Deck 18: Convertible Bonds and Convertible Preferred Stock

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/46

العب

ملء الشاشة (f)

Deck 18: Convertible Bonds and Convertible Preferred Stock

1

If a convertible bond is called,the bondholder must convert the bond or lose the appreciation achieved by the stock.

True

2

Convertible preferred stock is usually less risky to investors than the firm's convertible bonds.

False

3

The value of a convertible bond as a debt instrument sets a floor (i.e.,the minimum price)for the bond.

True

4

Convertible bonds are often subordinated to the firm's other debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

5

A convertible bond's value fluctuates with the price of the stock into which the bond may be converted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a $1,000 convertible bond may be converted into 25 shares,the exercise price is $40 a share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

7

A convertible bond may be converted at the firm's option into common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

8

Convertible preferred stock may be converted into debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

9

The longer it takes to overcome the capital gains advantage to the stock,the less attractive is a convertible bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

10

The premium paid over a convertible bond's value as stock tends to fall as the price of the stock rises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

11

Convertible bonds tend to pay more interest than comparable non-convertible bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

12

As the price of the stock rises,the probability that a convertible bond will be called increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

13

Generally,convertible bonds lack a call provision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

14

If interest rates rise,the value of a convertible bond as debt increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

15

As interest rates increase,the probability that a convertible bond will be called declines.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

16

Convertible bonds tend to sell for a premium over their value as stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

17

The premium paid over a convertible bond's value as debt tends to decline as the price of the stock rises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

18

The potential capital gains from a convertible bond tend to be less than the potential capital gains on the stock into which the bond may be converted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

19

If the value of the stock rises,the value of a convertible bond falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

20

Convertible preferred stock generally has a call feature designed to force conversion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

21

The value of a convertible bond as stock depends on the

1)current rate of interest

2)number of shares into which it is convertible

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

1)current rate of interest

2)number of shares into which it is convertible

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

22

The price of a convertible bond increases when 1.interest rates rise

2)interest rates fall

3)the price of the stock rises

4)the price of the stock falls

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

2)interest rates fall

3)the price of the stock rises

4)the price of the stock falls

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

23

When a convertible bond is called,

1)interest ceases to accrue

2)the bondholder receives the principal

3)the bondholder generally converts the bond

4)dividends are paid to the bondholder

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

1)interest ceases to accrue

2)the bondholder receives the principal

3)the bondholder generally converts the bond

4)dividends are paid to the bondholder

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

24

When interest rates rise,the price of a put bond will tend to fluctuate more than a bond without the put option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

25

If the price of common stock falls,the value of a convertible preferred stock will also tend to fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

26

A put bond permits

A) the investor to convert the bond into stock

B) the firm to call the bond

C) the investor to sell the bond back to the company

D) the firm to pay a variable rate of interest

A) the investor to convert the bond into stock

B) the firm to call the bond

C) the investor to sell the bond back to the company

D) the firm to pay a variable rate of interest

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

27

Convertible preferred stock 12.Convertible preferred stock

1)pays a fixed dividend

2)pays a variable dividend

3)may be converted into the firm's bonds

4)may be converted into the firm's stock

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

1)pays a fixed dividend

2)pays a variable dividend

3)may be converted into the firm's bonds

4)may be converted into the firm's stock

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

28

As the price of common stock rises,

A) the value of convertible bonds and convertible preferred stock declines

B) the value of convertible bonds falls but convertible preferred stock rises

C) the value of convertible bonds rises but convertible preferred stock falls

D) the value of convertible bonds and convertible preferred stock rises

A) the value of convertible bonds and convertible preferred stock declines

B) the value of convertible bonds falls but convertible preferred stock rises

C) the value of convertible bonds rises but convertible preferred stock falls

D) the value of convertible bonds and convertible preferred stock rises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

29

Put bonds tend to have lower coupons than bonds that lack the put feature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

30

If interest rates fall,the investor will not exercise the option in a put bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

31

Convertible bonds sell for a premium over their

A) market price

B) value as stock

C) value as debt

D) value as stock and as debt

A) market price

B) value as stock

C) value as debt

D) value as stock and as debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

32

The dividends paid by a convertible preferred stock are treated as a tax-deductible expense to the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

33

The price of a convertible bond is often 1.greater than its value as stock

2)less than its value as stock

3)greater than its value as debt

4)less than its value as debt

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

2)less than its value as stock

3)greater than its value as debt

4)less than its value as debt

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

34

The value of convertible preferred stock depends on the 12.Convertible preferred stock

1)pays a fixed dividend

2)pays a variable dividend

3)may be converted into the firm's bonds

4)may be converted into the firm's stock

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

1)pays a fixed dividend

2)pays a variable dividend

3)may be converted into the firm's bonds

4)may be converted into the firm's stock

A)1 and 3

B)1 and 4

C)2 and 3

D)2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

35

Convertible bonds have a call feature to

A) protect stockholders from early conversions

B) protect bondholders from conversions by stockholders

C) force stockholders to convert

D) force bondholders to convert

A) protect stockholders from early conversions

B) protect bondholders from conversions by stockholders

C) force stockholders to convert

D) force bondholders to convert

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

36

The value of a convertible bond as debt does not depend on

A) the bond's coupon

B) the conversion price of the bond

C) current interest rates

D) the term of the bond

A) the bond's coupon

B) the conversion price of the bond

C) current interest rates

D) the term of the bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

37

Convertible bonds may dilute current stockholders' equity because

A) the bonds require interest payments

B) the bonds are callable

C) dividends to bondholders reduce earnings

D) new shares are issued when the bonds are converted

A) the bonds require interest payments

B) the bonds are callable

C) dividends to bondholders reduce earnings

D) new shares are issued when the bonds are converted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

38

A put bond permits the investor to sell the bond back to the issuer at par prior to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

39

Buying a bond with an option to sell the bond back to the firm at par is more speculative than buying a bond that lacks this feature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

40

Generally a convertible bond lacks

A)an indenture

B)a call feature

C)a strong sinking fund

D)a maturity date

A)an indenture

B)a call feature

C)a strong sinking fund

D)a maturity date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

41

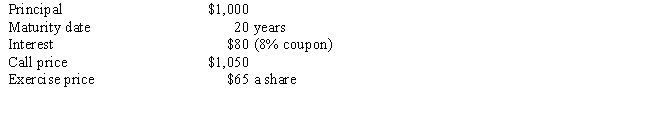

Given the information below,answer the following questions.

A convertible bond has the following features:

A convertible bond has the following features:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

42

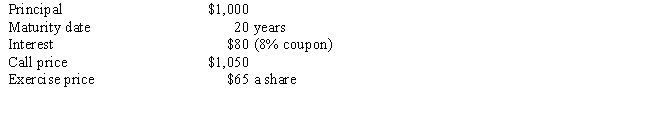

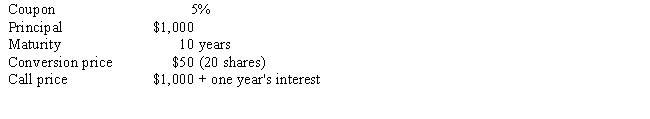

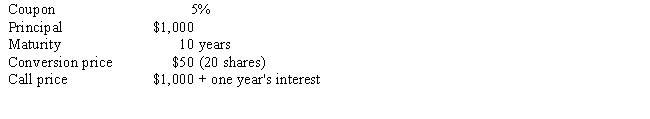

Corporation HBM has a convertible bond with the following terms:

The bond's credit rating is BBB,and comparable BBB-rated bonds yield 9 percent.

The bond's credit rating is BBB,and comparable BBB-rated bonds yield 9 percent.

The firm's stock is selling for $45 and pays a dividend of $1.50 a share.The convertible bond is selling for $1,000.

a.What is the premium paid over the bond's value as stock?

b.Given the bond's income advantage, how long must the investor hold the bond to overcome the premium over the bond's value as stock?

c.If the price of the stock increased to $65, is there any reason to expect the firm to call the bond?

d.If the convertible bond is held to maturity, what is the annualized return on an investment in the bond?

e.If the price of the stock declines to $25 a share while interest rates on BBB-rated bonds rise to 12 percent, what impact does the increase in interest rates have on this convertible bond?

The bond's credit rating is BBB,and comparable BBB-rated bonds yield 9 percent.

The bond's credit rating is BBB,and comparable BBB-rated bonds yield 9 percent.The firm's stock is selling for $45 and pays a dividend of $1.50 a share.The convertible bond is selling for $1,000.

a.What is the premium paid over the bond's value as stock?

b.Given the bond's income advantage, how long must the investor hold the bond to overcome the premium over the bond's value as stock?

c.If the price of the stock increased to $65, is there any reason to expect the firm to call the bond?

d.If the convertible bond is held to maturity, what is the annualized return on an investment in the bond?

e.If the price of the stock declines to $25 a share while interest rates on BBB-rated bonds rise to 12 percent, what impact does the increase in interest rates have on this convertible bond?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

43

The interest paid by a convertible bond tends

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

44

If an investor expected the firm to grow slowly,which of the following strategies would be best?

A) sell the stock short

B) buy a convertible bond and short the stock

C) buy the stock

D) buy the firm's convertible securities

A) sell the stock short

B) buy a convertible bond and short the stock

C) buy the stock

D) buy the firm's convertible securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

45

A convertible bond's payback period 1.increases as the bond's coupon increases

2)decreases as the bond's coupon increases

3)increases as the stock's dividend increases

4)decreases as the stock's dividend increases

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

2)decreases as the bond's coupon increases

3)increases as the stock's dividend increases

4)decreases as the stock's dividend increases

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck

46

A $50 par value convertible preferred stock is convertible into 5 shares (exercise price of $10).The preferred is selling for $75,and the price of the common stock is $12.If the price of the common stock rises to $20,what is the minimum percentage price increase the holder of the preferred stock should experience?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 46 في هذه المجموعة.

فتح الحزمة

k this deck