Deck 17: Alternative Exit and Restructuring Strategies: Bankruptcy Reorganization and Liquidation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/80

العب

ملء الشاشة (f)

Deck 17: Alternative Exit and Restructuring Strategies: Bankruptcy Reorganization and Liquidation

1

A debt-for-equity swap occurs when creditors surrender a portion of their claims on the firm in exchange for an ownership position in the firm.

True

2

By law,corporate liquidation can only be conducted outside of the U.S.bankruptcy court.

False

3

Reforms in creditor rights tend to increase the availability and reduce the cost of credit in countries where court enforcement is quick and fair.

True

4

Credit ratings provided by Moody's and Standard & Poor's are highly reliable indicators of a firm's degree of financial distress.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

5

The term financial distress could apply to a firm unable to meet its obligations or to a specific security on which the issuer has defaulted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a creditor is owed a large amount of money,it could become a major or even the controlling shareholder in the reorganized firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

7

Increasingly,distressed companies are choosing to restructure inside of bankruptcy court,rather than reaching a general agreement with creditors before seeking Chapter 11 protection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

8

For capital markets to function smoothly,disputes involving the legal rights of all participants (both debtors and creditors)need to be resolved quickly and equitably by the courts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

9

Financially distressed firms also affect communities in which they are located in terms of increasing unemployment and eroding the tax base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

10

A firm is said to be bankrupt once it defaults on a bond payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

11

A composition is an agreement in which creditors agree to settle for less than the full amount they are owed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

12

A firm is said to be technically solvent when it is unable to pay its liabilities as they come due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

13

A workout is an arrangement conducted inside of bankruptcy court by a debtor and its creditors for payment or re-scheduling of payment of the debtor's obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

14

Large companies often have a difficult time achieving out-of-court settlements because they usually have hundreds of creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

15

A debt extension occurs when creditors agree to lengthen the period during which the debtor firm can repay its debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

16

Bankruptcy is a state-level legal proceeding designed to protect the technically or legally insolvent firm from lawsuits by its creditors until a decision can be made to shut down or to continue to operate the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

17

A debt-for-equity swap occurs when the distressed firm's shareholders are willing to surrender a portion of their ownership for debt in the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

18

The debtor firm often initiates the voluntary settlement process,because it generally offers the best chance for the current owners to recover a portion of their investments either by continuing to operate the firm or through a planned liquidation of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

19

Legal insolvency occurs when a firm's liabilities exceed the book value of its assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

20

A firm is not bankrupt or in bankruptcy until it files or its creditors file a petition for reorganization or liquidation with the federal bankruptcy courts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

21

In the absence of a voluntary settlement out of court,the debtor firm may seek protection from its creditors by initiating bankruptcy.However,creditors cannot force the debtor firm into bankruptcy.

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

22

As part of a Chapter 15 proceeding,the U.S.bankruptcy court may authorize a trustee to act in a foreign country on behalf of the U.S.Bankruptcy Court.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

23

Prior to the Bankruptcy Abuse Protection and Consumer Protection Act of 2005,the debtor had the exclusive right to file a plan of reorganization for the first 120 days after it filed the case.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

24

Chapter 11 of the U.S.bankruptcy code deals with liquidation while Chapter 7 addresses reorganization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

25

In liquidation,bankruptcy professionals,including attorneys,accountants,and trustees,often end up with the majority of the proceeds generated by selling the assets of the failing firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

26

The court can ignore the objections of creditors and stockholders if it feels the reorganization is both fair and feasible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

27

In the absence of a voluntary settlement out of court,the debtor firm may seek protection from its creditors by initiating bankruptcy or may be forced into bankruptcy by its creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

28

Chapter 11 reorganization often enables creditors to recover relatively more of their claims than under liquidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

29

Empirical studies show that company size (measured by assets),case duration (measured in days),and the number of parties involved in the proceedings (measured in terms of the numbers of professional firms working)explain most of the case-to-case variation in professional fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

30

The court must approve any plan accepted by the debtor's shareholders and creditors.True of False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

31

U.S.bankruptcy laws and practices focus on maintaining shareholder value during the bankruptcy process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

32

Companies may not seek the protection of bankruptcy court to avoid liquidation.True of False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

33

The filing of a petition triggers an automatic stay once the court accepts the request,which provides a period suspending all judgments,collection activities,foreclosures,and repossessions of property by the creditors on any debt or claim that arose before the filing of the bankruptcy petition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

34

Under a prepackaged bankruptcy,the debtor negotiates with creditors well in advance of filing for a Chapter 7 bankruptcy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

35

Through a process called an assignment,a committee representing creditors grants the power to liquidate the firm's assets to a third party called an assignee or trustee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

36

If the insolvent firm is willing to accept liquidation,,legal proceedings are not necessary,regardless of what the creditors think.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

37

Prepackaged bankruptcies are less common today than in years past.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

38

Automatic stays are granted by the court only when the debtor files for bankruptcy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

39

Prior to the Bankruptcy Abuse Protection and Consumer Protection Act of 2005 (BAPCPA),commercial enterprises used Chapter 11 Reorganization to continue operating a business and to repay creditors through a court-approved plan of reorganization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

40

The purpose of Chapter 15 of the U.S.Bankruptcy Code is to prioritize the payment of creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

41

Sales within the protection of Chapter 11 reorganization may be accomplished either by a negotiated private sale to a particular purchaser or through a public auction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

42

All of the following are true of the bankruptcy process except for

A) The debtor firm may seek protection from its creditors by initiating bankruptcy or may be forced into bankruptcy by its creditors.

B) When creditors file for bankruptcy on behalf of the debtor firm, the action is said to be involuntary bankruptcy.

C) Once either a voluntary or involuntary petition is filed, the debtor firm is protected from any further legal action related to its debts until the bankruptcy proceedings are completed.

D) The filing of a petition triggers an automatic stay even before the court accepts the request.

E) An automatic stay suspends all judgments, collection activities, foreclosures, and repossessions of property by the creditors on any debt or claim that arose before the filing of the bankruptcy petition

A) The debtor firm may seek protection from its creditors by initiating bankruptcy or may be forced into bankruptcy by its creditors.

B) When creditors file for bankruptcy on behalf of the debtor firm, the action is said to be involuntary bankruptcy.

C) Once either a voluntary or involuntary petition is filed, the debtor firm is protected from any further legal action related to its debts until the bankruptcy proceedings are completed.

D) The filing of a petition triggers an automatic stay even before the court accepts the request.

E) An automatic stay suspends all judgments, collection activities, foreclosures, and repossessions of property by the creditors on any debt or claim that arose before the filing of the bankruptcy petition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following are commonly used strategic alternatives for failing firms?

A) Merge with another firm

B) Reach out of court voluntary settlement with creditors

C) File for protection from creditors from the U.S. bankruptcy court

D) A, B, and C

E) A and B only

A) Merge with another firm

B) Reach out of court voluntary settlement with creditors

C) File for protection from creditors from the U.S. bankruptcy court

D) A, B, and C

E) A and B only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

44

All of the following are conditions most favorable for reaching settlement outside of bankruptcy court except for

A) The debtor firm is willing to share all necessary information with its creditors

B) Creditors have confidence in the debtor firm's management.

C) The debtor firm has relatively few creditors.

D) The debtor firm has many creditors.

E) The period of economic distress afflicting the firm is expected to be short-lived.

A) The debtor firm is willing to share all necessary information with its creditors

B) Creditors have confidence in the debtor firm's management.

C) The debtor firm has relatively few creditors.

D) The debtor firm has many creditors.

E) The period of economic distress afflicting the firm is expected to be short-lived.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

45

To determine which strategy to pursue,the failing firm's management needs to estimate which of the following:

A) Going concern value

B) Liquidation value

C) Selling price of the firm

D) A and B only

E) A, B, and C

A) Going concern value

B) Liquidation value

C) Selling price of the firm

D) A and B only

E) A, B, and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

46

Federal law prohibits trading in a bankrupt firm's securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

47

Smaller creditors have little incentive to attempt to hold up the agreement unless they receive special treatment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

48

Financially distressed firms often are characterized by all of the following except for:

A) Underinvestment in operations

B) Employee layoffs

C) High levels of research and development spending

D) Declining product quality

E) Slower payments to suppliers

A) Underinvestment in operations

B) Employee layoffs

C) High levels of research and development spending

D) Declining product quality

E) Slower payments to suppliers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements is not true?

A) Technical insolvency arises when a firm is unable to meet its obligations when they come due.

B) Legal insolvency occurs when a firm's liabilities exceed the fair market value of its assets.

C) A firm must be legally insolvent to enter bankruptcy.

D) Bankruptcy is a legal proceeding which protects a debtor firm from its creditors.

E) A firm is not considered bankrupt until its petition for bankruptcy is accepted by the court.

A) Technical insolvency arises when a firm is unable to meet its obligations when they come due.

B) Legal insolvency occurs when a firm's liabilities exceed the fair market value of its assets.

C) A firm must be legally insolvent to enter bankruptcy.

D) Bankruptcy is a legal proceeding which protects a debtor firm from its creditors.

E) A firm is not considered bankrupt until its petition for bankruptcy is accepted by the court.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

50

If a firm enters into a workout in which a voluntary negotiated agreement with debtors is achieved,the firm may lose its right to claim NOLs in its tax filing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

51

Economic distress arises when a firm's growth and investment prospects deteriorate,causing a reduction in the value of the business due to the deteriorating outlook for the firm's cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

52

The leading causes of business failure include which of the following:

A) Recession

B) Excessive operating expenses

C) Excessive leverage

D) Management inexperience

E) All of the above

A) Recession

B) Excessive operating expenses

C) Excessive leverage

D) Management inexperience

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

53

While bankrupt firms generally are unable to meet the listing requirements of the major stock exchanges,their shares may trade in the over-the-counter market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

54

Why would creditors be willing to give a portion of what they are owed by the debtor firm for equity in the reorganized firm?

A) They are legally obligated to do so under U.S. bankruptcy law.

B) Ownership in a firm is inherently more valuable than being a creditor.

C) The value of the stock may in the long run far exceed the amount of debt the creditors were willing to forgive.

D) Creditors understand that they can sue the firm at a later date for what they are owed.

E) None of the above.

A) They are legally obligated to do so under U.S. bankruptcy law.

B) Ownership in a firm is inherently more valuable than being a creditor.

C) The value of the stock may in the long run far exceed the amount of debt the creditors were willing to forgive.

D) Creditors understand that they can sue the firm at a later date for what they are owed.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the going concern value is less than the selling or liquidation price,the firm should seek the protection of the bankruptcy court.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

56

Moody's credit rating agency defines instances of default as which of the following:

A) Missed or delayed payment of interest or principal

B) Bankruptcy

C) Receivership

D) Any exchange (equity for debt) diminishing the value of what is owed to bondholders

E) All of the above

A) Missed or delayed payment of interest or principal

B) Bankruptcy

C) Receivership

D) Any exchange (equity for debt) diminishing the value of what is owed to bondholders

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

57

All of the following represent different forms of debt restructuring except for

A) Debt extensions

B) Debt compositions

C) Share exchange ratios

D) Debt for equity swaps

E) A and D

A) Debt extensions

B) Debt compositions

C) Share exchange ratios

D) Debt for equity swaps

E) A and D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

58

If the selling price of the failing firm is less than the going concern and liquidation value,the firm should sell the firm to another party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

59

All of the following are true except for

A) Chapter 15 deals with international or cross-border bankruptcies.

B) Chapter 11 deals with reorganizing the firm.

C) Chapter 7 defines the process and priorities of the liquidation process for commercial businesses.

D) Chapter 11 also addresses issues pertaining to personal bankruptcy.

E) A and B

A) Chapter 15 deals with international or cross-border bankruptcies.

B) Chapter 11 deals with reorganizing the firm.

C) Chapter 7 defines the process and priorities of the liquidation process for commercial businesses.

D) Chapter 11 also addresses issues pertaining to personal bankruptcy.

E) A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

60

Debt restructuring of a bankrupt firm is usually accomplished in which of the following ways:

A) An extension

B) A composition

C) A debt for equity swap

D) Some combination of a, b, or c

E) All of the above

A) An extension

B) A composition

C) A debt for equity swap

D) Some combination of a, b, or c

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

61

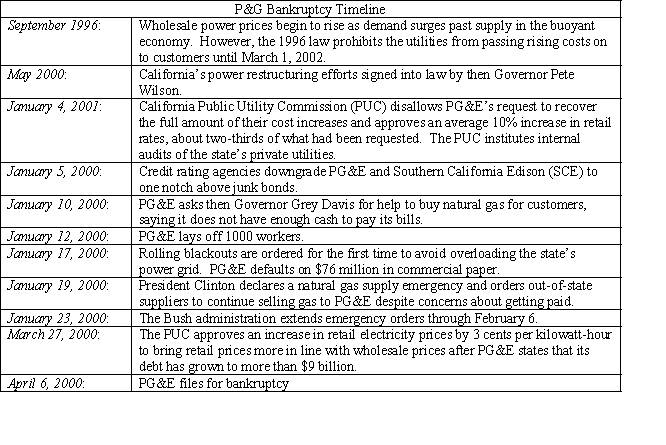

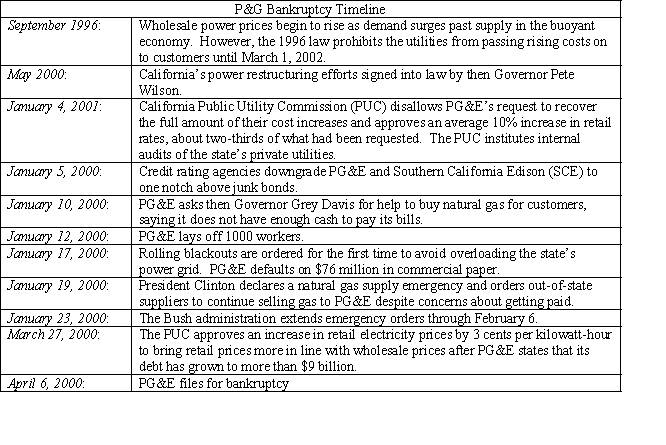

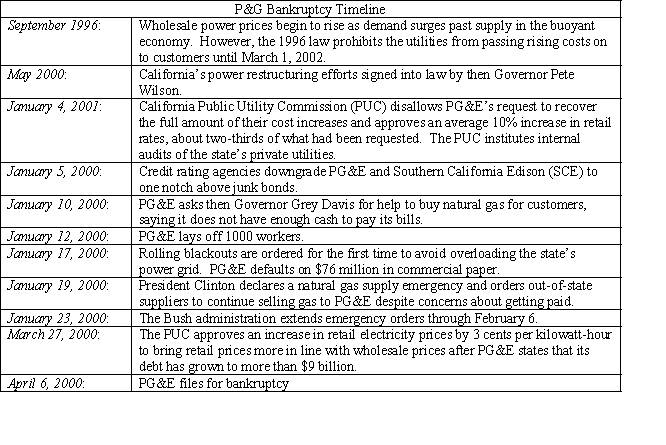

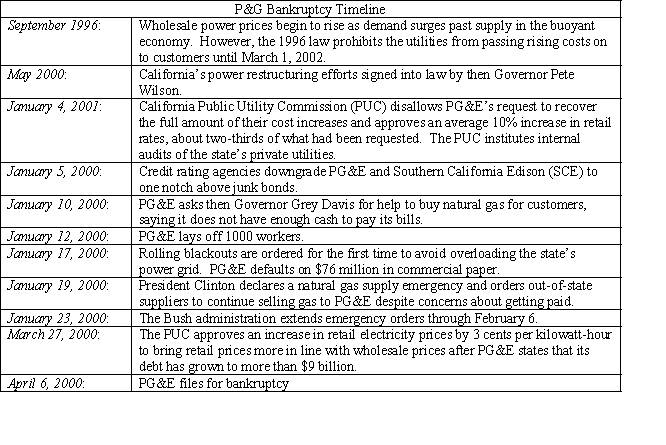

PG&E SEEKS BANKRUPTCY PROTECTION

Pacific, Gas, and Electric (PG&E), the San Francisco-based utility, filed for bankruptcy on April 7, 2001, citing nearly $9 billion in debt and un-reimbursed energy costs. The utility, one of three privately owned utilities in California, serves northern and central California. The intention of the Chapter 11 reorganization was to make the utility solvent again by protecting the firm from lawsuits or any other action by those who are owed money by the utility. The bankruptcy will also allow the utility to deal with all of the firm's debts in a single forum rather than with individual debtors in what had become a highly politicized venue. The following time line outlines the firm's road to bankruptcy. .

.

Utility industry analysts saw PG&E's move as largely an effort to escape the political paralysis that had befallen the state's regulatory apparatus. The bankruptcy filing came one day after Governor Davis dropped his opposition to raising retail rates. However, the Governor's reversal came after five month's of negotiations with the state's privately owned utilities on a rescue plan.

PG&E's common shares fell 37 percent on the day the firm filed for reorganization. Fearing a similar fate for San Diego Gas and Electric, the shares of Sempra Energy, SDG&E's parent corporation, also dropped by 35 percent

In an attempt to insulate California ratepayers from escalating wholesale electricity prices, the state entered into a series of 5-to-10 year contracts with electricity power generators that account for more than two-thirds of the state's projected power needs. The last contracts were signed by the state in June 2001. By September, a slowing economy pushed the wholesale price of electricity well below the level the state was required to pay in the "take or pay" contracts the state had just signed. Estimates suggest that California taxpayers will have to pay between $40 and $45 billion in power costs over the next decade depending on what happens to future energy costs. PG&E has continued to supply its customers without disruption or blackout while being under the protection of the bankruptcy court.

Southern California Edison, nearing bankruptcy for reasons similar to those that drove PG&E to seek protection from its creditors, reached agreement with the Public Utility Commission to pay off $3.3 billion in debt owed to power generators from customer revenues. Previously, the PUC had forbid the utility to use monies generated from two previous rate increases for this purpose. The U.S. District Court judge approved the plan on October 5, 2001. While some creditors complained that the settlement was not reassuring because it did not include a timetable for repayment of outstanding debt, others viewed the agreement as a voluntary reorganization plan without going through the expensive process of filing for bankruptcy with the federal court.

:

In your judgment,did regulators attenuate or exacerbate the situation? Explain your answer.

Pacific, Gas, and Electric (PG&E), the San Francisco-based utility, filed for bankruptcy on April 7, 2001, citing nearly $9 billion in debt and un-reimbursed energy costs. The utility, one of three privately owned utilities in California, serves northern and central California. The intention of the Chapter 11 reorganization was to make the utility solvent again by protecting the firm from lawsuits or any other action by those who are owed money by the utility. The bankruptcy will also allow the utility to deal with all of the firm's debts in a single forum rather than with individual debtors in what had become a highly politicized venue. The following time line outlines the firm's road to bankruptcy.

.

.Utility industry analysts saw PG&E's move as largely an effort to escape the political paralysis that had befallen the state's regulatory apparatus. The bankruptcy filing came one day after Governor Davis dropped his opposition to raising retail rates. However, the Governor's reversal came after five month's of negotiations with the state's privately owned utilities on a rescue plan.

PG&E's common shares fell 37 percent on the day the firm filed for reorganization. Fearing a similar fate for San Diego Gas and Electric, the shares of Sempra Energy, SDG&E's parent corporation, also dropped by 35 percent

In an attempt to insulate California ratepayers from escalating wholesale electricity prices, the state entered into a series of 5-to-10 year contracts with electricity power generators that account for more than two-thirds of the state's projected power needs. The last contracts were signed by the state in June 2001. By September, a slowing economy pushed the wholesale price of electricity well below the level the state was required to pay in the "take or pay" contracts the state had just signed. Estimates suggest that California taxpayers will have to pay between $40 and $45 billion in power costs over the next decade depending on what happens to future energy costs. PG&E has continued to supply its customers without disruption or blackout while being under the protection of the bankruptcy court.

Southern California Edison, nearing bankruptcy for reasons similar to those that drove PG&E to seek protection from its creditors, reached agreement with the Public Utility Commission to pay off $3.3 billion in debt owed to power generators from customer revenues. Previously, the PUC had forbid the utility to use monies generated from two previous rate increases for this purpose. The U.S. District Court judge approved the plan on October 5, 2001. While some creditors complained that the settlement was not reassuring because it did not include a timetable for repayment of outstanding debt, others viewed the agreement as a voluntary reorganization plan without going through the expensive process of filing for bankruptcy with the federal court.

:

In your judgment,did regulators attenuate or exacerbate the situation? Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

62

PG&E SEEKS BANKRUPTCY PROTECTION

Pacific, Gas, and Electric (PG&E), the San Francisco-based utility, filed for bankruptcy on April 7, 2001, citing nearly $9 billion in debt and un-reimbursed energy costs. The utility, one of three privately owned utilities in California, serves northern and central California. The intention of the Chapter 11 reorganization was to make the utility solvent again by protecting the firm from lawsuits or any other action by those who are owed money by the utility. The bankruptcy will also allow the utility to deal with all of the firm's debts in a single forum rather than with individual debtors in what had become a highly politicized venue. The following time line outlines the firm's road to bankruptcy. .

.

Utility industry analysts saw PG&E's move as largely an effort to escape the political paralysis that had befallen the state's regulatory apparatus. The bankruptcy filing came one day after Governor Davis dropped his opposition to raising retail rates. However, the Governor's reversal came after five month's of negotiations with the state's privately owned utilities on a rescue plan.

PG&E's common shares fell 37 percent on the day the firm filed for reorganization. Fearing a similar fate for San Diego Gas and Electric, the shares of Sempra Energy, SDG&E's parent corporation, also dropped by 35 percent

In an attempt to insulate California ratepayers from escalating wholesale electricity prices, the state entered into a series of 5-to-10 year contracts with electricity power generators that account for more than two-thirds of the state's projected power needs. The last contracts were signed by the state in June 2001. By September, a slowing economy pushed the wholesale price of electricity well below the level the state was required to pay in the "take or pay" contracts the state had just signed. Estimates suggest that California taxpayers will have to pay between $40 and $45 billion in power costs over the next decade depending on what happens to future energy costs. PG&E has continued to supply its customers without disruption or blackout while being under the protection of the bankruptcy court.

Southern California Edison, nearing bankruptcy for reasons similar to those that drove PG&E to seek protection from its creditors, reached agreement with the Public Utility Commission to pay off $3.3 billion in debt owed to power generators from customer revenues. Previously, the PUC had forbid the utility to use monies generated from two previous rate increases for this purpose. The U.S. District Court judge approved the plan on October 5, 2001. While some creditors complained that the settlement was not reassuring because it did not include a timetable for repayment of outstanding debt, others viewed the agreement as a voluntary reorganization plan without going through the expensive process of filing for bankruptcy with the federal court.

:

PG&E pursued bankruptcy protection,while Southern California Edison did not.What could PG&E have been done differently to avoid bankruptcy?

Pacific, Gas, and Electric (PG&E), the San Francisco-based utility, filed for bankruptcy on April 7, 2001, citing nearly $9 billion in debt and un-reimbursed energy costs. The utility, one of three privately owned utilities in California, serves northern and central California. The intention of the Chapter 11 reorganization was to make the utility solvent again by protecting the firm from lawsuits or any other action by those who are owed money by the utility. The bankruptcy will also allow the utility to deal with all of the firm's debts in a single forum rather than with individual debtors in what had become a highly politicized venue. The following time line outlines the firm's road to bankruptcy.

.

.Utility industry analysts saw PG&E's move as largely an effort to escape the political paralysis that had befallen the state's regulatory apparatus. The bankruptcy filing came one day after Governor Davis dropped his opposition to raising retail rates. However, the Governor's reversal came after five month's of negotiations with the state's privately owned utilities on a rescue plan.

PG&E's common shares fell 37 percent on the day the firm filed for reorganization. Fearing a similar fate for San Diego Gas and Electric, the shares of Sempra Energy, SDG&E's parent corporation, also dropped by 35 percent

In an attempt to insulate California ratepayers from escalating wholesale electricity prices, the state entered into a series of 5-to-10 year contracts with electricity power generators that account for more than two-thirds of the state's projected power needs. The last contracts were signed by the state in June 2001. By September, a slowing economy pushed the wholesale price of electricity well below the level the state was required to pay in the "take or pay" contracts the state had just signed. Estimates suggest that California taxpayers will have to pay between $40 and $45 billion in power costs over the next decade depending on what happens to future energy costs. PG&E has continued to supply its customers without disruption or blackout while being under the protection of the bankruptcy court.

Southern California Edison, nearing bankruptcy for reasons similar to those that drove PG&E to seek protection from its creditors, reached agreement with the Public Utility Commission to pay off $3.3 billion in debt owed to power generators from customer revenues. Previously, the PUC had forbid the utility to use monies generated from two previous rate increases for this purpose. The U.S. District Court judge approved the plan on October 5, 2001. While some creditors complained that the settlement was not reassuring because it did not include a timetable for repayment of outstanding debt, others viewed the agreement as a voluntary reorganization plan without going through the expensive process of filing for bankruptcy with the federal court.

:

PG&E pursued bankruptcy protection,while Southern California Edison did not.What could PG&E have been done differently to avoid bankruptcy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

63

All of the following are true of the bankruptcy process except for

A) Creditors and the debtor-in-possession have considerable flexibility in working together.

B) The purpose of creditor committees is to work with the debtor firm to develop an acceptable reorganization plan

C) The bankruptcy judge may choose to ignore the objections of creditors and shareholders and accept a reorganization plan.

D) The government is responsible for paying the expenses of all those who contributed to the formulation of a reorganization plan.

E) The debtor firm may emerge from Chapter 11 as an ongoing concern or be merged with another firm.

A) Creditors and the debtor-in-possession have considerable flexibility in working together.

B) The purpose of creditor committees is to work with the debtor firm to develop an acceptable reorganization plan

C) The bankruptcy judge may choose to ignore the objections of creditors and shareholders and accept a reorganization plan.

D) The government is responsible for paying the expenses of all those who contributed to the formulation of a reorganization plan.

E) The debtor firm may emerge from Chapter 11 as an ongoing concern or be merged with another firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

64

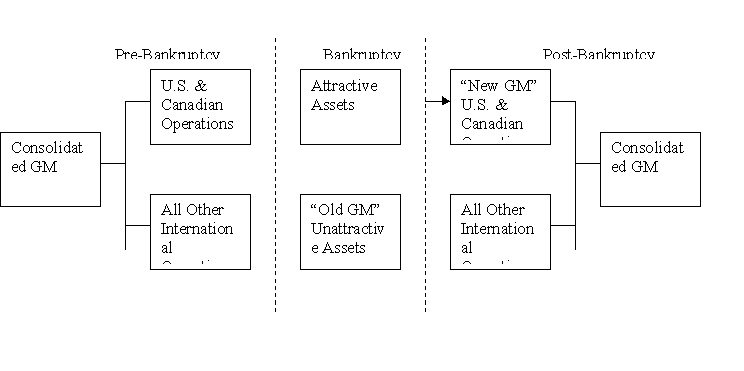

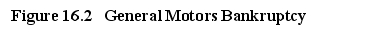

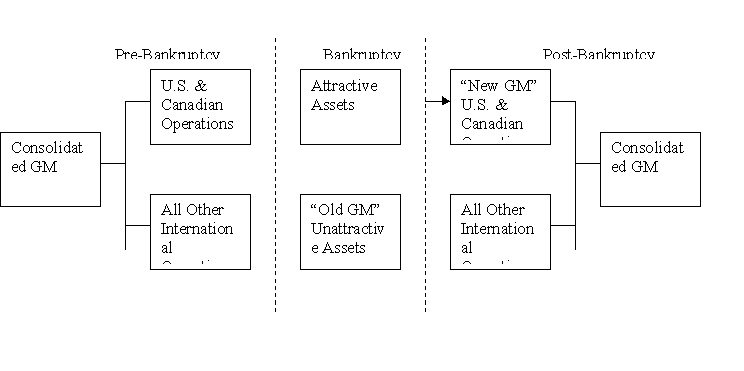

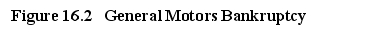

What alternative restructuring strategies do you believe may have been

considered for GM? Of these,do you believe that the 363 sale in bankruptcy

represented the best course of action? Explain your answers.

considered for GM? Of these,do you believe that the 363 sale in bankruptcy

represented the best course of action? Explain your answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

65

All of the following are true about voluntary liquidations except for

A) They can be conducted outside of court in a private auction.

B) They can be done within the protection of the bankruptcy court.

C) Creditors normally prefer liquidations to be conducted by the bankruptcy court..

D) A trustee is assigned to sell the debtor firm's assets as quickly as possible while obtaining the best possible price.

E) If the insolvent firm is willing to accept liquidation and all creditors agree, legal proceedings are not necessary.

A) They can be conducted outside of court in a private auction.

B) They can be done within the protection of the bankruptcy court.

C) Creditors normally prefer liquidations to be conducted by the bankruptcy court..

D) A trustee is assigned to sell the debtor firm's assets as quickly as possible while obtaining the best possible price.

E) If the insolvent firm is willing to accept liquidation and all creditors agree, legal proceedings are not necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

66

Lehman Brothers Files for Chapter 11 in the Biggest Bankruptcy in U.S. History

A casualty of the 2008 credit crisis that shook Wall Street to its core, Lehman Brothers Holdings, Inc., a holding company, announced on September 15, 2008, that it had filed a petition under Chapter 11 of the U.S. Bankruptcy Code. Lehman's board of directors decided to opt for court protection after attempts to find a buyer for the entire firm collapsed. With assets of $639 billion and liabilities of $613 billion, Lehman is the largest bankruptcy in history in terms of assets. The next biggest bankruptcies were WorldCom and Enron with $126 billion and $81 billion in assets, respectively.

None of the holding company's subsidiaries was included in the filing, enabling customers of Lehman's brokerage, Neuberger Berman Holdings, to continue to use their accounts to trade. Furthermore, by excluding its units from the bankruptcy filing, customers of its broker-dealer operations would not be subject to claims by LBHI's more than 100,000 creditors in the bankruptcy case.

Prior to the Dodd-Frank Act of 2010 (see Chapter 2) limiting such rights, counterparties could cancel contracts when a financial services firm went bankrupt. Lehman would normally hedge or protect its investments by taking opposite positions to minimize potential losses in its derivatives portfolios. Derivatives are financial instruments whose value changes in response to the value of the underlying assets over a specific period. For example, if the firm purchased a contract to buy oil at a specific price at some point in the future, it would also sell a contract at a somewhat lower price to another party (called a counterparty) to minimize losses if the price of oil dropped. Thus, the bankruptcy filing left Lehman's investment positions unprotected.

On September 20, 2008, Barclays PLC., a major U.K. bank, acquired Lehman's broker-dealer operations for $250 million and paid an additional $1.5 billion for the firm's New York headquarters building and two New Jersey-based data centers. Coming just five days after Lehman filed for bankruptcy, the deal reflected the urgency to find buyers for those businesses whose value consisted primarily of their employees. Barclays did not buy any of Lehman's commercial real estate assets or private equity and hedge fund investments. However, Barclays did agree to take $47.4 billion in securities and assume $45.5 billion in trading liabilities. On September 24, 2008, Japanese brokerage Nomura Securities acquired Lehman's Japanese and Australian operation for $250 million. Lehman's investment management group, Neuberger Berman, was sold in late December 2008 to a Neuberger management group for $922 million. Under the deal, Neuberger's management would own 51 percent of the firm, and Lehman's creditors would control the remainder. Other Lehman assets, consisting primarily of complex derivatives ranging from oil price futures to credit default swaps (i.e., debt insurance) to options on stock indices, with more than 8,000 counterparties, were expected to take years to identify, value, and liquidate. The firm also could expect to face numerous lawsuits.

The October 18, 2008, auction of $400 billion of Lehman's debt issues was valued at 8.5 cents on the dollar. Because such debt was backed by only the firm's creditworthiness, the buyers of the Lehman debt had purchased insurance from other financial institutions to mitigate the risk of a Lehman default. The existence of these credit default swap arrangements meant that the insurers were required to pay Lehman bondholders $366 billion (i.e., 0.915 × $400 billion). Purchasers of this debt were betting that, following Lehman's liquidation, holders of this debt would receive more than 8.5 cents on the dollar and the insurers would be able to satisfy their obligations.

Hedge funds also were affected by the Lehman bankruptcy. Hedge funds borrowed heavily from Lehman, putting up certain assets as collateral for the loans. While legal, Lehman was using this collateral to borrow from other firms. By using its customers' collateral as its own collateral, Lehman and other firms could borrow more money, using the proceeds to make additional investments. When Lehman filed for bankruptcy, the court took control of such assets until who was entitled to the assets could be determined. Moreover, while derivative agreements were designed to terminate whenever a party declares bankruptcy and be settled outside of court, Lehman's general creditors may lay claim to any collateral whose value exceeds the value of the derivative agreements. Disentangling these claims will take years.

In early 2010, a report compiled by bank examiners described how Lehman manipulated its financial statements, leaving the investing public, credit rating agencies, government regulators, and Lehman's board of directors totally unaware of the accounting tricks. By departing from common accounting practices, Lehman appeared to be less levered than it actually was. It was pressure from speculators, sensing that the firm was in disarray, which uncovered the scam by selling Lehman's stock short and accomplishing what the regulators and credit rating agencies could not. See the Inside M&A case study at the beginning of Chapter 2 for more details on Lehman's accounting practices.

Discussion Questions

1. Why did Lehman choose not to seek Chapter 11 protection for its subsidiaries?

2. How does Chapter 11 bankruptcy protect Lehman's creditors? How does it potentially hurt them? Explain your answers.

3. Do you believe the U.S. bankruptcy process was appropriate in this instance? Explain your answer.

4. Do you believe the U.S. government's failure to bail out Lehman, thereby forcing the firm to file for bankruptcy, exacerbated the global credit meltdown in October 2008? Explain your answer.

Case Study Short Essay Examination Questions:

A Reorganized Dana Corporation

Emerges from Bankruptcy Court

Dana Corporation, an automotive parts manufacturer, announced on February 1, 2008, that it had emerged from bankruptcy court with an exit financing facility of $2 billion. The firm had entered Chapter 11 reorganization on March 3, 2006. During the ensuing 21 months, the firm and its constituents identified, agreed on, and won court approval for approximately $440 million to $475 million in annual cost savings and the elimination of unprofitable products. These annual savings resulted from achieving better plant utilization due to changes in union work rules, wage and benefit reductions, the reduction of ongoing obligations for retiree health and welfare costs, and streamlining administrative expenses.

The plan of reorganization accepted by the court, creditors, and investors included a $750 million equity investment provided by Centerbridge Capital Partners to fund a portion of the firm's health-care and pension obligations. Under the plan, shareholders received no payout. Bondholders of some $1.62 billion in various maturities and holders of $1.63 billion in unsecured claims recovered about 60-90 percent of their claims. Centerbridge would acquire $250 million of convertible preferred stock in the reorganized Dana operation, and creditors, who had agreed to support the reorganization plan, could acquire up to $500 million of the convertible preferred shares. The preferred shares were issued as an inducement to get creditors to support the plan of reorganization. Under the reorganization plan, Dana sold some businesses, cut plants in the United States and Canada, reduced its hourly and salaried workforce, and sought price

Does the process outlined in this business case seem equitable for all parties to the bankruptcy proceedings? Why? Why not? Be specific.

A casualty of the 2008 credit crisis that shook Wall Street to its core, Lehman Brothers Holdings, Inc., a holding company, announced on September 15, 2008, that it had filed a petition under Chapter 11 of the U.S. Bankruptcy Code. Lehman's board of directors decided to opt for court protection after attempts to find a buyer for the entire firm collapsed. With assets of $639 billion and liabilities of $613 billion, Lehman is the largest bankruptcy in history in terms of assets. The next biggest bankruptcies were WorldCom and Enron with $126 billion and $81 billion in assets, respectively.

None of the holding company's subsidiaries was included in the filing, enabling customers of Lehman's brokerage, Neuberger Berman Holdings, to continue to use their accounts to trade. Furthermore, by excluding its units from the bankruptcy filing, customers of its broker-dealer operations would not be subject to claims by LBHI's more than 100,000 creditors in the bankruptcy case.

Prior to the Dodd-Frank Act of 2010 (see Chapter 2) limiting such rights, counterparties could cancel contracts when a financial services firm went bankrupt. Lehman would normally hedge or protect its investments by taking opposite positions to minimize potential losses in its derivatives portfolios. Derivatives are financial instruments whose value changes in response to the value of the underlying assets over a specific period. For example, if the firm purchased a contract to buy oil at a specific price at some point in the future, it would also sell a contract at a somewhat lower price to another party (called a counterparty) to minimize losses if the price of oil dropped. Thus, the bankruptcy filing left Lehman's investment positions unprotected.

On September 20, 2008, Barclays PLC., a major U.K. bank, acquired Lehman's broker-dealer operations for $250 million and paid an additional $1.5 billion for the firm's New York headquarters building and two New Jersey-based data centers. Coming just five days after Lehman filed for bankruptcy, the deal reflected the urgency to find buyers for those businesses whose value consisted primarily of their employees. Barclays did not buy any of Lehman's commercial real estate assets or private equity and hedge fund investments. However, Barclays did agree to take $47.4 billion in securities and assume $45.5 billion in trading liabilities. On September 24, 2008, Japanese brokerage Nomura Securities acquired Lehman's Japanese and Australian operation for $250 million. Lehman's investment management group, Neuberger Berman, was sold in late December 2008 to a Neuberger management group for $922 million. Under the deal, Neuberger's management would own 51 percent of the firm, and Lehman's creditors would control the remainder. Other Lehman assets, consisting primarily of complex derivatives ranging from oil price futures to credit default swaps (i.e., debt insurance) to options on stock indices, with more than 8,000 counterparties, were expected to take years to identify, value, and liquidate. The firm also could expect to face numerous lawsuits.

The October 18, 2008, auction of $400 billion of Lehman's debt issues was valued at 8.5 cents on the dollar. Because such debt was backed by only the firm's creditworthiness, the buyers of the Lehman debt had purchased insurance from other financial institutions to mitigate the risk of a Lehman default. The existence of these credit default swap arrangements meant that the insurers were required to pay Lehman bondholders $366 billion (i.e., 0.915 × $400 billion). Purchasers of this debt were betting that, following Lehman's liquidation, holders of this debt would receive more than 8.5 cents on the dollar and the insurers would be able to satisfy their obligations.

Hedge funds also were affected by the Lehman bankruptcy. Hedge funds borrowed heavily from Lehman, putting up certain assets as collateral for the loans. While legal, Lehman was using this collateral to borrow from other firms. By using its customers' collateral as its own collateral, Lehman and other firms could borrow more money, using the proceeds to make additional investments. When Lehman filed for bankruptcy, the court took control of such assets until who was entitled to the assets could be determined. Moreover, while derivative agreements were designed to terminate whenever a party declares bankruptcy and be settled outside of court, Lehman's general creditors may lay claim to any collateral whose value exceeds the value of the derivative agreements. Disentangling these claims will take years.

In early 2010, a report compiled by bank examiners described how Lehman manipulated its financial statements, leaving the investing public, credit rating agencies, government regulators, and Lehman's board of directors totally unaware of the accounting tricks. By departing from common accounting practices, Lehman appeared to be less levered than it actually was. It was pressure from speculators, sensing that the firm was in disarray, which uncovered the scam by selling Lehman's stock short and accomplishing what the regulators and credit rating agencies could not. See the Inside M&A case study at the beginning of Chapter 2 for more details on Lehman's accounting practices.

Discussion Questions

1. Why did Lehman choose not to seek Chapter 11 protection for its subsidiaries?

2. How does Chapter 11 bankruptcy protect Lehman's creditors? How does it potentially hurt them? Explain your answers.

3. Do you believe the U.S. bankruptcy process was appropriate in this instance? Explain your answer.

4. Do you believe the U.S. government's failure to bail out Lehman, thereby forcing the firm to file for bankruptcy, exacerbated the global credit meltdown in October 2008? Explain your answer.

Case Study Short Essay Examination Questions:

A Reorganized Dana Corporation

Emerges from Bankruptcy Court

Dana Corporation, an automotive parts manufacturer, announced on February 1, 2008, that it had emerged from bankruptcy court with an exit financing facility of $2 billion. The firm had entered Chapter 11 reorganization on March 3, 2006. During the ensuing 21 months, the firm and its constituents identified, agreed on, and won court approval for approximately $440 million to $475 million in annual cost savings and the elimination of unprofitable products. These annual savings resulted from achieving better plant utilization due to changes in union work rules, wage and benefit reductions, the reduction of ongoing obligations for retiree health and welfare costs, and streamlining administrative expenses.

The plan of reorganization accepted by the court, creditors, and investors included a $750 million equity investment provided by Centerbridge Capital Partners to fund a portion of the firm's health-care and pension obligations. Under the plan, shareholders received no payout. Bondholders of some $1.62 billion in various maturities and holders of $1.63 billion in unsecured claims recovered about 60-90 percent of their claims. Centerbridge would acquire $250 million of convertible preferred stock in the reorganized Dana operation, and creditors, who had agreed to support the reorganization plan, could acquire up to $500 million of the convertible preferred shares. The preferred shares were issued as an inducement to get creditors to support the plan of reorganization. Under the reorganization plan, Dana sold some businesses, cut plants in the United States and Canada, reduced its hourly and salaried workforce, and sought price

Does the process outlined in this business case seem equitable for all parties to the bankruptcy proceedings? Why? Why not? Be specific.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

67

Calpine Emerges from the Protection of Bankruptcy Court

Following approval of its sixth Plan of Reorganization by the U.S. Bankruptcy Court for the Southern District of New York, Calpine Corporation was able to emerge from Chapter 11 bankruptcy on January 31, 2008. Burdened by excessive debt and court battles with creditors on how to use its cash, the electric utility had sought Chapter 11 protection by petitioning the bankruptcy court in December 2005. After settlements with certain stakeholders, all classes of creditors voted to approve the Plan of Reorganization, which provided for the discharge of claims through the issuance of reorganized Calpine Corporation common stock, cash, or a combination of cash and stock to its creditors.

Shortly after exiting bankruptcy, Calpine cancelled all of its then outstanding common stock and authorized the issuance of 485 million shares of reorganized Calpine Corporation common stock for distribution to holders of unsecured claims. In addition, the firm issued warrants (i.e., securities) to purchase 48.5 million shares of reorganized Calpine Corporation common stock to the holders of the cancelled (i.e., previously outstanding) common stock. The warrants were issued on a pro rata basis reflecting the number of shares of "old common stock" held at the time of cancellation. These warrants carried an exercise price of $23.88 per share and expired on August 25, 2008. Relisted on the New York Stock Exchange, the reorganized Calpine Corporation common stock began trading under the symbol CPN on February 7, 2008, at about $18 per share.

The firm had improved its capital structure while in bankruptcy. On entering bankruptcy, Calpine carried $17.4 billion of debt with an average interest rate of 10.3 percent. By retiring unsecured debt with reorganized Calpine Corporation common stock and selling certain assets, Calpine was able to repay or refinance certain project debt, thereby reducing the prebankruptcy petition debt by approximately $7 billion. On exiting bankruptcy, Calpine negotiated approximately $7.3 billion of secured "exit facilities" (i.e., credit lines) from Goldman Sachs, Credit Suisse, Deutsche Bank, and Morgan Stanley. About $6.4 billion of these funds were used to satisfy cash payment obligations under the Plan of Reorganization. These obligations included the repayment of a portion of unsecured creditor claims and administrative claims, such as legal and consulting fees, as well as expenses incurred in connection with the "exit facilities" and immediate working capital requirements. On emerging from Chapter 11, the firm carried $10.4 billion of debt with an average interest rate of 8.1 percent.

The Enron Shuffle-A Scandal to Remember

What started in the mid-1980s as essentially a staid "old-economy" business became the poster child in the late 1990s for companies wanting to remake themselves into "new-economy" powerhouses. Unfortunately, what may have started with the best of intentions emerged as one of the biggest business scandals in U.S. history. Enron was created in 1985 as a result of a merger between Houston Natural Gas and Internorth Natural Gas. In 1989, Enron started trading natural gas commodities and eventually became the world's largest buyer and seller of natural gas. In the early 1990s, Enron became the nation's premier electricity marketer and pioneered the development of trading in such commodities as weather derivatives, bandwidth, pulp, paper, and plastics. Enron invested billions in its broadband unit and water and wastewater system management unit and in hard assets overseas. In 2000, Enron reported $101 billion in revenue and a market capitalization of $63 billion.

The Virtual Company

Enron was essentially a company whose trading and risk management business strategy was built on assets largely owned by others. The complex financial maneuvering and off-balance-sheet partnerships that former CEO Jeffrey K. Skilling and chief financial officer Andrew S. Fastow implemented were intended to remove everything from telecommunications fiber to water companies from the firm's balance sheet and into partnerships. What distinguished Enron's partnerships from those commonly used to share risks were their lack of independence from Enron and the use of Enron's stock as collateral to leverage the partnerships. If Enron's stock fell in value, the firm was obligated to issue more shares to the partnership to restore the value of the collateral underlying the debt or immediately repay the debt. Lenders in effect had direct recourse to Enron stock if at any time the partnerships could not repay their loans in full. Rather than limiting risk, Enron was assuming total risk by guaranteeing the loans with its stock.

Enron also engaged in transactions that inflated its earnings, such as selling time on its broadband system to a partnership at inflated prices at a time when the demand for broadband was plummeting. Enron then recorded a substantial profit on such transactions. The partnerships agreed to such transactions because Enron management seems to have exerted disproportionate influence in some instances over partnership decisions, although its ownership interests were very small, often less than 3 percent. Curiously, Enron's outside auditor, Arthur Andersen, had a dual role in these partnerships, collecting fees for helping to set them up and auditing them.

Time to Pay the Piper

At the time the firm filed for bankruptcy on December 2, 2001, it had $13.1 billion in debt on the books of the parent company and another $18.1 billion on the balance sheets of affiliated companies and partnerships. In addition to the partnerships created by Enron, a number of bad investments both in the United States and abroad contributed to the firm's malaise. Meanwhile, Enron's core energy distribution business was deteriorating. Enron was attempting to gain share in a maturing market by paring selling prices. Margins also suffered from poor cost containment.

Dynegy Corp. agreed to buy Enron for $10 billion on November 2, 2001. On November 8, Enron announced that its net income would have to be restated back to 1997, resulting in a $586 million reduction in reported profits. On November 15, chairman Kenneth Lay admitted that the firm had made billions of dollars in bad investments. Four days later, Enron said it would have to repay a $690 million note by mid-December and it might have to take an additional $700 million pretax charge. At the end of the month, Dynegy withdrew its offer and Enron's credit rating was reduced to junk bond status. Enron was responsible for another $3.9 billion owed by its partnerships. Enron had less than $2 billion in cash on hand.

The end came quickly as investors and customers completely lost faith in the energy behemoth as a result of its secrecy and complex financial maneuvers, forcing the firm into bankruptcy in early December. Enron's stock, which had reached a high of $90 per share on August 17, 2001, was trading at less than $1 by December 5, 2001.

In addition to its angry creditors, Enron faced class-action lawsuits by shareholders and employees, whose pensions were invested heavily in Enron stock. Enron also faced intense scrutiny from congressional committees and the U.S. Department of Justice. By the end of 2001, shareholders had lost more than $63 billion from its previous 52-week high, bondholders lost $2.6 billion in the face value of their debt, and banks appeared to be at risk on at least $15 billion of credit they had extended to Enron. In addition, potential losses on uncollateralized derivative contracts totaled $4 billion. Such contracts involved Enron commitments to buy various types of commodities at some point in the future.

Questions remain as to why Wall Street analysts, Arthur Andersen, federal or state regulatory authorities, the credit rating agencies, and the firm's board of directors did not sound the alarm sooner. It is surprising that the audit committee of the Enron board seems to have somehow been unaware of the firm's highly questionable financial maneuvers. Inquiries following the bankruptcy declaration seem to suggest that the audit committee followed all the rules stipulated by federal regulators and stock exchanges regarding director pay, independence, disclosure, and financial expertise. Enron seems to have collapsed in part because such rules did not do what they were supposed to do. For example, paying directors with stock may have aligned their interests with shareholders, but it also is possible to have been a disincentive to question aggressively senior management about their financial dealings.

The Lessons of Enron

Enron may be the best recent example of a complete breakdown in corporate governance, a system intended to protect shareholders. Inside Enron, the board of directors, management, and the audit function failed to do the job. Similarly, the firm's outside auditors, regulators, credit rating agencies, and Wall Street analysts also failed to alert investors. What seems to be apparent is that if the auditors fail to identify incompetence or fraud, the system of safeguards is likely to break down. The cost of failure to those charged with protecting the shareholders, including outside auditors, analysts, credit-rating agencies, and regulators, was simply not high enough to ensure adequate scrutiny.

What may have transpired is that company managers simply undertook aggressive interpretations of accounting principles then challenged auditors to demonstrate that such practices were not in accordance with GAAP accounting rules (Weil, 2002). This type of practice has been going on since the early 1980s and may account for the proliferation of specific accounting rules applicable only to certain transactions to insulate both the firm engaging in the transaction and the auditor reviewing the transaction from subsequent litigation. In one sense, the Enron debacle represents a failure of the free market system and its current shareholder protection mechanisms, in that it took so long for the dramatic Enron shell game to be revealed to the public. However, this incident highlights the remarkable resilience of the free market system. The free market system worked quite effectively in its rapid imposition of discipline in bringing down the Enron house of cards, without any noticeable disruption in energy distribution nationwide.

Epilogue

Due to the complexity of dealing with so many types of creditors, Enron filed its plan with the federal bankruptcy court to reorganize one and a half years after seeking bankruptcy protection on December 2, 2001. The resulting reorganization has been one of the most costly and complex on record, with total legal and consulting fees exceeding $500 million by the end of 2003. More than 350 classes of creditors, including banks, bondholders, and other energy companies that traded with Enron said they were owed about $67 billion.

Under the reorganization plan, unsecured creditors received an estimated 14 cents for each dollar of claims against Enron Corp., while those with claims against Enron North America received an estimated 18.3 cents on the dollar. The money came in cash payments and stock in two holding companies, CrossCountry containing the firm's North American pipeline assets and Prisma Energy International containing the firm's South American operations.

After losing its auditing license in 2004, Arthur Andersen, formerly among the largest auditing firms in the world, ceased operation. In 2006, Andrew Fastow, former Enron chief financial officer, and Lea Fastow plead guilty to several charges of conspiracy to commit fraud. Andrew Fastow received a sentence of 10 years in prison without the possibility of parole. His wife received a much shorter sentence. Also in 2006, Enron chairman Kenneth Lay died while awaiting sentencing, and Enron president Jeffery Skilling received a sentence of 24 years in prison.

Citigroup agreed in early 2008 to pay $1.66 billion to Enron creditors who lost money following the collapse of the firm. Citigroup was the last remaining defendant in what was known as the Mega Claims lawsuit, a bankruptcy lawsuit filed in 2003 against 11 banks and brokerages. The suit alleged that, with the help of banks, Enron kept creditors in the dark about the firm's financial problems through misleading accounting practices. Because of the Mega Claims suit, creditors recovered a total of $5 billion or about 37.4 cents on each dollar owed to them. This lawsuit followed the settlement of a $40 billion class action lawsuit by shareholders, which Citicorp settled in June 2005 for $2 billion.

In your judgment,what were the major factors contributing to the demise of Enron? Of these factors,which were the most important?

Following approval of its sixth Plan of Reorganization by the U.S. Bankruptcy Court for the Southern District of New York, Calpine Corporation was able to emerge from Chapter 11 bankruptcy on January 31, 2008. Burdened by excessive debt and court battles with creditors on how to use its cash, the electric utility had sought Chapter 11 protection by petitioning the bankruptcy court in December 2005. After settlements with certain stakeholders, all classes of creditors voted to approve the Plan of Reorganization, which provided for the discharge of claims through the issuance of reorganized Calpine Corporation common stock, cash, or a combination of cash and stock to its creditors.

Shortly after exiting bankruptcy, Calpine cancelled all of its then outstanding common stock and authorized the issuance of 485 million shares of reorganized Calpine Corporation common stock for distribution to holders of unsecured claims. In addition, the firm issued warrants (i.e., securities) to purchase 48.5 million shares of reorganized Calpine Corporation common stock to the holders of the cancelled (i.e., previously outstanding) common stock. The warrants were issued on a pro rata basis reflecting the number of shares of "old common stock" held at the time of cancellation. These warrants carried an exercise price of $23.88 per share and expired on August 25, 2008. Relisted on the New York Stock Exchange, the reorganized Calpine Corporation common stock began trading under the symbol CPN on February 7, 2008, at about $18 per share.

The firm had improved its capital structure while in bankruptcy. On entering bankruptcy, Calpine carried $17.4 billion of debt with an average interest rate of 10.3 percent. By retiring unsecured debt with reorganized Calpine Corporation common stock and selling certain assets, Calpine was able to repay or refinance certain project debt, thereby reducing the prebankruptcy petition debt by approximately $7 billion. On exiting bankruptcy, Calpine negotiated approximately $7.3 billion of secured "exit facilities" (i.e., credit lines) from Goldman Sachs, Credit Suisse, Deutsche Bank, and Morgan Stanley. About $6.4 billion of these funds were used to satisfy cash payment obligations under the Plan of Reorganization. These obligations included the repayment of a portion of unsecured creditor claims and administrative claims, such as legal and consulting fees, as well as expenses incurred in connection with the "exit facilities" and immediate working capital requirements. On emerging from Chapter 11, the firm carried $10.4 billion of debt with an average interest rate of 8.1 percent.

The Enron Shuffle-A Scandal to Remember

What started in the mid-1980s as essentially a staid "old-economy" business became the poster child in the late 1990s for companies wanting to remake themselves into "new-economy" powerhouses. Unfortunately, what may have started with the best of intentions emerged as one of the biggest business scandals in U.S. history. Enron was created in 1985 as a result of a merger between Houston Natural Gas and Internorth Natural Gas. In 1989, Enron started trading natural gas commodities and eventually became the world's largest buyer and seller of natural gas. In the early 1990s, Enron became the nation's premier electricity marketer and pioneered the development of trading in such commodities as weather derivatives, bandwidth, pulp, paper, and plastics. Enron invested billions in its broadband unit and water and wastewater system management unit and in hard assets overseas. In 2000, Enron reported $101 billion in revenue and a market capitalization of $63 billion.

The Virtual Company

Enron was essentially a company whose trading and risk management business strategy was built on assets largely owned by others. The complex financial maneuvering and off-balance-sheet partnerships that former CEO Jeffrey K. Skilling and chief financial officer Andrew S. Fastow implemented were intended to remove everything from telecommunications fiber to water companies from the firm's balance sheet and into partnerships. What distinguished Enron's partnerships from those commonly used to share risks were their lack of independence from Enron and the use of Enron's stock as collateral to leverage the partnerships. If Enron's stock fell in value, the firm was obligated to issue more shares to the partnership to restore the value of the collateral underlying the debt or immediately repay the debt. Lenders in effect had direct recourse to Enron stock if at any time the partnerships could not repay their loans in full. Rather than limiting risk, Enron was assuming total risk by guaranteeing the loans with its stock.

Enron also engaged in transactions that inflated its earnings, such as selling time on its broadband system to a partnership at inflated prices at a time when the demand for broadband was plummeting. Enron then recorded a substantial profit on such transactions. The partnerships agreed to such transactions because Enron management seems to have exerted disproportionate influence in some instances over partnership decisions, although its ownership interests were very small, often less than 3 percent. Curiously, Enron's outside auditor, Arthur Andersen, had a dual role in these partnerships, collecting fees for helping to set them up and auditing them.

Time to Pay the Piper

At the time the firm filed for bankruptcy on December 2, 2001, it had $13.1 billion in debt on the books of the parent company and another $18.1 billion on the balance sheets of affiliated companies and partnerships. In addition to the partnerships created by Enron, a number of bad investments both in the United States and abroad contributed to the firm's malaise. Meanwhile, Enron's core energy distribution business was deteriorating. Enron was attempting to gain share in a maturing market by paring selling prices. Margins also suffered from poor cost containment.

Dynegy Corp. agreed to buy Enron for $10 billion on November 2, 2001. On November 8, Enron announced that its net income would have to be restated back to 1997, resulting in a $586 million reduction in reported profits. On November 15, chairman Kenneth Lay admitted that the firm had made billions of dollars in bad investments. Four days later, Enron said it would have to repay a $690 million note by mid-December and it might have to take an additional $700 million pretax charge. At the end of the month, Dynegy withdrew its offer and Enron's credit rating was reduced to junk bond status. Enron was responsible for another $3.9 billion owed by its partnerships. Enron had less than $2 billion in cash on hand.

The end came quickly as investors and customers completely lost faith in the energy behemoth as a result of its secrecy and complex financial maneuvers, forcing the firm into bankruptcy in early December. Enron's stock, which had reached a high of $90 per share on August 17, 2001, was trading at less than $1 by December 5, 2001.

In addition to its angry creditors, Enron faced class-action lawsuits by shareholders and employees, whose pensions were invested heavily in Enron stock. Enron also faced intense scrutiny from congressional committees and the U.S. Department of Justice. By the end of 2001, shareholders had lost more than $63 billion from its previous 52-week high, bondholders lost $2.6 billion in the face value of their debt, and banks appeared to be at risk on at least $15 billion of credit they had extended to Enron. In addition, potential losses on uncollateralized derivative contracts totaled $4 billion. Such contracts involved Enron commitments to buy various types of commodities at some point in the future.

Questions remain as to why Wall Street analysts, Arthur Andersen, federal or state regulatory authorities, the credit rating agencies, and the firm's board of directors did not sound the alarm sooner. It is surprising that the audit committee of the Enron board seems to have somehow been unaware of the firm's highly questionable financial maneuvers. Inquiries following the bankruptcy declaration seem to suggest that the audit committee followed all the rules stipulated by federal regulators and stock exchanges regarding director pay, independence, disclosure, and financial expertise. Enron seems to have collapsed in part because such rules did not do what they were supposed to do. For example, paying directors with stock may have aligned their interests with shareholders, but it also is possible to have been a disincentive to question aggressively senior management about their financial dealings.

The Lessons of Enron

Enron may be the best recent example of a complete breakdown in corporate governance, a system intended to protect shareholders. Inside Enron, the board of directors, management, and the audit function failed to do the job. Similarly, the firm's outside auditors, regulators, credit rating agencies, and Wall Street analysts also failed to alert investors. What seems to be apparent is that if the auditors fail to identify incompetence or fraud, the system of safeguards is likely to break down. The cost of failure to those charged with protecting the shareholders, including outside auditors, analysts, credit-rating agencies, and regulators, was simply not high enough to ensure adequate scrutiny.

What may have transpired is that company managers simply undertook aggressive interpretations of accounting principles then challenged auditors to demonstrate that such practices were not in accordance with GAAP accounting rules (Weil, 2002). This type of practice has been going on since the early 1980s and may account for the proliferation of specific accounting rules applicable only to certain transactions to insulate both the firm engaging in the transaction and the auditor reviewing the transaction from subsequent litigation. In one sense, the Enron debacle represents a failure of the free market system and its current shareholder protection mechanisms, in that it took so long for the dramatic Enron shell game to be revealed to the public. However, this incident highlights the remarkable resilience of the free market system. The free market system worked quite effectively in its rapid imposition of discipline in bringing down the Enron house of cards, without any noticeable disruption in energy distribution nationwide.

Epilogue

Due to the complexity of dealing with so many types of creditors, Enron filed its plan with the federal bankruptcy court to reorganize one and a half years after seeking bankruptcy protection on December 2, 2001. The resulting reorganization has been one of the most costly and complex on record, with total legal and consulting fees exceeding $500 million by the end of 2003. More than 350 classes of creditors, including banks, bondholders, and other energy companies that traded with Enron said they were owed about $67 billion.

Under the reorganization plan, unsecured creditors received an estimated 14 cents for each dollar of claims against Enron Corp., while those with claims against Enron North America received an estimated 18.3 cents on the dollar. The money came in cash payments and stock in two holding companies, CrossCountry containing the firm's North American pipeline assets and Prisma Energy International containing the firm's South American operations.