Deck 13: Flexible Budgets, cost Variances, and Management Control

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/118

العب

ملء الشاشة (f)

Deck 13: Flexible Budgets, cost Variances, and Management Control

1

The static-budget is based on the level of output planned at the end of the budget period.

False

Explanation: The static-budget is based on the level of output planned at the start of the budget period,not at the end of the budget period.

Explanation: The static-budget is based on the level of output planned at the start of the budget period,not at the end of the budget period.

2

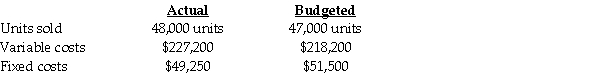

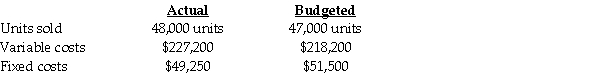

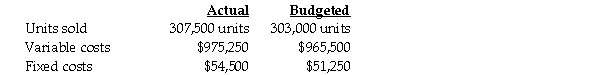

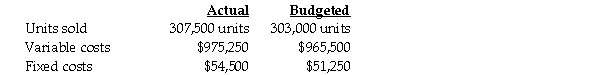

Laurel Corporation used the following data to evaluate their current operating system.The company sells items to $30 each and used a budgeted selling price $30 per unit.

Required:

Compute the static-budget variance of revenues,the static-budget variance of variable costs,and the static-budget variance of operating income.

A)$30,000 F;$9,000 U;$23,250 F

B)$32,000 U;$9,100 F;$23,400 F

C)$33,000 F;$9,150 F;$23,410 F

D)$33,100 F;$9,200 U;$23,420 U

E)$33,200 U;$9,250 F;$23,430 F

Required:

Compute the static-budget variance of revenues,the static-budget variance of variable costs,and the static-budget variance of operating income.

A)$30,000 F;$9,000 U;$23,250 F

B)$32,000 U;$9,100 F;$23,400 F

C)$33,000 F;$9,150 F;$23,410 F

D)$33,100 F;$9,200 U;$23,420 U

E)$33,200 U;$9,250 F;$23,430 F

A

Explanation: A)Static-budget variance of revenues [(48,000 units × $30)- (47,000 × $30)] = $30,000 F

Static-budget variance of variable costs [($227,200 - $218,200)] = $9,000 U

![A Explanation: A)Static-budget variance of revenues [(48,000 units × $30)- (47,000 × $30)] = $30,000 F Static-budget variance of variable costs [($227,200 - $218,200)] = $9,000 U](https://d2lvgg3v3hfg70.cloudfront.net/TB3439/11ea7c93_bf49_c173_9d3f_c55ab07051cc_TB3439_00.jpg)

Explanation: A)Static-budget variance of revenues [(48,000 units × $30)- (47,000 × $30)] = $30,000 F

Static-budget variance of variable costs [($227,200 - $218,200)] = $9,000 U

![A Explanation: A)Static-budget variance of revenues [(48,000 units × $30)- (47,000 × $30)] = $30,000 F Static-budget variance of variable costs [($227,200 - $218,200)] = $9,000 U](https://d2lvgg3v3hfg70.cloudfront.net/TB3439/11ea7c93_bf49_c173_9d3f_c55ab07051cc_TB3439_00.jpg)

3

Unfavorable variances are also referred to as ________.

A)favorable variances

B)adverse variances

C)bottom-out variances

D)substandard variances

E)dissatisfactory variances

A)favorable variances

B)adverse variances

C)bottom-out variances

D)substandard variances

E)dissatisfactory variances

B

4

The expected performance is also referred to as the ________.

A)variance

B)target output

C)critical value set

D)financial objective

E)budgeted performance

A)variance

B)target output

C)critical value set

D)financial objective

E)budgeted performance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

5

B&C Entertainment,film distribution center,has a static-budget operating income of $164,000 and an actual operating income of $48,000.

Required

Compute the static-budget variance for operating income and identify whether the variance is favorable,F,or unfavorable,U.

A)$116,000;U variance

B)$116,000;F variance

C)$212,000;U variance

D)$212,000;F variance

E)$787,200;F variance

Required

Compute the static-budget variance for operating income and identify whether the variance is favorable,F,or unfavorable,U.

A)$116,000;U variance

B)$116,000;F variance

C)$212,000;U variance

D)$212,000;F variance

E)$787,200;F variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

6

The managerial accountant at Rainy Day Umbrella Company needs to calculate the direct material cost per umbrella that is manufactured.The company produced 35,000 umbrellas in the fiscal year with a direct material total cost of $760,000.

Required

Compute the direct material cost per umbrella.

A)$35.46 per umbrella

B)$23.60 per umbrella

C)$32.50 per umbrella

D)$21.71 per umbrella

E)$18.50 per umbrella

Required

Compute the direct material cost per umbrella.

A)$35.46 per umbrella

B)$23.60 per umbrella

C)$32.50 per umbrella

D)$21.71 per umbrella

E)$18.50 per umbrella

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

7

The static-budget variance is the difference between the actual result and the corresponding budgeted amount in the static budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

8

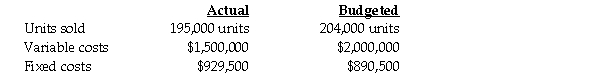

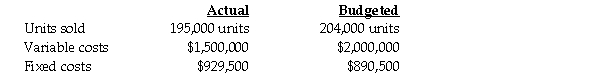

Ring Corporation used the following data to evaluate their current operating system.The company sells items for $25 each and used a budgeted selling price of $25 per unit.

Required:

Compute the static-budget variance of revenues,the static-budget variance of variable costs,and the static-budget variance of operating income.

A)$225,000 U;$500,000 F;$236,000 F

B)$226,000 U;$510,000 F;$237,000 F

C)$225,000 F;$500,000 U;$236,000 U

D)$226,000 F;$500,000 U;$236,000 U

E)$227,000 F;$480,000 F;$239,000 F

Required:

Compute the static-budget variance of revenues,the static-budget variance of variable costs,and the static-budget variance of operating income.

A)$225,000 U;$500,000 F;$236,000 F

B)$226,000 U;$510,000 F;$237,000 F

C)$225,000 F;$500,000 U;$236,000 U

D)$226,000 F;$500,000 U;$236,000 U

E)$227,000 F;$480,000 F;$239,000 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

9

The difference between actual results and expected performances is referred to as the ________.

A)variance

B)critical area

C)target numerate

D)cardinal denominator

E)parameter of importance

A)variance

B)critical area

C)target numerate

D)cardinal denominator

E)parameter of importance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

10

To indicate revenues,an F indicates ________.

A)actual costs are less than budgeted costs.

B)actual revenues exceed budgeted revenues.

C)operating income is decreasing relative to the budgeted amount.

D)actual costs are decreasing relative to the budgeted amount.

E)variable costs are decreasing relative to operating income.

A)actual costs are less than budgeted costs.

B)actual revenues exceed budgeted revenues.

C)operating income is decreasing relative to the budgeted amount.

D)actual costs are decreasing relative to the budgeted amount.

E)variable costs are decreasing relative to operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

11

A favorable variance indicates which of the following outcomes?

A)A favorable variance has the effect of increasing the static budget variance.

B)A favorable variance has the effect of decreasing operating income relative to the budgeted amount.

C)A favorable variance has the effect of increasing operating income relative to the budgeted amount.

D)A favorable variance has the effect of increasing output relative to the previous budget cycle.

E)A favorable variance has the effect of decreasing individual variable costs.

A)A favorable variance has the effect of increasing the static budget variance.

B)A favorable variance has the effect of decreasing operating income relative to the budgeted amount.

C)A favorable variance has the effect of increasing operating income relative to the budgeted amount.

D)A favorable variance has the effect of increasing output relative to the previous budget cycle.

E)A favorable variance has the effect of decreasing individual variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

12

The master budget is called a static budget because the budget for the period is developed around a single,or static,planned output level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

13

The managerial accountant at Northern Shoe Factory,a work boot manufacturer,needs to calculate the actual selling price of their product.The direct material cost is $836,000.The company produced 20,000 pairs of work boots in the cycle.Actual revenues amount to $1,670,000.

Required

Compute the actual selling price of the product and compute the direct material cost per pair of work boots.Assume that sales equal $20,000.

A)$29.50 per pair;$18.30 per pair

B)$83.50 per pair;$41.80 per pair

C)$67.40 per pair;$48.50 per pair

D)$16.70 per pair;$14.30 per pair

E)$83.60 per pair;$67.00 per pair

Required

Compute the actual selling price of the product and compute the direct material cost per pair of work boots.Assume that sales equal $20,000.

A)$29.50 per pair;$18.30 per pair

B)$83.50 per pair;$41.80 per pair

C)$67.40 per pair;$48.50 per pair

D)$16.70 per pair;$14.30 per pair

E)$83.60 per pair;$67.00 per pair

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

14

Managers use detailed variance analysis for which of the following reasons?

A)To better plan for the next budget period.

B)Detailed variance analysis minimizes the invoice error rate.

C)Detailed variance analysis better predicts the earnings per share.

D)Detailed variance analysis better illustrates the data trends of the prior cycle.

E)To understand why actual results differ from the static-budget developed for that period.

A)To better plan for the next budget period.

B)Detailed variance analysis minimizes the invoice error rate.

C)Detailed variance analysis better predicts the earnings per share.

D)Detailed variance analysis better illustrates the data trends of the prior cycle.

E)To understand why actual results differ from the static-budget developed for that period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

15

Variances are also used in performance evaluation and to motivate managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

16

Variances assist managers in implementing their strategies by enabling ________.

A)variant budgeting

B)directed functioning

C)divisional awareness

D)deviational sentience

E)management by exception

A)variant budgeting

B)directed functioning

C)divisional awareness

D)deviational sentience

E)management by exception

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

17

What are the benefits of variance analysis to a public official?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

18

The managerial accountant at Niagara Fishing Company needs to estimate the expected revenues in 2014.The company purchased materials at $1,750,000 to produce 25,000 fishing poles.The price per fishing pole is estimated to be $260.

Required

Compute the expected revenues.

A)$4,860,000

B)$5,800,000

C)$3,200,000

D)$6,500,000

E)$11,590,000

Required

Compute the expected revenues.

A)$4,860,000

B)$5,800,000

C)$3,200,000

D)$6,500,000

E)$11,590,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

19

How does variance analysis relate to the five-step decision-making process?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

20

Greenhouse Corporation used the following data to evaluate their current operating system.The company sells items for $12 each and had used a budgeted selling price of $13 per unit.

Required

Compute the static-budget variance of revenues,the static-budget variance of variable costs,and the static-budget variance of operating income.

A)$200,000 F;$8,000 F;$258,000 F

B)$210,000 U;$8,100 U;$259,000 U

C)$205,000 F;$8,500 F;$260,000 F

D)$210,000 U;$9,250 U;$261,000 F

E)$249,000 U;$9,750 U;$262,000 U

Required

Compute the static-budget variance of revenues,the static-budget variance of variable costs,and the static-budget variance of operating income.

A)$200,000 F;$8,000 F;$258,000 F

B)$210,000 U;$8,100 U;$259,000 U

C)$205,000 F;$8,500 F;$260,000 F

D)$210,000 U;$9,250 U;$261,000 F

E)$249,000 U;$9,750 U;$262,000 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

21

Flexible-budget variances are a better measure of operating performance than static-budget variances because they compare actual revenues to budgeted revenues and actual costs to budgeted costs for the same units of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

22

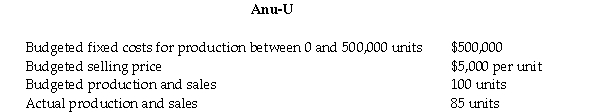

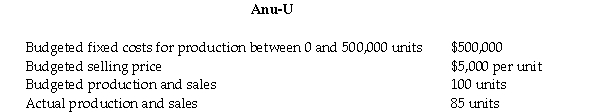

The following data was gathered for Anu-U,an electronic commercial hair dryer manufacturer:

Required

Compute the static-budget variance and identify whether the variance is favorable,F,or unfavorable,U.

A)$75,000 U variance

B)$89,000 F variance

C)$64,000 U variance

D)$97,000 F variance

E)$58,000 U variance

Required

Compute the static-budget variance and identify whether the variance is favorable,F,or unfavorable,U.

A)$75,000 U variance

B)$89,000 F variance

C)$64,000 U variance

D)$97,000 F variance

E)$58,000 U variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

23

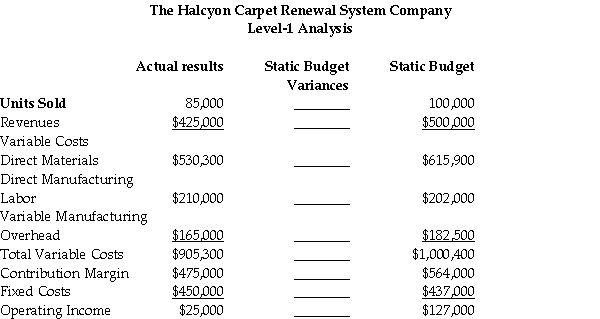

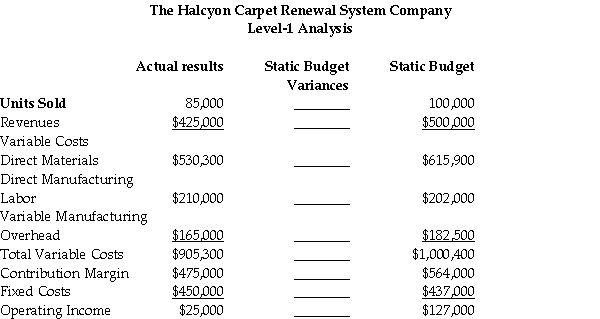

The managerial accountant prepared the following Level-1 analysis for The Halcyon Carpet renewal system company:

Required

Compute the static-budget variances of (a)units sold; (b)revenues; (c)direct materials; (d)direct manufacturing labor; (e)variable manufacturing overhead; (f)total variable costs; (g)contribution margin; (h)fixed costs; (i)operating income.

A)(a)15,000, (b)$75,000,U, (c)$85,600, (d)$8,000,U, (e)$17,500, (f)$95,100,F, (g)$89,000, (h)$13,000,U, (i)$102,000,U.

B)(a)17,000, (b)$80,000,F, (c)$92,300, (d)$6,000,U, (e)$12,600, (f)$98,100,U, (g)$93,000, (h)$15,000,F, (i)$112,000,F.

C)(a)13,000, (b)$85,000,F, (c)$95,000, (d)$4,000,F, (e)$14,300, (f)$103,000,F, (g)$95,000, (h)$108,000,U, (i)$135,000,U

D)(a)16,000 (b)$85,000,F, (c)$64,200, (d)$18,000,U, (e)$7,000, (f)$113,000,F, (g)$75,000, (h)$78,000,U, (i)$103,000,F.

E)(a)9,000, (b)$54,000,F, (c)$68,000, (d)$12,000,U, (e)$23,000, (f)$110,500,U, (g)$63,000, (h)$92,000,F, (i)$100,000,U.

Required

Compute the static-budget variances of (a)units sold; (b)revenues; (c)direct materials; (d)direct manufacturing labor; (e)variable manufacturing overhead; (f)total variable costs; (g)contribution margin; (h)fixed costs; (i)operating income.

A)(a)15,000, (b)$75,000,U, (c)$85,600, (d)$8,000,U, (e)$17,500, (f)$95,100,F, (g)$89,000, (h)$13,000,U, (i)$102,000,U.

B)(a)17,000, (b)$80,000,F, (c)$92,300, (d)$6,000,U, (e)$12,600, (f)$98,100,U, (g)$93,000, (h)$15,000,F, (i)$112,000,F.

C)(a)13,000, (b)$85,000,F, (c)$95,000, (d)$4,000,F, (e)$14,300, (f)$103,000,F, (g)$95,000, (h)$108,000,U, (i)$135,000,U

D)(a)16,000 (b)$85,000,F, (c)$64,200, (d)$18,000,U, (e)$7,000, (f)$113,000,F, (g)$75,000, (h)$78,000,U, (i)$103,000,F.

E)(a)9,000, (b)$54,000,F, (c)$68,000, (d)$12,000,U, (e)$23,000, (f)$110,500,U, (g)$63,000, (h)$92,000,F, (i)$100,000,U.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

24

The measure of the actual result deducted from the flexible budget amount is the:

A)static budget.

B)price variance.

C)rate variance.

D)sales-budget variance.

E)flexible-budget variance.

A)static budget.

B)price variance.

C)rate variance.

D)sales-budget variance.

E)flexible-budget variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

25

Why is the flexible-budget variance for revenues referred to as the selling-price variance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

26

The difference between the static-budget and the flexible-budget amounts is the ________.

A)unused capacity

B)growth component

C)sales volume variance

D)flexible-budget variance

E)balanced scorecard

A)unused capacity

B)growth component

C)sales volume variance

D)flexible-budget variance

E)balanced scorecard

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

27

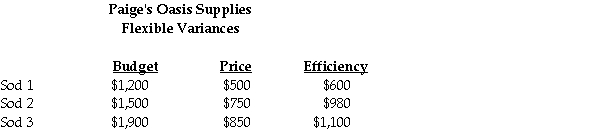

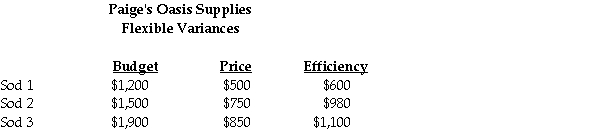

Paige's Oasis Supplies,a backyard and garden super-store,has retained an accountant to assess the variances in their budget for more efficient ordering and sale practices.The accountant compiled the following data:

Required

Compute the actual amount spent on Sod 1,Sod 2,and Sod 3.

A)$1,300,U;$1,140,F;$1,450,U

B)$1,100,F;$1,270,U;$1,650,F

C)$1,360,U;$1,040,F;$1,350,F

D)$1,200,U;$1,000,F;$1,600,F

E)$1,850,U;$1,700,U;$1,988,U

Required

Compute the actual amount spent on Sod 1,Sod 2,and Sod 3.

A)$1,300,U;$1,140,F;$1,450,U

B)$1,100,F;$1,270,U;$1,650,F

C)$1,360,U;$1,040,F;$1,350,F

D)$1,200,U;$1,000,F;$1,600,F

E)$1,850,U;$1,700,U;$1,988,U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

28

The only difference between the static budget and the flexible budget is that the static budget is prepared for the planned output of units,whereas the flexible budget is based on the actual output of units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

29

Little World Clothing Company has an actual result of $52,000 and a static budget of $122,000.Required

Compute the static-budget variance for operating income at Little World Clothing Company.and identify whether the variance is favorable,F,or unfavorable,U.

A)$182,000;F variance

B)$135,000;U variance

C)$122,000;U variance

D)$115,000;U variance

E)$95,000;F variance

Compute the static-budget variance for operating income at Little World Clothing Company.and identify whether the variance is favorable,F,or unfavorable,U.

A)$182,000;F variance

B)$135,000;U variance

C)$122,000;U variance

D)$115,000;U variance

E)$95,000;F variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

30

BlueRing Corporation planned to use $169 of material per unit but actually used $165 of material per unit,and planned to make 1,500 units,but actually made 1,300 units.

Required:

Compute the flexible budget,the flexible-budget variance,and the sales-volume variance.

A)$253,500;$(5,200);$(33,800)

B)$254,500;$(6,200);$(34,900)

C)$255,000;$(7,200);$(35,900)

D)$256,000;$(8,200)' $(36,900)

E)$257,000;$(9,200);$(37,000)

Required:

Compute the flexible budget,the flexible-budget variance,and the sales-volume variance.

A)$253,500;$(5,200);$(33,800)

B)$254,500;$(6,200);$(34,900)

C)$255,000;$(7,200);$(35,900)

D)$256,000;$(8,200)' $(36,900)

E)$257,000;$(9,200);$(37,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

31

The sales-volume variance is the difference between a flexible-budget amount and the corresponding static-budget amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

32

In March 2013,Busy Brains Text Company produced and sold 26,000 textbooks,each at a cost of $230.

Required

Compute the flexible-budget revenues for textbooks.

A)$3,690,430

B)$5,980,000

C)$38,380,000

D)$27,945,000

E)$53,650,000

Required

Required

Compute the flexible-budget revenues for textbooks.

A)$3,690,430

B)$5,980,000

C)$38,380,000

D)$27,945,000

E)$53,650,000

Required

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

33

Keepsake Corporation currently produces picture frames in an automated process.Expected production per month is 39,000 units,direct-material costs are $0.47 per unit,and manufacturing overhead costs are $16,500 per month.Manufacturing overhead consists of fixed costs.

Required

Compute the flexible budget for 19,250 units.

A)$25,047.50

B)$26,157.50

C)$27,189.50

D)$25,347.50

E)$25,547.50

Required

Compute the flexible budget for 19,250 units.

A)$25,047.50

B)$26,157.50

C)$27,189.50

D)$25,347.50

E)$25,547.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

34

Why is the flexible-budget variance for revenues referred to as the selling-price variance?

A)It is a result of the difference between the actual selling price and budgeted selling price.

B)It is a result of the actual selling price deducted from the price recovery component.

C)It is the variance by which selling prices are calculated.

D)It is a result of the average of the selling prices from several cycle periods.

E)It is based on the difference between the growth component and the price recovery component.

A)It is a result of the difference between the actual selling price and budgeted selling price.

B)It is a result of the actual selling price deducted from the price recovery component.

C)It is the variance by which selling prices are calculated.

D)It is a result of the average of the selling prices from several cycle periods.

E)It is based on the difference between the growth component and the price recovery component.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

35

Micro-Niche,a mobile home manufacturer,has a sales volume variance of $600,000,U,and a flexible-budget variance of $345,000,F.

Required

Compute the static-budget variance and identify whether the variance is favorable,F,or unfavorable,U.

A)$350,000 F

B)$245,000 U

C)$255,000 F

D)$245,000 F

E)$255,000 U

Required

Compute the static-budget variance and identify whether the variance is favorable,F,or unfavorable,U.

A)$350,000 F

B)$245,000 U

C)$255,000 F

D)$245,000 F

E)$255,000 U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

36

Spectrum Fine Glass,a glass door manufacturer,has a static-budget variance of $35,000,U,and a sales-volume variance of $430,000,U.

Required

Compute the flexible-budget variance for Spectrum Fine Glass and identify whether the flexible-budget variance is favorable or unfavorable.

A)$395,000 U variance

B)$295,000 F variance.

C)$405,000 U variance

D)$465,000 U variance

E)$505,000 F variance

Required

Required

Compute the flexible-budget variance for Spectrum Fine Glass and identify whether the flexible-budget variance is favorable or unfavorable.

A)$395,000 U variance

B)$295,000 F variance.

C)$405,000 U variance

D)$465,000 U variance

E)$505,000 F variance

Required

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

37

A sales-volume variance is the difference between a flexible budget amount and what other data factor?

A)The total flexible budget variable costs.

B)The corresponding static-budget amount.

C)The flexible-budget fixed costs.

D)The percentage of returns on sales.

E)The price recovery rate.

A)The total flexible budget variable costs.

B)The corresponding static-budget amount.

C)The flexible-budget fixed costs.

D)The percentage of returns on sales.

E)The price recovery rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

38

The following data was compiled for Busy Brains Text Company:

Required

Compute the variable manufacturing overhead cost and the flexible-budget total cost.

A)$945,000;$1,100,000

B)$1,040,000;$1,300,000

C)$1,120,000;$790,000

D)$1,300,000;$865,000

E)$675,500;$1,400,500

Required

Compute the variable manufacturing overhead cost and the flexible-budget total cost.

A)$945,000;$1,100,000

B)$1,040,000;$1,300,000

C)$1,120,000;$790,000

D)$1,300,000;$865,000

E)$675,500;$1,400,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

39

How can managers respond to unfavorable sales-volume variances?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

40

A flexible budget calculates budgeted revenues and budgeted costs based on ________.

A)actual input in the budget period

B)data from previous budget periods

C)data from multiple budget periods

D)actual output in the budget period

E)variances in the accuracy of previous budget periods.

A)actual input in the budget period

B)data from previous budget periods

C)data from multiple budget periods

D)actual output in the budget period

E)variances in the accuracy of previous budget periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

41

Laughton Incorporated planned to use $30 of material per unit but actually used $31 of material per unit,and planned to make 1,500 units but actually made 1,900 units.

Required:

Compute the flexible budget;the flexible-budget variance,and the sales-volume variance.

Required:

Compute the flexible budget;the flexible-budget variance,and the sales-volume variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

42

Managers determine the cause of flexible-budget variances when they subdivide the flexible-budget variance for direct-cost inputs into two or more detailed variances.What are two detailed variances of the flexible-budget variance for direct-cost inputs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

43

What could cause the two manufacturing efficiency variances,direct materials efficiency variance and the direct manufacturing labor efficiency variable,to show as unfavorable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

44

To effectively plan variable overhead costs for a product or service,managers must focus attention on the activities that make a superior product and ________.

A)create a balanced scorecard

B)eliminate activities that do not add value

C)instruct staff in time-saving initiatives

D)calculate possible unused capacities

E)curtail activities that are not absolutely necessary

A)create a balanced scorecard

B)eliminate activities that do not add value

C)instruct staff in time-saving initiatives

D)calculate possible unused capacities

E)curtail activities that are not absolutely necessary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following statements is an advantage to managers who use data from other companies that have similar processes?

A)Input-price data from other companies are often not available.

B)Input-quantity data from other companies are often not available.

C)Input-price data may not be comparable to a particular company's situation.

D)Input-quantity data may not be comparable to a particular company's situation.

E)The budget numbers represent competitive benchmarks from other companies.

A)Input-price data from other companies are often not available.

B)Input-quantity data from other companies are often not available.

C)Input-price data may not be comparable to a particular company's situation.

D)Input-quantity data may not be comparable to a particular company's situation.

E)The budget numbers represent competitive benchmarks from other companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

46

Managers use actual input data from past periods because this historical data can be analyzed for trends or patterns to obtain estimates of budgeted prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

47

In what important way is the planning of fixed overhead costs different from the planning of variable overhead costs?

A)Timing.

B)Return on assets.

C)Peak consumption periods.

D)Imposed limits on customers.

E)Choosing the appropriate level of capacity.

A)Timing.

B)Return on assets.

C)Peak consumption periods.

D)Imposed limits on customers.

E)Choosing the appropriate level of capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

48

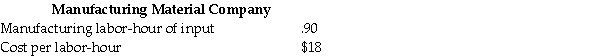

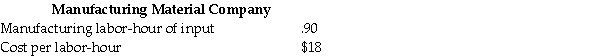

The Manufacturing Material Company reported the following information:

Required

Compute the standard direct manufacturing labor cost per unit.

A)$15.00

B)$15.50

C)$15.75

D)$16.00

E)$16.20

Required

Compute the standard direct manufacturing labor cost per unit.

A)$15.00

B)$15.50

C)$15.75

D)$16.00

E)$16.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

49

Match the following terms with their definitions:

1.Standard price A.A carefully determined cost of a unit of output.

2.Standard cost B.A carefully determined quantity of input.

3.Standard input C.A carefully determined price a company pays per

Unit of input.

A)1-C;2-A;3-B

B)1-A;2-B;3-C

C)1-B;2-A;3-C

D)1-C;2-B,3-A

E)1-A;2-C;3-B

1.Standard price A.A carefully determined cost of a unit of output.

2.Standard cost B.A carefully determined quantity of input.

3.Standard input C.A carefully determined price a company pays per

Unit of input.

A)1-C;2-A;3-B

B)1-A;2-B;3-C

C)1-B;2-A;3-C

D)1-C;2-B,3-A

E)1-A;2-C;3-B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

50

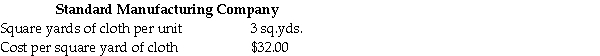

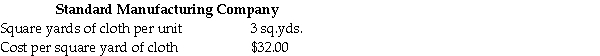

Standard Manufacturing Clothing Curtain reported the following information:

Required

Compute the standard direct material cost per curtain.

A)$90

B)$92

C)$94

D)$96

E)$98

Required

Compute the standard direct material cost per curtain.

A)$90

B)$92

C)$94

D)$96

E)$98

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

51

Effective planning for fixed overhead costs is similar to effective planning for ________.

A)variable overhead costs

B)production operations

C)product differentiation

D)performance improvement

E)acquiring new customers

A)variable overhead costs

B)production operations

C)product differentiation

D)performance improvement

E)acquiring new customers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

52

The price variance is also called a rate variance when managers refer price variances for direct manufacturing labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

53

Standards are usually expressed on a per-unit basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

54

Managers find it useful to subdivide the flexible-budget variance for direct cost variance into a ________ variance and an efficiency variance.

A)price

B)input

C)price recovery

D)productivity

E)sales-volume

A)price

B)input

C)price recovery

D)productivity

E)sales-volume

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

55

A disadvantage of using actual input data from past periods is that past data can include inefficiencies such as wastage of direct materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

56

Maryland Company planned to use $40 of material per unit,but actually used $38.75 of material per unit,and planned to make 2,000 units but actually made 1,785 units.

Required:

Compute the flexible-budget amount;the flexible-budget variance;and,the sales-volume variance.

Required:

Compute the flexible-budget amount;the flexible-budget variance;and,the sales-volume variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

57

What is a disadvantage to managers that use actual input data from past periods to calculate price and efficiency variances?

A)Past data is typically available at low cost.

B)Past data is advantageous because it excludes inefficiencies.

C)Past data can serve as benchmarks for continuous improvement.

D)Past data can include inefficiencies and does not incorporate any changes expected for the budget period.

E)Past data represents quantities and prices that are real,rather than hypothetical.

A)Past data is typically available at low cost.

B)Past data is advantageous because it excludes inefficiencies.

C)Past data can serve as benchmarks for continuous improvement.

D)Past data can include inefficiencies and does not incorporate any changes expected for the budget period.

E)Past data represents quantities and prices that are real,rather than hypothetical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following does not result in a favorable direct materials price variance?

A)The purchasing manager changed to a lower-price supplier.

B)The purchasing manager negotiated the direct materials prices more skillfully than was planned for the budget.

C)The purchasing manager ordered larger quantities than the quantities budgeted,and therefore obtained quantity discounts.

D)The price of direct materials decreased as a result of industry oversupply.

E)Budgeted purchase prices of direct materials were set too low without careful analysis of market conditions.

A)The purchasing manager changed to a lower-price supplier.

B)The purchasing manager negotiated the direct materials prices more skillfully than was planned for the budget.

C)The purchasing manager ordered larger quantities than the quantities budgeted,and therefore obtained quantity discounts.

D)The price of direct materials decreased as a result of industry oversupply.

E)Budgeted purchase prices of direct materials were set too low without careful analysis of market conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

59

What three sources do managers use to obtain budgeted input prices and budgeted input quantities?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

60

In a standard costing system,managers use standards that are attainable through efficient operations but that allow for normal disruptions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is the purpose of standard costing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following steps is not one of the four steps of developing a budgeted fixed overhead rate?

A)Choose the period to use for the budget.

B)Select the cut-off parameters of the fixed overhead cost allocations.

C)Select the cost-allocation bases to use in allocating fixed overhead costs to output produced.

D)Compute the rate per unit of each cost allocation base used to allocate fixed overhead costs to output produced.

E)Identify the fixed overhead costs associated with each cost allocation base.

A)Choose the period to use for the budget.

B)Select the cut-off parameters of the fixed overhead cost allocations.

C)Select the cost-allocation bases to use in allocating fixed overhead costs to output produced.

D)Compute the rate per unit of each cost allocation base used to allocate fixed overhead costs to output produced.

E)Identify the fixed overhead costs associated with each cost allocation base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

63

Fixed overhead costs are,by definition,a lump-sum of costs that remains unchanged in total for a given period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

64

Delicious Dishes Company is developing the budgeted variable overhead cost-allocation rates for the next twelve months.DDC's operating managers select machine-hours as the cost-allocation base.Based on past performance,the operating managers estimate that it takes 0.70 machine hours per actual output unit.For 2013,the budgeted output is 167,000 dish sets,DDC budgets 60,000(0.70 × 167,000)machine hours.All of DDCs variable overhead costs are budgeted in a pool and estimated to be $1,950,000 for 2013.

Required

Compute the budgeted variable overhead cost rate per output unit.

A)$26.10 per dish set

B)$15.50 per dish set

C)$22.75 per dish set

D)$33.50 per dish set

E)$19.80 per dish set

Required

Compute the budgeted variable overhead cost rate per output unit.

A)$26.10 per dish set

B)$15.50 per dish set

C)$22.75 per dish set

D)$33.50 per dish set

E)$19.80 per dish set

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

65

A flexible budget allows management to highlight the differences between actual costs and ________;and,management uses budgeted costs;and,________ for the actual output level.

A)actual quantities;budgeted quantities

B)expected costs;actual quantities

C)expected quantities;expected costs

D)cost variances;output variances

E)fixed overhead;overhead variances

A)actual quantities;budgeted quantities

B)expected costs;actual quantities

C)expected quantities;expected costs

D)cost variances;output variances

E)fixed overhead;overhead variances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

66

Dynamo Building Supply Company's operational management is calculating the variable overhead efficiency variance for 2011.The machine hour cost per unit was calculated to be 0.40 hours and the company budgeted for 20,000 units.However,the actual quantity of variable overhead hours amounted to 8,500 after computation.The budgeted overhead cost per unit has been determined to be $40 per hour.

Required

Compute the variable overhead efficiency variance and identify whether the variance if favorable,F,or unfavorable,U.

A)$15,000;U

B)$20,000;U

C)$5,000;U

D)$20,000;F

E)$15,000;F

Required

Compute the variable overhead efficiency variance and identify whether the variance if favorable,F,or unfavorable,U.

A)$15,000;U

B)$20,000;U

C)$5,000;U

D)$20,000;F

E)$15,000;F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

67

Variable overhead flexible-budget variance measures the difference between ________ and flexible-budget variable overhead amounts.

A)expected overhead variance cost

B)past data of variable overhead costs

C)actual variable overhead costs incurred

D)the revenue effect of price of recovery

E)the cost effect of price recovery for fixed costs

A)expected overhead variance cost

B)past data of variable overhead costs

C)actual variable overhead costs incurred

D)the revenue effect of price of recovery

E)the cost effect of price recovery for fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

68

Why is constructing and using a flexible budget beneficial to management?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

69

A manager should not always view a favorable variable overhead spending variance as desirable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

70

Atlas Cable Company has a total variable overhead cost at $3,200,000;operational management has estimated that one actual output unit takes 0.5 machine hours.The 80,000 machine hours have been budgeted for the year 2013.

Required

Compute the budgeted variable overhead cost rate per output unit.

A)$35 per cable unit

B)$15 per cable unit

C)$20 per cable unit

D)$30 per cable unit

E)$28 per cable unit

Required

Compute the budgeted variable overhead cost rate per output unit.

A)$35 per cable unit

B)$15 per cable unit

C)$20 per cable unit

D)$30 per cable unit

E)$28 per cable unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

71

The planning of fixed overhead costs differs from the planning of variable overhead costs in one important respect: timing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

72

How does the planning of fixed overhead costs differ from the planning of variable overhead costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

73

How are efficiency variances of direct cost items interpreted differently from the variable overhead efficiency variances?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

74

Management can get further insight in the reason of flexible-budget variance for direct-cost input variances when they subdivide them into ________ and spending variances.

A)defect rates

B)post-sales affect flexible-budget variance for direct-cost input

C)revenue variances

D)efficiency variances

E)gross margin percentage

A)defect rates

B)post-sales affect flexible-budget variance for direct-cost input

C)revenue variances

D)efficiency variances

E)gross margin percentage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

75

Delicious Dishes Company has a fixed overhead budget of $3,600,000 in 2013,the operating managers budgeted 60,000 machine-hours for the year.A fixed overhead cost rate of $65 per machine hour and rate of 0.70 hours per actual output unit.

Required

Compute the budgeted fixed overhead cost per output unit.

A)$35 per dish set

B)$42 per dish set

C)$18 per dish set

D)$32 per dish set

E)$23 per dish set

Required

Compute the budgeted fixed overhead cost per output unit.

A)$35 per dish set

B)$42 per dish set

C)$18 per dish set

D)$32 per dish set

E)$23 per dish set

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

76

What period do managers make the most of the decisions that determine levels of fixed overhead costs to be incurred?

A)The prior fiscal year.

B)After the budget period.

C)At the start of the budget period.

D)By the end of the prior budget period.

E)Within the first half of the budget period.

A)The prior fiscal year.

B)After the budget period.

C)At the start of the budget period.

D)By the end of the prior budget period.

E)Within the first half of the budget period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

77

________ is the difference between actual quantity of the cost-allocation base used and budgeted quantity of the cost-allocation base that should have been used to produce actual output,multiplied by budgeted variable overhead cost per unit of the cost-allocation base.

A)Contribution margin

B)Budgeted sales price

C)Budgeted level of output

D)Fixed overhead efficiency variance

E)Variable overhead efficiency variance

A)Contribution margin

B)Budgeted sales price

C)Budgeted level of output

D)Fixed overhead efficiency variance

E)Variable overhead efficiency variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

78

The variable overhead efficiency variance is computed the same way as the efficiency variance for direct cost items,nevertheless,the interpretation of the variance is very different.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

79

Dynamo Building Supply Company's management is calculating the variable overhead flexible-budget variance for 2012.The actual variable overhead costs incurred amounted to $245,000 while the flexible budgeted amount was $230,000.

Required

Compute the variable overhead flexible-budget variance for Dynamo Building Supply Company and identify whether the variance is favorable,F,or unfavorable,U.

A)$575,000;U

B)$15,000;F

C)$15,000;U

D)$575,000;F

E)$56,350;U

Required

Compute the variable overhead flexible-budget variance for Dynamo Building Supply Company and identify whether the variance is favorable,F,or unfavorable,U.

A)$575,000;U

B)$15,000;F

C)$15,000;U

D)$575,000;F

E)$56,350;U

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

80

In what type of situation would management want to subdivide a flexible-budget variance into the efficiency variance and the spending variance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck