Deck 20: Income Inequality and Poverty

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/70

العب

ملء الشاشة (f)

Deck 20: Income Inequality and Poverty

1

Which of the following is correct?

A)Governments can never improve market outcomes.

B)Governments can sometimes improve market outcomes.

C)Governments can always improve market outcomes.

D)Government can never make the income distribution more equal.

A)Governments can never improve market outcomes.

B)Governments can sometimes improve market outcomes.

C)Governments can always improve market outcomes.

D)Government can never make the income distribution more equal.

B

2

Which of the following statements is correct?

A)The poverty line is a relative standard.

B)More families are pushed above the poverty line as economic growth pushes the entire income distribution upward.

C)Increasing income inequality reduces poverty.

D)Economic growth,by definition,affects all families equally.

A)The poverty line is a relative standard.

B)More families are pushed above the poverty line as economic growth pushes the entire income distribution upward.

C)Increasing income inequality reduces poverty.

D)Economic growth,by definition,affects all families equally.

B

3

Of the four countries below,the country that has the most income equality is

A)Japan.

B)Brazil.

C)South Africa.

D)the United States.

A)Japan.

B)Brazil.

C)South Africa.

D)the United States.

A

4

Which of the following is most likely to occur when the government enacts policies to make the distribution of income more equal?

A)a more efficient allocation of resources

B)a distortion of incentives

C)unchanged behavior

D)All of the above are correct.

A)a more efficient allocation of resources

B)a distortion of incentives

C)unchanged behavior

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

5

Table 20-8

-Refer to Table 20-8.In 2008,the bottom 60% of families has

A)about 14% of total income in the U.S.

B)about 29% of total income in the U.S.

C)about 50% of total income in the U.S.

D)about 73% of total income in the U.S.

-Refer to Table 20-8.In 2008,the bottom 60% of families has

A)about 14% of total income in the U.S.

B)about 29% of total income in the U.S.

C)about 50% of total income in the U.S.

D)about 73% of total income in the U.S.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

6

Measuring poverty using an absolute income scale like the poverty line can be misleading because

A)income measures do not include the value of in-kind transfers.

B)money is more highly valued by the rich than by the poor.

C)the poor are not likely to participate in the labor market.

D)income measures are not adjusted for the effects of labor-market discrimination.

A)income measures do not include the value of in-kind transfers.

B)money is more highly valued by the rich than by the poor.

C)the poor are not likely to participate in the labor market.

D)income measures are not adjusted for the effects of labor-market discrimination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following represents a problem in measuring inequality?

A)Measurements of income distributions typically include in-kind transfers,which distort the measure of inequality.

B)A normal life-cycle pattern causes inequality in the income distribution but may not reflect inequality in living standards.

C)Transitory income is a better measure of inequality than permanent income.

D)Both a and b are correct.

A)Measurements of income distributions typically include in-kind transfers,which distort the measure of inequality.

B)A normal life-cycle pattern causes inequality in the income distribution but may not reflect inequality in living standards.

C)Transitory income is a better measure of inequality than permanent income.

D)Both a and b are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

8

-Refer to Table 20-4.In 2007,the top fifth of families have

A)almost 15 times as much income as the bottom fifth of families.

B)96.6% more income than the bottom fifth of families.

C)50.3% more income than the bottom fifth of families.

D)46.9% more income than the bottom fifth of families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

9

Table 20-5

-Refer to Table 20-5.Which country has the most equal income distribution?

A)Latvia

B)Italy

C)France

D)Sweden

-Refer to Table 20-5.Which country has the most equal income distribution?

A)Latvia

B)Italy

C)France

D)Sweden

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

10

Measures of poverty that fail to account for the value of in-kind transfers

A)understate the actual poverty rate.

B)have little effect on the validity of reported poverty rates.

C)are generally more reliable measures of actual poverty rates.

D)overstate the actual poverty rate.

A)understate the actual poverty rate.

B)have little effect on the validity of reported poverty rates.

C)are generally more reliable measures of actual poverty rates.

D)overstate the actual poverty rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

11

The poverty line is adjusted each year to reflect changes in the

A)number of people currently on public assistance.

B)level of prices.

C)nutritional content of an "adequate" diet.

D)size of a family.

A)number of people currently on public assistance.

B)level of prices.

C)nutritional content of an "adequate" diet.

D)size of a family.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is not correct?

A)Poverty is long-term problem for relatively few families.

B)Measurements of income inequality usually do not include in-kind transfers.

C)Measurements of income inequality use lifetime incomes rather than annual incomes.

D)Measurements of income inequality would be more meaningful if they reflected permanent rather than current income.

A)Poverty is long-term problem for relatively few families.

B)Measurements of income inequality usually do not include in-kind transfers.

C)Measurements of income inequality use lifetime incomes rather than annual incomes.

D)Measurements of income inequality would be more meaningful if they reflected permanent rather than current income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

13

Table 20-8

-Refer to Table 20-8.In 2008,the top fifth of families has

A)about 12 times as much income as the bottom fifth of families.

B)6.8% more income than the bottom fifth of families.

C)47.8% more income than the bottom fifth of families.

D)96.6% more income than the bottom fifth of families.

-Refer to Table 20-8.In 2008,the top fifth of families has

A)about 12 times as much income as the bottom fifth of families.

B)6.8% more income than the bottom fifth of families.

C)47.8% more income than the bottom fifth of families.

D)96.6% more income than the bottom fifth of families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

14

If income were equally distributed among households,

A)each household's relative share of income would increase.

B)each household's relative share of income would decrease.

C)the top fifth of households would have 50 percent of the income.

D)50 percent of the households would receive exactly 50 percent of the income.

A)each household's relative share of income would increase.

B)each household's relative share of income would decrease.

C)the top fifth of households would have 50 percent of the income.

D)50 percent of the households would receive exactly 50 percent of the income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

15

-Refer to Table 20-4.In 2007,the bottom 60% of families have

A)only 12% of total income in the U.S.

B)only 27% of total income in the U.S.

C)50% of total income in the U.S.

D)73% of total income in the U.S.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

16

Of the four countries below,which has the highest degree of income inequality?

A)Japan

B)Brazil

C)South Africa

D)United States

A)Japan

B)Brazil

C)South Africa

D)United States

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

17

A commonly-used gauge of poverty is the

A)income inequality rate.

B)average income rate.

C)poverty rate.

D)social inequality rate.

A)income inequality rate.

B)average income rate.

C)poverty rate.

D)social inequality rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

18

Table 20-5

-Refer to Table 20-5.Which country has the most unequal income distribution?

A)Latvia

B)Italy

C)France

D)Sweden

-Refer to Table 20-5.Which country has the most unequal income distribution?

A)Latvia

B)Italy

C)France

D)Sweden

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

19

Governments enact policies to

A)make the distribution of income more efficient.

B)make the distribution of income more equal.

C)maximize the use of the welfare system.

D)minimize the use of in-kind transfers.

A)make the distribution of income more efficient.

B)make the distribution of income more equal.

C)maximize the use of the welfare system.

D)minimize the use of in-kind transfers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

20

The poverty rate is based on a family's

A)income,in-kind transfers,and other government aid.

B)income and in-kind transfers.

C)in-kind transfers only.

D)income only.

A)income,in-kind transfers,and other government aid.

B)income and in-kind transfers.

C)in-kind transfers only.

D)income only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is not correct?

A)Poverty is correlated with race.

B)Poverty is correlated with age.

C)Poverty is correlated with family composition.

D)All of the above are correct.

A)Poverty is correlated with race.

B)Poverty is correlated with age.

C)Poverty is correlated with family composition.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

22

The typical economic life cycle illustrates how people tend to

A)borrow more when they are younger and save more when they are middle-aged.

B)earn their peak incomes immediately prior to the typical retirement age of 65.

C)adjust their consumption based on changes in their transitory income.

D)All of the above are correct.

A)borrow more when they are younger and save more when they are middle-aged.

B)earn their peak incomes immediately prior to the typical retirement age of 65.

C)adjust their consumption based on changes in their transitory income.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

23

Libertarians believe that in considering economic fairness,one should primarily consider the

A)outcome of the system.

B)process by which outcomes arise.

C)maximin criterion.

D)maximization total social utility.

A)outcome of the system.

B)process by which outcomes arise.

C)maximin criterion.

D)maximization total social utility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

24

The goal of libertarianism is to

A)redistribute income based on the assumption of diminishing marginal utility.

B)redistribute income in order to maximize the well-being of the worst-off person in society.

C)punish crimes and enforce voluntary agreements but not to redistribute income.

D)measure happiness and satisfaction.

A)redistribute income based on the assumption of diminishing marginal utility.

B)redistribute income in order to maximize the well-being of the worst-off person in society.

C)punish crimes and enforce voluntary agreements but not to redistribute income.

D)measure happiness and satisfaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

25

The regular pattern of income variation over a person's life is called

A)the earned income cycle.

B)the substitution effect.

C)the life cycle.

D)the pattern of change.

A)the earned income cycle.

B)the substitution effect.

C)the life cycle.

D)the pattern of change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

26

In-kind transfers are

A)obtained only by those who have political connections.

B)provided only by the government.

C)non-monetary items given to the poor.

D)obtained primarily through private charities.

A)obtained only by those who have political connections.

B)provided only by the government.

C)non-monetary items given to the poor.

D)obtained primarily through private charities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

27

A family's ability to buy goods and services depends largely on the family's

A)economic mobility.

B)place in the economic life cycle.

C)transitory income.

D)permanent income.

A)economic mobility.

B)place in the economic life cycle.

C)transitory income.

D)permanent income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

28

Whether or not policymakers should try to make our society more egalitarian is largely a matter of

A)economic efficiency.

B)political philosophy.

C)egalitarian principles.

D)enhanced opportunity.

A)economic efficiency.

B)political philosophy.

C)egalitarian principles.

D)enhanced opportunity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

29

Utilitarianism is

A)a liberal religion that focuses on individual rights.

B)a political philosophy that believes the government should choose policies deemed to be just by an impartial observer.

C)a political philosophy that believes the government should not redistribute income.

D)a political philosophy that believes the government should choose policies to maximize the total utility of society.

A)a liberal religion that focuses on individual rights.

B)a political philosophy that believes the government should choose policies deemed to be just by an impartial observer.

C)a political philosophy that believes the government should not redistribute income.

D)a political philosophy that believes the government should choose policies to maximize the total utility of society.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

30

People have their highest saving rates when they are

A)retired.

B)middle-aged.

C)married with young children.

D)young and single.

A)retired.

B)middle-aged.

C)married with young children.

D)young and single.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

31

Would the maximin criterion achieve perfect income equality?

A)Yes.There would be no way to reallocate resources to raise the utility of the poor.

B)Yes.The maximin criterion would eliminate poverty.

C)No.It is impossible for complete equality to benefit the worst-off people in society.

D)No.Complete equality would reduce incentives to work,which would reduce total income,which would reduce the incomes of the worst-off people in society.

A)Yes.There would be no way to reallocate resources to raise the utility of the poor.

B)Yes.The maximin criterion would eliminate poverty.

C)No.It is impossible for complete equality to benefit the worst-off people in society.

D)No.Complete equality would reduce incentives to work,which would reduce total income,which would reduce the incomes of the worst-off people in society.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

32

Diminishing marginal utility suggests that

A)more is always preferred to less.

B)the well-being of society is maximized when the distribution of income is equal.

C)the poor are less efficient at spending money than the rich.

D)the poor receive more satisfaction from the last dollar spent than the rich.

A)more is always preferred to less.

B)the well-being of society is maximized when the distribution of income is equal.

C)the poor are less efficient at spending money than the rich.

D)the poor receive more satisfaction from the last dollar spent than the rich.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

33

According to the doctrine of liberalism,principles of justice are the result of

A)fair agreement and bargain.

B)command-and-control policies.

C)domination of the powerful by the weak.

D)workers owning the factors of production.

A)fair agreement and bargain.

B)command-and-control policies.

C)domination of the powerful by the weak.

D)workers owning the factors of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

34

Liberalism suggests that public policies should aim to

A)maximize the sum of utility of everyone in society.

B)maximize the well-being of the average person in society.

C)maximize the well-being of the worst-off person in society.

D)minimize the difference between the utility of the best-off person in the society and the utility of the worst-off person in society.

A)maximize the sum of utility of everyone in society.

B)maximize the well-being of the average person in society.

C)maximize the well-being of the worst-off person in society.

D)minimize the difference between the utility of the best-off person in the society and the utility of the worst-off person in society.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

35

A utilitarian government has to balance the gains from greater income equality against the losses from distorted work incentives.To maximize total utility,therefore,the government

A)would never tax labor income.

B)must always achieve a fully egalitarian society.

C)enacts policies that only benefit the middle class.

D)stops short of a fully egalitarian society.

A)would never tax labor income.

B)must always achieve a fully egalitarian society.

C)enacts policies that only benefit the middle class.

D)stops short of a fully egalitarian society.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

36

Suppose that a family saves and borrows to buffer itself against changes in income.These actions relate to which problem in measuring inequality?

A)in-kind transfers

B)negative income tax

C)transitory versus permanent income

D)economic mobility

A)in-kind transfers

B)negative income tax

C)transitory versus permanent income

D)economic mobility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

37

An example of a transitory change in income is the

A)annual cost of living adjustment to your salary.

B)increase in income that results from a job promotion linked to your education.

C)increase in income of California orange growers that results from an orange-killing frost in Florida.

D)All of the above are correct.

A)annual cost of living adjustment to your salary.

B)increase in income that results from a job promotion linked to your education.

C)increase in income of California orange growers that results from an orange-killing frost in Florida.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

38

The normal life cycle pattern of income

A)contributes to more inequality in the distribution of annual income and to more inequality in living standards.

B)contributes to more inequality in the distribution of annual income,but it does not necessarily contribute to more inequality in living standards.

C)contributes to less inequality in the distribution of annual income and to less inequality in living standards.

D)has no effect on either the distribution of annual income or on living standards.

A)contributes to more inequality in the distribution of annual income and to more inequality in living standards.

B)contributes to more inequality in the distribution of annual income,but it does not necessarily contribute to more inequality in living standards.

C)contributes to less inequality in the distribution of annual income and to less inequality in living standards.

D)has no effect on either the distribution of annual income or on living standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

39

The best government policy to reduce poverty is

A)a minimum wage law because the resulting unemployment is small in comparison to the benefits to people it helps.

B)an expanded welfare program because people must have an additional "need" such as small children or a disability.

C)an in-kind transfer because it ensures that the poor receive what they need most such as food or shelter.

D)not obvious.Government programs to reduce poverty have many advantages but also many disadvantages.

A)a minimum wage law because the resulting unemployment is small in comparison to the benefits to people it helps.

B)an expanded welfare program because people must have an additional "need" such as small children or a disability.

C)an in-kind transfer because it ensures that the poor receive what they need most such as food or shelter.

D)not obvious.Government programs to reduce poverty have many advantages but also many disadvantages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

40

The concept of diminishing marginal utility is embedded in the utilitarian rationale for

A)trickle-down effects.

B)enhancing market efficiency.

C)redistributing income.

D)maintaining the status quo income distribution.

A)trickle-down effects.

B)enhancing market efficiency.

C)redistributing income.

D)maintaining the status quo income distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

41

When the government enacts policies to make the distribution of income more equitable,it distorts incentives,alters behavior,and makes the allocation of resources less efficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

42

Unemployment insurance benefits is a type of

A)in-kind transfer.

B)negative income tax payment.

C)property income.

D)welfare payment.

A)in-kind transfer.

B)negative income tax payment.

C)property income.

D)welfare payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

43

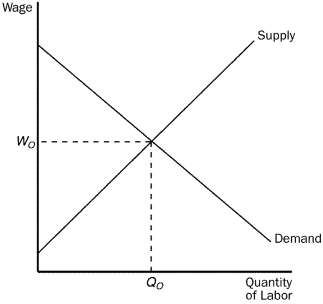

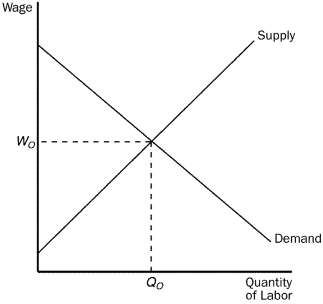

Figure 20-5

Refer to Figure 20-5.If the government imposes a minimum wage above Wo,it is likely to

A)increase employment to a level above Qo.

B)reduce employment to a level below Qo.

C)provide more income to the working poor than they collectively received before the minimum wage was set.

D)have no effect on employment.

Refer to Figure 20-5.If the government imposes a minimum wage above Wo,it is likely to

A)increase employment to a level above Qo.

B)reduce employment to a level below Qo.

C)provide more income to the working poor than they collectively received before the minimum wage was set.

D)have no effect on employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

44

The utilitarian justification for redistributing income is based on the assumption of diminishing marginal utility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

45

The maximin criterion is the idea that the government should aim to maximize the well-being of the worst-off person in society.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

46

A negative income tax system is designed to

A)provide in-kind benefits to the poor.

B)provide a minimum income to the poor.

C)reduce taxes on the rich when their incomes surpass the maximum income tax bracket.

D)subsidize food consumption in poor families.

A)provide in-kind benefits to the poor.

B)provide a minimum income to the poor.

C)reduce taxes on the rich when their incomes surpass the maximum income tax bracket.

D)subsidize food consumption in poor families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

47

The economic life cycle describes how young people usually have higher savings rates than middle-aged people.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

48

John Rawls,who developed the way of thinking called liberalism,argued that government policies should be aimed at maximizing the sum of utility of everyone in society.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

49

Utilitarians believe that the proper goal of the government is to maximize the sum of the utilities of everyone in society.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

50

Economists who support minimum-wage legislation are likely to believe that the

A)demand for unskilled labor is relatively inelastic.

B)demand for unskilled labor is relatively elastic.

C)supply of unskilled labor is relatively elastic.

D)supply of unskilled labor is relatively inelastic.

A)demand for unskilled labor is relatively inelastic.

B)demand for unskilled labor is relatively elastic.

C)supply of unskilled labor is relatively elastic.

D)supply of unskilled labor is relatively inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

51

Many economists believe that a family bases its spending decisions on its permanent,or average,income rather than on transitory income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

52

If a government could successfully achieve the maximin criterion,each member of society would have an equal income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

53

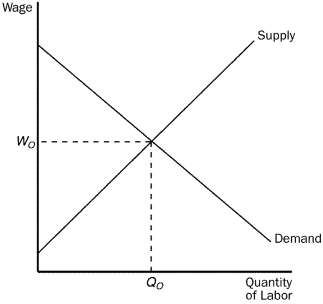

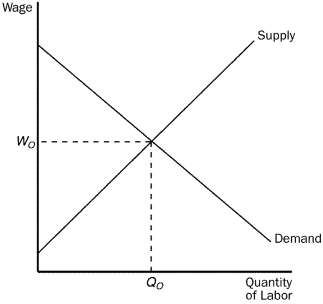

Figure 20-5

Refer to Figure 20-5.An effective minimum wage would be set at a level

A)above Wo,and employment would rise above Qo.

B)above Wo,and employment would fall below Qo.

C)below Wo,and employment would rise above Qo.

D)below Wo,and employment would fall below Qo.

Refer to Figure 20-5.An effective minimum wage would be set at a level

A)above Wo,and employment would rise above Qo.

B)above Wo,and employment would fall below Qo.

C)below Wo,and employment would rise above Qo.

D)below Wo,and employment would fall below Qo.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

54

A common criticism of welfare programs is that they

A)create self-reliant individuals.

B)encourage strong family values.

C)encourage illegitimate births.

D)have increasing benefits over time,in real terms.

A)create self-reliant individuals.

B)encourage strong family values.

C)encourage illegitimate births.

D)have increasing benefits over time,in real terms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

55

Standard measurements of the degree of income inequality take both money income and in-kind transfers into account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

56

The only qualification to receive government assistance under a negative income tax is

A)pre-school children.

B)to be enrolled in job training.

C)a working head-of-household.

D)a low income.

A)pre-school children.

B)to be enrolled in job training.

C)a working head-of-household.

D)a low income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

57

Relative to direct cash payments,in-kind transfers have the advantage of being

A)more politically popular.

B)more efficient.

C)more respectful of the poor.

D)of a higher dollar value than cash payments.

A)more politically popular.

B)more efficient.

C)more respectful of the poor.

D)of a higher dollar value than cash payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

58

There is very little economic mobility in the United States,which means that once a family is poor,it is very likely to remain poor for at least a decade.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

59

Binding minimum-wage laws

A)are most effective at alleviating poverty when labor demand is highly elastic.

B)force a market imbalance between the supply and demand for labor.

C)increase the efficiency of labor markets.

D)are typically associated with a rise in employment among the poor.

A)are most effective at alleviating poverty when labor demand is highly elastic.

B)force a market imbalance between the supply and demand for labor.

C)increase the efficiency of labor markets.

D)are typically associated with a rise in employment among the poor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is an advantage of an in-kind transfer in comparison to a cash payment?

A)In-kind transfers cost less to administer than cash transfers.

B)In-kind transfers restrict the use of the benefit; thus,recipients receive necessities such as food and health care.

C)In-kind transfers are more efficient than cash transfers.

D)In-kind transfers give the recipient more utility than cash transfers.

A)In-kind transfers cost less to administer than cash transfers.

B)In-kind transfers restrict the use of the benefit; thus,recipients receive necessities such as food and health care.

C)In-kind transfers are more efficient than cash transfers.

D)In-kind transfers give the recipient more utility than cash transfers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

61

An advantage of a negative income tax is that it does not encourage the breakup of families because the only criterion for assistance is family income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

62

Briefly describe the three prominent schools of thought in political philosophy.Identify one of the most well-known philosophers in each school.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

63

Explain the concept of diminishing marginal utility,and describe the role that it plays in the utilitarian argument for the redistribution of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

64

According to libertarians,the government should redistribute income from rich individuals to poor individuals to achieve a more equal distribution of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

65

Explain what is meant by "in-kind transfer" programs.Briefly outline the advantages and disadvantages of an in-kind transfer program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

66

Libertarians believe that the government should enforce individual rights to ensure that all people have the same opportunities to use their talents to achieve success.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

67

A goal of libertarians is to provide citizens with equal opportunities rather than to ensure equal outcomes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

68

Explain the relationship between labor earnings and the distribution of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

69

What is meant by a perfectly equal distribution of income?

Use a graph to depict such a situation.

Use a graph to depict such a situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

70

Critics argue that a disadvantage of minimum-wage laws is that they do not effectively target the working poor because many minimum-wage workers are the teenage children of middle-income families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck