Deck 10: Assessing the Cost of Capital: What Return Investors Require

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

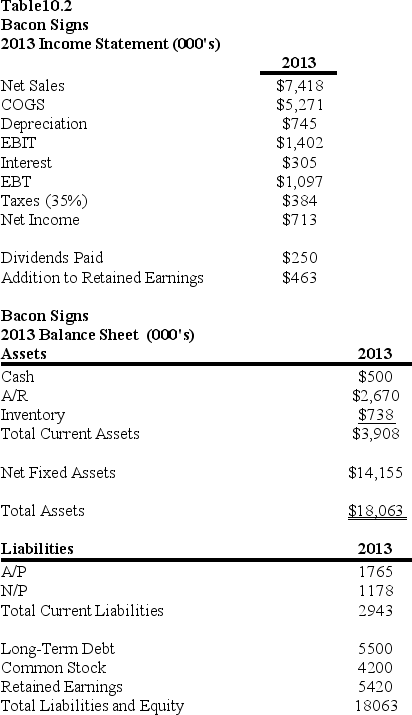

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/76

العب

ملء الشاشة (f)

Deck 10: Assessing the Cost of Capital: What Return Investors Require

1

All else equal,investors "like" ________ and "dislike" ________.

A)risk; return.

B)return; risk.

C)standard deviation; risk.

D)diversification; return.

A)risk; return.

B)return; risk.

C)standard deviation; risk.

D)diversification; return.

B

2

Most individuals are NOT risk-averse.

False

3

Diversification of stocks reduces unsystematic or firm-specific risk,leaving systematic or market risk.

True

4

Which of the following statements is TRUE?

A)The after-tax cost of debt is less than the before-tax cost of debt for a corporation with a tax rate greater than 0.00%.

B)The after-tax cost of preferred shares is less than the before-tax cost of preferred shares for a corporation with a tax rate greater than 0.00%.

C)The after-tax cost of equity is less than the before-tax cost of equity for a corporation with a tax rate greater than 0.00%.

D)None of the above are true.

A)The after-tax cost of debt is less than the before-tax cost of debt for a corporation with a tax rate greater than 0.00%.

B)The after-tax cost of preferred shares is less than the before-tax cost of preferred shares for a corporation with a tax rate greater than 0.00%.

C)The after-tax cost of equity is less than the before-tax cost of equity for a corporation with a tax rate greater than 0.00%.

D)None of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

5

The risk that can be eliminated through the practice of diversification is known as ________ risk.

A)unsystematic

B)systematic

C)nondiversifiable

D)speculative

A)unsystematic

B)systematic

C)nondiversifiable

D)speculative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

6

________ is a measure of dispersion and is one way of measuring the risk of securities and portfolios.

A)Diversification

B)Expected return

C)Standard deviation

D)Statistics

A)Diversification

B)Expected return

C)Standard deviation

D)Statistics

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

7

Another name for market risk is:

A)systematic risk.

B)standard deviation.

C)unsystematic risk.

D)total risk.

A)systematic risk.

B)standard deviation.

C)unsystematic risk.

D)total risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is an accurate list of risky securities ranked from most risky to the least?

A)speculative stocks,blue-chip stocks,government bonds,corporate bonds

B)corporate bonds,speculative stocks,blue-chip stocks,government bonds

C)government bonds,corporate bonds,blue-chip stocks,speculative stocks

D)speculative stocks,blue-chip stocks,corporate bonds,government bonds

A)speculative stocks,blue-chip stocks,government bonds,corporate bonds

B)corporate bonds,speculative stocks,blue-chip stocks,government bonds

C)government bonds,corporate bonds,blue-chip stocks,speculative stocks

D)speculative stocks,blue-chip stocks,corporate bonds,government bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

9

How do speculative risk and pure risk differ? Which is of greater concern to a corporate executive? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

10

The author describes three interpretations of the cost of capital; one as a value driver,one from the investor's view point,and one from the viewpoint of the entrepreneur.Explain these three different interpretations,provide an example of each,and confirm why each is an appropriate interpretation of the cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

11

To determine the cost of each source of a firm's financing,management must think of the terms cost and return interchangeably,or as different sides of the same coin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

12

How many randomly selected securities must be added to a portfolio so that on average almost all of the risk that can be diversified away has been diversified away?

A)1-3

B)20 -30

C)100-150

D)450-550

A)1-3

B)20 -30

C)100-150

D)450-550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

13

Carbon Fiber Design and Build Inc.is considering the purchase of new a new carbon molding machine for use in their Sports Operations department.The investment would be an expansion of an industry segment that the firm knows well.You have been tasked with helping the division manager determine the WACC in advance of an analysis of the expected cash flows for the project.You have collected the following information: The firm has no preferred stock outstanding and plans to issue new preferred stock.The estimated tax rate for the firm is 30%.The firm currently has 500 10-year $1,000 face value bonds outstanding with 7% semi-annual coupons that are selling for $1,036.35.The firm also has 31,888 shares of common stock outstanding at a price of $32.50 per share.You estimate that the market risk premium is 6%,the current yield to maturity on 10-year Treasury bonds is 3%,and the firm's beta is 0.95.Given this information,calculate the after-tax cost of debt,the cost of equity,and the firm's WACC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

14

As we move from government bonds to corporate bonds to blue chip stocks to small company stocks we tend to be moving away from safe investments toward investments with greater risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

15

If two firms have the same yield to maturity on their publicly traded debt then the firm with the ________ will have a ________ after-tax cost of debt.

A)lower tax rate; higher

B)higher tax rate; higher

C)shorter maturity of debt; higher

D)longer maturity of debt; lower

A)lower tax rate; higher

B)higher tax rate; higher

C)shorter maturity of debt; higher

D)longer maturity of debt; lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

16

A firm's cost of capital is:

A)the average cost of raising funds.

B)the key driver of the overall value of the firm.

C)reflects the required rate of return of investors and lenders.

D)All of the above.

A)the average cost of raising funds.

B)the key driver of the overall value of the firm.

C)reflects the required rate of return of investors and lenders.

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

17

At a firm level,the lower the cost of raising funds,the more valuable the firm will be.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a firm has publicly traded debt then the yield to maturity is approximately the same as:

A)the after-tax cost of debt.

B)the before-tax cost of debt.

C)the 10-year Treasury bond rate.

D)the WACC.

A)the after-tax cost of debt.

B)the before-tax cost of debt.

C)the 10-year Treasury bond rate.

D)the WACC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

19

Standard deviation is the practice of combining assets or investments in order to reduce risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

20

It is possible for a firm to generate an after-tax profit on an investment but to still consider the project unacceptable due to insufficient return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

21

When calculating the WACC it is common to include the estimated cost of accounts payable if a firm does not take the discount for early payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

22

The ________ is cited by the author as a reason for using just one rate,a long-term yield,as the average cost of debt financing for a firm that has multiple issues of debt with varying maturities.

A)efficient markets hypothesis

B)market substitution theory

C)biased expectation theory

D)unbiased expectations theory

A)efficient markets hypothesis

B)market substitution theory

C)biased expectation theory

D)unbiased expectations theory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is NOT a problem with the dividend model approach to estimating the cost of equity?

A)Some firms do not pay dividends.

B)Some firms pay dividends but do not follow a policy of constant growth.

C)Sometimes it is very difficult to estimate a constant dividend growth rate for a firm.

D)All of the above are problems with the dividend approach to estimating the cost of equity.

A)Some firms do not pay dividends.

B)Some firms pay dividends but do not follow a policy of constant growth.

C)Sometimes it is very difficult to estimate a constant dividend growth rate for a firm.

D)All of the above are problems with the dividend approach to estimating the cost of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

24

Your firm is considering the issuance of preferred shares for the first time.The average yield on preferred stock for firms in your industry is 6.50%.If you wish to issue preferred stock at par with a face value of $50.00 per share,approximately how large would you need to make your annual preferred dividend?

A)$3.00

B)$3.25

C)$6.50

D)There is not enough information to answer this question.

A)$3.00

B)$3.25

C)$6.50

D)There is not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

25

If interest rates rise,the price of preferred shares will also rise,other things equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

26

________ on preferred shares are paid ________ taxes and ________ common share dividends.

A)Interest payments; before; after

B)Dividends; before; after

C)Dividends; after; before

D)Interest payments; after; after

A)Interest payments; before; after

B)Dividends; before; after

C)Dividends; after; before

D)Interest payments; after; after

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

27

Picarello Corporation's next annual dividend is expected to be $4.64 per share,to be issued one year from today.The firm anticipates the growth rate in dividends will be 4% annually for the foreseeable future.If the current price is $51 per share,what is the required rate of return for the firm's equity?

A)13.46%

B)13.10%

C)8.44%

D)16.27%

A)13.46%

B)13.10%

C)8.44%

D)16.27%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is NOT a key component of the CAPM?

A)beta

B)diversifiable risk

C)the risk-free rate

D)the market risk premium

A)beta

B)diversifiable risk

C)the risk-free rate

D)the market risk premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

29

The cost of preferred shares reflects the rate that the firm would need to offer if it issued new preferred shares today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

30

The ________ is a popular and somewhat intuitive technique for estimating the required return on common equity.

A)dividend model

B)yield to maturity model

C)future value model

D)interest model

A)dividend model

B)yield to maturity model

C)future value model

D)interest model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

31

To estimate the after-tax cost of preferred stock you must:

A)multiply the cost of preferred by (1 - the tax rate).

B)multiply the cost of preferred by (1 + the tax rate).

C)multiply the cost of preferred by (the tax rate).

D)None of the above because preferred dividend payments are not tax deductible for the firm.

A)multiply the cost of preferred by (1 - the tax rate).

B)multiply the cost of preferred by (1 + the tax rate).

C)multiply the cost of preferred by (the tax rate).

D)None of the above because preferred dividend payments are not tax deductible for the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

32

Diamond Electronics Inc.has a current price of $18.45 per share for its preferred shares that pay an annual dividend of $0.96.What is the current return on the firm's preferred shares?

A)5.20%

B)19.22%

C)8.74%

D)There is not enough information to answer this question.

A)5.20%

B)19.22%

C)8.74%

D)There is not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

33

For purposes of pricing,preferred shares are considered a form of perpetuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

34

What is the logic behind using just one cost of debt financing rather than estimating the cost of financing with each specific issue of long and short-term debt?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

35

Freightway Trucking Inc.uses the CAPM to help estimate their cost of equity.Given the following information,what is the firm's estimated cost of equity? The risk-free return in the market is currently 3%,the market risk premium is 8%,the expected return on the market portfolio if 11% and the firm has a beta of 1.50

A)7.50%

B)15.00%

C)10.50%

D)19.50%

A)7.50%

B)15.00%

C)10.50%

D)19.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

36

The costs associated with the issuance of debt,or flotation costs,are generally of secondary consideration and are typically ignored in cost of debt estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

37

Janis Corp.just issued an annual dividend of $2.50 per share.The firm anticipates the growth rate in dividends will be 3% annually for the foreseeable future.If the current price is $61 per share,what is the required rate of return for the firm's equity?

A)7.10%

B)8.36%

C)7.22%

D)6.95%

A)7.10%

B)8.36%

C)7.22%

D)6.95%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

38

Beta is a/an ________ measure of risk and assumes that investors hold a ________ portfolio

A)absolute; well-diversified

B)relative or comparative; risk-free

C)relative or comparative; well-diversified

D)absolute; risk-free

A)absolute; well-diversified

B)relative or comparative; risk-free

C)relative or comparative; well-diversified

D)absolute; risk-free

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

39

If a firm does not have publicly traded debt and therefore does not have a yield to maturity as an estimate for its cost of debt,a common practice is to estimate the cost of debt by adding a premium to the rate on:

A)the cost of accounts payable.

B)equity.

C)long-term government bonds.

D)collateralized debt obligations.

A)the cost of accounts payable.

B)equity.

C)long-term government bonds.

D)collateralized debt obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

40

The cost of debt is measured on an after-tax basis and reflects the rate that the firm would need to offer if it issued new debt today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

41

Transit Design Inc.recently paid a $1.00 dividend,has a beta of 0.75,has determined that the market risk premium is 10% and the current risk-free rate is 4%.What is the firm's required return on equity?

A)14.00%

B)14.50%

C)11.50%

D)8.50%

A)14.00%

B)14.50%

C)11.50%

D)8.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is typically considered to be the most appropriate proxy for the risk-free rate when applying the CAPM?

A)10-year Treasury bonds

B)10-year AAA bonds

C)the prime rate

D)the firm's current yield to maturity on outstanding debt

A)10-year Treasury bonds

B)10-year AAA bonds

C)the prime rate

D)the firm's current yield to maturity on outstanding debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

43

________ represent current investor expectations about a firm whereas ________ are representations of historical costs.

A)Book values; market values

B)Market values; book values

C)Regulators; investment bankers

D)Common equity holders; bondholders

A)Book values; market values

B)Market values; book values

C)Regulators; investment bankers

D)Common equity holders; bondholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

44

By definition the market portfolio has a beta of 0.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

45

The CAPM incorporates the risk-free rate with the market risk premium and beta,a relative risk measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

46

The rate on 3-month Treasury Bills is always considered to be the risk-free rate when applying the CAPM.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

47

A firm with a beta of 2.0 should:

A)be forced to stop trading until the market perceives less risk.

B)require twice the return on the market portfolio.

C)require twice the market risk premium.

D)require twice the risk-free rate of return.

A)be forced to stop trading until the market perceives less risk.

B)require twice the return on the market portfolio.

C)require twice the market risk premium.

D)require twice the risk-free rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

48

Unlike bonds or preferred shares,common equity does NOT have any similar "guarantee" of returns.Rather,common stockholders are residual claimants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

49

The market risk premium represents the expected difference between:

A)the return on AAA bonds and Treasury bonds.

B)the prime rate and the 3-month Treasury bill rate.

C)the return on the stock market and the return on preferred shares.

D)the return on the stock market investment and the risk-free return.

A)the return on AAA bonds and Treasury bonds.

B)the prime rate and the 3-month Treasury bill rate.

C)the return on the stock market and the return on preferred shares.

D)the return on the stock market investment and the risk-free return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

50

The cost of equity is usually estimated either by the dividend model or the capital asset pricing model (CAPM).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

51

The thirty firms that comprise the Dow Jones Industrial Average all have remarkably similar betas.In fact,the thirty betas range from a low of 0.91 to a high 1.11.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

52

In the context of the CAPM and assuming investors' past expectations have been fulfilled,the average historical market risk premium is a useful initial estimate of the expected future market risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

53

In the constant growth dividend model for determining the required return on equity,the expected returns are determined by the expected dividend yield as well as the expected growth in dividends over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

54

Market values for equity are calculated as:

A)the sum of the value of equity and accumulated retained earnings as found on the balance sheet.

B)the price per share multiplied by the number of shares outstanding.

C)the price per share multiplied by the number of shares outstanding plus the accumulated retained earnings.

D)the price per share multiplied by the number of shares outstanding minus the accumulated retained earnings.

A)the sum of the value of equity and accumulated retained earnings as found on the balance sheet.

B)the price per share multiplied by the number of shares outstanding.

C)the price per share multiplied by the number of shares outstanding plus the accumulated retained earnings.

D)the price per share multiplied by the number of shares outstanding minus the accumulated retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

55

A firm with a beta of 1.0 and when held in a well-diversified portfolio should be considered to have ________ risk than the market portfolio.

A)less

B)neither more nor less

C)more

D)There is not enough information to answer this question.

A)less

B)neither more nor less

C)more

D)There is not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

56

Your author states that the CAPM is a more widely used model for estimating the required return on equity than the dividend growth model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

57

By definition,the market portfolio has a ________ and the risk free rate has a ________.

A)beta equal to 1.0; beta equal to 0.0.

B)beta equal 0.0; beta equal to 1.0.

C)standard deviation equal to 1.0; beta equal to 0.0.

D)standard deviation equal to 0.0; beta equal to 1.0.

A)beta equal to 1.0; beta equal to 0.0.

B)beta equal 0.0; beta equal to 1.0.

C)standard deviation equal to 1.0; beta equal to 0.0.

D)standard deviation equal to 0.0; beta equal to 1.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

58

To estimate the after-tax cost of common stock you must:

A)multiply the before-tax cost of equity by (1 - tax rate)

B)multiply the before-tax cost of equity by (1 + tax rate)

C)multiply the before-tax cost of equity by (tax rate)

D)None of the above because common stock dividend payments are not tax deductible for the firm.

A)multiply the before-tax cost of equity by (1 - tax rate)

B)multiply the before-tax cost of equity by (1 + tax rate)

C)multiply the before-tax cost of equity by (tax rate)

D)None of the above because common stock dividend payments are not tax deductible for the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

59

What is the WACC for Bacon Signs Inc,if the after-tax cost of long-term debt is 6.3% and the before tax cost of equity is 10.4%.

A)8.02%

B)8.91%

C)9.58%

D)Without a corporate tax rate,we cannot answer this question as written.

A)8.02%

B)8.91%

C)9.58%

D)Without a corporate tax rate,we cannot answer this question as written.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

60

Using the author's suggested process of ignoring short term capital,what are the book value weights for the component costs of capital for Bacon Signs?

A)LTD = 36.4% and Equity = 63.6%

B)LTD = 56.7% and Equity = 43.3%

C)LTD = 50.4% and Equity = 49.6%

D)LTD = 41.0% and Equity = 59.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

61

For a capital project to be accepted,the ________ should exceed the ________.

A)IRR; hurdle rate.

B)NPV; hurdle rate

C)MIRR; IRR

D)MIRR; NPV

A)IRR; hurdle rate.

B)NPV; hurdle rate

C)MIRR; IRR

D)MIRR; NPV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

62

If a firm increases the amount of debt that it has this could lead to an increase in:

A)financial risk.

B)the cost of equity.

C)both the cost of equity and the financial risk.

D)None of the above.

A)financial risk.

B)the cost of equity.

C)both the cost of equity and the financial risk.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

63

Cedar Computer Systems Inc.has two projects under consideration and a WACC of 10%.Project Alpha has a hurdle rate of 12% while project Beta has a hurdle rate of 8%.If project Alpha has an expected return of 11% and project Beta has an expected return of 11%,which project(s),if any,should the firm accept?

A)Project Alpha

B)Project Beta

C)Projects Alpha and Beta

D)Neither project should be accepted.

A)Project Alpha

B)Project Beta

C)Projects Alpha and Beta

D)Neither project should be accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

64

Within a firm,the WACC is the most appropriate required rate of return for all projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

65

Identify methods that firms use to establish hurdle rates for capital projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

66

We should expect the (weighted)average of all hurdle rates within a firm to be approximately equal to the overall WACC

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

67

If Home Depot has before-tax earnings of $7,000,000,Pays $2,400,000 in taxes,has no preferred stock,and a beta of 1.20,what is the firm's current average tax rate?

A)33.33%

B)34.29%

C)35.00%

D)36.14%

A)33.33%

B)34.29%

C)35.00%

D)36.14%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

68

Management statements is a third technique identified by the author as a method of determining the appropriate weights for WACC calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

69

Many firms in a particular industry strive to have very similar capital structures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

70

Hurdle rates may change if:

A)the cost of borrowing changes.

B)the firm's risk profile changes.

C)the overall economic environment changes.

D)All of the above.

A)the cost of borrowing changes.

B)the firm's risk profile changes.

C)the overall economic environment changes.

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

71

Most of the time the book values and market values for equity are very similar,but this is not true for debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

72

As of January 29,2012,Home Depot had an outstanding fixed rate bond issue with a 5.875% coupon rate that was priced such that the before-tax yield to maturity was 4.67%.From this information we can conclude that the current price of the bond was less than the bond's face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

73

Sadly,even though the author makes a strong case for using the CAPM to estimate the cost of equity,the truth is that few CFOs find the concept useful in practice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

74

The author estimates that in January of 2012,Home Depot had a required return on equity of 6.8%.He explains this relatively ________ rate as a reflection of ________.

A)low; near all-time low long-term interest rates.

B)low; Home Depot's very low beta.

C)high; near all-time high long-term interest rates.

D)high; Home Depot's very high beta.

A)low; near all-time low long-term interest rates.

B)low; Home Depot's very low beta.

C)high; near all-time high long-term interest rates.

D)high; Home Depot's very high beta.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

75

For a project to be accepted,the ________ may be greater than or less than the firm's WACC,but the ________ must be greater than the hurdle rate.

A)IRR; NPV

B)hurdle rate; IRR

C)MIRR; NPV

D)NPV; IRR

A)IRR; NPV

B)hurdle rate; IRR

C)MIRR; NPV

D)NPV; IRR

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

76

Hurdle rates depend on the perceived riskiness of divisions or projects and are used to evaluate different types of potential investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck