Deck 13: Measuring and Creating Value

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

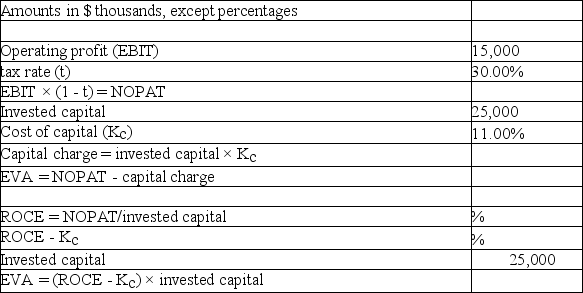

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/73

العب

ملء الشاشة (f)

Deck 13: Measuring and Creating Value

1

Which of the following equations for the Book value Plus Adjustment method is correct?

A)Value of equity (VE)= market value of equity - adjustments

B)Value of equity (VE)= book value of equity + adjustments

C)Value of equity (VE)= book value of equity - adjustments

D)Value of equity (VE)= market value of equity + adjustments

A)Value of equity (VE)= market value of equity - adjustments

B)Value of equity (VE)= book value of equity + adjustments

C)Value of equity (VE)= book value of equity - adjustments

D)Value of equity (VE)= market value of equity + adjustments

B

2

________ are common forms of non-cash expenses for a firm.

A)Depreciation and amortization

B)Depreciation and interest

C)Depreciation and dividends

D)All of the above

A)Depreciation and amortization

B)Depreciation and interest

C)Depreciation and dividends

D)All of the above

A

3

Which of the following descriptions of the component costs of capital is INCORRECT?

A)The cost of preferred shares,Kp,is estimated as the current dividend yield on any existing preferred shares or shares of similar firms.

B)The cost of debt,Kd,is estimated as the after-tax cost of issuing new debt (such as bonds)today.

C)The cost of debt is estimated using the CAPM as the risk-free rate or long-term government bond yield plus beta times a market risk premium.

D)All of the above are correct.

A)The cost of preferred shares,Kp,is estimated as the current dividend yield on any existing preferred shares or shares of similar firms.

B)The cost of debt,Kd,is estimated as the after-tax cost of issuing new debt (such as bonds)today.

C)The cost of debt is estimated using the CAPM as the risk-free rate or long-term government bond yield plus beta times a market risk premium.

D)All of the above are correct.

C

4

By changing a firm's capital structure to one more optimal,a firm may be able to

A)reduce its cost of capital.

B)increase its value.

C)find that more of its potential projects are financially attractive due to lower capital costs.

D)find that all of the above are true.

A)reduce its cost of capital.

B)increase its value.

C)find that more of its potential projects are financially attractive due to lower capital costs.

D)find that all of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements regarding the selection of how many years to use in estimating FCFF is FALSE?

A)There is no set rule for how many years to use.

B)Common practice suggest five to ten years is a reasonable amount of time to estimate individual year cash flows.

C)One guiding principle is to project out the number of years until you're willing to assume that a firm's free cash flows will grow at a constant rate.

D)All of the above are true.

A)There is no set rule for how many years to use.

B)Common practice suggest five to ten years is a reasonable amount of time to estimate individual year cash flows.

C)One guiding principle is to project out the number of years until you're willing to assume that a firm's free cash flows will grow at a constant rate.

D)All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

6

Mason Construction Inc.had net sales of $480,000,costs of sales of $130,000,additional expenses of $200,000,depreciation of $40,000,and a tax rate of 30%.Use this information to determine the firm's after tax earnings on a cash basis.

A)$77,000

B)$105,000

C)$117,000

D)$145,000

A)$77,000

B)$105,000

C)$117,000

D)$145,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

7

Simpson Productions Inc.had net sales of $300,000,costs of sales of $150,000,additional expenses of $100,000,depreciation of $50,000,and a tax rate of 30%.Use this information to determine the firm's after tax earnings on a cash basis.

A)$0

B)$30,000

C)$35,000

D)$50,000

A)$0

B)$30,000

C)$35,000

D)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

8

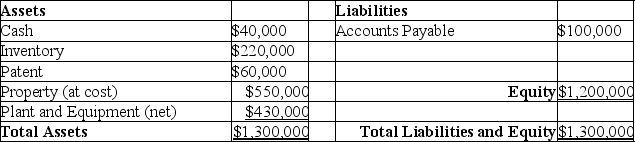

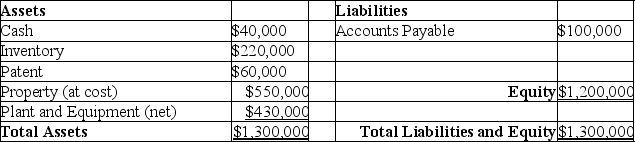

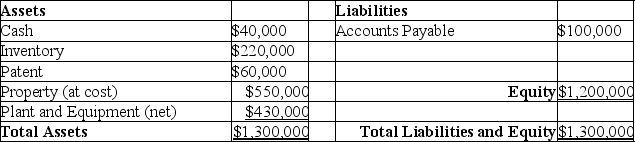

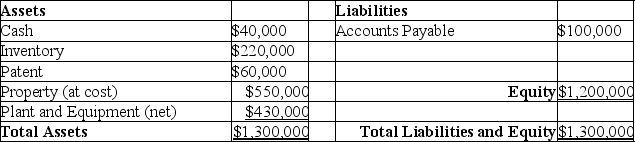

Figure 13-1 Bestor Travel Inc.Balance Sheet

Suppose you were fortunate on the timing of your property investment and the firm's property is now worth $750,000.An investor has offered you $100,000 for the patent.Further,some of the firm's inventory has become obsolete and is now worth only $180,000.

Suppose you were fortunate on the timing of your property investment and the firm's property is now worth $750,000.An investor has offered you $100,000 for the patent.Further,some of the firm's inventory has become obsolete and is now worth only $180,000.

Assume the information in Figure 13-1 is correct,EXCEPT the market value of property is now estimated to be $450,000.Use the Book value Plus Adjustment method along with the information from 13-1 and the new estimated value of property to value the firm's equity.

A)$1,100,000

B)$1,200,000

C)$1,300,000

D)$1,400,000

Suppose you were fortunate on the timing of your property investment and the firm's property is now worth $750,000.An investor has offered you $100,000 for the patent.Further,some of the firm's inventory has become obsolete and is now worth only $180,000.

Suppose you were fortunate on the timing of your property investment and the firm's property is now worth $750,000.An investor has offered you $100,000 for the patent.Further,some of the firm's inventory has become obsolete and is now worth only $180,000.Assume the information in Figure 13-1 is correct,EXCEPT the market value of property is now estimated to be $450,000.Use the Book value Plus Adjustment method along with the information from 13-1 and the new estimated value of property to value the firm's equity.

A)$1,100,000

B)$1,200,000

C)$1,300,000

D)$1,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

9

An advantage of the book value of equity plus adjustments approach is:

A)that it implicitly assumes that a firm is going to be shut down.

B)it doesn't consider the firm being valued as an ongoing concern.

C)we can immediately "plug in" the starting point of the book value of equity without having to do any calculations.

D)All of the above.

A)that it implicitly assumes that a firm is going to be shut down.

B)it doesn't consider the firm being valued as an ongoing concern.

C)we can immediately "plug in" the starting point of the book value of equity without having to do any calculations.

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

10

For the FCFF calculation:

A)we must examine changes in net working capital.

B)a firm that is not growing may be expected to have no changes in net working capital.

C)it is important to consider only incremental or changing working capital needs.

D)all of the above are true.

A)we must examine changes in net working capital.

B)a firm that is not growing may be expected to have no changes in net working capital.

C)it is important to consider only incremental or changing working capital needs.

D)all of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

11

If a viable firm is not growing but is expected to continue over time,then we would expect changes in net working capital to be equal to:

A)a percentage of total sale.

B)EBIT.

C)depreciation.

D)$0

A)a percentage of total sale.

B)EBIT.

C)depreciation.

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

12

If a viable firm is not growing but is expected to continue over time,then we would expect capital expenditures to be equal to:

A)sales.

B)depreciation.

C)EBIT.

D)taxes payable.

A)sales.

B)depreciation.

C)EBIT.

D)taxes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

13

Compared to a publicly traded firm,a comparable private firm is thought to be:

A)20% to 30% less valuable.

B)less liquid for the owners.

C)more difficult to accurately value.

D)all of the above.

A)20% to 30% less valuable.

B)less liquid for the owners.

C)more difficult to accurately value.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements regarding firms and value is NOT true?

A)We can create value by taking on negative net present value projects.

B)Shareholder control in and of itself has value.

C)Value is ultimately what someone is willing to pay for a firm.

D)It is important to know what is being valued; the assets or the equity in a firm.

A)We can create value by taking on negative net present value projects.

B)Shareholder control in and of itself has value.

C)Value is ultimately what someone is willing to pay for a firm.

D)It is important to know what is being valued; the assets or the equity in a firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is NOT a necessary step in the Discounted Cash Flow Analysis method of valuing equity?

A)Estimate a cost of capital.

B)Estimate the present value of terminal value cash flows.

C)Calculate the present value of free cash flows over the number of years in question.

D)All of the above are necessary steps for the discounted cash flow method of valuation.

A)Estimate a cost of capital.

B)Estimate the present value of terminal value cash flows.

C)Calculate the present value of free cash flows over the number of years in question.

D)All of the above are necessary steps for the discounted cash flow method of valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

16

Figure 13-1 Bestor Travel Inc.Balance Sheet

Suppose you were fortunate on the timing of your property investment and the firm's property is now worth $750,000.An investor has offered you $100,000 for the patent.Further,some of the firm's inventory has become obsolete and is now worth only $180,000.

Suppose you were fortunate on the timing of your property investment and the firm's property is now worth $750,000.An investor has offered you $100,000 for the patent.Further,some of the firm's inventory has become obsolete and is now worth only $180,000.

Bestor Travel,Inc manufactures and sells high quality light weight luggage highly prized in the market for its style and durability.Use the information from Figure 13-1 and the Book value Plus Adjustment method to value the firm's equity.

A)$1,100,000

B)$1,200,000

C)$1,300,000

D)$1,400,000

Suppose you were fortunate on the timing of your property investment and the firm's property is now worth $750,000.An investor has offered you $100,000 for the patent.Further,some of the firm's inventory has become obsolete and is now worth only $180,000.

Suppose you were fortunate on the timing of your property investment and the firm's property is now worth $750,000.An investor has offered you $100,000 for the patent.Further,some of the firm's inventory has become obsolete and is now worth only $180,000.Bestor Travel,Inc manufactures and sells high quality light weight luggage highly prized in the market for its style and durability.Use the information from Figure 13-1 and the Book value Plus Adjustment method to value the firm's equity.

A)$1,100,000

B)$1,200,000

C)$1,300,000

D)$1,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

17

Despite the clear cons of book value plus equity method of firm evaluation,we often see it used as a starting point for valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following formulas correctly estimates free cash flows to the firm?

A)FCFF = EBIT × (1 + tax rate)+ non cash expenses - capital expenditures - net increases in working capital

B)FCFF = EBIT × (1 - tax rate)+ non cash expenses - capital expenditures - net increases in working capital

C)FCFF = EBIT × (1 - tax rate)+ non cash expenses + capital expenditures - net increases in working capital

D)FCFF = EBIT × (1 - tax rate)- non cash expenses + capital expenditures - net increases in working capital

A)FCFF = EBIT × (1 + tax rate)+ non cash expenses - capital expenditures - net increases in working capital

B)FCFF = EBIT × (1 - tax rate)+ non cash expenses - capital expenditures - net increases in working capital

C)FCFF = EBIT × (1 - tax rate)+ non cash expenses + capital expenditures - net increases in working capital

D)FCFF = EBIT × (1 - tax rate)- non cash expenses + capital expenditures - net increases in working capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

19

Compared to a publicly traded firm,a comparable private firm is thought to be up to 20% to 30% more valuable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

20

Managers can create value by undertaking positive net present value projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

21

The major disadvantage of the Free Cash Flow to the Firm method (and DCF methods in general)is that it is based on sound time value of money principles,

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

22

When estimating a firm's FCFF we CANNOT ignore interest expenses because there is no way to incorporate these expenses into the cost of capital calculation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

23

For the FCFF calculation it is important to include the total net working capital of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is NOT a negative attribute of the price-earnings multiple valuation model?

A)It implicitly assumes that comparable firms are already fairly pried in the market place.

B)Its focus on earnings may be clouded by dubious accounting assumptions.

C)It is based on relative market measures rather than book measures.

D)It cannot be used when there are negative earnings.(This would imply a firm value of less than $0!)

A)It implicitly assumes that comparable firms are already fairly pried in the market place.

B)Its focus on earnings may be clouded by dubious accounting assumptions.

C)It is based on relative market measures rather than book measures.

D)It cannot be used when there are negative earnings.(This would imply a firm value of less than $0!)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

25

The weighted average cost of capital is estimated as Kc = wdKd + wpKp + weKe,where the w's represent the weights.The weights must sum to more than one so that the manager can then subtract taxes from the equation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is NOT a positive attribute of the price-earnings multiple valuation model?

A)It is easy to use.

B)It implicitly assumes that comparable firms are already fairly pried in the market place.

C)It is forward-looking.

D)It is based on relative market measures rather than book measures.

A)It is easy to use.

B)It implicitly assumes that comparable firms are already fairly pried in the market place.

C)It is forward-looking.

D)It is based on relative market measures rather than book measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

27

Complete by filling in each of the missing values (there are 18 total missing values).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

28

________ offer the advantage of ease of application offset by a lack of precision.

A)Relative valuation methods

B)Absolute valuation methods

C)Discounted cash flow methods

D)The Fama-Jensen methods

A)Relative valuation methods

B)Absolute valuation methods

C)Discounted cash flow methods

D)The Fama-Jensen methods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

29

Ellis Manufacturing Inc.has estimated FCFF for each of the next five years and believes that subsequent cash flows will grow at a constant annual rate of 3% indefinitely.If FCFF are $4,500,000 in year five,and the cost of capital is 9%,what is the value in year five of these terminal value cash flows?

A)$50,207,200

B)$75,000,000

C)$77,250,000

D)There is not enough information to answer this question.

A)$50,207,200

B)$75,000,000

C)$77,250,000

D)There is not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

30

When performing comparable analysis the ideal comparable firm will have each of the following characteristics EXCEPT:

A)it has similar growth of cash flow prospects.

B)it has similar risk as measured by variance.

C)it has a similar dividend payout.

D)these are all desirable comparables.

A)it has similar growth of cash flow prospects.

B)it has similar risk as measured by variance.

C)it has a similar dividend payout.

D)these are all desirable comparables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

31

All else equal,the forward-looking price-earnings multiple is ________ related to risk and ________ related to growth.

A)indirectly; directly

B)indirectly; indirectly

C)directly; directly

D)directly; indirectly

A)indirectly; directly

B)indirectly; indirectly

C)directly; directly

D)directly; indirectly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Price-Earnings valuation model estimates the price of a share of stock today as the:

A)sum of a forward looking P/E multiple and the EPS in the next period.

B)product of the firm's historic P/E multiple and the EPS in the next period.

C)product of a forward looking P/E multiple and the EPS in the next period.

D)product of a forward looking P/E multiple and the current EPS.

A)sum of a forward looking P/E multiple and the EPS in the next period.

B)product of the firm's historic P/E multiple and the EPS in the next period.

C)product of a forward looking P/E multiple and the EPS in the next period.

D)product of a forward looking P/E multiple and the current EPS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

33

InfoTech Solutions Inc.has a historic P/E multiple of 26,a current EPS of $1.10 projected to grow by 5% in the coming year,and a forward looking P/E multiple of 22.With this information please estimate the current price of the firm's stock

A)$30.03

B)$28.60

C)$26.20

D)$25.41

A)$30.03

B)$28.60

C)$26.20

D)$25.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

34

Legacy Industries Inc.has a historic P/E multiple of 15,a current EPS of $2.50 projected to grow by 4% in the coming year,and a forward looking P/E multiple of 18.With this information please estimate the current price of the firm's stock.

A)$37.50

B)$46.80

C)$39.00

D)$48.20

A)$37.50

B)$46.80

C)$39.00

D)$48.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

35

The basic premise of the Free Cash Flow to the Firm Method of Valuation is that a firm should be worth the present value of anticipated cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

36

Ellis Manufacturing Inc.has estimated FCFF for each of the next five years and believes that subsequent cash flows will grow at a constant annual rate of 3% indefinitely.If FCFF are $4,500,000 in year five,and the cost of capital is 9%,what is the value TODAY of these terminal value cash flows?

A)$48,744,854

B)$50,207,200

C)$77,250,000

D)There is not enough information to answer this question.

A)$48,744,854

B)$50,207,200

C)$77,250,000

D)There is not enough information to answer this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

37

As a rough guideline when using price-earnings multiples,keep in mind that the market-wide price-earnings multiples have historically averaged around:

A)24 to 25.

B)20 to 21.

C)16 to 17.

D)12 to 13.

A)24 to 25.

B)20 to 21.

C)16 to 17.

D)12 to 13.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

38

The major disadvantages of the Free Cash Flow to the Firm method are that it can be more time consuming and difficult to use than other methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

39

Bronson Building Products Inc.estimates that FCFF in the coming year will be $1,600,000,year two will be 15% greater than year one,and year three will be 10% greater than year two.Bronson has a cost of capital of 12%.Estimate the firm's terminal value FCFF as of year three if cash flows are estimated to continue to increase at a rate of 5% indefinitely.What is the overall estimated (present)value of the firm?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

40

When performing comparable analysis the ideal comparable firm will have each of the following characteristics EXCEPT:

A)it is in a similar industry.

B)it is of a similar size.

C)it has similar risk as measured by beta.

D)these are all desirable comparables.

A)it is in a similar industry.

B)it is of a similar size.

C)it has similar risk as measured by beta.

D)these are all desirable comparables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

41

EBITDA is an acronym for:

A)earnings before interest,taxes,depreciation,and annuitization.

B)earnings before interest,taxes,depreciation,and amortization.

C)earnings before income taxes,depreciation,and amortization.

D)earnings before income taxes,depreciation,and annuitization.

A)earnings before interest,taxes,depreciation,and annuitization.

B)earnings before interest,taxes,depreciation,and amortization.

C)earnings before income taxes,depreciation,and amortization.

D)earnings before income taxes,depreciation,and annuitization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

42

Estimating a firm's forward looking EPS is considered to be easier than determining an appropriate price-earnings multiple to be used in a valuation process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

43

An uncanny truth in the U.S.equity market is that over time the price-earnings multiple has been almost constant,ranging fewer than two points up or down from the average over the past 130 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements about Economic Value Added (EVA)is NOT true?

A)EVA is a measure of value creation.

B)EVA is a process for attempting to create value.

C)If a firm generates positive EVA then it increases shareholder value.

D)All of the above are true.

A)EVA is a measure of value creation.

B)EVA is a process for attempting to create value.

C)If a firm generates positive EVA then it increases shareholder value.

D)All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

45

In order for a firm to realize positive EVA,the:

A)ROCE must be less than the cost of capital.

B)cost of capital must be greater than the ROCE.

C)ROCE must be greater than the cost of capital.

D)the ROCE and cost of capital must be equal.

A)ROCE must be less than the cost of capital.

B)cost of capital must be greater than the ROCE.

C)ROCE must be greater than the cost of capital.

D)the ROCE and cost of capital must be equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the equation P0 = (K * EPS1) /r-g)to demonstrate the relationship between the price-earnings model and the constant growth dividend model.P0 = the current price per share of stock,K = the dividend payout ratio,is the forward looking earnings per share,r is the required rate of return for common stock,and g is the anticipated constant rate of growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

47

EBITDA represents a simple proxy for cash flows from financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following decisions by management could increase a firm's Market Value Added (MVA)?

A)Improve the rate of return on the existing capital base.

B)Invest more capital in attractive projects with returns that exceed the cost of capital.

C)Stop investing in projects that have returns less than the appropriate cost of capital.

D)All of the above.

A)Improve the rate of return on the existing capital base.

B)Invest more capital in attractive projects with returns that exceed the cost of capital.

C)Stop investing in projects that have returns less than the appropriate cost of capital.

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

49

The Enterprise Value-to-EBITDA model of valuation is a RELATIVE valuation approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

50

The EV/EBITDA model involves a two-step process: first estimating firm value or EV,then subtracting other claims (such as debt)in order to isolate the value of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements about Economic Value Added (EVA)is NOT true?

A)EVA suggests that in order to make relevant business decisions,we must consider all costs associated with those decisions.

B)Typical financial statements do NOT present all relevant information related to the economic costs associated with generating revenues.

C)Proponents of EVA claim that the EVA measure is more closely related to changes in shareholder value (i.e.,changes in stock prices)than to changes in accounting measures such as earnings per share.

D)All of the above are true.

A)EVA suggests that in order to make relevant business decisions,we must consider all costs associated with those decisions.

B)Typical financial statements do NOT present all relevant information related to the economic costs associated with generating revenues.

C)Proponents of EVA claim that the EVA measure is more closely related to changes in shareholder value (i.e.,changes in stock prices)than to changes in accounting measures such as earnings per share.

D)All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

52

Information collected and published by finance professor Aswath Damodaran consistently demonstrates that,within industries,the price to book value ratio is GREATER than the EV to EBITDA ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

53

While the EV/EBITDA model offers the benefit of relative simplicity,it lacks the richness of the discounted cash flow models.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

54

Creative Centers Inc.has an EBIT of $200,000,$30,000 in depreciation,$450,000 in outstanding debt,a forward-looking EV/EBITDA multiple of 7.50,and an estimated cost of capital of 10%.Use the EV/EBITDA approach to value the firm.

A)$837,500

B)$950,000

C)$1,100,000

D)$1,275,000

A)$837,500

B)$950,000

C)$1,100,000

D)$1,275,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

55

An advantage of the Enterprise Value-to-EBITDA model of valuation over the Price-Earnings Multiple model of valuation is that it does NOT focus on earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following statements regarding Market Value Added (MVA)is TRUE?

A)MVA = market value of the firm - invested capital

B)A positive MVA indicates that the market believes the firm has created value for its stakeholders.

C)MVA represents the present value of anticipated EVAs,discounted at the appropriate cost of capital.

D)All of the statements are true.

A)MVA = market value of the firm - invested capital

B)A positive MVA indicates that the market believes the firm has created value for its stakeholders.

C)MVA represents the present value of anticipated EVAs,discounted at the appropriate cost of capital.

D)All of the statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is NOT an advantage of the EV/EBITDA valuation approach over the price-earnings approach?

A)Because the EV/EBITDA approach is more of a cash flow-oriented method,there is less room for accounting discretion.

B)Because EBITDA is measured before interest and depreciation expenses are deducted,this method maximizes potential distortions from capital structure differences

C)Because EBITDA is measured before interest and depreciation expenses are deducted,this method minimizes potential distortions from from fixed asset differences across firms when performing comparable analysis.

D)All of the above are advantages,not disadvantages for the EV/EBITDA approach.

A)Because the EV/EBITDA approach is more of a cash flow-oriented method,there is less room for accounting discretion.

B)Because EBITDA is measured before interest and depreciation expenses are deducted,this method maximizes potential distortions from capital structure differences

C)Because EBITDA is measured before interest and depreciation expenses are deducted,this method minimizes potential distortions from from fixed asset differences across firms when performing comparable analysis.

D)All of the above are advantages,not disadvantages for the EV/EBITDA approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

58

The price-earnings multiple reflects the growth prospects and riskiness of a firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

59

Active Athletics Inc.has an EBIT of $400,000,$150,000 in depreciation,$500,000 in outstanding debt,a forward-looking EV/EBITDA multiple of 6.0,and an estimated cost of capital of 14%.Use the EV/EBITDA approach to value the firm.

A)$2,800,000

B)$2,400,000

C)$1,700,000

D)$1,500,000

A)$2,800,000

B)$2,400,000

C)$1,700,000

D)$1,500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is NOT one of the three key value drivers behind the EVA approach?

A)Net operating profits after tax (NOPAT),which are similar to part of the free cash flow concept,EBIT × (1 - t).

B)The investment in net working capital.

C)The investment in capital.

D)The cost of capital.

A)Net operating profits after tax (NOPAT),which are similar to part of the free cash flow concept,EBIT × (1 - t).

B)The investment in net working capital.

C)The investment in capital.

D)The cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is NOT an appropriate reason for a merger or acquisition?

A)Economies of scale that result from the merger.

B)The replacement of an inefficient management team.

C)To promote "agency problems."

D)To reduce overlapping costs.

A)Economies of scale that result from the merger.

B)The replacement of an inefficient management team.

C)To promote "agency problems."

D)To reduce overlapping costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

62

EVA depends on both the amount of capital employed and the spread between ROCE and Kc.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

63

EVA is a multi-period rather than a one-period measure of true economic performance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

64

A synergistic merger is made for reasons of combining two failing firms in the hopes that the combined entity will not fail.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the information from Figure 13-2 and complete the missing information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

66

The EVA measure has the benefit of being conceptually simple,applicable to business units (in addition to the firm as a whole),but is uncorrelated with stock price performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

67

MegaToy Inc.is considering acquiring Action Figures Inc.,both publicly traded firms in the toy industry.Action Figures is currently trading at $18 per share and has 15 million shares outstanding.The executive team at MegaToy believes that the present value of potential synergies is $70 million if the firms combine.What is the highest bid price per share that MegaToy should consider paying for Action Figure shares? What is the largest percentage premium over the current share price MegaToy would be willing to pay?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

68

EVA assumes a business is worth the present value of anticipated net cash flows discounted by the cost of capital,less the amount invested in order to generate future cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements is TRUE?

A)Firms can grow externally through mergers and acquisitions.

B)A merger involves the formation of a new economic unit from two or more units.

C)An acquisition usually involves a much larger firm acquiring control of a smaller firm.

D)All of the above are true.

A)Firms can grow externally through mergers and acquisitions.

B)A merger involves the formation of a new economic unit from two or more units.

C)An acquisition usually involves a much larger firm acquiring control of a smaller firm.

D)All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following would NOT be classified as value added by the buyer in a merger?

A)The present value of estimated synergies due to the merger.

B)The current value of the target firm as a stand-alone entity.

C)New value-adding strategies initiated post-merger by the purchasing firm.

D)Enhanced credit ratings that develop as a result of the merger.

A)The present value of estimated synergies due to the merger.

B)The current value of the target firm as a stand-alone entity.

C)New value-adding strategies initiated post-merger by the purchasing firm.

D)Enhanced credit ratings that develop as a result of the merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

71

Traditional financial statements include only interest costs associated with any debt and not the return required or expected by equity holders,which is included in the EVA approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

72

The maximum value of a target firm to the buyer = the value to the seller - the value added by the buyer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck

73

Target firms in a merger or acquisition process realize,on average,

A)significantly positive per share price premiums.

B)significantly negative per share price reductions.

C)no significant change in price.

D)unknown returns.This is an unanswered research question.

A)significantly positive per share price premiums.

B)significantly negative per share price reductions.

C)no significant change in price.

D)unknown returns.This is an unanswered research question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 73 في هذه المجموعة.

فتح الحزمة

k this deck