Deck 2: Money Management Skills

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/75

العب

ملء الشاشة (f)

Deck 2: Money Management Skills

1

Insolvency is a result of having an unequal balance of tangible and intangible goods.

False

2

Furniture,jewelry,and an automobile are examples of liquid assets.

False

3

Insolvency is the inability to pay debts by the due date,because liabilities exceed the value of assets.

True

4

Personal records current budget,cheque book(s)and bank statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

5

If budgeted spending is less than actual spending,this is referred to as a deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

6

Most income tax documents and records should be kept in a safety deposit box.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

7

Definite financial obligations are referred to as variable expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

8

Financial records that may need to be referred to on a regular basis should not be kept in a safety deposit box.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

9

Opportunity costs are not only associated with money management decisions involving long-term financial security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

10

Medical expenses,clothing,and telephone are examples of fixed expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

11

Current liabilities are amounts that must be paid within a short period of time,usually less than a year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

12

If expenses for a month are greater than income,an increase in net worth will result.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

13

Liabilities are cash and items of value that can be easily converted to cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

14

A budget is a record of how a person or family has spent their money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

15

When one money management decision is selected,something else must be given up.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

16

A person's lifestyle is a reflection of his or her values,goals,career,and family situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

17

A personal cash flow statement presents income and outflows of cash for a given time period,such as a month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

18

A person's net worth is the difference between the value of the items owned and the amounts owed to others.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

19

Take-home pay is a person's earnings after deductions for taxes and other items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

20

A personal cash flow statement can serve as the basis for the budget categories used by an individual or family.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

21

Opportunity cost refers to:

A) current spending habits.

B) changing economic conditions that affect a person's cost of living.

C) storage facilities to make financial documents easily available.

D) trade-offs associated with financial decisions.

E) avoiding the use of consumer credit.

A) current spending habits.

B) changing economic conditions that affect a person's cost of living.

C) storage facilities to make financial documents easily available.

D) trade-offs associated with financial decisions.

E) avoiding the use of consumer credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following financial documents would most likely be stored in a safety deposit box?

A) FT-4 slips

B) Personal financial statements

C) Warranties

D) Stock certificates

E) Checking account statements

A) FT-4 slips

B) Personal financial statements

C) Warranties

D) Stock certificates

E) Checking account statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

23

Most Canadians have an adequate savings for emergencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

24

A brokerage statement is an example of a(n)____________ record.

A) investment

B) insurance

C) estate planning

D) tax

E) consumer purchase

A) investment

B) insurance

C) estate planning

D) tax

E) consumer purchase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

25

An example of a personal and employment document is a:

A) Social Insurance card.

B) passbook.

C) budget

D) property tax bill.

E) lease.

A) Social Insurance card.

B) passbook.

C) budget

D) property tax bill.

E) lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

26

An individual retirement account is an example of a(n)____________ asset.

A) liquid

B) common

C) investment

D) household

E) budgeted

A) liquid

B) common

C) investment

D) household

E) budgeted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

27

"Sharing the bills" is a budgeting strategy for two-income households where each partner contributes an equal amount into the pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

28

The current financial position of an individual or family is best presented with the use of a(n)

A) budget.

B) cash flow statement.

C) balance sheet.

D) bank statement.

E) time value of money report.

A) budget.

B) cash flow statement.

C) balance sheet.

D) bank statement.

E) time value of money report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

29

Current liabilities differ from long-term liabilities based on

A) the amount owed.

B) the financial situation of the creditor.

C) the interest rate charged.

D) when the debt is due.

E) current economic conditions.

A) the amount owed.

B) the financial situation of the creditor.

C) the interest rate charged.

D) when the debt is due.

E) current economic conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following are considered to be personal financial statements?

A) Budget and credit card statements

B) Balance sheet and cash flow statement

C) Checkbook and budget

D) Tax returns

E) Bank statement and savings passbook

A) Budget and credit card statements

B) Balance sheet and cash flow statement

C) Checkbook and budget

D) Tax returns

E) Bank statement and savings passbook

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

31

Warranties are commonly associated with ____________ purchases.

A) investment

B) insurance

C) consumer

D) financial services

E) credit

A) investment

B) insurance

C) consumer

D) financial services

E) credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

32

A family with $70,000 in assets and $22,000 of liabilities would have a net worth of:

A) $70,000.

B) $22,000.

C) $48,000

D) $92,000.

E) $41,000.

A) $70,000.

B) $22,000.

C) $48,000

D) $92,000.

E) $41,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

33

Liabilities are amounts representing

A) taxable income

B) items of value.

C) living expenses.

D) debts

E) current assets.

A) taxable income

B) items of value.

C) living expenses.

D) debts

E) current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

34

Under a direct deposit system the bank will make an automatic debit from you bank account and have the funds transferred periodically to an investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

35

A personal balance sheet presents

A) items owned and amounts owed.

B) income and expenses for a period of time.

C) earnings on savings and investments.

D) amounts budgeted for spending

E) family financial goals.

A) items owned and amounts owed.

B) income and expenses for a period of time.

C) earnings on savings and investments.

D) amounts budgeted for spending

E) family financial goals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

36

Liquid assets refer to

A) amounts that must be paid soon.

B) amounts on which taxes must be paid

C) total income available to a family for spending.

D) the value of investments.

E) items that are easily converted to cash.

A) amounts that must be paid soon.

B) amounts on which taxes must be paid

C) total income available to a family for spending.

D) the value of investments.

E) items that are easily converted to cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

37

Leveraged investing in common shares is expected to increase your net worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

38

Evidence exists that a person's choice of employment influences his or her lifestyle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

39

A home file should be used for:

A) storing all financial documents and records.

B) obsolete financial documents.

C) documents that require maximum security.

D) financial records for current needs.

E) records that are difficult to replace.

A) storing all financial documents and records.

B) obsolete financial documents.

C) documents that require maximum security.

D) financial records for current needs.

E) records that are difficult to replace.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

40

Items with a monetary worth are referred to as:

A) liabilities.

B) variable expenses.

C) net worth.

D) income.

E) assets.

A) liabilities.

B) variable expenses.

C) net worth.

D) income.

E) assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

41

Ed Bostrom wants to reduce his fixed expenses.What action would be appropriate?

A) Get a part-time job

B) Eat more meals at home than in restaurants

C) Find a place to live with a lower rent

D) Save more money for the future

E) Buy on credit for items that might cost more later

A) Get a part-time job

B) Eat more meals at home than in restaurants

C) Find a place to live with a lower rent

D) Save more money for the future

E) Buy on credit for items that might cost more later

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following payments would be considered a variable expense?

A) Rent

B) An installment loan payment

C) A mortgage payment

D) A monthly parking fee

E) A telephone bill

A) Rent

B) An installment loan payment

C) A mortgage payment

D) A monthly parking fee

E) A telephone bill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

43

A major expenditure for most families is

A) insurance.

B) contributions.

C) clothing.

D) utilities.

E) transportation.

A) insurance.

B) contributions.

C) clothing.

D) utilities.

E) transportation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

44

Payments that do not vary from month to month are ____________ expenses.

A) fixed

B) current

C) variable

D) luxury

E) budgeted

A) fixed

B) current

C) variable

D) luxury

E) budgeted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

45

A decrease in net worth would be the result of:

A) income greater than expenses for a month.

B) expenses greater than income for a month.

C) assets greater than expenses.

D) increased earnings on the job.

E) income and expenses equal for a month.

A) income greater than expenses for a month.

B) expenses greater than income for a month.

C) assets greater than expenses.

D) increased earnings on the job.

E) income and expenses equal for a month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

46

A person's net worth would increase as a result of

A) decreased value on investments

B) reduced earnings.

C) increased spending for current living expenses.

D) decreased value of personal possessions.

E) reduced amounts owed to others.

A) decreased value on investments

B) reduced earnings.

C) increased spending for current living expenses.

D) decreased value of personal possessions.

E) reduced amounts owed to others.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

47

During the past month,Jennifer Sinnet had income of $3,500 and a decrease in net worth of $200.This means Jennifer's payments for the month were:

A) $3,700.

B) $3,300.

C) $2,800.

D) $1,000.

E) $200.

A) $3,700.

B) $3,300.

C) $2,800.

D) $1,000.

E) $200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following presents a summary of income and outflows for a period of time?

A) A cash flow statement

B) A bank statement

C) An investment summary

D) balance sheet

E) An asset report

A) A cash flow statement

B) A bank statement

C) An investment summary

D) balance sheet

E) An asset report

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

49

A common deduction from a person's paycheck is for

A) interest.

B) unemployment

C) rent.

D) taxes.

E) current liabilities.

A) interest.

B) unemployment

C) rent.

D) taxes.

E) current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

50

The payment items that should be budgeted first are

A) variable expenses.

B) investment funds.

C) fixed expenses.

D) unplanned living expenses.

E) entertainment expenses.

A) variable expenses.

B) investment funds.

C) fixed expenses.

D) unplanned living expenses.

E) entertainment expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

51

To determine a person's solvency,which financial document should be consulted?

A) Cash flow statement

B) Budget

C) Debt consolidation statement

D) Personal balance sheet

E) Credit report

A) Cash flow statement

B) Budget

C) Debt consolidation statement

D) Personal balance sheet

E) Credit report

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following would be considered a long-term liability?

A) A charge account payment

B) A mortgage

C) An installment loan

D) An amount due for taxes

E) The amount due on a credit card

A) A charge account payment

B) A mortgage

C) An installment loan

D) An amount due for taxes

E) The amount due on a credit card

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

53

This year Taylor's gross income is $70,000.Her deductions for federal and provincial taxes,CPP contributions and employment insurance are $13,500.She also had after-tax investment earnings of $6,000.Taylor's take-home pay is:

A) $70,000

B) $76,000

C) $77,500

D) $56,500

E) $62,000

A) $70,000

B) $76,000

C) $77,500

D) $56,500

E) $62,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

54

Improvements in a person's financial position are the result of:

A) increased liabilities.

B) reductions in earnings.

C) increased savings and investments.

D) increased purchases on credit.

E) lower amounts deposited in savings.

A) increased liabilities.

B) reductions in earnings.

C) increased savings and investments.

D) increased purchases on credit.

E) lower amounts deposited in savings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following situations is a person who could be insolvent?

A) Assets $56,000; annual expenses $60,000

B) Assets $68,000; net worth $22,000

C) Liabilities $45,000; net worth $6,000

D) Assets $60,000; liabilities $61,000

E) Annual cash inflows $48,000; liabilities $50,000

A) Assets $56,000; annual expenses $60,000

B) Assets $68,000; net worth $22,000

C) Liabilities $45,000; net worth $6,000

D) Assets $60,000; liabilities $61,000

E) Annual cash inflows $48,000; liabilities $50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

56

A person's net worth is computed by

A) subtracting total liabilities from total assets.

B) deducting current living expenses from total assets.

C) adding assets and liabilities

D) subtracting assets from current liabilities.

E) adding liabilities and budgeted expenses.

A) subtracting total liabilities from total assets.

B) deducting current living expenses from total assets.

C) adding assets and liabilities

D) subtracting assets from current liabilities.

E) adding liabilities and budgeted expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

57

Ben Chase needs to pay off some of his debts over the next few months.Which item on his balance sheet would help him decide what amounts are due in the near future?

A) the budget variance

B) investment assets

C) long-term liabilities

D) current liabilities

E) current assets

A) the budget variance

B) investment assets

C) long-term liabilities

D) current liabilities

E) current assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

58

During the last month,Mary Jane had expenses of $5,000 and an increase in net worth of $700.This means Mary Jane's income for the month was:

A) $700.

B) $4,300.

C) $5,000.

D) $5,700.

E) $5,200.

A) $700.

B) $4,300.

C) $5,000.

D) $5,700.

E) $5,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

59

A cash flow statement reports a person's or a family's

A) net worth.

B) current income and payments.

C) plan for spending.

D) value of investments.

E) balance of savings.

A) net worth.

B) current income and payments.

C) plan for spending.

D) value of investments.

E) balance of savings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

60

Total earnings of a person less deductions for taxes and other items is called

A) budgeted income.

B) gross pay.

C) net worth.

D) total revenue.

E) take-home pay.

A) budgeted income.

B) gross pay.

C) net worth.

D) total revenue.

E) take-home pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

61

Jennifer,a recent Concordia graduate,is struggling to pay off her $15,000 student loan.She has found employment with an international firm.Jennifer manages to balance her cash flows,but has only $500 in a chequing account to pay incoming bills.Her monthly after-tax cash inflows and expenses equal $2,000.What should be Jennifer's number one financial goal?

A) Pay off her student loan immediately.

B) Start an emergency fund.

C) Contribute to an RRSP.

D) Purchase life insurance coverage.

E) Accumulate funds for a down payment on a home

A) Pay off her student loan immediately.

B) Start an emergency fund.

C) Contribute to an RRSP.

D) Purchase life insurance coverage.

E) Accumulate funds for a down payment on a home

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

62

When it comes to savings,most Canadians

A) have an adequate emergency fund.

B) use several different savings techniques.

C) find saving difficult.

D) keep substantial amounts in a regular savings account.

E) reduce the amount they save during their working life.

A) have an adequate emergency fund.

B) use several different savings techniques.

C) find saving difficult.

D) keep substantial amounts in a regular savings account.

E) reduce the amount they save during their working life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

63

Janice spends a total of $1,500 a month to cover all living expenses.Which of the following would represent the appropriate emergency fund?

A) $1,500 to $4,500

B) $3,000 to $7,500

C) $4,500 to $9,000

D) $5,000 to $10,000

E) $6,000 to $12,000

A) $1,500 to $4,500

B) $3,000 to $7,500

C) $4,500 to $9,000

D) $5,000 to $10,000

E) $6,000 to $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

64

Describe the four budgeting strategies suggested for dual income households.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

65

Changes in the cost of living are

A) different in various geographic areas.

B) the same for different locations.

C) constant from month to month.

D) the same for all goods and services.

E) not a factor when preparing a budget.

A) different in various geographic areas.

B) the same for different locations.

C) constant from month to month.

D) the same for all goods and services.

E) not a factor when preparing a budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Crown family has a difficult time staying on a budget.In an effort to actually see what funds are available for various expenses,a ____________ budget would be most appropriate.

A) written

B) computerized

C) physical

D) deficit

E) mental

A) written

B) computerized

C) physical

D) deficit

E) mental

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

67

Janice spends a total of $1,500 a month to cover all living expenses.Which of the following would represent the minimum acceptable emergency fund?

A) Zero

B) $1,500

C) $4,500

D) $9,000

E) $3,000

A) Zero

B) $1,500

C) $4,500

D) $9,000

E) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

68

What are the main components of a personal balance sheet and a cash flow statement? What is the main purpose of each of these personal financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

69

If a family planned to spend $370 for food during March but only spent $348,this difference would be referred to as a

A) surplus.

B) deficit.

C) fixed living expense.

D) budget reduction.

E) contribution to net worth.

A) surplus.

B) deficit.

C) fixed living expense.

D) budget reduction.

E) contribution to net worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

70

A five-year non-redeemable GIC is classified as a(n)_______________ asset on the personal balance sheet.

A) liquid

B) investment

C) personal

D) business

E) marketable

A) liquid

B) investment

C) personal

D) business

E) marketable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

71

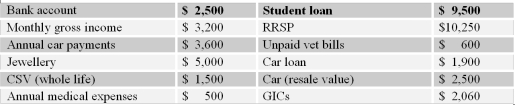

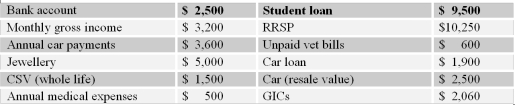

Given the following,what is the individual's net worth?

A) $11,810

B) $11,410

C) $10,910

D) $6,810

E) $6,500

A) $11,810

B) $11,410

C) $10,910

D) $6,810

E) $6,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

72

The difference between the amount budgeted and the actual amount is called a

A) financial plan.

B) current liability.

C) change in net worth.

D) budget variance.

E) variable living expense.

A) financial plan.

B) current liability.

C) change in net worth.

D) budget variance.

E) variable living expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

73

A budget deficit would result when a person's or family's

A) actual expenses are less than planned expenses.

B) actual expenses are greater than planned expenses.

C) actual expenses equal planned expenses.

D) assets exceed liabilities.

E) net worth decreases.

A) actual expenses are less than planned expenses.

B) actual expenses are greater than planned expenses.

C) actual expenses equal planned expenses.

D) assets exceed liabilities.

E) net worth decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

74

What types of financial records and documents should be kept in a safety deposit box?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

75

____________ is the recommended budgeting strategy for dual income households where the two partners have trust and shared values and goals?

A) Pooled income

B) 50/50

C) Proportionate contributions

D) Sharing the bills

E) Sharing goals

A) Pooled income

B) 50/50

C) Proportionate contributions

D) Sharing the bills

E) Sharing goals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck