Deck 11: Structuring the Deal: Payment and Legal Considerations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/112

العب

ملء الشاشة (f)

Deck 11: Structuring the Deal: Payment and Legal Considerations

1

Earn-outs tend to shift risk from the seller to the buyer in that a higher price is paid only when the seller has met or exceeded certain performance criteria.

False

2

When buyers and sellers cannot reach agreement on price,other mechanisms can be used to close the gap.These include balance sheet adjustments,earn-outs,rights to intellectual property,and licensing fees.

True

3

Form of payment may consist of something other than cash,stock,or debt such as tangible and intangible assets.

True

4

Asset purchases require the acquiring company to buy all or a portion of the target company's assets and to assume at least some of the target's liabilities in exchange for cash or stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

5

Form of payment refers only to the acquirer's common stock used to make up the purchase price paid to target shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

6

Rights to intellectual property,royalties from licenses and employment agreements are often used to close the gap on price between what the seller wants and what the buyer is willing to pay because the income generated is tax free to the recipient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

7

In a balance sheet adjustment,the buyer increases the total purchase price by an amount equal to the decrease in net working capital or shareholders' equity of the target company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

8

Stock purchases involve the exchange of the target's stock for cash,debt,stock of the acquiring company,or some combination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

9

The assumption of seller liabilities by the buyer in a merger may induce the seller to demand a higher selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

10

The acquired company should be fully integrated into the acquiring company if an earn-out is used to consummate the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

11

Such legal structures as holding company,joint venture,and limited liability corporations are suitable only for acquisition vehicles but not post closing organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

12

A holding company structure is the preferred post-closing organization if the acquiring firm is interested in integrating the target firm immediately following acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

13

The acquirer may reduce the total cost of an acquisition by deferring some portion of the purchase price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

14

The form of payment does not affect whether a transaction is taxable to the seller's shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

15

The acquisition vehicle is the legal structure used to acquire the target.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

16

The appropriate deal structure is that which satisfies,without regard to risk,as many of the primary objectives of the parties involved as necessary to reach overall agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

17

Because they can be potentially so lucrative to sellers,earn-outs are sometimes used to close the gap between what the seller wants and what the buyer might be willing to pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

18

Employee stock ownership plans cannot be legally used to acquire companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

19

If the form of acquisition is a statutory merger,the seller retains all known,unknown or contingent liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

20

Deal structuring is fundamentally about satisfying as many of the primary objectives of the parties involved and deciding how risk will be shared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

21

A partnership or JV structure may be appropriate acquisition vehicle if the risk associated with the target firm is

believed to be high.

believed to be high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

22

In an earnout agreement,the acquirer must directly control the operations of the target firm to ensure the target firm adheres to the terms of the agreement..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

23

Staged transactions may be used to structure an earn-out,to enable the target to complete the development of a technology or process,to await regulatory approval,to eliminate the need to obtain shareholder approval,and to minimize cultural conflicts with the target.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

24

By acquiring the target firm through the JV,the corporate investor limits the potential liability to the extent of their investment in the JV corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

25

Decision-making in JVs and partnerships is likely to be faster than in a corporate structure.Consequently,JVs and partnerships are more commonly used if speed is desired during the post-closing integration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

26

A post-closing organization must always be a C corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

27

The reverse triangular merger involves the acquisition subsidiary being merged with the target and subsidiary surviving.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

28

If the acquirer is interested in integrating the target business immediately following closing,the holding structure may be most desirable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

29

Sellers may find a sale of assets attractive because they are able to maintain their corporate existence and therefore ownership of tangible assets not acquired by the buyer and intangible assets such as licenses,franchises,and patents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

30

ESOP structures are rarely used vehicles for transferring the owner's interest in the business to the employees in small,privately owned firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

31

A holding company is an example of either an acquisition vehicle or post-closing organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

32

When the target is a foreign firm,it is often appropriate to operate it separately from the rest of the acquirer's operations because of the potential disruption from significant cultural differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

33

In a statutory merger,only assets and liabilities shown on the target firm's balance sheet automatically transfer to the acquiring firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

34

The acquisition vehicle refers to the legal structure created to acquire the target company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

35

Non-U.S.buyers intending to make additional acquisitions may prefer a holding company structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

36

A financial buyer may use a holding company structure because they expect to sell the firm within a relatively short time period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

37

Decisions made in one area of a deal structure rarely affect other areas of the overall deal structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

38

The forward triangular merger involves the acquisition subsidiary being merged with the target and the target surviving.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

39

Statutory mergers are governed by the statutory provisions of the state in which the surviving entity is chartered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

40

A corporate structure is the preferred post-closing organization when an earn-out is involved in acquiring the target firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

41

Balance sheet adjustments most often are used in purchases of stock when the elapsed time between the agreement on price and the actual closing date is short.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

42

Buyers and sellers generally view purchase price adjustments as a form of insurance against any erosion or accretion in assets,such as plant and equipment..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

43

A fixed exchange collar agreement may involve a fixed exchange ratio as long as the acquirer's share price remains within a narrow range,calculated as of the effective date of the signing of the agreement of purchase and sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

44

Offering sellers consulting contracts to defer a portion of the purchase price is illegal in most states.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

45

The use of convertible preferred stock as a form of payment provides some downside protection to sellers in the form of continuing dividends,while providing upside potential if the acquirer's common stock price increases above the conversion point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

46

Earnouts tend to shift risk from the seller to the acquirer in that a higher price is paid only when the seller or acquired firm has met or exceeded certain performance criteria.True of False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

47

The seller's preference for stock or cash will reflect their desire for liquidity,the attractiveness of the acquirer's shares,and whether the seller is organized as a joint venture corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

48

A bidder may choose to use cash rather than to issue voting shares if the voting control of its dominant shareholder is threatened as a result of the issuance of voting stock to acquire the target firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

49

Sellers who are structured as C corporations generally prefer to sell assets for cash than acquirer stock because of more favorable tax treatment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

50

Whether cash is the predominant form of payment will depend on a variety of factors.These include the acquirer's current leverage,potential near-term earnings per share dilution of issuing new shares,the seller's preference for cash or acquirer stock,and the extent to which the acquirer wishes to maintain control over the combined firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

51

Stock purchases involve the exchange of the target's stock for acquirer stock only..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

52

The multiple option bidding strategy introduces a certain level of uncertainty in determining the amount of cash the acquirer will have to ultimately pay out to target firm shareholders,since the number choosing the all cash or cash and stock option is not known prior to the completion of the tender offer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

53

Collar agreements provide for certain changes in the exchange ratio contingent on the level of the acquirer's share price around the effective date of the merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

54

Bidders may use a combination of cash and non-cash forms of payment as part of their bidding strategies to broaden the appeal to target shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

55

The risk to the bidder associated with bidding strategy of offering target firm shareholders multiple payment options is that the range of options is likely to discourage target firm shareholders from participating in the bidder's tender offer for their shares..

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

56

An earnout agreement is a financial contract whereby a portion of the purchase price of a company is to be paid to the buyer in the future contingent on the realization of a previously agreed upon future earnings level or some other performance measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

57

Acquirer stock is a rarely used form of payment in large transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

58

Both the acquirer and target boards of directors have a fiduciary responsibility to demand that the merger terms be renegotiated if the value of the offer made by the bidder changes materially relative to the value of the target's stock or if their has been any other material change in the target's operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

59

Using stock as a form of payment is generally less complicated than using cash from the buyer's point of view.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

60

The value of an earnout payment is never subject to a cap so as not to discourage the seller from working diligently to exceed the payment threshold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

61

Case Study Short Essay Examination Questions

Boston Scientific Overcomes Johnson & Johnson to Acquire Guidant-A Lesson in Bidding Strategy

Johnson & Johnson, the behemoth American pharmaceutical company, announced an agreement in December 2004 to acquire Guidant for $76 per share for a combination of cash and stock. Guidant is a leading manufacturer of implantable heart defibrillators and other products used in angioplasty procedures. The defibrillator market has been growing at 20 percent annually, and J&J desired to reenergize its slowing growth rate by diversifying into this rapidly growing market. Soon after the agreement was signed, Guidant's defibrillators became embroiled in a regulatory scandal over failure to inform doctors about rare malfunctions. Guidant suffered a serious erosion of market share when it recalled five models of its defibrillators.

The subsequent erosion in the market value of Guidant prompted J&J to renegotiate the deal under a material adverse change clause common in most M&A agreements. J&J was able to get Guidant to accept a lower price of $63 a share in mid-November. However, this new agreement was not without risk.

The renegotiated agreement gave Boston Scientific an opportunity to intervene with a more attractive informal offer on December 5, 2005, of $72 per share. The offer price consisted of 50 percent stock and 50 percent cash. Boston Scientific, a leading supplier of heart stents, saw the proposed acquisition as a vital step in the company's strategy of diversifying into the high-growth implantable defibrillator market.

Despite the more favorable offer, Guidant's board decided to reject Boston Scientific's offer in favor of an upwardly revised offer of $71 per share made by J&J on January 11, 2005. The board continued to support J&J's lower bid, despite the furor it caused among big Guidant shareholders. With a market capitalization nine times the size of Boston Scientific, the Guidant board continued to be enamored with J&J's size and industry position relative to Boston Scientific.

Boston Scientific realized that it would be able to acquire Guidant only if it made an offer that Guidant could not refuse without risking major shareholder lawsuits. Boston Scientific reasoned that if J&J hoped to match an improved bid, it would have to be at least $77, slightly higher than the $76 J&J had initially offered Guidant in December 2004. With its greater borrowing capacity, Boston Scientific knew that J&J also had the option of converting its combination stock and cash bid to an all-cash offer. Such an offer could be made a few dollars lower than Boston Scientific's bid, since Guidant investors might view such an offer more favorably than one consisting of both stock and cash, whose value could fluctuate between the signing of the agreement and the actual closing. This was indeed a possibility, since the J&J offer did not include a collar arrangement.

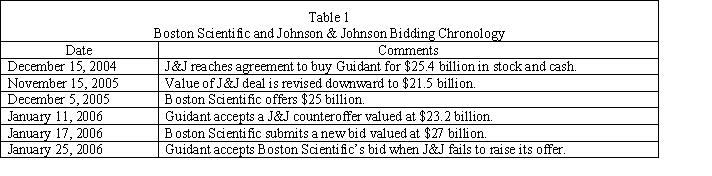

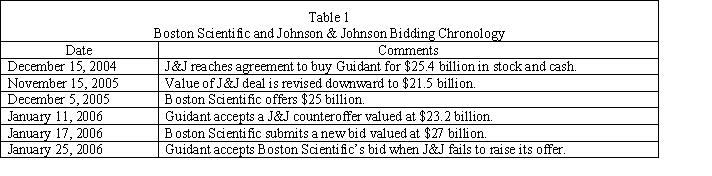

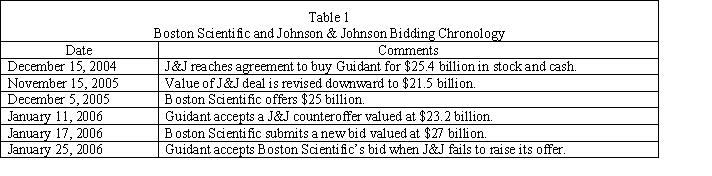

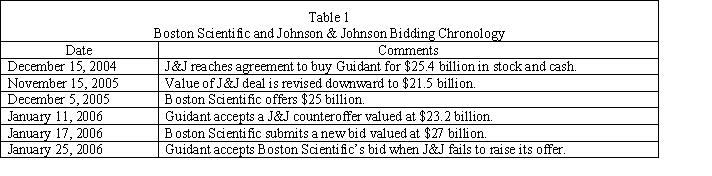

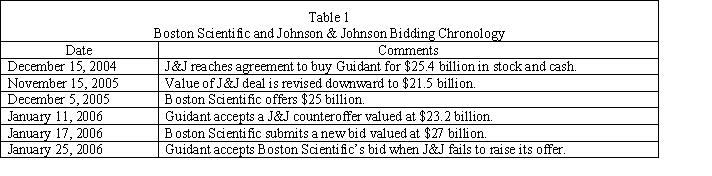

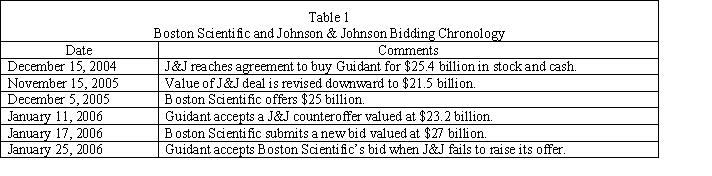

Boston Scientific decided to boost the new bid to $80 per share, which it believed would deter any further bidding from J&J. J&J had been saying publicly that Guidant was already "fully valued." Boston Scientific reasoned that J&J had created a public relations nightmare for itself. If J&J raised its bid, it would upset J&J shareholders and make it look like an undisciplined buyer. J&J refused to up its offer, saying that such an action would not be in the best interests of its shareholders. Table 1 summarizes the key events timeline. A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.

A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.

To complete the transaction, Boston Scientific paid $27 billion, consisting of cash and stock, to Guidant shareholders and another $800 million as a breakup fee to J&J. In addition, the firm is burdened with $14.9 billion in new debt. Within days of Boston Scientific's winning bid, the firm received a warning from the U.S. Food and Drug Administration to delay the introduction of new products until the firm's safety procedures improved.

Between December 2004, the date of Guidant's original agreement with J&J, and January 25, 2006, the date of its agreement with Boston Scientific, Guidant's stock rose by 16 percent, reflecting the bidding process. During the same period, J&J's stock dropped by a modest 3 percent, while Boston Scientific's shares plummeted by 32 percent.

As a result of product recalls and safety warnings on more than 50,000 Guidant cardiac devices, the firm's sales and profits plummeted. Between the announcement date of its purchase of Guidant in December 2005 and year-end 2006, Boston Scientific lost more than $18 billion in shareholder value. In acquiring Guidant, Boston Scientific increased its total shares outstanding by more than 80 percent and assumed responsibility for $6.5 billion in debt, with no proportionate increase in earnings. In early 2010, Boston Scientific underwent major senior management changes and spun off several business units in an effort to improve profitability. Ongoing defibrillator recalls could shave the firm's revenue by $0.5 billion during the next two years. In 2010, continuing product-related problems forced the firm to write off $1.8 billion in impaired goodwill associated with the Guidant acquisition. At less than $8 per share throughout most of 2010, Boston Scientific's share price is about one-fifth of its peak of $35.55 on December 5, 2005, the day the firm announced its bid for Guidant.

What were the key differences between J&J's and Boston Scientific's bidding strategy? Be specific.

Boston Scientific Overcomes Johnson & Johnson to Acquire Guidant-A Lesson in Bidding Strategy

Johnson & Johnson, the behemoth American pharmaceutical company, announced an agreement in December 2004 to acquire Guidant for $76 per share for a combination of cash and stock. Guidant is a leading manufacturer of implantable heart defibrillators and other products used in angioplasty procedures. The defibrillator market has been growing at 20 percent annually, and J&J desired to reenergize its slowing growth rate by diversifying into this rapidly growing market. Soon after the agreement was signed, Guidant's defibrillators became embroiled in a regulatory scandal over failure to inform doctors about rare malfunctions. Guidant suffered a serious erosion of market share when it recalled five models of its defibrillators.

The subsequent erosion in the market value of Guidant prompted J&J to renegotiate the deal under a material adverse change clause common in most M&A agreements. J&J was able to get Guidant to accept a lower price of $63 a share in mid-November. However, this new agreement was not without risk.

The renegotiated agreement gave Boston Scientific an opportunity to intervene with a more attractive informal offer on December 5, 2005, of $72 per share. The offer price consisted of 50 percent stock and 50 percent cash. Boston Scientific, a leading supplier of heart stents, saw the proposed acquisition as a vital step in the company's strategy of diversifying into the high-growth implantable defibrillator market.

Despite the more favorable offer, Guidant's board decided to reject Boston Scientific's offer in favor of an upwardly revised offer of $71 per share made by J&J on January 11, 2005. The board continued to support J&J's lower bid, despite the furor it caused among big Guidant shareholders. With a market capitalization nine times the size of Boston Scientific, the Guidant board continued to be enamored with J&J's size and industry position relative to Boston Scientific.

Boston Scientific realized that it would be able to acquire Guidant only if it made an offer that Guidant could not refuse without risking major shareholder lawsuits. Boston Scientific reasoned that if J&J hoped to match an improved bid, it would have to be at least $77, slightly higher than the $76 J&J had initially offered Guidant in December 2004. With its greater borrowing capacity, Boston Scientific knew that J&J also had the option of converting its combination stock and cash bid to an all-cash offer. Such an offer could be made a few dollars lower than Boston Scientific's bid, since Guidant investors might view such an offer more favorably than one consisting of both stock and cash, whose value could fluctuate between the signing of the agreement and the actual closing. This was indeed a possibility, since the J&J offer did not include a collar arrangement.

Boston Scientific decided to boost the new bid to $80 per share, which it believed would deter any further bidding from J&J. J&J had been saying publicly that Guidant was already "fully valued." Boston Scientific reasoned that J&J had created a public relations nightmare for itself. If J&J raised its bid, it would upset J&J shareholders and make it look like an undisciplined buyer. J&J refused to up its offer, saying that such an action would not be in the best interests of its shareholders. Table 1 summarizes the key events timeline.

A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.

A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.To complete the transaction, Boston Scientific paid $27 billion, consisting of cash and stock, to Guidant shareholders and another $800 million as a breakup fee to J&J. In addition, the firm is burdened with $14.9 billion in new debt. Within days of Boston Scientific's winning bid, the firm received a warning from the U.S. Food and Drug Administration to delay the introduction of new products until the firm's safety procedures improved.

Between December 2004, the date of Guidant's original agreement with J&J, and January 25, 2006, the date of its agreement with Boston Scientific, Guidant's stock rose by 16 percent, reflecting the bidding process. During the same period, J&J's stock dropped by a modest 3 percent, while Boston Scientific's shares plummeted by 32 percent.

As a result of product recalls and safety warnings on more than 50,000 Guidant cardiac devices, the firm's sales and profits plummeted. Between the announcement date of its purchase of Guidant in December 2005 and year-end 2006, Boston Scientific lost more than $18 billion in shareholder value. In acquiring Guidant, Boston Scientific increased its total shares outstanding by more than 80 percent and assumed responsibility for $6.5 billion in debt, with no proportionate increase in earnings. In early 2010, Boston Scientific underwent major senior management changes and spun off several business units in an effort to improve profitability. Ongoing defibrillator recalls could shave the firm's revenue by $0.5 billion during the next two years. In 2010, continuing product-related problems forced the firm to write off $1.8 billion in impaired goodwill associated with the Guidant acquisition. At less than $8 per share throughout most of 2010, Boston Scientific's share price is about one-fifth of its peak of $35.55 on December 5, 2005, the day the firm announced its bid for Guidant.

What were the key differences between J&J's and Boston Scientific's bidding strategy? Be specific.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the represent disadvantages of a cash purchase of target stock?

A) Buyer responsible for known and unknown liabilities.

B) Buyer may avoid need to obtain consents to assignments on contracts.

C) NOLs and tax credits pass to the buyer.

D) No state sales transfer, or use taxes have to be paid.

E) Enables circumvention of target's board in the event a hostile takeover is initiated.

A) Buyer responsible for known and unknown liabilities.

B) Buyer may avoid need to obtain consents to assignments on contracts.

C) NOLs and tax credits pass to the buyer.

D) No state sales transfer, or use taxes have to be paid.

E) Enables circumvention of target's board in the event a hostile takeover is initiated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

63

A "floating or flexible share exchange ratio is used primarily to

A) Protect the value of the transaction for the acquirer's shareholders

B) Protect the value of the transaction for the target's shareholders

C) Minimize the number of new acquirer shares that must be issued

D) Increase the value for the acquiring firm

E) Increase the value for the target firm

A) Protect the value of the transaction for the acquirer's shareholders

B) Protect the value of the transaction for the target's shareholders

C) Minimize the number of new acquirer shares that must be issued

D) Increase the value for the acquiring firm

E) Increase the value for the target firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following may be used as acquisition vehicles?

A) Partnership

B) Limited liability corporation

C) Corporate shell

D) ESOP

E) All of the above

A) Partnership

B) Limited liability corporation

C) Corporate shell

D) ESOP

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

65

Case Study Short Essay Examination Questions

Boston Scientific Overcomes Johnson & Johnson to Acquire Guidant-A Lesson in Bidding Strategy

Johnson & Johnson, the behemoth American pharmaceutical company, announced an agreement in December 2004 to acquire Guidant for $76 per share for a combination of cash and stock. Guidant is a leading manufacturer of implantable heart defibrillators and other products used in angioplasty procedures. The defibrillator market has been growing at 20 percent annually, and J&J desired to reenergize its slowing growth rate by diversifying into this rapidly growing market. Soon after the agreement was signed, Guidant's defibrillators became embroiled in a regulatory scandal over failure to inform doctors about rare malfunctions. Guidant suffered a serious erosion of market share when it recalled five models of its defibrillators.

The subsequent erosion in the market value of Guidant prompted J&J to renegotiate the deal under a material adverse change clause common in most M&A agreements. J&J was able to get Guidant to accept a lower price of $63 a share in mid-November. However, this new agreement was not without risk.

The renegotiated agreement gave Boston Scientific an opportunity to intervene with a more attractive informal offer on December 5, 2005, of $72 per share. The offer price consisted of 50 percent stock and 50 percent cash. Boston Scientific, a leading supplier of heart stents, saw the proposed acquisition as a vital step in the company's strategy of diversifying into the high-growth implantable defibrillator market.

Despite the more favorable offer, Guidant's board decided to reject Boston Scientific's offer in favor of an upwardly revised offer of $71 per share made by J&J on January 11, 2005. The board continued to support J&J's lower bid, despite the furor it caused among big Guidant shareholders. With a market capitalization nine times the size of Boston Scientific, the Guidant board continued to be enamored with J&J's size and industry position relative to Boston Scientific.

Boston Scientific realized that it would be able to acquire Guidant only if it made an offer that Guidant could not refuse without risking major shareholder lawsuits. Boston Scientific reasoned that if J&J hoped to match an improved bid, it would have to be at least $77, slightly higher than the $76 J&J had initially offered Guidant in December 2004. With its greater borrowing capacity, Boston Scientific knew that J&J also had the option of converting its combination stock and cash bid to an all-cash offer. Such an offer could be made a few dollars lower than Boston Scientific's bid, since Guidant investors might view such an offer more favorably than one consisting of both stock and cash, whose value could fluctuate between the signing of the agreement and the actual closing. This was indeed a possibility, since the J&J offer did not include a collar arrangement.

Boston Scientific decided to boost the new bid to $80 per share, which it believed would deter any further bidding from J&J. J&J had been saying publicly that Guidant was already "fully valued." Boston Scientific reasoned that J&J had created a public relations nightmare for itself. If J&J raised its bid, it would upset J&J shareholders and make it look like an undisciplined buyer. J&J refused to up its offer, saying that such an action would not be in the best interests of its shareholders. Table 1 summarizes the key events timeline. A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.

A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.

To complete the transaction, Boston Scientific paid $27 billion, consisting of cash and stock, to Guidant shareholders and another $800 million as a breakup fee to J&J. In addition, the firm is burdened with $14.9 billion in new debt. Within days of Boston Scientific's winning bid, the firm received a warning from the U.S. Food and Drug Administration to delay the introduction of new products until the firm's safety procedures improved.

Between December 2004, the date of Guidant's original agreement with J&J, and January 25, 2006, the date of its agreement with Boston Scientific, Guidant's stock rose by 16 percent, reflecting the bidding process. During the same period, J&J's stock dropped by a modest 3 percent, while Boston Scientific's shares plummeted by 32 percent.

As a result of product recalls and safety warnings on more than 50,000 Guidant cardiac devices, the firm's sales and profits plummeted. Between the announcement date of its purchase of Guidant in December 2005 and year-end 2006, Boston Scientific lost more than $18 billion in shareholder value. In acquiring Guidant, Boston Scientific increased its total shares outstanding by more than 80 percent and assumed responsibility for $6.5 billion in debt, with no proportionate increase in earnings. In early 2010, Boston Scientific underwent major senior management changes and spun off several business units in an effort to improve profitability. Ongoing defibrillator recalls could shave the firm's revenue by $0.5 billion during the next two years. In 2010, continuing product-related problems forced the firm to write off $1.8 billion in impaired goodwill associated with the Guidant acquisition. At less than $8 per share throughout most of 2010, Boston Scientific's share price is about one-fifth of its peak of $35.55 on December 5, 2005, the day the firm announced its bid for Guidant.

What evidence is given that J&J may not have taken Boston Scientific as a serious bidder?

Boston Scientific Overcomes Johnson & Johnson to Acquire Guidant-A Lesson in Bidding Strategy

Johnson & Johnson, the behemoth American pharmaceutical company, announced an agreement in December 2004 to acquire Guidant for $76 per share for a combination of cash and stock. Guidant is a leading manufacturer of implantable heart defibrillators and other products used in angioplasty procedures. The defibrillator market has been growing at 20 percent annually, and J&J desired to reenergize its slowing growth rate by diversifying into this rapidly growing market. Soon after the agreement was signed, Guidant's defibrillators became embroiled in a regulatory scandal over failure to inform doctors about rare malfunctions. Guidant suffered a serious erosion of market share when it recalled five models of its defibrillators.

The subsequent erosion in the market value of Guidant prompted J&J to renegotiate the deal under a material adverse change clause common in most M&A agreements. J&J was able to get Guidant to accept a lower price of $63 a share in mid-November. However, this new agreement was not without risk.

The renegotiated agreement gave Boston Scientific an opportunity to intervene with a more attractive informal offer on December 5, 2005, of $72 per share. The offer price consisted of 50 percent stock and 50 percent cash. Boston Scientific, a leading supplier of heart stents, saw the proposed acquisition as a vital step in the company's strategy of diversifying into the high-growth implantable defibrillator market.

Despite the more favorable offer, Guidant's board decided to reject Boston Scientific's offer in favor of an upwardly revised offer of $71 per share made by J&J on January 11, 2005. The board continued to support J&J's lower bid, despite the furor it caused among big Guidant shareholders. With a market capitalization nine times the size of Boston Scientific, the Guidant board continued to be enamored with J&J's size and industry position relative to Boston Scientific.

Boston Scientific realized that it would be able to acquire Guidant only if it made an offer that Guidant could not refuse without risking major shareholder lawsuits. Boston Scientific reasoned that if J&J hoped to match an improved bid, it would have to be at least $77, slightly higher than the $76 J&J had initially offered Guidant in December 2004. With its greater borrowing capacity, Boston Scientific knew that J&J also had the option of converting its combination stock and cash bid to an all-cash offer. Such an offer could be made a few dollars lower than Boston Scientific's bid, since Guidant investors might view such an offer more favorably than one consisting of both stock and cash, whose value could fluctuate between the signing of the agreement and the actual closing. This was indeed a possibility, since the J&J offer did not include a collar arrangement.

Boston Scientific decided to boost the new bid to $80 per share, which it believed would deter any further bidding from J&J. J&J had been saying publicly that Guidant was already "fully valued." Boston Scientific reasoned that J&J had created a public relations nightmare for itself. If J&J raised its bid, it would upset J&J shareholders and make it look like an undisciplined buyer. J&J refused to up its offer, saying that such an action would not be in the best interests of its shareholders. Table 1 summarizes the key events timeline.

A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.

A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.To complete the transaction, Boston Scientific paid $27 billion, consisting of cash and stock, to Guidant shareholders and another $800 million as a breakup fee to J&J. In addition, the firm is burdened with $14.9 billion in new debt. Within days of Boston Scientific's winning bid, the firm received a warning from the U.S. Food and Drug Administration to delay the introduction of new products until the firm's safety procedures improved.

Between December 2004, the date of Guidant's original agreement with J&J, and January 25, 2006, the date of its agreement with Boston Scientific, Guidant's stock rose by 16 percent, reflecting the bidding process. During the same period, J&J's stock dropped by a modest 3 percent, while Boston Scientific's shares plummeted by 32 percent.

As a result of product recalls and safety warnings on more than 50,000 Guidant cardiac devices, the firm's sales and profits plummeted. Between the announcement date of its purchase of Guidant in December 2005 and year-end 2006, Boston Scientific lost more than $18 billion in shareholder value. In acquiring Guidant, Boston Scientific increased its total shares outstanding by more than 80 percent and assumed responsibility for $6.5 billion in debt, with no proportionate increase in earnings. In early 2010, Boston Scientific underwent major senior management changes and spun off several business units in an effort to improve profitability. Ongoing defibrillator recalls could shave the firm's revenue by $0.5 billion during the next two years. In 2010, continuing product-related problems forced the firm to write off $1.8 billion in impaired goodwill associated with the Guidant acquisition. At less than $8 per share throughout most of 2010, Boston Scientific's share price is about one-fifth of its peak of $35.55 on December 5, 2005, the day the firm announced its bid for Guidant.

What evidence is given that J&J may not have taken Boston Scientific as a serious bidder?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

66

Case Study Short Essay Examination Questions

Boston Scientific Overcomes Johnson & Johnson to Acquire Guidant-A Lesson in Bidding Strategy

Johnson & Johnson, the behemoth American pharmaceutical company, announced an agreement in December 2004 to acquire Guidant for $76 per share for a combination of cash and stock. Guidant is a leading manufacturer of implantable heart defibrillators and other products used in angioplasty procedures. The defibrillator market has been growing at 20 percent annually, and J&J desired to reenergize its slowing growth rate by diversifying into this rapidly growing market. Soon after the agreement was signed, Guidant's defibrillators became embroiled in a regulatory scandal over failure to inform doctors about rare malfunctions. Guidant suffered a serious erosion of market share when it recalled five models of its defibrillators.

The subsequent erosion in the market value of Guidant prompted J&J to renegotiate the deal under a material adverse change clause common in most M&A agreements. J&J was able to get Guidant to accept a lower price of $63 a share in mid-November. However, this new agreement was not without risk.

The renegotiated agreement gave Boston Scientific an opportunity to intervene with a more attractive informal offer on December 5, 2005, of $72 per share. The offer price consisted of 50 percent stock and 50 percent cash. Boston Scientific, a leading supplier of heart stents, saw the proposed acquisition as a vital step in the company's strategy of diversifying into the high-growth implantable defibrillator market.

Despite the more favorable offer, Guidant's board decided to reject Boston Scientific's offer in favor of an upwardly revised offer of $71 per share made by J&J on January 11, 2005. The board continued to support J&J's lower bid, despite the furor it caused among big Guidant shareholders. With a market capitalization nine times the size of Boston Scientific, the Guidant board continued to be enamored with J&J's size and industry position relative to Boston Scientific.

Boston Scientific realized that it would be able to acquire Guidant only if it made an offer that Guidant could not refuse without risking major shareholder lawsuits. Boston Scientific reasoned that if J&J hoped to match an improved bid, it would have to be at least $77, slightly higher than the $76 J&J had initially offered Guidant in December 2004. With its greater borrowing capacity, Boston Scientific knew that J&J also had the option of converting its combination stock and cash bid to an all-cash offer. Such an offer could be made a few dollars lower than Boston Scientific's bid, since Guidant investors might view such an offer more favorably than one consisting of both stock and cash, whose value could fluctuate between the signing of the agreement and the actual closing. This was indeed a possibility, since the J&J offer did not include a collar arrangement.

Boston Scientific decided to boost the new bid to $80 per share, which it believed would deter any further bidding from J&J. J&J had been saying publicly that Guidant was already "fully valued." Boston Scientific reasoned that J&J had created a public relations nightmare for itself. If J&J raised its bid, it would upset J&J shareholders and make it look like an undisciplined buyer. J&J refused to up its offer, saying that such an action would not be in the best interests of its shareholders. Table 1 summarizes the key events timeline. A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.

A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.

To complete the transaction, Boston Scientific paid $27 billion, consisting of cash and stock, to Guidant shareholders and another $800 million as a breakup fee to J&J. In addition, the firm is burdened with $14.9 billion in new debt. Within days of Boston Scientific's winning bid, the firm received a warning from the U.S. Food and Drug Administration to delay the introduction of new products until the firm's safety procedures improved.

Between December 2004, the date of Guidant's original agreement with J&J, and January 25, 2006, the date of its agreement with Boston Scientific, Guidant's stock rose by 16 percent, reflecting the bidding process. During the same period, J&J's stock dropped by a modest 3 percent, while Boston Scientific's shares plummeted by 32 percent.

As a result of product recalls and safety warnings on more than 50,000 Guidant cardiac devices, the firm's sales and profits plummeted. Between the announcement date of its purchase of Guidant in December 2005 and year-end 2006, Boston Scientific lost more than $18 billion in shareholder value. In acquiring Guidant, Boston Scientific increased its total shares outstanding by more than 80 percent and assumed responsibility for $6.5 billion in debt, with no proportionate increase in earnings. In early 2010, Boston Scientific underwent major senior management changes and spun off several business units in an effort to improve profitability. Ongoing defibrillator recalls could shave the firm's revenue by $0.5 billion during the next two years. In 2010, continuing product-related problems forced the firm to write off $1.8 billion in impaired goodwill associated with the Guidant acquisition. At less than $8 per share throughout most of 2010, Boston Scientific's share price is about one-fifth of its peak of $35.55 on December 5, 2005, the day the firm announced its bid for Guidant.

What might J&J have done differently to avoid igniting a bidding war?

Boston Scientific Overcomes Johnson & Johnson to Acquire Guidant-A Lesson in Bidding Strategy

Johnson & Johnson, the behemoth American pharmaceutical company, announced an agreement in December 2004 to acquire Guidant for $76 per share for a combination of cash and stock. Guidant is a leading manufacturer of implantable heart defibrillators and other products used in angioplasty procedures. The defibrillator market has been growing at 20 percent annually, and J&J desired to reenergize its slowing growth rate by diversifying into this rapidly growing market. Soon after the agreement was signed, Guidant's defibrillators became embroiled in a regulatory scandal over failure to inform doctors about rare malfunctions. Guidant suffered a serious erosion of market share when it recalled five models of its defibrillators.

The subsequent erosion in the market value of Guidant prompted J&J to renegotiate the deal under a material adverse change clause common in most M&A agreements. J&J was able to get Guidant to accept a lower price of $63 a share in mid-November. However, this new agreement was not without risk.

The renegotiated agreement gave Boston Scientific an opportunity to intervene with a more attractive informal offer on December 5, 2005, of $72 per share. The offer price consisted of 50 percent stock and 50 percent cash. Boston Scientific, a leading supplier of heart stents, saw the proposed acquisition as a vital step in the company's strategy of diversifying into the high-growth implantable defibrillator market.

Despite the more favorable offer, Guidant's board decided to reject Boston Scientific's offer in favor of an upwardly revised offer of $71 per share made by J&J on January 11, 2005. The board continued to support J&J's lower bid, despite the furor it caused among big Guidant shareholders. With a market capitalization nine times the size of Boston Scientific, the Guidant board continued to be enamored with J&J's size and industry position relative to Boston Scientific.

Boston Scientific realized that it would be able to acquire Guidant only if it made an offer that Guidant could not refuse without risking major shareholder lawsuits. Boston Scientific reasoned that if J&J hoped to match an improved bid, it would have to be at least $77, slightly higher than the $76 J&J had initially offered Guidant in December 2004. With its greater borrowing capacity, Boston Scientific knew that J&J also had the option of converting its combination stock and cash bid to an all-cash offer. Such an offer could be made a few dollars lower than Boston Scientific's bid, since Guidant investors might view such an offer more favorably than one consisting of both stock and cash, whose value could fluctuate between the signing of the agreement and the actual closing. This was indeed a possibility, since the J&J offer did not include a collar arrangement.

Boston Scientific decided to boost the new bid to $80 per share, which it believed would deter any further bidding from J&J. J&J had been saying publicly that Guidant was already "fully valued." Boston Scientific reasoned that J&J had created a public relations nightmare for itself. If J&J raised its bid, it would upset J&J shareholders and make it look like an undisciplined buyer. J&J refused to up its offer, saying that such an action would not be in the best interests of its shareholders. Table 1 summarizes the key events timeline.

A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.

A side deal with Abbott Labs made the lofty Boston Scientific offer possible. The firm entered into an agreement with Abbott Laboratories in which Boston Scientific would divest Guidant's stent business while retaining the rights to Guidant's stent technology. In return, Boston Scientific received $6.4 billion in cash on the closing date, consisting of $4.1 billion for the divested assets, a loan of $900 million, and Abbott's purchase of $1.4 billion of Boston Scientific stock. The additional cash helped fund the purchase price. This deal also helped Boston Scientific gain regulatory approval by enabling Abbott Labs to become a competitor in the stent business. Merrill Lynch and Bank of America each would lend $7 billion to fund a portion of the purchase price and provide the combined firms with additional working capital.To complete the transaction, Boston Scientific paid $27 billion, consisting of cash and stock, to Guidant shareholders and another $800 million as a breakup fee to J&J. In addition, the firm is burdened with $14.9 billion in new debt. Within days of Boston Scientific's winning bid, the firm received a warning from the U.S. Food and Drug Administration to delay the introduction of new products until the firm's safety procedures improved.

Between December 2004, the date of Guidant's original agreement with J&J, and January 25, 2006, the date of its agreement with Boston Scientific, Guidant's stock rose by 16 percent, reflecting the bidding process. During the same period, J&J's stock dropped by a modest 3 percent, while Boston Scientific's shares plummeted by 32 percent.

As a result of product recalls and safety warnings on more than 50,000 Guidant cardiac devices, the firm's sales and profits plummeted. Between the announcement date of its purchase of Guidant in December 2005 and year-end 2006, Boston Scientific lost more than $18 billion in shareholder value. In acquiring Guidant, Boston Scientific increased its total shares outstanding by more than 80 percent and assumed responsibility for $6.5 billion in debt, with no proportionate increase in earnings. In early 2010, Boston Scientific underwent major senior management changes and spun off several business units in an effort to improve profitability. Ongoing defibrillator recalls could shave the firm's revenue by $0.5 billion during the next two years. In 2010, continuing product-related problems forced the firm to write off $1.8 billion in impaired goodwill associated with the Guidant acquisition. At less than $8 per share throughout most of 2010, Boston Scientific's share price is about one-fifth of its peak of $35.55 on December 5, 2005, the day the firm announced its bid for Guidant.

What might J&J have done differently to avoid igniting a bidding war?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

67

The seller's insistence that the buyer agree to purchase its stock may encourage the buyer to

A) offer a lower purchase price because it is assuming all of the target firm's liabilities

B) offer a higher purchase price because it is assuming all of the target firm's liabilities

C) offer a lower purchase price because it is receiving all of the target's tax benefits

D) use its stock rather than cash to purchase the target firm

E) use cash rather than its stock to purchase the target firm

A) offer a lower purchase price because it is assuming all of the target firm's liabilities

B) offer a higher purchase price because it is assuming all of the target firm's liabilities

C) offer a lower purchase price because it is receiving all of the target's tax benefits

D) use its stock rather than cash to purchase the target firm

E) use cash rather than its stock to purchase the target firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

68

Form of payment can involve which of the following:

A) Cash

B) Stock

C) Cash and stock

D) Rights, royalties and fees

E) All of the above

A) Cash

B) Stock

C) Cash and stock

D) Rights, royalties and fees

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following are commonly used to close the gap between what the seller wants and what the buyer is willing to pay?

A) Consulting contracts offered to the seller

B) Earn-outs

C) Employment contracts offered to the seller

D) Giving seller rights to license a valuable technology or process

E) All of the above.

A) Consulting contracts offered to the seller

B) Earn-outs

C) Employment contracts offered to the seller

D) Giving seller rights to license a valuable technology or process

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is true of collar arrangements?

A) A fixed or constant share exchange ratio is one in which the number of acquirer shares exchanged for each target share is unchanged between the signing of the agreement of purchase and sale and closing.

B) Collar agreements provide for certain changes in the exchange ratio contingent on the level of the acquirer's share price around the effective date of the merger.

C) A fixed exchange collar agreement may involve a fixed exchange ratio as long as the acquirer's share price remains within a narrow range, calculated as of the effective date of merger.

D) A fixed payment collar agreement guarantees that the target firm shareholder receives a certain dollar value in terms of acquirer stock as long as the acquirer's stock remains within a narrow range, and a fixed exchange ratio if the acquirer's average stock price is outside the bounds around the effective date of the merger.

E) All of the above.

A) A fixed or constant share exchange ratio is one in which the number of acquirer shares exchanged for each target share is unchanged between the signing of the agreement of purchase and sale and closing.

B) Collar agreements provide for certain changes in the exchange ratio contingent on the level of the acquirer's share price around the effective date of the merger.

C) A fixed exchange collar agreement may involve a fixed exchange ratio as long as the acquirer's share price remains within a narrow range, calculated as of the effective date of merger.

D) A fixed payment collar agreement guarantees that the target firm shareholder receives a certain dollar value in terms of acquirer stock as long as the acquirer's stock remains within a narrow range, and a fixed exchange ratio if the acquirer's average stock price is outside the bounds around the effective date of the merger.

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

71

The tax status of the transaction may influence the purchase price by

A) Raising the price demanded by the seller to offset potential tax liabilities

B) Reducing the price demanded by the seller to offset potential tax liabilities

C) Causing the buyer to lower the purchase price if the transaction is taxable to the target firm's shareholders

D) Forcing the seller to agree to defer a portion of the purchase price

E) Forcing the buyer to agree to defer a portion of the purchase price

A) Raising the price demanded by the seller to offset potential tax liabilities

B) Reducing the price demanded by the seller to offset potential tax liabilities

C) Causing the buyer to lower the purchase price if the transaction is taxable to the target firm's shareholders

D) Forcing the seller to agree to defer a portion of the purchase price

E) Forcing the buyer to agree to defer a portion of the purchase price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is not true of mergers?

A) Liabilities and assets transfer automatically

B) May be subject to transfer taxes.

C) No minority shareholders remain.

D) May be time consuming due to need for shareholder approvals.

E) May have to pay dissenting shareholders appraised value of stock

A) Liabilities and assets transfer automatically

B) May be subject to transfer taxes.

C) No minority shareholders remain.

D) May be time consuming due to need for shareholder approvals.

E) May have to pay dissenting shareholders appraised value of stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is a disadvantage of balance sheet adjustments?

A) Protects buyer from eroding values of receivable before closing

B) Audit expense

C) Protects seller from increasing values of receivables before closing

D) Protects from decreasing values of inventories before closing

E) Protects seller from increasing values of inventories before closing

A) Protects buyer from eroding values of receivable before closing

B) Audit expense

C) Protects seller from increasing values of receivables before closing

D) Protects from decreasing values of inventories before closing

E) Protects seller from increasing values of inventories before closing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

74

A holding company may be used as a post-closing organizational structure for all but which of the following reasons?

A) A portion of the purchase price for the target firm included an earn-out

B) The target firm has a substantial amount of unknown liabilities

C) The acquired firm's culture is very different from that of the acquiring firm

D) Profits from operations are not taxable

E) The transaction involves a cross border transaction

A) A portion of the purchase price for the target firm included an earn-out

B) The target firm has a substantial amount of unknown liabilities

C) The acquired firm's culture is very different from that of the acquiring firm

D) Profits from operations are not taxable

E) The transaction involves a cross border transaction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

75

In a statutory merger,

A) Only known assets and liabilities are automatically transferred to the buyer.

B) Only known and unknown assets are transferred to the buyer.

C) All known and unknown assets and liabilities are automatically transferred to the buyer except for those the seller agrees to retain.

D) The total consideration received by the target's shareholders is automatically taxable.

E) None of the above.

A) Only known assets and liabilities are automatically transferred to the buyer.

B) Only known and unknown assets are transferred to the buyer.

C) All known and unknown assets and liabilities are automatically transferred to the buyer except for those the seller agrees to retain.

D) The total consideration received by the target's shareholders is automatically taxable.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

76

If an acquirer buys most of the operating assets of a target firm,the target generally is forced to

liquidate its remaining assets and pay the after-tax proceeds to its shareholders.

liquidate its remaining assets and pay the after-tax proceeds to its shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following should be considered important components of the deal structuring process?

A) Legal structure of the acquiring and selling entities

B) Post closing organization

C) Tax status of the transaction

D) What is being purchased, i.e., stock or assets

E) All of the above

A) Legal structure of the acquiring and selling entities

B) Post closing organization

C) Tax status of the transaction

D) What is being purchased, i.e., stock or assets

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

78

The form of acquisition refers to which of the following:

A) Tax status of the transaction

B) Acquisition vehicle

C) What is being acquired, i.e., stock or assets

D) Form of payment

E) How the transaction will be displayed for financial reporting purposes

A) Tax status of the transaction

B) Acquisition vehicle

C) What is being acquired, i.e., stock or assets

D) Form of payment

E) How the transaction will be displayed for financial reporting purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following are disadvantages of an asset purchase?

A) Asset write-up

B) May require consents to assignment of contracts

C) Potential for double-taxation of buyer

D) May be subject to sales, use, and transfer taxes

E) B and D

A) Asset write-up

B) May require consents to assignment of contracts

C) Potential for double-taxation of buyer

D) May be subject to sales, use, and transfer taxes

E) B and D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is not a characteristic of a joint venture corporation?

A) Profits and losses can be divided between the partners disproportionately to their ownership shares.

B) New investors can become part of the JV corporation without having to dissolve the original JV corporate structure.

C) The JV corporation can be used to acquire other firms.

D) Investors' liability is limited to the extent of their investment.

E) The JV corporation may be subject to double taxation.

A) Profits and losses can be divided between the partners disproportionately to their ownership shares.

B) New investors can become part of the JV corporation without having to dissolve the original JV corporate structure.

C) The JV corporation can be used to acquire other firms.

D) Investors' liability is limited to the extent of their investment.

E) The JV corporation may be subject to double taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck