Deck 13: Analysis of Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/55

العب

ملء الشاشة (f)

Deck 13: Analysis of Financial Statements

1

If the firm's current ratio exceeds 1:1 and the firm retires an account payable,the quick ratio increases.

True

2

The return on equity measures earnings before interest and taxes.

False

3

If accounts receivable are collected more rapidly,the average collection period is reduced.

True

4

An inventory turnover of 3.0 suggests that inventory is sold every four months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

5

The current ratio and the quick ratio are measures of asset usage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

6

The quick ratio excludes inventory,plant,and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

7

The greater the numerical value of the debt ratio,the riskier the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

8

If inventory is sold for cash instead of on credit,inventory turnover is increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a firm's inventory turnover is 4.0 and receivables turnover is 6.0,then it takes about five months for newly acquired inventory to generate cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

10

Senior debt should have a lower times-interest-earned than junior debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

11

The proportion of a firm's assets that are financed by debt is measured by the debt ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

12

If accounts receivable are collected,the quick ratio is unaffected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

13

Coverage ratios may be used to measure the safety of debt and other fixed obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

14

The return on assets employs operating income instead of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

15

An increase in retained earnings will increase the debt to equity ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

16

Ratios may be used in both time-series and cross-section types of analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

17

An increase in assets financed by equity increases the debt ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

18

Net profit margins on sales tend to exceed operating profit margins on sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

19

A times-interest-earned of 0.9 means that interest will not be paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

20

The quick ratio is a better measure of liquidity than the current ratio for manufacturers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

21

When a firm makes a profitable sale,its total assets increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

22

Cash flow depends on depreciation as well as the firm's earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

23

If the ratio of debt to equity increases,the proportion of assets financed by debt is increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

24

The current ratio is unaffected by

A) using cash to retire an account payable

B) the collection of an account receivable

C) selling inventory for a profit

D) selling bonds and using the funds to finance inventory

A) using cash to retire an account payable

B) the collection of an account receivable

C) selling inventory for a profit

D) selling bonds and using the funds to finance inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

25

Firms with too much debt are undercapitalized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

26

As the debt ratio increases,

1)fewer assets are debt financed

2)more assets are debt financed

3)the ratio of debt to equity increases

4)the ratio of debt to equity decreases

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

1)fewer assets are debt financed

2)more assets are debt financed

3)the ratio of debt to equity increases

4)the ratio of debt to equity decreases

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

27

Coverage ratios measure a firm's

A) ability to use debt financing

B) use of plant and equipment

C) ability to cover (i.e., sell) its inventory

D) ability to meet fixed payments such as interest

A) ability to use debt financing

B) use of plant and equipment

C) ability to cover (i.e., sell) its inventory

D) ability to meet fixed payments such as interest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

28

The comparability of the individual investor's ratio computations with industry averages is reduced by the age of industry averages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

29

The net profit margin increases as the firm's interest expense declines.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

30

The quick ratio

A) excludes accounts payable

B) excludes accounts receivable

C) includes inventory

D) includes cash and cash equivalents

A) excludes accounts payable

B) excludes accounts receivable

C) includes inventory

D) includes cash and cash equivalents

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

31

As times-interest-earned increases,

A) bondholders' position deteriorates

B) net income decreases

C) interest payments become more assured

D) taxes decrease

A) bondholders' position deteriorates

B) net income decreases

C) interest payments become more assured

D) taxes decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

32

Activity ratios measure

A) how rapidly assets flow through the firm

B) how frequently the firm's stock is traded

C) how rapidly employees turn over

D) the profitableness of accounts receivable

A) how rapidly assets flow through the firm

B) how frequently the firm's stock is traded

C) how rapidly employees turn over

D) the profitableness of accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

33

Lower cash flow may be the result of higher depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

34

The more financially leveraged a firm,the smaller is its debt ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

35

The average collection period measures

A) the speed with which accounts payable are paid

B) the speed with which accounts receivable are collected

C) the safety of accounts receivable

D) the safety of accounts payable

A) the speed with which accounts payable are paid

B) the speed with which accounts receivable are collected

C) the safety of accounts receivable

D) the safety of accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

36

The statement of cash flow places emphasis on management's ability to retire debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

37

Bondholders are concerned with the firm's operating income,while stockholders are concerned with its net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

38

Lower depreciation increases earnings and cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

39

Inventory turnover may increase if

A) the firm increases its accounts payable

B) the firm uses less debt financing

C) the firm increases its inventory

D) the firm lowers the prices of its goods

A) the firm increases its accounts payable

B) the firm uses less debt financing

C) the firm increases its inventory

D) the firm lowers the prices of its goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

40

Stockholders who seek capital gains prefer a large payout ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

41

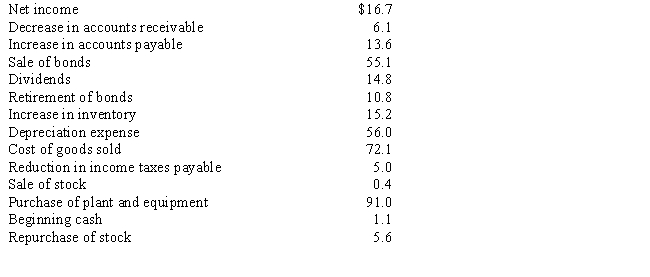

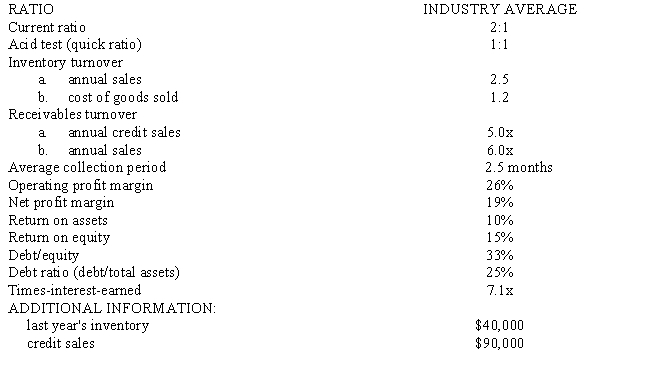

Given the following information,construct the statement of cash flows.What happened to the firm's liquidity position during the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

42

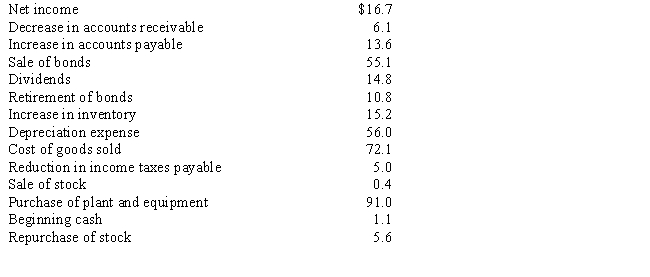

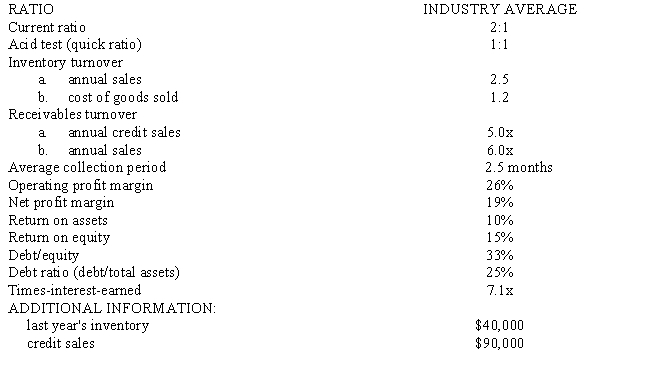

Using the income statement and balance sheet constructed in (1)and (2),compute the following ratios.Compare the results with the industry averages.What strengths and weaknesses are apparent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

43

Determine a firm's earnings per share from the following information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following has no impact on cash flow?

A) the firm's equity

B) depreciation expense

C) taxes paid

D) net income

A) the firm's equity

B) depreciation expense

C) taxes paid

D) net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

45

Creditors would prefer

1)a quick ratio of 1.2 to a quick ratio of 0.8

2)a quick ratio of 0.8 to a quick ratio of 1.2

3)an average collection period of 46 to an average collection period of 35

4)an average collection period of 35 to an average collection period of 46

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

1)a quick ratio of 1.2 to a quick ratio of 0.8

2)a quick ratio of 0.8 to a quick ratio of 1.2

3)an average collection period of 46 to an average collection period of 35

4)an average collection period of 35 to an average collection period of 46

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

46

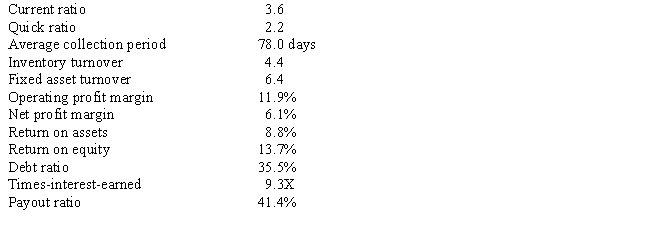

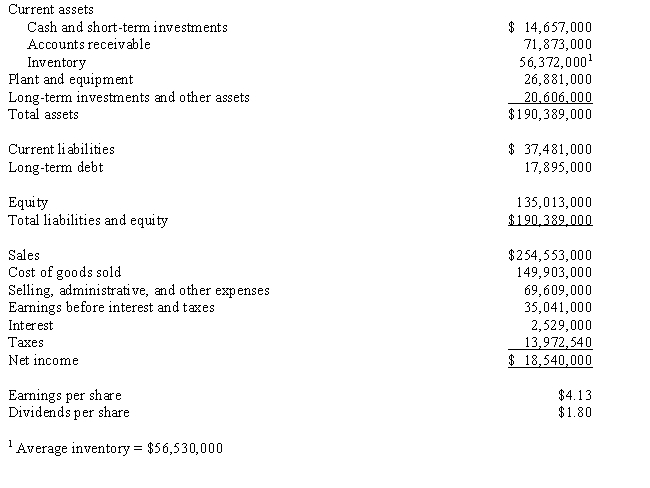

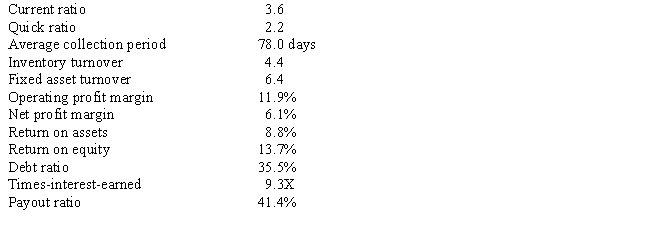

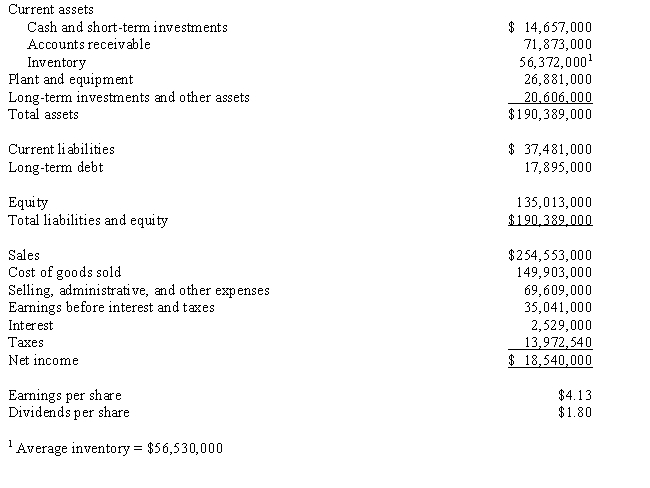

An analysis of last year's financial statements produced the following results.

Use the following data to compute the comparable financial ratios for next fiscal year.Has the firm's financial position changed?

Use the following data to compute the comparable financial ratios for next fiscal year.Has the firm's financial position changed?

Use the following data to compute the comparable financial ratios for next fiscal year.Has the firm's financial position changed?

Use the following data to compute the comparable financial ratios for next fiscal year.Has the firm's financial position changed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

47

Operating income is not affected by

A) depreciation

B) cost of goods sold

C) rent payments

D) interest earned

A) depreciation

B) cost of goods sold

C) rent payments

D) interest earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

48

Owners of bonds would prefer

1)a debt ratio of 60 percent to a debt ratio of 40 percent

2)a debt ratio of 40 percent to a debt ratio of 60 percent

3)a times-interest-earned of 5.1 to a times-interest-earned of 3.9

4)a times-interest-earned of 3.9 to a times-interest-earned of 5.1

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

1)a debt ratio of 60 percent to a debt ratio of 40 percent

2)a debt ratio of 40 percent to a debt ratio of 60 percent

3)a times-interest-earned of 5.1 to a times-interest-earned of 3.9

4)a times-interest-earned of 3.9 to a times-interest-earned of 5.1

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

49

Efficient financial markets suggest that

A) fundamental analysis leads to superior returns

B) fundamental analysis does not lead to superior returns

C) ratio analysis predicts changes in stock prices

D) ratio analysis reduces market efficiency

A) fundamental analysis leads to superior returns

B) fundamental analysis does not lead to superior returns

C) ratio analysis predicts changes in stock prices

D) ratio analysis reduces market efficiency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is a cash inflow?

A) distributing a stock dividend

B) retiring an account payable

C) collecting an account receivable

D) paying property taxes

A) distributing a stock dividend

B) retiring an account payable

C) collecting an account receivable

D) paying property taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

51

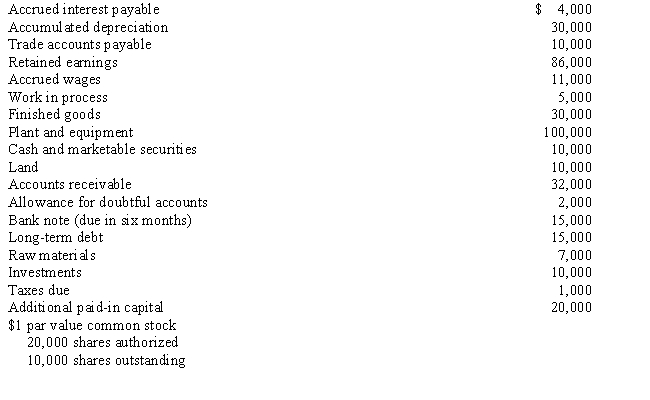

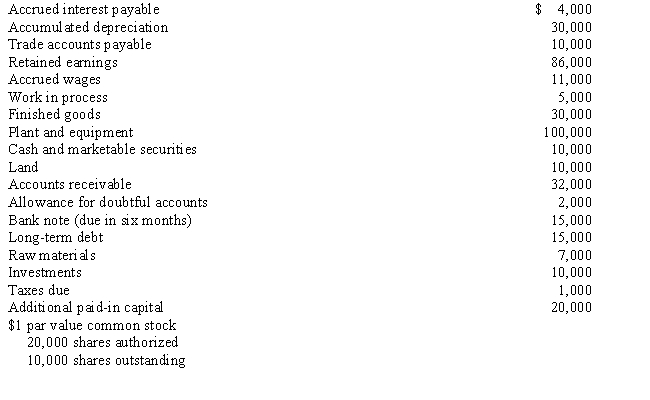

Construct a balance sheet from the following information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

52

The return on equity

A) is the ratio of sales to equity

B) measures what the firm earns on assets

C) is the ratio of net income to total equity

D) measures what the firm earns on sales

A) is the ratio of sales to equity

B) measures what the firm earns on assets

C) is the ratio of net income to total equity

D) measures what the firm earns on sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is a cash outflow?

A) splitting the stock two for one

B) acquiring inventory

C) retaining earnings

D) switching from straight-line depreciation to accelerated depreciation

A) splitting the stock two for one

B) acquiring inventory

C) retaining earnings

D) switching from straight-line depreciation to accelerated depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

54

Cash flow differs from earnings because

A) cash flow includes depreciation expense

B) earnings can be negative

C) taxes only affect earnings

D) interest expense only affects cash flow

A) cash flow includes depreciation expense

B) earnings can be negative

C) taxes only affect earnings

D) interest expense only affects cash flow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

55

The debt ratio is a measure of

1)financial leverage

2)the use of debt financing

3)asset utilization

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

1)financial leverage

2)the use of debt financing

3)asset utilization

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck