Deck 18: Depreciation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/57

العب

ملء الشاشة (f)

Deck 18: Depreciation

1

Apex Electronics

Apex Electronics uses the straight-line method of depreciation. Electronic equipment costing $112,500 has an estimated life of ten years and an estimated scrap value of $7,250.

Refer to Apex Electronics. Compute the annual depreciation amount.

Apex Electronics uses the straight-line method of depreciation. Electronic equipment costing $112,500 has an estimated life of ten years and an estimated scrap value of $7,250.

Refer to Apex Electronics. Compute the annual depreciation amount.

$10,525

2

Mendocino Gas and Storage

Mendocino Gas and Storage uses the units-of-production method of depreciation. A piece of equipment costing $112,500 has 360,000 estimated hours of operation and an estimated scrap value of $8,100. It operated 56,000 hours in the first year.

Refer to Mendocino Gas and Storage. Compute the depreciation expense for the first year.

Mendocino Gas and Storage uses the units-of-production method of depreciation. A piece of equipment costing $112,500 has 360,000 estimated hours of operation and an estimated scrap value of $8,100. It operated 56,000 hours in the first year.

Refer to Mendocino Gas and Storage. Compute the depreciation expense for the first year.

$16,240

3

XOSCCO Steel Company

XOSCCO Steel Company uses the straight-line method of depreciation. A new equipment costing $350,000 has an estimated life of ten years and an estimated scrap value of $6,500.

Refer to XOSCCO Steel Company. Compute the annual depreciation amount.

XOSCCO Steel Company uses the straight-line method of depreciation. A new equipment costing $350,000 has an estimated life of ten years and an estimated scrap value of $6,500.

Refer to XOSCCO Steel Company. Compute the annual depreciation amount.

$34,350

4

Northgate Coal Mining

Northgate Coal Mining uses the units of production method of depreciation. A piece of heavy equipment costing $368,000 produces an estimated 1,740,000 units in its life and has an estimated scrap value of $20,000. It produced 316,000 units in the first year.

Refer to Northgate Coal Mining. Compute the depreciation for the first year.

Northgate Coal Mining uses the units of production method of depreciation. A piece of heavy equipment costing $368,000 produces an estimated 1,740,000 units in its life and has an estimated scrap value of $20,000. It produced 316,000 units in the first year.

Refer to Northgate Coal Mining. Compute the depreciation for the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

5

Mason Towel

Mason Towel uses the units-of-production method of depreciation. A new knitting machine was purchased for $22,500. It will produce an estimated 800,000 units in its life and has an estimated scrap value of $2,500. It produced 150,000 units in the first year.

Refer to Mason Towel. Compute the depreciation for the first year.

Mason Towel uses the units-of-production method of depreciation. A new knitting machine was purchased for $22,500. It will produce an estimated 800,000 units in its life and has an estimated scrap value of $2,500. It produced 150,000 units in the first year.

Refer to Mason Towel. Compute the depreciation for the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

6

Voice Genesis, Inc.

Voice Genesis, Inc. uses the units-of-production method of depreciation. Electronic equipment costing $82,300 has 60,000 estimated hours of operation and an estimated scrap value of $2,500. It operated 20,000 hours in the first year.

Refer to Voice Genesis, Inc. Compute the book value at the end of the first year.

Voice Genesis, Inc. uses the units-of-production method of depreciation. Electronic equipment costing $82,300 has 60,000 estimated hours of operation and an estimated scrap value of $2,500. It operated 20,000 hours in the first year.

Refer to Voice Genesis, Inc. Compute the book value at the end of the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

7

XOSCCO Steel Company

XOSCCO Steel Company uses the straight-line method of depreciation. A new equipment costing $350,000 has an estimated life of ten years and an estimated scrap value of $6,500.

Refer to XOSCCO Steel Company. Compute the book value of the equipment at the end of the fifth year.

XOSCCO Steel Company uses the straight-line method of depreciation. A new equipment costing $350,000 has an estimated life of ten years and an estimated scrap value of $6,500.

Refer to XOSCCO Steel Company. Compute the book value of the equipment at the end of the fifth year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

8

Voice Genesis, Inc.

Voice Genesis, Inc. uses the units-of-production method of depreciation. Electronic equipment costing $82,300 has 60,000 estimated hours of operation and an estimated scrap value of $2,500. It operated 20,000 hours in the first year.

Refer to Voice Genesis, Inc. Compute the depreciation expense for the first year.

Voice Genesis, Inc. uses the units-of-production method of depreciation. Electronic equipment costing $82,300 has 60,000 estimated hours of operation and an estimated scrap value of $2,500. It operated 20,000 hours in the first year.

Refer to Voice Genesis, Inc. Compute the depreciation expense for the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

9

Cole Camping Company, Inc.

Cole Camping Company, Inc. uses the double-declining-balance method of depreciation. A piece of equipment costing $37,500 has an estimated life of five years and an estimated scrap value of $2,700.

Refer to Cole Camping Company, Inc. Compute the book value at the end of the second year.

Cole Camping Company, Inc. uses the double-declining-balance method of depreciation. A piece of equipment costing $37,500 has an estimated life of five years and an estimated scrap value of $2,700.

Refer to Cole Camping Company, Inc. Compute the book value at the end of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

10

Miracle Manufacturing

Miracle Manufacturing uses the units-of-production method of depreciation. A piece of heavy equipment costing $112,500 produces an estimated 2,088,000 units in its life and has an estimated scrap value of $8,100. It produced 288,000 units in the first year.

Refer to Miracle Manufacturing. Compute the depreciation for the first year.

Miracle Manufacturing uses the units-of-production method of depreciation. A piece of heavy equipment costing $112,500 produces an estimated 2,088,000 units in its life and has an estimated scrap value of $8,100. It produced 288,000 units in the first year.

Refer to Miracle Manufacturing. Compute the depreciation for the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

11

Mason Towel

Mason Towel uses the units-of-production method of depreciation. A new knitting machine was purchased for $22,500. It will produce an estimated 800,000 units in its life and has an estimated scrap value of $2,500. It produced 150,000 units in the first year.

Refer to Mason Towel. Compute the book value at the end of the first year.

Mason Towel uses the units-of-production method of depreciation. A new knitting machine was purchased for $22,500. It will produce an estimated 800,000 units in its life and has an estimated scrap value of $2,500. It produced 150,000 units in the first year.

Refer to Mason Towel. Compute the book value at the end of the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

12

Mendocino Gas and Storage

Mendocino Gas and Storage uses the units-of-production method of depreciation. A piece of equipment costing $112,500 has 360,000 estimated hours of operation and an estimated scrap value of $8,100. It operated 56,000 hours in the first year.

Refer to Mendocino Gas and Storage. Compute the book value at the end of the first year.

Mendocino Gas and Storage uses the units-of-production method of depreciation. A piece of equipment costing $112,500 has 360,000 estimated hours of operation and an estimated scrap value of $8,100. It operated 56,000 hours in the first year.

Refer to Mendocino Gas and Storage. Compute the book value at the end of the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

13

Perry Processing, Inc.

Perry Processing, Inc. uses the units-of-production method of depreciation. A packaging machine costing $108,500 has 40,000 estimated hours of operation and an estimated scrap value of $12,500. It operated 4,200 hours in the first year.

Refer to Perry Processing, Inc. Compute the book value at the end of the first year.

Perry Processing, Inc. uses the units-of-production method of depreciation. A packaging machine costing $108,500 has 40,000 estimated hours of operation and an estimated scrap value of $12,500. It operated 4,200 hours in the first year.

Refer to Perry Processing, Inc. Compute the book value at the end of the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

14

Rolex Watch Company

Rolex Watch Company uses the straight-line method of depreciation. A new lathe costing $222,500 has an estimated life of five years and an estimated scrap value of $8,500.

Refer to Rolex Watch Company. Compute the book value of the equipment at the end of the third year.

Rolex Watch Company uses the straight-line method of depreciation. A new lathe costing $222,500 has an estimated life of five years and an estimated scrap value of $8,500.

Refer to Rolex Watch Company. Compute the book value of the equipment at the end of the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

15

Miracle Manufacturing

Miracle Manufacturing uses the units-of-production method of depreciation. A piece of heavy equipment costing $112,500 produces an estimated 2,088,000 units in its life and has an estimated scrap value of $8,100. It produced 288,000 units in the first year.

Refer to Miracle Manufacturing. Compute the book value at the end of the first year.

Miracle Manufacturing uses the units-of-production method of depreciation. A piece of heavy equipment costing $112,500 produces an estimated 2,088,000 units in its life and has an estimated scrap value of $8,100. It produced 288,000 units in the first year.

Refer to Miracle Manufacturing. Compute the book value at the end of the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

16

Northgate Coal Mining

Northgate Coal Mining uses the units of production method of depreciation. A piece of heavy equipment costing $368,000 produces an estimated 1,740,000 units in its life and has an estimated scrap value of $20,000. It produced 316,000 units in the first year.

Refer to Northgate Coal Mining. Compute the book value at the end of the first year.

Northgate Coal Mining uses the units of production method of depreciation. A piece of heavy equipment costing $368,000 produces an estimated 1,740,000 units in its life and has an estimated scrap value of $20,000. It produced 316,000 units in the first year.

Refer to Northgate Coal Mining. Compute the book value at the end of the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

17

Perry Processing, Inc.

Perry Processing, Inc. uses the units-of-production method of depreciation. A packaging machine costing $108,500 has 40,000 estimated hours of operation and an estimated scrap value of $12,500. It operated 4,200 hours in the first year.

Refer to Perry Processing, Inc. Compute the depreciation expense for the first year.

Perry Processing, Inc. uses the units-of-production method of depreciation. A packaging machine costing $108,500 has 40,000 estimated hours of operation and an estimated scrap value of $12,500. It operated 4,200 hours in the first year.

Refer to Perry Processing, Inc. Compute the depreciation expense for the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

18

Apex Electronics

Apex Electronics uses the straight-line method of depreciation. Electronic equipment costing $112,500 has an estimated life of ten years and an estimated scrap value of $7,250.

Refer to Apex Electronics. Compute the book value at the end of the third year.

Apex Electronics uses the straight-line method of depreciation. Electronic equipment costing $112,500 has an estimated life of ten years and an estimated scrap value of $7,250.

Refer to Apex Electronics. Compute the book value at the end of the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

19

Cole Camping Company, Inc.

Cole Camping Company, Inc. uses the double-declining-balance method of depreciation. A piece of equipment costing $37,500 has an estimated life of five years and an estimated scrap value of $2,700.

Refer to Cole Camping Company, Inc. Compute the amount of depreciation taken in the second year.

Cole Camping Company, Inc. uses the double-declining-balance method of depreciation. A piece of equipment costing $37,500 has an estimated life of five years and an estimated scrap value of $2,700.

Refer to Cole Camping Company, Inc. Compute the amount of depreciation taken in the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

20

Rolex Watch Company

Rolex Watch Company uses the straight-line method of depreciation. A new lathe costing $222,500 has an estimated life of five years and an estimated scrap value of $8,500.

Refer to Rolex Watch Company. Compute the annual depreciation amount.

Rolex Watch Company uses the straight-line method of depreciation. A new lathe costing $222,500 has an estimated life of five years and an estimated scrap value of $8,500.

Refer to Rolex Watch Company. Compute the annual depreciation amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

21

Brook Stone and Paving

Brook Stone and Paving purchased a new truck for $68,500. The truck has an estimated life of four years and an estimated scrap value of $4,500.The company uses the double-declining-balance method of depreciation.

Refer to Brook Stone and Paving. Compute the depreciation for the third year.

Brook Stone and Paving purchased a new truck for $68,500. The truck has an estimated life of four years and an estimated scrap value of $4,500.The company uses the double-declining-balance method of depreciation.

Refer to Brook Stone and Paving. Compute the depreciation for the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

22

Lewiswhite Farms

Lewiswhite Farms uses the sum-of-the-years-digits method of depreciation. A farm tractor costing $40,000 has an estimated life of ten years and an estimated scrap value of $1,000.

Refer to Lewiswhite Farms. Compute the book value at the end of the fourth year. (Round depreciation amounts to the nearest dollar.)

Lewiswhite Farms uses the sum-of-the-years-digits method of depreciation. A farm tractor costing $40,000 has an estimated life of ten years and an estimated scrap value of $1,000.

Refer to Lewiswhite Farms. Compute the book value at the end of the fourth year. (Round depreciation amounts to the nearest dollar.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

23

Reilly Construction Company

The bookkeeper for the Reilly Construction Company is computing depreciation for income tax purposes, using the figures from the MACRS tables supplied by the IRS. Reilly Construction Company purchased a truck in February 2005 for $40,000. In March 2005, a second truck was purchased for $48,000. Assume that allowable depreciation for each truck is 20% for the first year and 32% for the second year.

-Refer to Reilly Construction Company. Compute the total allowable cost recovery on the two trucks for the year 2006.

The bookkeeper for the Reilly Construction Company is computing depreciation for income tax purposes, using the figures from the MACRS tables supplied by the IRS. Reilly Construction Company purchased a truck in February 2005 for $40,000. In March 2005, a second truck was purchased for $48,000. Assume that allowable depreciation for each truck is 20% for the first year and 32% for the second year.

-Refer to Reilly Construction Company. Compute the total allowable cost recovery on the two trucks for the year 2006.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

24

The bookkeeper for the Martel Company is computing depreciation for income tax purposes, using the figures from the MACRS tables supplied by the IRS. The equipment being depreciated had a cost of $16,000 and falls under the class of equipment to be depreciated at a rate of 25% for the first year and 21.43% for the second year. The equipment was purchased and put into use during the first quarter. Compute the amount of depreciation expense for the first year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

25

Collenlee Company, Inc.

Collenlee Company, Inc. uses the double-declining-balance method of depreciation. A piece of equipment costing $50,000 has an estimated life of five years and an estimated scrap value of $4,000.

Refer to Collenlee Company, Inc. Compute the book value at the end of the second year.

Collenlee Company, Inc. uses the double-declining-balance method of depreciation. A piece of equipment costing $50,000 has an estimated life of five years and an estimated scrap value of $4,000.

Refer to Collenlee Company, Inc. Compute the book value at the end of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

26

Zenix Electronic

Zenix Electronic uses the double-declining-balance method of depreciation. An oscilloscope costing $28,500 has an estimated life of five years and an estimated scrap value of $2,500.

Refer to Zenix Electronic. Compute the amount of depreciation taken in the second year.

Zenix Electronic uses the double-declining-balance method of depreciation. An oscilloscope costing $28,500 has an estimated life of five years and an estimated scrap value of $2,500.

Refer to Zenix Electronic. Compute the amount of depreciation taken in the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

27

Warner Brothers Studios

Warner Brothers Studios uses the sum-of-the-years-digits method of depreciation. A camera unit costing $112,500 has an estimated life of ten years and an estimated scrap value of $8,100.

Refer to Warner Brothers Studios. Compute the book value at the end of the third year. (Round depreciation amounts to the nearest dollar.)

Warner Brothers Studios uses the sum-of-the-years-digits method of depreciation. A camera unit costing $112,500 has an estimated life of ten years and an estimated scrap value of $8,100.

Refer to Warner Brothers Studios. Compute the book value at the end of the third year. (Round depreciation amounts to the nearest dollar.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

28

Reilly Construction Company

The bookkeeper for the Reilly Construction Company is computing depreciation for income tax purposes, using the figures from the MACRS tables supplied by the IRS. Reilly Construction Company purchased a truck in February 2005 for $40,000. In March 2005, a second truck was purchased for $48,000. Assume that allowable depreciation for each truck is 20% for the first year and 32% for the second year.

-Refer to Reilly Construction Company. Compute the total allowable cost recovery on the two trucks for the year 2005.

The bookkeeper for the Reilly Construction Company is computing depreciation for income tax purposes, using the figures from the MACRS tables supplied by the IRS. Reilly Construction Company purchased a truck in February 2005 for $40,000. In March 2005, a second truck was purchased for $48,000. Assume that allowable depreciation for each truck is 20% for the first year and 32% for the second year.

-Refer to Reilly Construction Company. Compute the total allowable cost recovery on the two trucks for the year 2005.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

29

Dental Office

A dental office using the straight-line method of depreciation purchased equipment costing $72,000 and put it into use on June 1. The equipment is expected to have a useful life of ten years and an estimated resale value of $4,800.

Refer to the Dental Office scenario. Compute the book value at end of the third year.

A dental office using the straight-line method of depreciation purchased equipment costing $72,000 and put it into use on June 1. The equipment is expected to have a useful life of ten years and an estimated resale value of $4,800.

Refer to the Dental Office scenario. Compute the book value at end of the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

30

Lewiswhite Farms

Lewiswhite Farms uses the sum-of-the-years-digits method of depreciation. A farm tractor costing $40,000 has an estimated life of ten years and an estimated scrap value of $1,000.

Refer to Lewiswhite Farms. Compute the amount of depreciation taken in the sixth year.

Lewiswhite Farms uses the sum-of-the-years-digits method of depreciation. A farm tractor costing $40,000 has an estimated life of ten years and an estimated scrap value of $1,000.

Refer to Lewiswhite Farms. Compute the amount of depreciation taken in the sixth year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

31

Bellinger Broadcasting

Bellinger Broadcasting uses the double-declining-balance method of depreciation. A transmitter costing $112,500 has an estimated life of ten years and an estimated scrap value of $8,100.

Refer to Bellinger Broadcasting. Compute the book value at the end of the third year.

Bellinger Broadcasting uses the double-declining-balance method of depreciation. A transmitter costing $112,500 has an estimated life of ten years and an estimated scrap value of $8,100.

Refer to Bellinger Broadcasting. Compute the book value at the end of the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

32

Brook Stone and Paving

Brook Stone and Paving purchased a new truck for $68,500. The truck has an estimated life of four years and an estimated scrap value of $4,500.The company uses the double-declining-balance method of depreciation.

Refer to Brook Stone and Paving. Compute the book value at the end of the third year.

Brook Stone and Paving purchased a new truck for $68,500. The truck has an estimated life of four years and an estimated scrap value of $4,500.The company uses the double-declining-balance method of depreciation.

Refer to Brook Stone and Paving. Compute the book value at the end of the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

33

Warner Brothers Studios

Warner Brothers Studios uses the sum-of-the-years-digits method of depreciation. A camera unit costing $112,500 has an estimated life of ten years and an estimated scrap value of $8,100.

Refer to Warner Brothers Studios. Compute the amount of depreciation taken in the seventh year.

Warner Brothers Studios uses the sum-of-the-years-digits method of depreciation. A camera unit costing $112,500 has an estimated life of ten years and an estimated scrap value of $8,100.

Refer to Warner Brothers Studios. Compute the amount of depreciation taken in the seventh year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

34

Zenix Electronic

Zenix Electronic uses the double-declining-balance method of depreciation. An oscilloscope costing $28,500 has an estimated life of five years and an estimated scrap value of $2,500.

Refer to Zenix Electronic. Compute the book value at the end of the second year.

Zenix Electronic uses the double-declining-balance method of depreciation. An oscilloscope costing $28,500 has an estimated life of five years and an estimated scrap value of $2,500.

Refer to Zenix Electronic. Compute the book value at the end of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

35

The bookkeeper for the Martel Company is computing depreciation for income tax purposes, using the figures from the MACRS tables supplied by the IRS. The equipment being depreciated had a cost of $16,000 and falls under the class of equipment to be depreciated at a rate of 20% for the first year and 32% for the second year. The equipment was purchased and put into use during the first quarter. Compute the total amount of depreciation expense through the end of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

36

Collenlee Company, Inc.

Collenlee Company, Inc. uses the double-declining-balance method of depreciation. A piece of equipment costing $50,000 has an estimated life of five years and an estimated scrap value of $4,000.

Refer to Collenlee Company, Inc. Compute the amount of depreciation taken in the second year.

Collenlee Company, Inc. uses the double-declining-balance method of depreciation. A piece of equipment costing $50,000 has an estimated life of five years and an estimated scrap value of $4,000.

Refer to Collenlee Company, Inc. Compute the amount of depreciation taken in the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

37

Dental Office

A dental office using the straight-line method of depreciation purchased equipment costing $72,000 and put it into use on June 1. The equipment is expected to have a useful life of ten years and an estimated resale value of $4,800.

Refer to the Dental Office scenario. Compute the depreciation expense for June 1 through December 31 of the first tax year and all 12 months of the second and third years.

A dental office using the straight-line method of depreciation purchased equipment costing $72,000 and put it into use on June 1. The equipment is expected to have a useful life of ten years and an estimated resale value of $4,800.

Refer to the Dental Office scenario. Compute the depreciation expense for June 1 through December 31 of the first tax year and all 12 months of the second and third years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

38

Bellinger Broadcasting

Bellinger Broadcasting uses the double-declining-balance method of depreciation. A transmitter costing $112,500 has an estimated life of ten years and an estimated scrap value of $8,100.

Refer to Bellinger Broadcasting. Compute the amount of depreciation taken in the third year.

Bellinger Broadcasting uses the double-declining-balance method of depreciation. A transmitter costing $112,500 has an estimated life of ten years and an estimated scrap value of $8,100.

Refer to Bellinger Broadcasting. Compute the amount of depreciation taken in the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

39

Young Manufacturing

Young Manufacturing uses the sum-of-the-years-digits method of depreciation. A piece of heavy equipment costing $37,500 has an estimated life of five years and an estimated scrap value of $2,700.

Refer to Young Manufacturing. Compute the book value at the end of the second year.

Young Manufacturing uses the sum-of-the-years-digits method of depreciation. A piece of heavy equipment costing $37,500 has an estimated life of five years and an estimated scrap value of $2,700.

Refer to Young Manufacturing. Compute the book value at the end of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

40

Young Manufacturing

Young Manufacturing uses the sum-of-the-years-digits method of depreciation. A piece of heavy equipment costing $37,500 has an estimated life of five years and an estimated scrap value of $2,700.

Refer to Young Manufacturing. Compute the amount of depreciation taken in the third year.

Young Manufacturing uses the sum-of-the-years-digits method of depreciation. A piece of heavy equipment costing $37,500 has an estimated life of five years and an estimated scrap value of $2,700.

Refer to Young Manufacturing. Compute the amount of depreciation taken in the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

41

Accounting Firm

An accounting firm using the sum-of-the-years-digits method of depreciation purchased office furniture costing $9,000 and put it into use on April 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $600.

Refer to the Accounting Firm scenario. Compute the book value at the end of the second year.

An accounting firm using the sum-of-the-years-digits method of depreciation purchased office furniture costing $9,000 and put it into use on April 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $600.

Refer to the Accounting Firm scenario. Compute the book value at the end of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

42

Medical Office

A medical office using the double-declining-balance method of depreciation purchased office furniture costing $36,000 and put it in use on May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Medical Office scenario. Compute the book value at the end of the third year.

A medical office using the double-declining-balance method of depreciation purchased office furniture costing $36,000 and put it in use on May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Medical Office scenario. Compute the book value at the end of the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

43

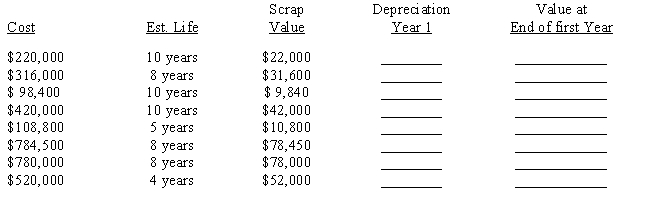

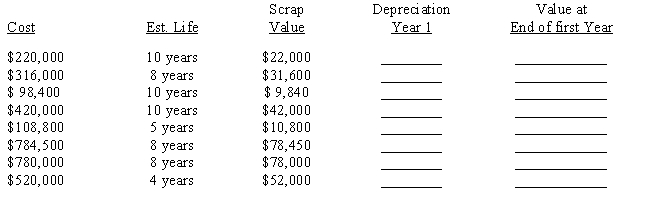

The California Crane Company purchased eight new cranes of different sizes and qualities. CCC uses the double-declining balance method of calculating depreciation. The data for each crane is given below. From this data, compute the first year depreciation for each crane and the value of each crane at the end of its first year of use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

44

Publisher

A publisher using the sum-of-the-years-digits method of depreciation purchased office furniture costing $36,000 and put it into use on May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Publisher scenario. Compute the depreciation expense for May 1 through December 31 of the first year and all 12 months of the second year. (Round depreciation for each year to the nearest dollar.)

A publisher using the sum-of-the-years-digits method of depreciation purchased office furniture costing $36,000 and put it into use on May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Publisher scenario. Compute the depreciation expense for May 1 through December 31 of the first year and all 12 months of the second year. (Round depreciation for each year to the nearest dollar.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

45

Legal Office

A legal office using the straight-line method of depreciation purchased office furniture costing $36,000 and put it into use May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Legal Office scenario. Compute the book value at the end of the third year.

A legal office using the straight-line method of depreciation purchased office furniture costing $36,000 and put it into use May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Legal Office scenario. Compute the book value at the end of the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

46

Medical Office

A medical office using the double-declining-balance method of depreciation purchased office furniture costing $36,000 and put it in use on May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Medical Office scenario. Compute the depreciation expense for May 1 through December 31 of the first tax year and all 12 months of the second and third years.

A medical office using the double-declining-balance method of depreciation purchased office furniture costing $36,000 and put it in use on May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Medical Office scenario. Compute the depreciation expense for May 1 through December 31 of the first tax year and all 12 months of the second and third years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

47

Publisher

A publisher using the sum-of-the-years-digits method of depreciation purchased office furniture costing $36,000 and put it into use on May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Publisher scenario. Compute the book value at the end of the second year.

A publisher using the sum-of-the-years-digits method of depreciation purchased office furniture costing $36,000 and put it into use on May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Publisher scenario. Compute the book value at the end of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

48

Accounting Firm

An accounting firm using the sum-of-the-years-digits method of depreciation purchased office furniture costing $9,000 and put it into use on April 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $600.

Refer to the Accounting Firm scenario. Compute the depreciation expense for April 1 through December 31 of the first tax year and all 12 months of the second year.

An accounting firm using the sum-of-the-years-digits method of depreciation purchased office furniture costing $9,000 and put it into use on April 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $600.

Refer to the Accounting Firm scenario. Compute the depreciation expense for April 1 through December 31 of the first tax year and all 12 months of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

49

Legal Office

A legal office using the straight-line method of depreciation purchased office furniture costing $36,000 and put it into use May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Legal Office scenario. Compute the depreciation expense for May 1 through December 31 of the first tax year and all 12 months of the second and third years.

A legal office using the straight-line method of depreciation purchased office furniture costing $36,000 and put it into use May 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Legal Office scenario. Compute the depreciation expense for May 1 through December 31 of the first tax year and all 12 months of the second and third years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

50

An insurance office purchased office furniture costing $9,000 and put it into use on April 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $600. Using the straight-line method of depreciation, compute the book value at the end of the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

51

An insurance office purchased office furniture costing $9,600 and put it into use on April 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $600. Using the straight-line method of depreciation, compute the depreciation expense for April 1 through December 31 of the first year and all 12 months of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

52

Retail Store

A retail store using sum-of-the-years-digits method of depreciation purchased equipment costing $36,000 and put it use on June 1. The equipment is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Retail Store scenario. Compute the book value at the end of the second year.

A retail store using sum-of-the-years-digits method of depreciation purchased equipment costing $36,000 and put it use on June 1. The equipment is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Retail Store scenario. Compute the book value at the end of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

53

Real Estate Office

A real estate office using the double-declining-balance method of depreciation purchased office furniture costing $9,000 and put it into use on April 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $600.

Refer to the Real Estate Office scenario. Compute the book value at the end of the third year.

A real estate office using the double-declining-balance method of depreciation purchased office furniture costing $9,000 and put it into use on April 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $600.

Refer to the Real Estate Office scenario. Compute the book value at the end of the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

54

Real Estate Office

A real estate office using the double-declining-balance method of depreciation purchased office furniture costing $9,000 and put it into use on April 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $600.

Refer to the Real Estate Office scenario. Compute the depreciation expense for April 1 through December 31 of the first tax year and all 12 months of the second and third years.

A real estate office using the double-declining-balance method of depreciation purchased office furniture costing $9,000 and put it into use on April 1. The furniture is expected to have a useful life of 10 years and an estimated resale value of $600.

Refer to the Real Estate Office scenario. Compute the depreciation expense for April 1 through December 31 of the first tax year and all 12 months of the second and third years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

55

Day-Care Center

A day-care center using the double-declining-balance method of depreciation purchased equipment costing $36,000 and put it use on June 1. The equipment is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Day-Care Center scenario. Compute the book value at the end of the third year.

A day-care center using the double-declining-balance method of depreciation purchased equipment costing $36,000 and put it use on June 1. The equipment is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Day-Care Center scenario. Compute the book value at the end of the third year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

56

Retail Store

A retail store using sum-of-the-years-digits method of depreciation purchased equipment costing $36,000 and put it use on June 1. The equipment is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Retail Store scenario. Compute the depreciation expense for June 1 through December 31 of the first year and all 12 months of the second year.

A retail store using sum-of-the-years-digits method of depreciation purchased equipment costing $36,000 and put it use on June 1. The equipment is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Retail Store scenario. Compute the depreciation expense for June 1 through December 31 of the first year and all 12 months of the second year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

57

Day-Care Center

A day-care center using the double-declining-balance method of depreciation purchased equipment costing $36,000 and put it use on June 1. The equipment is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Day-Care Center scenario. Compute the depreciation expense for June 1 through December 31 of the first tax year and all 12 months of the second and third years.

A day-care center using the double-declining-balance method of depreciation purchased equipment costing $36,000 and put it use on June 1. The equipment is expected to have a useful life of 10 years and an estimated resale value of $2,400.

Refer to the Day-Care Center scenario. Compute the depreciation expense for June 1 through December 31 of the first tax year and all 12 months of the second and third years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck