Deck 14: Working Capital Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/31

العب

ملء الشاشة (f)

Deck 14: Working Capital Policy

1

Due to advanced technology and the similarity of general procedures,working capital management for multinational firms is no more complex than it is for domestic firms.

False

2

The average length of time required to convert a firm's receivables into cash is called the __________.

A) cash conversion cycle

B) inventory conversion period

C) receivables collection period

D) payables deferral period

E) days sales outstanding

A) cash conversion cycle

B) inventory conversion period

C) receivables collection period

D) payables deferral period

E) days sales outstanding

C

3

Net working capital is

A) current liabilities.

B) current assets.

C) current liabilities plus current assets.

D) current assets minus current liabilities.

E) current liabilities minus current assets.

A) current liabilities.

B) current assets.

C) current liabilities plus current assets.

D) current assets minus current liabilities.

E) current liabilities minus current assets.

D

4

The cash conversion cycle is the sum of the inventory conversion period,the receivables collection period,and the payables deferral period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

5

The average length of time between the purchase of raw material and labor and the payment of cash for them is called the __________.

A) cash conversion cycle

B) inventory conversion period

C) receivables collection period

D) payables deferral period

E) days sales outstanding

A) cash conversion cycle

B) inventory conversion period

C) receivables collection period

D) payables deferral period

E) days sales outstanding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

6

The best and most comprehensive picture of a firm's liquidity position is obtained by examining its cash budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following current liabilities are considered when calculating net working capital?

A) Use of short-term debt to finance fixed assets.

B) Commercial paper issued to finance inventory.

C) Current maturities of long term debt.

D) Accounts receivable generated by sales on credit.

E) Inventory purchased with cash.

A) Use of short-term debt to finance fixed assets.

B) Commercial paper issued to finance inventory.

C) Current maturities of long term debt.

D) Accounts receivable generated by sales on credit.

E) Inventory purchased with cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

8

The average length of time required to convert materials into finished products and sell that product is called the __________.

A) cash conversion cycle

B) inventory conversion period

C) receivables collection period

D) payables deferral period

E) days sales outstanding

A) cash conversion cycle

B) inventory conversion period

C) receivables collection period

D) payables deferral period

E) days sales outstanding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

9

Firms following a restricted current asset policy are likely to __________ holdings of cash and have a __________ credit policy on sales.

A) have large; conservative

B) minimize the; conservative

C) have large; liberal

D) minimize the; liberal

E) have zero; liberal

A) have large; conservative

B) minimize the; conservative

C) have large; liberal

D) minimize the; liberal

E) have zero; liberal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

10

In terms of the cash conversion cycle,a restricted investment policy would tend to reduce the inventory conversion and receivables collection periods,which would result in a relatively short cash conversion cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

11

The fact that no explicit interest cost is paid on accruals and that the firm can exercise considerable control over their level makes accruals an attractive source of additional funding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

12

The inventory conversion period is calculated by dividing inventory by the cost of goods sold per day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

13

The sale of common stock for cash will increase the current assets for a firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

14

The cash conversion cycle is the length of time from the __________ raw materials to manufacture a product until the __________ of accounts receivable associated with the sale of the product.

A) ordering of; creation

B) ordering of; collection

C) payment for; creation

D) payment for; collection

E) none of the above

A) ordering of; creation

B) ordering of; collection

C) payment for; creation

D) payment for; collection

E) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

15

A firm's goal should be to lengthen the cash conversion cycle since shorter cash conversion cycles leads firms to increase their dependence on costly external financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

16

Firms following a relaxed current asset policy are likely to __________ holdings of cash and have a __________ credit policy on sales.

A) have large; conservative

B) minimize the; conservative

C) have large; liberal

D) minimize the; liberal

E) have zero; liberal

A) have large; conservative

B) minimize the; conservative

C) have large; liberal

D) minimize the; liberal

E) have zero; liberal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

17

A firm with a current ratio equal to four will have its current ratio increase if both current assets and current liabilities increase by the same amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

18

The sale of inventory at cost for cash will increase the current assets for a firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

19

A high current ratio insures that a firm will have the cash required to meet its needs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

20

Working capital management is not important for new firms since they will be able to generate positive cash flows at some time in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

21

You have recently been hired to improve the performance of Multiplex Corporation which has been experiencing a severe cash shortage.As one part of your analysis,you want to determine the firm's cash conversion cycle.Using the following information and a 360-day year,what is your estimate of the firm's current cash conversion cycle? Current inventory = $120,000

Annual sales = $600,000

Accounts receivable = $160,000

Accounts payable = $25,000

Total annual purchases = $360,000

Purchases credit terms: net 30 days

Receivables credit terms: net 50 days

A) 49 days

B) 143 days

C) 100 days

D) 168 days

E) 191 days

Annual sales = $600,000

Accounts receivable = $160,000

Accounts payable = $25,000

Total annual purchases = $360,000

Purchases credit terms: net 30 days

Receivables credit terms: net 50 days

A) 49 days

B) 143 days

C) 100 days

D) 168 days

E) 191 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

22

The aggressive approach towards working capital policy requires the __________ use of short-term debt,whereas the conservative approach of working capital policy requires the __________ use of short-term debt.

A) greatest; least

B) least; greatest

C) limited; total

D) lack of; heavy

E) heavy; heavy

A) greatest; least

B) least; greatest

C) limited; total

D) lack of; heavy

E) heavy; heavy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

23

The average cash conversion cycle of European firms is __________ as long as the average cash conversion cycle of American firms.

A) equally

B) one-half

C) twice

D) one-fourth

E) four times

A) equally

B) one-half

C) twice

D) one-fourth

E) four times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

24

A firm following a conservative approach to working capital policy will finance __________ of the fixed assets,__________ of the permanent current assets,and __________ of temporary current assets are financed with long term capital.

A) all; some; none

B) none; all; all

C) all; none; none

D) all; all; some

E) some; all; all

A) all; some; none

B) none; all; all

C) all; none; none

D) all; all; some

E) some; all; all

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

25

A firm following an aggressive approach to working capital policy will finance all of the fixed assets with __________,and some of the firm's permanent current assets will be financed with __________.

A) short-term nonspontaneous sources of funds; long term capital

B) commercial paper; long term capital

C) long term capital; short-term nonspontaneous sources of funds

D) long term capital; corporate bonds

E) short-term nonspontaneous sources of funds; corporate bonds

A) short-term nonspontaneous sources of funds; long term capital

B) commercial paper; long term capital

C) long term capital; short-term nonspontaneous sources of funds

D) long term capital; corporate bonds

E) short-term nonspontaneous sources of funds; corporate bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

26

Golden Fritter Corporation has a current ratio equal to three.If Golden Fritter issues $1,000,000 in long term bonds and uses the proceeds to purchase inventory,what will happen to the current ratio?

A) Increase

B) Decrease

C) Stay the same

D) Change, but more information is required to determine the direction of the change.

E) None of the above.

A) Increase

B) Decrease

C) Stay the same

D) Change, but more information is required to determine the direction of the change.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

27

Gator Corporation currently has a current ratio equal to 0.65.If Gator Corporation increases current assets and current liabilities by the same amount,what will happen to their current ratio?

A) Increase

B) Decrease

C) Stay the same

D) Change, but more information is required to determine the direction of the change.

E) None of the above.

A) Increase

B) Decrease

C) Stay the same

D) Change, but more information is required to determine the direction of the change.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

28

Jordan Air Inc.has average inventory of $1,000,000.Its estimated annual sales are 15 million and the firm estimates its receivables collection period to be twice as long as its inventory conversion period.The firm pays its trade credit on time; its terms are net 30.The firm wants to decrease its cash conversion cycle by 10 days.It believes that it can reduce its average inventory to $900,000.Assume a 360-day year and that sales will not change.Cost of goods sold equal 80 percent of sales.By how much must the firm also reduce its accounts receivable to meet its goal of a 10-day reduction?

A) $101,900

B) $1,000,000

C) $291,667

D) $333,520

E) $0

A) $101,900

B) $1,000,000

C) $291,667

D) $333,520

E) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

29

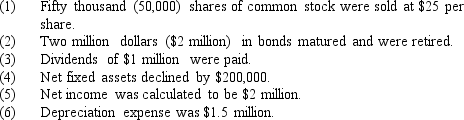

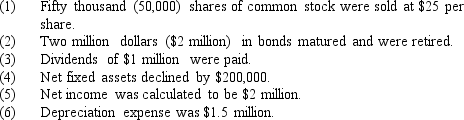

The accounts of Weston Inc.indicate the following changes in long-term assets and capital for the past year:  What was the increase or decrease in net working capital? (Hint: Changes in net fixed assets incorporate changes in both gross fixed assets and accumulated depreciation.)

What was the increase or decrease in net working capital? (Hint: Changes in net fixed assets incorporate changes in both gross fixed assets and accumulated depreciation.)

A) +$450,000

B) -$250,000

C) -$1,950,000

D) +$1,950,000

E) +$3,300,000

What was the increase or decrease in net working capital? (Hint: Changes in net fixed assets incorporate changes in both gross fixed assets and accumulated depreciation.)

What was the increase or decrease in net working capital? (Hint: Changes in net fixed assets incorporate changes in both gross fixed assets and accumulated depreciation.)A) +$450,000

B) -$250,000

C) -$1,950,000

D) +$1,950,000

E) +$3,300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

30

Sea Sport Boat Corporation currently has a current ratio of two.If Sea Sport Boat Corporation increases current assets and current liabilities by the same amount,what will happen to their current ratio?

A) Increase

B) Decrease

C) Stay the same

D) Change, but more information is required to determine the direction of the change.

E) None of the above.

A) Increase

B) Decrease

C) Stay the same

D) Change, but more information is required to determine the direction of the change.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

31

On average,a firm sells $2,500,000 in merchandise a month.Its cost of goods sold equals 80 percent of sales,and it keeps inventory equal to one-half of its monthly cost of goods on hand at all times.If the firm analyzes its accounts using a 360-day year,what is the firm's inventory conversion period?

A) 360 days

B) 180 days

C) 30 days

D) 15 days

E) 10 days

A) 360 days

B) 180 days

C) 30 days

D) 15 days

E) 10 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck