Deck 26: A Comprehensive Analysis for Real Estate Investment Decisions

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/2

العب

ملء الشاشة (f)

Deck 26: A Comprehensive Analysis for Real Estate Investment Decisions

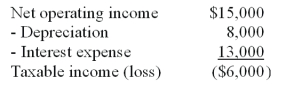

An apartment complex has net operating income of $15,000,depreciation of $8,000,and interest expense of $13,000.The tax rate is 30 percent.

(a)What is taxable income or loss?

(b)what is the tax shield benefit or tax owed?

(a)What is taxable income or loss?

(b)what is the tax shield benefit or tax owed?

a)  b)

b)

b)

b)

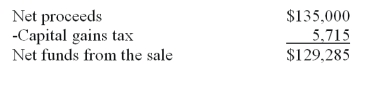

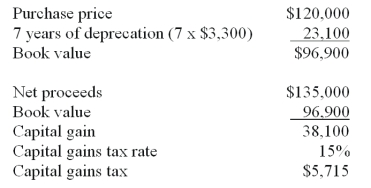

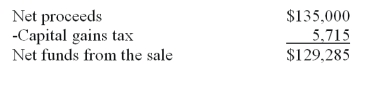

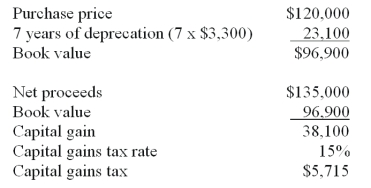

A duplex was purchases for $120,000 and depreciation of $3,300 has been taken for the last seven years.The net proceeds from the sale of the property is $135,000.

(a)Assuming the property qualifies for capital gains treatment at a 15% rate,what is the tax owed?

(b)What are the net funds from the sale?

(a)Assuming the property qualifies for capital gains treatment at a 15% rate,what is the tax owed?

(b)What are the net funds from the sale?

a)  b)

b)

b)

b)