Deck 22: Investing in Foreign Securities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/54

العب

ملء الشاشة (f)

Deck 22: Investing in Foreign Securities

1

Foreign travel is recorded in the current account of the balance of payments.

True

2

If a speculator expects the value of the pound to fall,then that individual may establish a long position in pounds or a short position in dollars.

False

3

If a nation exports more goods than it imports,it has a surplus in the current account.

True

4

An increase in the demand for dollars will tend to reduce the return on foreign investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

5

If the American dollar is devalued,American goods are cheaper to individuals holding dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

6

If the demand for a currency exceeds the supply,the currency will be devalued under a system of freely fluctuating exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

7

The devaluation (depreciation)of one currency implies the revaluation (appreciation)of other currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

8

Returns on investments in foreign securities are unaffected by fluctuations in the value of foreign currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

9

Foreign currencies are bought and sold in the foreign exchange market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

10

If Americans buy British securities,they may hedge the foreign exchange risk by entering into futures contracts to sell pounds at a specified price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under a system of fluctuating exchange rates,a currency will depreciate if supply exceeds the demand for the currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

12

The risk associated with fluctuations in exchange rates is increased through hedging with foreign currencies futures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

13

Fluctuations in exchange rates are one source of risk that investors in domestic securities avoid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

14

If a country's currency is devalued,its price relative to other currencies is reduced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

15

If speculators anticipate the value of the Euro to rise,they enter into futures contracts requiring they deliver Euros in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

16

If American investors buy German stocks,they may sustain losses if the Euro is devalued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

17

American investors who own foreign securities may have dividend payments taxed by the local country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a country exports more goods than it imports,it has a surplus in its balance of payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

19

If you own British pounds and the American dollar is devalued,that implies American goods will be cheaper.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

20

American investors seeking foreign investments are limited to foreign securities traded on the New York and American stock exchanges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

21

Because of differences in the units of trading,investors may not be able to completely hedge their positions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

22

If foreign securities markets are as efficient as U.S.securities markets,then foreign investments may offer the U.S.investor no advantages over investing in domestic securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

23

The futures price of a currency equals the spot price of the currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

24

From the viewpoint of international currency flows,foreign investments in plant and equipment are no different from investments in foreign securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

25

If foreign demand for a country's goods increases, 1.the value of its currency will rise

2)the value of its currency will decline

3)the value of other currencies relative to its currency will be revalued

4)the value of other currencies relative to its currency will be devalued

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

2)the value of its currency will decline

3)the value of other currencies relative to its currency will be revalued

4)the value of other currencies relative to its currency will be devalued

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

26

A revaluation of the British pound implies 1.an increase in the price of British goods to U.S.citizens

2)a decrease in the price of British goods to U.S.citizens

3)an increase in the price of American goods to citizens of Britain

4)a decrease in the price of American goods to citizens of Britain

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

2)a decrease in the price of British goods to U.S.citizens

3)an increase in the price of American goods to citizens of Britain

4)a decrease in the price of American goods to citizens of Britain

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

27

The shares of closed-end investment companies that invest in foreign securities may sell for a premium over their net asset values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

28

Exchange rates are

A) prices at which foreign securities are bought and sold

B) prices at which American stocks are sold abroad

C) prices at which foreign securities are bought and sold in the United States

D) prices of foreign currencies

A) prices at which foreign securities are bought and sold

B) prices at which American stocks are sold abroad

C) prices at which foreign securities are bought and sold in the United States

D) prices of foreign currencies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

29

If an American investor buys a British stock,the individual will not sustain a loss if the value of the

A) security rises and the value of the pound falls

B) security falls and the value of the pound rises

C) security rises and the value of the pound rises

D) security falls and the value of the pound falls

A) security rises and the value of the pound falls

B) security falls and the value of the pound rises

C) security rises and the value of the pound rises

D) security falls and the value of the pound falls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

30

American investors may acquire shares in mutual funds that specialize in foreign investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

31

If a nation exports fewer goods than it imports,it 1.experiences an outflow of currency

2)experiences an inflow of currency

3)has a surplus in its current account

4)has a deficit in its current account

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

2)experiences an inflow of currency

3)has a surplus in its current account

4)has a deficit in its current account

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

32

For diversification to be achieved by foreign investments,the returns on such investments must be positively correlated with the returns from U.S.securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

33

Foreign securities markets may be less efficient than American securities markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

34

Advantages associated with investing in foreign securities do not include

A) inefficient foreign security markets producing larger returns

B) global diversification

C) reduction in unsystematic risk

D) tax avoidance on dividend income

A) inefficient foreign security markets producing larger returns

B) global diversification

C) reduction in unsystematic risk

D) tax avoidance on dividend income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

35

A global fund invests solely in foreign securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following causes a currency inflow?

1)foreign travel and foreign investments

2)domestic travel by foreigners

3)dividend payments from foreign corporations

4)dividend payments to foreign investors

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

1)foreign travel and foreign investments

2)domestic travel by foreigners

3)dividend payments from foreign corporations

4)dividend payments to foreign investors

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

37

One advantage offered by investments in foreign stocks is diversification of the portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

38

Anticipation that the value of a currency will rise results in the spot price exceeding the futures price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

39

British mutual funds are called unit trusts,and their shares are registered with the Securities and Exchange Commission.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is recorded in the current account of the balance of payments?

A) a purchase of a foreign money market security

B) a foreign company's buying equipment in the U.S.

C) a foreign government spending in the U.S.

D) the statistical adjustment for differences in imports and exports

A) a purchase of a foreign money market security

B) a foreign company's buying equipment in the U.S.

C) a foreign government spending in the U.S.

D) the statistical adjustment for differences in imports and exports

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

41

The balance of payments excludes

A) the value of a country's assets

B) exports of securities

C) government purchases of foreign goods

D) a reserve account

A) the value of a country's assets

B) exports of securities

C) government purchases of foreign goods

D) a reserve account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

42

The EAFE is

A) an index of European stocks

B) a global index of stocks

C) an index of stocks traded in Europe, Australia, and the far east

D) an index of stocks trade in Europe, the Americas, and the far east

A) an index of European stocks

B) a global index of stocks

C) an index of stocks traded in Europe, Australia, and the far east

D) an index of stocks trade in Europe, the Americas, and the far east

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

43

If foreign securities markets are inefficient,

A) investors cannot expect to outperform the market

B) investors will outperform the market consistently

C) some individuals may consistently outperform the market

D) investors can expect to outperform the market

A) investors cannot expect to outperform the market

B) investors will outperform the market consistently

C) some individuals may consistently outperform the market

D) investors can expect to outperform the market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

44

The portfolios of international funds

A) stress European securities

B) exclude U.S. securities

C) are a diversified mix of securities from all countries with security markets

D) specialize in the securities of one country

A) stress European securities

B) exclude U.S. securities

C) are a diversified mix of securities from all countries with security markets

D) specialize in the securities of one country

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

45

Eurodollars are

A) dollars spent abroad by tourists

B) foreign deposits in American banks

C) U.S. securities traded abroad

D) dollar-denominated deposits in foreign banks

A) dollars spent abroad by tourists

B) foreign deposits in American banks

C) U.S. securities traded abroad

D) dollar-denominated deposits in foreign banks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

46

Systematic risk associated with investing in foreign securities excludes

A) how firms finance their assets

B) exchange rate risk

C) changes in interest rates

D) inflation

A) how firms finance their assets

B) exchange rate risk

C) changes in interest rates

D) inflation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

47

If the price of the European euro is $1.36,how many euros are necessary to purchase $1.00?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

48

On means to hedge against an anticipated decline in the Euro would be to sell

A) currency put options

B) American denominated securities

C) Eurobonds

D) euro currency futures

A) currency put options

B) American denominated securities

C) Eurobonds

D) euro currency futures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

49

An American investor may take a position in foreign equities by acquiring

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

A) 1 and 2

B) 1 and 3

C) 2 and 3

D) all of these choices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

50

The European Economic Monetary Union created the euro which is

1)iShares

2)international mutual funds

3)country closed-end investment companies

A) a European equities market

B) a common European currency

C) a European bond traded outside of Europe

D) a currency for clearing security trades

1)iShares

2)international mutual funds

3)country closed-end investment companies

A) a European equities market

B) a common European currency

C) a European bond traded outside of Europe

D) a currency for clearing security trades

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

51

Correlation coefficients relating U.S.stock markets and foreign stock markets

A) tend to be negative

B) diminish over time

C) are equal to beta coefficients relating U.S. and foreign markets

D) suggest possible diversification

A) tend to be negative

B) diminish over time

C) are equal to beta coefficients relating U.S. and foreign markets

D) suggest possible diversification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

52

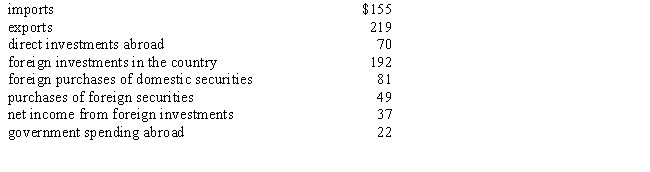

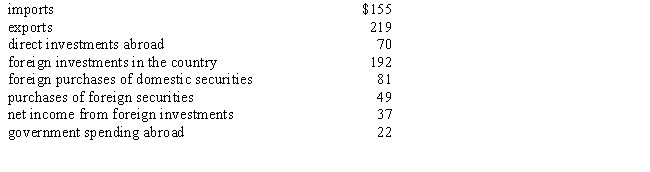

What is a nation's cash inflow (outflow)on its current account and its capital account given the following information? Was there a net currency inflow or outflow?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

53

A deficit in a country's balance of trade suggests

A) excessive investment in that country by foreign firms

B) the balance of payments is in disequilibrium

C) imports of goods and services exceed exports

D) income paid foreign nationals exceeds domestic income

A) excessive investment in that country by foreign firms

B) the balance of payments is in disequilibrium

C) imports of goods and services exceed exports

D) income paid foreign nationals exceeds domestic income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

54

If a nation has a surplus in its current account, 1.it exports fewer goods than it imports

2)it exports more goods than it imports

3)the value of its currency should fall

4)the value of its currency should rise

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

2)it exports more goods than it imports

3)the value of its currency should fall

4)the value of its currency should rise

A) 1 and 3

B) 1 and 4

C) 2 and 3

D) 2 and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck