Deck 20: Option Valuation and Strategies

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/33

العب

ملء الشاشة (f)

Deck 20: Option Valuation and Strategies

1

According to the Black/Scholes option valuation model,the value of a call option increases if

A) the option approaches expiration

B) the return on the stock is more certain

C) interest rates on a discounted bond decline

D) the standard deviation of the stock's return increases

A) the option approaches expiration

B) the return on the stock is more certain

C) interest rates on a discounted bond decline

D) the standard deviation of the stock's return increases

D

2

The "collar strategy" is used to lock in profits from an increase in the price of a stock.

True

3

If the hedge ratio is 0.7,the number of call options necessary to offset a long position in a stock is 7.0.

False

4

The hedge ratio is one piece of information given by the Black/Scholes option valuation model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

5

Put-call parity suggests that the sum of the prices of a stock,a call and a put on that stock,and a debt instrument maturing at the expiration of the options must equal zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

6

An investor cannot buy and sell two different call options with the same expiration dates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

7

The hedge indicates the number of call options that is necessary to offset price movements in the underlying stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

8

According to the Black/Scholes option valuation model,the value of a call option rises as interest rates increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

9

According to the Black/Scholes option valuation model,a call option's value increases if

A) stock prices increase and interest rates decrease

B) the time to expiration decreases and interest rates increase

C) the variability of the stock's return increases and stock prices increase

D) interest rates decrease and the variability of the stock's return increases

A) stock prices increase and interest rates decrease

B) the time to expiration decreases and interest rates increase

C) the variability of the stock's return increases and stock prices increase

D) interest rates decrease and the variability of the stock's return increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

10

If investors believe that a stock's prices will fluctuate but they are not certain as to the direction,these investors may buy a straddle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

11

Since spreads involve buying or selling more than one option,commissions costs tend to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

12

The Black/Scholes option valuation model divides the option's strike price by the probability that the option will be exercised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

13

Put-call parity explains why a change in interest rates by the Federal Reserve must affect stock and option prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

14

Writing both a put and a call at the same strike price and expiration date is an illustration of a straddle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

15

An investor buys a straddle in anticipation of stable stock prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

16

According to the Black/Scholes option valuation model,a call option's value decreases if

A) interest rates increase as the option approaches expiration

B) the variability of the stock's return declines and the interest rate decreases

C) an increase in the price of the stock results in a two for one stock split

D) the option is exercised

A) interest rates increase as the option approaches expiration

B) the variability of the stock's return declines and the interest rate decreases

C) an increase in the price of the stock results in a two for one stock split

D) the option is exercised

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

17

According to the Black/Scholes option valuation model,the value of a call option rises as it approaches expiration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

18

According to put-call parity,if a stock is overvalued,the investor should sell the stock short,sell the put,buy the call,and buy the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

19

If an individual sells a stock short,that investor is protected from a large increase in the price of the stock by selling a call option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

20

The protective call strategy is an illustration of a short position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the investor anticipates that the price of stock will be stable,he or she may

A) sell a straddle

B) sell a call

C) buy a call

D) buy a put

A) sell a straddle

B) sell a call

C) buy a call

D) buy a put

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

22

If a call is overvalued,put-call parity suggests that the investor should

A) sell the call and the stock and buy the put and the bond

B) sell the call and the bond and buy the put and the stock

C) sell the bond and the put and buy the stock and the call

D) sell the stock and the put and buy the call and the bond

A) sell the call and the stock and buy the put and the bond

B) sell the call and the bond and buy the put and the stock

C) sell the bond and the put and buy the stock and the call

D) sell the stock and the put and buy the call and the bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

23

If the investor buys a bear spread,the individual anticipates

A) higher interest rates

B) higher option prices

C) lower stock prices

D) lower put prices

A) higher interest rates

B) higher option prices

C) lower stock prices

D) lower put prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

24

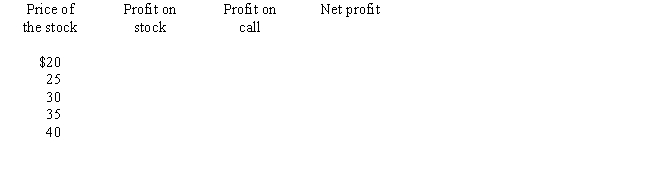

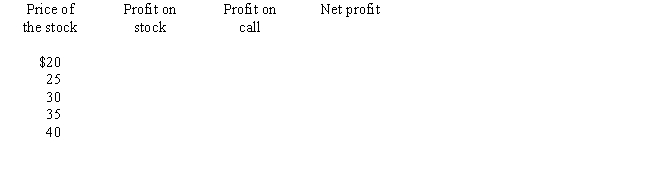

A put and a call have the following terms:

The price of the stock is currently $29.You sell the stock short and purchase the call.Complete the following table and answer the questions.

The price of the stock is currently $29.You sell the stock short and purchase the call.Complete the following table and answer the questions.

a.What is the maximum possible profit on the position?

b.What is the maximum possible loss on the position?

c.What is the range of stock prices that generates a profit?

d.What advantage does this position offer?

The price of the stock is currently $29.You sell the stock short and purchase the call.Complete the following table and answer the questions.

The price of the stock is currently $29.You sell the stock short and purchase the call.Complete the following table and answer the questions.

a.What is the maximum possible profit on the position?

b.What is the maximum possible loss on the position?

c.What is the range of stock prices that generates a profit?

d.What advantage does this position offer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

25

The hedge ratio determines the number of

A) call options to offset movements in the price of the stock

B) call options to offset a straddle

C) put options to offset movements in the price of a call option

D) call options to offset the impact of changes in interest rates

A) call options to offset movements in the price of the stock

B) call options to offset a straddle

C) put options to offset movements in the price of a call option

D) call options to offset the impact of changes in interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

26

If an investor sells a stock short,that individual reduces the risk of loss by

A) buying a put

B) buying a call

C) entering a limit order to sell the stock if its price declines

D) increasing the collateral with the broker

A) buying a put

B) buying a call

C) entering a limit order to sell the stock if its price declines

D) increasing the collateral with the broker

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

27

The price of a stock is $46 and the prices of call options to buy the stock at $45 and $50 are $6 and $3,respectively.What are the potential profits and losses when the price of the stock is $40,$45,$50,and $55 if the investor buys the call at $45 and sells the call at $50?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

28

If the price of a stock is $100 while the price of a call option at $100 is $3,the price of the put option is $2,and the rate of interest is 10 percent so the investor can purchase a $100 discounted note for $90.90 ,what should you do? Verify the potential losses and profits from the position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

29

The investor owns 1,000 shares of stock but anticipates its price may decline.To reduce the risk of loss,how many call options must be sold if the hedge ratio is 0.7?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

30

To acquire a straddle,the investor

A) buys stock and a call

B) buys two calls with different strike prices

C) buys a put and sells a call

D) buys a put and buys a call

A) buys stock and a call

B) buys two calls with different strike prices

C) buys a put and sells a call

D) buys a put and buys a call

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

31

A call option is the right to buy stock at $25 a share.According to the Black/Scholes option valuation model,what is the value of the call

a.

if the price of the stock is $25, the interest rate is 8 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

b.

if the price of the stock is $25, the interest rate is 6 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

c.

if the price of the stock is $27, the interest rate is 8 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

a.

if the price of the stock is $25, the interest rate is 8 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

b.

if the price of the stock is $25, the interest rate is 6 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

c.

if the price of the stock is $27, the interest rate is 8 percent, the option expires in three months, and the standard deviation of the stock's return is 0.20 (20 percent)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

32

Put-call parity suggests that the sum of the

A) prices of a stock and call equal zero

B) prices of a put and a call equal zero

C) sum of the prices of a stock, a call, a put, and a bond equal zero

D) sum of the prices of a stock and a put be equal to the prices of a call and a discounted bond

A) prices of a stock and call equal zero

B) prices of a put and a call equal zero

C) sum of the prices of a stock, a call, a put, and a bond equal zero

D) sum of the prices of a stock and a put be equal to the prices of a call and a discounted bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a stock is selling for $33 and you expect the price not to fluctuate,what are the potential profits and losses from writing a straddle if a call option at $35 sells for $3 and the put option at $35 sells for $4?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck