Deck 12: Annuities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

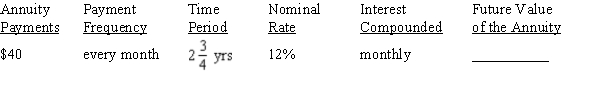

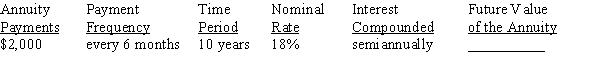

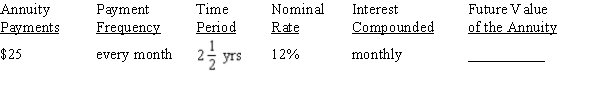

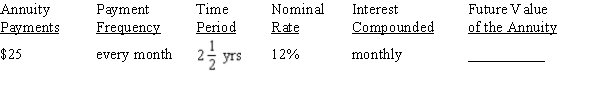

سؤال

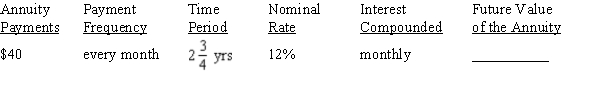

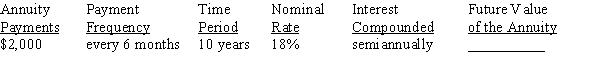

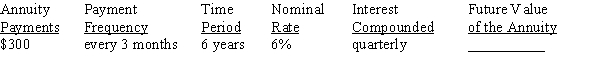

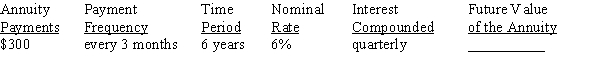

سؤال

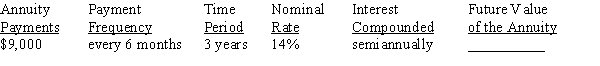

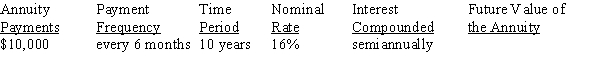

سؤال

سؤال

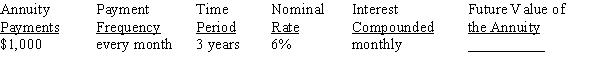

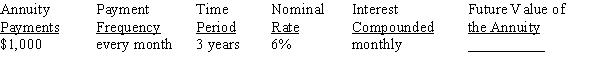

سؤال

سؤال

سؤال

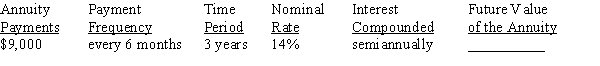

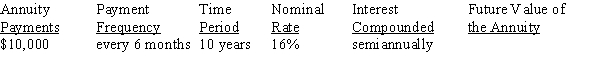

سؤال

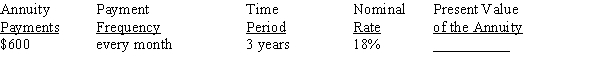

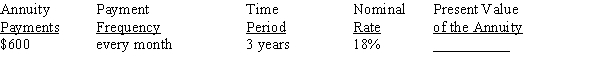

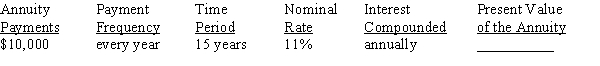

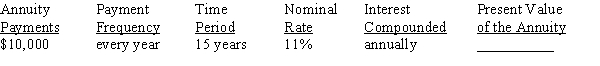

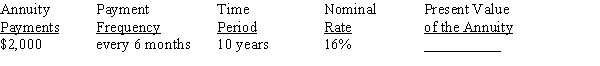

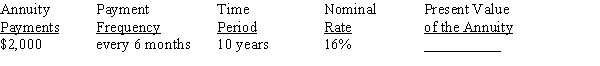

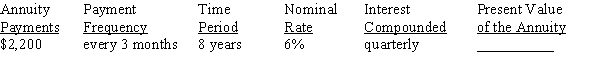

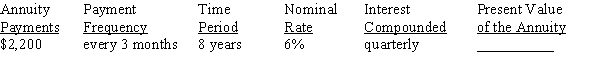

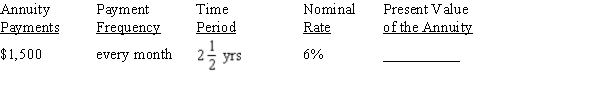

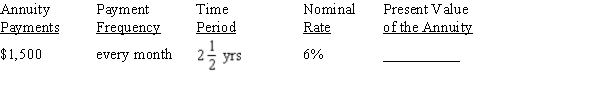

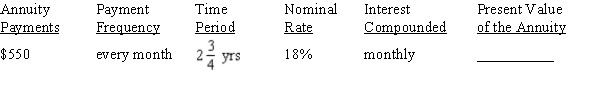

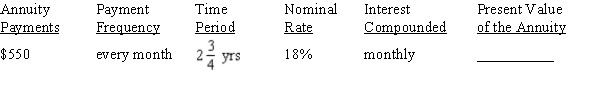

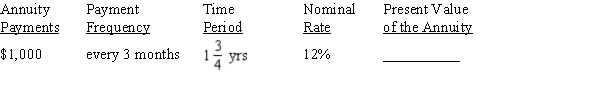

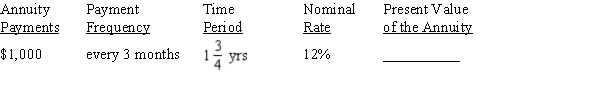

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

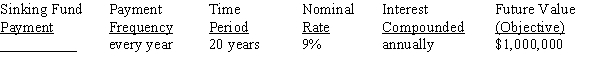

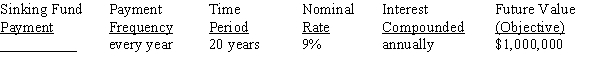

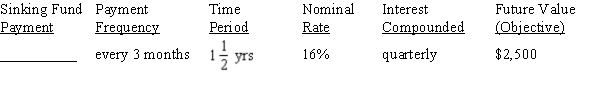

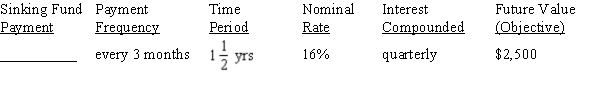

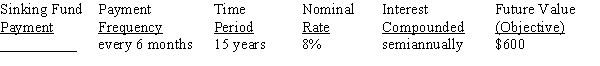

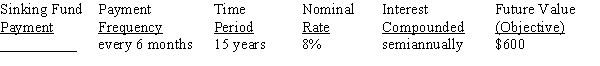

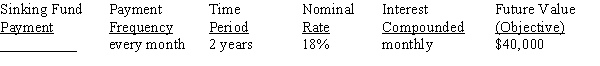

سؤال

سؤال

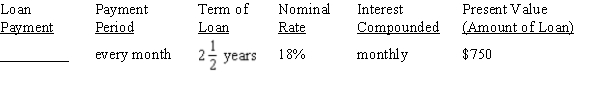

سؤال

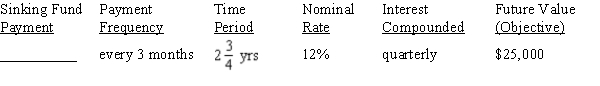

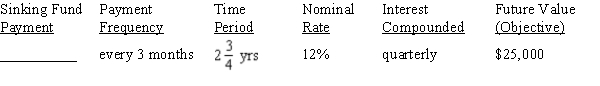

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

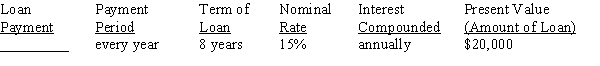

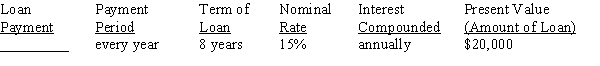

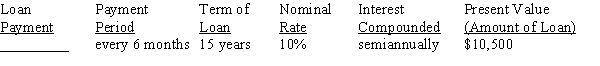

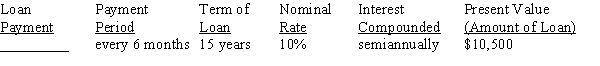

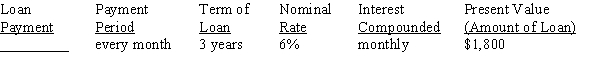

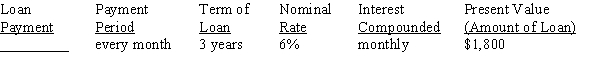

سؤال

سؤال

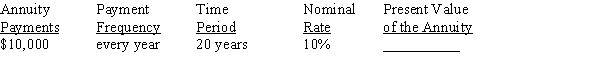

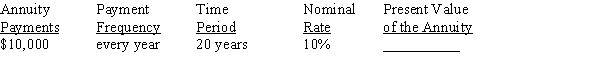

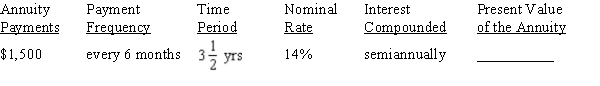

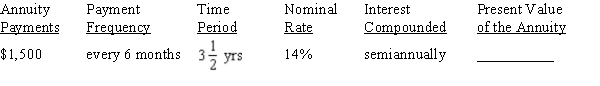

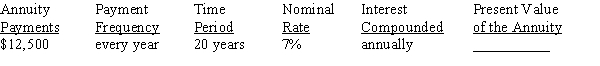

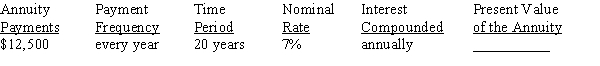

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/135

العب

ملء الشاشة (f)

Deck 12: Annuities

1

When the annuity payment is made at the end of each period, it is known as an ____________________ annuity.

ordinary

2

A(n) ____________________ is the payment or receipt of equal cash amounts per period for a specified amount of time.

annuity

3

Kia deposited $1,200, at the BEGINNING of each year for 30 years in a credit union account. If the account paid 12% interest, compounded annually, use the appropriate formula to find the future value of her account.

A) $311,097.91

B) $288,399.20

C) $298,569.33

D) $324,351.13

A) $311,097.91

B) $288,399.20

C) $298,569.33

D) $324,351.13

$324,351.13

4

____________________ annuities are those in which the annuity payments and compounding periods do not coincide.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

5

Benigno deposited $1,000, at the END of every month for 3 years in a savings account. If the account paid 12% interest, compounded monthly, use Table 12-1 from your text to find the future value of his account.

A) $3,374.40

B) $4,320.00

C) $40,320.00

D) $43,076.88

A) $3,374.40

B) $4,320.00

C) $40,320.00

D) $43,076.88

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

6

____________________ annuities are annuities based on an uncertain time period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

7

Annuities ____________________ are annuities that have a specified number of time periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

8

Lidia deposits $900 at the END of each year for 9 years in a savings account. The account pays 8% interest, compounded annually. Lidia calculates that the future value of the ordinary annuity is $11,238.80. What would be the future value if deposits are made at the BEGINNING of each period rather than the END?

A) $11,238.80

B) $12,137.90

C) $12,960.00

D) $13,037.91

A) $11,238.80

B) $12,137.90

C) $12,960.00

D) $13,037.91

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

9

Shiraz deposited $500 at the END of each year for 18 years in a savings account. If the account paid 5% interest, compounded annually, use Table 12-1 from your text to find the future value of his account.

A) $12,822.71

B) $12,920.19

C) $14,066.19

D) $15,452.83

A) $12,822.71

B) $12,920.19

C) $14,066.19

D) $15,452.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

10

Use Table 12-1 of your text to find the future value of $1,300 deposited at the BEGINNING of every three months, for 3 years if the bank pays 12% interest, compounded quarterly.

A) $18,789.65

B) $19,955.20

C) $19,003.13

D) $20,830.22

A) $18,789.65

B) $19,955.20

C) $19,003.13

D) $20,830.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

11

Peter deposits $500 at the END of every month for 3 years in a savings account. The account pays 12% interest, compounded monthly. Peter calculates that the future value of the ordinary annuity is $21,538.44. What would be the future value if deposits were made at the BEGINNING of each period rather than the END? (Calculate the future value by formula)

A) $21,753.83

B) $25,734.44

C) $22,273.44

D) $22,349.85

A) $21,753.83

B) $25,734.44

C) $22,273.44

D) $22,349.85

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

12

____________________ are accounts used to set aside equal amounts of money at the end of each period, at compound interest, for the purpose of saving for a future obligation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

13

The amount that must be deposited now at compound interest to yield a series of equal periodic payments is the ____________________ value of an annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

14

The ____________________ value of an annuity is also known as the amount of an annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

15

Lorna deposited $1,500, at the BEGINNING of every six months for 12 years, in an account at her credit union. If the account paid 6% interest, compounded semiannually, use Table 12-1 from your text to find the future value of her account.

A) $50,549.75

B) $51,815.72

C) $51,930.92

D) $53,188.89

A) $50,549.75

B) $51,815.72

C) $51,930.92

D) $53,188.89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

16

John deposited $2,000, at the END of every month for 2 years in a savings account. If the account paid 6% interest, compounded monthly, use Table 12-1 from your text to find the future value of his account.

A) $53,374.40

B) $44,320.00

C) $50,320.10

D) $50,863.92

A) $53,374.40

B) $44,320.00

C) $50,320.10

D) $50,863.92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

17

Use Table 12-1 of your text to find the future value of $300 deposited at the BEGINNING of every year, for 15 years if the bank pays 6% interest compounded annually.

A) $3,500.00

B) $6,982.79

C) $7,401.76

D) $4,770.00

A) $3,500.00

B) $6,982.79

C) $7,401.76

D) $4,770.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

18

____________________ is the opposite of a sinking fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

19

When the payment is made at the beginning of each period, it is called an ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

20

A(n) ____________________ annuity is one in which the number of compounding periods per year coincides with the number of annuity payments per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

21

Kirk wishes to accumulate $10,000 in 3 years for a down payment on a house. Use Table 12-1 from your text to find the sinking fund payment he would need to make at the END of every month, at 6% interest compounded monthly.

A) $2,773.58

B) $3,733.58

C) $254.22

D) $356.59

A) $2,773.58

B) $3,733.58

C) $254.22

D) $356.59

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

22

Second Hand Software needs to accumulate $12,000 in 3 years to meet future needs. What sinking fund payment would they need to make at the end of each year, at 6% interest compounded annually? (Use Table 12-1 from your text)

A) $4,110.34

B) $3,769.32

C) $4,392.65

D) $4,634.15

A) $4,110.34

B) $3,769.32

C) $4,392.65

D) $4,634.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

23

Linens Plus wishes to pay off a debt of $15,000 in 2 years. What amortization payment would they need to make every month, at 12% interest compounded monthly? (Use Table 12-2 from your text)

A) $625.00

B) $664.81

C) $684.10

D) $706.10

A) $625.00

B) $664.81

C) $684.10

D) $706.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

24

Ryan must pay off a loan of $3,500 in 5 years. Use the appropriate formula to find the amortization payment he would need to make each six months, at 12% interest compounded semiannually.

A) $475.54

B) $970.93

C) $195.69

D) $394.89

A) $475.54

B) $970.93

C) $195.69

D) $394.89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

25

What amortization payment would you need to make every month, at 12% interest compounded monthly, to pay off a loan of $8,500 in 3 years? (Use Table 12-2 from your text)

A) $3,538.97

B) $282.32

C) $197.32

D) $279.53

A) $3,538.97

B) $282.32

C) $197.32

D) $279.53

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

26

Jon wishes to accumulate $4,500 in 8 years for a long vacation. Use Table 12-1 from your text to find the sinking fund payment he would need to make at the END of every six months, at 4% interest compounded semiannually.

A) $241.43

B) $233.97

C) $207.63

D) $344.10

A) $241.43

B) $233.97

C) $207.63

D) $344.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

27

Best Ribs wishes to pay off a debt of $40,000 in 7 years. What amortization payment would they need to make each six months, at 6% interest compounded semiannually? (Use Table 12-2 from your text)

A) $3,541.05

B) $3,910.63

C) $2,727.79

D) $2,955.32

A) $3,541.05

B) $3,910.63

C) $2,727.79

D) $2,955.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

28

What amortization payment would you need to make each year, at 12% interest compounded annually, to pay off a loan of $4,000 in 6 years? (Use Table 12-2 from your text)

A) $477.11

B) $486.45

C) $972.90

D) $954.22

A) $477.11

B) $486.45

C) $972.90

D) $954.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

29

Use the appropriate formula to find how much you should deposit now at 7% interest, compounded annually, to yield an annuity payment of $800 at the BEGINNING of each year, for 14 years.

A) $6,996.37

B) $7,870.92

C) $7,486.12

D) $8,421.89

A) $6,996.37

B) $7,870.92

C) $7,486.12

D) $8,421.89

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use Table 12-2 in your text to find how much should be deposited now at 8% interest, compounded semiannually, to yield an annuity payment of $400 at the END of each 6 months, for 1 year.

A) $859.24

B) $754.44

C) $645.59

D) $923.72

A) $859.24

B) $754.44

C) $645.59

D) $923.72

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

31

Mechanic's Hardware needs to accumulate $41,000 in 3 years to purchase new equipment. What sinking fund payment would they need to make at the END of each month, at 6% interest compounded monthly? (Use Table 12-1 from your text)

A) $2,111.35

B) $1,885.21

C) $1,042.30

D) $1,399.56

A) $2,111.35

B) $1,885.21

C) $1,042.30

D) $1,399.56

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

32

Your bank pays 9% interest, compounded annually. Use the appropriate formula to find how much you should deposit now to yield an annuity payment of $800 at the END of each year, for 10 years.

A) $5,134.13

B) $6,099.86

C) $5,596.20

D) $6,454.28

A) $5,134.13

B) $6,099.86

C) $5,596.20

D) $6,454.28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

33

Hot Wheels Depot needs to accumulate $25,000 in 6 years to purchase new equipment. What sinking fund payment would they need to make at the END of every three months, at 8% interest compounded quarterly? (Use Table 12-1 from your text)

A) $821.78

B) $679.42

C) $545.96

D) $620.42

A) $821.78

B) $679.42

C) $545.96

D) $620.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use Table 12-2 from your text to find how much should be deposited now at 8% interest, compounded semiannually, to yield an annuity payment of $400 at the BEGINNING of each six months, for 2 years.

A) $1,510.04

B) $1,110.04

C) $1,451.96

D) $1,354.22

A) $1,510.04

B) $1,110.04

C) $1,451.96

D) $1,354.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

35

Arun wants to have $500 at the END of every year for 20 years. The bank pays 11% interest, compounded annually. Arun calculates that the present value of the ordinary annuity is $3,981.67. What would be the present value if payments were to be received at the BEGINNING of every period rather than the END?

A) $5,183.91

B) $5,525.98

C) $4,043.26

D) $4,419.65

A) $5,183.91

B) $5,525.98

C) $4,043.26

D) $4,419.65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

36

Connie wants to have an annuity payment of $2,000 at the END of every three months. How much should she deposit now at 6% interest, compounded quarterly, to yield this payment for 3 years? (Use Table 12-2 in your text)

A) $21,815.02

B) $20,786.85

C) $21,577.10

D) $22,783.26

A) $21,815.02

B) $20,786.85

C) $21,577.10

D) $22,783.26

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

37

Your bank pays 8% interest, compounded quarterly. Use Table 12-2 from your text to find how much you should deposit now to yield an annuity payment of $1,300 at the BEGINNING of each three months, for 2 years.

A) $9,713.59

B) $10,823.13

C) $9,523.13

D) $8,413.59

A) $9,713.59

B) $10,823.13

C) $9,523.13

D) $8,413.59

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

38

Jeff wishes to accumulate $5,000 in 5 years. Use the appropriate formula to find the sinking fund payment she would need to make at the end of each year, at 5% interest, compounded annually.

A) $989.94

B) $917.47

C) $904.87

D) $949.87

A) $989.94

B) $917.47

C) $904.87

D) $949.87

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

39

Robert wants to have $2,300 at the END of every three months for 8 years. The bank pays 8% interest, compounded quarterly. Robert calculates that the present value of the ordinary annuity is $53,977.16. What would be the present value if payments were to be received at the BEGINNING of every period rather than the END? (Use Table 12-2 from your text)

A) $52,016.20

B) $55,056.71

C) $55,344.83

D) $55,986.21

A) $52,016.20

B) $55,056.71

C) $55,344.83

D) $55,986.21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

40

Suppose that your bank pays 10% interest, compounded semiannually. Use Table 12-2 of your text to find how much should be deposited now to yield an annuity payment of $400 at the END of every six months, for 4 years.

A) $2,585.28

B) $3,819.64

C) $1,267.95

D) $1,856.40

A) $2,585.28

B) $3,819.64

C) $1,267.95

D) $1,856.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

41

What sinking fund payment would you need to make at the END of each three months, at 12% interest compounded quarterly, to amount to $3,500 in 4 years? (Use Table 12-1 from your text)

A) $232.93

B) $732.32

C) $481.05

D) $173.64

A) $232.93

B) $732.32

C) $481.05

D) $173.64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

42

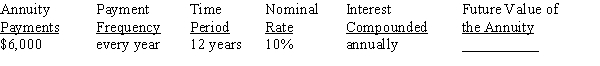

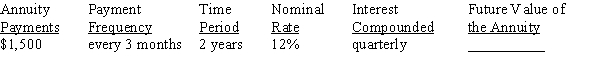

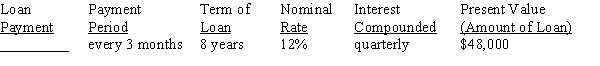

Use Table 12-1 in your text to calculate the future value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

43

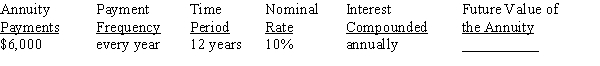

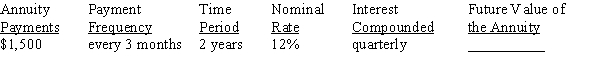

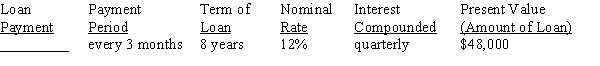

Use Table 12-1 from your text to calculate the future value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

44

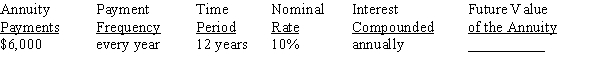

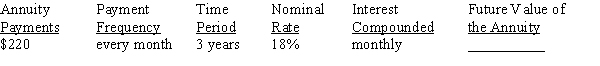

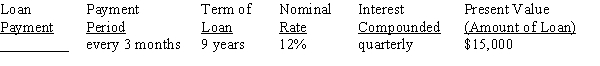

Use Table 12-1 from your text to calculate the future value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

45

Leon's Plumbing wishes to pay off a debt of $21,000 in 6 years. What amortization payment would they need to make every three months, at 6% interest compounded quarterly? (Use Table 12-2 from your text)

A) $722.57

B) $1,032.91

C) $1,048.41

D) $733.41

A) $722.57

B) $1,032.91

C) $1,048.41

D) $733.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use Table 12-1 from your text to calculate the future value of the ordinary annuity, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use Table 12-1 from your text to calculate the future value of the ordinary annuity, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the appropriate formula to find how much you should deposit now at 9% interest, compounded annually, to yield an annuity payment of $1,200 at the BEGINNING of each year, for 18 years.

A) $10,252.36

B) $7,870.92

C) $7,486.12

D) $11,452.36

A) $10,252.36

B) $7,870.92

C) $7,486.12

D) $11,452.36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

49

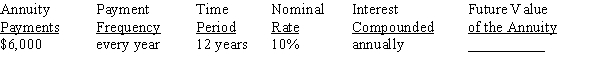

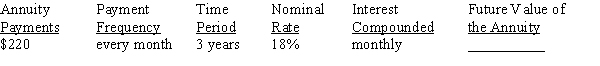

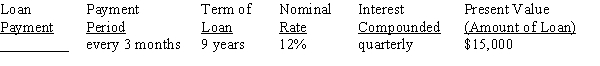

Use Table 12-1 from your text to calculate the future value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use Table 12-2 from your text to calculate the present value of the ordinary annuity, rounding to the nearest cent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use Table 12-1 from your text to calculate the future value of the ordinary annuity, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use Table 12-1 from your text to calculate the future value of the ordinary annuity, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the appropriate formula to find the amortization payment you would need to make each three months, at 8% interest compounded quarterly, to pay off a loan of $8,000 in 6 years.

A) $1,730.52

B) $422.97

C) $1,288.29

D) $316.61

A) $1,730.52

B) $422.97

C) $1,288.29

D) $316.61

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

54

Find the amortization payment you would need to make every six months, at 6% interest compounded semiannually, to pay off a loan of $4,000 in 6 years. (Use Table 12-2 from text)

A) $767.41

B) $813.45

C) $390.14

D) $401.85

A) $767.41

B) $813.45

C) $390.14

D) $401.85

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use Table 12-1 from your text to calculate the future value of the ordinary annuity, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

56

Use Table 12-1 from your text to calculate the future value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

57

What amortization payment would you need to make each year, at 14% interest compounded semiannually, to pay off a loan of $24,000 in 4 years? (Use Table 12-2 from your text)

A) $5,000.00

B) $4,086.45

C) $4,019.23

D) $954.22

A) $5,000.00

B) $4,086.45

C) $4,019.23

D) $954.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

58

Find the sinking fund payment you would need to make at the end of each year, at 5% interest compounded annually, to amount to $8,000 in 2 years. (Use the appropriate formula)

A) $2,719.86

B) $1,537.27

C) $2,128.56

D) $3,902.44

A) $2,719.86

B) $1,537.27

C) $2,128.56

D) $3,902.44

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

59

Dempsey Electric wishes to pay off a debt of $28,000 in 3 years. What amortization payment would they need to make every month, at 12% interest compounded monthly? (Use Table 12-2 from your text)

A) $625.00

B) $844.12

C) $930.00

D) $706.10

A) $625.00

B) $844.12

C) $930.00

D) $706.10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

60

Use Table 12-1 from your text to calculate the future value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

61

For the sinking funds, use Table 12-1 from your text to calculate the amount of the periodic payments needed to amount to the financial objective (future value of the annuity), rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

62

Use Table 12-2 from your text to calculate the present value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

63

Use Table 12-2 from your text to calculate the amount of the periodic payment required to amortize (pay off) the loans, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

64

For the sinking funds, use Table 12-1 from your text to calculate the amount of the periodic payments needed to amount to the financial objective (future value of the annuity), rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use Table 12-2 from your text to calculate the present value of the ordinary annuity, rounding to the nearest cent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

66

Use Table 12-2 from your text to calculate the amount of the periodic payment required to amortize (pay off) the loans, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

67

For the sinking funds, use Table 12-1 from your text to calculate the amount of the periodic payments needed to amount to the financial objective (future value of the annuity), rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use Table 12-2 from your text to calculate the present value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

69

Use Table 12-2 from your text to calculate the amount of the periodic payment required to amortize (pay off) the loans, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

70

For the sinking funds, use Table 12-1 from your text to calculate the amount of the periodic payments needed to amount to the financial objective (future value of the annuity), rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

71

Use Table 12-2 from your text to calculate the amount of the periodic payment required to amortize (pay off) the loans, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

72

For the sinking funds, use Table 12-1 from your text to calculate the amount of the periodic payments needed to amount to the financial objective (future value of the annuity), rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use Table 12-2 in your text to calculate the amount of the periodic payment required to amortize (pay off) the loans, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

74

Use Table 12-2 from your text to calculate the amount of the periodic payment required to amortize (pay off) the loans, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use Table 12-2 from your text to calculate the present value of the ordinary annuity, rounding to the nearest cent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

76

Use Table 12-2 from your text to calculate the present value of the ordinary annuity, rounding to the nearest cent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

77

Use Table 12-2 from your text to calculate the present value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

78

Use Table 12-2 from your text to calculate the present value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

79

Use Table 12-2 from your text to calculate the present value of the ordinary annuity, rounding to the nearest cent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck

80

Use Table 12-2 from your text to calculate the present value of the annuity due, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 135 في هذه المجموعة.

فتح الحزمة

k this deck