Deck 22: Decision Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

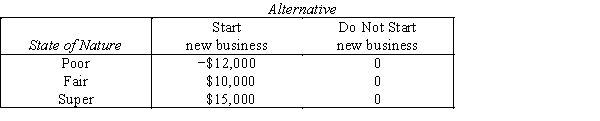

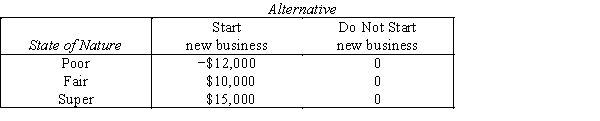

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

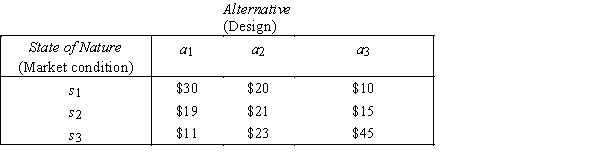

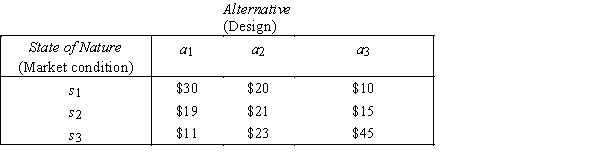

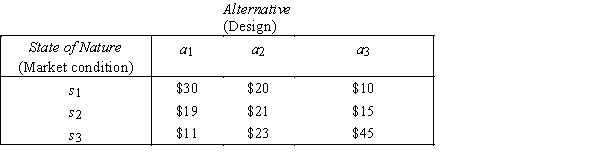

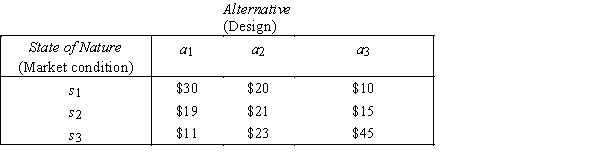

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/123

العب

ملء الشاشة (f)

Deck 22: Decision Analysis

1

In making decisions,we choose the decision with the largest expected monetary value,or the smallest expected opportunity loss.

True

2

If EOL(a1)= $13,000,EOL(a2)= $25,000,and EOL(a3)= $20,000,then EOL* = $13,000.

True

3

Incentive programs for sales staff would be considered a state of nature for a business firm.

False

4

Opportunity loss is the difference between the lowest profit for an event and the actual profit obtained for an action taken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

5

A payoff table lists the monetary values for each possible combination of the

A)event (state of nature)and act (alternative).

B)mean and standard deviation.

C)mean and median.

D)None of these choices.

A)event (state of nature)and act (alternative).

B)mean and standard deviation.

C)mean and median.

D)None of these choices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

6

All entries of any opportunity loss table are negative values since they represent losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

7

The expected monetary value (EMV)decision is always the same as the expected opportunity loss (EOL)decision because the opportunity loss table is produced directly from the payoff table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

8

A tabular presentation that shows the outcome for each decision alternative under the various states of nature is called a:

A)payback period matrix.

B)decision matrix.

C)decision tree.

D)payoff table.

A)payback period matrix.

B)decision matrix.

C)decision tree.

D)payoff table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

9

We can use the payoff table to calculate the expected monetary value (EMV)and the expected opportunity loss (EOL)of each act (alternative).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

10

Worker safety laws would be considered a state of nature for a business firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

11

The payoff table is a table in which the rows are states of nature,the columns are decision alternatives,and the entry at each intersection of a row and column is a numerical payoff such as a profit or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

12

An opportunity loss is the difference between what the decision maker's profit for an act (alternative)is and what the profit could have been had the best decision been made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

13

If EMV(a1)= $50,000,EMV(a2)= $65,000,and EMV(a3)= $45,000,then EMV* = $160,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following would not be considered a state of nature for a business firm?

A)Federal Reserve regulations

B)Food and Drug Administration regulations

C)The number of employees to hire

D)Minimum wage regulations

A)Federal Reserve regulations

B)Food and Drug Administration regulations

C)The number of employees to hire

D)Minimum wage regulations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

15

In general,the expected monetary values (EMV)represent possible payoffs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

16

A surgeon is involved in a $3 million malpractice suit.He can either settle out of court for $750,000 or go to court.If he goes to court and loses,he must pay $2,500,000 plus $500,000 in court costs.If he wins in court the plaintiffs pay the court costs.Identify the actions of this decision-making problem.

A)Two choices: (1)go to court and (2)settle out of court.

B)Two choices: (1)win the case in court and (2)lose the case in court.

C)Four consequences resulting from Go/Settle and Win/Lose combinations.

D)The amount of money paid by the doctor.

A)Two choices: (1)go to court and (2)settle out of court.

B)Two choices: (1)win the case in court and (2)lose the case in court.

C)Four consequences resulting from Go/Settle and Win/Lose combinations.

D)The amount of money paid by the doctor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

17

The expected monetary value decision is always the same as the expected opportunity loss decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

18

The expected monetary value (EMV)of a decision alternative is the sum of the products of the payoffs and the state of nature probabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following would be considered a state of nature for a business firm?

A)Inventory levels

B)Worker safety laws

C)Site for new plant

D)Salaries for employees

A)Inventory levels

B)Worker safety laws

C)Site for new plant

D)Salaries for employees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

20

In general,the branches of a decision tree represent acts and states of nature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

21

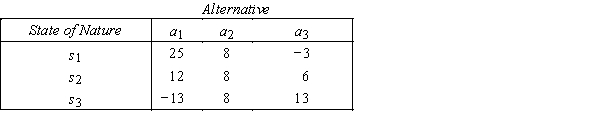

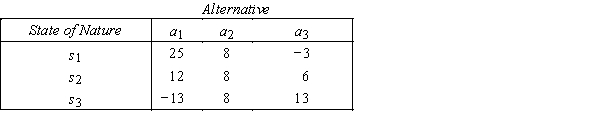

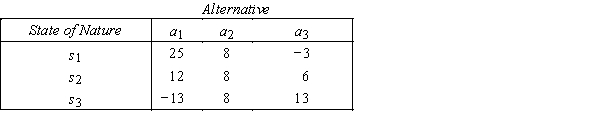

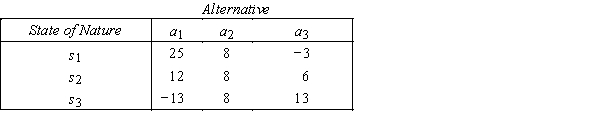

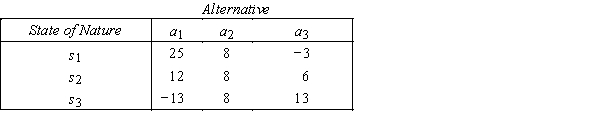

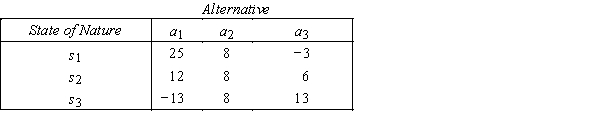

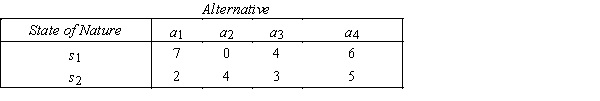

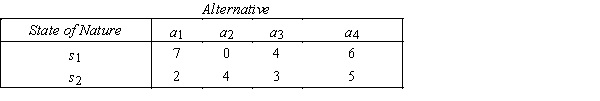

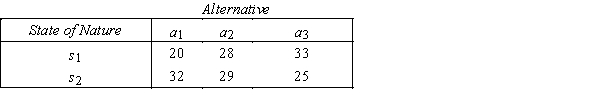

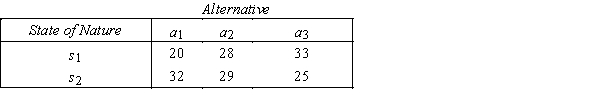

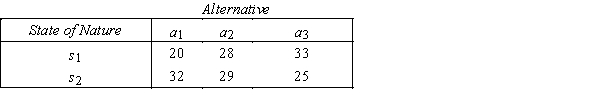

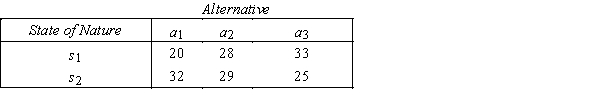

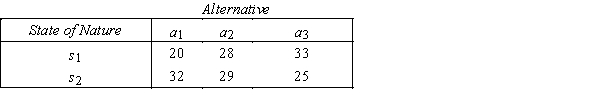

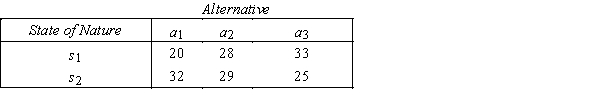

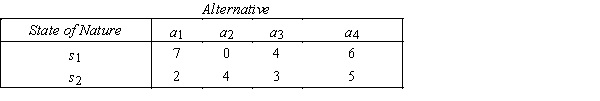

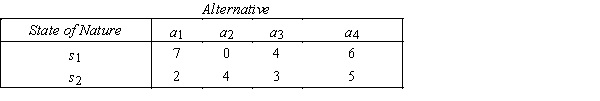

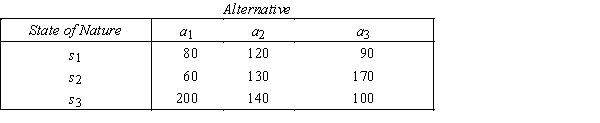

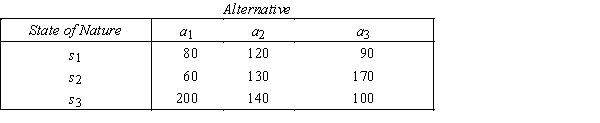

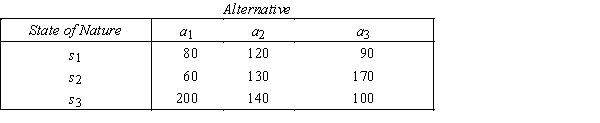

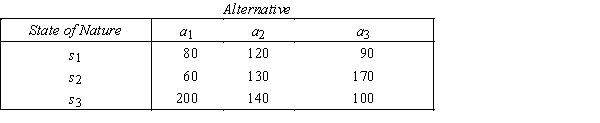

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} The opportunity loss for a2 when s1 occurs is________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} The opportunity loss for a2 when s1 occurs is________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

22

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the optimal alternative using EMV is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the optimal alternative using EMV is ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements is false regarding the expected monetary value (EMV)?

A)To calculate the EMV,the probabilities of the states of nature must be already decided upon.

B)We choose the decision with the largest EMV.

C)In general,the expected monetary values represent possible payoffs.

D)None of these choices.

A)To calculate the EMV,the probabilities of the states of nature must be already decided upon.

B)We choose the decision with the largest EMV.

C)In general,the expected monetary values represent possible payoffs.

D)None of these choices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

24

What is meant by the expected monetary value (EMV)of a decision alternative?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

25

Sporting Goods Store

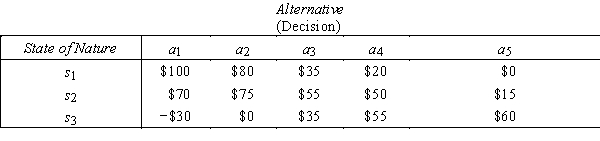

A payoff table for a clothing store is shown below. The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

{Sporting Goods Store Narrative} Determine the EOL decision.

A payoff table for a clothing store is shown below.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2. {Sporting Goods Store Narrative} Determine the EOL decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

26

Sporting Goods Store

A payoff table for a clothing store is shown below. The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

{Sporting Goods Store Narrative} Set up the opportunity loss table.

A payoff table for a clothing store is shown below.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2. {Sporting Goods Store Narrative} Set up the opportunity loss table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

27

Sporting Goods Store

A payoff table for a clothing store is shown below. The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

{Sporting Goods Store Narrative} Determine the EMV decision.

A payoff table for a clothing store is shown below.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.2,P(s2)= 0.6,and P(s3)= 0.2. {Sporting Goods Store Narrative} Determine the EMV decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

28

Gas Company

A payoff table for an electric company is shown below: The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

{Gas Company Narrative} Calculate the expected monetary value for each act with present information.What decision should be made using the EMV criterion?

A payoff table for an electric company is shown below:

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7. {Gas Company Narrative} Calculate the expected monetary value for each act with present information.What decision should be made using the EMV criterion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

29

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2 and s2 is 0.8,then the expected monetary value (EMV)of a1 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2 and s2 is 0.8,then the expected monetary value (EMV)of a1 is ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

30

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected monetary value (EMV)for a1 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected monetary value (EMV)for a1 is ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

31

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected monetary value (EMV)for a2 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected monetary value (EMV)for a2 is ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

32

A company that manufactures baseball gloves is contemplating whether to increase its advertising budget by $3 million for next year.If the expanded advertising campaign is successful,the company expects sales to increase by $4.8 million next year.If the advertising campaign fails,the company expects sales to increase by only $900,000 next year.If the advertising budget is not increased,the company expects sales to increase by $450,000.Identify the possible outcomes in this decision-making problem.

A)Two choices: (1)increase the budget and (2)do not increase the budget.

B)Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

C)Two choices: (1)campaign is successful and (2)campaign is not successful.

D)The increase in sales dollars next year.

A)Two choices: (1)increase the budget and (2)do not increase the budget.

B)Four consequences resulting from the Increase/Do Not Increase and Successful/Not Successful combinations.

C)Two choices: (1)campaign is successful and (2)campaign is not successful.

D)The increase in sales dollars next year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

33

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} The opportunity loss for a3 when s2 occurs is________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} The opportunity loss for a3 when s2 occurs is________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

34

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2,the optimal alternative using EOL is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2,the optimal alternative using EOL is ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

35

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.4,then the probability of s2 is______________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.4,then the probability of s2 is______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

36

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2 and s2 is 0.8,then the expected opportunity loss (EOL)for a1 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.2 and s2 is 0.8,then the expected opportunity loss (EOL)for a1 is ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is true?

A)The process of determining the EMV decision is called the rollback technique.

B)We choose the act that produces the smallest expected opportunity loss (EOL)

C)The EMV decision is always the same as the EOL decision.

D)All of these choices are true.

A)The process of determining the EMV decision is called the rollback technique.

B)We choose the act that produces the smallest expected opportunity loss (EOL)

C)The EMV decision is always the same as the EOL decision.

D)All of these choices are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

38

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected opportunity loss (EOL)for a3 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected opportunity loss (EOL)for a3 is ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

39

Gross Profits

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected opportunity loss (EOL)for a1 is ____________________.

The following payoff table shows gross profits (in $1000)associated with a set of 3 acts under 2 possible states of nature.

{Gross Profits Narrative} If the probability of s1 is 0.5,then the expected opportunity loss (EOL)for a1 is ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

40

What is meant by a payoff table?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

41

Gas Company

A payoff table for an electric company is shown below: The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

{Gas Company Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

A payoff table for an electric company is shown below:

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7. {Gas Company Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

42

Demolition Company

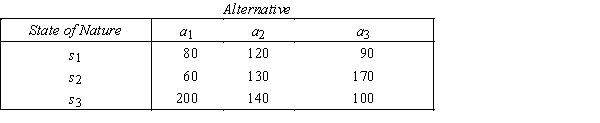

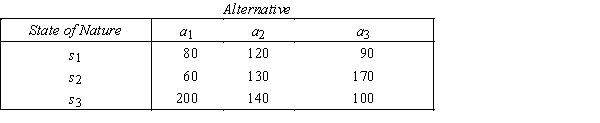

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below: Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

{Demolition Company Narrative} Determine the EMV decision.

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below:

Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1. {Demolition Company Narrative} Determine the EMV decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

43

Container Company

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future. Scenario 1: The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now. Scenario 2: The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now. Scenario 3: The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now. The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} What decision will be made to maximize expected payoff?

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future. Scenario 1: The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now. Scenario 2: The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now. Scenario 3: The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now. The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} What decision will be made to maximize expected payoff?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

44

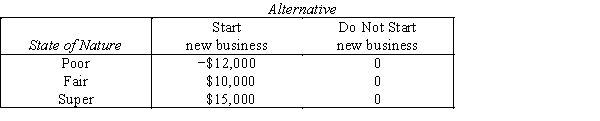

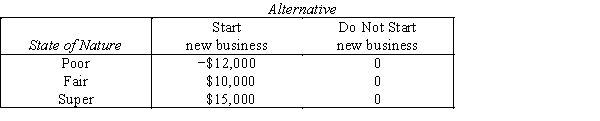

Video Business

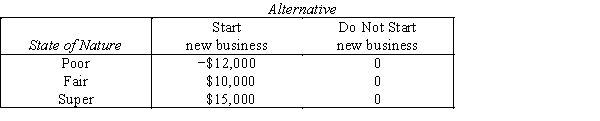

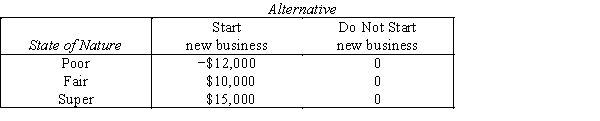

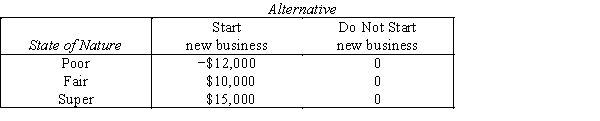

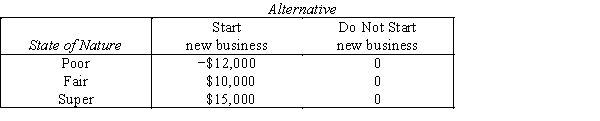

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is: The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

{Video Business Narrative} Calculate the expected monetary value for each act with present information.What decision should be made using the EMV criterion?

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2. {Video Business Narrative} Calculate the expected monetary value for each act with present information.What decision should be made using the EMV criterion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

45

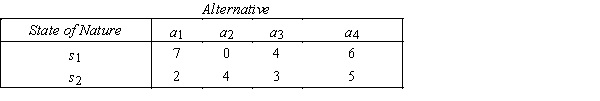

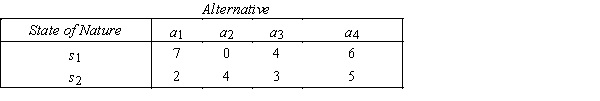

Hobby Shop

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below: Payoff Table: Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6.

Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6.

{Hobby Shop Narrative} Determine the EOL decision.

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below: Payoff Table:

Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6.

Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6. {Hobby Shop Narrative} Determine the EOL decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

46

Container Company

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future. Scenario 1: The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now. Scenario 2: The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now. Scenario 3: The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now. The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Develop a payoff table for this decision situation.

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future. Scenario 1: The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now. Scenario 2: The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now. Scenario 3: The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now. The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Develop a payoff table for this decision situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

47

Container Company

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future. Scenario 1: The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now. Scenario 2: The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now. Scenario 3: The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now. The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Which decision has the minimum expected opportunity loss?

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future. Scenario 1: The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now. Scenario 2: The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now. Scenario 3: The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now. The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Which decision has the minimum expected opportunity loss?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

48

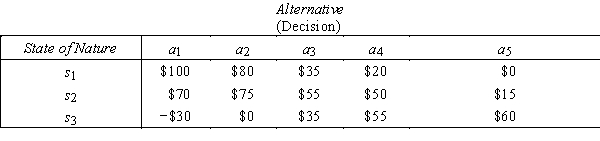

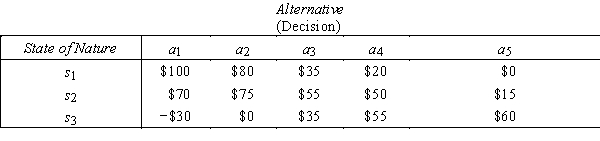

Food Market

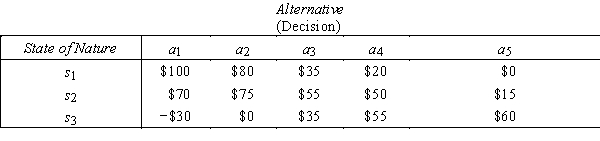

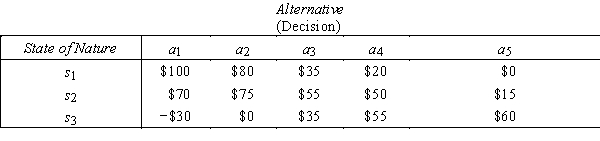

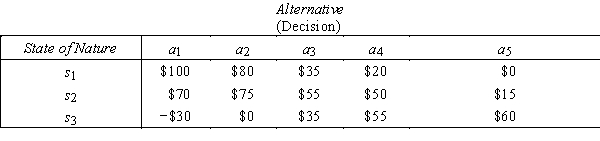

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market: The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

{Food Market Narrative} Calculate the expected monetary value for each alternative with present information.What decision should be made using the EMV criterion?

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market:

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5. {Food Market Narrative} Calculate the expected monetary value for each alternative with present information.What decision should be made using the EMV criterion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

49

Video Business

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is: The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

{Video Business Narrative} Review the decisions made in the previous questions.Is this a coincidence? Explain.

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2. {Video Business Narrative} Review the decisions made in the previous questions.Is this a coincidence? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

50

Food Market

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market: The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

{Food Market Narrative} Convert the payoff table to an opportunity loss table.

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market:

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5. {Food Market Narrative} Convert the payoff table to an opportunity loss table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

51

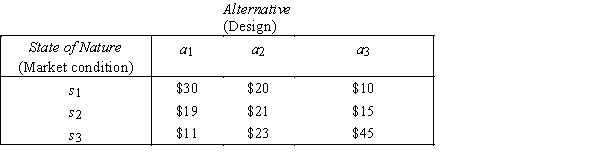

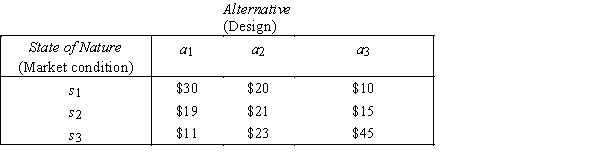

Dishwasher Designs

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars. Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

{Dishwasher Designs Narrative} Calculate the expected monetary value for each design with present information.Which design should be selected in order to maximize the firm's expected profit?

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3. {Dishwasher Designs Narrative} Calculate the expected monetary value for each design with present information.Which design should be selected in order to maximize the firm's expected profit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

52

Dishwasher Designs

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars. Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

{Dishwasher Designs Narrative} Calculate the expected opportunity loss for each design with present information.Which design should be selected in order to minimize the firm's expected loss?

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3. {Dishwasher Designs Narrative} Calculate the expected opportunity loss for each design with present information.Which design should be selected in order to minimize the firm's expected loss?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

53

Video Business

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is: The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

{Video Business Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2. {Video Business Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

54

Hobby Shop

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below: Payoff Table: Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6.

Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6.

{Hobby Shop Narrative} Set up the opportunity loss table.

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below: Payoff Table:

Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6.

Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6. {Hobby Shop Narrative} Set up the opportunity loss table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

55

Hobby Shop

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below: Payoff Table: Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6.

Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6.

{Hobby Shop Narrative} Determine the EMV decision.

A payoff table and the prior probabilities for two states of nature for a Hobby Shop are shown below: Payoff Table:

Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6.

Prior Probabilities: P(s1)= 0.4,and P(s2)= 0.6. {Hobby Shop Narrative} Determine the EMV decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

56

Container Company

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future. Scenario 1: The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now. Scenario 2: The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now. Scenario 3: The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now. The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Set up the opportunity loss table.

A company must decide whether or not to change its packaging to a more environmentally safe material.The impact of the decision on profits depends on which of the following three possible scenarios develops in the future. Scenario 1: The media does not focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $35 million if they change their packaging now,but will make $75 million if they do not change their packaging now. Scenario 2: The media does focus heavily on concerns about packaging and no new laws requiring changes in packaging are passed.Under this scenario,the company will make $50 million if they change their packaging now,but will make $55 million if they do not change their packaging now. Scenario 3: The media does focus heavily on concerns about packaging and new laws requiring changes in packaging are passed.Under this scenario,the company will make $60 million if they change their packaging now,but will make only $15 million if they do not change their packaging now. The prior probabilities of the three scenarios are 0.3,0.5,and 0.2,respectively.

{Container Company Narrative} Set up the opportunity loss table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

57

Gas Company

A payoff table for an electric company is shown below: The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

{Gas Company Narrative} Convert the payoff table to an opportunity loss table.

A payoff table for an electric company is shown below:

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7.

The following prior probabilities are assigned to the states of nature: P(s1)= 0.3,P(s2)= 0.7. {Gas Company Narrative} Convert the payoff table to an opportunity loss table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

58

Food Market

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market: The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

{Food Market Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

The following table displays the payoffs (in thousands of dollars)for five different decision alternatives under three possible states of nature for a new food market:

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5.

The prior probabilities of the states of nature are: P(s1)= 0.2,P(s2)= 0.3,and P(s3)= 0.5. {Food Market Narrative} Calculate the expected opportunity loss for each act with present information.What decision should be made using the EOL criterion?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

59

Dishwasher Designs

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars. Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

{Dishwasher Designs Narrative} Convert the payoff table to an opportunity loss table.

Three different designs are being considered for a new dishwasher,and profits will depend on the combination of the dishwasher design and market condition.The following payoff table summarizes the decision situation,with amounts in millions of dollars.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3.

Assume that the following probabilities are assigned to the three market conditions: P(s1)= 0.1,P(s2)= 0.6,and P(s3)= 0.3. {Dishwasher Designs Narrative} Convert the payoff table to an opportunity loss table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

60

Video Business

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is: The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

{Video Business Narrative} Convert the payoff table to an opportunity loss table.

A high school student,who started doing videos as a hobby,is considering going into the videography business.The anticipated payoff table is:

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2.

The following prior probabilities are assigned to the states of nature: P(poor)= 0.4,P(fair)= 0.4,and P(super)= 0.2. {Video Business Narrative} Convert the payoff table to an opportunity loss table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following statements is correct?

A)The EMV criterion selects the act with the largest expected monetary value.

B)The EOL criterion selects the act with the smallest expected opportunity loss.

C)The expected value of perfect information (EVPI)equals the smallest expected opportunity loss.

D)All of these choices are true.

A)The EMV criterion selects the act with the largest expected monetary value.

B)The EOL criterion selects the act with the smallest expected opportunity loss.

C)The expected value of perfect information (EVPI)equals the smallest expected opportunity loss.

D)All of these choices are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

62

The preposterior analysis determines whether or not sample information should be purchased to revise the prior probabilities associated with the states of nature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

63

The expected value of perfect information (EVPI)equals the largest expected opportunity loss (EOL*).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

64

The objective of a preposterior analysis is to determine whether the value of the prediction is greater or less than the cost of the information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

65

Demolition Company

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below: Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

{Demolition Company Narrative} Determine the EOL decision.

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below:

Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1. {Demolition Company Narrative} Determine the EOL decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

66

The expected value of perfect information (EVPI)is the difference between the expected payoff with perfect information (EPPI)and the expected monetary value (EMV*).That is,EVPI = EPPI − EMV*.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

67

The expected value of perfect information is the same as the:

A)expected monetary value for the best alternative.

B)expected monetary value for worst alternative.

C)expected opportunity loss for the best alternative.

D)expected opportunity loss for the worst alternative.

A)expected monetary value for the best alternative.

B)expected monetary value for worst alternative.

C)expected opportunity loss for the best alternative.

D)expected opportunity loss for the worst alternative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

68

The procedure for revising probabilities based upon additional information is referred to as:

A)utility theory.

B)Bernoulli's theorem.

C)central limit theorem.

D)Bayes Law.

A)utility theory.

B)Bernoulli's theorem.

C)central limit theorem.

D)Bayes Law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

69

The minimum expected opportunity loss is also equal to the:

A)expected profit under certainty.

B)expected value of perfect information.

C)coefficient of variation.

D)expected value under certainty minus the expected monetary value of the worst alternative.

A)expected profit under certainty.

B)expected value of perfect information.

C)coefficient of variation.

D)expected value under certainty minus the expected monetary value of the worst alternative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

70

The difference between expected payoff under certainty and expected value of the best act without certainty is the:

A)expected monetary value.

B)expected net present value.

C)expected value of perfect information.

D)expected rate of return.

A)expected monetary value.

B)expected net present value.

C)expected value of perfect information.

D)expected rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

71

The expected payoff with perfect information (EPPI)represents the maximum amount a decision maker would be willing to pay for perfect information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

72

Demolition Company

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below: Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

{Demolition Company Narrative} Set up the opportunity loss table.

The payoff table and the prior probabilities for three states of nature for a demolition company are shown below:

Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1.

Prior Probabilities: P(s1)= 0.4,P(s2)= 0.5,and P(s3)= 0.1. {Demolition Company Narrative} Set up the opportunity loss table.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

73

The expected value of sample information (EVSI)is the difference between the expected monetary value with additional information (EMV')and the expected monetary value without additional information (EMV*).That is,EVSI = (EMV')− EMV*.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

74

We calculate the expected payoff with perfect information (EPPI)by multiplying the probability of each state of nature by the smallest payoff associated with that state of nature,and then summing the products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

75

The expected value of sample information (EVSI)is the difference between:

A)the posterior probabilities and the prior probabilities of the states of nature.

B)the expected payoff with perfect information (EPPI)and the expected monetary value for the best decision (EMV*).

C)the expected monetary value with additional information (EMV')and the expected monetary value for the best decision (EMV*).

D)the expected value of perfect information (EVPI)and the smallest expected opportunity loss (EOL*).

A)the posterior probabilities and the prior probabilities of the states of nature.

B)the expected payoff with perfect information (EPPI)and the expected monetary value for the best decision (EMV*).

C)the expected monetary value with additional information (EMV')and the expected monetary value for the best decision (EMV*).

D)the expected value of perfect information (EVPI)and the smallest expected opportunity loss (EOL*).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

76

The EVPI represents the ____________________ amount that a decision maker should be willing to pay for perfect information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following statements is correct?

A)The expected value of perfect information (EVPI)equals the largest expected monetary value (EMV*).

B)The expected value of perfect information (EVPI)equals the smallest expected opportunity loss (EOL*).

C)The expected value of perfect information (EVPI)equals the expected payoff with perfect information (EPPI).

D)All of these choices are true

A)The expected value of perfect information (EVPI)equals the largest expected monetary value (EMV*).

B)The expected value of perfect information (EVPI)equals the smallest expected opportunity loss (EOL*).

C)The expected value of perfect information (EVPI)equals the expected payoff with perfect information (EPPI).

D)All of these choices are true

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

78

To calculate expected profit under certainty,we need to have perfect information about which event will occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

79

Removal of uncertainty from a decision-making problem leads to a case referred to as perfect information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck

80

The expected value of perfect information (EVPI)is always the same as the expected opportunity loss for the best alternative.That is,EVPI = EOL*.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 123 في هذه المجموعة.

فتح الحزمة

k this deck