Deck 4: The General Journal and the General Ledger

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

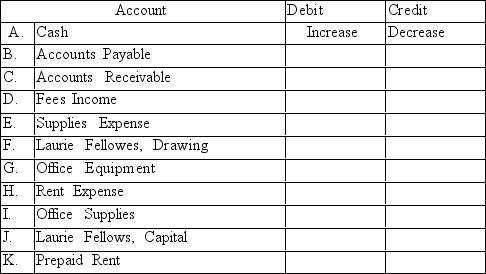

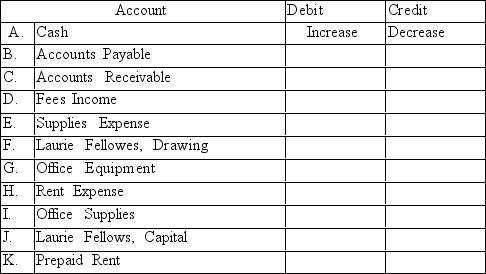

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/97

العب

ملء الشاشة (f)

Deck 4: The General Journal and the General Ledger

1

If a journal entry that contains an error has already been posted, a correcting entry should be journalized and posted.

True

2

The journal entry to record the sale of services on credit should include:

A)a debit to Accounts Receivable and a credit to Capital.

B)a debit to Accounts Receivable and a credit to Fees Income.

C)a debit to Cash and a credit to Accounts Receivable.

D)a debit to Fees Income and a credit to Accounts Receivable.

A)a debit to Accounts Receivable and a credit to Capital.

B)a debit to Accounts Receivable and a credit to Fees Income.

C)a debit to Cash and a credit to Accounts Receivable.

D)a debit to Fees Income and a credit to Accounts Receivable.

B

3

A ledger account contains a complete record of the individual transaction activity in each account.

True

4

Account names are written in the general journal exactly as they appear in the chart of accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

5

Transactions are entered in the journal in chronological order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

6

When an entry is made in the general journal,

A)the accounts to be credited should be indented.

B)liability, capital, and revenue accounts should be indented.

C)asset accounts should be indented.

D)the first account entered should be indented.

A)the accounts to be credited should be indented.

B)liability, capital, and revenue accounts should be indented.

C)asset accounts should be indented.

D)the first account entered should be indented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

7

If an error is discovered before the entry is posted, the incorrect amount can be erased and the correct amount recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

8

Transactions are recorded in either a journal or a ledger, but not in both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

9

The balance ledger form always shows the current balance of an account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

10

Transactions in a journal are initially recorded in:

A)chronological order.

B)randomly.

C)dollar amount order.

D)alphabetical order.

A)chronological order.

B)randomly.

C)dollar amount order.

D)alphabetical order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

11

When an entry is made in the general journal,

A)accounts to be increased should be listed first.

B)assets should be listed first.

C)accounts may be listed in any order.

D)accounts to be debited should be listed first.

A)accounts to be increased should be listed first.

B)assets should be listed first.

C)accounts may be listed in any order.

D)accounts to be debited should be listed first.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

12

An amount debited to Cash in a journal entry should be posted as a credit to the Cash account in the ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

13

Posting references are part of the audit trail.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

14

A journal entry can consist of no more than one account to be debited and one account to be credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

15

Posting references provide a useful cross-reference when entries must be traced and verified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

16

The revenue accounts come before the expense accounts in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statements is NOT correct?

A)A firm should be able to trace amounts through the accounting records and back to their source documents.

B)The description of a journal entry should include a reference to the source of the information contained in the entry.

C)The credit portion of a general journal entry is always recorded first.

D)If goods are purchased on credit, the supplier's invoice number is used as the source document for the transaction.

A)A firm should be able to trace amounts through the accounting records and back to their source documents.

B)The description of a journal entry should include a reference to the source of the information contained in the entry.

C)The credit portion of a general journal entry is always recorded first.

D)If goods are purchased on credit, the supplier's invoice number is used as the source document for the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

18

When transactions are entered in a general journal, the asset accounts are listed first, followed by the liability and owner's equity accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

19

A ledger is sometimes referred to as a record of original entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

20

When a transaction is entered in a general journal, the first account title is indented about half an inch from the left margin of the Description column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

21

The first place a transaction is recorded is in the:

A)journal

B)trial balance

C)source document

D)general ledger

A)journal

B)trial balance

C)source document

D)general ledger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

22

Identify the entry below that records the purchase of office supplies on account.

A)debit Office Supplies Expense; credit Accounts Payable

B)debit Office Supplies; credit Cash

C)debit Accounts Payable; credit Office Supplies

D)debit Office Supplies; credit Accounts Payable

A)debit Office Supplies Expense; credit Accounts Payable

B)debit Office Supplies; credit Cash

C)debit Accounts Payable; credit Office Supplies

D)debit Office Supplies; credit Accounts Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements is CORRECT?

A)Accounts being debited should always follow the accounts being credited in a compound entry.

B)Compound entries affect more than one debit and/or more than one credit.

C)All transactions require compound entries.

D)Compound entries include only debits.

A)Accounts being debited should always follow the accounts being credited in a compound entry.

B)Compound entries affect more than one debit and/or more than one credit.

C)All transactions require compound entries.

D)Compound entries include only debits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the owner of the business wants to see both the debit and credit entry for a specific transaction, he would look in:

A)the journal

B)the source document

C)the chart of accounts

D)the ledger

A)the journal

B)the source document

C)the chart of accounts

D)the ledger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

25

The journal entry to record the payment of salaries for the month is:

A)Debit Cash; Credit Salaries Payable

B)Debit Salaries; Credit Accounts Payable

C)Debit Salaries Expense; Credit Cash

D)Debit Cash; Credit Salaries Expense

A)Debit Cash; Credit Salaries Payable

B)Debit Salaries; Credit Accounts Payable

C)Debit Salaries Expense; Credit Cash

D)Debit Cash; Credit Salaries Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

26

The journal entry to record the receipt of cash from credit clients would include:

A)a debit to Cash and a credit to Fees Income.

B)a debit to Cash and a credit to Accounts Receivable.

C)a debit to Accounts Receivable and a credit to Cash.

D)a debit to Fees Income and a credit to Cash.

A)a debit to Cash and a credit to Fees Income.

B)a debit to Cash and a credit to Accounts Receivable.

C)a debit to Accounts Receivable and a credit to Cash.

D)a debit to Fees Income and a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

27

The journal entry to record the payment of salaries should include:

A)a debit to Salaries Expense.

B)a credit to Accounts Receivable.

C)a credit to Salaries Expense.

D)a debit to Salaries Payable.

A)a debit to Salaries Expense.

B)a credit to Accounts Receivable.

C)a credit to Salaries Expense.

D)a debit to Salaries Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a transaction is properly analyzed and recorded,

A)one asset account will be debited and one liability account will be credited.

B)the total dollar amount debited will equal the total dollar amount credited.

C)only two accounts will be used to record the transaction.

D)one account balance will increase and another will decrease.

A)one asset account will be debited and one liability account will be credited.

B)the total dollar amount debited will equal the total dollar amount credited.

C)only two accounts will be used to record the transaction.

D)one account balance will increase and another will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

29

A purchase of office equipment for cash is journalized as:

A)Debit Office Equipment; Credit Cash

B)Debit Office Equipment; Credit Accounts Payable

C)Debit Equipment Expense; Credit Cash

D)Debit Cash; Credit Office Equipment

A)Debit Office Equipment; Credit Cash

B)Debit Office Equipment; Credit Accounts Payable

C)Debit Equipment Expense; Credit Cash

D)Debit Cash; Credit Office Equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

30

The process of transferring the data from the journal to the general ledger is called:

A)footing

B)journalizing

C)posting

D)transposing

A)footing

B)journalizing

C)posting

D)transposing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

31

The journal entry to record the payment of the monthly rent would include:

A)a debit to Rent Expense and a credit to Capital.

B)a debit to Rent Expense and a credit to Accounts Receivable.

C)a debit to Capital and a credit to Cash.

D)a debit to Rent Expense and a credit to Cash.

A)a debit to Rent Expense and a credit to Capital.

B)a debit to Rent Expense and a credit to Accounts Receivable.

C)a debit to Capital and a credit to Cash.

D)a debit to Rent Expense and a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

32

Business papers, such as checks, invoices, receipts, letters, and memos, that furnish proof that a transaction has taken place are called:

A)source documents

B)accounts

C)debits

D)ledgers

A)source documents

B)accounts

C)debits

D)ledgers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

33

Anna Conda Landscaping service received a bill for the utilities used during September. The bill will be paid in October. The journal entry to record the utility bill received is:

A)Debit Utilities Expense; Credit Accounts Payable

B)Debit Utilities Expense; Credit Cash

C)Debit Accounts Payable; Credit Cash

D)Debit Cash; Credit Utilities Expense

A)Debit Utilities Expense; Credit Accounts Payable

B)Debit Utilities Expense; Credit Cash

C)Debit Accounts Payable; Credit Cash

D)Debit Cash; Credit Utilities Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

34

In which of the following transactions would Utilities Expense be debited:

A)the company paid a utility bill on account

B)the company received and paid a bill for utilities

C)the company received a bill for utilities to be paid the following month

D)both A and B

A)the company paid a utility bill on account

B)the company received and paid a bill for utilities

C)the company received a bill for utilities to be paid the following month

D)both A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

35

On July 3, the ABC Company received $865 in cash on account from customers. The correct journal entry to record this transaction is:

A)debit Cash, $865; credit Accounts Receivable, $865

B)debit Accounts Receivable, $865; credit Cash, $865

C)debit Cash, $865; credit Accounts Payable, $865

D)debit Cash, $865; credit Income from Services, $865

A)debit Cash, $865; credit Accounts Receivable, $865

B)debit Accounts Receivable, $865; credit Cash, $865

C)debit Cash, $865; credit Accounts Payable, $865

D)debit Cash, $865; credit Income from Services, $865

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

36

Agatha Panthis Landscape Architect Company earned $2,500 of revenue collecting $1,000 immediately and will correct the remaining amount in 30 days. The journal entry to record this transaction is:

A)Debit Fees Income $2,500; Credit Cash $1,000; credit Accounts Receivable $1,500

B)Debit Cash $1,000; Debit Accounts Receivable $1,500; Credit Fees Income $2,500

C)Debit Fees Income $2,500; Credit Accounts Receivable $2,500

D)Debit Cash $1,000; Credit Fees Income $1,000

A)Debit Fees Income $2,500; Credit Cash $1,000; credit Accounts Receivable $1,500

B)Debit Cash $1,000; Debit Accounts Receivable $1,500; Credit Fees Income $2,500

C)Debit Fees Income $2,500; Credit Accounts Receivable $2,500

D)Debit Cash $1,000; Credit Fees Income $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

37

The journal entry to record the performance of services for cash would include:

A)a debit to Cash and a credit to Fees Income.

B)a debit to Accounts Receivable and a credit to Cash.

C)a debit to Fees Income and a credit to Cash.

D)a debit to Cash and a credit to Accounts Receivable.

A)a debit to Cash and a credit to Fees Income.

B)a debit to Accounts Receivable and a credit to Cash.

C)a debit to Fees Income and a credit to Cash.

D)a debit to Cash and a credit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

38

When recording a business transaction into the journal, certain steps are followed. Identify the statement below that is CORRECT regarding the journalizing process.

A)All transactions are recorded first in the general ledger and then they are journalized in the journal.

B)An explanation is indented and entered on the line underneath the last credit in the entry.

C)All credited accounts are listed first and then all debited accounts are indented and listed on the next lines.

D)No dates are used in the journal.

A)All transactions are recorded first in the general ledger and then they are journalized in the journal.

B)An explanation is indented and entered on the line underneath the last credit in the entry.

C)All credited accounts are listed first and then all debited accounts are indented and listed on the next lines.

D)No dates are used in the journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

39

The journal entry to record a payment made in January for rent for the months of February and March would include:

A)a debit to Rent Expense, and a credit to Sue Snow, Capital.

B)a debit to Sue Snow, Drawing and a credit to Rent Expense.

C)a debit to Rent Expense and a credit to Cash.

D)a debit to Prepaid Rent and a credit to Cash.

A)a debit to Rent Expense, and a credit to Sue Snow, Capital.

B)a debit to Sue Snow, Drawing and a credit to Rent Expense.

C)a debit to Rent Expense and a credit to Cash.

D)a debit to Prepaid Rent and a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

40

The journal entry to record the withdrawal of cash by Sue Snow, the owner, to pay a personal utility bill would include:

A)a debit to Utilities Expense and a credit to Cash.

B)a debit to Sue Snow, Drawing and a credit to Cash.

C)a debit to Sue Snow, Capital and a credit to Utilities Expense.

D)a debit to Sue Snow, Capital, and a credit to Cash.

A)a debit to Utilities Expense and a credit to Cash.

B)a debit to Sue Snow, Drawing and a credit to Cash.

C)a debit to Sue Snow, Capital and a credit to Utilities Expense.

D)a debit to Sue Snow, Capital, and a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

41

The account numbers from the ledger are recorded in the Posting Reference column of the general journal:

A)as the first amount written in the journal.

B)as the transaction is journalized.

C)after each amount is posted.

D)after all entries on the journal page have been posted.

A)as the first amount written in the journal.

B)as the transaction is journalized.

C)after each amount is posted.

D)after all entries on the journal page have been posted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

42

Listed below in random order are the steps in the accounting cycle.

(1) prepare the financial statements

(2) post the journal entries to the ledger

(3) record journal entries

(4) prepare a trial balance

What is the proper order of these steps?

A)(3), (2), (1), (4)

B)(2), (3), (4), (1)

C)(4), (3), (2), (1)

D)(3), (2), (4), (1)

(1) prepare the financial statements

(2) post the journal entries to the ledger

(3) record journal entries

(4) prepare a trial balance

What is the proper order of these steps?

A)(3), (2), (1), (4)

B)(2), (3), (4), (1)

C)(4), (3), (2), (1)

D)(3), (2), (4), (1)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

43

On December 1, the Accounts Receivable account had a $22,000 debit balance. During December the business earned $10,500 in revenue on account and collected $13,200 from its charge-account customers. After posting these transaction, the balance in the Accounts Receivable account on December 31 is:

A)a $19,300 debit balance.

A)a $24,700 credit balance.

B)a $24,700 debit balance.

D)a $23,700 credit balance.

A)a $19,300 debit balance.

A)a $24,700 credit balance.

B)a $24,700 debit balance.

D)a $23,700 credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

44

If a journal entry that contains an error has already been posted,

A)the journal need not be corrected but the posting to the ledger should be corrected by crossing out the incorrect data and writing the correct data above it.

B)the incorrect items should be corrected by crossing out the incorrect data and writing the correct data above it in both the journal and the ledger.

C)the incorrect items should be erased and replaced with the correct data.

D)a correcting entry should be journalized and posted.

A)the journal need not be corrected but the posting to the ledger should be corrected by crossing out the incorrect data and writing the correct data above it.

B)the incorrect items should be corrected by crossing out the incorrect data and writing the correct data above it in both the journal and the ledger.

C)the incorrect items should be erased and replaced with the correct data.

D)a correcting entry should be journalized and posted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

45

On December 1, the Accounts Receivable account had a $5,000 balance. The business received

$400 during the month from its charge-account customer. After posting this transaction, the new balance in the Accounts Receivable account is:

A)a $4,600 credit balance.

A)a $5,400 debit balance.

B)a $4,600 debit balance.

D)a $5,400 credit balance.

$400 during the month from its charge-account customer. After posting this transaction, the new balance in the Accounts Receivable account is:

A)a $4,600 credit balance.

A)a $5,400 debit balance.

B)a $4,600 debit balance.

D)a $5,400 credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Posting Reference column of a journal is used to:

A)record the number of the ledger account to which the information is posted.

B)record the number of amounts posted to that ledger account since the beginning of the current accounting period.

C)record the page number of the ledger account.

D)record the date on which an amount is posted to a ledger account.

A)record the number of the ledger account to which the information is posted.

B)record the number of amounts posted to that ledger account since the beginning of the current accounting period.

C)record the page number of the ledger account.

D)record the date on which an amount is posted to a ledger account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

47

The general ledger accounts are usually arranged in the following order:

A)first the temporary accounts, then the permanent accounts.

B)first the accounts with debit balances, then the accounts with credit balances.

C)first the accounts used most often, then those used less frequently.

D)first the balance sheet accounts, then the income statement accounts.

A)first the temporary accounts, then the permanent accounts.

B)first the accounts with debit balances, then the accounts with credit balances.

C)first the accounts used most often, then those used less frequently.

D)first the balance sheet accounts, then the income statement accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

48

On December 10, Yummy Catering purchased a new oven costing $10,000. They issued a check a check for $2,000 and promised to pay the balance in 30 days. The journal entry to record this transaction is:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

49

A firm purchased telephone equipment for cash. By mistake, the accountant debited Utilities Expense instead of Office Equipment. The error was discovered after the data posted. The correcting entry should contain:

A)a debit to Utilities Expense and a credit to Cash.

B)a debit to Cash and a credit to Office Equipment.

C)a debit to Office Equipment and a credit to Utilities Expense.

D)a debit to Office Equipment and a credit to Cash.

A)a debit to Utilities Expense and a credit to Cash.

B)a debit to Cash and a credit to Office Equipment.

C)a debit to Office Equipment and a credit to Utilities Expense.

D)a debit to Office Equipment and a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

50

ABC Co. performed $5,000 of consulting work. Their customer paid them $3,500 right away and agreed to pay the balance in 30 days. Select the correct journal entry from the options below to record the transaction:

A)a debit to Cash for $3,500, a debit to Accounts Receivable for $1,500 and a credit to Capital for $5,000.

B)a debit to Cash for $3,500 and a credit to Fees Income for $3,500.

C)a debit to Fees Income for $5,000, a credit to Cash for $3,500 and a credit to Accounts Receivable for $1,500.

D)a debit to Cash for $3,500; a debit to Accounts Receivable for $1,500 and a credit to Fees Income for $5,000.

A)a debit to Cash for $3,500, a debit to Accounts Receivable for $1,500 and a credit to Capital for $5,000.

B)a debit to Cash for $3,500 and a credit to Fees Income for $3,500.

C)a debit to Fees Income for $5,000, a credit to Cash for $3,500 and a credit to Accounts Receivable for $1,500.

D)a debit to Cash for $3,500; a debit to Accounts Receivable for $1,500 and a credit to Fees Income for $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

51

On September 1, Lazy A, Inc. paid $2,200 for a one year insurance policy. The journal entry to record this transaction is:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

52

On December 5, Honor Consulting Services issued a check to purchase $1,800 of office equipment. The journal entry to record this transaction is:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

53

On June 1, XYZ Inc. paid $400 to its landlord for rent for the current month. The journal entry to record this transaction is:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

54

The Accounts Payable account has a $3,000 credit balance. An entry for the payment of $1,000 on the amount owed is recorded and posted. The new balance of the Accounts Payable account is:

A)a $2,000 debit balance.

B)a $1,000 debit balance.

C)a $2,000 credit balance.

D)a $4,000 credit balance.

A)a $2,000 debit balance.

B)a $1,000 debit balance.

C)a $2,000 credit balance.

D)a $4,000 credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Cash account has a $15,000 debit balance. A $5,000 credit entry and a $7,000 debit entry are posted to the account. The final balance of the Cash account is:

A)a $17,000 debit balance.

B)a $27,000 debit balance.

C)a $3,000 debit balance.

D)a $13,000 debit balance.

A)a $17,000 debit balance.

B)a $27,000 debit balance.

C)a $3,000 debit balance.

D)a $13,000 debit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

56

The journal entry to record the purchase of equipment for a $100 cash down payment and a balance of $400 due in 30 days would include:

A)a debit to Equipment for $100 and a credit to Accounts Payable for $400.

B)a debit to Equipment for $100 and a credit to Cash for $100.

C)a debit to Equipment for $500, a credit to Cash for $100, and a credit to Accounts Payable for

$400.

D)debit to Equipment for $500 and a credit to Cash for $500.

A)a debit to Equipment for $100 and a credit to Accounts Payable for $400.

B)a debit to Equipment for $100 and a credit to Cash for $100.

C)a debit to Equipment for $500, a credit to Cash for $100, and a credit to Accounts Payable for

$400.

D)debit to Equipment for $500 and a credit to Cash for $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

57

The accounts on the Trial Balance are always listed in the following order:

A)Assets, Liabilities, Equity, Revenue, Expense

B)Assets, Expense, Liabilities, Equity, Revenue

C)Assets, Equity, Expense, Liabilities, Revenue

D)Expense, Revenue, Equity, Liabilities, Assets

A)Assets, Liabilities, Equity, Revenue, Expense

B)Assets, Expense, Liabilities, Equity, Revenue

C)Assets, Equity, Expense, Liabilities, Revenue

D)Expense, Revenue, Equity, Liabilities, Assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following statements is CORRECT?

A)When entries are posted from the general journal to the general ledger, the account number is written in the Posting Reference column in the general ledger.

B)The general ledger contains the accounts that are used to prepare the financial statements.

C)Some companies use the general ledger instead of a general journal.

D)When entries are posted from the general journal to the general ledger, the page number is written in the Posting Reference column in the general journal.

A)When entries are posted from the general journal to the general ledger, the account number is written in the Posting Reference column in the general ledger.

B)The general ledger contains the accounts that are used to prepare the financial statements.

C)Some companies use the general ledger instead of a general journal.

D)When entries are posted from the general journal to the general ledger, the page number is written in the Posting Reference column in the general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

59

When recording a business transaction into the general ledger, certain steps are followed. Identify the statement below that is NOT CORRECT regarding this process.

A)All transactions are recorded first in the general journal and then they are transferred to the general ledger.

B)After posting a transaction, the new balance in an account can be seen in the general ledger.

C)The process of transferring data from the journal to the ledger is called posting.

D)All transactions are recorded first in the general ledger and then they are transferred to the journal.

A)All transactions are recorded first in the general journal and then they are transferred to the general ledger.

B)After posting a transaction, the new balance in an account can be seen in the general ledger.

C)The process of transferring data from the journal to the ledger is called posting.

D)All transactions are recorded first in the general ledger and then they are transferred to the journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

60

A company purchased equipment costing $15,000. They paid $1,000 right away and agreed to pay the balance in 30 days, the journal entry to record the purchase of equipment would include:

A)a debit to Equipment for $14,000 and a credit to Accounts Payable for $14,000.

B)a debit to Equipment for $15,000 and a credit to Cash for $15,000.

C)a debit to Equipment for $1,000 and a credit to Cash for $1,000.

D)a debit to Equipment for $15,000, a credit to Cash for $1,000 and a credit to Accounts Payable for $14,000.

A)a debit to Equipment for $14,000 and a credit to Accounts Payable for $14,000.

B)a debit to Equipment for $15,000 and a credit to Cash for $15,000.

C)a debit to Equipment for $1,000 and a credit to Cash for $1,000.

D)a debit to Equipment for $15,000, a credit to Cash for $1,000 and a credit to Accounts Payable for $14,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

61

Constantine Corporation reported Net Income for the year ended December 31, 2019, of $23,760 then discovered that the entry to pay the rent for December in the amount of $1,600 was not journalized and posted. What is the Net Income after the correcting journal entry is journalized and posted?

A)$20,560

B)$22,160

C)$25,360

D)$23,760

A)$20,560

B)$22,160

C)$25,360

D)$23,760

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

62

When posting, the ________ is recorded in the Posting Reference column of the journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following statements is CORRECT?

A)If an error in a journal entry is discovered before the entry is posted to the general ledger, the entry can simply be erased and replaced with the correct journal entry.

B)If an error in a journal entry is discovered before the entry is posted to the general ledger, the error in the entry should be crossed out and the correct data written above it.

C)If an error in a journal entry is discovered before the entry is posted to the general ledger, a journal entry should be made to correct the erroneous entry.

D)All errors made in journal entries should be corrected by the preparation of a correcting journal entry.

A)If an error in a journal entry is discovered before the entry is posted to the general ledger, the entry can simply be erased and replaced with the correct journal entry.

B)If an error in a journal entry is discovered before the entry is posted to the general ledger, the error in the entry should be crossed out and the correct data written above it.

C)If an error in a journal entry is discovered before the entry is posted to the general ledger, a journal entry should be made to correct the erroneous entry.

D)All errors made in journal entries should be corrected by the preparation of a correcting journal entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

64

Kelly Corporation reported Net Income for the year ended December 31, 2019, of $16,900 then discovered that an entry for revenue earned on December 30, 2019, in the amount of $1,400 had not been journalized and posted. What is the Net Income after the correcting journal entry is journalized and posted?

A)$15,500

B)$16,900

C)$14,100

D)$18,300

A)$15,500

B)$16,900

C)$14,100

D)$18,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

65

A permanent, classified record of all accounts used in a firm's operation is called a(n)________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

66

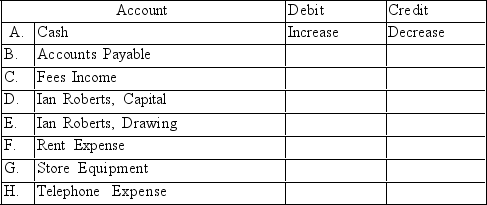

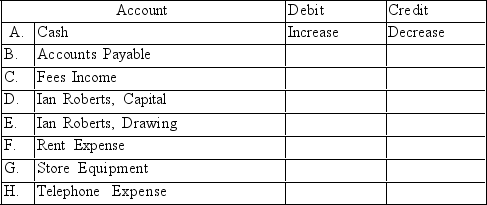

For each of the accounts listed below, enter the words, Increase or Decrease, in the Debit and Credit columns to indicate the effects of each on the account balance. The first row has been completed for reference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

67

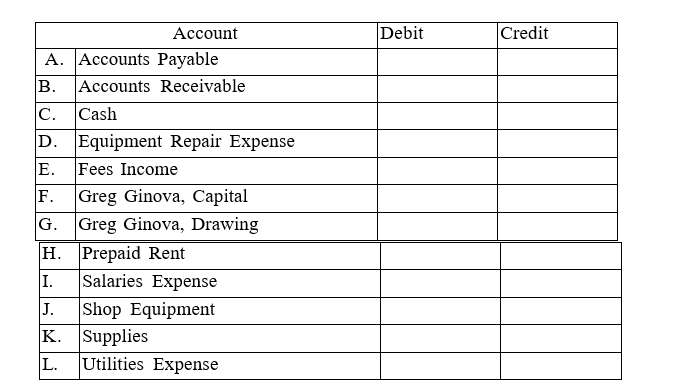

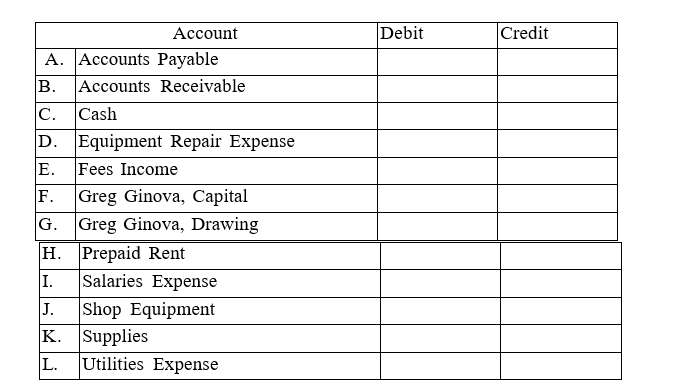

For each of the accounts listed below, enter the words, Increase or Decrease, in the Debit and Credit columns to indicate the effects of each on the account balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

68

Bertrand Inc. performed services for clients in the amount of $1,350 on credit. If this transaction had been posted in error to the Cash account instead of the Accounts Receivable account, what correcting entry would be necessary?

A)Debit Accounts Receivable $1,350; credit Fees Income $1,350

B)Debit Fees Income $1,350; credit Cash $1,350

C)Debit Accounts Receivable $1,350; credit Cash $1,350

D)Debit Cash $1,350; credit Accounts Receivable $1,350

A)Debit Accounts Receivable $1,350; credit Fees Income $1,350

B)Debit Fees Income $1,350; credit Cash $1,350

C)Debit Accounts Receivable $1,350; credit Cash $1,350

D)Debit Cash $1,350; credit Accounts Receivable $1,350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

69

The process of transferring data from a journal to a ledger is known as ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

70

Bertrand Inc. purchased some shop equipment for $4,500 in cash. By mistake, the journal entry debited the Office Equipment account rather than the Shop Equipment account. What correcting entry would be necessary?

A)Debit Shop Equipment $4,500; credit Office Equipment $4,500

B)Debit Cash $4,500; credit Shop Equipment $4,500

C)Debit Office Equipment $4,500; credit Cash $4,500

D)Debit Office Equipment $4,500; credit Shop Equipment $4,500

A)Debit Shop Equipment $4,500; credit Office Equipment $4,500

B)Debit Cash $4,500; credit Shop Equipment $4,500

C)Debit Office Equipment $4,500; credit Cash $4,500

D)Debit Office Equipment $4,500; credit Shop Equipment $4,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

71

The ________ is recorded in the Posting Reference column of the ledger account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

72

When a transaction is entered in the general journal, the account to be______ is always recorded first in the Description column.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

73

The______ is referred to as the record of final entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

74

A description should accompany each entry made in the ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

75

For each of the accounts listed below, enter the words, Increase or Decrease, in the Debit and Credit columns to indicate the effects of each on the account balance. The first row has been completed for reference.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

76

Notations that allow transactions to be quickly and easily traced from the journal to the ledger or from the ledger to the journal are called ______ references.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

77

A journal entry containing more than one debit or more than one credit is called a(n)________ entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

78

A(n)______ entry is recorded when there is an error in data that has been journalized and posted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

79

The process of recording transactions in a journal is referred to as ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

80

A ________ is referred to as a record of original entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck