Deck 14: Financial Reporting by the Federal Government

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/68

العب

ملء الشاشة (f)

Deck 14: Financial Reporting by the Federal Government

1

The budgetary accounts of a federal agency are used to prepare the accrual basis financial statements of the federal government and its agencies.

False

2

The difference between assets and liabilities of a federal agency is comprised of Net Assets and may be classified as Unrestricted,Restricted,and Invested in Capital Assets Net of Related Debt.

False

3

The Statement of Operations and Changes in Net Position for the consolidated report of the federal government is prepared on the budgetary basis of accounting.

False

4

The Statement of Budgetary Resources for a federal agency presents a comparison of budgeted and actual revenues and expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

5

The Statement of Changes in Net Position of a federal agency presents the same information as a Statement of Cash Flows for a state or local government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

6

The Statement of Net Cost of a federal agency is prepared on the accrual basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

7

The Treasury Department maintains a government-wide system of accounts and prepares the federal government's consolidated financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

8

The account,Fund Balance with Treasury is classified as an asset on a federal agency's balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

9

Federal agencies must include a Managements' Discussion and Analysis in their financial report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

10

Accounting standards for the federal government and its agencies are established by the Government Accountability Office.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

11

Allotments are made at the agency level and assign portions of the appropriation to subunits or programs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

12

Accounting standards for the federal government and its agencies are established by the Governmental Accounting Standards Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Statement of Custodial Activity is not required of every federal agency but is prepared by the SEC,IRS and Customs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

14

The budgetary accounts of a federal agency reflect the status of an appropriation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

15

The budgetary authority process for a federal agency begins with an appropriation by Congress.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

16

Apportionments are issued by the OMB and establish the amount of an appropriation that will be available each quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

17

The Federal Accounting Standards Advisory Board was formed by the Secretary of the Treasury,Director of OMB,and Comptroller General.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

18

The account Obligations - Undelivered Orders is debited as goods and services are received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

19

The difference between assets and liabilities of a federal agency is comprised of Cumulative Results of Operations and Unexpended Appropriations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

20

Federal agencies must include a Statement of Cash Flows in their annual report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

21

Federal agencies which are required to report a Statement of Custodial Activity have transactions which are similar to which fund type of a state or local government?

A) Internal service funds

B) Capital projects funds

C) Agency funds

D) Permanent funds

A) Internal service funds

B) Capital projects funds

C) Agency funds

D) Permanent funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following federal entities would not be required to prepare a Statement of Custodial Activity?

A) Internal Revenue Service

B) Securities and Exchange Commission

C) U.S. Customs and Border Protection

D) Department of Defense

A) Internal Revenue Service

B) Securities and Exchange Commission

C) U.S. Customs and Border Protection

D) Department of Defense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is required in a federal agency's financial report?

A) Statement of Revenues, Expenditures and Changes in Fund Balance

B) Statement of Cash Flows

C) Statement of Activity

D) Statement of Net Cost

A) Statement of Revenues, Expenditures and Changes in Fund Balance

B) Statement of Cash Flows

C) Statement of Activity

D) Statement of Net Cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is (are)true regarding Federal Accounting Standards Advisory Board?

A) Statements issued by the board are recognized as the highest level of authoritative standard for federal government entities

B) The Board is called "Advisory" because Statements issued by the board are recommended accounting standards but are not "level A GAAP" for federal agencies

C) Both (a) and (b) above

D) Neither (a) nor (b) above

A) Statements issued by the board are recognized as the highest level of authoritative standard for federal government entities

B) The Board is called "Advisory" because Statements issued by the board are recommended accounting standards but are not "level A GAAP" for federal agencies

C) Both (a) and (b) above

D) Neither (a) nor (b) above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following should not appear within the asset section of a federal agency balance sheet?

A) Fund Balance with Treasury

B) Property and Equipment

C) Net Position - Unexpended Appropriations

D) All of the above

A) Fund Balance with Treasury

B) Property and Equipment

C) Net Position - Unexpended Appropriations

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

26

Typically budgetary authority that is not obligated by a federal agency before the end of the fiscal year is returned to Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is (are)accurate regarding a federal agency's Statement of Changes in Net Position?

A) The statement starts with the beginning of year balances in the net position accounts and reconciles these to the ending balances appearing on the agency's Balance Sheet.

B) Costs are measured using the budgetary basis of accounting.

C) Both (a) and (b) above

D) Neither (a) nor (b) above

A) The statement starts with the beginning of year balances in the net position accounts and reconciles these to the ending balances appearing on the agency's Balance Sheet.

B) Costs are measured using the budgetary basis of accounting.

C) Both (a) and (b) above

D) Neither (a) nor (b) above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which organization promulgates Statements of Federal Financial Accounting Standards?

A) The American Institute of Certified Public Accountants

B) The U.S. Office of Management and Budget

C) The U.S. Government Accountability Office

D) The Federal Accounting Standards Advisory Board

A) The American Institute of Certified Public Accountants

B) The U.S. Office of Management and Budget

C) The U.S. Government Accountability Office

D) The Federal Accounting Standards Advisory Board

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is (are)accurate regarding a federal agency's Statement of Budgetary Resources?

A) The statement reports the status of budgetary resources at year end.

B) Outlays are measured using the budgetary basis of accounting.

C) Both (a) and (b)

D) Neither (a) nor (b)

A) The statement reports the status of budgetary resources at year end.

B) Outlays are measured using the budgetary basis of accounting.

C) Both (a) and (b)

D) Neither (a) nor (b)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is not one of the principal organizations that formed the Federal Accounting Standards Advisory Board?

A. Congressional Budget Office

B. Department of Treasury

C. Office of Management and Budget

D. Government Accountability Office

A. Congressional Budget Office

B. Department of Treasury

C. Office of Management and Budget

D. Government Accountability Office

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is responsible for auditing the federal government' consolidated financial statements?

A) Congressional Budget Office

B) Department of Treasury

C) Office of Management and Budget

D) Government Accountability Office

A) Congressional Budget Office

B) Department of Treasury

C) Office of Management and Budget

D) Government Accountability Office

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following organizations is (are)part of the legislative branch of the federal government?

A) Department of Treasury

B) Office of Management and Budget

C) Both (a) and (b) above

D) Neither (a) nor (b) above

A) Department of Treasury

B) Office of Management and Budget

C) Both (a) and (b) above

D) Neither (a) nor (b) above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is accurate regarding a federal agency's Statement of Net Costs?

A) It is similar in presentation to the GASB government-wide Statement of Activities in that earned revenues are subtracted from costs to determine the net cost of government services.

B) Costs are measured using the budgetary basis of accounting.

C) Both (a) and (b) above

D) Neither (a) nor (b) above

A) It is similar in presentation to the GASB government-wide Statement of Activities in that earned revenues are subtracted from costs to determine the net cost of government services.

B) Costs are measured using the budgetary basis of accounting.

C) Both (a) and (b) above

D) Neither (a) nor (b) above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is/are accurate regarding a federal agency's Statement of Net Costs?

A) The costs of government activities are presented by the reporting agency's strategic goals.

B) Net costs reported on the Statement of Net Costs should also appear on the Statement of Changes in Net Position.

C) Both (a) and (b) above

D) Neither (a) nor (b) above

A) The costs of government activities are presented by the reporting agency's strategic goals.

B) Net costs reported on the Statement of Net Costs should also appear on the Statement of Changes in Net Position.

C) Both (a) and (b) above

D) Neither (a) nor (b) above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is true regarding the Balance Sheet of a federal agency?

A) The balance sheet is prepared using the current financial resource measurement focus.

B) Assets, including non-current assets, are measured on the accrual basis.

C) The difference between assets and liabilities is termed "Net Assets".

D) Assets are separated between current and noncurrent.

A) The balance sheet is prepared using the current financial resource measurement focus.

B) Assets, including non-current assets, are measured on the accrual basis.

C) The difference between assets and liabilities is termed "Net Assets".

D) Assets are separated between current and noncurrent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is responsible for preparing the federal government' consolidated financial statements?

A) Congressional Budget Office

B) Department of Treasury

C) Office of Management and Budget

D) Government Accountability Office

A) Congressional Budget Office

B) Department of Treasury

C) Office of Management and Budget

D) Government Accountability Office

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following is (are)true regarding the Chief Financial Officers Act?

A) The Act created the position of chief financial officer within federal agencies

B) The Act called for audits of the financial statements of federal agencies

C) Both (a) and (b) above

D) Neither (a) nor (b) above

A) The Act created the position of chief financial officer within federal agencies

B) The Act called for audits of the financial statements of federal agencies

C) Both (a) and (b) above

D) Neither (a) nor (b) above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is not required in a federal agency's financial report?

A) Management's Discussion and Analysis

B) Notes to the Financial Statements

C) Citizen's Guide to the Financial Report

D) Required Supplemental Information

A) Management's Discussion and Analysis

B) Notes to the Financial Statements

C) Citizen's Guide to the Financial Report

D) Required Supplemental Information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is (are)true regarding the Government Accountability Office?

A) The GAO establishes accounting standards applicable to the federal government and its agencies

B) The GAO establishes auditing standards applicable to the federal government and its agencies

C) Both (a) and (b) above

D) Neither (a) nor (b) above

A) The GAO establishes accounting standards applicable to the federal government and its agencies

B) The GAO establishes auditing standards applicable to the federal government and its agencies

C) Both (a) and (b) above

D) Neither (a) nor (b) above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following accounts are used to display the difference between assets and liabilities in a federal agency Balance Sheet?

A) Unrestricted Net Assets, Restricted Net Assets, and Invested in Capital Assets Net of Related Debt.

B) Unassigned, assigned, committed, restricted and nonspendable fund balance.

C) Unexpended Appropriations and Cumulative Results of Operations

D) Unrestricted, Temporarily Restricted, and Permanently Restricted Net Assets

A) Unrestricted Net Assets, Restricted Net Assets, and Invested in Capital Assets Net of Related Debt.

B) Unassigned, assigned, committed, restricted and nonspendable fund balance.

C) Unexpended Appropriations and Cumulative Results of Operations

D) Unrestricted, Temporarily Restricted, and Permanently Restricted Net Assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

41

Assume the director of a federal agency allots a portion of the agency's apportionment to subunits within the agency.The journal entries at the agency level to record this event will include:

A) a debit to the account Apportionments

B) a debit to the account Allotments

C) a credit to the account Obligations - Undelivered Orders

D) None of the above

A) a debit to the account Apportionments

B) a debit to the account Allotments

C) a credit to the account Obligations - Undelivered Orders

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

42

Assume a federal agency receives supplies that had been previously ordered that will be used to support a federal program.The journal entries at the agency level to record this event will include:

A) a credit to a liability account such as Accounts Payable

B) a credit to the account Expended Appropriations

C) Both (a) and (b)

D) Neither (a) nor (b)

A) a credit to a liability account such as Accounts Payable

B) a credit to the account Expended Appropriations

C) Both (a) and (b)

D) Neither (a) nor (b)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following events will result in a journal entry being recorded in both the budgetary and proprietary accounts of a federal agency?

A) OMB establishes the amount of the total appropriation that the agency may expend in the first quarter.

B) The agency places orders for goods or services.

C) Both (a) and (b)

D) Neither (a) nor (b)

A) OMB establishes the amount of the total appropriation that the agency may expend in the first quarter.

B) The agency places orders for goods or services.

C) Both (a) and (b)

D) Neither (a) nor (b)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

44

Assume an outstanding account payable of a federal agency is paid.The journal entries at the agency level to record this event will include:

A) a credit to the account Fund Balance with Treasury

B) a credit to the account Cash

C) Both (a) and (b)

D) Neither (a) nor (b)

A) a credit to the account Fund Balance with Treasury

B) a credit to the account Cash

C) Both (a) and (b)

D) Neither (a) nor (b)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

45

At what point in the budgetary authority process may a federal agency or its subunits begin to place orders for goods and services?

A) Appropriation

B) Apportionment

C) Allotment

D) Obligation

A) Appropriation

B) Apportionment

C) Allotment

D) Obligation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

46

Assume the OMB apportions 1/4th of an appropriation to a federal agency for the first quarter of the fiscal year.The journal entries at the agency level to record this event will include:

A) a debit to the account Unexpended Appropriations

B) a debit to the account Unapportioned Authority

C) a credit to the account Fund Balance with Treasury

D) None of the above

A) a debit to the account Unexpended Appropriations

B) a debit to the account Unapportioned Authority

C) a credit to the account Fund Balance with Treasury

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is not required in the federal government's consolidated financial report?

A) Management's Discussion and Analysis

B) Notes to the Financial Statements

C) Statement of Custodial Activity

D) Statement of Social Insurance

A) Management's Discussion and Analysis

B) Notes to the Financial Statements

C) Statement of Custodial Activity

D) Statement of Social Insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following statements appearing in the federal government's consolidated financial report are not prepared on the accrual basis of accounting?

A) Balance Sheet

B) Statement of Changes in Cash Balance from Unified Budget and Other Activities

C) Both (a) and (b) above

D) Neither (a) nor (b) above

A) Balance Sheet

B) Statement of Changes in Cash Balance from Unified Budget and Other Activities

C) Both (a) and (b) above

D) Neither (a) nor (b) above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following are true of the proprietary accounts of the federal government?

A) The accounts provide a record by which federal expenditures may be traced to the budgetary authority granted by Congress.

B) The accounts are used to present the financial position and results of operations of the federal government and its agencies using the accrual basis of accounting.

C) Both (a) and (b) above

D) Neither (a) nor (b) above

A) The accounts provide a record by which federal expenditures may be traced to the budgetary authority granted by Congress.

B) The accounts are used to present the financial position and results of operations of the federal government and its agencies using the accrual basis of accounting.

C) Both (a) and (b) above

D) Neither (a) nor (b) above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following steps in the budgetary authority process occurs when the Office of Management and Budget establishes the quarterly amount available to a federal agency for spending?

A) Appropriation

B) Apportionment

C) Allotment

D) Obligation

A) Appropriation

B) Apportionment

C) Allotment

D) Obligation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following steps in the budgetary authority process occurs when a federal agency issues a purchase order?

A) Appropriation

B) Apportionment

C) Allotment

D) Obligation

A) Appropriation

B) Apportionment

C) Allotment

D) Obligation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following are included in the Financial Snapshot section of the federal government's Citizens' Guide to the Financial Report of the US Government?

A) The Net Operating Cost of the federal government

B) The Net Position (assets minus liabilities) of the federal government

C) Both (a) and (b) above

D) Neither (a) nor (b) above

A) The Net Operating Cost of the federal government

B) The Net Position (assets minus liabilities) of the federal government

C) Both (a) and (b) above

D) Neither (a) nor (b) above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following events will result in a journal entry being recorded in both the budgetary and proprietary accounts of a federal agency?

A) Treasury notifies the agency that Congress passed legislation (signed by the President) granting budgetary authority to fund its activities.

B) Goods or services are received and approved for payment.

C) Both (a) and (b)

D) Neither (a) nor (b)

A) Treasury notifies the agency that Congress passed legislation (signed by the President) granting budgetary authority to fund its activities.

B) Goods or services are received and approved for payment.

C) Both (a) and (b)

D) Neither (a) nor (b)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

54

Assume a federal agency places orders for contracted services supporting a federal program.The journal entries at the agency level to record this event will include:

A) a debit to the account Obligations - Undelivered Orders

B) a debit to the account Operating (program) Expense

C) Both (a) and (b)

D) Neither (a) nor (b)

A) a debit to the account Obligations - Undelivered Orders

B) a debit to the account Operating (program) Expense

C) Both (a) and (b)

D) Neither (a) nor (b)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

55

Assume a spending bill has been passed by Congress and signed by the President.The journal entries at the agency level to record this event will include:

A) a credit to the account Unexpended Appropriations

B) a debit to the account Unapportioned Authority

C) a credit to the account Fund Balance with Treasury

D) None of the above

A) a credit to the account Unexpended Appropriations

B) a debit to the account Unapportioned Authority

C) a credit to the account Fund Balance with Treasury

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

56

Assume a federal agency has $150,000 of unobligated budgetary authority at the end of the fiscal year that must be returned to Treasury.The journal entries at the agency level to record this event will include:

A) a credit to the account Appropriations withdrawn

B) a credit to the account Fund Balance with Treasury

C) Both (a) and (b)

D) Neither (a) nor (b)

A) a credit to the account Appropriations withdrawn

B) a credit to the account Fund Balance with Treasury

C) Both (a) and (b)

D) Neither (a) nor (b)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

57

Assume a federal agency places orders for contracted services supporting a federal program.The journal entries at the agency level to record this event will include:

A) a debit to the account Allotments

B) a credit to the account Fund Balance with Treasury

C) Both (a) and (b)

D) Neither (a) nor (b)

A) a debit to the account Allotments

B) a credit to the account Fund Balance with Treasury

C) Both (a) and (b)

D) Neither (a) nor (b)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following steps in the budgetary authority process occurs when Congress passes a spending bill which is signed by the President?

A) Appropriation

B) Apportionment

C) Allotment

D) Obligation

A) Appropriation

B) Apportionment

C) Allotment

D) Obligation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following steps in the federal government's budgetary authority process is most similar to the recording of encumbrances by state and local governments?

A) Appropriation

B) Apportionment

C) Allotment

D) Obligation

A) Appropriation

B) Apportionment

C) Allotment

D) Obligation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

60

Unapportioned Authority is an example of which type of federal government account?

Budgetary Proprietary

Account Account

A) Yes Yes

B) No Yes

C) Yes No

D) No No

Budgetary Proprietary

Account Account

A) Yes Yes

B) No Yes

C) Yes No

D) No No

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

61

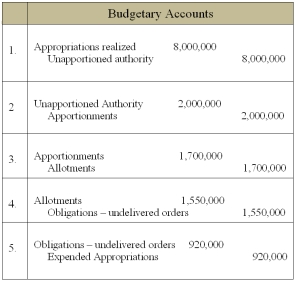

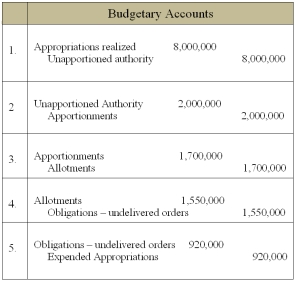

Assume a federal agency prepared the following journal entries during the first quarter of the year.Prepare a schedule showing the status of the appropriation at the end of the first quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

62

List the financial statements required of every federal government agency and indicate whether the statement is prepared using the accrual or budgetary basis of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

63

Reserve for Encumbrances is an example of which type of federal government account?

Budgetary Proprietary

Account Account

A) Yes Yes

B) No Yes

C) Yes No

D) No No

Budgetary Proprietary

Account Account

A) Yes Yes

B) No Yes

C) Yes No

D) No No

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

64

Fund Balance with Treasury is an example of which type of federal government account?

Budgetary Proprietary

Account Account

A) Yes Yes

B) No Yes

C) Yes No

D) No No

Budgetary Proprietary

Account Account

A) Yes Yes

B) No Yes

C) Yes No

D) No No

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

65

Assume a federal agency has the following events:

Receives a warrant from the Treasury notifying the agency of appropriations of $6,000,000.

OMB apportions 1/4th of the appropriation for the first quarter of the year.

The Director of the agency allots $1,400,000 to program units.

Program units place orders $950,000.

Supplies ($500,000)and services ($420,000)are received and paid during the first quarter.Supplies of $380,000 were used in the quarter.

Required:

Prepare any necessary journal entries to reflect the events described above.Identify whether the entry is a budgetary or proprietary type.

Receives a warrant from the Treasury notifying the agency of appropriations of $6,000,000.

OMB apportions 1/4th of the appropriation for the first quarter of the year.

The Director of the agency allots $1,400,000 to program units.

Program units place orders $950,000.

Supplies ($500,000)and services ($420,000)are received and paid during the first quarter.Supplies of $380,000 were used in the quarter.

Required:

Prepare any necessary journal entries to reflect the events described above.Identify whether the entry is a budgetary or proprietary type.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

66

Describe the purpose of the following:

a)Federal government budgetary accounts

b)Federal government proprietary accounts

a)Federal government budgetary accounts

b)Federal government proprietary accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

67

Identify (in order of occurrence)the steps in the federal budgetary authority process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck

68

Identify the primary functions of the following entities as they relate to financial reporting by the federal government:

a)Office of Management and Budget

b)Department of Treasury

c)Government Accountability Office

a)Office of Management and Budget

b)Department of Treasury

c)Government Accountability Office

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 68 في هذه المجموعة.

فتح الحزمة

k this deck