Deck 8: Relative,asset-Oriented,and Real Option Valuation Basics

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/84

العب

ملء الشاشة (f)

Deck 8: Relative,asset-Oriented,and Real Option Valuation Basics

1

The replacement cost approach to valuation of a target firm ignores value created by operating the assets in combination as a going concern.

True

2

If the market leader in an industry has a $300 million market value and a 30% market share,the market is valuing each percentage point of market share at $10 million.If a target company in the same industry has a 20% market share,the market value of the target company is $200 million.

True

3

Liquidation value is the projected sale value of a firm's assets.

False

4

Liquidation value provides an estimate of the minimum value of the target firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

5

The capitalization rate is equivalent to the discount rate when the firm's revenues are not expected to grow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

6

Valuations of target firms based on the comparable companies and recent transactions methods must be adjusted to reflect control premiums.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

7

The principal limitation to the comparable companies' valuation approach is the difficulty in finding companies that are truly comparable to the target firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

8

If the P/E ratio for the comparable firm is equal to 10 and the after-tax earnings of the target firm are $2 million,the market value of the target firm would be $5 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

9

The comparable recent transactions method is usually considered less reliable than the comparable companies' valuation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

10

The weighted average valuation approach involves the use of a number of different valuation methods,weighted by the relative importance the appraiser attributes to each method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

11

Break-up value assumes that individual businesses can be sold quickly without any material loss of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

12

Tangible book value is the value of shareholders' equity less net fixed assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

13

The use of market-based valuation methods usually reflect actual demand and supply considerations at a moment in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

14

Relative valuation methods are often described as market-based,as they reflect the amounts investors are willing to pay for each dollar of earnings,cash flow,sales,or book value at a moment in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

15

Asset oriented approaches to valuation involve the use of tangible book value,liquidation value,discounted cash flows,and break-up values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the tangible book value of a firm significantly exceeds its market value for an extended period of time,it can become an attractive takeover target.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

17

Book values are maligned as measures of value,because they represent historical rather than current market values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

18

Price-to-earnings ratios of comparable companies provide an excellent means of valuing the target firm at any point in the business cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

19

The comparable companies' valuation method uses the discounted value of a firm's free cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

20

Market-based valuation measures are meaningful only for firms with a stable earnings,cash flow,or sales history.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

21

Conceptually,firms with P/E ratios less than their projected growth rates may be considered undervalued; while those with P/E ratios greater than their projected growth rates may be viewed as overvalued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

22

In constructing the enterprise value,the market value of the firm's common equity value is added to the market value of the firm's long-term debt and the market value of preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

23

Like the recent transactions method,comparable company valuation estimates do not require the addition of a purchase price premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

24

The enterprise value to EBITDA multiple relates the total book value of the firm from the perspective of the liability side of the balance sheet (i.e.,long-term debt plus preferred and common equity),excluding cash,to EBITDA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

25

The comparable companies' method and recent transactions methods of valuation are conceptually similar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

26

Investors may be willing to pay considerably more for a stock whose PEG ratio is greater than one if they believe the increase in earnings will result in future financial returns that significantly exceed the firm's cost of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

27

The analyst should be careful not to mechanically add an acquisition premium to the target firm's estimated value based on the comparable companies' method if there is evidence that the market values of these "comparable firms" already reflect the effects of acquisition activity elsewhere in the industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

28

It is critical for the analyst to remember that high growth rates by themselves are likely to increase multiples such as a firm's price to earnings ratio even without any improvement in financial returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

29

Disadvantages of the comparable industry method of valuation include the presumption that industry multiples are actually comparable and that analysts' earnings projections are unbiased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

30

A higher P/E ratio for a firm may be justified if its earnings are expected to grow significantly faster than firm's future earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

31

The comparable companies' transactions valuation method is generally considered the most accurate of all the valuation methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

32

The enterprise value to EBITDA method is useful because more firms are likely to have negative earnings than negative EBITDA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

33

The so-called PEG ratio is calculated by dividing the firm's price-to-earning ratio by the expected growth rate in the firm's share price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

34

Market-based valuation methods are less prone to manipulation than discounted cash flow methods because they require a more detailed statement of assumptions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

35

The enterprise to EBITDA method of valuation can be compared more readily among firms exhibiting different levels of leverage than for other measures of earnings,since the numerator represents the total value of the firm and the denominator measures earnings before interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

36

Studies show that rival firms' share prices will rise in response to the announced acquisition of a competitor,regardless of whether the proposed acquisition is ultimately successful or unsuccessful.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

37

Analysts have increasingly used the relationship between enterprise value to earnings before interest and taxes,depreciation,and amortization to value firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

38

The comparable companies' method is widely used in so-called "fairness opinion" letters.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

39

The value of the comparable companies' method may vary widely depending upon when it is calculated in the business cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

40

Empirical evidence suggests that forecasts of earnings and other value indicators are better predictors of firm value than value indicators based on historical data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

41

Real options,also called strategic management options,refer to management's ability to adopt and later revise corporate investment decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

42

The PEG ratio can be helpful in evaluating the potential market values of a number of different firms in the same industry in selecting which may be the most attractive acquisition target.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

43

In determining the liquidation value of inventories,it is not necessary to look at their composition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

44

Since real options provide flexibility that can greatly change the value of a project,it should be considered in capital budgeting methodology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

45

Liquidation or breakup value is the projected price of the firm's assets sold separately in liquidating or breaking up the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

46

When estimating liquidation value,analysts often make a simplifying assumption that the assets can be sold in an orderly fashion,which is defined as a reasonable amount of time to solicit bids from qualified buyers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

47

Tangible book value is widely used for valuing financial services companies,where tangible book value is primarily cash or liquid assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

48

An option is the exclusive right,but not the obligation,to buy,sell,or use property for a specific period of time in exchange for a predetermined amount of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

49

The major advantage of the value driver approach to valuation is the implied assumption that a single value driver or factor is representative of the total value of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

50

The number of billing errors as a percent of total invoices is a specific example of a macro value driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

51

The replacement cost approach to valuation estimates what it would cost to replace the target firm's assets at current market prices using professional appraisers less the present value of the firm's liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

52

In the absence of earnings,other factors that drive the creation of value for a firm may be used for valuation purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

53

Investment decisions,including M&As,often contain certain "embedded options" such as the ability to accelerate growth by adding to the initial investment (i.e.,expand),to delay the timing of the initial investment (i.e.,delay),or to walk away from the project (i.e.,abandon).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

54

All investment decisions include clearly identifiable and measurable real options whose estimated value should be included in the valuation of the opportunity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

55

Micro value drivers are those factors affecting specific functions within the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which one of the following factors is not considered calculating a firm's PEG ratio?

A) Projected growth rate of the value indicator (e.g., earnings)

B) Ratio of market price to value indicator (e.g., P/E)

C) Share exchange ratio

D) Historical growth rate of the value indicator

E) None of the above

A) Projected growth rate of the value indicator (e.g., earnings)

B) Ratio of market price to value indicator (e.g., P/E)

C) Share exchange ratio

D) Historical growth rate of the value indicator

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

57

Macro value drivers are those factors which directly influence specific activities within the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

58

The NPV of an acquisition of a manufacturer operating at full capacity may have a lower value than if the NPV is adjusted for a decision made at a later date to expand capacity.If the additional capacity is fully utilized,the resulting higher level of future cash flows may increase the acquisition's NPV.In this instance,the value of the real option to expand is the difference between the NPV with and without expansion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

59

Valuing the assets separately in terms of what it would cost to replace them may seriously overstate the firm's true going concern value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

60

Real options include the right to buy land,commercial property,and equipment.Such assets can be valued as call options if its current value exceeds the difference between the asset's current value and some predetermined level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following are examples of intangible assets that may have value to the acquiring company?

A) Patents

B) Trade names

C) Customer lists and relationships

D) Covenants not to compete

E) All of the above

A) Patents

B) Trade names

C) Customer lists and relationships

D) Covenants not to compete

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

62

All of the following are true for market based valuation methods except for which of the following?

A) Assumes that markets are efficient such that current values reflect all the information currently known about the business

B) Current values represent what a willing buyer and seller are willing to pay for a business in the absence of full information

C) Market based methods are always superior to discounted cash flow techniques

D) Include comparable company and recent transactions methods

E) Include the tangible book value approach

A) Assumes that markets are efficient such that current values reflect all the information currently known about the business

B) Current values represent what a willing buyer and seller are willing to pay for a business in the absence of full information

C) Market based methods are always superior to discounted cash flow techniques

D) Include comparable company and recent transactions methods

E) Include the tangible book value approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

63

The purchase price paid for YouTube represented more than one percent of Google's then market value.If you were a Google

shareholder,how might you have evaluated the wisdom of the acquisition?

shareholder,how might you have evaluated the wisdom of the acquisition?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is the appropriate cost of equity for discounting future cash flows? Should it be Google's or YouTube's? Explain your

answer.

answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following represent limitations of real options?

A) Key assumptions often are very difficult to quantify, especially volatility

B) Project delays may incur significant opportunity costs

C) Options often are not independent; therefore, selecting one option may foreclose other options

D) Often requires complex modeling

E) All of the above

A) Key assumptions often are very difficult to quantify, especially volatility

B) Project delays may incur significant opportunity costs

C) Options often are not independent; therefore, selecting one option may foreclose other options

D) Often requires complex modeling

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is not generally considered a valuation method?

A) Discounted cash flow method

B) Comparable companies' method

C) Share exchange ratio method

D) Liquidation value method

E) Comparable transaction's method

A) Discounted cash flow method

B) Comparable companies' method

C) Share exchange ratio method

D) Liquidation value method

E) Comparable transaction's method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following represent advantages of the comparable companies' valuation method?

A) Uses the most accurate market-based valuation at a point in time

B) Valuations need to be adjusted to reflect control premiums

C) Adjusts for risk of future cash flows

D) Adjusts for the timing of future cash flows

E) A & B only

A) Uses the most accurate market-based valuation at a point in time

B) Valuations need to be adjusted to reflect control premiums

C) Adjusts for risk of future cash flows

D) Adjusts for the timing of future cash flows

E) A & B only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

68

Case Study Short Essay Examination Questions

A Real Options' Perspective on Microsoft's Dealings with Yahoo

In a bold move to transform two relatively weak online search businesses into a competitor capable of challenging market leader Google, Microsoft proposed to buy Yahoo for $44.6 billion on February 2, 2008. At $31 per share in cash and stock, the offer represented a 62 percent premium over Yahoo's prior day closing price. Despite boosting its bid to $33 per share to offset a decline in the value of Microsoft's share price following the initial offer, Microsoft was rebuffed by Yahoo's board and management. In early May, Microsoft withdrew its bid to buy the entire firm and substituted an offer to acquire the search business only. Incensed at Yahoo's refusal to accept the Microsoft bid, activist shareholder Carl Icahn initiated an unsuccessful proxy fight to replace the Yahoo board. Throughout this entire melodrama, critics continued to ask how Microsoft could justify an offer valued at $44.6 billion when the market prior to the announcement had valued Yahoo at only $27.5 billion.

Microsoft could have continued to slug it out with Yahoo and Google, as it has been for the last five years, but this would have given Google more time to consolidate its leadership position. Despite having spent billions of dollars on Microsoft's online service (Microsoft Network or MSN) in recent years, the business remains a money loser (with losses exceeding one half billion dollars in 2007). Furthermore, MSN accounted for only 5 percent of the firm's total revenue at that time.

Microsoft argued that its share of the online Internet search (i.e., ads appearing with search results) and display (i.e., website banner ads) advertising markets would be dramatically increased by combining Yahoo with MSN. Yahoo also is the leading consumer email service. Anticipated cost savings from combining the two businesses were expected to reach $1 billion annually. Longer term, Microsoft expected to bundle search and advertising capabilities into the Windows operating system to increase the usage of the combined firms' online services by offering compatible new products and enhanced search capabilities.

The two firms have very different cultures. The iconic Silicon Valley-based Yahoo often is characterized as a company with a free-wheeling, fun-loving culture, potentially incompatible with Microsoft's more structured and disciplined environment. Melding or eliminating overlapping businesses represents a potentially mind-numbing effort given the diversity and complexity of the numerous sites available. To achieve the projected cost savings, Microsoft would have to choose which of the businesses and technologies would survive. Moreover, the software driving all of these sites and services is largely incompatible.

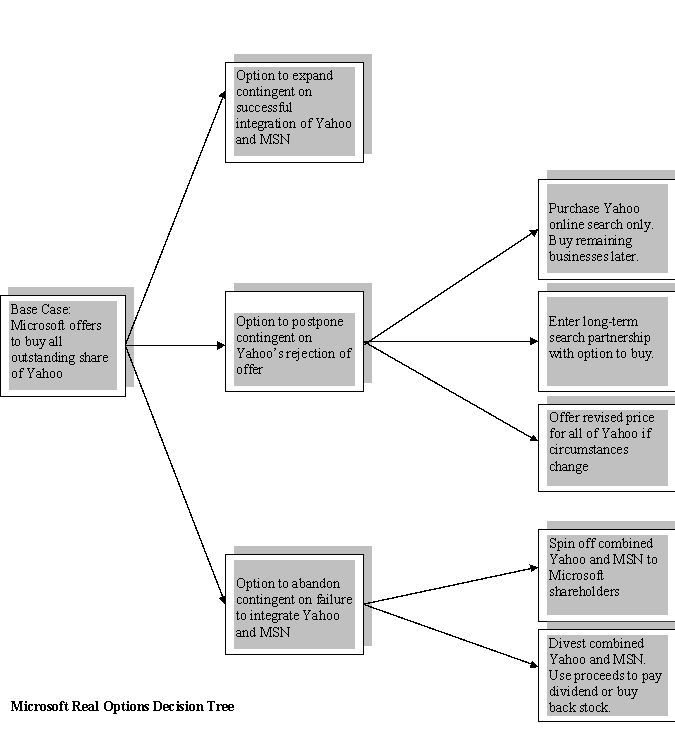

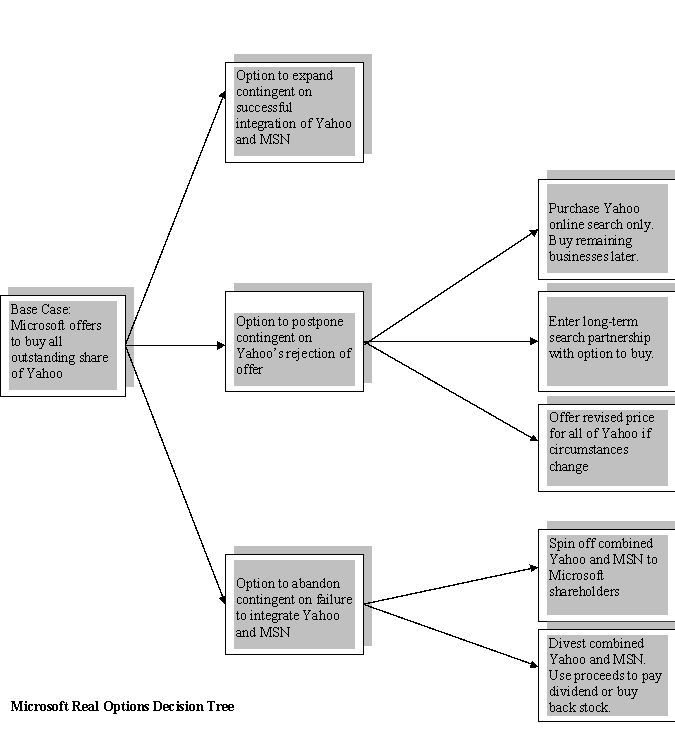

As an independent or stand-alone business, the market valued Yahoo at approximately $17 billion less than Microsoft's valuation. Microsoft was valuing Yahoo based on its intrinsic stand-alone value plus perceived synergy resulting from combining Yahoo and MSN. Standard discounted cash flow analysis assumes implicitly that, once Microsoft makes an investment decision, it cannot change its mind. In reality, once an investment decision is made, management often has a number of opportunities to make future decisions based on the outcome of things that are currently uncertain. These opportunities, or real options, include the decision to expand (i.e., accelerate investment at a later date), delay the initial investment, or abandon an investment. With respect to Microsoft's effort to acquire Yahoo, the major uncertainties dealt with the actual timing of an acquisition and whether the two businesses could be integrated successfully. For Microsoft's attempted takeover of Yahoo, such options included the following:

Base case. Buy 100 percent of Yahoo immediately.

Option to expand. If Yahoo were to accept the bid, accelerate investment in new products and services contingent on the successful integration of Yahoo and MSN.

Option to delay. (1) Temporarily walk away keeping open the possibility of returning for 100 percent of Yahoo if circumstances change, (2) offer to buy only the search business with the intent of purchasing the remainder of Yahoo at a later date, or (3) enter into a search partnership, with an option to buy at a later date.

Option to abandon. If Yahoo were to accept the bid, spin off or divest combined Yahoo/MSN if integration is unsuccessful.

The decision tree in the following exhibit illustrates the range of real options (albeit an incomplete list) available to the Microsoft board at that time. Each branch of the tree represents a specific option. The decision-tree framework is helpful in depicting the significant flexibility senior management often has in changing an existing investment decision at some point in the future.

With neither party making headway against Google, Microsoft again approached Yahoo in mid-2009, which resulted in an announcement in early 2010 of an internet search agreement between the two firms. Yahoo transferred control of its internet search technology to Microsoft in an attempt to boost its sagging profits. Microsoft is relying on a 10-year arrangement with Yahoo to help counter the dominance of Google in the internet search market. Both firms hope to be able to attract more advertising dollars paid by firms willing to pay for links on the firms' sites. Case Study Short Essay Examination Questions

Case Study Short Essay Examination Questions

Merrill Lynch and BlackRock Agree to Swap Assets

During the 1990s, many financial services companies began offering mutual funds to their current customers who were pouring money into the then booming stock market. Hoping to become financial supermarkets offering an array of financial services to their customers, these firms offered mutual funds under their own brand name. The proliferation of mutual funds made it more difficult to be noticed by potential customers and required the firms to boost substantially advertising expenditures at a time when increased competition was reducing mutual fund management fees. In addition, potential customers were concerned that brokers would promote their own firm's mutual funds to boost profits.

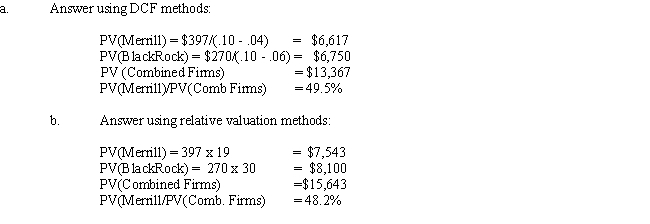

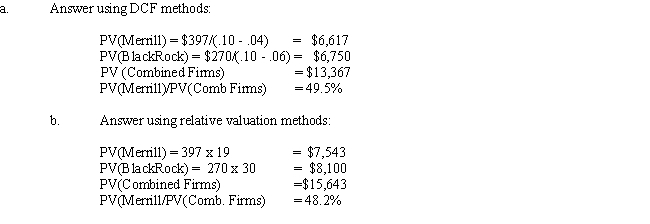

This trend reversed in recent years, as banks, brokerage houses, and insurance companies are exiting the mutual fund management business. Merrill Lynch agreed on February 15, 2006, to swap its mutual funds business for an approximate 49 percent stake in money-manager BlackRock Inc. The mutual fund or retail accounts represented a new customer group for BlackRock, founded in 1987, which had previously managed primarily institutional accounts.

At $453 billion in 2005, BlackRock's assets under management had grown four times faster than Merrill's $544 billion mutual fund assets. During 2005, BlackRock's net income increased to $270 million, or 63 percent over the prior year, as compared to Merrill's 27 percent growth in net income in its mutual fund business to $397 million. BlackRock and Merrill stock traded at 30 and 19 times estimated 2006 earnings, respectively.

Merrill assets and net income represented 55 percent and 60 percent of the combined BlackRock and Merrill assets and net income, respectively. Under the terms of the transaction, BlackRock would issue 65 million new common shares to Merrill. Based on BlackRock's February 14, 2005, closing price, the deal is valued at $9.8 billion. The common stock gave Merrill 49 percent of the outstanding BlackRock voting stock. PNC Financial and employees and public shareholders owned 34 percent and 17 percent, respectively. Merrill's ability to influence board decisions is limited, since it has only 2 of 17 seats on the BlackRock board of directors. Certain "significant matters" require a 70 percent vote of all board members and 100 percent of the nine independent members, which include the two Merrill representatives. Merrill (along with PNC) must also vote its shares as recommended by the BlackRock board.

Merrill owns less than half of the combined firms,although it contributed more than one- half of the combined firms' assets and net income.Discuss how you might use DCF and relative valuation methods to determine Merrill's proportionate ownership in the combined firms.

A Real Options' Perspective on Microsoft's Dealings with Yahoo

In a bold move to transform two relatively weak online search businesses into a competitor capable of challenging market leader Google, Microsoft proposed to buy Yahoo for $44.6 billion on February 2, 2008. At $31 per share in cash and stock, the offer represented a 62 percent premium over Yahoo's prior day closing price. Despite boosting its bid to $33 per share to offset a decline in the value of Microsoft's share price following the initial offer, Microsoft was rebuffed by Yahoo's board and management. In early May, Microsoft withdrew its bid to buy the entire firm and substituted an offer to acquire the search business only. Incensed at Yahoo's refusal to accept the Microsoft bid, activist shareholder Carl Icahn initiated an unsuccessful proxy fight to replace the Yahoo board. Throughout this entire melodrama, critics continued to ask how Microsoft could justify an offer valued at $44.6 billion when the market prior to the announcement had valued Yahoo at only $27.5 billion.

Microsoft could have continued to slug it out with Yahoo and Google, as it has been for the last five years, but this would have given Google more time to consolidate its leadership position. Despite having spent billions of dollars on Microsoft's online service (Microsoft Network or MSN) in recent years, the business remains a money loser (with losses exceeding one half billion dollars in 2007). Furthermore, MSN accounted for only 5 percent of the firm's total revenue at that time.

Microsoft argued that its share of the online Internet search (i.e., ads appearing with search results) and display (i.e., website banner ads) advertising markets would be dramatically increased by combining Yahoo with MSN. Yahoo also is the leading consumer email service. Anticipated cost savings from combining the two businesses were expected to reach $1 billion annually. Longer term, Microsoft expected to bundle search and advertising capabilities into the Windows operating system to increase the usage of the combined firms' online services by offering compatible new products and enhanced search capabilities.

The two firms have very different cultures. The iconic Silicon Valley-based Yahoo often is characterized as a company with a free-wheeling, fun-loving culture, potentially incompatible with Microsoft's more structured and disciplined environment. Melding or eliminating overlapping businesses represents a potentially mind-numbing effort given the diversity and complexity of the numerous sites available. To achieve the projected cost savings, Microsoft would have to choose which of the businesses and technologies would survive. Moreover, the software driving all of these sites and services is largely incompatible.

As an independent or stand-alone business, the market valued Yahoo at approximately $17 billion less than Microsoft's valuation. Microsoft was valuing Yahoo based on its intrinsic stand-alone value plus perceived synergy resulting from combining Yahoo and MSN. Standard discounted cash flow analysis assumes implicitly that, once Microsoft makes an investment decision, it cannot change its mind. In reality, once an investment decision is made, management often has a number of opportunities to make future decisions based on the outcome of things that are currently uncertain. These opportunities, or real options, include the decision to expand (i.e., accelerate investment at a later date), delay the initial investment, or abandon an investment. With respect to Microsoft's effort to acquire Yahoo, the major uncertainties dealt with the actual timing of an acquisition and whether the two businesses could be integrated successfully. For Microsoft's attempted takeover of Yahoo, such options included the following:

Base case. Buy 100 percent of Yahoo immediately.

Option to expand. If Yahoo were to accept the bid, accelerate investment in new products and services contingent on the successful integration of Yahoo and MSN.

Option to delay. (1) Temporarily walk away keeping open the possibility of returning for 100 percent of Yahoo if circumstances change, (2) offer to buy only the search business with the intent of purchasing the remainder of Yahoo at a later date, or (3) enter into a search partnership, with an option to buy at a later date.

Option to abandon. If Yahoo were to accept the bid, spin off or divest combined Yahoo/MSN if integration is unsuccessful.

The decision tree in the following exhibit illustrates the range of real options (albeit an incomplete list) available to the Microsoft board at that time. Each branch of the tree represents a specific option. The decision-tree framework is helpful in depicting the significant flexibility senior management often has in changing an existing investment decision at some point in the future.

With neither party making headway against Google, Microsoft again approached Yahoo in mid-2009, which resulted in an announcement in early 2010 of an internet search agreement between the two firms. Yahoo transferred control of its internet search technology to Microsoft in an attempt to boost its sagging profits. Microsoft is relying on a 10-year arrangement with Yahoo to help counter the dominance of Google in the internet search market. Both firms hope to be able to attract more advertising dollars paid by firms willing to pay for links on the firms' sites.

Case Study Short Essay Examination Questions

Case Study Short Essay Examination QuestionsMerrill Lynch and BlackRock Agree to Swap Assets

During the 1990s, many financial services companies began offering mutual funds to their current customers who were pouring money into the then booming stock market. Hoping to become financial supermarkets offering an array of financial services to their customers, these firms offered mutual funds under their own brand name. The proliferation of mutual funds made it more difficult to be noticed by potential customers and required the firms to boost substantially advertising expenditures at a time when increased competition was reducing mutual fund management fees. In addition, potential customers were concerned that brokers would promote their own firm's mutual funds to boost profits.

This trend reversed in recent years, as banks, brokerage houses, and insurance companies are exiting the mutual fund management business. Merrill Lynch agreed on February 15, 2006, to swap its mutual funds business for an approximate 49 percent stake in money-manager BlackRock Inc. The mutual fund or retail accounts represented a new customer group for BlackRock, founded in 1987, which had previously managed primarily institutional accounts.

At $453 billion in 2005, BlackRock's assets under management had grown four times faster than Merrill's $544 billion mutual fund assets. During 2005, BlackRock's net income increased to $270 million, or 63 percent over the prior year, as compared to Merrill's 27 percent growth in net income in its mutual fund business to $397 million. BlackRock and Merrill stock traded at 30 and 19 times estimated 2006 earnings, respectively.

Merrill assets and net income represented 55 percent and 60 percent of the combined BlackRock and Merrill assets and net income, respectively. Under the terms of the transaction, BlackRock would issue 65 million new common shares to Merrill. Based on BlackRock's February 14, 2005, closing price, the deal is valued at $9.8 billion. The common stock gave Merrill 49 percent of the outstanding BlackRock voting stock. PNC Financial and employees and public shareholders owned 34 percent and 17 percent, respectively. Merrill's ability to influence board decisions is limited, since it has only 2 of 17 seats on the BlackRock board of directors. Certain "significant matters" require a 70 percent vote of all board members and 100 percent of the nine independent members, which include the two Merrill representatives. Merrill (along with PNC) must also vote its shares as recommended by the BlackRock board.

Merrill owns less than half of the combined firms,although it contributed more than one- half of the combined firms' assets and net income.Discuss how you might use DCF and relative valuation methods to determine Merrill's proportionate ownership in the combined firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

69

Limitations in applying the comparable companies' method of valuation include which of the following?

A) A, B, & C

A) Finding truly comparable companies is difficult

B) A & B only

B) The use of market-based methods can result in significant under- or overvaluation during periods of declining or rising stock markets

C) Market-based methods can be manipulated easily, because the methods do not require a clear statement of assumptions with respect to risk, growth, or the timing or magnitude of future earnings and cash flows.

A) A, B, & C

A) Finding truly comparable companies is difficult

B) A & B only

B) The use of market-based methods can result in significant under- or overvaluation during periods of declining or rising stock markets

C) Market-based methods can be manipulated easily, because the methods do not require a clear statement of assumptions with respect to risk, growth, or the timing or magnitude of future earnings and cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

70

What are the key valuation assumptions implicit in the valuation method discussed in this case study?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

71

Intangible assets often constitute a substantial source of value to the acquiring firm.Which of the following are not generally considered intangible assets?

A) Patents and technical know-how

B) Warranty and contingent claims

C) Trademarks and customer lists

D) Covenants not to compete and franchises

E) Copyrights and software

A) Patents and technical know-how

B) Warranty and contingent claims

C) Trademarks and customer lists

D) Covenants not to compete and franchises

E) Copyrights and software

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

72

In determining the purchase price for an acquisition target,which one of the following valuation methods does not require the addition of a purchase price premium?

A) Discounted cash flow method

B) Comparable companies' method

C) Comparable industries' method

D) Recent transactions' method

E) A & B only

A) Discounted cash flow method

B) Comparable companies' method

C) Comparable industries' method

D) Recent transactions' method

E) A & B only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

73

The tangible book value or equity per share method is applicable primarily to the following industries:

A) Steel and financial services

B) Distribution and financial services

C) Electric and natural gas utilities

D) Coal and copper mining

E) Space and defense

A) Steel and financial services

B) Distribution and financial services

C) Electric and natural gas utilities

D) Coal and copper mining

E) Space and defense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is not true about the liquidation/break-up valuation methods?

A) Highly diversified companies are often valued in terms of the sum of the standalone values of their operating units

B) The calculation of such values is heavily dependent on the skill of appraisers who are intimately familiar with the operations to be liquidated.

C) Assets can sometimes be liquidated in an orderly fashion.

D) Legal, appraisal, and consulting fees may comprise a substantial share of the total proceeds of the sale of the assets

E) The liquidation value of most of the firm's assets is about the same.

A) Highly diversified companies are often valued in terms of the sum of the standalone values of their operating units

B) The calculation of such values is heavily dependent on the skill of appraisers who are intimately familiar with the operations to be liquidated.

C) Assets can sometimes be liquidated in an orderly fashion.

D) Legal, appraisal, and consulting fees may comprise a substantial share of the total proceeds of the sale of the assets

E) The liquidation value of most of the firm's assets is about the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which one of the following is not a commonly used method of valuing target firms?

A) Discounted cash flow

B) Comparable companies method

C) Recent transactions method

D) Asset oriented method

E) Share exchange ratio method

A) Discounted cash flow

B) Comparable companies method

C) Recent transactions method

D) Asset oriented method

E) Share exchange ratio method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

76

What alternative valuation methods could Google have used to justify the purchase price it paid for YouTube? Discuss the

advantages and disadvantages of each.

advantages and disadvantages of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

77

To what extent might the use of stock by Google have influenced the amount they were willing to pay for YouTube? How might

the use of "overvalued" shares impact future appreciation of Google stock?

the use of "overvalued" shares impact future appreciation of Google stock?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following statements about the comparable companies' valuation method is not true?

A) Requires the use of firms that are "substantially" similar to the target firm

B) Uses market based rather than cash flow based valuations

C) Often used as the basis of investment banker fairness opinions

D) Generally provides the most accurate valuation method

E) Provides an estimate of the target firm at a moment in time.

A) Requires the use of firms that are "substantially" similar to the target firm

B) Uses market based rather than cash flow based valuations

C) Often used as the basis of investment banker fairness opinions

D) Generally provides the most accurate valuation method

E) Provides an estimate of the target firm at a moment in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following represent options available to managers in making investment decisions?

A) Delay initial investment

B) Accelerate cumulative investment

C) Abandon the investment at a later date

D) A & B only

E) A, B, & C

A) Delay initial investment

B) Accelerate cumulative investment

C) Abandon the investment at a later date

D) A & B only

E) A, B, & C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is not true about real options?

A) All investment decisions contain identifiable and measurable real options.

B) Under certain circumstances, management may be able to delay their initial investment in a project or M&A.

C) Real options may be valued as the expected value of various alternative cash flow projections.

D) Real options can be valued using the Black-Sholes method.

E) None of the above

A) All investment decisions contain identifiable and measurable real options.

B) Under certain circumstances, management may be able to delay their initial investment in a project or M&A.

C) Real options may be valued as the expected value of various alternative cash flow projections.

D) Real options can be valued using the Black-Sholes method.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck