax savings from their itemized deductions.

A) $0

B) $396

C) $4,158

D) $4,554

A) $0

B) $396

C) $4,158

D) $4,554

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements regarding a qualifying child is false?

A) The child must have been alive at least 180 days during the tax year.

B) The child must be a U.S. citizen or resident of the United States, Canada, or Mexico.

C) The child must not have provided more than 50% of his or her own financial support during the year.

D) The child must not have filed a joint return with a spouse unless the return was filed only as a refund claim.

A) The child must have been alive at least 180 days during the tax year.

B) The child must be a U.S. citizen or resident of the United States, Canada, or Mexico.

C) The child must not have provided more than 50% of his or her own financial support during the year.

D) The child must not have filed a joint return with a spouse unless the return was filed only as a refund claim.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

72

Benjamin, who files as a single taxpayer, has $359,900 taxable income in 2015. Compute his regular tax liability.

A) $101,341

B) $112,684

C) $118,767

D) None of the above.

A) $101,341

B) $112,684

C) $118,767

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

73

Mr. and Mrs. Jelk file a joint return. They provide 65% of the financial support for David, the 14-year old son of a friend who died three years ago. David lives in the home of his aunt Sarah, who provides 35% of his financial support. Which of the following statements is true?

A) David is a qualifying child of the Jelks.

B) If David earns less than $4,000 gross income this year, he is a qualifying child of the Jelks.

C) If David earns less than $4,000 gross income this year, he is a qualifying relative of the Jelks.

D) David is neither a qualifying child nor a qualifying relative of the Jelks.

A) David is a qualifying child of the Jelks.

B) If David earns less than $4,000 gross income this year, he is a qualifying child of the Jelks.

C) If David earns less than $4,000 gross income this year, he is a qualifying relative of the Jelks.

D) David is neither a qualifying child nor a qualifying relative of the Jelks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following statements regarding the calculation of regular tax liability is false?

A) Regardless of filing status, the highest marginal rate for individual taxpayers is 39.6%.

B) The individual tax rate schedules are adjusted annually for inflation.

C) The tax brackets in the married-filing-separately rate schedule are one-half of the brackets in the married-filing-jointly rate schedule.

D) None of the above is false.

A) Regardless of filing status, the highest marginal rate for individual taxpayers is 39.6%.

B) The individual tax rate schedules are adjusted annually for inflation.

C) The tax brackets in the married-filing-separately rate schedule are one-half of the brackets in the married-filing-jointly rate schedule.

D) None of the above is false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

75

Hunter, age 17, is claimed as a dependent on his parents' tax return. This year, Hunter earned $8,500 for appearing in a television commercial. Compute Hunter's standard deduction.

A) $1,050

B) $8,500

C) $6,300

D) $0

A) $1,050

B) $8,500

C) $6,300

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

76

Mr. and Mrs. Anderson file a joint return. They provide more than 50% of the financial support of their two children, Dana, age 26, and John, age 17. Both children live in the Andersons' home. Dana earned $7,100 from a part-time job, while John earned no income this year. Which of the following statements is true?

A) Both Dana and John are qualifying children of the Andersons.

B) Dana is a qualifying relative and John is a qualifying child of the Andersons.

C) John is a qualifying child of the Andersons.

D) Neither Dana nor John is a qualifying child of the Andersons.

A) Both Dana and John are qualifying children of the Andersons.

B) Dana is a qualifying relative and John is a qualifying child of the Andersons.

C) John is a qualifying child of the Andersons.

D) Neither Dana nor John is a qualifying child of the Andersons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following statements describing individual tax deductions is false?

A) In a year in which an individual takes the standard deduction, any itemized deductions yield no tax benefit.

B) The majority of individual taxpayers itemize rather than taking the standard deduction.

C) Individuals elect to itemize deductions in a tax year in which total itemized deductions exceed the standard deduction.

D) Individuals who pay self-employment tax can deduct one half of the tax as an above-the-line deduction.

A) In a year in which an individual takes the standard deduction, any itemized deductions yield no tax benefit.

B) The majority of individual taxpayers itemize rather than taking the standard deduction.

C) Individuals elect to itemize deductions in a tax year in which total itemized deductions exceed the standard deduction.

D) Individuals who pay self-employment tax can deduct one half of the tax as an above-the-line deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following statements describing individual tax deductions is false?

A) Individuals can take both above-the-line and the standard deduction in the same year.

B) Individuals elect to itemize deductions in a tax year in which total itemized deductions exceed the standard deduction.

C) In a year in which an individual takes the standard deduction, any itemized deductions yield no tax benefit.

D) Individuals who pay self-employment tax can deduct the tax as an itemized deduction.

A) Individuals can take both above-the-line and the standard deduction in the same year.

B) Individuals elect to itemize deductions in a tax year in which total itemized deductions exceed the standard deduction.

C) In a year in which an individual takes the standard deduction, any itemized deductions yield no tax benefit.

D) Individuals who pay self-employment tax can deduct the tax as an itemized deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

79

Melissa, age 16, is claimed as a dependent on her parents' tax return. This year, Melissa earned $510 from babysitting and $220 interest income from a savings account. Compute Melissa's standard deduction.

A) $730

B) $860

C) $510

D) $1,050

A) $730

B) $860

C) $510

D) $1,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

80

Ms. Lewis' maintains a household which is the principal place of residence for Kathy. Ms. Lewis' provides more than 50% of Kathy's financial support. In which of the following cases can Ms. Lewis' claim Kathy as a qualifying child?

A) Kathy is age 8 and the child of Ms. Lewis' best friend, who died three years ago.

B) Kathy is Ms. Lewis' 15-year old niece.

C) Kathy is Ms. Lewis' 30-year old unmarried sister.

D) Both B. and C.

A) Kathy is age 8 and the child of Ms. Lewis' best friend, who died three years ago.

B) Kathy is Ms. Lewis' 15-year old niece.

C) Kathy is Ms. Lewis' 30-year old unmarried sister.

D) Both B. and C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck