Deck 9: Payroll

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

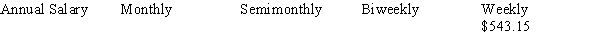

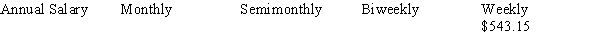

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

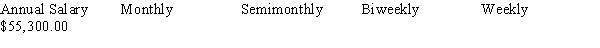

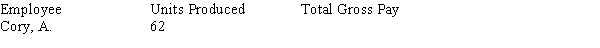

سؤال

سؤال

سؤال

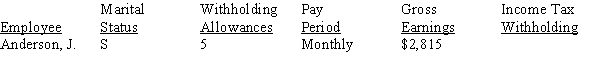

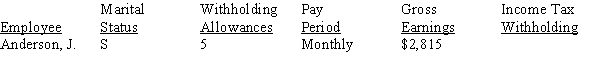

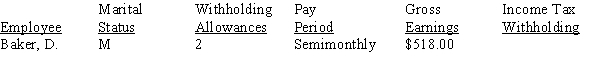

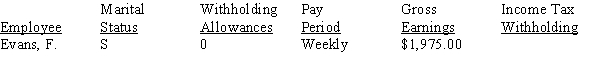

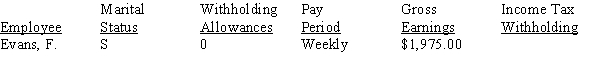

سؤال

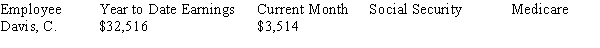

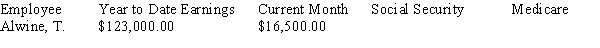

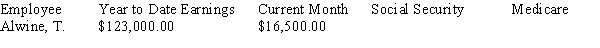

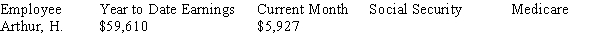

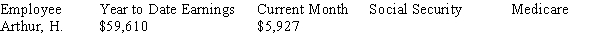

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

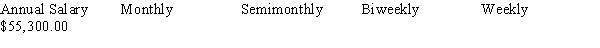

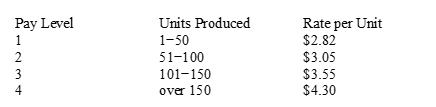

سؤال

سؤال

سؤال

سؤال

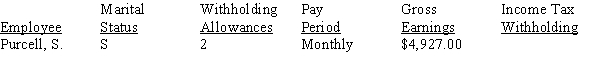

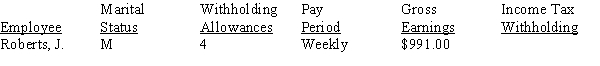

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/132

العب

ملء الشاشة (f)

Deck 9: Payroll

1

Saira's weekly salary is $1,063.46. What would her gross salary be if it were on a semimonthly basis? (Round your answer to the nearest cent)

A) $2,126.92

B) $50,089.92

C) $2,304.16

D) $2,043.46

A) $2,126.92

B) $50,089.92

C) $2,304.16

D) $2,043.46

$2,126.92

2

Lee Lu is paid $12.50 per hour, with overtime pay of time-and-a-half for Saturday work and double time for Sunday. Calculate her gross pay if she worked 35 hours during the week, 5 hours Saturday and 3 hours Sunday. (Round your answer to the nearest cent)

A) $575.00

B) $587.50

C) $606.25

D) $750.00

A) $575.00

B) $587.50

C) $606.25

D) $750.00

$606.25

3

The ____________________ pay schedule requires that wages be paid every two weeks or twenty-six paychecks per year.

biweekly

4

The ____________________ payroll tax has no annual maximum salary limit for the employee and the employer share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

5

A(n) ____________________ is a commission paid in advance of sales and later deducted from the commissions earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

6

Walt's monthly salary is $6,962.50. What would be his equivalent semimonthly salary?

A) $2,451.92

B) $2,375.96

C) $2,840.41

D) $3,481.25

A) $2,451.92

B) $2,375.96

C) $2,840.41

D) $3,481.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

7

Jessica has a job making baskets. Last week she made a total of 226 baskets. Calculate her gross pay if she is paid on the following differential piecework schedule:

A) $1,604.60

B) $1,839.64

C) $1,730.44

D) $2,210.28

A) $1,604.60

B) $1,839.64

C) $1,730.44

D) $2,210.28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

8

Rai's base pay rate is $9.00 per hour, with overtime pay of time-and-a-half, and double-time for holidays. Calculate her gross pay if she worked 6 holiday hours in addition to 39.5 hours Monday through Saturday. (Round your answer to the nearest cent)

A) $463.50

B) $408.00

C) $364.00

D) $340.50

A) $463.50

B) $408.00

C) $364.00

D) $340.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

9

Frank's base pay rate is $15.50 per hour, with overtime pay of time-and-a-half, and double-time for holidays. Calculate her gross pay if she worked 6.5 holiday hours in addition to 38.5 hours Monday through Saturday. (Round your answer to the nearest cent)

A) $643.75

B) $359.50

C) $823.50

D) $798.25

A) $643.75

B) $359.50

C) $823.50

D) $798.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

10

Workers who manufacture shirts are sometimes paid based on the number of shirts they produce. Compute Lyle's gross pay if she made 380 shirts. The rate per shirt is given by the differential piecework schedule below:

A) $2,586.00

B) $2,650.20

C) $2,753.20

D) $2,989.86

A) $2,586.00

B) $2,650.20

C) $2,753.20

D) $2,989.86

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

11

The term ____________________ earnings means the total amount of earnings due an employee for work performed before payroll deductions are withheld.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

12

____________________ is a method of compensation primarily used to pay employees who sell a company's goods or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

13

The ____________________ payroll tax that is also known as the ____________________ tax has an annual maximum salary limit for both the employee and employer shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

14

FUTA is a federal tax that is paid by employers for each employee to provide ____________________ compensation to workers who have lost their jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

15

____________________ are earnings for routine or manual work, usually based on the number of hours worked.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

16

Wind Song is paid $15.50 per hour, with overtime pay of time-and-a-half for Saturday work and double time for Sunday. Calculate her gross pay if she worked 38 hours during the week (Monday through Friday) and 8 hours Sunday. (Round your answer to the nearest cent)

A) $587.55

B) $837.00

C) $705.25

D) $535.75

A) $587.55

B) $837.00

C) $705.25

D) $535.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

17

A(n) ____________________ is a fixed gross amount of pay, equally distributed over periodic payments, without regard to the number of hours worked.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

18

Kate's base pay rate is $12.50 per hour, with overtime paid at time-and-a-half. Find her gross pay if she worked 45.5 hours Monday through Saturday. (Round your answer to the nearest cent)

A) $603.13

B) $568.75

C) $613.03

D) $630.13

A) $603.13

B) $568.75

C) $613.03

D) $630.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

19

A(n) ____________________ pay rate schedule is based on production output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

20

Workers who manufacture belts are sometimes paid based on the number of belts they produce. Compute Ada's gross pay if she made 754 belts. The rate per belt is given by the differential piecework schedule below:

A) $1,092.80

B) $3,644.82

C) $2,452.82

D) $4,321.82

A) $1,092.80

B) $3,644.82

C) $2,452.82

D) $4,321.82

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

21

Cross receives a monthly paycheck from a bakery plant of $3,500.30. She is married and is entitled to 3 withholding allowances. How much is her taxable income? Use the percentage method tables in Exhibits 9-1 and 9-2 from your text.

A) $2,462.90

B) $3,044.06

C) $3,079.16

D) $3,289.73

A) $2,462.90

B) $3,044.06

C) $3,079.16

D) $3,289.73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Monty Corporation has a staff of sales people who are paid a monthly salary of $1,600.00 plus an incremental commission based on the table below. If Sally sells $29,700.00, what is her total gross pay for the month?

A) $4,414.60

B) $4,114.60

C) $4,214.60

D) $4,314.60

A) $4,414.60

B) $4,114.60

C) $4,214.60

D) $4,314.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

23

Family Flowers employs 17 people, of whom 14 earn gross pay of $640.00 each and 3 earn gross pay of $720.00 each on a weekly basis. What is the employer's share of total social security and Medicare taxes for the first quarter of the year? (Social security tax is 6.2% of wages up to $128,400. Medicare tax is 1.45% of all wages.)

A) $640.00

B) $720.00

C) $850.68

D) $11,058.84

A) $640.00

B) $720.00

C) $850.68

D) $11,058.84

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

24

Compute Darryl's total social security and Medicare taxes for the third quarter, if she is self-employed and earns $1,020.00 on a weekly basis.

A) $2,028.78

B) $1,014.39

C) $1,269.45

D) $1,885.58

A) $2,028.78

B) $1,014.39

C) $1,269.45

D) $1,885.58

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

25

Carolyne is paid $1,000.00 biweekly. This year, to date, she has earned $25,300.00. What will be the total deduction for Social Security and Medicare taxes on her next paycheck? (Social Security tax is 6.2% of gross wages up to $128,400. Medicare tax is 1.45% of all gross wages.)

A) $155.80

B) $94.60

C) $76.50

D) $213.05

A) $155.80

B) $94.60

C) $76.50

D) $213.05

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

26

Naomi received weekly wages of $1,185.58. She is married and is entitled to 7 withholding allowances. How much income tax will be withheld, based on the percentage method tables in Exhibits 9-1 and 9-2 from your text?

A) $0

B) $20.29

C) $41.27

D) $82.66

A) $0

B) $20.29

C) $41.27

D) $82.66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

27

Find the amount of income tax withheld from Sun Jung's monthly paycheck of $8,612.50 using the percentage method tables in Exhibits 9-1 and 9-2 from your text. Sun Jung is single and claims 2 withholding allowances.

A) $1,156.36

B) $1,279.24

C) $1,351.22

D) $1,754.27

A) $1,156.36

B) $1,279.24

C) $1,351.22

D) $1,754.27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

28

Mary earned $41,258.75 for the past calendar year. How much did she pay for the year in social security and Medicare taxes? (Social Security Tax is 6.2% of gross wages up to $117,000. Medicare Tax is 1.45% of all gross wages.)

A) $2,931.25

B) $3,225.31

C) $3,156.29

D) $3,425.31

A) $2,931.25

B) $3,225.31

C) $3,156.29

D) $3,425.31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

29

What will be the total deduction for social security and Medicare taxes on Rony's next semimonthly paycheck of $3,960.00, if she has already earned $42,560.00 this year? (Social security tax is 6.2% of gross wages up to $117,00. Medicare tax is 1.45% of all gross wages.)

A) $283.52

B) $302.94

C) $101.87

D) $242.92

A) $283.52

B) $302.94

C) $101.87

D) $242.92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

30

Robert works for Southern Consulting as a sales executive. He is paid a monthly salary of $3,350.00 plus a straight commission of 4.3% on all sales over $10,100.00. If he sells $15,300.00, what is his total gross pay for the month?

A) $3,573.60

B) $3,784.30

C) $4,007.90

D) $8,550.00

A) $3,573.60

B) $3,784.30

C) $4,007.90

D) $8,550.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

31

Christopher receives gross monthly wages of $5,250.00. He is married and is entitled to 3 withholding allowances. How much income tax will be withheld, based on the percentage method tables in Exhibits 9-1 and 9-2 from your text?

A) $539.22

B) $482.57

C) $690.12

D) $787.50

A) $539.22

B) $482.57

C) $690.12

D) $787.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

32

Penny is paid a gross wage of $2,806.00 on a monthly basis. She is single and is entitled to 2 withholding allowances. How much income tax, social security, and Medicare will be withheld based on the combined wage bracket tables in Exhibits 9-3 and 9-4 from your text?

A) $429.11

B) $439.11

C) $419.11

D) $449.11

A) $429.11

B) $439.11

C) $419.11

D) $449.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

33

Compute Austin's total social security and Medicare taxes for the fourth quarter, if she is self-employed and earns $5,000.00 on a semimonthly basis. (For self-employed persons, social security tax is 12.4% of wages up to $128,400, and Medicare tax is 2.9% of all wages.)

A) $1,476.60

B) $2,295.00

C) $4,180.80

D) $4,590.00

A) $1,476.60

B) $2,295.00

C) $4,180.80

D) $4,590.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

34

Manny is paid $915 on a weekly basis. He is married and is entitled to 1 withholding allowance. How much income, social security, and Medicare taxes will be withheld, based on the combined wage bracket tables in Exhibits 9-3 and 9-4 from your text?

A) $147.48

B) $157.48

C) $137.38

D) $167.38

A) $147.48

B) $157.48

C) $137.38

D) $167.38

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

35

As a sales person for Fresh Flowers, Carlos is paid an incremental commission based on the table below. If he sells $12,900.00, what is his total gross pay?

A) $623.70

B) $644.59

C) $657.90

D) $748.90

A) $623.70

B) $644.59

C) $657.90

D) $748.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

36

Cazz receives a semimonthly paycheck from a jazz club of $4,500.00. He is married and is entitled to 1 withholding allowance. Using the percentage method, calculate the amount of income tax that should be withheld from his paycheck each pay period. Use tables in Exhibits 9-1 and 9-2 from your text.

A) $507.76

B) $931.41

C) $650.55

D) $630.54

A) $507.76

B) $931.41

C) $650.55

D) $630.54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

37

The weekly payroll of Abkar Hardware includes 19 employees who earn $280.00 each. How much is the employer's share of total social security and Medicare taxes for the first quarter of the year?

A) $278.46

B) $5,290.74

C) $516.28

D) $10,581.48

A) $278.46

B) $5,290.74

C) $516.28

D) $10,581.48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

38

Find the amount of income tax withheld from Karen's semimonthly gross paycheck of $1,937.50 using the percentage method tables in Exhibits 9-1 and 9-2 from your text. Karen is married and claims 4 withholding allowances.

A) $159.50

B) $152.48

C) $97.75

D) $76.49

A) $159.50

B) $152.48

C) $97.75

D) $76.49

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

39

Frank's Factories has a staff of sales people like Anthony, who receives a monthly salary of $2,750.00 plus an incremental commission based on the table below. If he sells $27,300.00, what is his total gross pay for the month?

A) $3,930.80

B) $1,950.67

C) $3,337.14

D) $4293.60

A) $3,930.80

B) $1,950.67

C) $3,337.14

D) $4293.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

40

The SUTA rate for Worldwide Industries is 5.4% and its FUTA rate is 6.0% less the 5.4% SUTA credit. If its weekly payroll is $52,174.00 and none was for payments to employees in excess of the $7,000.00 wage base, then what are the total FUTA and SUTA taxes for the payroll?

A) $3,233.11

B) $2,764.65

C) $3,130.44

D) $6,052.19

A) $3,233.11

B) $2,764.65

C) $3,130.44

D) $6,052.19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

41

Scott Stewart is the self-employed owner of Stewart Software. His estimated annual earnings are $48,000.00 and he expects to pay 18% of this amount in income tax. What will be his quarterly estimated tax payment for the second quarter? (For self-employed persons, social security tax is 12.4% of wages up to $128,400, and Medicare tax is 2.9% of all wages.)

A) $348.00

B) $2,160.00

C) $3,996.00

D) $1,488.00

A) $348.00

B) $2,160.00

C) $3,996.00

D) $1,488.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

42

The SUTA rate for LARVA Corporation is 5.4% and its FUTA rate is 6.0% less the 5.4% SUTA credit. If its semimonthly GROSS payroll is $252,400.00 and none was for payments to employees in excess of the $7,000.00 wage base, then what are the total FUTA and SUTA taxes for the payroll?

A) $18,231.71

B) $22,219.51

C) $24,934.52

D) $15,144.00

A) $18,231.71

B) $22,219.51

C) $24,934.52

D) $15,144.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

43

The last semimonthly payroll of Capital Construction was $77,763.00 of gross wages for 49 employees. The company pays 4.9% of payroll for vacations and sick leave and $62.19 per employee for health insurance. What percent of payroll is the total cost of fringe benefits? (Round your answer to the nearest tenth of a percent)

A) 3.9%

B) 4.9%

C) 8.8%

D) 55.6%

A) 3.9%

B) 4.9%

C) 8.8%

D) 55.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

44

Compute Lenny's estimated tax payment for the third quarter. He is self-employed and he expects to earn $40,800.00 this year. His estimated income tax rate is 19%.

A) $3,202.80

B) $7,752.00

C) $2,505.33

D) $3,498.60

A) $3,202.80

B) $7,752.00

C) $2,505.33

D) $3,498.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

45

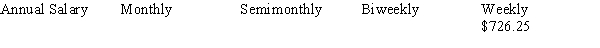

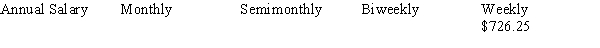

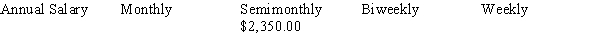

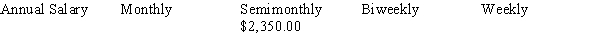

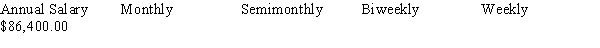

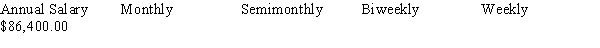

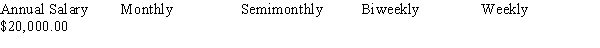

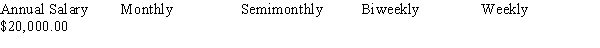

Calculate the gross earnings per pay period for the pay schedule, rounding to the nearest cent:

Annual Salary

Monthly

Semimonthly

Biweekly

Weekly

$2,400.00

Annual Salary

Monthly

Semimonthly

Biweekly

Weekly

$2,400.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

46

East Coast DVD employs 54 workers with a gross biweekly payroll of $94,126. Fringe benefits are $10.18 per employee for life insurance and 12.3% of payroll for a stock purchase plan. What is the total cost of fringe benefits?

A) $5,494.28

B) $104,126.22

C) $2357.34

D) $12,127.22

A) $5,494.28

B) $104,126.22

C) $2357.34

D) $12,127.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

47

The last semimonthly payroll of Available Temp Services was $135,600.00 of gross wages for 113 employees. Of the total, none was for payments to employees in excess of the $7,000.00 wage base. What were the total FUTA and SUTA taxes for the payroll? The company's SUTA rate is 5.4% and its FUTA rate is 6.0% less the 5.4% SUTA credit.

A) $8,136.00

B) $15,729.60

C) $7,322.40

D) $9,492.00

A) $8,136.00

B) $15,729.60

C) $7,322.40

D) $9,492.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

48

Capital Construction employs 79 workers with a gross weekly payroll of $35,076.00. Fringe benefits are $30.98 per employee for dental insurance, $9.15 per employee for discount club memberships and 6.6% of payroll for a pension plan. What is the total cost of fringe benefits?

A) $5,485.29

B) $4,245.67

C) $3,170.27

D) $2,447.42

A) $5,485.29

B) $4,245.67

C) $3,170.27

D) $2,447.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

49

Seaside Hotels employs 64 workers with a gross weekly payroll of $41,536.00. Fringe benefits are $36.33 per employee for dental insurance and $8.86 per employee for discount club memberships. What percent of payroll is the total cost of fringe benefits? (Round your answer to the nearest tenth of a percent)

A) 5.6%

B) 7.0%

C) 1.4%

D) 19.6%

A) 5.6%

B) 7.0%

C) 1.4%

D) 19.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

50

The last weekly payroll of Available Temp Services was $33,110.00 for 55 employees. The company pays 7.1% of payroll for vacations and sick leave and $58.06 per employee for health insurance. What percent of payroll is the total cost of fringe benefits? (Round your answer to the nearest tenth of a percent)

A) 9.6%

B) 10.3%

C) 16.7%

D) 18.9%

A) 9.6%

B) 10.3%

C) 16.7%

D) 18.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

51

Mount Pleasant Hotels employs 114 workers with a gross weekly payroll of $91,898. Fringe benefits are $42.29 per employee for dental insurance and $9.34 per employee for discount club memberships. What percent of payroll is the total cost of fringe benefits? (Round your answer to the nearest tenth of a percent)

A) 9.5%

B) 5.4%

C) 11.4%

D) 6.4%

A) 9.5%

B) 5.4%

C) 11.4%

D) 6.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

52

Wind Song is paid $14.70 per hour, with overtime pay of time-and-a-half for Saturday work and double time for Sunday. Calculate her gross pay if she worked 33 hours during the week (Monday through Friday) and 10 hours Sunday. (Round your answer to the nearest cent)

A) $879.10

B) $779.10

C) $632.21

D) $532.21

A) $879.10

B) $779.10

C) $632.21

D) $532.21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

53

West-Coast Publishers employs 43 workers with a gross biweekly payroll of $47,128.00. Fringe benefits are $8.31 per employee for life insurance and 10.9% of payroll for a stock purchase plan. What is the total cost of fringe benefits?

A) $5,494.28

B) $5,163.95

C) $357.33

D) $5,136.95

A) $5,494.28

B) $5,163.95

C) $357.33

D) $5,136.95

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

54

The SUTA rate for Westcoast Publishers is 5.4% and its FUTA rate is 6.0% less the 5.4% SUTA credit. If its biweekly payroll was $32,806.00 for 47 employees and none was for payments to employees in excess of the $7,000.00 wage base, then what were the total FUTA and SUTA taxes for the payroll?

A) $1,524.90

B) $1,968.36

C) $2,989.96

D) $1,476.27

A) $1,524.90

B) $1,968.36

C) $2,989.96

D) $1,476.27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

55

Gus is the self-employed owner of Four Paws Pet Supply. His estimated annual earnings are $43,280.00 and he expects to pay 18% of this amount in income tax. What will be his quarterly estimated tax payment for the second quarter?

A) $7,790.40

B) $3,603.06

C) $1,655.46

D) $2,319.00

A) $7,790.40

B) $3,603.06

C) $1,655.46

D) $2,319.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

56

Gina's base pay rate is $12.25 per hour, with overtime pay of time-and-a-half, and double-time for holidays. Calculate her gross pay if she worked 4.5 holiday hours in addition to 39 hours Monday through Saturday. (Round your answer to the nearest cent)

A) $688.00

B) $588.00

C) $532.88

D) $798.25

A) $688.00

B) $588.00

C) $532.88

D) $798.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

57

Workers who manufacture baseball caps are sometimes paid based on the number of baseball caps they produce. Compute Jillian's gross pay if she made 359 belts. The rate per belt is given by the differential piecework schedule below:

A) $1,829.95

B) $3,644.82

C) $2,829.95

D) $1,992.45

A) $1,829.95

B) $3,644.82

C) $2,829.95

D) $1,992.45

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

58

The last semimonthly payroll of Garcia Carpentry was $84,248 of gross wages for 38 employees. The company pays 5.2% of payroll for vacations and sick leave and $72.22 per employee for health insurance. What percent of payroll is the total cost of fringe benefits? (Round your answer to the nearest tenth of a percent)

A) 2.9%

B) 8.5%

C) 9.5%

D) 25.4%

A) 2.9%

B) 8.5%

C) 9.5%

D) 25.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

59

Juanita is the self-employed owner of Juanita's Linens. Her estimated annual earnings are $73,040 and she expects to pay 27% of this amount in income tax. What will be her quarterly estimated tax payment for the third quarter? (For self-employed persons, social security tax is 12.4% of wages up to $128,400, and Medicare tax is 2.9% of all wages.)

A) $2,264.24

B) $4,930.20

C) $7,723.98

D) $529.54

A) $2,264.24

B) $4,930.20

C) $7,723.98

D) $529.54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

60

Bono is the self-employed owner of JAB Consulting. Her estimated annual earnings are $68,480.00 and she expects to pay 22% of this amount in income tax. What will be her quarterly estimated tax payment for the second quarter? (For self-employed persons, social security tax is 12.4% of wages up to $128,400, and Medicare tax is 2.9% of all wages.)

A) $6,385.76

B) $3,766.40

C) $2,122.88

D) $496.48

A) $6,385.76

B) $3,766.40

C) $2,122.88

D) $496.48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

61

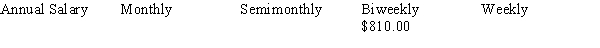

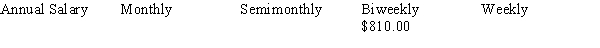

Calculate the gross earnings per pay period for the pay schedule, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

62

Calculate the gross earnings per pay period for the pay schedule, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

63

Calculate the gross earnings per pay period for the pay schedule, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

64

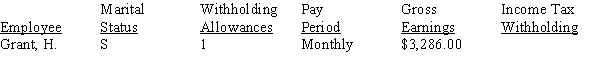

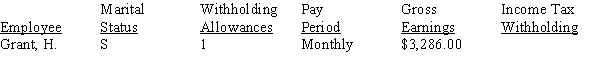

Use the percentage method of income tax calculations to complete the payroll roster:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

65

Calculate the monthly social security and Medicare withholding for the employee, rounding to nearest cent (Social security tax is 6.2% of wages up to $128,400. Medicare tax is 1.45% of all wages):

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

66

Use the combined wage bracket tables to complete the payroll roster:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

67

Use the combined wage bracket tables to complete the payroll roster:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

68

Calculate the gross earnings per pay period for the pay schedule, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

69

Calculate the gross earnings per pay period for the pay schedule, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

70

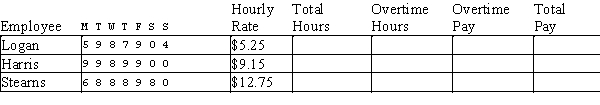

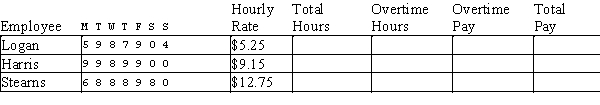

Complete the payroll record. The company pays overtime for all hours worked over 40 at the rate of time-and-a-half, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

71

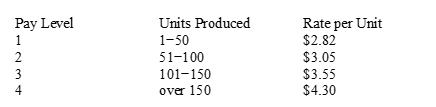

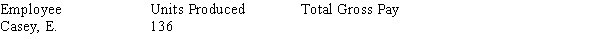

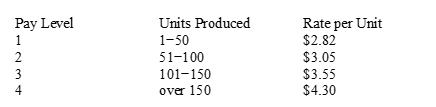

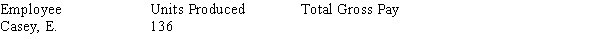

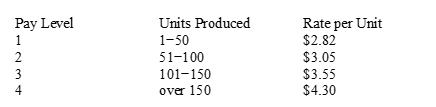

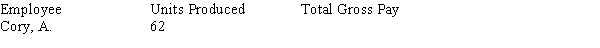

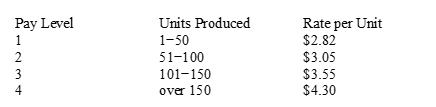

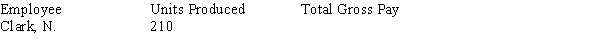

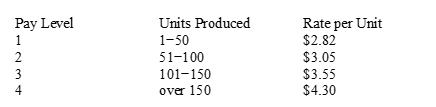

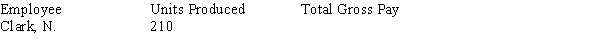

Narrative 9-1

Workers are paid on a differential piecework schedule as follows:

Refer to Narrative in your text 9-1. Calculate the amount of last week's total gross pay for the employees:

Workers are paid on a differential piecework schedule as follows:

Refer to Narrative in your text 9-1. Calculate the amount of last week's total gross pay for the employees:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

72

Calculate the gross earnings per pay period for the pay schedule, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

73

Narrative 9-1

Workers are paid on a differential piecework schedule as follows:

Refer to Narrative in your text 9-1. Calculate the amount of last week's total gross pay for the employees:

Workers are paid on a differential piecework schedule as follows:

Refer to Narrative in your text 9-1. Calculate the amount of last week's total gross pay for the employees:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

74

Calculate the gross earnings per pay period for the pay schedule, rounding to the nearest cent:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the percentage method of income tax calculations to complete the payroll roster:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

76

Use the combined wage bracket tables to complete the payroll roster:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

77

Use the percentage method of income tax calculations to complete the payroll roster:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

78

Calculate the monthly social security and Medicare withholding for the employee, rounding to nearest cent (Social security tax is 6.2% of wages up to $106,800. Medicare tax is 1.45% of all wages):

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

79

Narrative 9-1

Workers are paid on a differential piecework schedule as follows:

Refer to Narrative in your text 9-1. Calculate the amount of last week's total gross pay for the employees:

Workers are paid on a differential piecework schedule as follows:

Refer to Narrative in your text 9-1. Calculate the amount of last week's total gross pay for the employees:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck

80

Calculate the monthly social security and Medicare withholding for the employee, rounding to nearest cent (Social security tax is 6.2% of wages up to $106,800. Medicare tax is 1.45% of all wages):

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 132 في هذه المجموعة.

فتح الحزمة

k this deck