Deck 6: Supply,demand,and Government Policies

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/62

العب

ملء الشاشة (f)

Deck 6: Supply,demand,and Government Policies

1

Economists generally believe that rent control is

A)an efficient and fair way to help the poor.

B)inefficient but the best available means of solving a serious social problem.

C)a highly inefficient way to help the poor raise their standard of living.

D)an efficient way to allocate housing,but not a good way to help the poor.

A)an efficient and fair way to help the poor.

B)inefficient but the best available means of solving a serious social problem.

C)a highly inefficient way to help the poor raise their standard of living.

D)an efficient way to allocate housing,but not a good way to help the poor.

C

2

When a binding price ceiling is imposed on a market to benefit buyers,

A)no buyers actually benefit.

B)some buyers benefit,but no buyers are harmed.

C)some buyers benefit,and some buyers are harmed.

D)all buyers benefit.

A)no buyers actually benefit.

B)some buyers benefit,but no buyers are harmed.

C)some buyers benefit,and some buyers are harmed.

D)all buyers benefit.

C

3

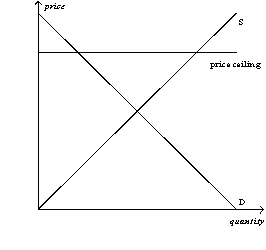

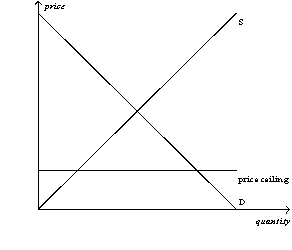

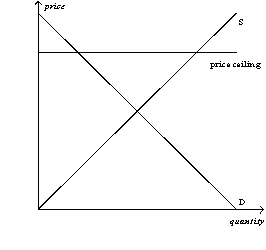

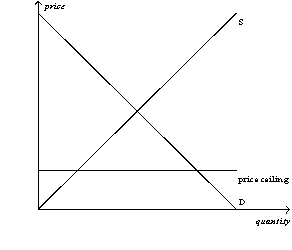

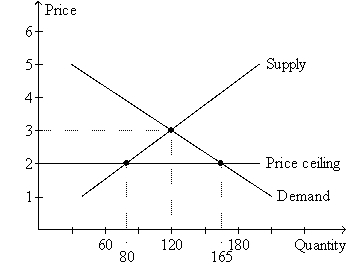

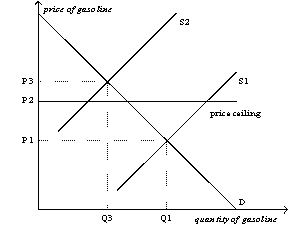

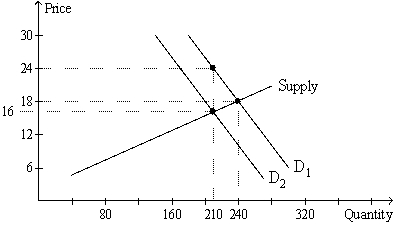

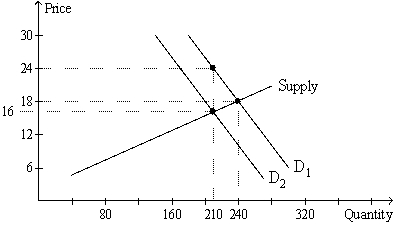

Figure 6-1

Refer to Figure 6-1.A binding price ceiling is shown in

A)panel (a)only.

B)panel (b)only.

C)both panel (a)and panel (b).

D)neither panel (a)nor panel (b).

Refer to Figure 6-1.A binding price ceiling is shown in

A)panel (a)only.

B)panel (b)only.

C)both panel (a)and panel (b).

D)neither panel (a)nor panel (b).

B

4

A legal maximum on the price at which a good can be sold is called a price

A)floor.

B)subsidy.

C)support.

D)ceiling.

A)floor.

B)subsidy.

C)support.

D)ceiling.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

5

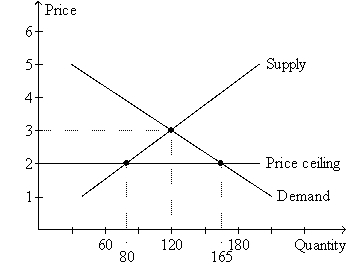

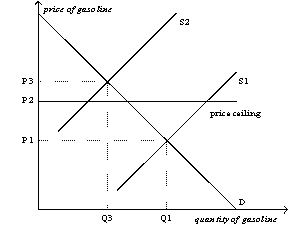

Figure 6-2

Refer to Figure 6-2.The price ceiling causes quantity

A)supplied to exceed quantity demanded by 45 units.

B)supplied to exceed quantity demanded by 85 units.

C)demanded to exceed quantity supplied by 45 units.

D)demanded to exceed quantity supplied by 85 units.

Refer to Figure 6-2.The price ceiling causes quantity

A)supplied to exceed quantity demanded by 45 units.

B)supplied to exceed quantity demanded by 85 units.

C)demanded to exceed quantity supplied by 45 units.

D)demanded to exceed quantity supplied by 85 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

6

In a competitive market free of government regulation,

A)price adjusts until quantity demanded is greater than quantity supplied.

B)price adjusts until quantity demanded is less than quantity supplied.

C)price adjusts until quantity demanded equals quantity supplied.

D)supply adjusts to meet demand at every price.

A)price adjusts until quantity demanded is greater than quantity supplied.

B)price adjusts until quantity demanded is less than quantity supplied.

C)price adjusts until quantity demanded equals quantity supplied.

D)supply adjusts to meet demand at every price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

7

A binding minimum wage tends to

A)cause a labor surplus.

B)cause unemployment.

C)have the greatest impact in the market for teenage labor.

D)All of the above are correct.

A)cause a labor surplus.

B)cause unemployment.

C)have the greatest impact in the market for teenage labor.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

8

Rent control

A)is an example of a price ceiling.

B)leads to a larger shortage of apartments in the long run than in the short run.

C)leads to lower rents and,in the long run,to lower-quality housing.

D)All of the above are correct.

A)is an example of a price ceiling.

B)leads to a larger shortage of apartments in the long run than in the short run.

C)leads to lower rents and,in the long run,to lower-quality housing.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

9

An example of a price floor is

A)the regulation of gasoline prices in the U.S.in the 1970s.

B)rent control.

C)the minimum wage.

D)any restriction on price that leads to a shortage.

A)the regulation of gasoline prices in the U.S.in the 1970s.

B)rent control.

C)the minimum wage.

D)any restriction on price that leads to a shortage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

10

Price controls are usually enacted

A)as a means of raising revenue for public purposes.

B)when policymakers believe that the market price of a good or service is unfair to buyers or sellers.

C)when policymakers detect inefficiencies in a market.

D)All of the above are correct.

A)as a means of raising revenue for public purposes.

B)when policymakers believe that the market price of a good or service is unfair to buyers or sellers.

C)when policymakers detect inefficiencies in a market.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

11

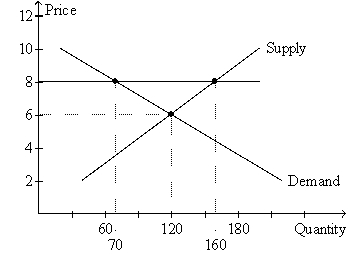

Figure 6-5

Refer to Figure 6-5.Suppose the market is initially in equilibrium.Then the government imposes a price control,as represented by the horizontal line on the graph.If the price control is a price floor,then the price control

A)causes the quantity demanded to decrease by 50 units,relative to the initial equilibrium.

B)causes the quantity supplied to increase by 40 units,relative to the initial equilibrium.

C)results in some firms being more successful than others in selling their goods.

D)All of the above are correct.

Refer to Figure 6-5.Suppose the market is initially in equilibrium.Then the government imposes a price control,as represented by the horizontal line on the graph.If the price control is a price floor,then the price control

A)causes the quantity demanded to decrease by 50 units,relative to the initial equilibrium.

B)causes the quantity supplied to increase by 40 units,relative to the initial equilibrium.

C)results in some firms being more successful than others in selling their goods.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

12

Figure 6-12

Refer to Figure 6-12.When the price ceiling applies in this market,and the supply curve for gasoline shifts from S1 to S2,

A)the market price will increase to P3.

B)a surplus will occur at the new market price of P2.

C)the market price will stay at P1.

D)a shortage will occur at the new market price of P2.

Refer to Figure 6-12.When the price ceiling applies in this market,and the supply curve for gasoline shifts from S1 to S2,

A)the market price will increase to P3.

B)a surplus will occur at the new market price of P2.

C)the market price will stay at P1.

D)a shortage will occur at the new market price of P2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

13

If the minimum wage exceeds the equilibrium wage,then

A)the quantity demanded of labor will exceed the quantity supplied.

B)the quantity supplied of labor will exceed the quantity demanded.

C)the minimum wage will not be binding.

D)there will be no unemployment.

A)the quantity demanded of labor will exceed the quantity supplied.

B)the quantity supplied of labor will exceed the quantity demanded.

C)the minimum wage will not be binding.

D)there will be no unemployment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

14

When government imposes a price ceiling or a price floor on a market,

A)price no longer serves as a rationing device.

B)efficiency in the market is enhanced.

C)shortages and surpluses are eliminated.

D)both buyers and sellers become better off.

A)price no longer serves as a rationing device.

B)efficiency in the market is enhanced.

C)shortages and surpluses are eliminated.

D)both buyers and sellers become better off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following observations would be consistent with the imposition of a binding price ceiling on a market?

After the price ceiling becomes effective,

A)a smaller quantity of the good is bought and sold.

B)a smaller quantity of the good is demanded.

C)a larger quantity of the good is supplied.

D)the price rises above the previous equilibrium.

After the price ceiling becomes effective,

A)a smaller quantity of the good is bought and sold.

B)a smaller quantity of the good is demanded.

C)a larger quantity of the good is supplied.

D)the price rises above the previous equilibrium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

16

When OPEC raised the price of crude oil in the 1970s,it caused the

A)demand for gasoline to increase.

B)demand for gasoline to decrease.

C)supply of gasoline to increase.

D)supply of gasoline to decrease.

A)demand for gasoline to increase.

B)demand for gasoline to decrease.

C)supply of gasoline to increase.

D)supply of gasoline to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a binding price floor is imposed on the video game market,then

A)the quantity of video games demanded will decrease.

B)the quantity of video games supplied will increase.

C)a surplus of video games will develop.

D)All of the above are correct.

A)the quantity of video games demanded will decrease.

B)the quantity of video games supplied will increase.

C)a surplus of video games will develop.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

18

Suppose the government has imposed a price floor on the market for soybeans.Which of the following events could transform the price floor from one that is not binding into one that is binding?

A)Farmers use improved,draught-resistant seeds,which lowers the cost of growing soybeans.

B)The number of farmers selling soybeans decreases.

C)Consumers' income increases,and soybeans are a normal good.

D)The number of consumers buying soybeans increases.

A)Farmers use improved,draught-resistant seeds,which lowers the cost of growing soybeans.

B)The number of farmers selling soybeans decreases.

C)Consumers' income increases,and soybeans are a normal good.

D)The number of consumers buying soybeans increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

19

The long-run effects of rent controls are a good illustration of the principle that

A)society faces a short-run tradeoff between unemployment and inflation.

B)the cost of something is what you give up to get it.

C)people respond to incentives.

D)government can sometimes improve on market outcomes.

A)society faces a short-run tradeoff between unemployment and inflation.

B)the cost of something is what you give up to get it.

C)people respond to incentives.

D)government can sometimes improve on market outcomes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

20

A nonbinding price ceiling

(i)causes a surplus.

(ii)causes a shortage.

(iii)is set at a price above the equilibrium price.

(iv)is set at a price below the equilibrium price.

A)(i)only

B)(iii)only

C)(i)and (iii)only

D)(ii)and (iv)only

(i)causes a surplus.

(ii)causes a shortage.

(iii)is set at a price above the equilibrium price.

(iv)is set at a price below the equilibrium price.

A)(i)only

B)(iii)only

C)(i)and (iii)only

D)(ii)and (iv)only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

21

When a tax is placed on the buyers of cell phones,the size of the cell phone market

A)and the effective price received by sellers both decrease.

B)decreases,but the effective price received by sellers increases.

C)increases,but the effective price received by sellers decreases.

D)and the effective price received by sellers both increase.

A)and the effective price received by sellers both decrease.

B)decreases,but the effective price received by sellers increases.

C)increases,but the effective price received by sellers decreases.

D)and the effective price received by sellers both increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

22

The price received by sellers in a market will increase if the government

A)decreases a binding price floor in that market.

B)increases a binding price ceiling in that market.

C)increases a tax on the good sold in that market.

D)imposes a binding price ceiling in that market.

A)decreases a binding price floor in that market.

B)increases a binding price ceiling in that market.

C)increases a tax on the good sold in that market.

D)imposes a binding price ceiling in that market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

23

The minimum wage,if it is binding,raises the incomes of

A)no workers.

B)only those workers who cannot find jobs.

C)only those workers whose jobs would pay less than the minimum wage if it didn't exist.

D)all workers.

A)no workers.

B)only those workers who cannot find jobs.

C)only those workers whose jobs would pay less than the minimum wage if it didn't exist.

D)all workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

24

The price paid by buyers in a market will increase if the government

(i)increases a binding price floor in that market.

(ii)increases a binding price ceiling in that market.

(iii)decreases a tax on the good sold in that market.

A)(ii)only

B)(iii)only

C)(i)and (ii)only

D)(i),(ii),and (iii)

(i)increases a binding price floor in that market.

(ii)increases a binding price ceiling in that market.

(iii)decreases a tax on the good sold in that market.

A)(ii)only

B)(iii)only

C)(i)and (ii)only

D)(i),(ii),and (iii)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

25

As a rationing mechanism,discrimination according to seller bias is

A)efficient and fair.

B)efficient,but potentially unfair.

C)inefficient,but fair.

D)inefficient and potentially unfair.

A)efficient and fair.

B)efficient,but potentially unfair.

C)inefficient,but fair.

D)inefficient and potentially unfair.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

26

Refer to Figure 6-18.As the figure is drawn,who sends the tax payment to the government?

A)The buyers send the tax payment.

B)The sellers send the tax payment.

C)A portion of the tax payment is sent by the buyers,and the remaining portion is sent by the sellers.

D)The question of who sends the tax payment cannot be determined from the graph.

A)The buyers send the tax payment.

B)The sellers send the tax payment.

C)A portion of the tax payment is sent by the buyers,and the remaining portion is sent by the sellers.

D)The question of who sends the tax payment cannot be determined from the graph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following would not interfere with market equilibria?

A)a minimum wage

B)a rent control

C)a non-binding price floor

D)a binding price ceiling

A)a minimum wage

B)a rent control

C)a non-binding price floor

D)a binding price ceiling

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

28

The term tax incidence refers to

A)whether buyers or sellers of a good are required to send tax payments to the government.

B)whether the demand curve or the supply curve shifts when the tax is imposed.

C)the distribution of the tax burden between buyers and sellers.

D)widespread view that taxes (and death)are the only certainties in life.

A)whether buyers or sellers of a good are required to send tax payments to the government.

B)whether the demand curve or the supply curve shifts when the tax is imposed.

C)the distribution of the tax burden between buyers and sellers.

D)widespread view that taxes (and death)are the only certainties in life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

29

Unlike minimum wage laws,wage subsidies

A)discourage firms from hiring the working poor.

B)cause unemployment.

C)help only wealthy workers.

D)raise the living standards of the working poor without creating unemployment.

A)discourage firms from hiring the working poor.

B)cause unemployment.

C)help only wealthy workers.

D)raise the living standards of the working poor without creating unemployment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

30

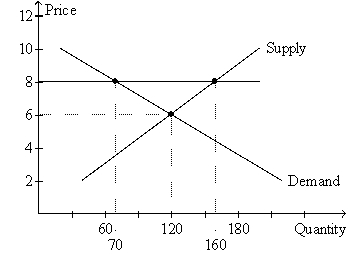

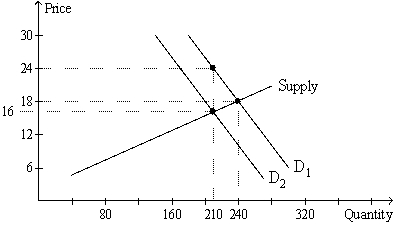

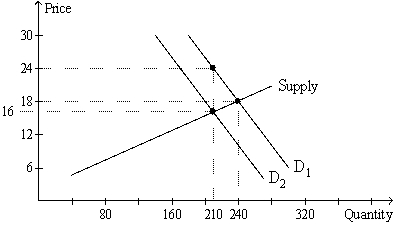

Figure 6-20

Refer to Figure 6-20.What is the amount of the tax per unit?

A)8

B)6

C)4

D)2

Refer to Figure 6-20.What is the amount of the tax per unit?

A)8

B)6

C)4

D)2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

31

How is the burden of a tax divided?

(i)When the tax is levied on the sellers,the sellers bear a higher proportion of the tax burden.

(ii)When the tax is levied on the buyers,the buyers bear a higher proportion of the tax burden.

(iii)Regardless of whether the tax is levied on the buyers or the sellers,the buyers and sellers bear an equal proportion of the tax burden.

(iv)Regardless of whether the tax is levied on the buyers or the sellers,the buyers and sellers bear some proportion of the tax burden.

A)(i)and (ii)only

B)(iv)only

C)(i),(ii),and (iii)only

D)(i),(ii),and (iv)only

(i)When the tax is levied on the sellers,the sellers bear a higher proportion of the tax burden.

(ii)When the tax is levied on the buyers,the buyers bear a higher proportion of the tax burden.

(iii)Regardless of whether the tax is levied on the buyers or the sellers,the buyers and sellers bear an equal proportion of the tax burden.

(iv)Regardless of whether the tax is levied on the buyers or the sellers,the buyers and sellers bear some proportion of the tax burden.

A)(i)and (ii)only

B)(iv)only

C)(i),(ii),and (iii)only

D)(i),(ii),and (iv)only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

32

Figure 6-20

Refer to Figure 6-20.Suppose sellers,rather than buyers,were required to pay this tax (in the same amount per unit as shown in the graph).Relative to the tax on buyers,the tax on sellers would result in

A)buyers bearing the same share of the tax burden.

B)sellers bearing the same share of the tax burden.

C)the same amount of tax revenue for the government.

D)All of the above are correct.

Refer to Figure 6-20.Suppose sellers,rather than buyers,were required to pay this tax (in the same amount per unit as shown in the graph).Relative to the tax on buyers,the tax on sellers would result in

A)buyers bearing the same share of the tax burden.

B)sellers bearing the same share of the tax burden.

C)the same amount of tax revenue for the government.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following causes a surplus of a good?

A)a binding price floor

B)a binding price ceiling

C)a tax on the good

D)More than one of the above is correct.

A)a binding price floor

B)a binding price ceiling

C)a tax on the good

D)More than one of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is correct?

Price controls

A)always help those they are designed to help.

B)never help those they are designed to help.

C)often hurt those they are designed to help.

D)always hurt those they are designed to help.

Price controls

A)always help those they are designed to help.

B)never help those they are designed to help.

C)often hurt those they are designed to help.

D)always hurt those they are designed to help.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

35

The price paid by buyers in a market will decrease if the government

A)increases a binding price floor in that market.

B)increases a binding price ceiling in that market.

C)decreases a tax on the good sold in that market.

D)All of the above are correct.

A)increases a binding price floor in that market.

B)increases a binding price ceiling in that market.

C)decreases a tax on the good sold in that market.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

36

If the government removes a tax on a good,then the price paid by buyers will

A)increase,and the price received by sellers will increase.

B)increase,and the price received by sellers will decrease.

C)decrease,and the price received by sellers will increase.

D)decrease,and the price received by sellers will decrease.

A)increase,and the price received by sellers will increase.

B)increase,and the price received by sellers will decrease.

C)decrease,and the price received by sellers will increase.

D)decrease,and the price received by sellers will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

37

A payroll tax is a

A)fixed number of dollars that every firm must pay to the government for each worker that the firm hires.

B)tax that each firm must pay to the government before the firm can hire workers and operate its business.

C)tax on the wages that firms pay their workers.

D)tax on all wages above the minimum wage.

A)fixed number of dollars that every firm must pay to the government for each worker that the firm hires.

B)tax that each firm must pay to the government before the firm can hire workers and operate its business.

C)tax on the wages that firms pay their workers.

D)tax on all wages above the minimum wage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

38

If the government wants to reduce the burning of fossil fuels,it should impose a tax on

A)buyers of gasoline.

B)sellers of gasoline.

C)either buyers or sellers of gasoline.

D)whichever side of the market is less elastic.

A)buyers of gasoline.

B)sellers of gasoline.

C)either buyers or sellers of gasoline.

D)whichever side of the market is less elastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

39

If a tax is levied on the sellers of a product,then the demand curve will

A)shift down.

B)shift up.

C)become flatter.

D)not shift.

A)shift down.

B)shift up.

C)become flatter.

D)not shift.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

40

Suppose the government imposes a 20-cent tax on the sellers of artificially-sweetened beverages.The tax would shift

A)demand,raising both the equilibrium price and quantity in the market for artificially-sweetened beverages.

B)demand,lowering the equilibrium price and raising the equilibrium quantity in the market for artificially-sweetened beverages.

C)supply,raising the equilibrium price and lowering the equilibrium quantity in the market for artificially-sweetened beverages.

D)supply,lowering the equilibrium price and raising the equilibrium quantity in the market for artificially-sweetened beverages.

A)demand,raising both the equilibrium price and quantity in the market for artificially-sweetened beverages.

B)demand,lowering the equilibrium price and raising the equilibrium quantity in the market for artificially-sweetened beverages.

C)supply,raising the equilibrium price and lowering the equilibrium quantity in the market for artificially-sweetened beverages.

D)supply,lowering the equilibrium price and raising the equilibrium quantity in the market for artificially-sweetened beverages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

41

One common example of a price ceiling is rent control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

42

A price ceiling set above the equilibrium price is not binding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

43

If a tax is imposed on a market with inelastic supply and elastic demand,then

A)buyers will bear most of the burden of the tax.

B)sellers will bear most of the burden of the tax.

C)the burden of the tax will be shared equally between buyers and sellers.

D)it is impossible to determine how the burden of the tax will be shared.

A)buyers will bear most of the burden of the tax.

B)sellers will bear most of the burden of the tax.

C)the burden of the tax will be shared equally between buyers and sellers.

D)it is impossible to determine how the burden of the tax will be shared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

44

A price floor set below the equilibrium price causes a surplus in the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

45

Most labor economists believe that the supply of labor is

A)less elastic than the demand,and,therefore,firms bear most of the burden of the payroll tax.

B)less elastic than the demand,and,therefore,workers bear most of the burden of the payroll tax.

C)more elastic than the demand,and,therefore,workers bear most of the burden of the payroll tax.

D)more elastic than the demand,and,therefore,firms bear most of the burden of the payroll tax.

A)less elastic than the demand,and,therefore,firms bear most of the burden of the payroll tax.

B)less elastic than the demand,and,therefore,workers bear most of the burden of the payroll tax.

C)more elastic than the demand,and,therefore,workers bear most of the burden of the payroll tax.

D)more elastic than the demand,and,therefore,firms bear most of the burden of the payroll tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

46

The term tax incidence refers to how the burden of a tax is distributed among the various people who make up the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

47

A binding minimum wage creates a surplus of labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

48

Most economists are in favor of price controls as a way of allocating resources in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

49

Tax incidence

A)depends on the legislated burden.

B)is entirely random.

C)depends on the elasticities of supply and demand.

D)falls entirely on buyers or entirely on sellers.

A)depends on the legislated burden.

B)is entirely random.

C)depends on the elasticities of supply and demand.

D)falls entirely on buyers or entirely on sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

50

Suppose that in a particular market,the supply curve is highly elastic and the demand curve is highly inelastic.If a tax is imposed in this market,then the

A)buyers will bear a greater burden of the tax than the sellers.

B)sellers will bear a greater burden of the tax than the buyers.

C)buyers and sellers are likely to share the burden of the tax equally.

D)buyers and sellers will not share the burden equally,but it is impossible to determine who will bear the greater burden of the tax without more information.

A)buyers will bear a greater burden of the tax than the sellers.

B)sellers will bear a greater burden of the tax than the buyers.

C)buyers and sellers are likely to share the burden of the tax equally.

D)buyers and sellers will not share the burden equally,but it is impossible to determine who will bear the greater burden of the tax without more information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

51

In a free market,the price of housing adjusts to eliminate the shortages that give rise to undesirable landlord behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

52

The burden of a luxury tax falls

A)more on the rich than on the middle class.

B)more on the poor than on the rich.

C)more on the middle class than on the rich.

D)equally on the rich,the middle class,and the poor.

A)more on the rich than on the middle class.

B)more on the poor than on the rich.

C)more on the middle class than on the rich.

D)equally on the rich,the middle class,and the poor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

53

When a tax is imposed on a good,the result is always a shortage of the good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

54

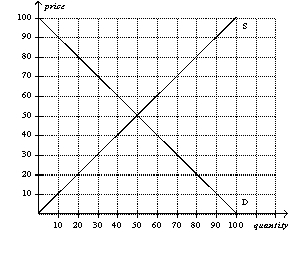

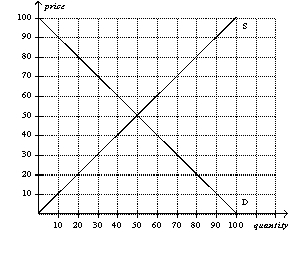

Figure 6-26

Refer to Figure 6-26.A price ceiling set at 30 would create a shortage of 20 units.

Refer to Figure 6-26.A price ceiling set at 30 would create a shortage of 20 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

55

A tax on sellers and an increase in input prices affect the supply curve in the same way.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

56

Prices are inefficient rationing devices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

57

The rationing mechanisms that develop under binding price ceilings are usually inefficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

58

Economic policies often have effects that their architects did not intend or anticipate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

59

Workers,rather than firms,bear most of the burden of the payroll tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

60

In an unregulated labor market,the wage adjusts to balance labor supply and labor demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

61

How does elasticity affect the burden of a tax?

Justify your answer using supply and demand diagrams.

Justify your answer using supply and demand diagrams.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

62

Using a supply and demand diagram,show a labor market with a binding minimum wage.Use the diagram to show those who are helped by the minimum wage and those who are hurt by the minimum wage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck