Deck 5: Inventory

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

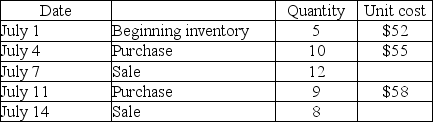

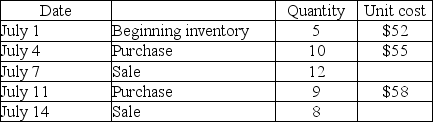

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

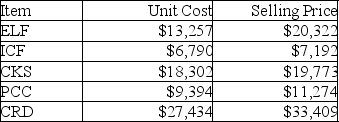

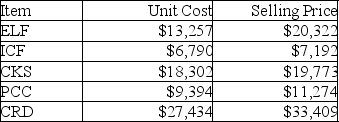

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/152

العب

ملء الشاشة (f)

Deck 5: Inventory

1

Under the average cost method,the physical flow of goods through the business will:

A)have no relationship to the flow of costs through the accounting records.

B)closely match the flow of costs through the accounting records.

C)exactly match the flow of costs through the accounting records.

D)be nearly the opposite of the flow of costs through the accounting records.

A)have no relationship to the flow of costs through the accounting records.

B)closely match the flow of costs through the accounting records.

C)exactly match the flow of costs through the accounting records.

D)be nearly the opposite of the flow of costs through the accounting records.

A

2

A piece of artwork would probably be inventoried using the specific-identification method.

True

3

An inventory layer is synonymous with a separate:

A)sale of merchandise.

B)purchase of merchandise.

C)return of merchandise.

D)customer return of merchandise.

A)sale of merchandise.

B)purchase of merchandise.

C)return of merchandise.

D)customer return of merchandise.

B

4

Under the FIFO method,the flow of costs through the accounting records will:

A)be nearly the opposite of the physical flow of goods through the business.

B)closely match the physical flow of goods through the business.

C)exactly match the physical flow of goods through the business.

D)have no relationship to the physical flow of goods through the business.

A)be nearly the opposite of the physical flow of goods through the business.

B)closely match the physical flow of goods through the business.

C)exactly match the physical flow of goods through the business.

D)have no relationship to the physical flow of goods through the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

5

Under the specific-identification method,the physical flow of goods through the business will:

A)have no relationship to the flow of costs through the accounting records.

B)closely match the flow of costs through the accounting records.

C)exactly match the flow of costs through the accounting records.

D)be nearly the opposite of the flow of costs through the accounting records.

A)have no relationship to the flow of costs through the accounting records.

B)closely match the flow of costs through the accounting records.

C)exactly match the flow of costs through the accounting records.

D)be nearly the opposite of the flow of costs through the accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

6

Under the average cost method,the flow of costs through the accounting records will:

A)be nearly the opposite of the physical flow of goods through the business.

B)closely match the physical flow of goods through the business.

C)exactly match the physical flow of goods through the business.

D)have no relationship to the physical flow of goods through the business.

A)be nearly the opposite of the physical flow of goods through the business.

B)closely match the physical flow of goods through the business.

C)exactly match the physical flow of goods through the business.

D)have no relationship to the physical flow of goods through the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

7

Under the LIFO method,the physical flow of goods through the business will:

A)have no relationship to the flow of costs through the accounting records.

B)closely match the flow of costs through the accounting records.

C)exactly match the flow of costs through the accounting records.

D)be nearly the opposite of the flow of costs through the accounting records.

A)have no relationship to the flow of costs through the accounting records.

B)closely match the flow of costs through the accounting records.

C)exactly match the flow of costs through the accounting records.

D)be nearly the opposite of the flow of costs through the accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

8

Manufacturers have three different kinds of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

9

Under the LIFO method,the flow of costs through the accounting records will:

A)be nearly the opposite of the physical flow of goods through the business.

B)closely match the physical flow of goods through the business.

C)exactly match the physical flow of goods through the business.

D)have no relationship to the physical flow of goods through the business.

A)be nearly the opposite of the physical flow of goods through the business.

B)closely match the physical flow of goods through the business.

C)exactly match the physical flow of goods through the business.

D)have no relationship to the physical flow of goods through the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

10

Merchandise inventory represents the goods that a merchandiser has available to sell to its customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

11

Inventory is probably the retailer's smallest (by value)current asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

12

Under the specific-identification method,the flow of costs through the accounting records will:

A)be nearly the opposite of the physical flow of goods through the business.

B)closely match the physical flow of goods through the business.

C)exactly match the physical flow of goods through the business.

D)have no relationship to the physical flow of goods through the business.

A)be nearly the opposite of the physical flow of goods through the business.

B)closely match the physical flow of goods through the business.

C)exactly match the physical flow of goods through the business.

D)have no relationship to the physical flow of goods through the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Vintage Showroom,an antique shop,would most likely use the FIFO method of accounting for inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under the FIFO method,the physical flow of goods through the business will:

A)have no relationship to the flow of costs through the accounting records.

B)closely match the flow of costs through the accounting records.

C)exactly match the flow of costs through the accounting records.

D)be nearly the opposite of the flow of costs through the accounting records.

A)have no relationship to the flow of costs through the accounting records.

B)closely match the flow of costs through the accounting records.

C)exactly match the flow of costs through the accounting records.

D)be nearly the opposite of the flow of costs through the accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

15

When using LIFO,an accounting department only needs to know:

A)how many units were sold,not which units were sold.

B)which units were sold,not how many units were sold.

C)the specific price of a specific unit.

D)the average price of a specific unit.

A)how many units were sold,not which units were sold.

B)which units were sold,not how many units were sold.

C)the specific price of a specific unit.

D)the average price of a specific unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

16

GAAP allows two different kinds of inventory costing methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

17

The inventory system whereby the merchandise inventory account balance is merely a record of the most recent physical inventory count is called the:

A)periodic system.

B)perpetual system.

C)LIFO system.

D)FIFO system.

A)periodic system.

B)perpetual system.

C)LIFO system.

D)FIFO system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

18

Grocery stores are required to use the FIFO method because they sell the oldest stock first to avoid spoilage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

19

The inventory system that uses the merchandise inventory account as an active account is called the:

A)periodic system.

B)perpetual system.

C)LIFO system.

D)FIFO system.

A)periodic system.

B)perpetual system.

C)LIFO system.

D)FIFO system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

20

A method of valuing inventory based on the average of units is called the:

A)LIFO method.

B)average cost method.

C)specific cost method.

D)FIFO method.

A)LIFO method.

B)average cost method.

C)specific cost method.

D)FIFO method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

21

A method of valuing inventory based on the assumption that the oldest goods will be sold first is called the:

A)LIFO method.

B)average cost method.

C)specific cost method.

D)FIFO method.

A)LIFO method.

B)average cost method.

C)specific cost method.

D)FIFO method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

22

When merchandise is sold and the perpetual system of inventory is used,the journal entry to record a sale of merchandise on account would include:

A)debiting Accounts Receivable and crediting Sales.

B)debiting Accounts Receivable and crediting Inventory.

C)debiting Accounts Receivable and crediting Cost of Goods Sold.

D)debiting Cost of Goods Sold and crediting Accounts Receivable.

A)debiting Accounts Receivable and crediting Sales.

B)debiting Accounts Receivable and crediting Inventory.

C)debiting Accounts Receivable and crediting Cost of Goods Sold.

D)debiting Cost of Goods Sold and crediting Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

23

A method of valuing inventory based on the assumption that the newest goods will be sold first is called the:

A)LIFO method.

B)average cost method.

C)specific cost method.

D)FIFO method.

A)LIFO method.

B)average cost method.

C)specific cost method.

D)FIFO method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

24

Part of the journal entry to record the cost of an item for $28 that sold for $40 cash under the perpetual inventory system is:

A)debit Sales,$40;credit Cost of Goods Sold,$28;credit Cash,$12.

B)debit Cost of Goods Sold,$40;sales,$40.

C)debit Cash,$40;credit Inventory $40.

D)debit Cost of Goods Sold $28;credit Inventory,$28.

A)debit Sales,$40;credit Cost of Goods Sold,$28;credit Cash,$12.

B)debit Cost of Goods Sold,$40;sales,$40.

C)debit Cash,$40;credit Inventory $40.

D)debit Cost of Goods Sold $28;credit Inventory,$28.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

25

The LEAST widely used of the four inventory valuation methods is:

A)FIFO.

B)LIFO.

C)average cost.

D)specific-identification.

A)FIFO.

B)LIFO.

C)average cost.

D)specific-identification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

26

A method of valuing inventory based on the costs for each individual item is called the:

A)LIFO method.

B)average cost method.

C)specific cost method.

D)FIFO method.

A)LIFO method.

B)average cost method.

C)specific cost method.

D)FIFO method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

27

A new car lot would probably cost its inventory using the:

A)LIFO method of inventory costing.

B)FIFO method of inventory costing.

C)moving average method of inventory costing.

D)specific-identification method of inventory costing.

A)LIFO method of inventory costing.

B)FIFO method of inventory costing.

C)moving average method of inventory costing.

D)specific-identification method of inventory costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

28

The journal entries to record the purchases of inventory on account are different based on the costing method chosen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

29

The various inventory costing methods will still produce the same cost of goods sold value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

30

The sum of ending inventory and cost of goods available for sale equals cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

31

A manufacturer uses ________ inventory to produce the goods it sells.

A)raw materials

B)purchases

C)finished goods

D)work-in-process

A)raw materials

B)purchases

C)finished goods

D)work-in-process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

32

Inventory is shown on the:

A)Balance Sheet as an asset.

B)Income Statement before gross profit.

C)Statement of Retained Earnings.

D)Income Statement after gross profit.

A)Balance Sheet as an asset.

B)Income Statement before gross profit.

C)Statement of Retained Earnings.

D)Income Statement after gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

33

Beginning inventory plus net purchases equals cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

34

Goods such as milk,bread,and cheese need to be sold quickly due to potential spoilage.Therefore,they would probably be costed using the:

A)LIFO method of inventory costing.

B)FIFO method of inventory costing.

C)average cost method of inventory costing.

D)any method as the physical flow and the cost flow are different.

A)LIFO method of inventory costing.

B)FIFO method of inventory costing.

C)average cost method of inventory costing.

D)any method as the physical flow and the cost flow are different.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

35

New technology,like the latest cell phones and HDTV,would probably be costed using the:

A)LIFO method of inventory costing.

B)FIFO method of inventory costing.

C)moving average method of inventory costing.

D)any method as the physical flow and the cost flow are different.

A)LIFO method of inventory costing.

B)FIFO method of inventory costing.

C)moving average method of inventory costing.

D)any method as the physical flow and the cost flow are different.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

36

The journal entry to record the purchase of $7,400 of inventory on account under the perpetual inventory system is:

A)debit Inventory,$7,400;credit Cash,$7,400.

B)debit Purchases,$7,400;credit Accounts Payable,$7,400.

C)debit Inventory,$7,400;credit Accounts Payable,$7,400.

D)debit Cost of Goods Sold,$7,400;credit Inventory,$7,400.

A)debit Inventory,$7,400;credit Cash,$7,400.

B)debit Purchases,$7,400;credit Accounts Payable,$7,400.

C)debit Inventory,$7,400;credit Accounts Payable,$7,400.

D)debit Cost of Goods Sold,$7,400;credit Inventory,$7,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

37

The amount of cost of goods sold is MOST influenced by the:

A)cost of the items sold.

B)cost of the unsold items.

C)inventory costing method used.

D)number of items sold.

A)cost of the items sold.

B)cost of the unsold items.

C)inventory costing method used.

D)number of items sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

38

A manufacturer's goods available for sale represents:

A)work-in-process inventory.

B)raw materials inventory.

C)cost of goods sold inventory.

D)finished goods inventory.

A)work-in-process inventory.

B)raw materials inventory.

C)cost of goods sold inventory.

D)finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

39

Cost of goods sold is shown on the:

A)Balance Sheet as an asset.

B)Income Statement before gross profit.

C)Statement of Retained Earnings.

D)Income Statement after gross profit.

A)Balance Sheet as an asset.

B)Income Statement before gross profit.

C)Statement of Retained Earnings.

D)Income Statement after gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

40

The objective of inventory tracking is to allocate the cost of goods available for sale between the cost of units sold and the cost of unsold inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

41

The choice of inventory costing method does not have an effect on net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

42

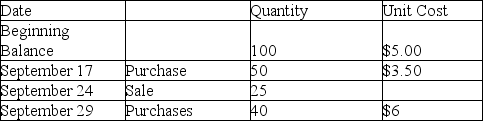

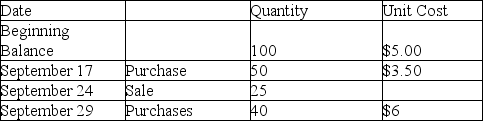

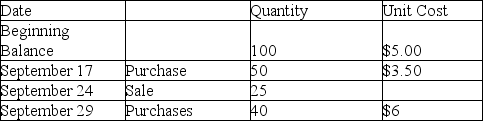

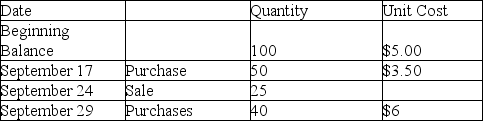

Given the following inventory activity,what is ending inventory using the perpetual LIFO costing method?

A)165 units @ $4.86

B)100 units @ $5.00 and 25 units @ $3.50 and 40 units @ $6.00

C)125 units @ $4.50 and 40 units @ $6.00

D)75 units @ $5.00 and 50 units @ $3.50 and 40 units @ $6.00

A)165 units @ $4.86

B)100 units @ $5.00 and 25 units @ $3.50 and 40 units @ $6.00

C)125 units @ $4.50 and 40 units @ $6.00

D)75 units @ $5.00 and 50 units @ $3.50 and 40 units @ $6.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

43

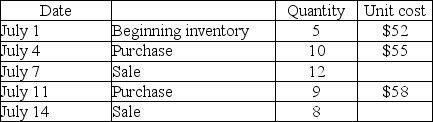

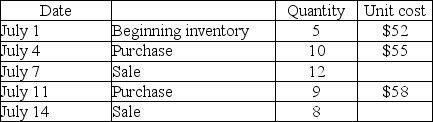

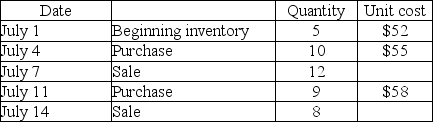

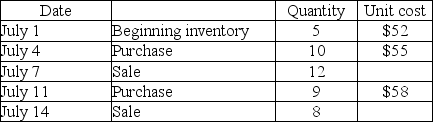

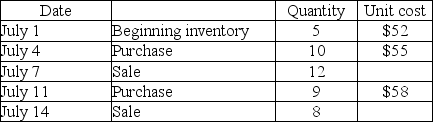

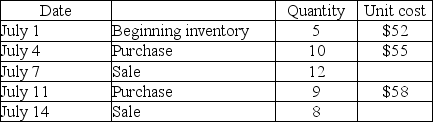

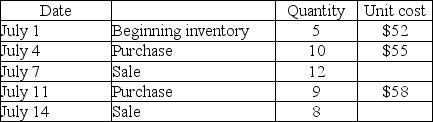

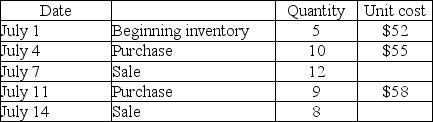

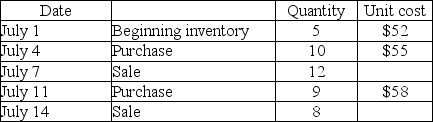

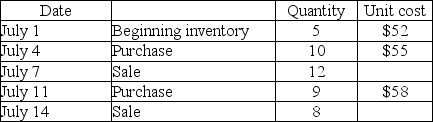

Lionworks Enterprises had the following inventory data:

Assuming FIFO,what is the ending inventory after the July 14 sale?

A)$208

B)$228

C)$232

D)$214

Assuming FIFO,what is the ending inventory after the July 14 sale?

A)$208

B)$228

C)$232

D)$214

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

44

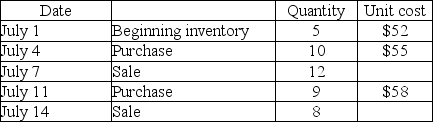

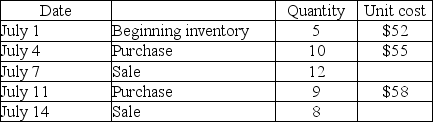

Lionworks Enterprises had the following inventory data:

Assuming LIFO,what is the cost of goods sold for the July 7 sale?

A)$648

B)$654

C)$660

D)$645

Assuming LIFO,what is the cost of goods sold for the July 7 sale?

A)$648

B)$654

C)$660

D)$645

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

45

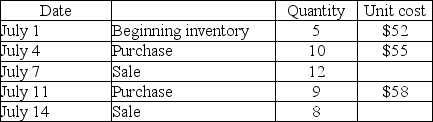

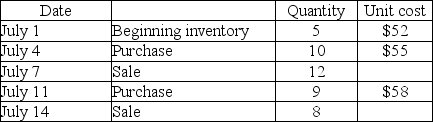

Lionworks Enterprises had the following inventory data:

Assuming LIFO,what is the cost of goods sold for the July 14 sale?

A)$455

B)$440

C)$456

D)$464

Assuming LIFO,what is the cost of goods sold for the July 14 sale?

A)$455

B)$440

C)$456

D)$464

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

46

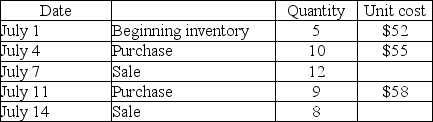

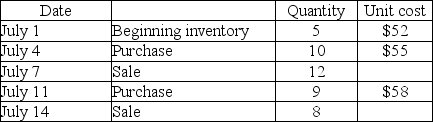

Lionworks Enterprises had the following inventory data:

Assuming LIFO,what is the ending inventory after the July 14 sale?

A)$232

B)$214

C)$228

D)$208

Assuming LIFO,what is the ending inventory after the July 14 sale?

A)$232

B)$214

C)$228

D)$208

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

47

When purchasing inventory on account in a perpetual inventory system,which of the following is TRUE?

A)The journal entry would be exactly the same for all inventory costing methods.

B)LIFO and FIFO inventory valuation methods require a debit to inventory while all others require a debit to purchases.

C)GAAP does not allow inventory to be purchased on account.

D)The average costing method requires a credit to inventory.

A)The journal entry would be exactly the same for all inventory costing methods.

B)LIFO and FIFO inventory valuation methods require a debit to inventory while all others require a debit to purchases.

C)GAAP does not allow inventory to be purchased on account.

D)The average costing method requires a credit to inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

48

When using the LIFO inventory method,the ending inventory has the newer,higher costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

49

Given the following inventory activity,what is ending inventory using the perpetual average costing method?

A)165 units @ $4.86

B)100 units @ $5.00 and 25 units @ $3.50 and 40 units @ $6.00

C)125 units @ $4.50 and 40 units @ $6.00

D)75 units @ $5.00 and 50 units @ $3.50 and 40 units @ $6.00

A)165 units @ $4.86

B)100 units @ $5.00 and 25 units @ $3.50 and 40 units @ $6.00

C)125 units @ $4.50 and 40 units @ $6.00

D)75 units @ $5.00 and 50 units @ $3.50 and 40 units @ $6.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

50

One benefit of the LIFO inventory method is that it most closely matches the actual flow of goods in most cases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

51

Lionworks Enterprises had the following inventory data:

Assuming average cost,what is the cost of goods sold for the July 14 sale?

A)$455

B)$456

C)$452

D)$464

Assuming average cost,what is the cost of goods sold for the July 14 sale?

A)$455

B)$456

C)$452

D)$464

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

52

Lionworks Enterprises had the following inventory data:

Assuming FIFO,what is the cost of goods sold for the July 14 sale?

A)$455

B)$440

C)$456

D)$464

Assuming FIFO,what is the cost of goods sold for the July 14 sale?

A)$455

B)$440

C)$456

D)$464

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

53

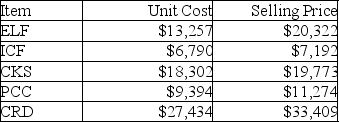

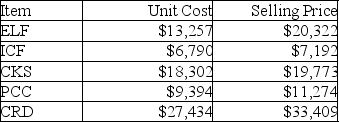

Liberty,Inc.has the following list of inventory:

Under specific-identification,what is Liberty's ending inventory if ICF and CRD are not sold during the current period?

A)$34,224

B)$40,601

C)$40,953

D)$51,369

Under specific-identification,what is Liberty's ending inventory if ICF and CRD are not sold during the current period?

A)$34,224

B)$40,601

C)$40,953

D)$51,369

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

54

Cost of goods sold equals:

A)ending inventory plus net purchases minus beginning inventory.

B)beginning inventory minus net purchases plus ending inventory.

C)beginning inventory plus net sales minus ending inventory.

D)beginning inventory plus net purchases minus ending inventory.

A)ending inventory plus net purchases minus beginning inventory.

B)beginning inventory minus net purchases plus ending inventory.

C)beginning inventory plus net sales minus ending inventory.

D)beginning inventory plus net purchases minus ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

55

Lionworks Enterprises had the following inventory data:

Assuming FIFO,what is the cost of goods sold for the July 7 sale?

A)$624

B)$654

C)$648

D)$645

Assuming FIFO,what is the cost of goods sold for the July 7 sale?

A)$624

B)$654

C)$648

D)$645

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

56

Lionworks Enterprises had the following inventory data:

Assuming average cost,what is the ending inventory after the July 14 sale?

A)$228

B)$232

C)$214

D)$208

Assuming average cost,what is the ending inventory after the July 14 sale?

A)$228

B)$232

C)$214

D)$208

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

57

Cost of goods sold may include all of the following EXCEPT for:

A)the actual cost of the item.

B)shipping costs.

C)insurance.

D)management salaries.

A)the actual cost of the item.

B)shipping costs.

C)insurance.

D)management salaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

58

Liberty,Inc.has the following list of inventory:

Under specific-identification,what is Liberty's cost of goods sold if ICF and CRD were not sold during the current period?

A)$34,224

B)$40,601

C)$40,953

D)$51,369

Under specific-identification,what is Liberty's cost of goods sold if ICF and CRD were not sold during the current period?

A)$34,224

B)$40,601

C)$40,953

D)$51,369

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

59

When using the FIFO inventory method,the ending inventory has the newer costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

60

Lionworks Enterprises had the following inventory data:

Assuming average cost,what is the cost of goods sold for the July 7 sale?

A)$642

B)$654

C)$648

D)$645

Assuming average cost,what is the cost of goods sold for the July 7 sale?

A)$642

B)$654

C)$648

D)$645

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

61

Under the LCM rule,a business must report inventory at the current replacement cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

62

Under the conservatism rule,assets and income would be understated,rather than overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

63

The average cost method generates gross profit,net income,and income tax amounts that fall between the extremes of FIFO and LIFO.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

64

In order to pay the least income tax possible in periods of decreasing inventory costs,the company should use which of the following inventory costing methods?

A)FIFO

B)LIFO

C)Average cost

D)Specific identification

A)FIFO

B)LIFO

C)Average cost

D)Specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

65

________ helps investors compare a company's financial statements from one period to the next.

A)Reliability

B)Consistency

C)Objectivity

D)Entity

A)Reliability

B)Consistency

C)Objectivity

D)Entity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

66

Ignoring a write-off of inventory because it will not make a difference to financial statement users is an example of:

A)conservatism.

B)consistency.

C)materiality.

D)entity.

A)conservatism.

B)consistency.

C)materiality.

D)entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

67

Companies that want a "middle ground" solution to net income and the amount of income taxes that the company will pay will value their inventory at:

A)FIFO.

B)LIFO.

C)average cost.

D)specific identification.

A)FIFO.

B)LIFO.

C)average cost.

D)specific identification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

68

A drawback to using ________ when inventory costs are rising is that the company reports lower net income.

A)LIFO

B)FIFO

C)average costing

D)specific-identification costing

A)LIFO

B)FIFO

C)average costing

D)specific-identification costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

69

A material amount of value is one large enough to cause someone to change a decision that has been made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

70

Changing from LIFO to FIFO over two accounting periods could be viewed as a violation of which accounting concept or principle?

A)Conservatism

B)Consistency

C)Materiality

D)Entity

A)Conservatism

B)Consistency

C)Materiality

D)Entity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

71

The most popular inventory costing method is:

A)FIFO.

B)LIFO.

C)average cost.

D)specific identification.

A)FIFO.

B)LIFO.

C)average cost.

D)specific identification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

72

________ produces the lowest cost of goods sold and the highest gross profit when prices are increasing.

A)FIFO

B)LIFO

C)Average cost

D)Specific identification

A)FIFO

B)LIFO

C)Average cost

D)Specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

73

In order to attract investors and borrow on favorable terms,a company would use ________ in times when inventory costs are rising.

A)LIFO

B)FIFO

C)average costing

D)specific-identification costing

A)LIFO

B)FIFO

C)average costing

D)specific-identification costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

74

________ produces the highest cost of goods sold and the lowest gross profit when prices are increasing.

A)FIFO

B)LIFO

C)Average cost

D)Specific identification

A)FIFO

B)LIFO

C)Average cost

D)Specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

75

In order to pay the least income tax possible in periods of rising inventory costs,the company should use which of the following inventory costing methods?

A)FIFO

B)LIFO

C)Average cost

D)Specific identification

A)FIFO

B)LIFO

C)Average cost

D)Specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

76

The LCM rule compares original cost to current replacement cost to determine the amount at which inventory should be valued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

77

In order to pay the least income tax possible in periods of constant costs,the company should use which of the following inventory costing methods?

A)FIFO

B)LIFO

C)Average cost

D)Any method,as there is no effect on net income or taxes for the period if costs are constant.

A)FIFO

B)LIFO

C)Average cost

D)Any method,as there is no effect on net income or taxes for the period if costs are constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which inventory costing method results in the oldest costs in ending inventory?

A)Average cost

B)Last-In,First-Out

C)First-In,First-Out

D)Average-In,First-Out

A)Average cost

B)Last-In,First-Out

C)First-In,First-Out

D)Average-In,First-Out

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

79

Under the conservatism principle,liabilities and expenses would be overstated,rather than understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

80

Consistency is mandated by:

A)the IRS.

B)the SEC.

C)GAAP.

D)the federal government.

A)the IRS.

B)the SEC.

C)GAAP.

D)the federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck