Deck 2: Introduction to Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/89

العب

ملء الشاشة (f)

Deck 2: Introduction to Financial Statement Analysis

1

What are the five financial statements that all public companies are required to produce by IFRS?

1.The Balance Sheet

2.The Income Statement

3.The Statement of Cash Flows

4.The Statement of Shareholders' Equity

5.The Statement of Comprehensive Income

2.The Income Statement

3.The Statement of Cash Flows

4.The Statement of Shareholders' Equity

5.The Statement of Comprehensive Income

2

Which of the following statements regarding the balance sheet is incorrect?

A) The balance sheet provides a snapshot of the firm's financial position at a given point in time.

B) The balance sheet lists the firm's assets and liabilities.

C) The balance sheet reports stockholders' equity on the right hand side.

D) The balance sheet reports liabilities on the left hand side.

A) The balance sheet provides a snapshot of the firm's financial position at a given point in time.

B) The balance sheet lists the firm's assets and liabilities.

C) The balance sheet reports stockholders' equity on the right hand side.

D) The balance sheet reports liabilities on the left hand side.

The balance sheet reports liabilities on the left hand side.

3

Goodwill captures the value of other ________ that the firm acquired through the acquisition.If the value of these ________ assets declines over time,the amount of goodwill listed on the balance sheet will be ________ by a write-down that captures the change in value of the acquired assets.

A) "tangibles", tangible, reduced

B) "tangibles", tangible, raised

C) "intangibles", intangible, raised

D) "intangibles", intangible, reduced

A) "tangibles", tangible, reduced

B) "tangibles", tangible, raised

C) "intangibles", intangible, raised

D) "intangibles", intangible, reduced

"intangibles", intangible, reduced

4

What is the role of an auditor in financial statement analysis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

5

Shareholders' equity,the difference between the firm's ________,is an accounting measure of the firm's ________.

A) assets and liabilities, net value

B) assets and liabilities, book value

C) short-term liabilities and long-term liabilities, net value

D) short-term liabilities and long-term liabilities, book value

A) assets and liabilities, net value

B) assets and liabilities, book value

C) short-term liabilities and long-term liabilities, net value

D) short-term liabilities and long-term liabilities, book value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

6

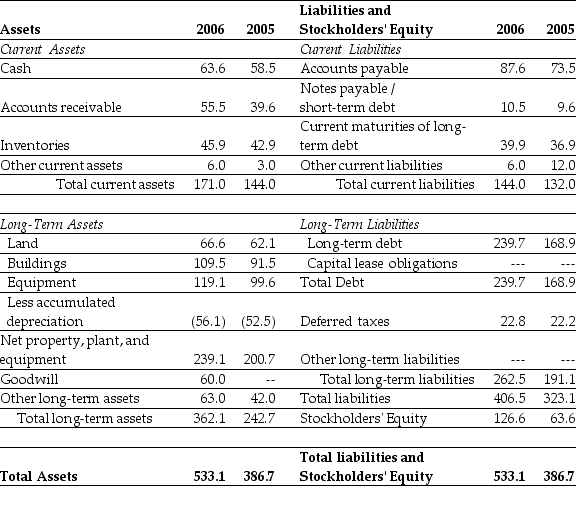

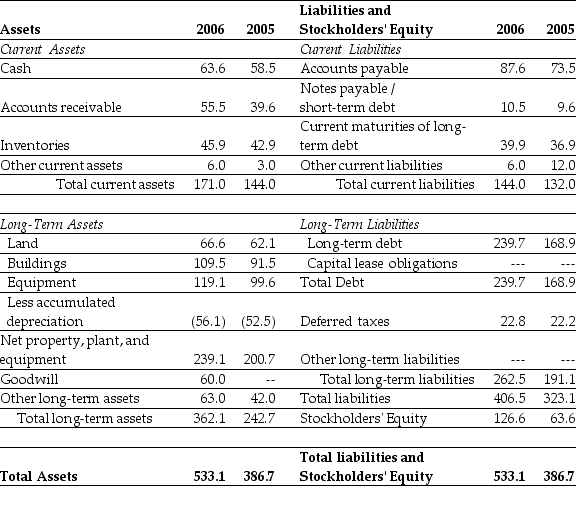

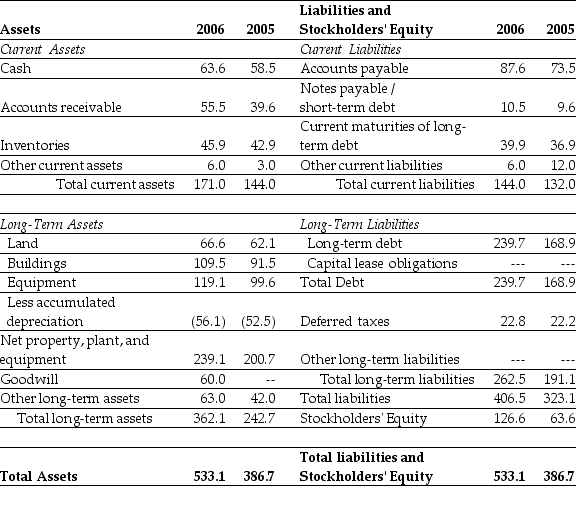

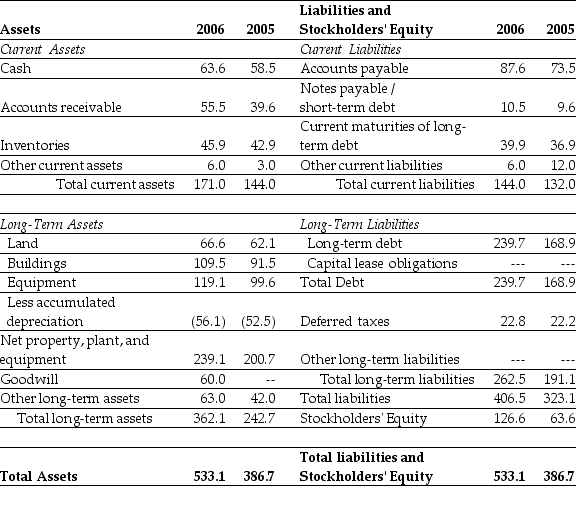

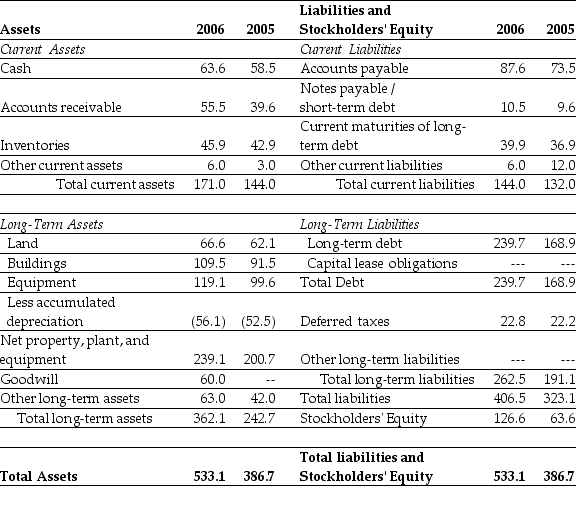

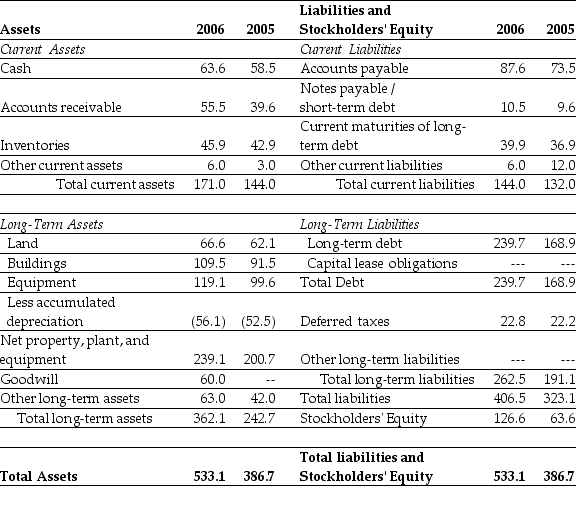

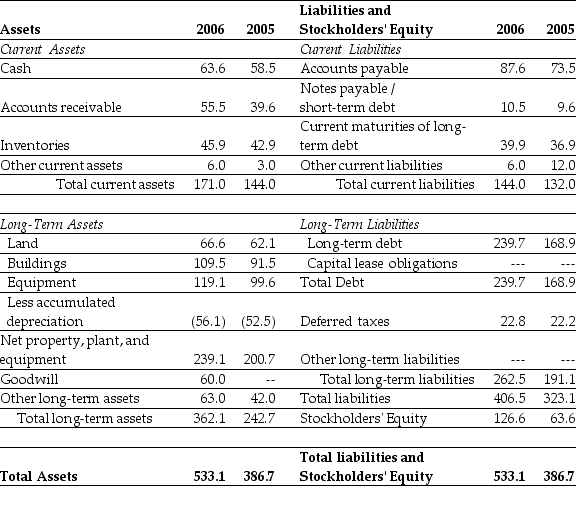

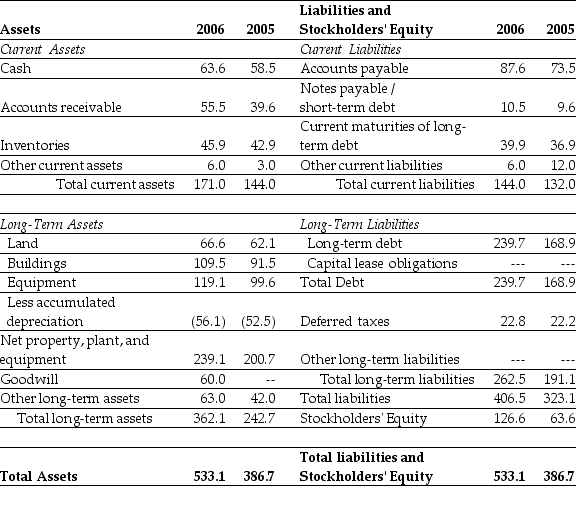

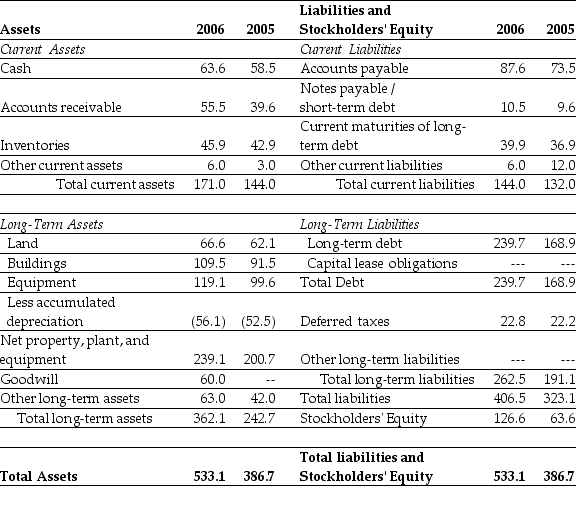

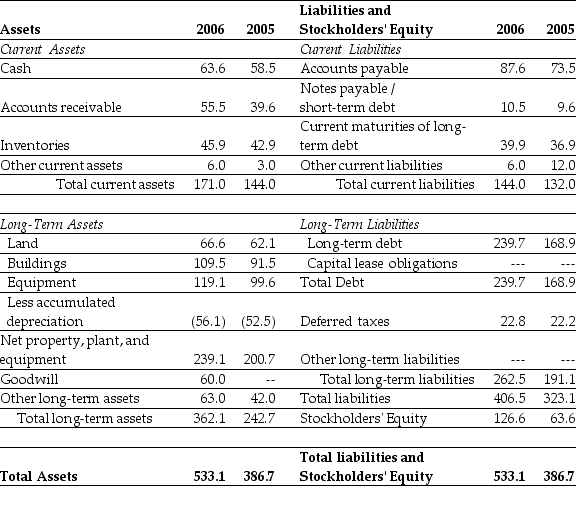

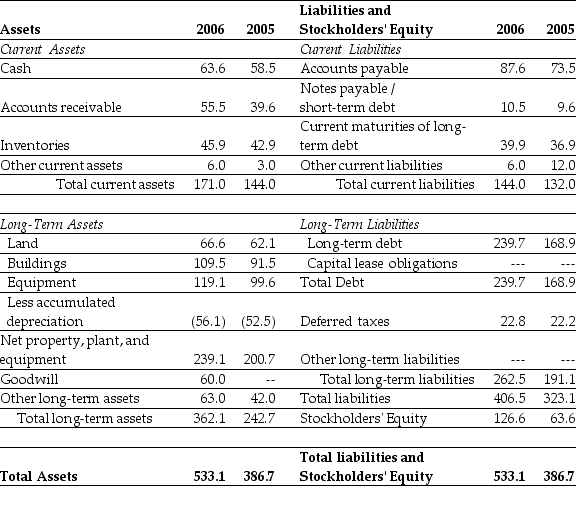

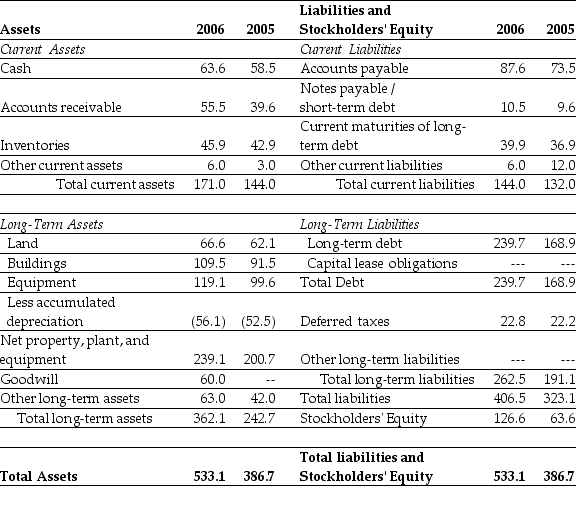

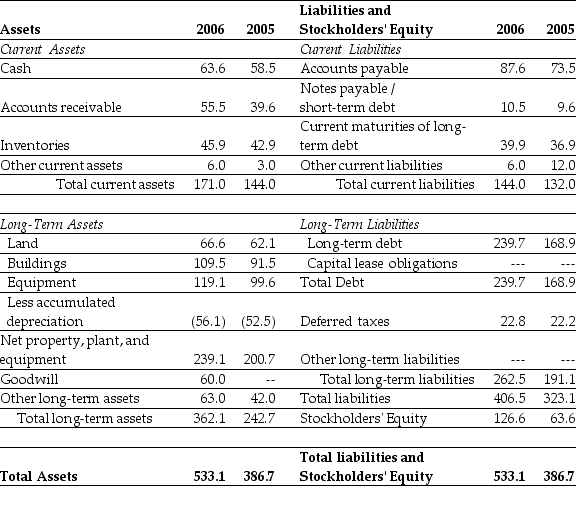

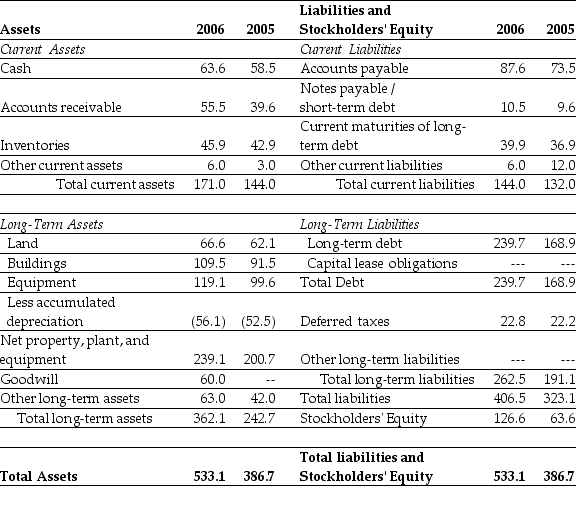

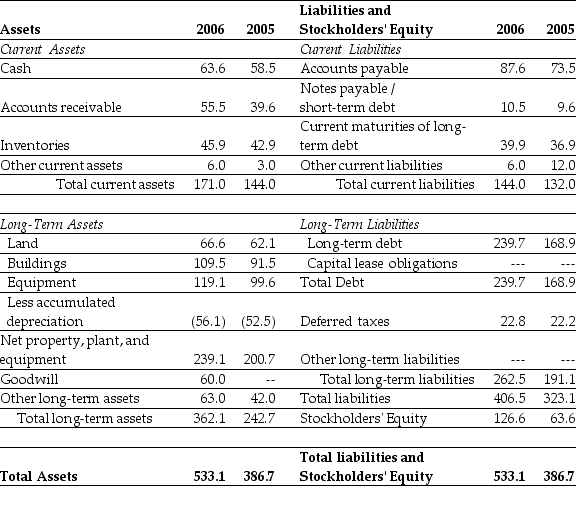

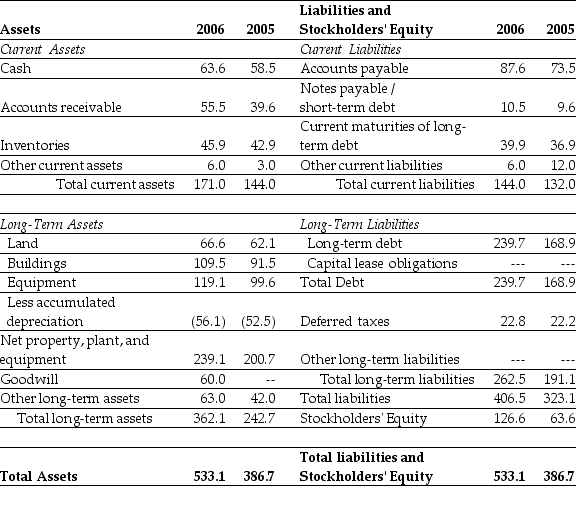

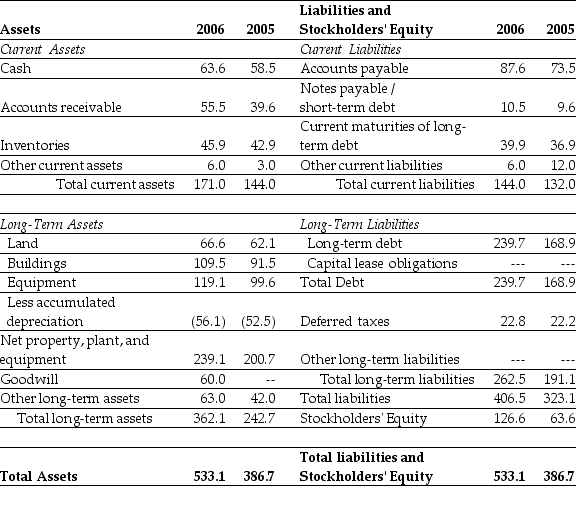

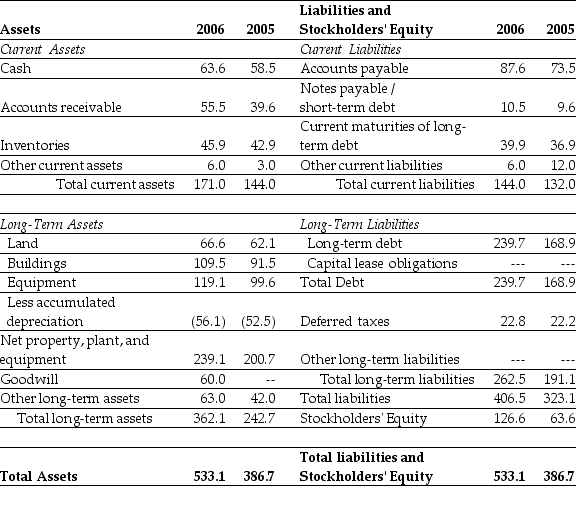

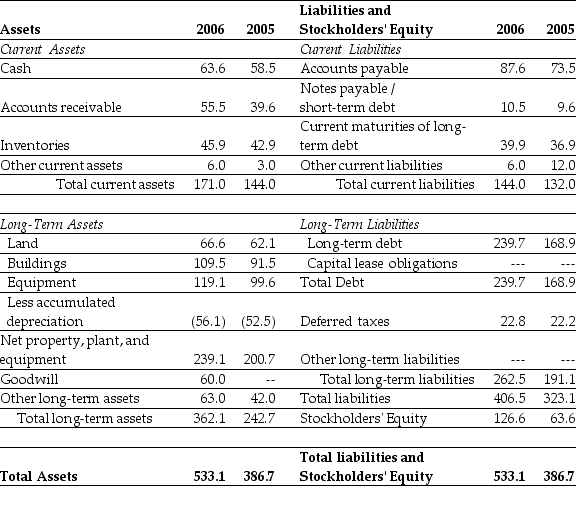

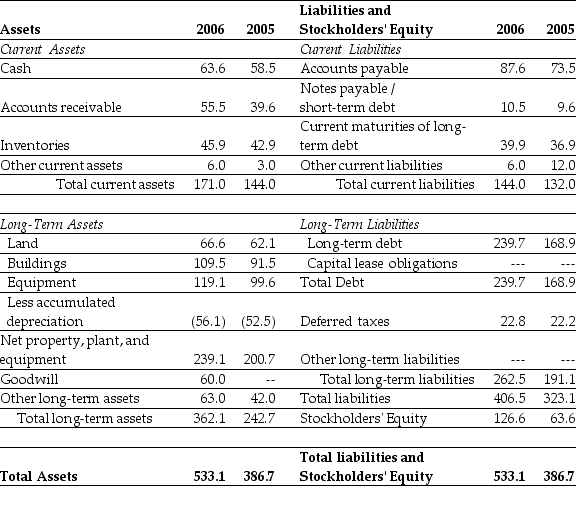

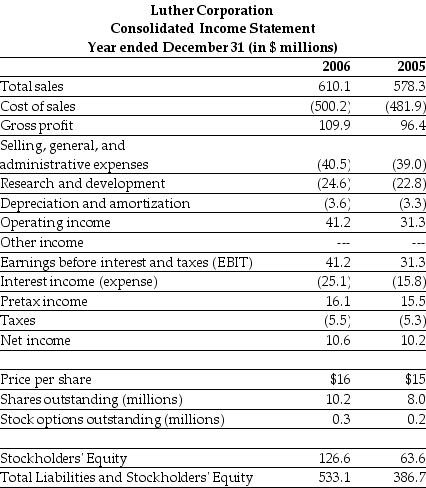

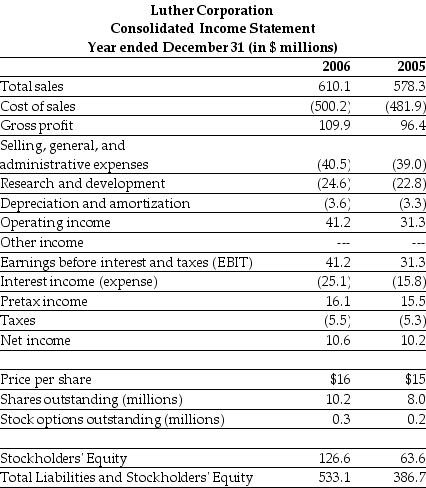

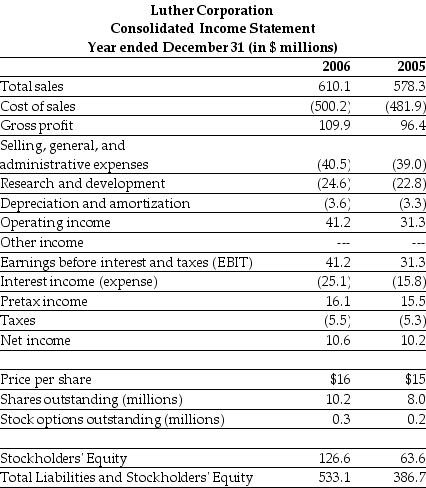

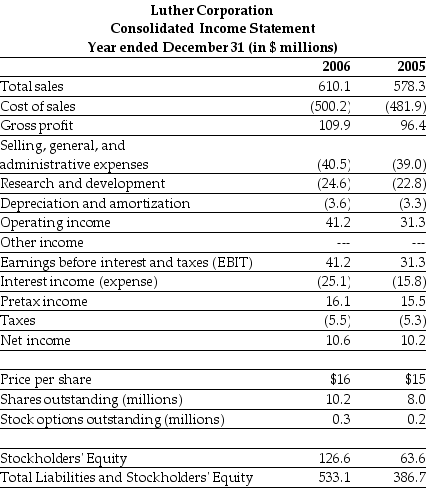

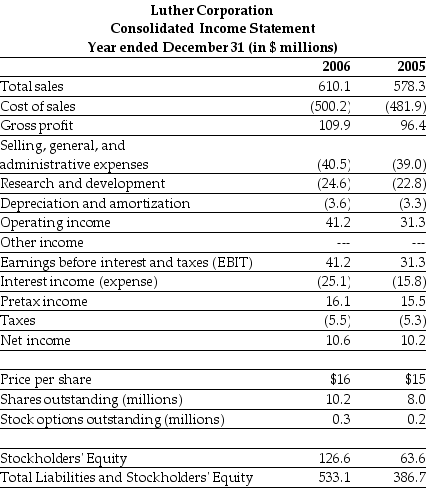

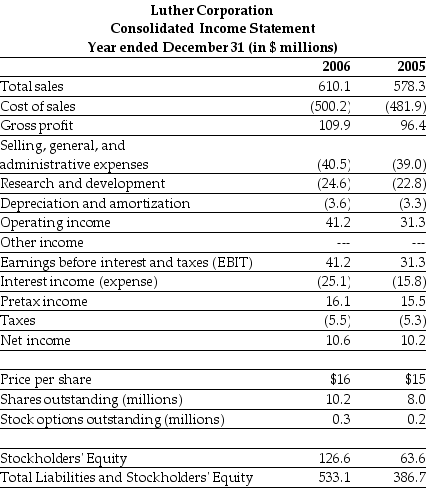

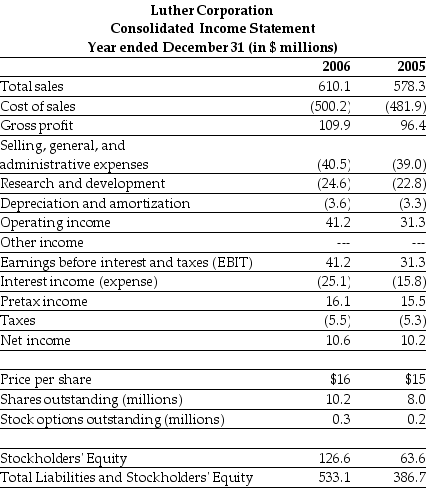

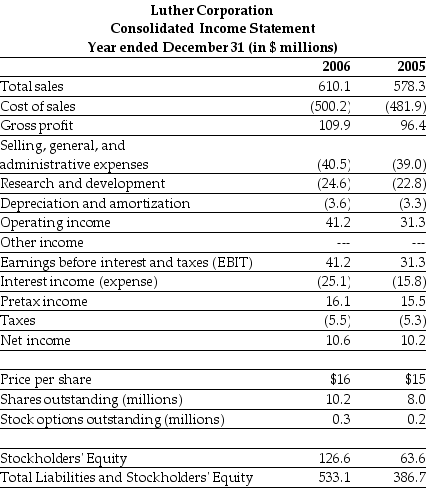

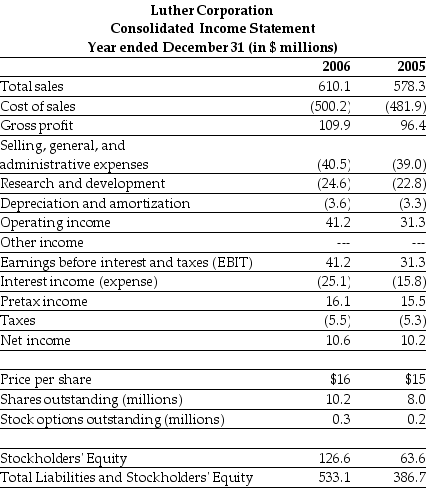

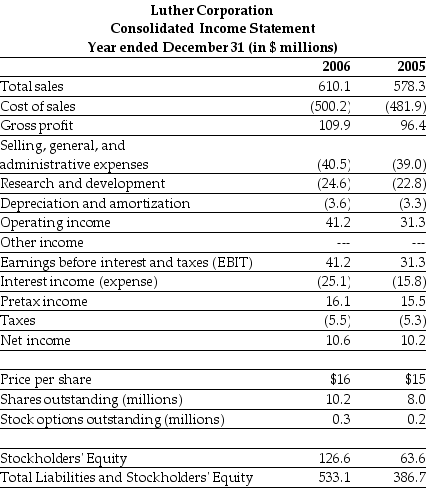

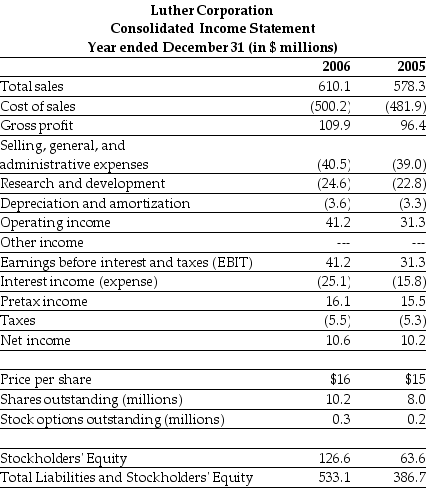

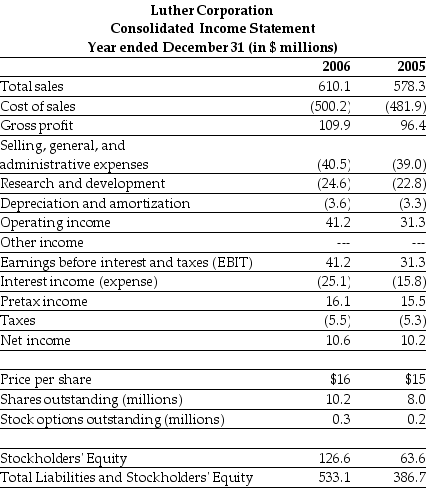

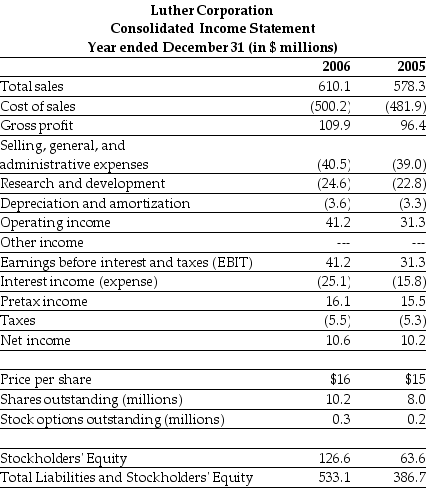

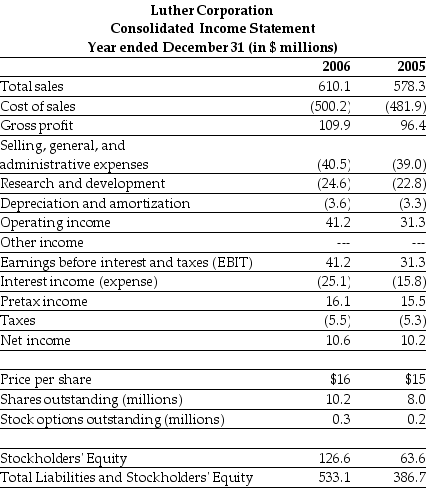

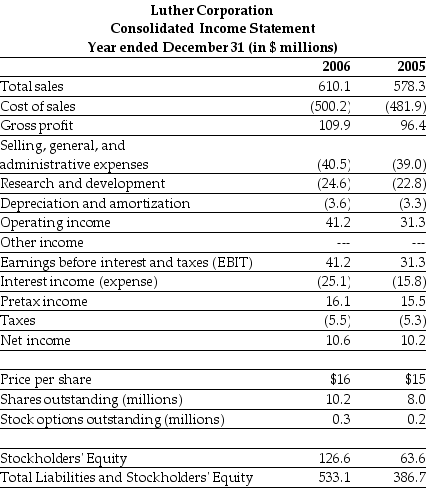

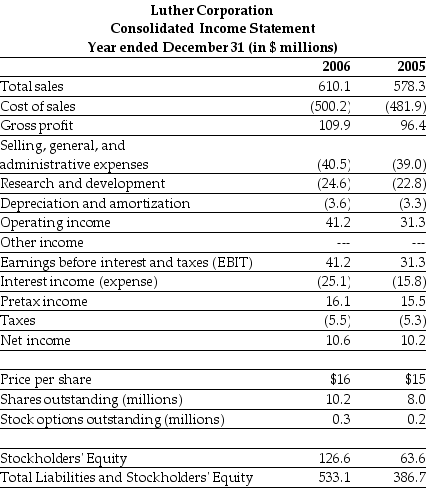

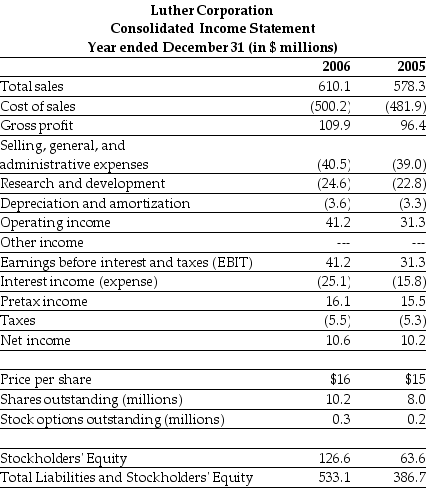

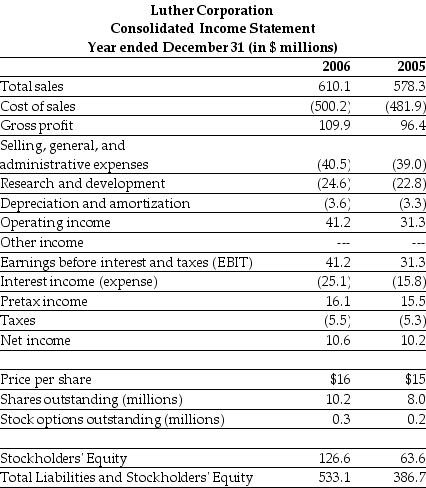

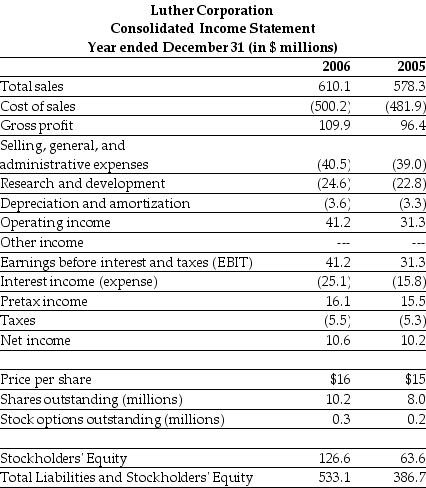

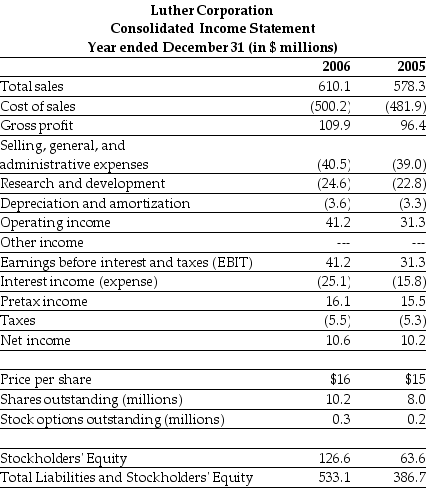

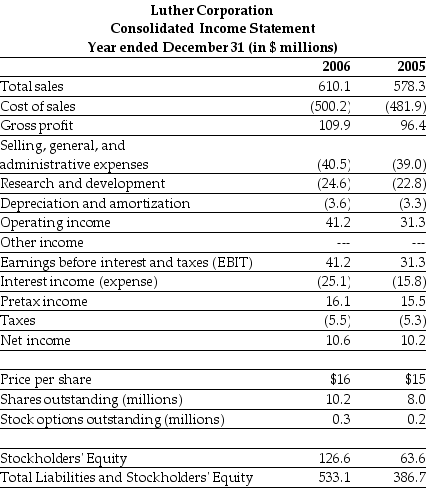

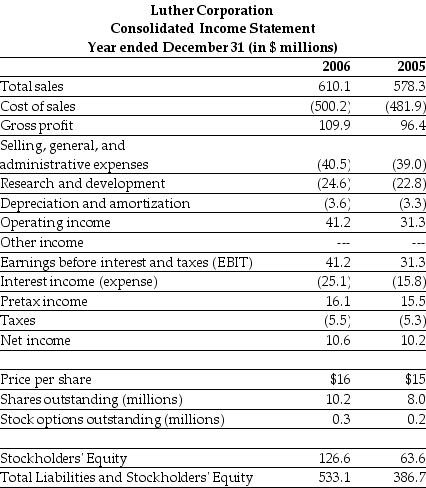

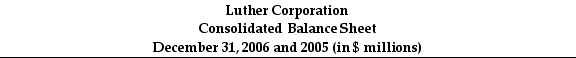

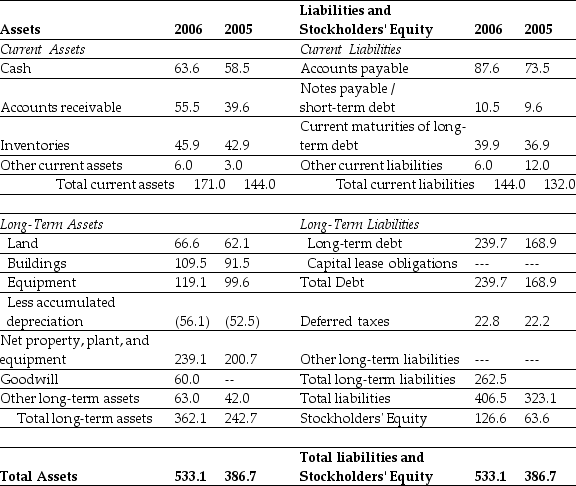

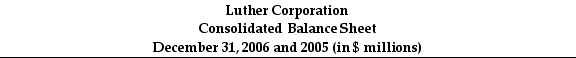

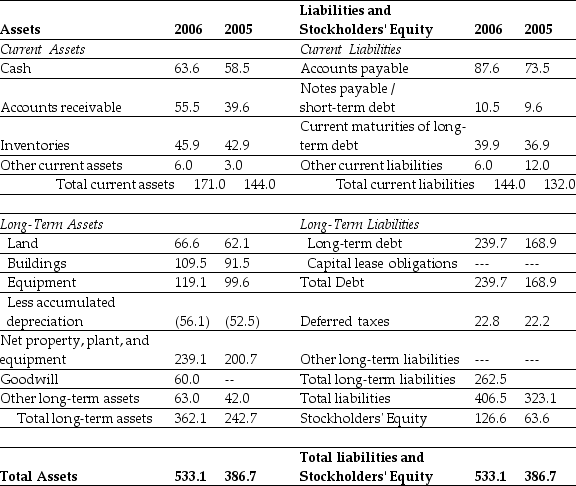

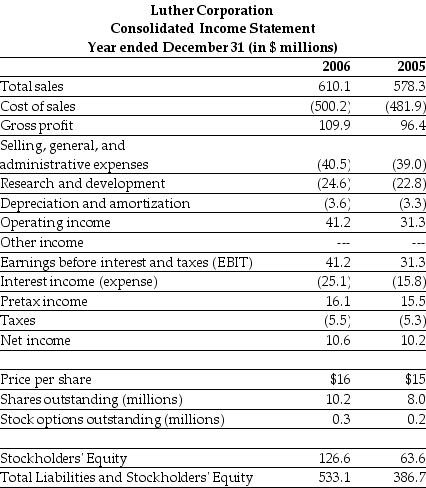

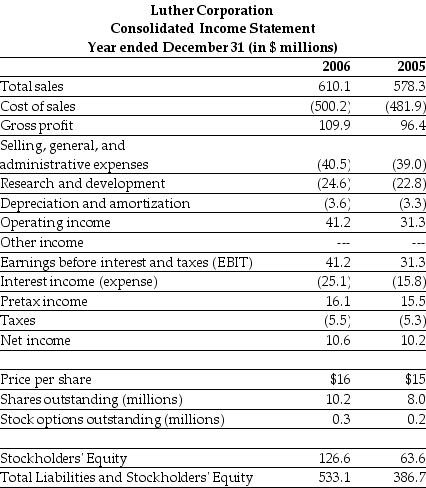

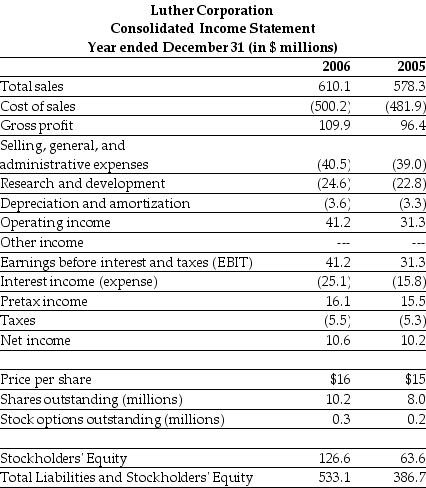

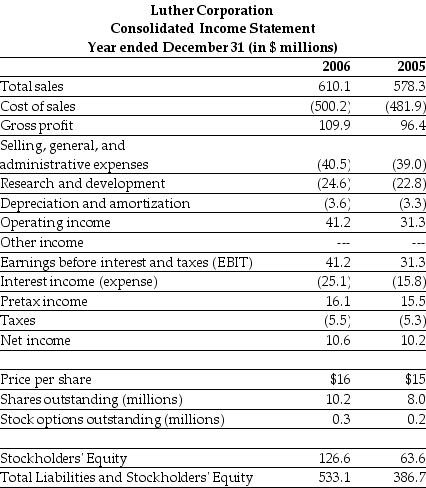

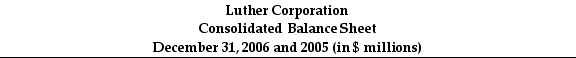

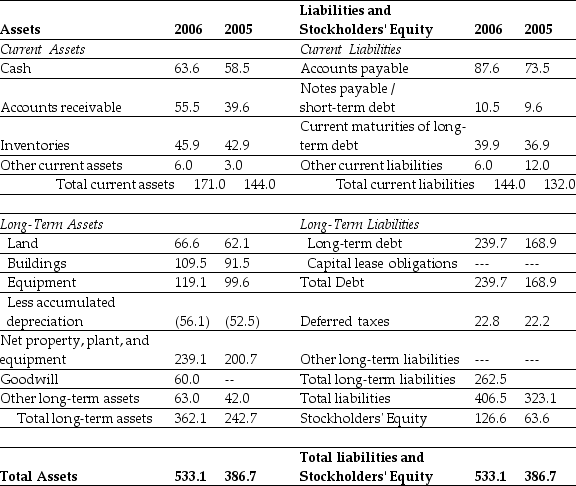

Use the table for the question(s) below.

Consider the following balance sheet:

Luther's current ratio for 2006 is closest to:

A) 0.84

B) 0.87

C) 1.15

D) 1.19

Consider the following balance sheet:

Luther's current ratio for 2006 is closest to:

A) 0.84

B) 0.87

C) 1.15

D) 1.19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

7

Cash is a

A) long-term asset.

B) current asset.

C) current liability.

D) long-term liability.

A) long-term asset.

B) current asset.

C) current liability.

D) long-term liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following balance sheet equations is incorrect?

A) Assets - Liabilities = Shareholders' Equity

B) Assets = Liabilities + Shareholders' Equity

C) Assets - Current Liabilities = Long Term Liabilities

D) Assets - Current Liabilities = Long Term Liabilities + Shareholders' Equity

A) Assets - Liabilities = Shareholders' Equity

B) Assets = Liabilities + Shareholders' Equity

C) Assets - Current Liabilities = Long Term Liabilities

D) Assets - Current Liabilities = Long Term Liabilities + Shareholders' Equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

9

Accounts payable is a

A) long-term liability.

B) current asset.

C) long-term asset.

D) current liability.

A) long-term liability.

B) current asset.

C) long-term asset.

D) current liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is NOT a financial statement that every public company is required by IFRS to produce?

A) Income Statement

B) Statement of Sources and Uses of Cash

C) Balance Sheet

D) Statement of Shareholders' Equity

A) Income Statement

B) Statement of Sources and Uses of Cash

C) Balance Sheet

D) Statement of Shareholders' Equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

11

Use the table for the question(s) below.

Consider the following balance sheet:

What is Luther's net working capital in 2005?

A) $12 million

B) $27 million

C) $39 million

D) $63.6 million

Consider the following balance sheet:

What is Luther's net working capital in 2005?

A) $12 million

B) $27 million

C) $39 million

D) $63.6 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

12

Canadian public companies are required to file their interim financial statements and annual financial statements with which one of the following authorities?

A) Provincial Security Commissions

B) Federal Security Commissions

C) Provincial Finance Ministry

D) Federal Finance Ministry

A) Provincial Security Commissions

B) Federal Security Commissions

C) Provincial Finance Ministry

D) Federal Finance Ministry

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

13

Use the table for the question(s) below.

Consider the following balance sheet:

If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's market-to-book ratio would be closest to:

A) 0.39

B) 0.76

C) 1.29

D) 2.57

Consider the following balance sheet:

If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's market-to-book ratio would be closest to:

A) 0.39

B) 0.76

C) 1.29

D) 2.57

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

14

Depreciation is ________ that the firm ________.

A) an actual cash expense, pays

B) not an actual cash expense, receives

C) not an actual cash expense, pays

D) an actual cash expense, pays.

A) an actual cash expense, pays

B) not an actual cash expense, receives

C) not an actual cash expense, pays

D) an actual cash expense, pays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under IFRS,every public company is required to produce ________ financial statements.

A) four

B) five

C) six

D) seven

A) four

B) five

C) six

D) seven

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

16

Use the table for the question(s) below.

Consider the following balance sheet:

When using the book value of equity,the debt to equity ratio for Luther in 2006 is closest to:

A) 2.21

B) 2.29

C) 2.98

D) 3.03

Consider the following balance sheet:

When using the book value of equity,the debt to equity ratio for Luther in 2006 is closest to:

A) 2.21

B) 2.29

C) 2.98

D) 3.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

17

Canadian publicly accountable companies must follow IFRS in their financial statements for fiscal years beginning ________.

A) January 1st, 2010

B) January 1st, 2005

C) January 1st, 2016

D) January 1st, 2011

A) January 1st, 2010

B) January 1st, 2005

C) January 1st, 2016

D) January 1st, 2011

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

18

The third party who checks annual financial statements to ensure that they are prepared according to Canadian GAAP and verifies that the information reported is reliable is the

A) Toronto Stock Exchange Board.

B) Accounting Standards Board.

C) Provincial Securities Commission.

D) Auditor.

A) Toronto Stock Exchange Board.

B) Accounting Standards Board.

C) Provincial Securities Commission.

D) Auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

19

A 30 year mortgage loan is a

A) long-term liability.

B) current liability.

C) current asset.

D) long-term asset.

A) long-term liability.

B) current liability.

C) current asset.

D) long-term asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

20

Use the table for the question(s) below.

Consider the following balance sheet:

Luther's quick ratio for 2005 is closest to:

A) 0.77

B) 1.31

C) 1.09

D) 0.92

Consider the following balance sheet:

Luther's quick ratio for 2005 is closest to:

A) 0.77

B) 1.31

C) 1.09

D) 0.92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

21

Gross profit is calculated as:

A) Total sales - cost of sales - selling, general and administrative expenses - depreciation and amortization

B) Total sales - cost of sales - selling, general and administrative expenses

C) Total sales - cost of sales

D) None of the above

A) Total sales - cost of sales - selling, general and administrative expenses - depreciation and amortization

B) Total sales - cost of sales - selling, general and administrative expenses

C) Total sales - cost of sales

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

22

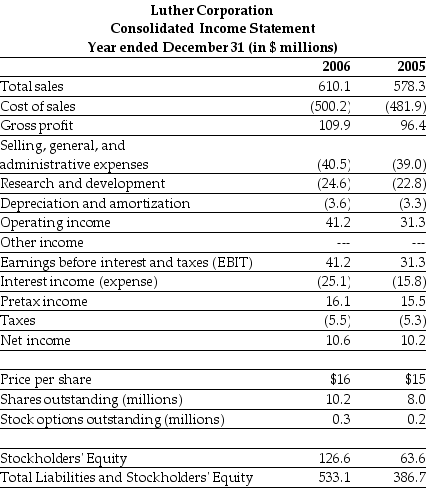

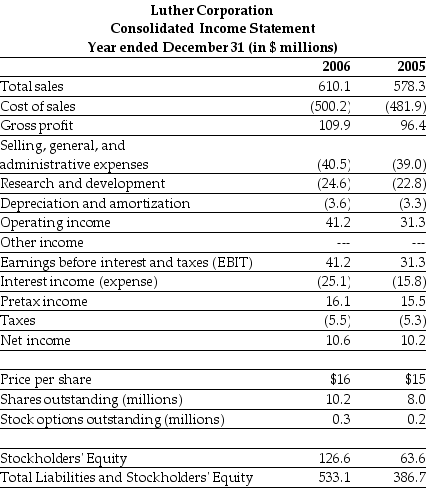

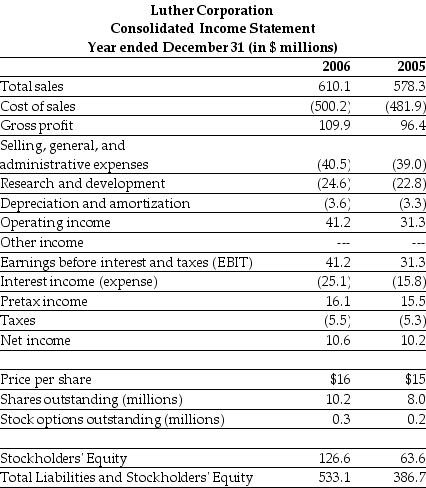

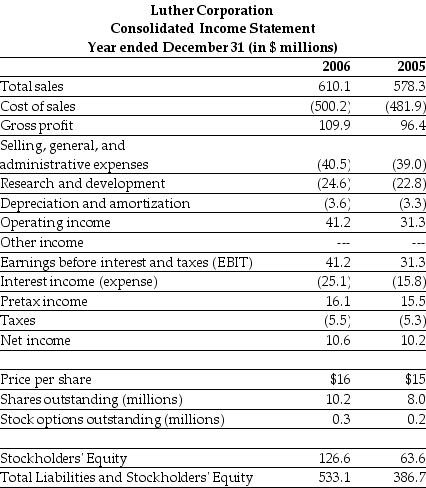

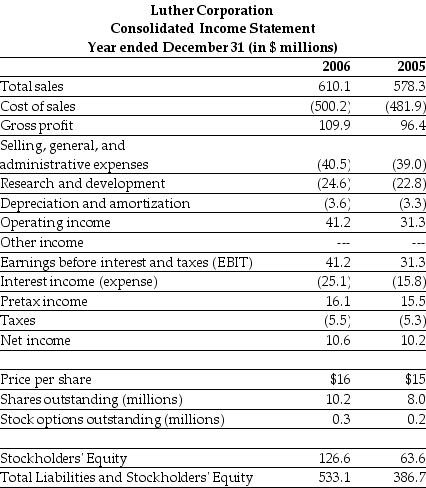

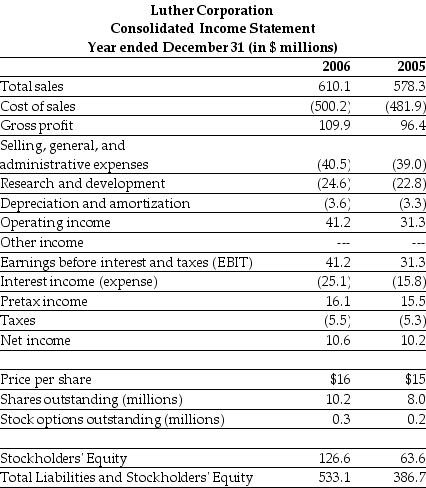

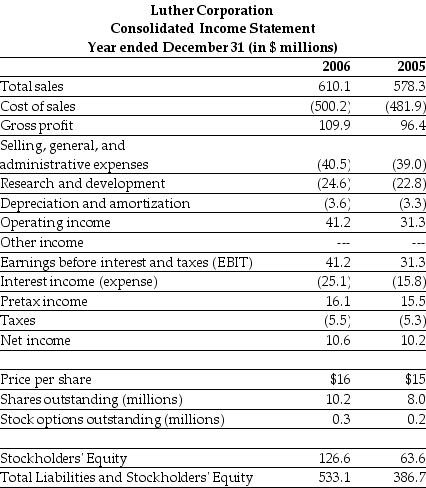

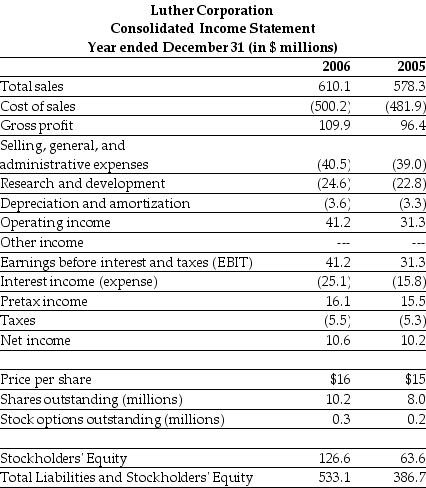

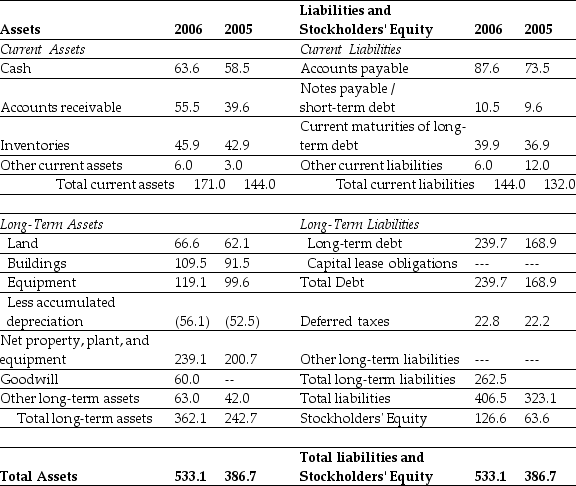

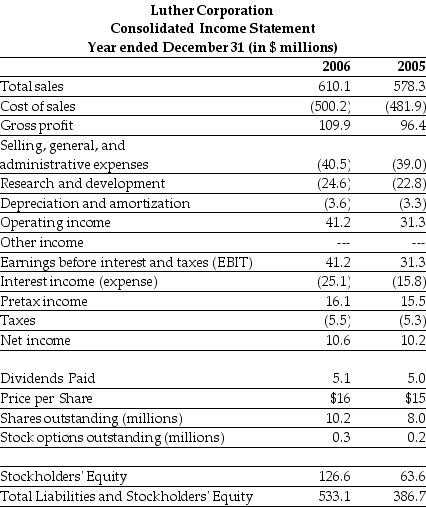

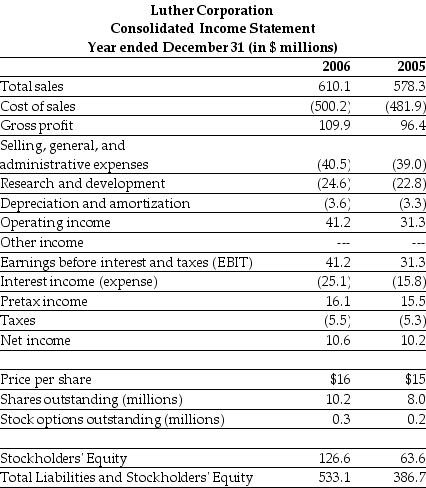

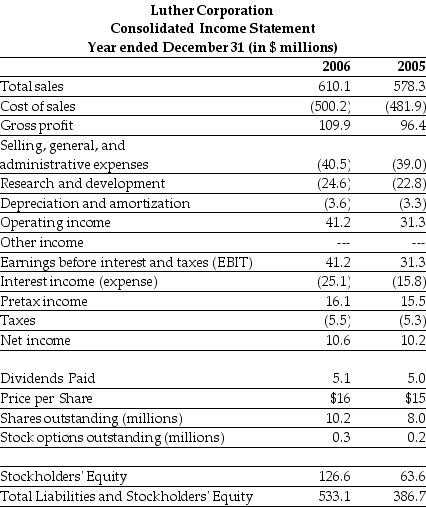

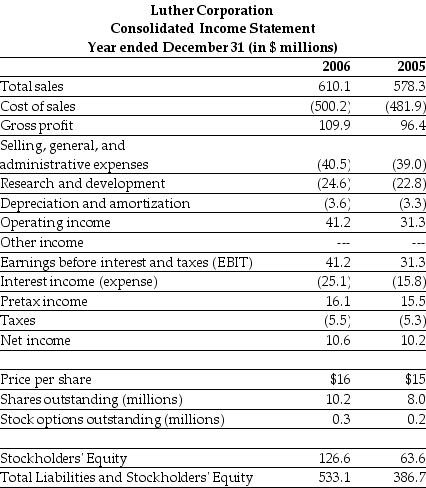

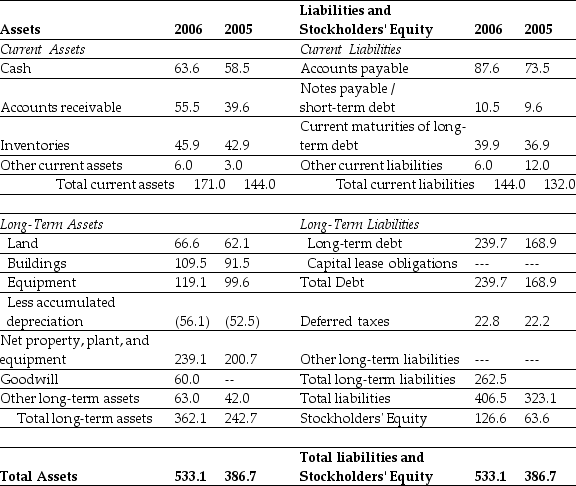

Use the table for the question(s) below.

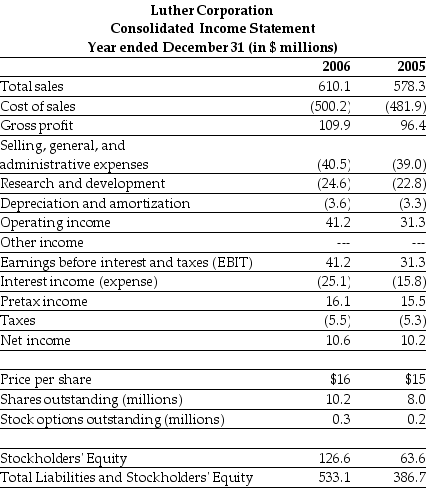

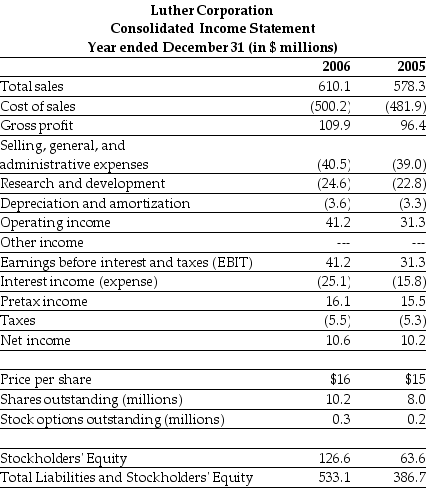

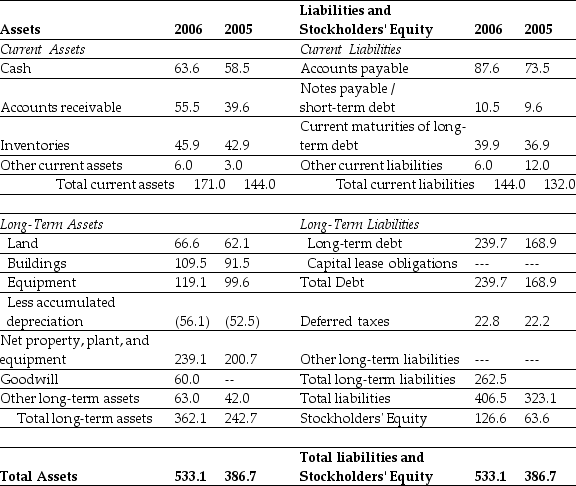

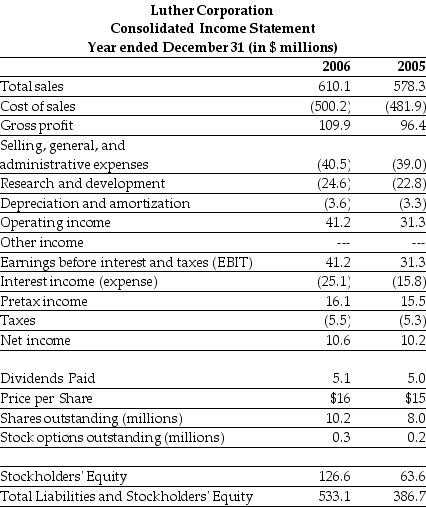

Consider the following income statement and other information:

For the year ending December 31,2006 Luther's earnings per share are closest to:

A) $1.01

B) $1.04

C) $1.58

D) $4.04

Consider the following income statement and other information:

For the year ending December 31,2006 Luther's earnings per share are closest to:

A) $1.01

B) $1.04

C) $1.58

D) $4.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

23

________ is the difference between total asset value minus total liability value.

A) Market value

B) Residual value

C) Liquidity value

D) Discounted value

A) Market value

B) Residual value

C) Liquidity value

D) Discounted value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

24

P/B ratio is ________.

A) price-to-book ratio

B) profit-to-book ratio

C) property-to-book ratio

D) price-to-benefit ratio

A) price-to-book ratio

B) profit-to-book ratio

C) property-to-book ratio

D) price-to-benefit ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is NOT an operating expense?

A) Interest expense

B) Depreciation and amortization

C) Selling, general and administrative expenses

D) Research and development

A) Interest expense

B) Depreciation and amortization

C) Selling, general and administrative expenses

D) Research and development

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the table for the question(s) below.

Consider the following balance sheet:

If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then what is Luther's Enterprise Value?

A) -$63.3 million

B) $353.1 million

C) $389.7 million

D) $516.9 million

Consider the following balance sheet:

If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then what is Luther's Enterprise Value?

A) -$63.3 million

B) $353.1 million

C) $389.7 million

D) $516.9 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use the table for the question(s) below.

Consider the following balance sheet:

The change in Luther's quick ratio from 2005 to 2006 is closest to:

A) a decrease of .10

B) an increase of .10

C) a decrease of .15

D) an increase of .15

Consider the following balance sheet:

The change in Luther's quick ratio from 2005 to 2006 is closest to:

A) a decrease of .10

B) an increase of .10

C) a decrease of .15

D) an increase of .15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

28

The debt-to-equity ratio is calculated by dividing the ________ by ________.

A) total debt, total shareholders' equity

B) short-term debt, retained earnings

C) long-term debt, total equity

D) long-term debt, preferred equity

A) total debt, total shareholders' equity

B) short-term debt, retained earnings

C) long-term debt, total equity

D) long-term debt, preferred equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

29

Use the table for the question(s) below.

Consider the following balance sheet:

If on December 31,2005 Luther has 8 million shares outstanding trading at $15 per share,then what is Luther's enterprise value?

Consider the following balance sheet:

If on December 31,2005 Luther has 8 million shares outstanding trading at $15 per share,then what is Luther's enterprise value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

30

Creditors often compare a firm's ________ and ________ to assess whether the firm has sufficient working capital to meet its short-term needs.

A) total assets, total liabilities

B) current assets, current liabilities

C) total assets, current liabilities

D) current assets, total liabilities

A) total assets, total liabilities

B) current assets, current liabilities

C) total assets, current liabilities

D) current assets, total liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

31

By comparing a firm's current assets and current liabilities,one can assess whether the firm has sufficient ________ to meet its ________ needs.

A) long-term capital, short-term

B) working capital, short-term

C) working capital, long-term

D) marketable securities, long-term

A) long-term capital, short-term

B) working capital, short-term

C) working capital, long-term

D) marketable securities, long-term

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

32

Market-to-Book-Ratio is a ratio between ________.

A) market value of asset and book value of asset

B) market value of inventory and book value of inventory

C) market value of liabilities and book value of liabilities

D) market value of equity and book value of equity

A) market value of asset and book value of asset

B) market value of inventory and book value of inventory

C) market value of liabilities and book value of liabilities

D) market value of equity and book value of equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the table for the question(s) below.

Consider the following balance sheet:

If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then using the market value of equity,the debt to equity ratio for Luther in 2006 is closest to:

A) 1.71

B) 1.78

C) 2.31

D) 2.35

Consider the following balance sheet:

If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then using the market value of equity,the debt to equity ratio for Luther in 2006 is closest to:

A) 1.71

B) 1.78

C) 2.31

D) 2.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

34

Enterprise Value is equal to ________.

A) market value of equity plus debt minus current assets

B) market value of current assets plus current liabilities minus inventory

C) market value of assets plus debt minus equity

D) market value of equity plus debt minus cash

A) market value of equity plus debt minus current assets

B) market value of current assets plus current liabilities minus inventory

C) market value of assets plus debt minus equity

D) market value of equity plus debt minus cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

35

Market-to-book-ratio is also called the ________.

A) price-to-debt ratio

B) price-to-book ratio

C) price-to-asset ratio

D) price-to-equity ratio

A) price-to-debt ratio

B) price-to-book ratio

C) price-to-asset ratio

D) price-to-equity ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the table for the question(s) below.

Consider the following balance sheet:

If on December 31,2005 Luther has 8 million shares outstanding trading at $15 per share,then what is Luther's market-to-book ratio?

Consider the following balance sheet:

If on December 31,2005 Luther has 8 million shares outstanding trading at $15 per share,then what is Luther's market-to-book ratio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

37

Firms disclose the potential for the dilution from options they have awarded by reporting ________.

A) diluted total earnings before interest and taxes

B) diluted earnings per share

C) diluted dividend payment

D) diluted total earnings

A) diluted total earnings before interest and taxes

B) diluted earnings per share

C) diluted dividend payment

D) diluted total earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

38

The debt-equity ratio is a common ratio used to assess a firm's ________.

A) liquidity

B) return on equity

C) leverage

D) retained earnings

A) liquidity

B) return on equity

C) leverage

D) retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following statements regarding the income statement is incorrect?

A) The income statement shows the earnings and expenses at a given point in time.

B) The income statement shows the flow of earnings and expenses generated by the firm between two dates.

C) The last or "bottom" line of the income statement shows the firm's net income.

D) The first line of an income statement lists the revenues from the sales of products or services.

A) The income statement shows the earnings and expenses at a given point in time.

B) The income statement shows the flow of earnings and expenses generated by the firm between two dates.

C) The last or "bottom" line of the income statement shows the firm's net income.

D) The first line of an income statement lists the revenues from the sales of products or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

40

A higher ________ implies less risk of the firm experiencing a cash shortfall in the near future.

A) return on asset ratio

B) market-to-book ratio

C) current ratio

D) return on equity ratio

A) return on asset ratio

B) market-to-book ratio

C) current ratio

D) return on equity ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's return on assets (ROA)for the year ending December 31,2006 is closest to:

A) 2.0%

B) 6.5%

C) 8.4%

D) 12.7%

Consider the following income statement and other information:

Luther's return on assets (ROA)for the year ending December 31,2006 is closest to:

A) 2.0%

B) 6.5%

C) 8.4%

D) 12.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's Operating Margin for the year ending December 31,2005 is closest to:

A) 1.8%

B) 2.7%

C) 5.4%

D) 16.7%

Consider the following income statement and other information:

Luther's Operating Margin for the year ending December 31,2005 is closest to:

A) 1.8%

B) 2.7%

C) 5.4%

D) 16.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

43

The income statement lists the firm's ________.

A) assets and equities over a period of time

B) assets and liabilities over a period of time

C) variable costs and fixed costs at the end of the fiscal year

D) revenues and expenses over a period of time

A) assets and equities over a period of time

B) assets and liabilities over a period of time

C) variable costs and fixed costs at the end of the fiscal year

D) revenues and expenses over a period of time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

44

Gross profit is calculated as:

A) total sales - cost of sales - selling, general and administrative expenses - depreciation and amortization

B) total sales - cost of sales - selling, general and administrative expenses

C) total sales - cost of sales

D) none of the above

A) total sales - cost of sales - selling, general and administrative expenses - depreciation and amortization

B) total sales - cost of sales - selling, general and administrative expenses

C) total sales - cost of sales

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the table for the question(s) below.

Consider the following income statement and other information:

For the year ending December 31,2006 Luther's earnings per share are closest to:

A) $1.01

B) $1.04

C) $1.58

D) $4.04

Consider the following income statement and other information:

For the year ending December 31,2006 Luther's earnings per share are closest to:

A) $1.01

B) $1.04

C) $1.58

D) $4.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following statements regarding the income statement is incorrect?

A) The income statement shows the earnings and expenses at a given point in time.

B) The income statement shows the flow of earnings and expenses generated by the firm between two dates.

C) The last or "bottom" line of the income statement shows the firm's net income.

D) The first line of an income statement lists the revenues from the sales of products or services.

A) The income statement shows the earnings and expenses at a given point in time.

B) The income statement shows the flow of earnings and expenses generated by the firm between two dates.

C) The last or "bottom" line of the income statement shows the firm's net income.

D) The first line of an income statement lists the revenues from the sales of products or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's Net Profit Margin for the year ending December 31,2005 is closest to:

A) 1.8%

B) 2.7%

C) 5.4%

D) 16.7%

Consider the following income statement and other information:

Luther's Net Profit Margin for the year ending December 31,2005 is closest to:

A) 1.8%

B) 2.7%

C) 5.4%

D) 16.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the table for the question(s) below.

Consider the following income statement and other information:

Calculate Luther's return of equity (ROE),return of assets (ROA),and price-to-earnings ratio (P/E)for the year ending December 31,2005.

Consider the following income statement and other information:

Calculate Luther's return of equity (ROE),return of assets (ROA),and price-to-earnings ratio (P/E)for the year ending December 31,2005.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's Operating Margin for the year ending December 31,2005 is closest to:

A) 1.8%

B) 2.7%

C) 5.4%

D) 16.7%

Consider the following income statement and other information:

Luther's Operating Margin for the year ending December 31,2005 is closest to:

A) 1.8%

B) 2.7%

C) 5.4%

D) 16.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

50

The P/E ratio is not useful when the firm's ________ are negative.In this case,it is common to look at the firm's ________ relative to sales.

A) operating earnings, enterprise value

B) net earnings, enterprise value

C) operating earnings, market value

D) net earnings, market value

A) operating earnings, enterprise value

B) net earnings, enterprise value

C) operating earnings, market value

D) net earnings, market value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's earnings before interest,taxes,depreciation,and amortization (EBITDA)for the year ending December 31,2006 are closest to:

A) 19.7 million

B) 37.6 million

C) 41.2 million

D) 44.8 million

Consider the following income statement and other information:

Luther's earnings before interest,taxes,depreciation,and amortization (EBITDA)for the year ending December 31,2006 are closest to:

A) 19.7 million

B) 37.6 million

C) 41.2 million

D) 44.8 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

52

DuPont Identity expresses the ROE in terms of the firm's ________.

A) profitability, asset efficiency, and leverage

B) current assets, current liabilities, long-term debts

C) profitability, interest expense, and net income

D) total assets, total liabilities, and total equity

A) profitability, asset efficiency, and leverage

B) current assets, current liabilities, long-term debts

C) profitability, interest expense, and net income

D) total assets, total liabilities, and total equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the table for the question(s) below.

Consider the following income statement and other information:

If Luther's accounts receivable were $55.5 million in 2006,then calculate Luther's accounts receivable days for 2006.

Consider the following income statement and other information:

If Luther's accounts receivable were $55.5 million in 2006,then calculate Luther's accounts receivable days for 2006.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's return on equity (ROE)for the year ending December 31,2006 is closest to:

A) 2.0%

B) 6.5%

C) 8.4%

D) 12.7%

Consider the following income statement and other information:

Luther's return on equity (ROE)for the year ending December 31,2006 is closest to:

A) 2.0%

B) 6.5%

C) 8.4%

D) 12.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's price - earnings ratio (P/E)for the year ending December 31,2006 is closest to:

A) 7.9

B) 10.1

C) 15.4

D) 16.0

Consider the following income statement and other information:

Luther's price - earnings ratio (P/E)for the year ending December 31,2006 is closest to:

A) 7.9

B) 10.1

C) 15.4

D) 16.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

56

The balance sheet shows the ________ of a firm ________.The income statement shows the flow of ________ generated by them ________.

A) assets and liabilities, between two dates, revenues and expenses, at a given point in time

B) revenues and expenses, between two dates, assets and liabilities, at a given point in time

C) assets and liabilities, at a given point in time, revenues and expenses, between two dates

D) revenues and expenses, at a given point in time, assets and liabilities, between two dates

A) assets and liabilities, between two dates, revenues and expenses, at a given point in time

B) revenues and expenses, between two dates, assets and liabilities, at a given point in time

C) assets and liabilities, at a given point in time, revenues and expenses, between two dates

D) revenues and expenses, at a given point in time, assets and liabilities, between two dates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is NOT an operating expense?

A) Interest expense

B) Depreciation and amortization

C) Selling, general and administrative expenses

D) Research and development

A) Interest expense

B) Depreciation and amortization

C) Selling, general and administrative expenses

D) Research and development

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the table for the question(s) below.

Consider the following income statement and other information:

Assuming that Luther has no convertible bonds outstanding,then for the year ending December 31,2006 Luther's diluted earnings per share are closest to:

A) $1.01

B) $1.04

C) $1.53

D) $3.92

Consider the following income statement and other information:

Assuming that Luther has no convertible bonds outstanding,then for the year ending December 31,2006 Luther's diluted earnings per share are closest to:

A) $1.01

B) $1.04

C) $1.53

D) $3.92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the table for the question(s) below.

Consider the following income statement and other information:

Assuming that Luther has no convertible bonds outstanding,then for the year ending December 31,2006 Luther's diluted earnings per share are closest to:

A) $1.01

B) $1.04

C) $1.53

D) $3.92

Consider the following income statement and other information:

Assuming that Luther has no convertible bonds outstanding,then for the year ending December 31,2006 Luther's diluted earnings per share are closest to:

A) $1.01

B) $1.04

C) $1.53

D) $3.92

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

60

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's Net Profit Margin for the year ending December 31,2005 is closest to:

A) 1.8%

B) 2.7%

C) 5.4%

D) 16.7%

Consider the following income statement and other information:

Luther's Net Profit Margin for the year ending December 31,2005 is closest to:

A) 1.8%

B) 2.7%

C) 5.4%

D) 16.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

61

Why is the firm's statement of cash flows very important?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

62

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's price - earnings ratio (P/E)for the year ending December 31,2006 is closest to:

A) 7.9

B) 10.1

C) 15.4

D) 16.0

Consider the following income statement and other information:

Luther's price - earnings ratio (P/E)for the year ending December 31,2006 is closest to:

A) 7.9

B) 10.1

C) 15.4

D) 16.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

63

Use the table for the question(s) below.

Consider the following income statement and other information:

Calculate Luther's return of equity (ROE),return of assets (ROA),and price-to-earnings ratio (P/E)for the year ending December 31,2005.

Consider the following income statement and other information:

Calculate Luther's return of equity (ROE),return of assets (ROA),and price-to-earnings ratio (P/E)for the year ending December 31,2005.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following adjustments is NOT correct if you are trying to calculate cash flow from financing activities?

A) Add dividends paid.

B) Add any increase in long-term borrowing.

C) Add any increase in short-term borrowing.

D) Add proceeds from the sale of stock.

A) Add dividends paid.

B) Add any increase in long-term borrowing.

C) Add any increase in short-term borrowing.

D) Add proceeds from the sale of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

65

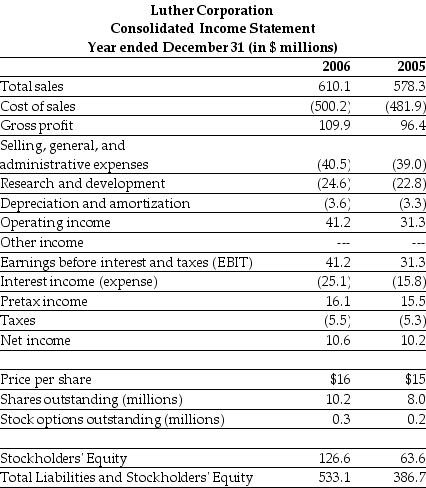

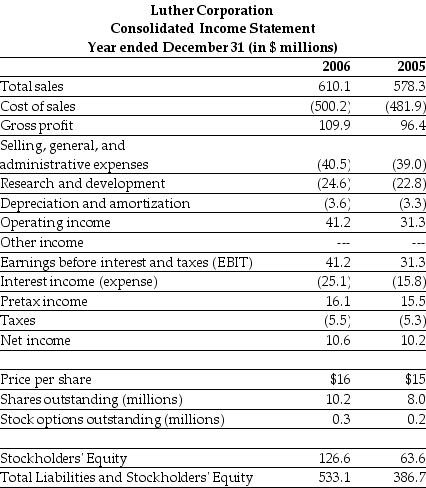

Use the tables for the question(s) below.

Consider the following financial information:

Calculate Luther's cash flow from operating activities for the year ending December 31,2006.

Consider the following financial information:

Calculate Luther's cash flow from operating activities for the year ending December 31,2006.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

66

According to the IFRS,in addition to the balance sheet,income statement,and the statement of cash flows,a firm's complete financial statements will include all of the following EXCEPT:

A) Management discussion and analysis

B) Notes to the financial statements

C) Securities Commission's commentary

D) A statement of shareholders' equity

A) Management discussion and analysis

B) Notes to the financial statements

C) Securities Commission's commentary

D) A statement of shareholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

67

The statement of cash flows is divided into three sections: ________.

A) operating leverage, investment leverage, and financing leverage

B) cash inflows, cash outflows, and cash flow cycle

C) cash-in-use, cash-in-resource, and cash conversion cycle

D) operating activity, investment activity, and financing activity

A) operating leverage, investment leverage, and financing leverage

B) cash inflows, cash outflows, and cash flow cycle

C) cash-in-use, cash-in-resource, and cash conversion cycle

D) operating activity, investment activity, and financing activity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use the table for the question(s) below.

Consider the following income statement and other information:

If Luther's accounts receivable were $55.5 million in 2006,then calculate Luther's accounts receivable days for 2006.

Consider the following income statement and other information:

If Luther's accounts receivable were $55.5 million in 2006,then calculate Luther's accounts receivable days for 2006.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

69

Use the tables for the question(s) below.

Consider the following financial information:

Why does a firm's net income not correspond to cash generated?

Consider the following financial information:

Why does a firm's net income not correspond to cash generated?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

70

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's return on equity (ROE)for the year ending December 31,2006 is closest to:

A) 2.0%

B) 6.5%

C) 8.4%

D) 12.7%

Consider the following income statement and other information:

Luther's return on equity (ROE)for the year ending December 31,2006 is closest to:

A) 2.0%

B) 6.5%

C) 8.4%

D) 12.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements regarding net income transferred to retained earnings is correct?

A) Net income = net income transferred to retained earnings - dividends

B) Net income transferred to retained earnings = net income + dividends

C) Net income = net income transferred to retained earnings + dividends

D) Net income transferred to retained earnings - net income = dividends

A) Net income = net income transferred to retained earnings - dividends

B) Net income transferred to retained earnings = net income + dividends

C) Net income = net income transferred to retained earnings + dividends

D) Net income transferred to retained earnings - net income = dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

72

In the IFRS,in addition to the five financial statements,companies provide ________ with further details on the information provided in the statements.

A) pro forma statements

B) statements of cash used and sources

C) extensive notes

D) ratio analysis

A) pro forma statements

B) statements of cash used and sources

C) extensive notes

D) ratio analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's earnings before interest,taxes,depreciation,and amortization (EBITDA)for the year ending December 31,2006 are closest to:

A) $19.7 million

B) $37.6 million

C) $41.2 million

D) $44.8 million

Consider the following income statement and other information:

Luther's earnings before interest,taxes,depreciation,and amortization (EBITDA)for the year ending December 31,2006 are closest to:

A) $19.7 million

B) $37.6 million

C) $41.2 million

D) $44.8 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is NOT a section on the cash flow statement?

A) Income generating activities

B) Investing activities

C) Operating activities

D) Financing activities

A) Income generating activities

B) Investing activities

C) Operating activities

D) Financing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

75

How many reasons are there that net income does not correspond to cash earned?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

76

In response to corporate scandals such as Enron and WorldCom,in 2002 the U.S.Congress passed a law that requires,among other things,that CEOs and CFOs certify the accuracy and appropriateness of their firm's financial statements and increases the penalties against them if the financial statements later prove to be fraudulent.The name of this act is

A) the Glass-Steagall Act.

B) the Sarbanes-Oxley Act.

C) the Accuracy in Accounting Act.

D) the McCain-Feingold Act.

A) the Glass-Steagall Act.

B) the Sarbanes-Oxley Act.

C) the Accuracy in Accounting Act.

D) the McCain-Feingold Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

77

Use the table for the question(s) below.

Consider the following income statement and other information:

Luther's return on assets (ROA)for the year ending December 31,2006 is closest to:

A) 2.0%

B) 6.5%

C) 8.4%

D) 12.7%

Consider the following income statement and other information:

Luther's return on assets (ROA)for the year ending December 31,2006 is closest to:

A) 2.0%

B) 6.5%

C) 8.4%

D) 12.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following adjustments to net income is NOT correct if you are trying to calculate cash flow from operating activities?

A) Add increases in accounts payable.

B) Add back depreciation.

C) Add increases in accounts receivable.

D) Deduct increases in inventory.

A) Add increases in accounts payable.

B) Add back depreciation.

C) Add increases in accounts receivable.

D) Deduct increases in inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is NOT a reason why cash flow may not equal net income?

A) Amortization is added in when calculating net income.

B) Changes in inventory will change cash flows but not income.

C) Capital expenditures are not recorded on the income statement.

D) Depreciation is deducted when calculating net income.

A) Amortization is added in when calculating net income.

B) Changes in inventory will change cash flows but not income.

C) Capital expenditures are not recorded on the income statement.

D) Depreciation is deducted when calculating net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

80

Use the tables for the question(s) below.

Consider the following financial information:

Calculate Luther's cash flow from financing activities for the year ending December 31,2006.

Consider the following financial information:

Calculate Luther's cash flow from financing activities for the year ending December 31,2006.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck