Deck 15: Option Valuation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

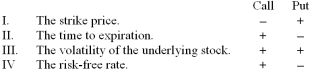

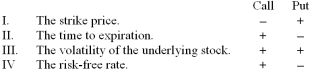

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/86

العب

ملء الشاشة (f)

Deck 15: Option Valuation

1

__________ is a term used to mean "time to maturity".

A) Expiry

B) Dating

C) Timing

D) Elapsing

E) Flowing

A) Expiry

B) Dating

C) Timing

D) Elapsing

E) Flowing

A

2

How many options values at expiration would you have to calculate in a four-period binomial option pricing model?

A) 1

B) 2

C) 3

D) 4

E) 5

A) 1

B) 2

C) 3

D) 4

E) 5

B

3

The delta of a call is between __________ and __________.

A) -1; 1

B) -1; 0

C) 0; 1

D) negative infinity; 0

E) 0; infinity

A) -1; 1

B) -1; 0

C) 0; 1

D) negative infinity; 0

E) 0; infinity

C

4

The Black-Scholes-Merton option pricing model:

A) Is used to value calls only

B) Incorporates the stock's price, not the exercise price into its computation

C) Base the value of an option strictly on that option's intrinsic value

D) Considers the relationship between the market return and stock return into the option calculation

E) Recognizes the fact that dividend yields vary from one stock to another

A) Is used to value calls only

B) Incorporates the stock's price, not the exercise price into its computation

C) Base the value of an option strictly on that option's intrinsic value

D) Considers the relationship between the market return and stock return into the option calculation

E) Recognizes the fact that dividend yields vary from one stock to another

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is true?

A) Delta is always positive.

B) Call option delta is always negative.

C) Put option Beta is always greater than +1.

D) Vega is always positive.

E) Rho is always negative for calls and positive for puts.

A) Delta is always positive.

B) Call option delta is always negative.

C) Put option Beta is always greater than +1.

D) Vega is always positive.

E) Rho is always negative for calls and positive for puts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

6

ISD and IVOL are symbols denoting ___________.

A) Rho factors

B) Implied volatility indexes

C) Theta values

D) Variance measures

E) Option maturity dates

A) Rho factors

B) Implied volatility indexes

C) Theta values

D) Variance measures

E) Option maturity dates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following will have a positive impact on the price of a put option?

A) Increase in the underlying stock price.

B) Decrease in the time to maturity.

C) Decrease in the risk-free rate of interest.

D) Decrease in the exercise price.

E) Decrease in the volatility of the underlying stock.

A) Increase in the underlying stock price.

B) Decrease in the time to maturity.

C) Decrease in the risk-free rate of interest.

D) Decrease in the exercise price.

E) Decrease in the volatility of the underlying stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

8

The volatility of a stock's price estimated from the stock's option is called ________.

A) market volatility

B) estimated variance

C) a volatility skew

D) implied standard deviation

E) rho factor

A) market volatility

B) estimated variance

C) a volatility skew

D) implied standard deviation

E) rho factor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

9

Increasing which of the following will have a negative impact on the price of a call option?

A) The stock price.

B) The time to maturity.

C) The risk-free rate of interest.

D) The dividend yield.

E) The volatility of the underlying stock.

A) The stock price.

B) The time to maturity.

C) The risk-free rate of interest.

D) The dividend yield.

E) The volatility of the underlying stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following have the greatest effect on stock option prices?

A) Stock price and delta

B) Theta and delta

C) Rho and exercise price

D) Delta and vega

E) Stock price and exercise price

A) Stock price and delta

B) Theta and delta

C) Rho and exercise price

D) Delta and vega

E) Stock price and exercise price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

11

The dollar impact of a change in the underlying stock price on the value of a stock option is measured by __________.

A) Gamma

B) Delta

C) Theta

D) Beta

E) Vega

A) Gamma

B) Delta

C) Theta

D) Beta

E) Vega

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

12

An increase in __________ will have a negative effect on the price of a put option.

A) The underlying stock price.

B) The time to maturity.

C) The risk-free rate of interest.

D) The dividend yield.

E) The volatility of the underlying stock.

A) The underlying stock price.

B) The time to maturity.

C) The risk-free rate of interest.

D) The dividend yield.

E) The volatility of the underlying stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

13

A term that is synonymous with implied standard deviation is:

A) implied volatility

B) estimated risk factor

C) implied volatility skew

D) implied delta

E) implied correlation

A) implied volatility

B) estimated risk factor

C) implied volatility skew

D) implied delta

E) implied correlation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

14

The impact of a change in volatility on a stock option's value is known as __________.

A) Gamma

B) Delta

C) Theta

D) Beta

E) Vega

A) Gamma

B) Delta

C) Theta

D) Beta

E) Vega

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

15

What happens to the price of an option using a binomial option pricing model with many periods as the numbers of periods increases?

A) The model because useless for calculating the price of an option.

B) The value of a put and a call option are less divergent.

C) The put option price gets closer to zero and the call option price gets closer to infinity.

D) The option price converges towards the option price from the Black-Scholes model.

E) The time value of the option decreases exponentially with the number of periods.

A) The model because useless for calculating the price of an option.

B) The value of a put and a call option are less divergent.

C) The put option price gets closer to zero and the call option price gets closer to infinity.

D) The option price converges towards the option price from the Black-Scholes model.

E) The time value of the option decreases exponentially with the number of periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

16

The measure of an option's price sensitivity to a change in the interest rate is __________.

A) Gamma

B) Rho

C) Theta

D) Beta

E) Vega

A) Gamma

B) Rho

C) Theta

D) Beta

E) Vega

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

17

In Canada, __________ shows investor expectations about future stock market volatility.

A) VIA

B) POP

C) OSC

D) MVX

E) VAR

A) VIA

B) POP

C) OSC

D) MVX

E) VAR

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

18

The Black-Scholes option pricing model:

A) Must express time as the number of years until an option expires

B) Assumes the call and put options have different exercise prices

C) Is based on European style, not American style, options

D) Assumes the call and put options have different expiration dates

E) Uses a stock's variance as the measure of volatility

A) Must express time as the number of years until an option expires

B) Assumes the call and put options have different exercise prices

C) Is based on European style, not American style, options

D) Assumes the call and put options have different expiration dates

E) Uses a stock's variance as the measure of volatility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

19

The change in an option's price in response to a change in the time to the option's expiration is reflected by

A) Gamma

B) Delta

C) Theta

D) Beta

E) Vega

A) Gamma

B) Delta

C) Theta

D) Beta

E) Vega

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which one of the following statements is correct

A) Both call and put option deltas are always positive.

B) Put option deltas are always positive.

C) Call option deltas are always positive.

D) Both call and put option deltas are always negative.

E) All deltas can be positive, negative, or equal to zero.

A) Both call and put option deltas are always positive.

B) Put option deltas are always positive.

C) Call option deltas are always positive.

D) Both call and put option deltas are always negative.

E) All deltas can be positive, negative, or equal to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is/are false?

A) II and III only

B) I, II, and II only

C) I and IV only

D) I, III, and IV only

E) I, II, III, and IV

A) II and III only

B) I, II, and II only

C) I and IV only

D) I, III, and IV only

E) I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following will produce the highest put price, all else constant? Assume that the options are all in-the-money.

A) $45 stock price; 50% standard deviation.

B) $45 stock price; 75% standard deviation.

C) $50 stock price; 50% standard deviation.

D) $50 stock price; 75% standard deviation.

E) Not enough information.

A) $45 stock price; 50% standard deviation.

B) $45 stock price; 75% standard deviation.

C) $50 stock price; 50% standard deviation.

D) $50 stock price; 75% standard deviation.

E) Not enough information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

23

All else the same, as the delta of a stock index option used to hedge a stock portfolio increases, the number of options needed to hedge the portfolio will __________.

A) Increase

B) Decrease

C) not change

D) increase only if the delta is less than 0.5

E) increase only if the delta is greater than 0.5

A) Increase

B) Decrease

C) not change

D) increase only if the delta is less than 0.5

E) increase only if the delta is greater than 0.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

24

Theta is commonly calibrated to a time interval of one

A) Year

B) Day

C) Month

D) Quarter

E) Week

A) Year

B) Day

C) Month

D) Quarter

E) Week

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following will produce the highest put price, all else constant? Assume that the options are all in-the-money.

A) $30 stock price; 60 days to option expiration.

B) $35 stock price; 60 days to option expiration.

C) $30 stock price; 30 days to option expiration.

D) $35 stock price; 30 days to option expiration.

E) Undetermined due to insufficient information.

A) $30 stock price; 60 days to option expiration.

B) $35 stock price; 60 days to option expiration.

C) $30 stock price; 30 days to option expiration.

D) $35 stock price; 30 days to option expiration.

E) Undetermined due to insufficient information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

26

Stock prices and call option prices are

A) Unrelated

B) Negatively correlated

C) Directly related

D) Perfectly related

E) Inversely related

A) Unrelated

B) Negatively correlated

C) Directly related

D) Perfectly related

E) Inversely related

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

27

Stock prices and put option prices are

A) Unrelated

B) Negatively correlated

C) Directly related

D) Perfectly related

E) Inversely related

A) Unrelated

B) Negatively correlated

C) Directly related

D) Perfectly related

E) Inversely related

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following will produce the highest put price, all else constant? Assume that the options are all in-the-money.

A) $20 stock price; 30 days to option expiration.

B) $20 stock price; 40 days to option expiration.

C) $25 stock price; 30 days to option expiration.

D) $25 stock price; 40 days to option expiration.

E) Undetermined due to insufficient information.

A) $20 stock price; 30 days to option expiration.

B) $20 stock price; 40 days to option expiration.

C) $25 stock price; 30 days to option expiration.

D) $25 stock price; 40 days to option expiration.

E) Undetermined due to insufficient information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is/are correct?

A) II and III only

B) I, II, and II only

C) I and IV only

D) I, III, and IV only

E) I, II, III, and IV

A) II and III only

B) I, II, and II only

C) I and IV only

D) I, III, and IV only

E) I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is/are false?

A) I and III only

B) II and IV only

C) II and III only

D) I, II, and III only

E) II, III, and IV only

A) I and III only

B) II and IV only

C) II and III only

D) I, II, and III only

E) II, III, and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

31

Typically, an employee stock option is which one of the following?

A) call option

B) covered call

C) put option

D) protective put

E) index option

A) call option

B) covered call

C) put option

D) protective put

E) index option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following will produce the highest call price, all else constant? Assume that the options are all in-the-money.

A) $40 exercise price; 30 days to option expiration.

B) $40 exercise price; 40 days to option expiration.

C) $45 exercise price; 30 days to option expiration.

D) $45 exercise price; 40 days to option expiration.

E) Insufficient information to answer this question.

A) $40 exercise price; 30 days to option expiration.

B) $40 exercise price; 40 days to option expiration.

C) $45 exercise price; 30 days to option expiration.

D) $45 exercise price; 40 days to option expiration.

E) Insufficient information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following will produce the highest call price, all else constant? Assume that the options are all in-the-money.

A) $20 exercise price; 45 days to option expiration.

B) $25 exercise price; 45 days to option expiration.

C) $20 exercise price; 60 days to option expiration.

D) $25 exercise price; 60 days to option expiration.

E) Insufficient information to answer this question.

A) $20 exercise price; 45 days to option expiration.

B) $25 exercise price; 45 days to option expiration.

C) $20 exercise price; 60 days to option expiration.

D) $25 exercise price; 60 days to option expiration.

E) Insufficient information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

34

When hedging an equity portfolio with stock index options, an increase in the beta of the portfolio will __________ the number of options needed to hedge the portfolio, all else the same.

A) Increase

B) Decrease

C) Not change

D) Increase only if the beta is less than one

E) Increase only if the beta is greater than one

A) Increase

B) Decrease

C) Not change

D) Increase only if the beta is less than one

E) Increase only if the beta is greater than one

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is correct to complete the formula for ascertaining the number of option required to hedge an equity portfolio?

Change in stock price Shares = Option __________ Number of Options

A) Delta

B) Beta

C) Gamma

D) Rho

E) Theta

Change in stock price Shares = Option __________ Number of Options

A) Delta

B) Beta

C) Gamma

D) Rho

E) Theta

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

36

Hedging a stock portfolio with stock options involves __________ options.

A) Buying call

B) Selling call

C) Buying put

D) Selling put

E) Buying both call and put

A) Buying call

B) Selling call

C) Buying put

D) Selling put

E) Buying both call and put

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

37

How frequently should you probably rebalance your options hedge on a stock portfolio?

A) Weekly

B) Quarterly

C) Annually

D) Only when the options expire

E) Only if you make significant change to your portfolio

A) Weekly

B) Quarterly

C) Annually

D) Only when the options expire

E) Only if you make significant change to your portfolio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following will produce the highest call price, all else constant?

A) $24 stock price; $25 exercise price.

B) $36 stock price; $35 exercise price.

C) $15 stock price; $15 exercise price.

D) $29 stock price; $30 exercise price.

E) $19 stock price; $20 exercise price.

A) $24 stock price; $25 exercise price.

B) $36 stock price; $35 exercise price.

C) $15 stock price; $15 exercise price.

D) $29 stock price; $30 exercise price.

E) $19 stock price; $20 exercise price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is/are correct?

A) I and II only

B) I and III only

C) II and III only

D) II and IV only

E) I, II, and IV

A) I and II only

B) I and III only

C) II and III only

D) II and IV only

E) I, II, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

40

The formula for determining the number of stock index option contracts needed to hedge an equity portfolio is:

A) (Portfolio beta portfolio value)/(Option vega Option contract value)

B) (Portfolio beta portfolio value)/(Option theta Option contract value)

C) (Portfolio beta portfolio value)/(Option delta Option contract value)

D) (Portfolio standard deviation portfolio value)/(Option Beta Option contract value)

E) (Portfolio standard deviation portfolio value)/(Option delta Option contract value)

A) (Portfolio beta portfolio value)/(Option vega Option contract value)

B) (Portfolio beta portfolio value)/(Option theta Option contract value)

C) (Portfolio beta portfolio value)/(Option delta Option contract value)

D) (Portfolio standard deviation portfolio value)/(Option Beta Option contract value)

E) (Portfolio standard deviation portfolio value)/(Option delta Option contract value)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

41

You are managing a stock portfolio with a value of $50,000,000 and a beta of 1.15. The S&P 500 index is trading at 1,120. If the delta of the options is-0.48, how can you hedge your portfolio using put options?

A) buy 1,070 contracts

B) sell 1,130 contracts

C) sell 1,070 contracts

D) sell 1,095 contracts

E) buy 1,130 contracts

A) buy 1,070 contracts

B) sell 1,130 contracts

C) sell 1,070 contracts

D) sell 1,095 contracts

E) buy 1,130 contracts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

42

All else the same, an increase in the volatility of the underlying stock will __________ the price of a call option and __________ the price of a put option.

A) increase; increase

B) increase; decrease

C) decrease; decrease

D) decrease; increase

E) not affect; not affect

A) increase; increase

B) increase; decrease

C) decrease; decrease

D) decrease; increase

E) not affect; not affect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

43

An implied standard deviation can be computed by using the directly observable Black-Scholes-Merton option pricing variables plus an option price and solving the Black-Scholes-Merton formula for

A) Beta

B) Vega

C) Sigma

D) Rho

E) Gamma

A) Beta

B) Vega

C) Sigma

D) Rho

E) Gamma

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

44

A rising MVX implies

A) a relatively stable stock market

B) investors having heightened fears for the future

C) the options traded on the Montreal Exchange are in-the-money

D) no risk of market turmoil

E) the options traded on the Montreal Exchange are out-of-the-money

A) a relatively stable stock market

B) investors having heightened fears for the future

C) the options traded on the Montreal Exchange are in-the-money

D) no risk of market turmoil

E) the options traded on the Montreal Exchange are out-of-the-money

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

45

Hedging a long position in a stock is best accomplished by

A) Selling a put

B) Buying a put

C) Selling a call

D) Buying a call

E) Doing nothing

A) Selling a put

B) Buying a put

C) Selling a call

D) Buying a call

E) Doing nothing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

46

You manage a stock portfolio with a beta of 0.90 and a market value of $250 million. S&P 500 index call options with a delta of 0.53 are available at a strike price of 1,100. If the index is currently trading at 1,084, how many call options should you write?

A) 3,705

B) 3,859

C) 3,534

D) 3,916

E) 4,102

A) 3,705

B) 3,859

C) 3,534

D) 3,916

E) 4,102

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

47

All else the same, an increase in the risk-free rate will __________ the price of a call option and __________ the price of a put option.

A) increase; increase

B) increase; decrease

C) decrease; decrease

D) decrease; increase

E) not affect; not affect

A) increase; increase

B) increase; decrease

C) decrease; decrease

D) decrease; increase

E) not affect; not affect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Black-Scholes-Merton model assumes __________ volatility.

A) stochastic

B) high

C) low

D) constant

E) random

A) stochastic

B) high

C) low

D) constant

E) random

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

49

An increase in the price of the underlying stock will __________ the price of a put option because put option delta is always __________.

A) increase; negative

B) decrease; negative

C) decrease; positive

D) increase; positive

E) not affect; equal to one

A) increase; negative

B) decrease; negative

C) decrease; positive

D) increase; positive

E) not affect; equal to one

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is/are the same for a call option and a put option?

I) Rho

II) Theta

III) Beta

IV Vega

A) I only

B) II only

C) II and IV only

D) I and III only

E) I, II and IV only

I) Rho

II) Theta

III) Beta

IV Vega

A) I only

B) II only

C) II and IV only

D) I and III only

E) I, II and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

51

The risk-free rate used in the Black-Scholes-Merton model is the:

A) 30-day Treasury bill.

B) 90-day Treasury bill.

C) 1-year Treasury bill.

D) 10-year Treasury bond.

E) Treasury bill with the same maturity as the option.

A) 30-day Treasury bill.

B) 90-day Treasury bill.

C) 1-year Treasury bill.

D) 10-year Treasury bond.

E) Treasury bill with the same maturity as the option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

52

The S&P 500 is currently trading at 1,040. Call options with a strike price of 1,075 and a delta of 0.25 are available. If you want to hedge portfolio with a value of $300 million and a beta of 1.10, how many options should you write?

A) 12,843

B) 12,503

C) 12,692

D) 12,386

E) 12,279

A) 12,843

B) 12,503

C) 12,692

D) 12,386

E) 12,279

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following inputs for the Black-Scholes-Merton model is not directly observable?

A) The risk-free rate.

B) The strike price.

C) The time to maturity.

D) The standard deviation.

E) The dividend yield.

A) The risk-free rate.

B) The strike price.

C) The time to maturity.

D) The standard deviation.

E) The dividend yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

54

A call option that sells for $7.18 has a delta of 0.63. If the stock price decreases by $1.50, what is your estimate of the new call price?

A) $6.86

B) $6.24

C) $6.55

D) $6.37

E) $6.64

A) $6.86

B) $6.24

C) $6.55

D) $6.37

E) $6.64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

55

The change in a put option's price in response to a 1% increase in interest rates is approximately equal to

A) Rho

B) B.-1 * rho

C) 0.01 * rho

D) 0.01 * -1 * rho

E) 0.01-rho

A) Rho

B) B.-1 * rho

C) 0.01 * rho

D) 0.01 * -1 * rho

E) 0.01-rho

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

56

S&P 500 stock index options are settled:

A) in cash.

B) with a portfolio of stocks.

C) with Spyders.

D) in one of the above methods at the discretion of the option owner.

E) None of the above.

A) in cash.

B) with a portfolio of stocks.

C) with Spyders.

D) in one of the above methods at the discretion of the option owner.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

57

You want to hedge a stock portfolio with a beta 0.95 and a value of $150 million with S&P 500 call options. The options have a strike price of 1,100 and a delta of 0.62. If the index is currently trading at 1,128, how many options should you write?

A) 1,996

B) 2,089

C) 2,147

D) 2,193

E) 2,038

A) 1,996

B) 2,089

C) 2,147

D) 2,193

E) 2,038

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

58

You are managing a stock portfolio with a value of $100 million. The portfolio is unique in that the beta is-0.10. The S&P 500 is currently trading at 1,108. The delta of a call option on the index with a strike price of 1,150 has a delta of 0.52. How can you hedge your portfolio using call options?

A) Buy 174 contracts

B) Sell 167 contracts

C) Buy 156 contracts

D) Sell 174 contracts

E) Buy 167 contracts

A) Buy 174 contracts

B) Sell 167 contracts

C) Buy 156 contracts

D) Sell 174 contracts

E) Buy 167 contracts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

59

You own shares of AZT stock. Which of the following strategies can you use to hedge your risk associated with a price decrease in AZT stock?

I) buy call options

II) write call options

III) buy put options

IV) write put options

A) I only

B) I and III only

C) I and IV only

D) II and III only

E) II and IV only

I) buy call options

II) write call options

III) buy put options

IV) write put options

A) I only

B) I and III only

C) I and IV only

D) II and III only

E) II and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

60

All else the same, an increase in the time to maturity will __________ the price of a call option and __________ the price of a put option.

A) increase; increase

B) increase; decrease

C) decrease; decrease

D) decrease; increase

E) not affect; not affect

A) increase; increase

B) increase; decrease

C) decrease; decrease

D) decrease; increase

E) not affect; not affect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

61

A stock is currently priced at $90. A put option with a delta of-0.45 has a price of $6.15. If the stock price decreases $0.80, what is the new price of the put?

A) $5.79

B) $6.51

C) $5.35

D) $6.95

E) $6.74

A) $5.79

B) $6.51

C) $5.35

D) $6.95

E) $6.74

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

62

An option with a strike price of $90 sells for $6.67 and has a delta of 0.55. If the underlying stock price increases from $90 to $90.68, what is the new price of the call?

A) $7.35

B) $6.83

C) $7.04

D) $6.95

E) $7.17

A) $7.35

B) $6.83

C) $7.04

D) $6.95

E) $7.17

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

63

A put option is priced at $1.43 and has an option delta of-0.21. The underlying stock price is $23. If the stock price increases to $24, the put option price will be approximately;

A) $1.10

B) $1.14

C) $1.16

D) $1.19

E) $1.22

A) $1.10

B) $1.14

C) $1.16

D) $1.19

E) $1.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

64

A call option has a delta of 0.48 and sells for $6.59. What is the estimate of the new call price if the stock price increases by $0.75?

A) $6.83

B) $6.72

C) $7.01

D) $7.07

E) $6.95

A) $6.83

B) $6.72

C) $7.01

D) $7.07

E) $6.95

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is the delta of the put option?

A) -0.50

B) -0.42

C) -0.38

D) -0.32

E) -0.28

A) -0.50

B) -0.42

C) -0.38

D) -0.32

E) -0.28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is the call option premium?

A) $2.11

B) $2.29

C) $2.36

D) $2.45

E) $2.51

A) $2.11

B) $2.29

C) $2.36

D) $2.45

E) $2.51

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

67

You have been granted stock options on 100 shares of your employer's stock. The stock is currently selling for $20.32, has a dividend yield of 1.4%, and a standard deviation of 23%. The option's exercise price is $20 and the time to maturity is 10 years. What is the value of your options given a risk-free rate of 5%?

A) $7.04

B) $7.53

C) $7.78

D) $7.97

E) $8.04

A) $7.04

B) $7.53

C) $7.78

D) $7.97

E) $8.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

68

You own 1,200 shares of Banner Co. stock that is currently priced at $42 a share. Given this price, the option delta for a $40 call option on this stock is .664. How many $40 call options do you need to hedge against a-$1 change in the price of the stock?

A) buy 1,613 options

B) buy 1,713 options

C) buy 1,8.7 options

D) write 1,713 options

E) write 1,807 options

A) buy 1,613 options

B) buy 1,713 options

C) buy 1,8.7 options

D) write 1,713 options

E) write 1,807 options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

69

When the time period is in days, such as 56 days, the input for the time period is " = 56/365"

-What is the delta of the put option?

A) -0.489

B) -0.315

C) -0.500

D) -0.388

E) -0.494

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

70

A call option is currently priced at $5.81. The price of the underlying stock is $53, the strike price is $55, the dividend yield of the stock is 2 percent, the risk-free rate is 6 percent, and the option has 74 days to maturity. What is the implied standard deviation of the stock?

A) 68.14%

B) 72.68%

C) 65.27%

D) 57.26%

E) 61.08%

A) 68.14%

B) 72.68%

C) 65.27%

D) 57.26%

E) 61.08%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

71

When the time period is in days, such as 56 days, the input for the time period is " = 56/365"

-What is the price of the put option?

A) $8.50

B) $5.94

C) $6.43

D) $6.22

E) $5.97

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

72

When the time period is in days, such as 56 days, the input for the time period is " = 56/365"

-What is the delta of the call option?

A) 0.506

B) 0.511

C) 0.652

D) 0.762

E) 0.916

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

73

From the calculation, you have found that you need -2,019.68 options to hedge your stock portfolio. Based on this information, you should __________ option contracts.

A) Buy 2,020

B) Buy 202

C) Sell 20

D) Sell 202

E) Sell 2,020

A) Buy 2,020

B) Buy 202

C) Sell 20

D) Sell 202

E) Sell 2,020

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

74

A call option with a strike price of $85 is currently trading at $6.17. The stock price is $86 and the risk-free rate is 5 percent. If the option has 48 days to maturity, what is the implied standard deviation?

A) 47.29%

B) 52.18%

C) 57.21%

D) 43.44%

E) 38.67%

A) 47.29%

B) 52.18%

C) 57.21%

D) 43.44%

E) 38.67%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

75

What is the price of the put option?

A) $2.87

B) $2.91

C) $2.94

D) $2.99

E) $3.03

A) $2.87

B) $2.91

C) $2.94

D) $2.99

E) $3.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

76

When the time period is in days, such as 56 days, the input for the time period is " = 56/365"

-What is the price of the call option?

A) $9.32

B) $8.12

C) $8.73

D) $9.80

E) $5.97

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

77

What is the delta of the call option?

A) 0.48

B) 0.50

C) 0.53

D) 0.55

E) 0.58

A) 0.48

B) 0.50

C) 0.53

D) 0.55

E) 0.58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

78

You have been granted stock options on 100 shares of your employer's stock. The stock is currently selling for $50.63, has a dividend yield of 3.2%, and a standard deviation of 55%. The option's exercise price is $50 and the time to maturity is 15 years. What is the value of your options given a risk-free rate of 4.5%?

A) $21.20

B) $22.15

C) $22.67

D) $23.01

E) $23.25

A) $21.20

B) $22.15

C) $22.67

D) $23.01

E) $23.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

79

A put option with a price of $10.21 has a delta of-0.51. If the underlying stock price increases by $1.30, what is the new put price?

A) $10.87

B) $9.70

C) $10.72

D) $9.55

E) $10.61

A) $10.87

B) $9.70

C) $10.72

D) $9.55

E) $10.61

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

80

You own 1,000 shares of ABC stock at a price of $50 per share. A put option is priced at $0.56 and has an option delta of -0.1614. The stock price is expected to fall to $49. To hedge your stock portfolio, how many put option contracts you need?

A) Buy 124

B) Buy 62

C) Sell 62

D) Sell 31

E) Undetermined due to insufficient information

A) Buy 124

B) Buy 62

C) Sell 62

D) Sell 31

E) Undetermined due to insufficient information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck