Deck 12: Accounting for Employee Benefits

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/84

العب

ملء الشاشة (f)

Deck 12: Accounting for Employee Benefits

1

Defined benefit plans are fairly simplistic and AASB 119 devotes only a small section to them.

False

2

The creation of cash reserves through accounting provisions ensures employees can be paid their entitlements as they fall due.

False

3

In a long-service leave liability to an employee,a conditional period refers to the period where no legal entitlement to any cash payment or leave exists.

False

4

Long-service leave must be accrued and recorded as a liability from the first day of employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

5

In a defined contribution plan,the employer effectively bears the risks associated with the movements in the value of the superannuation plan set up for its employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

6

When employees finish their time with their employer,it is normal practice to pay them for any annual leave earned but not taken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

7

In relation to required disclosures,AASB 119 requires an entity to disclose the amount recognised as an expense for defined contribution plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

8

The general philosophy behind offering shares to employees is that it makes them wealthier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

9

AASB 119 defines employees as 'natural persons (including a director)appointed or engaged under a contract for services who is subject to the directions of an employer in respect of the manner of execution of those services,whether on a full-time,part-time,permanent,casual or temporary basis'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

10

There are no accounting requirements relating to how superannuation plans should account for the plan's assets,liabilities,expenses and revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

11

Any employee benefits that have been earned but not paid as at the reporting date are assets of the employer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

12

Post-employment benefits can include the employee's insurance and medical costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a long-service leave liability,a conditional period is the period during which an employee gains legal entitlement to pro rata payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

14

AASB 119 Employee Benefits prescribes that all obligations relating to wages and salaries,annual leave and sick-leave entitlements,regardless of whether they were expected to be settled within 12 months of the reporting date be measured at nominal (undiscounted)amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

15

Any employee benefit that is incurred by the employer during the period and that contributes to the generation of items expected to provide future economic benefits for the employer may be capitalised as an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

16

When determining accounting entries to be made in relation to the defined benefit liability of an entity,AASB 119 Employee Benefits requires actuarial gains and losses to be recognised as part of the income or expense of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

17

Long-service leave that is payable beyond 12 months after the financial year is to be measured at its present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

18

If there is no deep market for high quality corporate bonds,AASB 119 Employee Benefits permits the use of market yields on government bonds at a discount rate to determine the present value of a defined benefit obligation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

19

Non-vesting sick leave that has accumulated will be paid to employees when their employment ceases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

20

Employees generally receive superannuation entitlements as part of their employment agreements.This usually involves the employer transferring funds to an independent superannuation fund that is administered by an independent trustee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

21

Short-term employee benefits are defined in AASB 119 as:

A) benefits that are paid to employees while they are employed by the company making the payment.

B) all payments made to an employee within 12 months of the date the employee rendered the service.

C) the undiscounted value of wages, salaries and social security contributions to which the employer is presently obliged.

D) employee benefits that are wholly due within 12 months after the end of the period in which the employee rendered the related service.

A) benefits that are paid to employees while they are employed by the company making the payment.

B) all payments made to an employee within 12 months of the date the employee rendered the service.

C) the undiscounted value of wages, salaries and social security contributions to which the employer is presently obliged.

D) employee benefits that are wholly due within 12 months after the end of the period in which the employee rendered the related service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

22

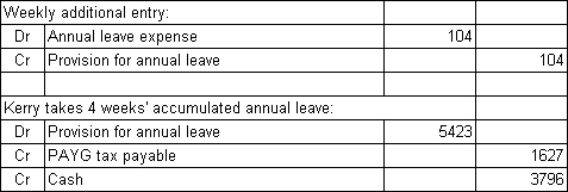

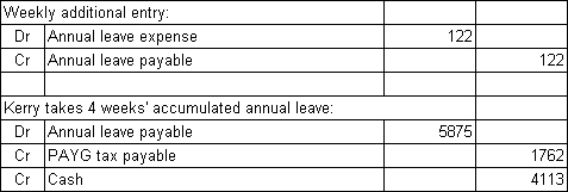

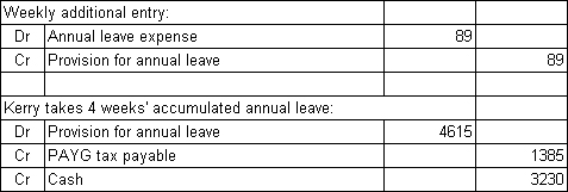

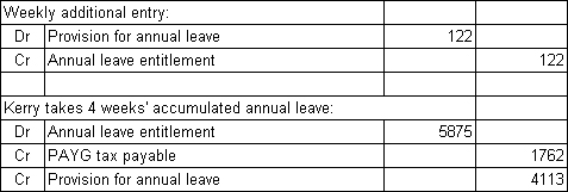

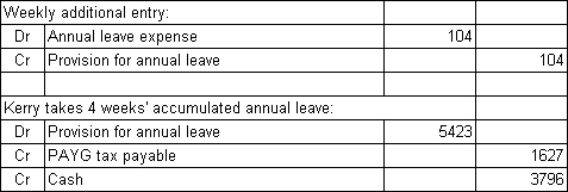

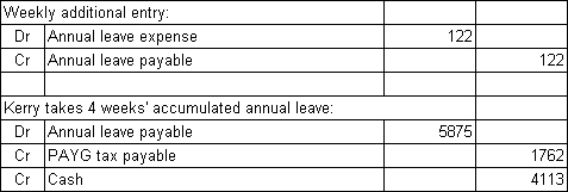

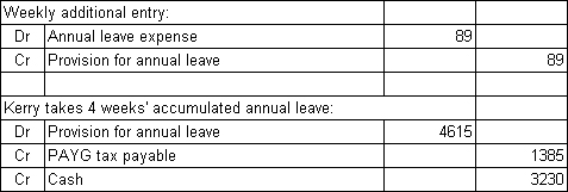

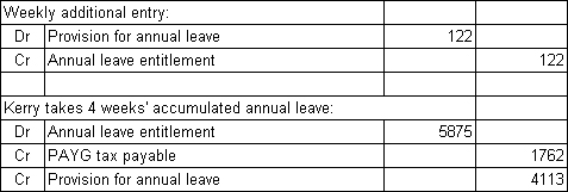

Kerry Gill works for Kentucky Enterprises for an annual salary of $60 000.Kerry is entitled to 4 weeks' annual leave per year with a leave loading of 17.5%.What entry each week,additional to the one recording wages expense and PAYG tax deduction,would be required to accrue Kerry's entitlement to annual leave? When Kerry takes his 4 weeks' annual leave,what entry would be made to record this (only)?

The tax is calculated at 30%.(Assume that there are 52 weeks in a year and round to the nearest dollar.)

A)

B)

C)

D)

The tax is calculated at 30%.(Assume that there are 52 weeks in a year and round to the nearest dollar.)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

23

For a defined benefit plan,if the fair value of the plan's assets match the expected payout to employees no further liabilities would exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

24

The appropriate accounting treatment for accumulating non-vesting sick leave is to:

A) recognise as a liability that part of the entitlement that has accumulated through past service and is expected to be taken if it can be reliably measured.

B) expense payments as they are made to a 'wages and salaries' account because the entitlement does not vest with the employee.

C) recognise as a liability the accumulated entitlement as at reporting date.

D) expense the entitlement as it accumulates over the reporting period as an on-cost.

A) recognise as a liability that part of the entitlement that has accumulated through past service and is expected to be taken if it can be reliably measured.

B) expense payments as they are made to a 'wages and salaries' account because the entitlement does not vest with the employee.

C) recognise as a liability the accumulated entitlement as at reporting date.

D) expense the entitlement as it accumulates over the reporting period as an on-cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

25

A defined contribution superannuation plan is one in which:

A) the contributions to the plan are only paid out to members on retirement.

B) the benefits paid out by the plan are based on the average salary of an employee over a period of years as a reflection of the employee's contribution to the employer.

C) the contributions are defined by the amount needed to pay out benefits to the members at a specified level on retirement.

D) the benefits paid out by the plan depend on the contributions made to the plan and the earnings of that plan.

A) the contributions to the plan are only paid out to members on retirement.

B) the benefits paid out by the plan are based on the average salary of an employee over a period of years as a reflection of the employee's contribution to the employer.

C) the contributions are defined by the amount needed to pay out benefits to the members at a specified level on retirement.

D) the benefits paid out by the plan depend on the contributions made to the plan and the earnings of that plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

26

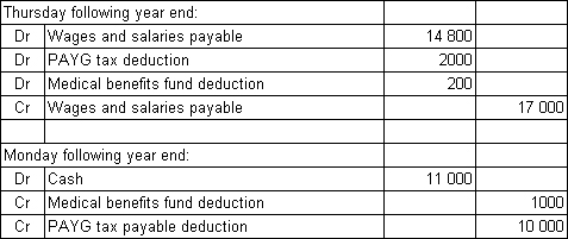

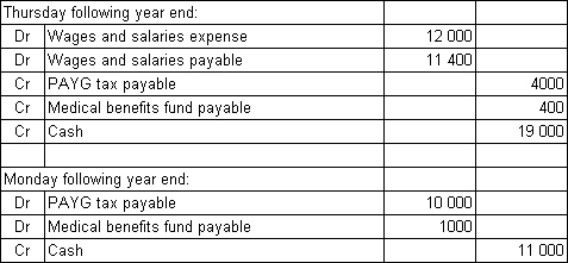

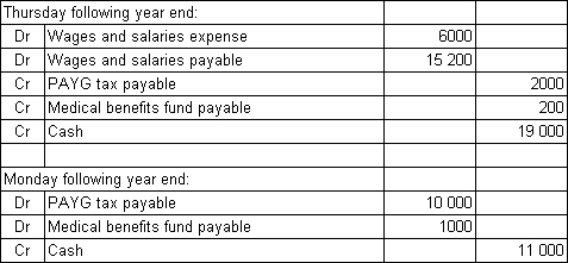

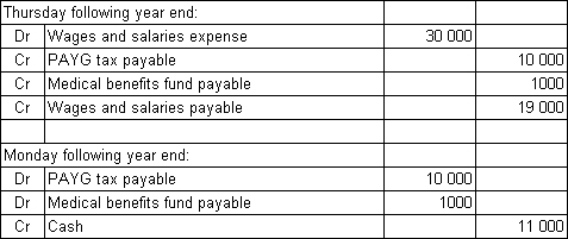

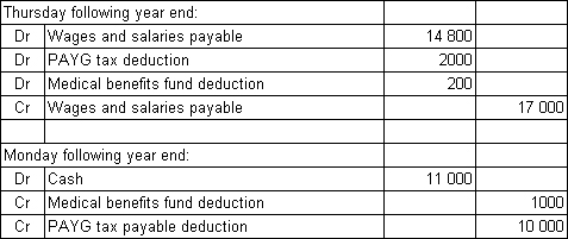

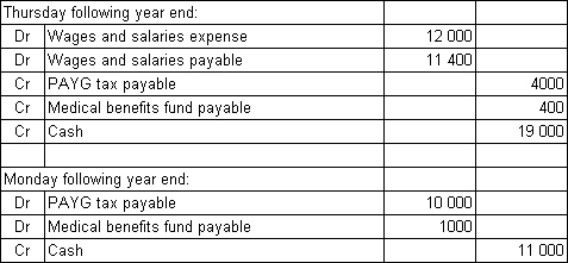

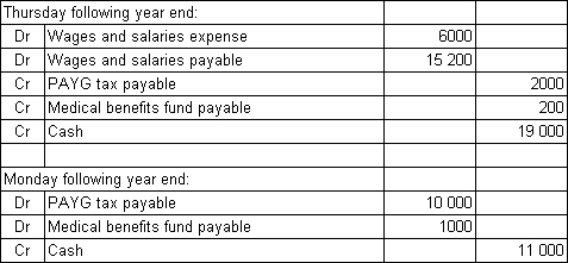

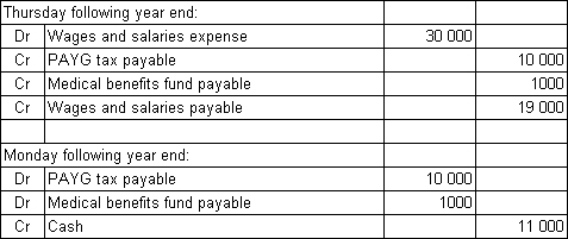

Minor Ltd has a weekly payroll of $30 000.Its employees work a 5-day week (Monday to Friday)and are paid on Thursdays in arrears (i.e.for the five days up to,and including,the Thursday).Pay-as-you-go tax on the weekly payroll is $10 000 and this is paid to the Australian Tax Office on the following Monday.Deductions of $1000 are also made on behalf of employees to pay into a medical benefits fund,which is also paid on the following Monday each week.The year ended 30 June 2014 falls on a Wednesday.Assuming that no reversing entry has been made since the year end,what is the entry to record the payment of the wages and salaries and the tax and medical benefits on the appropriate days immediately after the year end?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is not a step in accounting for contributions to a defined benefit superannuation plan?

A) Determine the fair value of any plan.

B) Discount any benefit employees have earned.

C) Estimate the amount of benefits the employees have earned in return for their service in the current and prior periods.

D) Establish the numbers of years until retirement for each employee to accurately calculate their likely benefit.

A) Determine the fair value of any plan.

B) Discount any benefit employees have earned.

C) Estimate the amount of benefits the employees have earned in return for their service in the current and prior periods.

D) Establish the numbers of years until retirement for each employee to accurately calculate their likely benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

28

An employee whose contract for service includes an entitlement to 2 weeks' non-cumulative,vesting sick leave tenders his/her resignation to take effect exactly halfway through their fifth year of employment.What is the employee's sick leave entitlement,in weeks,that will be paid out on his/her departure assuming that no sick leave has been used?

A) nine weeks

B) zero

C) ten weeks

D) one week

A) nine weeks

B) zero

C) ten weeks

D) one week

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

29

What discount rate does AASB 119 require to be used to discount estimated future cash outflows associated with the relevant employee entitlements?

A) risk-adjusted, organisation-specific discount rate

B) market-determined, organisation-specific discount rate

C) inflation adjusted, real rate of return required on equity financing

D) the interest rate on high quality corporate bonds with terms to maturity that match the terms of the related liabilities.

A) risk-adjusted, organisation-specific discount rate

B) market-determined, organisation-specific discount rate

C) inflation adjusted, real rate of return required on equity financing

D) the interest rate on high quality corporate bonds with terms to maturity that match the terms of the related liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

30

A defined contribution scheme:

A) moves any actuarial and investment risk from the employer to the employee.

B) requires the contribution made by an employer to be recognised as an expense.

C) will only create a liability for the employer to the extent that any agreed contribution remains unpaid at the end of the financial year.

D) All of the given answers are correct.

A) moves any actuarial and investment risk from the employer to the employee.

B) requires the contribution made by an employer to be recognised as an expense.

C) will only create a liability for the employer to the extent that any agreed contribution remains unpaid at the end of the financial year.

D) All of the given answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

31

Danish Ltd has an average weekly payroll of $200 000.The employees are entitled to 2 weeks',non-vesting sick leave per annum.Past experience suggests that 56% of employees will take the full 2 weeks' sick leave and 22% will take 1 week's leave each year.The rest of the employees take no sick leave.In the current week an employee with a weekly salary of $600 has been off sick for the first time this year.The employee took 2 days off out of her normal 5-day working week.Assuming that a weekly entry has been made to record the accumulated liability for sick leave and that PAYG tax is deducted at 30%,what would the entry be to record the employee's weekly salary (round amounts to the nearest dollar)?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

32

'On-costs' can be described as:

A) the additional monies owed to an employee for working overtime or on public holidays.

B) the costs incurred by the employer that will be received by the employee once they move on.

C) the extra costs incurred by the employer not directly received by the employee such as providing ergonomic equipment or an up-to-date computer.

D) additional costs borne by the employer such as payroll tax and workers compensation insurance.

A) the additional monies owed to an employee for working overtime or on public holidays.

B) the costs incurred by the employer that will be received by the employee once they move on.

C) the extra costs incurred by the employer not directly received by the employee such as providing ergonomic equipment or an up-to-date computer.

D) additional costs borne by the employer such as payroll tax and workers compensation insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

33

Sick leave may be classified as:

A) cumulative vesting.

B) cumulative non-vesting.

C) non-cumulative vesting.

D) all of the given answers.

A) cumulative vesting.

B) cumulative non-vesting.

C) non-cumulative vesting.

D) all of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

34

The amount represented as a current liability,'Provision for long-service leave' generally represents:

A) the amount to be expensed as long-service leave expense in the next 12 months.

B) the amount of long-service that has been provided for, for all employees of the entity.

C) the amount of long-service leave remaining to be taken by staff.

D) the amount of long-service leave that is expected to be taken in the 12 months following the balance date.

A) the amount to be expensed as long-service leave expense in the next 12 months.

B) the amount of long-service that has been provided for, for all employees of the entity.

C) the amount of long-service leave remaining to be taken by staff.

D) the amount of long-service leave that is expected to be taken in the 12 months following the balance date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

35

According to the former Australian guidance section of AASB 119 what are the categories of long-service leave entitlements and how should they be accounted for?

A) Categories-vesting and non-vesting accounting treatment: vesting entitlements should be treated as a liability and expense of the period in which they are accumulated, while non-vesting entitlements should not be recognised until they vest.

B) Categories-unconditional, conditional and pre-conditional accounting treatment: unconditional entitlements should be recognised as an expense and a liability as there is a commitment to a future cash outflow, whereas conditional and pre-conditional entitlements do not meet the AASB Framework requirements for recognition.

C) Categories-defined benefit and defined contribution accounting treatment: defined benefit entitlements should be treated as a liability and expense of the period in which they are accumulated, while defined contribution entitlements should not be recognised until they are actually taken by the employee.

D) Categories-pre-conditional, conditional and unconditional accounting treatment: to the extent that entitlements accumulated in a period in any of the three categories are expected to result in future cash outflows for the reporting entity, they should be treated as expenses.

A) Categories-vesting and non-vesting accounting treatment: vesting entitlements should be treated as a liability and expense of the period in which they are accumulated, while non-vesting entitlements should not be recognised until they vest.

B) Categories-unconditional, conditional and pre-conditional accounting treatment: unconditional entitlements should be recognised as an expense and a liability as there is a commitment to a future cash outflow, whereas conditional and pre-conditional entitlements do not meet the AASB Framework requirements for recognition.

C) Categories-defined benefit and defined contribution accounting treatment: defined benefit entitlements should be treated as a liability and expense of the period in which they are accumulated, while defined contribution entitlements should not be recognised until they are actually taken by the employee.

D) Categories-pre-conditional, conditional and unconditional accounting treatment: to the extent that entitlements accumulated in a period in any of the three categories are expected to result in future cash outflows for the reporting entity, they should be treated as expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

36

An employee whose contract for service includes an entitlement to 1 week's cumulative sick leave per annum will be entitled to how many weeks' sick leave after 3 years' employment if no sick leave has been taken?

A) one week

B) between 1 and 3 weeks depending on annual leave entitlements

C) three weeks

D) either 1 or 3 weeks depending on long-service leave entitlements

A) one week

B) between 1 and 3 weeks depending on annual leave entitlements

C) three weeks

D) either 1 or 3 weeks depending on long-service leave entitlements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

37

Employee benefits include:

A) wages and salaries, sick leave, payroll tax, annual leave.

B) superannuation, wages and salaries, sick leave and annual leave.

C) sick leave, annual leave, unemployment benefits, salaries and wages.

D) annual leave, wages and salaries, post-employment benefits, payroll tax.

A) wages and salaries, sick leave, payroll tax, annual leave.

B) superannuation, wages and salaries, sick leave and annual leave.

C) sick leave, annual leave, unemployment benefits, salaries and wages.

D) annual leave, wages and salaries, post-employment benefits, payroll tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

38

AASB 119 requires which items to be recorded at their discounted amounts?

A) annual leave and sick leave if they are expected to be settled after 12 months have elapsed from the reporting date.

B) cumulative sick leave that has accrued for longer than 12 months.

C) wages and salaries.

D) none of the given answers

A) annual leave and sick leave if they are expected to be settled after 12 months have elapsed from the reporting date.

B) cumulative sick leave that has accrued for longer than 12 months.

C) wages and salaries.

D) none of the given answers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

39

Dervish Ltd has an average weekly payroll of $700 000.The employees are entitled to 2 weeks',non-vesting sick leave per annum.Past experience suggests that 66% of employees will take the full 2 weeks' sick leave and 15% will take 1 week's leave each year.The rest of the employees take no sick leave.What weekly entry would Dervish make in relation to sick leave?

A)

B) No weekly entry is required.

C)

D)

A)

B) No weekly entry is required.

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

40

Major Ltd has a weekly payroll of $30 000.Its employees work a 5-day week (Monday to Friday)and are paid on Thursdays in arrears (i.e.for the five days up to,and including,the Thursday).Pay-as-you-go tax on the weekly payroll is $10 000 and this is paid to the Australian Tax Office on the following Monday.Deductions of $1000 are also made on behalf of employees to pay into a medical benefits fund.The year ended 30 June 2014 falls on a Wednesday.What is the accounting entry to record accrued salaries and wages for this period?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

41

AASB 119 divides employee benefits into a number of categories,including:

A) terminations benefits.

B) payroll tax.

C) PAYG tax.

D) performance increments.

A) terminations benefits.

B) payroll tax.

C) PAYG tax.

D) performance increments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

42

A non-contributory superannuation fund means:

A) No contributions are made to the fund by either the employer or employee.

B) Only the employer makes contributions to the fund.

C) Only the employee makes contributions to the fund.

D) It is a solely government-funded scheme.

A) No contributions are made to the fund by either the employer or employee.

B) Only the employer makes contributions to the fund.

C) Only the employee makes contributions to the fund.

D) It is a solely government-funded scheme.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

43

Manuka Ltd has seven employees who are entitled to long-service leave (LSL).The LSL can be taken after 15 years of service,at which time the employee is entitled to 13 weeks' leave.After 10 years the employee is entitled to a pro rata cash payment on leaving the company.Information about the employees is set out below.

Other information collected:

The inflation rate for the foreseeable future is 2%.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.Based on the information provided,what should the balance of the long-service leave provision account be (rounded to the nearest dollar)?

A) $47 163

B) $47 146

C) $47 545

D) $20 991

Other information collected:

The inflation rate for the foreseeable future is 2%.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.Based on the information provided,what should the balance of the long-service leave provision account be (rounded to the nearest dollar)?

A) $47 163

B) $47 146

C) $47 545

D) $20 991

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

44

The following journal entry accounts for one week's (five days)salaries and wages for an employee:

Which of the following statements is correct?

A) The employee's gross salary is $400 per week.

B) The employee was absent from work for 3 days during the week and was paid for his/her absence.

C) The PAYG tax rate for this employee is 20%.

D) All of the given answers are correct.

Which of the following statements is correct?

A) The employee's gross salary is $400 per week.

B) The employee was absent from work for 3 days during the week and was paid for his/her absence.

C) The PAYG tax rate for this employee is 20%.

D) All of the given answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

45

Suggested approaches to improving the financial security of employees in the case of the collapse of their employer include:

A) promoting compulsory, private self-insurance schemes for individuals so that they will be covered in the case of company failure.

B) providing stronger government funding for unions so they can act as a financial support for members who become unemployed by corporate failure.

C) creating a sub-committee of cabinet to oversee the raising of funds and investment of these funds to provide a special needs fund for employees who are severely financially affected by the collapse of their employer.

D) the establishment of central funds, either in the form of government-backed compulsory insurance or a trust to which it is compulsory for employers to contribute, from which employee entitlements could be paid in the case of corporate collapse.

A) promoting compulsory, private self-insurance schemes for individuals so that they will be covered in the case of company failure.

B) providing stronger government funding for unions so they can act as a financial support for members who become unemployed by corporate failure.

C) creating a sub-committee of cabinet to oversee the raising of funds and investment of these funds to provide a special needs fund for employees who are severely financially affected by the collapse of their employer.

D) the establishment of central funds, either in the form of government-backed compulsory insurance or a trust to which it is compulsory for employers to contribute, from which employee entitlements could be paid in the case of corporate collapse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

46

AASB 119 defines 'employee benefits' as:

A) salaries and wages, and associated on-costs.

B) all cash payments made to employees.

C) all cash payments made to employees in their roles as employees.

D) all forms of consideration given up by an entity in exchange for service rendered by employees.

A) salaries and wages, and associated on-costs.

B) all cash payments made to employees.

C) all cash payments made to employees in their roles as employees.

D) all forms of consideration given up by an entity in exchange for service rendered by employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

47

Masters Ltd has three employees who are entitled to long-service leave (LSL).The LSL can be taken after 15 years of service,at which time the employee is entitled to 13 weeks' leave.After 10 years the employee is entitled to a pro rata cash payment on leaving the company.Information about the employees is set out below.

Other information collected:

The inflation rate for the foreseeable future is 3.5%.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $20 561,what is the LSL expense for the current period (round amounts to the nearest dollar)?

A) $1202

B) $948

C) $1064

D) $21 763

Other information collected:

The inflation rate for the foreseeable future is 3.5%.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $20 561,what is the LSL expense for the current period (round amounts to the nearest dollar)?

A) $1202

B) $948

C) $1064

D) $21 763

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

48

Post-employment benefits include:

A) cash payments.

B) pensions payable through a superannuation fund.

C) insurance costs.

D) all of the given answers.

A) cash payments.

B) pensions payable through a superannuation fund.

C) insurance costs.

D) all of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

49

In Australia,employee entitlements are protected in the case of company insolvency because:

A) Employees are given first priority for payment after the taxation department and the company administrators.

B) Employees are given some preferential access to payment, but after secured creditors.

C) ASIC monitors companies' annual reports to ensure that their assets are greater than the total secured debt and employee entitlements.

D) Employees are encouraged to withdraw their labour in the case of a company beginning to fail in order to minimise their loss of employee entitlements.

A) Employees are given first priority for payment after the taxation department and the company administrators.

B) Employees are given some preferential access to payment, but after secured creditors.

C) ASIC monitors companies' annual reports to ensure that their assets are greater than the total secured debt and employee entitlements.

D) Employees are encouraged to withdraw their labour in the case of a company beginning to fail in order to minimise their loss of employee entitlements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

50

Junior Ltd employs three workers to develop and test games.The employees are currently earning $30 000 each and are expected to cease their employment in 20 years.At the end of their employment each employee is entitled to a lump sum payment equal to 10% of their final salary.Actuarial analysis suggests salaries will increase evenly at a rate of 5% per year over the 20 years.In 5 years' time,what total benefit will the three employees have accrued (rounded to the nearest dollar)?

A) $114 865

B) $23 899

C) $165 000

D) $119 399

A) $114 865

B) $23 899

C) $165 000

D) $119 399

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

51

The following journal entry shows:

A) An (some) employee(s) may have taken long-service leave.

B) An (some) employee(s) may have been paid out their long-service leave entitlement upon resignation.

C) An employer is building up a provision account for long-service leave to enable it to account for leave taken in the future.

D) An (some) employee(s) may have taken long-service leave and an (some) employee(s) may have been paid out their long-service leave entitlement upon resignation.

A) An (some) employee(s) may have taken long-service leave.

B) An (some) employee(s) may have been paid out their long-service leave entitlement upon resignation.

C) An employer is building up a provision account for long-service leave to enable it to account for leave taken in the future.

D) An (some) employee(s) may have taken long-service leave and an (some) employee(s) may have been paid out their long-service leave entitlement upon resignation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

52

Junior Ltd employs three workers to develop and test games.The employees are currently earning $30 000 each and are expected to cease their employment in 20 years.At the end of their employment each employee is entitled to a lump sum payment equal to 10% of their final salary.Actuarial analysis suggests salaries will increase evenly at a rate of 5% per year over the 20 years.At the end of the 20 years Junior's undiscounted obligation is $477 593.Assuming an interest rate of 8%,calculate the obligation that would be recorded at the end of year 1 (rounded to the nearest dollar).

A) $5123

B) $23 898

C) $21 986

D) $102 466

A) $5123

B) $23 898

C) $21 986

D) $102 466

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

53

AASB 119 has resulted in many more companies recognising liabilities for employee entitlements.There is evidence that this requirement has the effect of:

A) creating cash reserves from which employee entitlements can be paid in the case of company insolvency.

B) increasing the probability of companies becoming insolvent.

C) reducing the level of employment in Australia.

D) None of the given answers are correct.

A) creating cash reserves from which employee entitlements can be paid in the case of company insolvency.

B) increasing the probability of companies becoming insolvent.

C) reducing the level of employment in Australia.

D) None of the given answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

54

Performance bonuses:

A) are capitalised as part of the cost of an asset 'bonus payments'.

B) form part of salaries and wages and are treated in the same manner.

C) are charged directly against 'opening retained earnings'.

D) form part of the leave entitlements of employees.

A) are capitalised as part of the cost of an asset 'bonus payments'.

B) form part of salaries and wages and are treated in the same manner.

C) are charged directly against 'opening retained earnings'.

D) form part of the leave entitlements of employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

55

The expense recognised by an employer for a defined benefit superannuation plan:

A) will always equal the amount of the contribution for the period.

B) is not necessarily the amount of the contribution for the period.

C) will never equal the amount of the contribution for the period.

D) is always greater than the amount of the contribution for the period.

A) will always equal the amount of the contribution for the period.

B) is not necessarily the amount of the contribution for the period.

C) will never equal the amount of the contribution for the period.

D) is always greater than the amount of the contribution for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

56

Dennis Carter works for Midrift Ltd and has taken his long-service leave this period.He was paid $2450 as his entitlement.What account(s)is/are debited in the entry to record this event?

A) provision for long-service leave and PAYG tax deduction

B) provision for long-service leave

C) long-service leave expense

D) long-service leave expense and PAYG tax deduction

A) provision for long-service leave and PAYG tax deduction

B) provision for long-service leave

C) long-service leave expense

D) long-service leave expense and PAYG tax deduction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

57

Midrift Ltd has nine employees who are entitled to long-service leave (LSL).The LSL can be taken after 12 years of service,at which time the employee is entitled to 15 weeks' leave.After 10 years the employee is entitled to a pro rata cash payment on leaving the company.Information about the employees is set out below.

Other information collected:

The inflation rate for the foreseeable future is 1.5%.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $87 560 what is the entry to record LSL expense for the current period (round amounts to the nearest dollar)?

A)

B)

C)

D)

Other information collected:

The inflation rate for the foreseeable future is 1.5%.The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion.If the opening balance of the LSL provision is $87 560 what is the entry to record LSL expense for the current period (round amounts to the nearest dollar)?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

58

Because of the uncertainties involved in making future predictions,AASB 119 requires:

A) that the long-service leave estimate be based on the level of salary paid to employees at the time the entitlement was earned.

B) that there is no consideration given to future inflation rates or promotion prospects of employees.

C) that the discount rate used be based on the rates offered by high quality corporate bonds.

D) that market-adjusted expected cash flows be discounted at the risk-adjusted rate.

A) that the long-service leave estimate be based on the level of salary paid to employees at the time the entitlement was earned.

B) that there is no consideration given to future inflation rates or promotion prospects of employees.

C) that the discount rate used be based on the rates offered by high quality corporate bonds.

D) that market-adjusted expected cash flows be discounted at the risk-adjusted rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

59

Trailers of the World has a small group of four employees.Trailers take part in a defined contribution plan and pay the required government contribution of 9% plus an additional 4% to reward its employees.Based on the employee earnings below,what is Trailers' superannuation obligation for the year?

A) $10 920

B) $23 660

C) $47 320

D) $16 380

A) $10 920

B) $23 660

C) $47 320

D) $16 380

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

60

When salaries and wages are capitalised as part of the costs of an asset,such as inventory:

A) An expense will never be recognised for the salaries and wages.

B) An expense will only be recognised when the employee takes leave.

C) An expense is recognised as part of the cost of the inventory.

D) An expense is finally recognised in the form of 'cost of goods sold'.

A) An expense will never be recognised for the salaries and wages.

B) An expense will only be recognised when the employee takes leave.

C) An expense is recognised as part of the cost of the inventory.

D) An expense is finally recognised in the form of 'cost of goods sold'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

61

The causes of actuarial gains and losses when accounting for defined benefit superannuation plans includes:

A) the effect of changes in the CPI.

B) the effect of changes of future employee turnover.

C) the effect of changes to strategic direction for the entity.

D) the effect of differences between the actual return on plan assets and the actual payments on plan liabilities.

A) the effect of changes in the CPI.

B) the effect of changes of future employee turnover.

C) the effect of changes to strategic direction for the entity.

D) the effect of differences between the actual return on plan assets and the actual payments on plan liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

62

Entity A contributes to a defined benefit superannuation plan for its employees.It calculates the following:

The $786 represents:

A) the expense to be recognised in the statement of comprehensive income.

B) the asset to be recognised in the statement of financial position.

C) the liability to be recognised in the statement of financial position.

D) the revenue to be recognised in the statement of comprehensive income.

The $786 represents:

A) the expense to be recognised in the statement of comprehensive income.

B) the asset to be recognised in the statement of financial position.

C) the liability to be recognised in the statement of financial position.

D) the revenue to be recognised in the statement of comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

63

Discuss the implications of corporate collapses upon accrued employee benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

64

Whitsunday Ltd provides defined superannuation benefits to two (2)of its employees,which represents an entitlement of three times their final salary on retirement.The following details are relevant to the current superannuation obligation of the company for the two employees for the years ended 30 June 2011 and 2012:

In accordance with AASB 119 Employee Benefits,what is the expected return and actuarial gain (loss)for the plan assets for the year ending 2012,respectively?

A) $21 200; $6200

B) $21 200; ($6200)

C) $23 200; $8200

D) $23 200; ($8200)

In accordance with AASB 119 Employee Benefits,what is the expected return and actuarial gain (loss)for the plan assets for the year ending 2012,respectively?

A) $21 200; $6200

B) $21 200; ($6200)

C) $23 200; $8200

D) $23 200; ($8200)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

65

Dervish Ltd has an average weekly payroll of $800 000.The employees are entitled to 2 weeks',non-vesting sick leave per annum.Past experience suggests that 66% of employees will take the full 2 weeks' sick leave and 15% will take 1 week's leave each year.The rest of the employees take no sick leave.What weekly entry would Dervish make in relation to sick leave?

A)

B) No weekly entry is required.

C)

D)

A)

B) No weekly entry is required.

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

66

In a defined benefit plan the differences between expected and actual returns on high quality bonds will lead to:

A) any actuarial and investment risk moving from the employer to the employee.

B) actuarial gains and losses.

C) a change in the discount rate.

D) none of the given answers.

A) any actuarial and investment risk moving from the employer to the employee.

B) actuarial gains and losses.

C) a change in the discount rate.

D) none of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

67

Entity A contributes to a defined benefit superannuation plan for its employees.It calculates the following:

The $10 783 represents:

A) the expense to be recognised in the statement of comprehensive income.

B) the asset to be recognised in the statement of financial position.

C) the liability to be recognised in the statement of financial position.

D) the revenue to be recognised in the statement of comprehensive income.

The $10 783 represents:

A) the expense to be recognised in the statement of comprehensive income.

B) the asset to be recognised in the statement of financial position.

C) the liability to be recognised in the statement of financial position.

D) the revenue to be recognised in the statement of comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

68

In accounting for a defined benefit superannuation plan,explain how to estimate the 'benefits earned by an employee'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

69

Explain how salaries and wages may be included in the cost of an asset,rather than be treated as a period expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

70

Entity A contributes to a defined benefit superannuation plan for its employees.It calculates the following:

The 'Expected return on plan assets (1150)' represents:

A) the expected return at the start of the period, measured as a proportion of the current service cost.

B) the expected return at the start of the period, measured as a proportion of the opening fair value of the plan obligation.

C) the adjusted return for the period, measured as a proportion of the closing fair value of the plan assets.

D) the expected return at the start of the period, measured as a proportion of the opening fair value of the plan assets.

The 'Expected return on plan assets (1150)' represents:

A) the expected return at the start of the period, measured as a proportion of the current service cost.

B) the expected return at the start of the period, measured as a proportion of the opening fair value of the plan obligation.

C) the adjusted return for the period, measured as a proportion of the closing fair value of the plan assets.

D) the expected return at the start of the period, measured as a proportion of the opening fair value of the plan assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

71

Great Keppel Ltd provides defined superannuation benefits to two (2)of its employees,which represents an entitlement of three times their final salary on retirement.The company's superannuation plan is managed by Better Super Funds. The following details are relevant to the superannuation obligation of the company for the years ended 30 June 2011 and 2012:

Which of the following course of actions should Great Keppel Ltd take to comply with the accounting treatment on superannuation prescribed in AASB 119 Employee Benefits in preparation of the financial statements for the year ending 30 June 2012?

A) No action is necessary as the contribution of $10 000 was remitted to Better Super Ltd.

B) No action is necessary as the assets and liabilities of the superannuation for its employees are managed by Better Super Ltd.

C) Recognise a superannuation obligation of $13 390, being the difference between ending balance of plan assets and the present value of superannuation obligation as at 30 June 2012.

D) Recognise a superannuation expense of $38 390 for the year 2012, being the difference between beginning and ending balance of the present value of superannuation obligation.

Which of the following course of actions should Great Keppel Ltd take to comply with the accounting treatment on superannuation prescribed in AASB 119 Employee Benefits in preparation of the financial statements for the year ending 30 June 2012?

A) No action is necessary as the contribution of $10 000 was remitted to Better Super Ltd.

B) No action is necessary as the assets and liabilities of the superannuation for its employees are managed by Better Super Ltd.

C) Recognise a superannuation obligation of $13 390, being the difference between ending balance of plan assets and the present value of superannuation obligation as at 30 June 2012.

D) Recognise a superannuation expense of $38 390 for the year 2012, being the difference between beginning and ending balance of the present value of superannuation obligation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is not considered compensated absences under AASB 119Employee Benefits?

A) sick leave

B) annual leave

C) long-service leave

D) All of the given answers are considered compensation absences.

A) sick leave

B) annual leave

C) long-service leave

D) All of the given answers are considered compensation absences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

73

To determine whether the employer has any outstanding obligation for superannuation at year end we need to:

A) compare the closing obligation for superannuation entitlements with the fair value of the plan's assets.

B) reduce the closing obligation for superannuation entitlements by the fair value of the plan's assets.

C) increase the closing obligation for superannuation entitlements by the fair value of the plan's assets.

D) reduce the fair value of the plan's assets by the closing obligation for superannuation .

A) compare the closing obligation for superannuation entitlements with the fair value of the plan's assets.

B) reduce the closing obligation for superannuation entitlements by the fair value of the plan's assets.

C) increase the closing obligation for superannuation entitlements by the fair value of the plan's assets.

D) reduce the fair value of the plan's assets by the closing obligation for superannuation .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

74

Explain why recording a surplus of the fair value of a defined benefit superannuation plan's assets over the present value of the accrued benefits,as an asset in the books of the employee may not be consistent with the AASB Framework.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

75

Mackay Ltd provides defined superannuation benefits to two (2)of its employees,which represents an entitlement of three times their final salary on retirement.The following details are relevant to the current superannuation obligation of the company for the two employees for the years ended 30 June 2011 and 2012:

In accordance with AASB 119 Employee Benefits,what is the interest cost and actuarial gain (loss)for the defined benefit obligation for the year ending 2012?

A) $13 250; $10 140

B) $13 250; ($10 140)

C) $18 550; $4840

D) $18 550; ($4840)

In accordance with AASB 119 Employee Benefits,what is the interest cost and actuarial gain (loss)for the defined benefit obligation for the year ending 2012?

A) $13 250; $10 140

B) $13 250; ($10 140)

C) $18 550; $4840

D) $18 550; ($4840)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

76

Entity A contributes to a defined benefit superannuation plan for its employees.It calculates the following:

The 69 represents:

A) the expense to be recognised in the statement of comprehensive income.

B) the asset to be recognised in the statement of financial position.

C) the liability to be recognised in the statement of financial position.

D) the revenue to be recognised in the statement of comprehensive income.

The 69 represents:

A) the expense to be recognised in the statement of comprehensive income.

B) the asset to be recognised in the statement of financial position.

C) the liability to be recognised in the statement of financial position.

D) the revenue to be recognised in the statement of comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

77

What are the two key types of superannuation plans discussed in AASB 119?

Discuss the two types of plans and how they differ.

Discuss the two types of plans and how they differ.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

78

In accounting for a defined benefit superannuation plan,explain how to determine the 'present value of a defined benefit obligation'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

79

Annette French joined Paris Ltd on 1 July 2011 as a bookkeeper.She is the only permanent employee of Paris Ltd.On 30 June 2012 her salary was $35 000.Annette French's salary is expected to increase with inflation at a rate of 3%.Paris Ltd provides long-service leave entitlement of 13 weeks after 15 years of service.A pro rata payment is made after 10 years of service.The probability of Annette French staying in the job until the obligation vests is 35%. Other information:

What is the long-service leave liability (to the nearest dollar)of Paris Ltd as at 30 June 2012?

A) $133

B) $228

C) $253

D) $976

What is the long-service leave liability (to the nearest dollar)of Paris Ltd as at 30 June 2012?

A) $133

B) $228

C) $253

D) $976

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

80

An asset may arise where a defined benefit plan has been overfunded or in certain cases where actuarial gains are recognised.An entity recognises an asset in such cases because:

A) the entity controls a resource, which is the ability to use the surplus to generate future benefits

B) that control is a result of past events (contributions paid by the entity and service rendered by the employee);

C) future economic benefits are available to the entity in the form of a reduction in future contributions or a cash refund, either directly to the entity or indirectly to another plan in deficit.

D) All of the given answers.

A) the entity controls a resource, which is the ability to use the surplus to generate future benefits

B) that control is a result of past events (contributions paid by the entity and service rendered by the employee);

C) future economic benefits are available to the entity in the form of a reduction in future contributions or a cash refund, either directly to the entity or indirectly to another plan in deficit.

D) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck