Deck 4: Evaluating a Firms Financial Performance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/147

العب

ملء الشاشة (f)

Deck 4: Evaluating a Firms Financial Performance

1

Theoretically,market values of assets are better for evaluating the creation of shareholder wealth than accounting numbers,but accounting numbers are used because they are more readily available.

True

2

Financial ratios are used by managers inside the company and by lenders,credit-rating agencies,and investors outside of the company.

True

3

When the present financial ratios of a firm are compared with similar ratios for another firm in the same industry it is called trend analysis.

False

4

How managers choose to finance the business affects the company's risk,and as a result,the rate of return stockholders receive on their investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

5

Return on equity is driven by (1)the spread between the operating return on assets and the interest rate,and (2)changes in the debt ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

6

Financial ratios that are higher than industry averages may indicate problems that are as detrimental to the firm as ratios that are too low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

7

Ratios of almost all companies are easily comparable because all public companies prepare their financial reports based upon generally accepted accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company with a current ratio higher than industry average must also have a quick ratio higher than industry average because both ratios measure liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

9

Financial ratios are often reported by industry or line of business because differences in the type of business can make ratio comparisons uninformative or even misleading.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

10

Trend analysis is the forecasting of the firm's financial ratios for a future time period by using its own ratios from previous periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

11

Common-sized income statements

A)assist in the comparison of companies of different sizes.

B)show each income statement account as a percentage of total assets.

C)compare companies with the same level of total sales.

D)compare companies with the same level of net income.

A)assist in the comparison of companies of different sizes.

B)show each income statement account as a percentage of total assets.

C)compare companies with the same level of total sales.

D)compare companies with the same level of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

12

Financial ratios are useful for evaluating performance but should not be used for making financial projections.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

13

Common-size balance sheets are balance sheets of companies with almost identical total assets (within 2% of each other).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

14

Common-sized balance sheets

A)show data for companies in the same industry.

B)show data for companies with approximately the same amount of assets.

C)show each balance sheet account as a percentage of total sales.

D)show each balance sheet account as a percentage of total assets.

A)show data for companies in the same industry.

B)show data for companies with approximately the same amount of assets.

C)show each balance sheet account as a percentage of total sales.

D)show each balance sheet account as a percentage of total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

15

Accounting information is used in financial ratio analysis because it is theoretically the best data to guide financial decision-making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

16

Ratio analysis enhances our understanding of three basic attributes of performance: liquidity,profitability,and the ability to create shareholder value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

17

Common stockholders may use financial ratios to monitor manager actions to help lessen agency problems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

18

Ratios are used to standardize financial information,thereby making it easier to interpret.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

19

Financial ratios cannot be used to evaluate the creation of shareholder wealth because they are based on accounting numbers that reflect historical cost and not current market values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

20

Financial analysis

A)uses historical financial statements and is thus useful only to assess past performance.

B)relies on generally accepted accounting principles to make comparisons between companies valid.

C)uses historical financial statements to measure a company's performance and in making financial projections of future performance.

D)is accounting record-keeping using generally accepted accounting principles.

A)uses historical financial statements and is thus useful only to assess past performance.

B)relies on generally accepted accounting principles to make comparisons between companies valid.

C)uses historical financial statements to measure a company's performance and in making financial projections of future performance.

D)is accounting record-keeping using generally accepted accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

21

DuPont analysis indicates that the return on equity may be boosted above the return on assets by using leverage (debt).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

22

A common method of evaluating a firm's financial ratios is to compare the current values of the firm's ratios to its own ratios from prior periods.This is referred to as trend analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

23

Economic value added is calculated by taking (net income less the cost of all capital)times total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

24

Economic value added includes a charge for the cost of equity that is not included on financial statements prepared according to GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

25

One weakness of the times interest earned ratio is that it includes only the annual interest expense as a finance expense and ignores other financing items such as lease payments that must be paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

26

Financial ratios are useful for measuring performance because maximizing the return on equity for common shareholders is the primary goal of financial managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

27

Operating return on assets is equal to the operating profit margin times total asset turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

28

Borrowing more money will always increase a company's return on equity because the company is using financial leverage,but it also adds to the riskiness of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

29

Lower asset turnover ratios are generally indicative of more efficient asset management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

30

If company A has a lower average collection period than company B,then company A will have a higher accounts receivable turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

31

Net income is the best measure to use for evaluating a firm's profits on assets because it includes the effect of financing as well as the effect of operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

32

The astute financial manager will seek to attain the highest current ratio possible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

33

Ratios that examine profit relative to investment are useful in evaluating the overall effectiveness of the firm's management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

34

Operating profits or EBIT is used to measure a firm's profits on assets because it does not include the firm's cost of debt financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

35

Borrowing money causes a corporation's return on operating assets to decrease because of the interest that must be paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

36

Economic Value Added attempts to measure a firm's economic profit rather than its accounting profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

37

Operating return on assets (OROA)is equal to operating profit margin times total asset turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

38

The current ratio and the acid test ratio both measure financial leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

39

A high debt ratio can be favorable because higher leverage may result in a higher return on equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

40

Total asset turnover is equal to accounts receivable turnover plus inventory turnover plus fixed asset turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

41

Benkart Corporation has sales of $5,000,000,net income of $800,000,total assets of $2,000,000,and 100,000 shares of common stock outstanding.If Benkart's P/E ratio is 12,what is the company's current stock price?

A)$60 per share

B)$96 per share

C)$240 per share

D)$360 per share

A)$60 per share

B)$96 per share

C)$240 per share

D)$360 per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

42

Company A and Company B have the same gross profit margin and the same total asset turnover,but company A has a higher return on equity.This may result from

A)Company B has more common stock.

B)Company A has a lower debt ratio.

C)Company A has lower selling and administrative expenses,resulting in a higher net profit margin.

D)Company A has lower cost of goods sold,resulting in a higher net profit margin.

A)Company B has more common stock.

B)Company A has a lower debt ratio.

C)Company A has lower selling and administrative expenses,resulting in a higher net profit margin.

D)Company A has lower cost of goods sold,resulting in a higher net profit margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

43

The computation of return on equity,or ROE,does not include retained earnings as part of common equity because retained earnings includes all net income for the company since its inception and analysts are trying to calculate the return for just the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

44

Jones,Inc.has a current ratio equal to 1.40.Which of the following transactions will increase the company's current ratio?

A)The company collects $500,000 of its accounts receivable.

B)The company sells $1 million of inventory on credit.

C)The company pays back $50,000 of its long-term debt.

D)The company writes a $30,000 check to pay off some existing accounts payable.

A)The company collects $500,000 of its accounts receivable.

B)The company sells $1 million of inventory on credit.

C)The company pays back $50,000 of its long-term debt.

D)The company writes a $30,000 check to pay off some existing accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

45

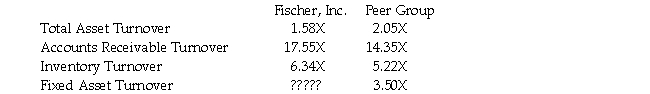

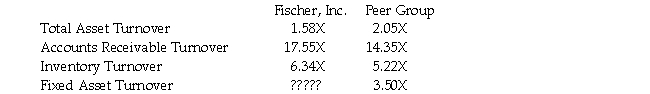

Asset efficiency ratios for Fischer,Inc.are given in the table below.Based on this information,Fischer,Inc.'s fixed asset turnover ratio is likely to be ________.

A)equal to 3.50

B)less than 3.50

C)greater than 3.50

D)negative

A)equal to 3.50

B)less than 3.50

C)greater than 3.50

D)negative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

46

In an ideal world,which of the following would be used to evaluate firm performance?

A)book value of assets

B)corporate retained earnings from the day of incorporation

C)accounting assets and profits

D)market value of assets

A)book value of assets

B)corporate retained earnings from the day of incorporation

C)accounting assets and profits

D)market value of assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

47

Smith Corporation has earned a return on capital invested of 10% for the past two years,but an investment analyst reviewing the company has stated the company is not creating shareholder value.This may be due to the fact that

A)the risk free rate of interest is 3%.

B)the corporation's inventory turnover is high.

C)investors' required rate of return is 8%.

D)investors' required rate of return is 12%.

A)the risk free rate of interest is 3%.

B)the corporation's inventory turnover is high.

C)investors' required rate of return is 8%.

D)investors' required rate of return is 12%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

48

An analyst is evaluating two companies,A and B.Company A has a debt ratio of 50% and Company B has a debt ratio of 25%.In his report,the analyst is concerned about Company B's debt level,but not about Company A's debt level.Which of the following would best explain this position?

A)Company B has much higher operating income than Company A.

B)Company A has a lower times interest earned ratio and thus the analyst is not worried about the amount of debt.

C)Company B has a higher operating return on assets than Company A,but Company A has a higher return on equity than Company B.

D)Company B has more total assets than Company A.

A)Company B has much higher operating income than Company A.

B)Company A has a lower times interest earned ratio and thus the analyst is not worried about the amount of debt.

C)Company B has a higher operating return on assets than Company A,but Company A has a higher return on equity than Company B.

D)Company B has more total assets than Company A.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

49

Williams Inc.has a current ratio equal to 3,a quick ratio equal to 1.8,and total current assets of $6 million.Williams' inventory balance is

A)$2,000,000.

B)$2,400,000.

C)$4,000,000.

D)$4,800,000.

A)$2,000,000.

B)$2,400,000.

C)$4,000,000.

D)$4,800,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

50

Company A has a higher days sales outstanding ratio than Company B.Therefore

A)Company A sells more on credit than Company B.

B)Company A has a higher percentage of cash to credit sales than Company B.

C)Company A must be collecting its accounts receivable faster than Company B,on average.

D)Other things being equal,Company B has a cash flow advantage over Company A.

A)Company A sells more on credit than Company B.

B)Company A has a higher percentage of cash to credit sales than Company B.

C)Company A must be collecting its accounts receivable faster than Company B,on average.

D)Other things being equal,Company B has a cash flow advantage over Company A.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following transactions will increase a corporation's operating return on assets?

A)sell stock and use the money to pay off some long-term debt

B)sell 10-year bonds and use the money to pay off current liabilities

C)negotiate a new contract that lowers raw material costs by 10%

D)increase sales by 10%

A)sell stock and use the money to pay off some long-term debt

B)sell 10-year bonds and use the money to pay off current liabilities

C)negotiate a new contract that lowers raw material costs by 10%

D)increase sales by 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

52

HighLev Incorporated borrows heavily and uses the leverage to boost its return on equity to 30% this year,nearly 10% higher than the industry average.However,HighLev's stock price decreases relative to its industry counterparts.How is this possible?

A)Markets are inefficient and fail to recognize the benefits of leverage.

B)The increased debt resulted in interest payments that made HighLev's operating income drop even though return on equity increased.

C)Shareholders are not interested in return on equity.

D)the high levels of debt increased the riskiness of HighLev relative to its competitors.

A)Markets are inefficient and fail to recognize the benefits of leverage.

B)The increased debt resulted in interest payments that made HighLev's operating income drop even though return on equity increased.

C)Shareholders are not interested in return on equity.

D)the high levels of debt increased the riskiness of HighLev relative to its competitors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

53

Baker Corp.is required by a debt agreement to maintain a current ratio of at least 2.5,and Baker's current ratio now is 3.Baker wants to purchase additional inventory for its upcoming Christmas season,and will pay for the inventory with short-term debt.How much inventory can Baker purchase without violating its debt agreement if their total current assets equal $15 million?

A)$0.50 million

B)$1.67 million

C)$4.50 million

D)$6.00 million

A)$0.50 million

B)$1.67 million

C)$4.50 million

D)$6.00 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

54

All of the following measure liquidity EXCEPT

A)current ratio.

B)inventory turnover.

C)acid-test ratio.

D)operating return on assets.

A)current ratio.

B)inventory turnover.

C)acid-test ratio.

D)operating return on assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

55

Nelson Industries has a higher debt ratio than Butler,Inc.,and Nelson also has a higher times interest earned ratio than Butler.If Nelson and Butler both have the same amount of total assets,then

A)Nelson must have higher operating income than Butler.

B)if both companies have the same operating income,Butler must be paying a higher interest rate on its long-term debt than Nelson is paying.

C)Nelson may have more non-interest bearing liabilities,such as accounts payable,than Butler has.

D)if both companies have the same operating income,a mistake was made in the calculations because the company with a higher debt ratio must have a lower times interest earned ratio.

A)Nelson must have higher operating income than Butler.

B)if both companies have the same operating income,Butler must be paying a higher interest rate on its long-term debt than Nelson is paying.

C)Nelson may have more non-interest bearing liabilities,such as accounts payable,than Butler has.

D)if both companies have the same operating income,a mistake was made in the calculations because the company with a higher debt ratio must have a lower times interest earned ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

56

When comparing inventory turnover ratios,other things being equal

A)a lower inventory turnover is preferred in order to keep inventory costs low.

B)a higher inventory turnover is preferred to improve liquidity.

C)higher inventory turnover results from old or obsolete inventory increasing the inventory balance on the balance sheet.

D)higher inventory turnover results from an increase in the selling price of the product.

A)a lower inventory turnover is preferred in order to keep inventory costs low.

B)a higher inventory turnover is preferred to improve liquidity.

C)higher inventory turnover results from old or obsolete inventory increasing the inventory balance on the balance sheet.

D)higher inventory turnover results from an increase in the selling price of the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

57

For a retailer with inventory to sell,the acid-test ratio will be

A)less than the current ratio,thus providing a more stringent measure of liquidity.

B)greater than the current ratio,thus providing a more stringent measure of liquidity.

C)greater than the current ratio,thus providing a less stringent measure of liquidity.

D)unimportant because it doesn't include inventory.

A)less than the current ratio,thus providing a more stringent measure of liquidity.

B)greater than the current ratio,thus providing a more stringent measure of liquidity.

C)greater than the current ratio,thus providing a less stringent measure of liquidity.

D)unimportant because it doesn't include inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

58

How managers choose to finance the business does not affect the rate of return to shareholders because the rate of return is based on how the company uses the assets it has,not whether or not they paid for the assets with debt or equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

59

The goal of most financial managers is to reduce the amount of long-term debt to zero,thus maximizing shareholder wealth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

60

Operating return on assets captures the effect of taxes and financing costs,and hence provides the broadest possible measure of profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

61

The acid-test ratio of a firm would be unaffected by which of the following?

A)Accounts payable are reduced by obtaining a short-term loan.

B)Common stock is sold and the money is invested in marketable securities.

C)Inventories are sold for cash.

D)Inventories are sold on a short-term credit basis.

A)Accounts payable are reduced by obtaining a short-term loan.

B)Common stock is sold and the money is invested in marketable securities.

C)Inventories are sold for cash.

D)Inventories are sold on a short-term credit basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

62

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the operating profit margin is

A)47.5%.

B)37.5%.

C)26.4%.

D)32.8%.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the operating profit margin is

A)47.5%.

B)37.5%.

C)26.4%.

D)32.8%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

63

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the fixed asset turnover ratio is

A)1.69.

B)2.17.

C)4.39.

D)4.80.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the fixed asset turnover ratio is

A)1.69.

B)2.17.

C)4.39.

D)4.80.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

64

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the acid-test ratio is

A)1.71.

B)1.67.

C)1.02.

D)0.98.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the acid-test ratio is

A)1.71.

B)1.67.

C)1.02.

D)0.98.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

65

The current ratio of a firm would be increased by which of the following?

A)Land held for investment is sold for cash.

B)Equipment is purchased,financed by a long-term debt issue.

C)Inventories are sold for cash.

D)Inventories are sold on a credit basis.

A)Land held for investment is sold for cash.

B)Equipment is purchased,financed by a long-term debt issue.

C)Inventories are sold for cash.

D)Inventories are sold on a credit basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

66

Given an accounts receivable turnover of 10 and annual credit sales of $900,000,the average collection period is

A)18.25 days.

B)36.50 days.

C)90 days.

D)40.56 days.

A)18.25 days.

B)36.50 days.

C)90 days.

D)40.56 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

67

XYZ Corporation has a P/E ratio of 20 and EFG Corporation has a P/E ratio of 10.It is likely that

A)XYZ's earnings per share are twice the earnings per share of EFG.

B)investors expect XYZ's earnings to grow faster than EFG's earnings.

C)investors believe that for the same level of earnings growth,XYZ is a higher risk company.

D)investors believe XYZ stock is overvalued.

A)XYZ's earnings per share are twice the earnings per share of EFG.

B)investors expect XYZ's earnings to grow faster than EFG's earnings.

C)investors believe that for the same level of earnings growth,XYZ is a higher risk company.

D)investors believe XYZ stock is overvalued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

68

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the average collection period is

A)36.50 days.

B)32.85 days.

C)46.34 days.

D)29.85 days.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the average collection period is

A)36.50 days.

B)32.85 days.

C)46.34 days.

D)29.85 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

69

The current ratio of a firm would be decreased by which of the following?

A)Land held for investment is sold for cash.

B)Equipment is purchased,financed by a long-term debt issue.

C)Inventories are sold for cash.

D)Inventories are sold on a long-term credit basis.

A)Land held for investment is sold for cash.

B)Equipment is purchased,financed by a long-term debt issue.

C)Inventories are sold for cash.

D)Inventories are sold on a long-term credit basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

70

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the total asset turnover ratio is

A)1.11.

B)1.41.

C)2.33.

D)4.45.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the total asset turnover ratio is

A)1.11.

B)1.41.

C)2.33.

D)4.45.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements concerning Economic Value Added (EVA)is MOST correct?

A)the higher the cost of capital,the higher the EVA,other things being held constant

B)EVA can be negative even if operating profits are positive.

C)A company with positive net income will have positive EVA.

D)Higher operating return on assets will result in lower EVA for a company with a debt ratio over 50%.

A)the higher the cost of capital,the higher the EVA,other things being held constant

B)EVA can be negative even if operating profits are positive.

C)A company with positive net income will have positive EVA.

D)Higher operating return on assets will result in lower EVA for a company with a debt ratio over 50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

72

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the accounts receivable turnover is

A)10.00.

B)11.11.

C)8.11.

D)9.50.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the accounts receivable turnover is

A)10.00.

B)11.11.

C)8.11.

D)9.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

73

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,and assuming the company's stock price is $30 per share,the P/E ratio is

A)3.09.

B)4.83.

C)9.85.

D)10.99.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,and assuming the company's stock price is $30 per share,the P/E ratio is

A)3.09.

B)4.83.

C)9.85.

D)10.99.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

74

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,assuming that no preferred dividends were paid,the return on common equity is

A)55.15%.

B)44.86%.

C)38.83%.

D)17.56%.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,assuming that no preferred dividends were paid,the return on common equity is

A)55.15%.

B)44.86%.

C)38.83%.

D)17.56%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

75

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the debt ratio is

A)24.1%.

B)32.6%.

C)45.0%.

D)55.2%.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the debt ratio is

A)24.1%.

B)32.6%.

C)45.0%.

D)55.2%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

76

The current ratio of a firm would equal its quick ratio whenever

A)the firm has no inventory.

B)the firm's inventory is equal to its other current assets.

C)the firm's inventory is equal to its current liabilities.

D)the firm's current ratio is equal to one.

A)the firm has no inventory.

B)the firm's inventory is equal to its other current assets.

C)the firm's inventory is equal to its current liabilities.

D)the firm's current ratio is equal to one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

77

The acid-test ratio of a firm would be unaffected by which of the following?

A)Several short-term loans are consolidated and paid off using long-term debt.

B)Equipment is purchased,financed by a long-term debt issue.

C)Additional inventory is purchased for cash.

D)Large accounts receivable balances are collected.

A)Several short-term loans are consolidated and paid off using long-term debt.

B)Equipment is purchased,financed by a long-term debt issue.

C)Additional inventory is purchased for cash.

D)Large accounts receivable balances are collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

78

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the current ratio is

A)1.92.

B)1.98.

C)2.86.

D)2.88.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the current ratio is

A)1.92.

B)1.98.

C)2.86.

D)2.88.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

79

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the times interest earned ratio is

A)32.33 times.

B)23.75 times.

C)19.00 times.

D)12.33 times.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the times interest earned ratio is

A)32.33 times.

B)23.75 times.

C)19.00 times.

D)12.33 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck

80

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the OROA is

A)24.73%.

B)39.50%.

C)46.54%.

D)52.78%.

Table 4-1

Stewart Company

Balance Sheet

Based on the information in Table 4-1,the OROA is

A)24.73%.

B)39.50%.

C)46.54%.

D)52.78%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 147 في هذه المجموعة.

فتح الحزمة

k this deck