Deck 15: Accounts Receivable and Uncollectible Accounts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/92

العب

ملء الشاشة (f)

Deck 15: Accounts Receivable and Uncollectible Accounts

1

Which of the following statements is not correct?

A)When using the direct charge-off method, there is no Allowance for Doubtful Accounts account.

B)The use of the direct charge-off method of recording losses from uncollectible accounts usually results in the balance in the Accounts Receivable account being overstated.

C)The direct charge-off method of recording losses from uncollectible accounts is the method required by Federal income tax laws.

D)The direct charge-off method of recording losses from uncollectible accounts is an application of the matching principle.

A)When using the direct charge-off method, there is no Allowance for Doubtful Accounts account.

B)The use of the direct charge-off method of recording losses from uncollectible accounts usually results in the balance in the Accounts Receivable account being overstated.

C)The direct charge-off method of recording losses from uncollectible accounts is the method required by Federal income tax laws.

D)The direct charge-off method of recording losses from uncollectible accounts is an application of the matching principle.

D

2

The adjusting entry to record estimated losses from uncollectible accounts consists of a debit to Allowance for Doubtful Accounts.

False

3

To achieve good internal control over accounts receivable, it is important to separate the recording of accounts receivable transactions and the collection of cash from customers.

True

4

Allowance for Doubtful Accounts is a liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

5

When the estimate of the losses from uncollectible accounts is based on the aging method, the primary concern is proper valuation of the accounts receivable on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

6

Allowance for Doubtful Accounts is classified as

A)a Liability on the Balance Sheet.

B)a Contra Asset on the Balance Sheet.

C)a Contra Expense on the Income Statement.

D)an Expense on the Income Statement.

A)a Liability on the Balance Sheet.

B)a Contra Asset on the Balance Sheet.

C)a Contra Expense on the Income Statement.

D)an Expense on the Income Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

7

When the allowance method of recognizing losses from uncollectible accounts is used, the entry to record the write-off of a particular customer's account includes a debit to Uncollectible Accounts Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

8

The adjusting entry to record estimated losses from uncollectible accounts consists of a

A)debit to Accounts Receivable and a credit to Allowance for Doubtful Accounts.

B)debit to Uncollectible Accounts Expense and a credit to Allowance for Doubtful Accounts.

C)debit to Uncollectible Accounts Expense and a credit to Accounts Receivable.

D)debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable.

A)debit to Accounts Receivable and a credit to Allowance for Doubtful Accounts.

B)debit to Uncollectible Accounts Expense and a credit to Allowance for Doubtful Accounts.

C)debit to Uncollectible Accounts Expense and a credit to Accounts Receivable.

D)debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is the type of account and normal balance of Allowance for Doubtful Accounts?

A)Contra asset, credit

A)Liability, credit

B)Asset, debit

D)Contra asset, debit

A)Contra asset, credit

A)Liability, credit

B)Asset, debit

D)Contra asset, debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

10

The balance of the Allowance for Doubtful Accounts account is reported as

A)a deduction from Sales on the income statement.

B)an addition to Accounts Receivable on the balance sheet.

C)a deduction from Accounts Receivable on the balance sheet.

D)an expense on the income statement.

A)a deduction from Sales on the income statement.

B)an addition to Accounts Receivable on the balance sheet.

C)a deduction from Accounts Receivable on the balance sheet.

D)an expense on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

11

When there is a partial collection of a balance previously written off, the entry to record the reinstatement of the customer's account will be for the entire amount written off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

12

When the allowance method of recognizing losses from uncollectible accounts is used, the net value of accounts receivable on the balance sheet will more nearly reflect the amount that will ultimately be collected than if the direct write-off method is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

13

The allowance method may be used to record bad debt losses for income tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

14

Uncollectible Accounts Expense can be called Loss from Uncollectible Accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following statements is not correct?

A)The adjusting entry to record the estimated loss from uncollectible accounts includes a credit to Accounts Receivable.

B)Losses from uncollectible accounts can be estimated by analyzing sales or accounts receivable.

C)The allowance method involves anticipating losses from uncollectible accounts by recognizing an expense for these losses before the actual accounts are written off.

D)The balance of Uncollectible Accounts Expense appears among the operating expenses on the income statement.

A)The adjusting entry to record the estimated loss from uncollectible accounts includes a credit to Accounts Receivable.

B)Losses from uncollectible accounts can be estimated by analyzing sales or accounts receivable.

C)The allowance method involves anticipating losses from uncollectible accounts by recognizing an expense for these losses before the actual accounts are written off.

D)The balance of Uncollectible Accounts Expense appears among the operating expenses on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

16

Allowance for Doubtful Accounts may be used for the valuation of all types of receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

17

When using the allowance method, the collection of an account previously written off is recorded in the cash receipts journal only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

18

The balance of Allowance for Doubtful Accounts is added to the balance of Accounts Receivable on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

19

The experience of other firms in the same line of business may be used in estimating losses from uncollectible accounts for a new firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

20

Allowance for Doubtful Accounts may, at times, have a debit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

21

On December 31, prior to adjustment, Allowance for Doubtful Accounts has a credit balance of

$630. An analysis of the accounts receivable aging estimates $2,850 of probable losses from uncollectible accounts. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$2,220.

B)$3,480.

C)$2,850.

D)$630.

$630. An analysis of the accounts receivable aging estimates $2,850 of probable losses from uncollectible accounts. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$2,220.

B)$3,480.

C)$2,850.

D)$630.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

22

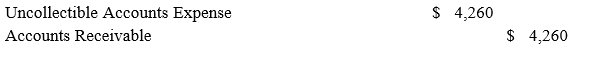

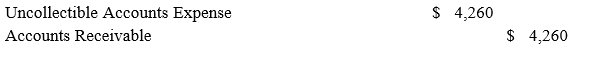

A firm reported sales of $460,000 for the year. Prior to adjustment, Allowance for Doubtful Accounts has a credit balance of $560. Based on an aging of accounts receivable, the firm estimated its losses from uncollectible accounts to be $6,460. The adjusting entry to record the estimated bad debt losses will be:

A)

B)

https://d2lvgg3v3hfg70.cloudfront.net/TB3077/ .

.

C)

11ee80ae_cb0c_e9b0_81bd_d34c781df894_TB3077_11

D)

https://d2lvgg3v3hfg70.cloudfront.net/TB3077/ .

.

A)

B)

https://d2lvgg3v3hfg70.cloudfront.net/TB3077/

.

.C)

11ee80ae_cb0c_e9b0_81bd_d34c781df894_TB3077_11

D)

https://d2lvgg3v3hfg70.cloudfront.net/TB3077/

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

23

A firm reported sales of $460,000 for the year. Prior to adjustment, Allowance for Doubtful Accounts has a credit balance of $560. Based on an aging of accounts receivable, the firm estimated its losses from uncollectible accounts to be $6,460.

-The amount to be reported on the income statement for Uncollectible Accounts Expense is:

A)$4,600.

B)$5,900.

C)$7,020.

D)$6,460.

-The amount to be reported on the income statement for Uncollectible Accounts Expense is:

A)$4,600.

B)$5,900.

C)$7,020.

D)$6,460.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

24

The existing balance in Allowance for Doubtful Accounts at the end of the year is not considered when the estimate of uncollectible accounts is based on

A)a percent of total accounts receivable outstanding.

B)a percent of net income.

C)an aging of accounts receivable.

D)a percent of net credit sales.

A)a percent of total accounts receivable outstanding.

B)a percent of net income.

C)an aging of accounts receivable.

D)a percent of net credit sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

25

A firm reported net credit sales of $960,000 for the year and an Accounts Receivable balance of

$120,000 at year-end. Prior to adjustments, Allowance for Doubtful Accounts has a debit balance of $820. The firm estimates its losses from uncollectible accounts to be one-half of 1 percent of net credit sales.

-The balance in Allowance for Doubtful Accounts after adjustment is:

A)$5,620.

B)$3,980.

C)$4,800.

D)$5,080.

$120,000 at year-end. Prior to adjustments, Allowance for Doubtful Accounts has a debit balance of $820. The firm estimates its losses from uncollectible accounts to be one-half of 1 percent of net credit sales.

-The balance in Allowance for Doubtful Accounts after adjustment is:

A)$5,620.

B)$3,980.

C)$4,800.

D)$5,080.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

26

On December 31, prior to adjustment, Allowance for Doubtful Accounts has a debit balance of

$730. An analysis of the aging of the accounts receivable produces an estimate of $6,200 of probable losses from uncollectible accounts. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$5,470.

B)$730.

C)$6,930.

D)$6,200.

$730. An analysis of the aging of the accounts receivable produces an estimate of $6,200 of probable losses from uncollectible accounts. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$5,470.

B)$730.

C)$6,930.

D)$6,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

27

On December 31, prior to adjustment, Allowance for Doubtful Accounts has a debit balance of

$400. An analysis of the aging of the accounts receivable produces an estimate of $3,100 of probable losses from uncollectible accounts. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$3,100.

B)$2,700.

C)$3,500.

D)$400.

$400. An analysis of the aging of the accounts receivable produces an estimate of $3,100 of probable losses from uncollectible accounts. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$3,100.

B)$2,700.

C)$3,500.

D)$400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

28

Under the Allowance Method of accounting for uncollectible accounts, a firm may base their estimate of uncollectible accounts on all of the following EXCEPT:

A)total accounts receivable at the end of the year

B)total current assets as of the end of the year

C)net credit sales for the year

D)aging of accounts receivable at the end of the year

A)total accounts receivable at the end of the year

B)total current assets as of the end of the year

C)net credit sales for the year

D)aging of accounts receivable at the end of the year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

29

A firm reported net credit sales of $960,000 for the year and an Accounts Receivable balance of

$120,000 at year-end. Prior to adjustments, Allowance for Doubtful Accounts has a debit balance of $820. The firm estimates its losses from uncollectible accounts to be one-half of 1 percent of net credit sales.

- The entry to record the estimated losses from uncollectible accounts will include a credit to Allowance for Doubtful Accounts for

A)$4,800.

B)$5,620.

C)$5,080.

D)$3,980.

$120,000 at year-end. Prior to adjustments, Allowance for Doubtful Accounts has a debit balance of $820. The firm estimates its losses from uncollectible accounts to be one-half of 1 percent of net credit sales.

- The entry to record the estimated losses from uncollectible accounts will include a credit to Allowance for Doubtful Accounts for

A)$4,800.

B)$5,620.

C)$5,080.

D)$3,980.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

30

A firm reported sales of $460,000 for the year. Prior to adjustment, Allowance for Doubtful Accounts has a credit balance of $560. Based on an aging of accounts receivable, the firm estimated its losses from uncollectible accounts to be $6,460.

-The balance in the Allowance for Doubtful Accounts after adjustment is:

A)$4,600.

B)$7,020.

C)$6,460.

D)$5,900.

-The balance in the Allowance for Doubtful Accounts after adjustment is:

A)$4,600.

B)$7,020.

C)$6,460.

D)$5,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

31

On December 31, prior to adjustments, the balance of Accounts Receivable is $28,000 and Allowance for Doubtful Accounts has a debit balance of $200. The firm estimates its losses from uncollectible accounts to be 5.5% of accounts receivable at the end of the year. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$200.

B)$1,540.

C)$1,340.

D)$1,740.

A)$200.

B)$1,540.

C)$1,340.

D)$1,740.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

32

On December 31, prior to adjustment, Allowance for Doubtful Accounts has a credit balance of

$430. An analysis of the accounts receivable aging estimates $1,900 of probable losses from uncollectible accounts. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$430.

B)$1,900.

C)$2,330.

D)$1,470.

$430. An analysis of the accounts receivable aging estimates $1,900 of probable losses from uncollectible accounts. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$430.

B)$1,900.

C)$2,330.

D)$1,470.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

33

On December 31, prior to adjustment, Allowance for Doubtful Accounts has a debit balance of

$630. An analysis of the accounts receivable aging estimates $2,850 of probable losses from uncollectible accounts. The ending balance in Allowance for Doubtful Accounts after adjustment is

A)$2,850.

B)$630.

C)$3,480.

D)$2,220.

$630. An analysis of the accounts receivable aging estimates $2,850 of probable losses from uncollectible accounts. The ending balance in Allowance for Doubtful Accounts after adjustment is

A)$2,850.

B)$630.

C)$3,480.

D)$2,220.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

34

A firm reported sales of $450,000 for the year. Prior to adjustment, Allowance for Doubtful Accounts has a debit balance of $280. Based on an aging of accounts receivable, the firm estimated its losses from uncollectible accounts to be $3,980. The entry to record the estimated bad debt losses will be:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

35

On December 31, prior to adjustments, the balance of Accounts Receivable is $32,000 and Allowance for Doubtful Accounts has a credit balance of $290. The firm estimates its losses from uncollectible accounts to be 5.5% of accounts receivable at the end of the year. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$290.

B)$1,470.

C)$1,310.

D)$1,760.

A)$290.

B)$1,470.

C)$1,310.

D)$1,760.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

36

The method of accounting for losses from uncollectible accounts that results in a valuation of the accounts receivable on the balance sheet that is a more reasonable estimate of the actual amount expected to be collected is

A)the direct charge-off method.

B)the allowance method based on a percentage of net credit sales.

C)either the allowance method or the direct charge-off method.

D)the allowance method based on aging the accounts receivable.

A)the direct charge-off method.

B)the allowance method based on a percentage of net credit sales.

C)either the allowance method or the direct charge-off method.

D)the allowance method based on aging the accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

37

A firm reported net credit sales of $355,000 for the year and an Accounts Receivable balance of

$20,000 at year-end. Prior to adjustments, Allowance for Doubtful Accounts has a debit balance of

$250. The firm estimates its losses from uncollectible accounts to be one-half of 1 percent of net credit sales. The entry to record the estimated losses from uncollectible accounts will include a credit to Allowance for Doubtful Accounts for

A)$1,775.

B)$2,025.

C)$1,525.

D)$3,550.

$20,000 at year-end. Prior to adjustments, Allowance for Doubtful Accounts has a debit balance of

$250. The firm estimates its losses from uncollectible accounts to be one-half of 1 percent of net credit sales. The entry to record the estimated losses from uncollectible accounts will include a credit to Allowance for Doubtful Accounts for

A)$1,775.

B)$2,025.

C)$1,525.

D)$3,550.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

38

A firm reported sales of $300,000 for the year and Accounts Receivable has a balance of $20,000 at year-end. Prior to adjustment, Allowance for Doubtful Accounts has a credit balance of $300. The firm estimated its losses from uncollectible accounts to be one-half of 1 percent of sales. The entry to record the estimated losses from uncollectible accounts will include a credit to Allowance for Doubtful Accounts for

A)$1,500.

B)$1,200.

C)$3,000.

D)$1,800.

A)$1,500.

B)$1,200.

C)$3,000.

D)$1,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

39

On December 31, prior to adjustments, the balance of Accounts Receivable is $22,000 and Allowance for Doubtful Accounts has a credit balance of $135. The firm estimates its losses from uncollectible accounts to be 4% of accounts receivable at the end of the year. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$135.

B)$1,015.

C)$745.

D)$880.

A)$135.

B)$1,015.

C)$745.

D)$880.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

40

A firm reported sales of $720,000 for the year and Accounts Receivable has a balance of $40,000 at year-end. Prior to adjustment, Allowance for Doubtful Accounts has a credit balance of $300. The firm estimated its losses from uncollectible accounts to be one-half of 1 percent of sales. The entry to record the estimated losses from uncollectible accounts will include a credit to Allowance for Doubtful Accounts for

A)$3,900.

B)$3,600.

C)$7,200.

D)$3,300.

A)$3,900.

B)$3,600.

C)$7,200.

D)$3,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

41

On December 31, 2019, prior to adjustments, Accounts Receivable has a debit balance of $370,000 and the Allowance for Doubtful Accounts has a credit balance of $800. The firm estimates its losses from uncollectible accounts to be 3% of accounts receivable at the end of the year. The amount of the adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$10,300

B)$11,900

C)$12,700

D)$11,100

A)$10,300

B)$11,900

C)$12,700

D)$11,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

42

Uncollectible Accounts Expense is classified as

A)a Contra Asset on the Balance Sheet.

B)a Liability on the Balance Sheet.

C)a Contra Expense on the Income Statement.

D)an Expense on the Income Statement.

A)a Contra Asset on the Balance Sheet.

B)a Liability on the Balance Sheet.

C)a Contra Expense on the Income Statement.

D)an Expense on the Income Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

43

Common internal controls for accounts receivable would not include:

A)obtaining proper authorization for write-offs.

B)sending invoices and monthly statements to customers.

C)allowing all sales personnel to charge-off any accounts deemed uncollectible.

D)developing procedures that ensure that all credit sales are recorded and customers' account are debited.

A)obtaining proper authorization for write-offs.

B)sending invoices and monthly statements to customers.

C)allowing all sales personnel to charge-off any accounts deemed uncollectible.

D)developing procedures that ensure that all credit sales are recorded and customers' account are debited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

44

On December 31, prior to adjustments, the balance of Accounts Receivable is $56,000 and Allowance for Doubtful Accounts has a debit balance of $1,200. The firm estimates its losses from uncollectible accounts to be 4% of accounts receivable at the end of the year. The adjusting entry needed to record the estimated losses from uncollectible accounts is

A)$1,200.

B)$2,240.

C)$3,440.

D)$1,040.

A)$1,200.

B)$2,240.

C)$3,440.

D)$1,040.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

45

On December 31, 2019, prior to adjustments, Accounts Receivable has a debit balance of $256,000 and the Allowance for Doubtful Accounts has a credit balance of $1,600. The firm estimates its losses from uncollectible accounts to be 5% of accounts receivable at the end of the year. The balance in the Allowance for Doubtful Accounts after the adjusting entry for the estimated losses from uncollectible accounts is:

A)$12,800

B)$12,100

C)$11,200

D)$14,400

A)$12,800

B)$12,100

C)$11,200

D)$14,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

46

When the allowance method of recognizing losses from uncollectible accounts is used, the entry to record the write-off of a specific account consists of a debit to

A)Accounts Receivable and a credit to Allowance for Doubtful Accounts.

B)Uncollectible Accounts Expense and a credit to Accounts Receivable.

C)Allowance for Doubtful Accounts and a credit to Accounts Receivable.

D)Uncollectible Accounts Expense and a credit to Allowance for Doubtful Accounts.

A)Accounts Receivable and a credit to Allowance for Doubtful Accounts.

B)Uncollectible Accounts Expense and a credit to Accounts Receivable.

C)Allowance for Doubtful Accounts and a credit to Accounts Receivable.

D)Uncollectible Accounts Expense and a credit to Allowance for Doubtful Accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

47

If the direct charge-off method of accounting for uncollectible receivables is used, what general ledger account is debited to write off a customer's account as uncollectible?

A)Accounts Receivable

B)Allowance for Doubtful Accounts

C)Uncollectible Accounts Expense

D)Uncollectible Accounts Payable

A)Accounts Receivable

B)Allowance for Doubtful Accounts

C)Uncollectible Accounts Expense

D)Uncollectible Accounts Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

48

On December 31, 2019, prior to adjustments, the Allowance for Doubtful Accounts has a debit balance of $750. An aging of the accounts receivable produces an estimate of $6,500 of probable losses from uncollectible accounts.

-The adjusting entry needed to record the estimated losses from uncollectible accounts includes a:

A)a credit to Allowance for Doubtful Accounts for $7,250

B)a debit to Uncollectible Accounts Expense for $5,750

C)a debit to Uncollectible Accounts Expense for $6,500

D)a credit to Allowance for Doubtful Accounts for $6,500

-The adjusting entry needed to record the estimated losses from uncollectible accounts includes a:

A)a credit to Allowance for Doubtful Accounts for $7,250

B)a debit to Uncollectible Accounts Expense for $5,750

C)a debit to Uncollectible Accounts Expense for $6,500

D)a credit to Allowance for Doubtful Accounts for $6,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

49

A firm using the allowance method to provide for losses from uncollectible accounts collected the cash due from a customer whose account was previously written off. The entry to reinstate the customer's account included a credit to

A)Accounts Receivable.

B)Sales.

C)Uncollectible Accounts Expense.

D)Allowance for Doubtful Accounts.

A)Accounts Receivable.

B)Sales.

C)Uncollectible Accounts Expense.

D)Allowance for Doubtful Accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

50

Allowance for Doubtful Accounts has a credit balance of $3,600 immediately before the write-off of a $750 account receivable. The balance of Allowance for Doubtful Accounts immediately after the write-off is

A)$750 debit.

B)$2,850 credit.

C)$4,350 credit.

D)$2,850 debit.

A)$750 debit.

B)$2,850 credit.

C)$4,350 credit.

D)$2,850 debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

51

Millie's Draperies uses the allowance method of recording bad debts. On June 13, the $200 account balance of Jane Murphy was written off as uncollectible. However, on August 5, Murphy paid $80 of the amount previously written off. The entry to reinstate Jane Murphy's account would include:

A)debit Cash $80; credit Uncollectible Accounts Expense $80

B)debit Accounts Receivable $200; credit Allowance for Doubtful Accounts $200

C)debit Allowance for Doubtful Accounts $80; credit Cash $80

D)debit Accounts Receivable $80; credit Allowance for Doubtful Accounts $80

A)debit Cash $80; credit Uncollectible Accounts Expense $80

B)debit Accounts Receivable $200; credit Allowance for Doubtful Accounts $200

C)debit Allowance for Doubtful Accounts $80; credit Cash $80

D)debit Accounts Receivable $80; credit Allowance for Doubtful Accounts $80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

52

Nigel Lighting uses the direct charge-off method of recording bad debts. On September 4, the company concluded that the $300 account balance of Louis Blue should be charged off. The entry to write off Blue's account will be:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

53

Allowance for Doubtful Accounts has a credit balance of $1,000 immediately before the write-off of a $300 account receivable. The balance of Allowance for Doubtful Accounts immediately after the write-off is

A)$1,300 credit.

B)$700 credit.

C)$300 debit.

D)$700 debit.

A)$1,300 credit.

B)$700 credit.

C)$300 debit.

D)$700 debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

54

Millie's Draperies uses the allowance method of recording bad debts. On June 13, the company concluded that the $200 account balance of Jane Murphy should be written off as uncollectible. The entry to write off Murphy's account will be:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

55

On December 31, 2019, prior to adjustments, Accounts Receivable has a debit balance of $256,000 and the Allowance for Doubtful Accounts has a credit balance of $1,600. The firm estimates its losses from uncollectible accounts to be 5% of accounts receivable at the end of the year. The amount of the adjusting entry needed to record the estimated losses from uncollectible accounts is:

A)$12,800

B)$14,400

C)$12,100

D)$11,200

A)$12,800

B)$14,400

C)$12,100

D)$11,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

56

On December 31, 2019, prior to adjustments, Accounts Receivable has a debit balance of $256,000 and the Allowance for Doubtful Accounts has a debit balance of $1,600. The firm estimates its losses from uncollectible accounts to be 5% of accounts receivable at the end of the year. The amount of the adjusting entry needed to record the estimated losses from uncollectible accounts is:

A)$12,800

B)$12,100

C)$14,400

D)$11,200

A)$12,800

B)$12,100

C)$14,400

D)$11,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

57

On December 31, prior to adjustments, the balance of Accounts Receivable is $28,000 and Allowance for Doubtful Accounts has a debit balance of $200. The firm estimates its losses from uncollectible accounts to be 5.5% of accounts receivable at the end of the year. The balance is Allowance for Doubtful Accounts after adjustment is

A)$1,740.

B)$1,340.

C)$200.

D)$1,540.

A)$1,740.

B)$1,340.

C)$200.

D)$1,540.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

58

When a firm uses the allowance method to provide for losses for uncollectible accounts, the collection of an account previously written off as uncollectible requires an entry to

A)decrease the balance of the Allowance for Doubtful Accounts.

B)reduce the balance of Uncollectible Accounts Expense.

C)increase the balance of the Sales account.

D)reinstate the account receivable.

A)decrease the balance of the Allowance for Doubtful Accounts.

B)reduce the balance of Uncollectible Accounts Expense.

C)increase the balance of the Sales account.

D)reinstate the account receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

59

Nigel Lighting uses the direct charge-off method of recording bad debts. On Sept. 4, the $300 account balance of Louis Blue was charged off. However, on November 15, Blue paid $70 of the amount previously written off. The entry to record the payment from Blue would include:

A)debit Accounts Receivable $300; credit Uncollectible Account Expense $300

B)debit Cash $70; credit Accounts Receivable $70

C)debit Allowance for Doubtful Accounts $70; credit Accounts Receivable $70

D)debit Uncollectible Account Expense $70; credit Cash $70

A)debit Accounts Receivable $300; credit Uncollectible Account Expense $300

B)debit Cash $70; credit Accounts Receivable $70

C)debit Allowance for Doubtful Accounts $70; credit Accounts Receivable $70

D)debit Uncollectible Account Expense $70; credit Cash $70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

60

On December 31, 2019, prior to adjustments, Accounts Receivable has a debit balance of $370,000 and the Allowance for Doubtful Accounts has a credit balance of $800. The firm estimates its losses from uncollectible accounts to be 3% of accounts receivable at the end of the year. The amount to be reported as Uncollectible Accounts Expense on the income statement for the year ending December 31, 2019, is

A)$10,300

B)$12,700

C)$11,100

D)$11,900

A)$10,300

B)$12,700

C)$11,100

D)$11,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

61

The practice of estimating losses from uncollectible accounts before specific accounts become uncollectible is referred to as the ________ method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

62

The estimated loss from uncollectible accounts can be based on the net credit sales for the year or the balance at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

63

The longer an account is past due, the ________ likely it is to be collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

64

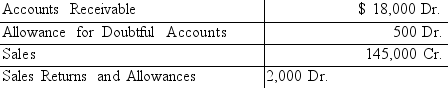

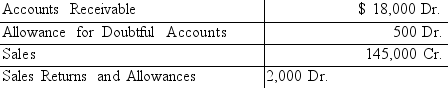

At the end of 2019, the trial balance of Bryant Paint Store included the accounts and balances shown below. Credit sales were $145,000. Returns and allowances on these sales were $2,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.3 percent of net credit sales.

Accounts Receivable $ 18,000 Dr. Allowance for Doubtful Accounts 500 Dr.

1. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts for 2019??

2. What is the amount to be reported as Uncollectible Accounts Expense on the income statement for the year ended December 31, 2019?

Accounts Receivable $ 18,000 Dr. Allowance for Doubtful Accounts 500 Dr.

1. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts for 2019??

2. What is the amount to be reported as Uncollectible Accounts Expense on the income statement for the year ended December 31, 2019?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

65

At the end of the current year, the trial balance of Carlton's Auto Sales included the accounts and balances shown below. Credit sales were $9,200,000. Returns and allowances on these sales were

$55,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.3 percent of net credit sales.

Accounts Receivable $ 1,300,000 Dr. Allowance for Doubtful Accounts 9,000 Cr.

Sales 14,000,000 Cr.

Sales Returns and Allowances 110,000 Dr.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the balance in the Allowance for Doubtful Accounts after adjustment?

$55,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.3 percent of net credit sales.

Accounts Receivable $ 1,300,000 Dr. Allowance for Doubtful Accounts 9,000 Cr.

Sales 14,000,000 Cr.

Sales Returns and Allowances 110,000 Dr.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the balance in the Allowance for Doubtful Accounts after adjustment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

66

At the end of the current year, the trial balance of Daniels' Furniture Store included the accounts and balances shown below. Credit sales were $180,000. Returns and allowances on these sales were

$2,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.4 percent of net credit sales.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

$2,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.4 percent of net credit sales.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

67

The entry to record the write-off of a specific uncollectible account using the allowance method includes a debit to ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

68

The adjusting entry to record estimated losses from uncollectible accounts includes a(n)credit to the ________ account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

69

When using the allowance method for accounting for uncollectible accounts, it takes ________ entries to record the collection of an account that was previously written off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

70

At the end of the current year, the trial balance of Kerry Hardware included the accounts and balances shown below. Credit sales were $7,560,000. Returns and allowances on these sales were

$62,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.4 percent of net credit sales.

Accounts Receivable $ 590,000 Dr.

Allowance for Doubtful Accounts 3,700 Cr.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

$62,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.4 percent of net credit sales.

Accounts Receivable $ 590,000 Dr.

Allowance for Doubtful Accounts 3,700 Cr.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

71

At the end of the current year, the trial balance of Tracey's Consulting Services included the accounts and balances shown below. Credit sales were $90,000. Returns and allowances on these sales were

$1,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.4 percent of net credit sales.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

$1,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.4 percent of net credit sales.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

72

After the adjusting entry is made to record the estimate of losses from uncollectible accounts, Allowance for Doubtful Accounts should have a(n) ________balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

73

At the end of the current year, the trial balance of Diane's Dress Shop included the accounts and balances shown below. Credit sales were $9,200,000. Returns and allowances on these sales were

$55,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on .6 percent of net credit sales.

Accounts Receivable $ 1,300,000 Dr. Allowance for Doubtful Accounts 9,000 Cr.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the balance in the Allowance for Doubtful Accounts after adjustment?

$55,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on .6 percent of net credit sales.

Accounts Receivable $ 1,300,000 Dr. Allowance for Doubtful Accounts 9,000 Cr.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the balance in the Allowance for Doubtful Accounts after adjustment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

74

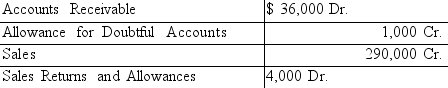

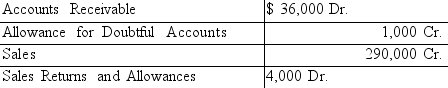

At the end of the current year, the trial balance of Cary's Craft Shop included the accounts and balances shown below. Credit sales were $290,000. Returns and allowances on these sales were

$4,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.3 percent of net credit sales.

Accounts Receivable $ 36,000 Dr. Allowance for Doubtful Accounts 1,000 Dr.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

$4,000. Assume that the firm bases its estimate of the loss from uncollectible accounts on 0.3 percent of net credit sales.

Accounts Receivable $ 36,000 Dr. Allowance for Doubtful Accounts 1,000 Dr.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

75

Allowance for Doubtful Accounts has a debit balance of $700 at the end of the year, before adjustments. Sales for the year amounted to $920,000, sales discounts amounted to $31,200 and sales returns and allowances amounted to $42,300.

- If the uncollectible accounts expense is estimated at 2% of net sales, the amount of the adjusting entry to record the estimated losses from uncollectible accounts will be

A)$16,930

B)$16,230

C)$18,400

D)$17,630

- If the uncollectible accounts expense is estimated at 2% of net sales, the amount of the adjusting entry to record the estimated losses from uncollectible accounts will be

A)$16,930

B)$16,230

C)$18,400

D)$17,630

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

76

Allowance for Doubtful Accounts has a debit balance of $700 at the end of the year, before adjustments. Sales for the year amounted to $920,000, sales discounts amounted to $31,200 and sales returns and allowances amounted to $42,300.

-If the uncollectible accounts expense is estimated at 2% of net sales, the balance in the Allowance for Doubtful Accounts after the entry to record estimated losses from uncollectible accounts will be

A)$17,630

B)$16,230

C)$18,400

D)$16,930

-If the uncollectible accounts expense is estimated at 2% of net sales, the balance in the Allowance for Doubtful Accounts after the entry to record estimated losses from uncollectible accounts will be

A)$17,630

B)$16,230

C)$18,400

D)$16,930

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

77

Allowance for Doubtful Accounts has a credit balance of $1,100 at the end of the year, before adjustments. Sales for the year amounted to $760,000, sales discounts amounted to $12,000 and sales returns and allowances amounted to $36,000. If the uncollectible accounts expense is estimated at 2% of net sales, the amount of the adjusting entry to record the estimated losses from uncollectible accounts will be

A)$15,200

B)$14,240

C)$15,340

D)$13,140

A)$15,200

B)$14,240

C)$15,340

D)$13,140

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

78

At the end of the current year, the trial balance of Monique's Fashion Industries included the accounts and balances shown below. Credit sales were $6,400,000. Returns and allowances on these

sales were $57,200. Assume that the firm bases its estimate of the loss from uncollectible accounts on

0.3 percent of net credit sales.

Accounts Receivable $ 650,000 Dr. Allowance for Doubtful Accounts 4,500 Cr.

Sales 7,000,000 Cr.

Sales Returns and Allowances 55,000 Dr.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts? (Round your answers to the nearest dollar.)

sales were $57,200. Assume that the firm bases its estimate of the loss from uncollectible accounts on

0.3 percent of net credit sales.

Accounts Receivable $ 650,000 Dr. Allowance for Doubtful Accounts 4,500 Cr.

Sales 7,000,000 Cr.

Sales Returns and Allowances 55,000 Dr.

1. What is the estimated loss from uncollectible accounts for the current year?

2. What is the amount of the adjusting entry for the estimated loss from uncollectible accounts? (Round your answers to the nearest dollar.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

79

A procedure that groups accounts receivable according to the length of time they have been outstanding is called ________ the accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

80

On December 31, 2019, prior to adjustments, the Allowance for Doubtful Accounts has a debit balance of $750. An aging of the accounts receivable produces an estimate of $6,500 of probable losses from uncollectible accounts.

-The balance in the Allowance for Doubtful Accounts after the entry to record estimated losses from uncollectible accounts will be:

A)a credit of $5,750

B)a credit of $7,250

C)a credit of $6,500

D)a debit of $6,500

-The balance in the Allowance for Doubtful Accounts after the entry to record estimated losses from uncollectible accounts will be:

A)a credit of $5,750

B)a credit of $7,250

C)a credit of $6,500

D)a debit of $6,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck