Deck 3: The Time Value of Money

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/145

العب

ملء الشاشة (f)

Deck 3: The Time Value of Money

1

You are offered a security that will pay you $2,500 at the end of the year forever.If your discount rate is 8%,what is the most you are willing to pay for this security?

A) $26,686

B) $62,500

C) $50,000

D) $31,250

A) $26,686

B) $62,500

C) $50,000

D) $31,250

$31,250

2

What is the effective annual rate of 12% compounded monthly?

A) 12%

B) 11.45%

C) 12.68%

D) 12.25%

A) 12%

B) 11.45%

C) 12.68%

D) 12.25%

12.68%

3

You have the choice between two investments that have the same maturity and the same nominal return.Investment A pays SIMPLE interest,investment B pays compounded interest.Which one should you pick?

A) A,because it has a higher effective annual return.

B) A and B offer the same return,thus they are equally as good.

C) B,because it has higher effective annual return.

D) Not enough information.

A) A,because it has a higher effective annual return.

B) A and B offer the same return,thus they are equally as good.

C) B,because it has higher effective annual return.

D) Not enough information.

B,because it has higher effective annual return.

4

When you retire you expect to live for another 30 years.During those 30 years you want to be able to withdraw $45,000 at the BEGINNING of each year for living expenses.How much money do you have to have in your retirement account to make this happen.Assume that you can earn 8% on your investments.

A) $1,350,000.00

B) $506,600.25

C) $547,128.27

D) $723,745.49

A) $1,350,000.00

B) $506,600.25

C) $547,128.27

D) $723,745.49

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following cannot be calculated?

A) Present value of an annuity.

B) Future value of an annuity.

C) Present value of a perpetuity.

D) Future value of a perpetuity.

A) Present value of an annuity.

B) Future value of an annuity.

C) Present value of a perpetuity.

D) Future value of a perpetuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

6

You set up a college fund in which you pay $2,000 each year at the end of the year.How much money will you have accumulated in the fund after 18 years,if your fund earns 7% compounded annually?

A) $72,757.93

B) $67,998.07

C) $20,118.17

D) $28,339.25

A) $72,757.93

B) $67,998.07

C) $20,118.17

D) $28,339.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

7

You want to buy your dream car,but you are $5,000 short.If you could invest your entire savings of $2,350 at an annual interest of 12%,how long would you have to wait until you have accumulated enough money to buy the car?

A) 9.40 years

B) 3.48 years

C) 7.24 years

D) 6.66 years

A) 9.40 years

B) 3.48 years

C) 7.24 years

D) 6.66 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

8

If you can earn 5% (compounded annually)on an investment,how long does it take for your money to triple?

A) 14.40 years

B) 22.52 years

C) 19.48 years

D) 29.29 years

A) 14.40 years

B) 22.52 years

C) 19.48 years

D) 29.29 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

9

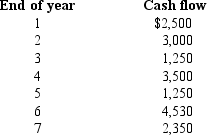

What is the future value of cash flows 1-5 AT THE END YEAR 5,assuming a 6% interest rate (compounded annually)?

A) $13,879.36

B) $13,093.74

C) $9,7844.40

D) $11,548.48

A) $13,879.36

B) $13,093.74

C) $9,7844.40

D) $11,548.48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is TRUE?

A) In an annuity due payments occur at the end of the period.

B) In an ordinary annuity payments occur at the end of the period.

C) A perpetuity will mature at some point in the future.

D) One cannot calculate the present value of a perpetuity.

A) In an annuity due payments occur at the end of the period.

B) In an ordinary annuity payments occur at the end of the period.

C) A perpetuity will mature at some point in the future.

D) One cannot calculate the present value of a perpetuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

11

How much do you have to invest today at an annual rate of 8%,if you need to have $5,000 six years from today?

A) $3,150.85

B) $4,236.75

C) $7,934.37

D) $2,938.48

A) $3,150.85

B) $4,236.75

C) $7,934.37

D) $2,938.48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

12

For a positive r,

A) future value will always exceed present value.

B) future and present will always be the same.

C) present value will always exceed future value.

D) None of the above is true.

A) future value will always exceed present value.

B) future and present will always be the same.

C) present value will always exceed future value.

D) None of the above is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

13

Florida considers any loan of more than an APR compounded monthly to be usurious.What is the usurious effective annual rate?

A) 18.00%

B) 19.25%

C) 19.56%

D) 22.25%

A) 18.00%

B) 19.25%

C) 19.56%

D) 22.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

14

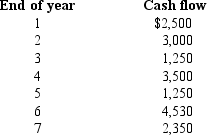

What is the present value of these cash flows,if the discount rate is 10% annually?

A) $18,380.00

B) $12,620.90

C) $22,358.69

D) $14,765.52

A) $18,380.00

B) $12,620.90

C) $22,358.69

D) $14,765.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

15

You are planning your retirement and you come to the conclusion that you need to have saved $1,250,000 in 30 years.You can invest into an retirement account that guarantees you a 5% annual return.How much do you have to put into your account at the end of each year to reach your retirement goal?

A) $81,314.29

B) $18,814.30

C) $23,346.59

D) $12,382.37

A) $81,314.29

B) $18,814.30

C) $23,346.59

D) $12,382.37

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Springfield Crusaders just signed their quarterback to a 10 year $50 million contract.Is this contract really worth $50 million? (assume r >0)

A) Yes,because the payments over time add up to $50 million.

B) No,it is worth more because he can invest the money.

C) No,it would only be worth $50 million if it were all paid out today.

D) Yes,because his agent told him so.

A) Yes,because the payments over time add up to $50 million.

B) No,it is worth more because he can invest the money.

C) No,it would only be worth $50 million if it were all paid out today.

D) Yes,because his agent told him so.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

17

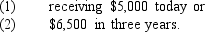

As a result of an injury settlement with your insurance you have the choice between  If you could invest your money at 8% compounded annually,which option should you pick?

If you could invest your money at 8% compounded annually,which option should you pick?

A) (1),because it has a higher PV.

B) You are indifferent between the two choices.

C) (2),because it has a higher PV.

D) You do not have enough information to make that decision.

If you could invest your money at 8% compounded annually,which option should you pick?

If you could invest your money at 8% compounded annually,which option should you pick?A) (1),because it has a higher PV.

B) You are indifferent between the two choices.

C) (2),because it has a higher PV.

D) You do not have enough information to make that decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

18

You set up a college fund in which you pay $2,000 each year at the BEGINNING of the year.How much money will you have accumulated in the fund after 18 years,if your fund earns 7% compounded annually?

A) $72,757.93

B) $67,998.07

C) $20,118.17

D) $28,339.25

A) $72,757.93

B) $67,998.07

C) $20,118.17

D) $28,339.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

19

You want to buy a house in 4 years and expect to need $25,000 for a down payment.If you have $15,000 to invest,how much interest do you have to earn (compounded annually)to reach your goal?

A) 16.67%

B) 13.62%

C) 25.74%

D) 21.53%

A) 16.67%

B) 13.62%

C) 25.74%

D) 21.53%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

20

Last national bank offers a CD paying 7% interest (compounded annually).If you invest $1,000 how much will you have at the end of year 5.

A) $712.99

B) $1,402.55

C) $1,350.00

D) $1,000

A) $712.99

B) $1,402.55

C) $1,350.00

D) $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

21

You will receive a stream of annual $70 payments to begin at the end of year 0 until the final payment at the end of year 5.What amount will you have at the end of year 5 if you can invest all amounts at a 11% interest rate?

A) $350.00

B) $420.00

C) $553.90

D) $614.83

A) $350.00

B) $420.00

C) $553.90

D) $614.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

22

You want to buy a new car.The car you picked will cost you $32,000 and you decide to go with the dealer's financing offer of 5.9% compounded monthly for 60 months.Unfortunately,you can only afford monthly loan payments of $300.However,the dealer allows you to pay off the rest of the loan in a one time lump sum payment at the end of the loan.How much do you have to pay to the dealer when the lump sum is due?

A) $14,000.00

B) $21,890.43

C) $25,455.37

D) $22,071.75

A) $14,000.00

B) $21,890.43

C) $25,455.37

D) $22,071.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

23

When you retire you expect to live for another 30 years.During those 30 years you want to be able to withdraw $4,000 at the BEGINNING of every month for living expenses.How much money do you have to have in your retirement account to make this happen.Assume that you can earn 8% on your investments.

A) $545,133.98

B) $1,440,000.00

C) $548,768.20

D) $673,625.34

A) $545,133.98

B) $1,440,000.00

C) $548,768.20

D) $673,625.34

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the rate of interest that investors can earn on a 2-year investment is zero then

A) you will repay the same amount of money at the conclusion of a loan that you borrowed at the beginning of the 2 year loan.

B) the "cost" of using money for 2 years is zero.

C) you will receive the same amount of money at maturity that you invested at the beginning of a 2 year investment.

D) all of the above.

A) you will repay the same amount of money at the conclusion of a loan that you borrowed at the beginning of the 2 year loan.

B) the "cost" of using money for 2 years is zero.

C) you will receive the same amount of money at maturity that you invested at the beginning of a 2 year investment.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

25

If you were to invest $120 for two years,while earning 8% compound interest,what is the TOTAL AMOUNT OF INTEREST that you will earn?

A) $139.97

B) $139.20

C) $19.20

D) $19.97

A) $139.97

B) $139.20

C) $19.20

D) $19.97

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

26

Pam is in need of cash right now and wants to sell the rights to a $1,000 cash flow that she will receive 5 years from today.If the discount rate for such a cash flow is 9.5%,then what is the fair price that someone should be willing to pay Pam today for rights to that future cash flow?

A) $1,574.24

B) $635.23

C) $260.44

D) $913.24

A) $1,574.24

B) $635.23

C) $260.44

D) $913.24

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

27

In the equation below,the exponent "3" represents $133.10 = $100 ´ (1 + .1)3

A) the future value of an investment.

B) the present value of an investment.

C) the annual rate of interest paid.

D) the number of periods that the present value is left on deposit.

A) the future value of an investment.

B) the present value of an investment.

C) the annual rate of interest paid.

D) the number of periods that the present value is left on deposit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

28

You are planning your retirement and you come to the conclusion that you need to have saved $1,250,000 in 30 years.You can invest into an retirement account that guarantees you a 5% return.How much do you have to put into your account at the end of every month to reach your retirement goal?

A) $1567.86

B) $1,501.94

C) $3,472.22

D) $2,526.27

A) $1567.86

B) $1,501.94

C) $3,472.22

D) $2,526.27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

29

You will receive a stream of $50 payments BEGINNING at the end of year 1 until the final payment at the end of year 5.What amount will you have at the end of year 5 if you can invest all amounts at a 9% interest rate?

A) $194.48

B) $200.00

C) $228.67

D) $299.24

A) $194.48

B) $200.00

C) $228.67

D) $299.24

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

30

The amount that someone is willing to pay today,for a single cash flow in the future is

A) the future value of the cash flow.

B) the future value of the stream of cash flows.

C) the present value of the cash flow.

D) the present value of the annuity of cash flows

A) the future value of the cash flow.

B) the future value of the stream of cash flows.

C) the present value of the cash flow.

D) the present value of the annuity of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

31

You will receive a stream of annual $70 payments to begin at the end of year 0 until the final payment at the BEGINNING of year 5.What amount will you have at the end of year 5 if you can invest all amounts at an 11% interest rate?

A) $350.00

B) $435.95

C) $483.90

D) $614.83

A) $350.00

B) $435.95

C) $483.90

D) $614.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

32

Your father's pension recently vested and he is told that if he never works another day in his life,he will receive a lump sum of $1,500,000 on his 65th birthday (exactly 15 years from today).Assume that your father needs to permanently retire today.What could he sell the rights to his lump sum for,today,if the correct discount rate for such a calculation is 6%?

A) $625,897.59

B) $1,415,094.34

C) $154,444.15

D) none of the above

A) $625,897.59

B) $1,415,094.34

C) $154,444.15

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

33

You found your dream house.It will cost you $175,000 and you will put down $35,000 as a down payment.For the rest you get a 30-year 6.25% mortgage.What will be your monthly mortgage payment (assume no early repayment)?

A) $729

B) $862

C) $389

D) $605

A) $729

B) $862

C) $389

D) $605

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

34

You will receive a stream of payments BEGINNING at the end of year 1 and the amount will increase by $10 each year until the final payment at the end of year 5.If the first payment is $50,what amount will you have at the end of year 5 if you can invest all amounts at a 7% interest rate?

A) $350.00

B) $374.50

C) $394.79

D) $422.43

A) $350.00

B) $374.50

C) $394.79

D) $422.43

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

35

If you invested $2,000 in an account that pays 12% interest,compounded continuously,how much would be in the account in 5 years?

A) $3,524.68

B) $3,644.24

C) $3,581.70

D) $3,200.00

A) $3,524.68

B) $3,644.24

C) $3,581.70

D) $3,200.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

36

You want to buy a new plasma television in 3 years,when you think prices will have gone down to a more reasonable level.You anticipate that the television will cost you $2,500.If you can invest your money at 8% compounded monthly,how much do you need to put aside today?

A) $1,895.37

B) $1,968.14

C) $1,984.58

D) $2,158.42

A) $1,895.37

B) $1,968.14

C) $1,984.58

D) $2,158.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

37

You are asked to choose between a 4-year investment that pays 10% compound interest and a similar investment that pays 11.5% SIMPLE interest.Which investment will you choose?

A) the 10% compound interest investment

B) the 11.5% simple interest investment

C) you are indifferent between the investment choices

D) there is not enough information to answer the question

A) the 10% compound interest investment

B) the 11.5% simple interest investment

C) you are indifferent between the investment choices

D) there is not enough information to answer the question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

38

In the equation below,the number "100" represents $75.13 = $100 / (1 + .1)3

A) the present value a cash flow to be received at a later date.

B) the future value a cash flow to be received at a later date.

C) the discount rate for the future cash flow.

D) the number of periods before the cash flow is to be received.

A) the present value a cash flow to be received at a later date.

B) the future value a cash flow to be received at a later date.

C) the discount rate for the future cash flow.

D) the number of periods before the cash flow is to be received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

39

If you were to invest $120 for two years,while earning 8% SIMPLE interest,what is the TOTAL AMOUNT OF INTEREST that you will earn?

A) $139.97

B) $139.20

C) $19.20

D) $19.97

A) $139.97

B) $139.20

C) $19.20

D) $19.97

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

40

Your parents set up a trust for you that you will not have access to until your 30th birthday,which is exactly 9 years from today.By prior arrangement,the trust will be worth exactly $200,000 on your 30th birthday.You need cash today and are willing to sell the rights to that trust today for a set amount.If the discount rate for such a cash flow is 12%,what is the maximum amount that someone should be willing to pay you today for the rights to the trust on your 30th birthday?

A) $72,122.01

B) $178,571.43

C) $224,000.00

D) $225,000.00

A) $72,122.01

B) $178,571.43

C) $224,000.00

D) $225,000.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

41

The ratio of interest to principal repayment on an amortizing loan

A) increases as the loan gets older.

B) decreases as the loan gets older.

C) remains constant over the life of the loan.

D) changes according to the level of market interest rates during the life of the loan.

A) increases as the loan gets older.

B) decreases as the loan gets older.

C) remains constant over the life of the loan.

D) changes according to the level of market interest rates during the life of the loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

42

An annuity can best be described as

A) a set of payments to be received during a period of time.

B) a stream of payments to be received at a common interval over the life of the payments.

C) an even stream of payments to be received at a common interval over the life of the payments.

D) the present value of a set of payments to be received during a future period of time.

A) a set of payments to be received during a period of time.

B) a stream of payments to be received at a common interval over the life of the payments.

C) an even stream of payments to be received at a common interval over the life of the payments.

D) the present value of a set of payments to be received during a future period of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

43

You are trying to accumulate $2,000 at the end of 5 years by contributing a fixed amount at the end of each year.You initially decide to contribute $300 per year but find that you are coming up short of the $2,000 goal.What could you do to increase the value of the investment at the end of year 5?

A) invest in an investment that has a lower rate of return.

B) invest in an investment that has a higher rate of return.

C) make a sixth year contribution.

D) contribute a smaller amount each year.

A) invest in an investment that has a lower rate of return.

B) invest in an investment that has a higher rate of return.

C) make a sixth year contribution.

D) contribute a smaller amount each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

44

A young couple buys their dream house.After paying their down payment and closing costs,the couple has borrowed $400,000 from the bank.The terms of the mortgage are 30 years of monthly payments at an APR of 6% with monthly compounding.What is the monthly payment for the couple?

A) $2,398.20

B) $2,421.63

C) $2,697.98

D) $2,700.00

A) $2,398.20

B) $2,421.63

C) $2,697.98

D) $2,700.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which is NOT correct regarding an ordinary annuity and annuity due?

A) An annuity is a series of equal payments.

B) The present value of an ordinary annuity is less than the present value of an annuity due (assuming interest rate is positive).

C) As the interest rate increases,the present value of an annuity decreases.

D) As the length of the annuity increases,the future value of the annuity decreases.

A) An annuity is a series of equal payments.

B) The present value of an ordinary annuity is less than the present value of an annuity due (assuming interest rate is positive).

C) As the interest rate increases,the present value of an annuity decreases.

D) As the length of the annuity increases,the future value of the annuity decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

46

What is the present value of $25 to be received at the end of each year for the next 6 years if the discount rate is 12%?

A) $125.00

B) $113.06

C) $102.79

D) none of the above

A) $125.00

B) $113.06

C) $102.79

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

47

You are trying to prepare a budget based upon the amount of cash flow that you will have available 5 years from now.You are initially promised a regular annuity of $50 with the first payment to be made 1 year from now and the last payment 5 years from now.However,you are actually going to receive an annuity due with the same number of payments but where the first payment is to begin immediately.How much (or less)cash will you have 5 years from now based upon that error if the rate to invest funds is 10%?

A) $50.00

B) $38.58

C) $30.52

D) ($30.52)

A) $50.00

B) $38.58

C) $30.52

D) ($30.52)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following should have the greatest value if the discount rate applying to the cash flows is a positive value?

A) the present value of a $5 payment of to be received one year from today.

B) the future value of a $5 payment received today but invested for one year.

C) the present value of a stream of $5 payments to be received at the end of the next two years.

D) the future value of a stream of $5 payments to be received at the end of the next two years.

A) the present value of a $5 payment of to be received one year from today.

B) the future value of a $5 payment received today but invested for one year.

C) the present value of a stream of $5 payments to be received at the end of the next two years.

D) the future value of a stream of $5 payments to be received at the end of the next two years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

49

You would like to have $1,000 one year (365 days)from now and you find that the bank is paying 7% compounded daily.How much will you have to deposit with the bank today to be able to have the $1,000?

A) $934.58

B) $933.51

C) $932.40

D) none of the above

A) $934.58

B) $933.51

C) $932.40

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

50

A bank account has a rate of 12% APR with quarterly compounding.What is the EAR for the account?

A) 3.00%

B) 12.00%

C) 12.36%

D) 12.55%

A) 3.00%

B) 12.00%

C) 12.36%

D) 12.55%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

51

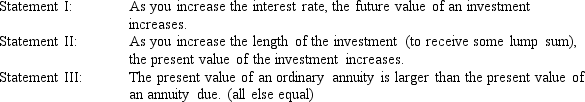

Which of the following statements are TRUE?

A) Statement I only

B) Statements I and II

C) Statement II only

D) Statements I and III only

A) Statement I only

B) Statements I and II

C) Statement II only

D) Statements I and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

52

Uncle Fester puts $50,000 into a bank account earning 6%.You can't withdraw the money until the balance has doubled.How long will you have to leave the money in the account?

A) 9 years

B) 10 years

C) 11 years

D) 12 years

A) 9 years

B) 10 years

C) 11 years

D) 12 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

53

A young couple buys their dream house.After paying their down payment and closing costs,the couple has borrowed $400,000 from the bank.The terms of the mortgage are 30 years of monthly payments at an APR of 6% with monthly compounding.Suppose the couple wants to pay off their mortgage early,and will make extra payments to accomplish this goal.Specifically,the couple will pay an EXTRA $2,000 every 12 months (this extra amount is in ADDITION to the regular scheduled mortgage payment).The first extra $2,000 will be paid after month 12.What will be the balance of the loan after the first year of the mortgage?

A) $392,940.44

B) $393,087.95

C) $394,090.84

D) $397,601.80

A) $392,940.44

B) $393,087.95

C) $394,090.84

D) $397,601.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

54

By increasing the number of compounding periods in a year,while holding the annual percentage rate constant,you will

A) decrease the annual percentage yield.

B) increase the annual percentage yield.

C) not effect the annual percentage yield.

D) increase the dollar return on an investment but will decrease the annual percentage yield.

A) decrease the annual percentage yield.

B) increase the annual percentage yield.

C) not effect the annual percentage yield.

D) increase the dollar return on an investment but will decrease the annual percentage yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

55

An investor puts $200 in a money market account TODAY that returns 3% per year with monthly compounding.The investor plans to keep his money in the account for 2 years.What is the future value of his investment when he closes the account two years from today?

A) $215.00

B) $212.35

C) $206.08

D) $188.37

A) $215.00

B) $212.35

C) $206.08

D) $188.37

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

56

What is the present value of $25 to be received at the BEGINNING of each year for the next 6 years if the discount rate is 12%?

A) $125.00

B) $126.63

C) $115.12

D) none of the above

A) $125.00

B) $126.63

C) $115.12

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

57

Forever Insurance Company has offered to pay you or your heirs $100 per year at the end of each year forever.If the correct discount rate for such a cash flow is 13%,what the amount that you would be willing to pay Forever Insurance for this set of cash flows?

A) $1,000.00

B) $869.23

C) $769.23

D) $100

A) $1,000.00

B) $869.23

C) $769.23

D) $100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

58

If you hold the annual percentage rate constant while increasing the number of compounding periods per year,then

A) the effective interest rate will increase.

B) the effective interest rate will decrease.

C) the effective interest rate will not change.

D) none of the above.

A) the effective interest rate will increase.

B) the effective interest rate will decrease.

C) the effective interest rate will not change.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

59

After graduating from college with a finance degree,you begin an ambitious plan to retire in 25 years.To build up your retirement fund,you will make quarterly payments into a mutual fund that on average will pay 12% APR compounded quarterly.To get you started,a relative gives you a graduation gift of $5,000.Once retired,you plan on moving your investment to a money market fund that will pay 6% APR with monthly compounding.As a young retiree,you believe you will live for 30 more years and will make monthly withdrawals of $10,000.To meet your retirement needs,what quarterly payment should you make?

A) $2,221.45

B) $2,588.27

C) $2,746.50

D) $2,904.73

A) $2,221.45

B) $2,588.27

C) $2,746.50

D) $2,904.73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

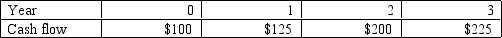

60

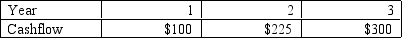

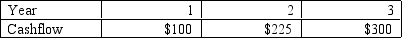

Consider the following set of cashflows to be received over the next 3 years:  If the discount rate is 10%,how would we write the formula to find the Future Value of this set of cash flows at year 3?

If the discount rate is 10%,how would we write the formula to find the Future Value of this set of cash flows at year 3?

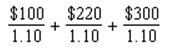

A)

B) $100 (1.10)+ $225 (1.10)+ $300 (1.10)

C) $100 (1.10)3 + $225 (1.10)2 + $300 (1.10)

D) $100 (1.10)2 + $225 (1.10)+ $300

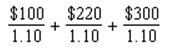

If the discount rate is 10%,how would we write the formula to find the Future Value of this set of cash flows at year 3?

If the discount rate is 10%,how would we write the formula to find the Future Value of this set of cash flows at year 3?A)

B) $100 (1.10)+ $225 (1.10)+ $300 (1.10)

C) $100 (1.10)3 + $225 (1.10)2 + $300 (1.10)

D) $100 (1.10)2 + $225 (1.10)+ $300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

61

Suppose you made a $10,000 investment ten years ago in a speculative stock fund.Your investment today is worth $100,000.What annual compounded return did you earn over the ten year period?

A) 10%

B) 15%

C) 25.89%

D) 27.54%

A) 10%

B) 15%

C) 25.89%

D) 27.54%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

62

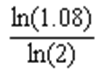

A bank is offering a new savings account that pays 8% per year.Which formula below shows the calculation for determining how long it will take a $100 investment to double?

A) n =

B) n = 1.08ln(2)

C) n = 2ln(1.08)

D) n = 11ec8746_971a_5ab7_b56c_ab8cae0a0293_TB2250_11

A) n =

B) n = 1.08ln(2)

C) n = 2ln(1.08)

D) n = 11ec8746_971a_5ab7_b56c_ab8cae0a0293_TB2250_11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

63

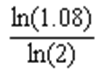

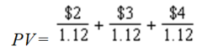

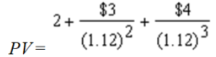

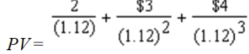

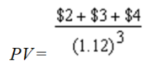

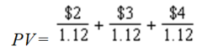

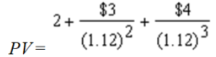

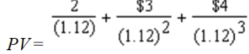

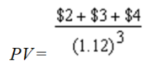

Suppose a professional sports team convinces a former player to come out of retirement and play for three seasons.They offer the player $2 million in year 1,$3 million in year 2,and $4 million in year 3.Assuming end of year payments of the salary,how would we find the value of his contract today if the player has a discount rate of 12%?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

64

A $100 investment yields $112.55 in one year.The interest on the investment was compounded quarterly.From this information,what was the stated rate or APR of the investment?

A) 12.55%

B) 12.25%

C) 12.15%

D) 12.00%

A) 12.55%

B) 12.25%

C) 12.15%

D) 12.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

65

Suppose that Hoosier Farms offers an investment that will pay $10 per year forever.How much is this offer worth if you need a 8% return on your investment?

A) $8

B) $80

C) $100

D) $125

A) $8

B) $80

C) $100

D) $125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

66

Cozmo Costanza just took out a $24,000 bank loan to help purchase his dream car.The bank offered a 5-year loan at a 6% APR.The loan will feature monthly payments and monthly compounding of interest.Suppose that Cozmo would like to pay off the remaining balance on his car loan at the end of the second year (24 payments).What is the remaining balance on the car loan after the second year?

A) $10,469

B) $12,171

C) $14,400

D) $15,252

A) $10,469

B) $12,171

C) $14,400

D) $15,252

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

67

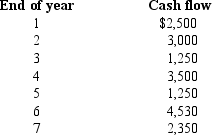

What is the future value at year 3 of the following set of cash flows if the discount rate is 11%?

A) $738

B) $761

C) $789

D) $812

A) $738

B) $761

C) $789

D) $812

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

68

What is the future value of a 5-year ordinary annuity with annual payments of $250,evaluated at a 15 percent interest rate?

A) $670.44

B) $838.04

C) $1,250

D) $1,685.60

A) $670.44

B) $838.04

C) $1,250

D) $1,685.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

69

A young graduate invests $10,000 in a mutual fund that pays 8% interest per year.What is the future value of this investment in 12 years?

A) $12,000

B) $19,600

C) $22,000

D) $25,182

A) $12,000

B) $19,600

C) $22,000

D) $25,182

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

70

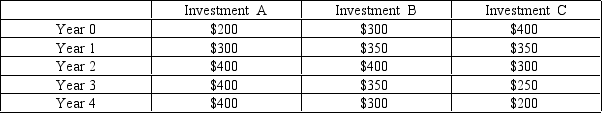

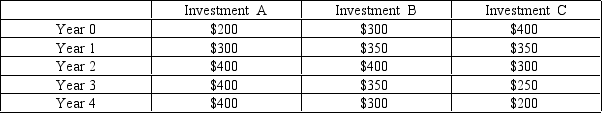

Which of the following investment opportunities has the highest present value if the discount rate is 10%?

A) Investment A

B) Investment B

C) Investment C

D) The present value of Investments A and C are equal and higher than the present value of Investment B.

A) Investment A

B) Investment B

C) Investment C

D) The present value of Investments A and C are equal and higher than the present value of Investment B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which statement is FALSE concerning the time value of money?

A) The greater the compound frequency,the greater the EAR.

B) The EAR is always greater than the APR.

C) An account that pays simple interest will have a lower FV than an account that pays compound interest.

D) The stated interest rate is also referred to as the APR.

A) The greater the compound frequency,the greater the EAR.

B) The EAR is always greater than the APR.

C) An account that pays simple interest will have a lower FV than an account that pays compound interest.

D) The stated interest rate is also referred to as the APR.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

72

The present value of an ordinary annuity is $2,000.The annuity features monthly payments from an account that pays 12% APR (with monthly compounding).If this was an annuity due,what would be the present value? (assume that same interest rate and same payments)

A) $1,785.71

B) $1,980.20

C) $2,020.00

D) $2,080.00

A) $1,785.71

B) $1,980.20

C) $2,020.00

D) $2,080.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

73

In five years,you plan on starting graduate school to earn your MBA.You know that graduate school can be expensive and you expect you will need $15,000 per year for tuition and other school expenses.These payments will be made at the BEGINNING of the school year.To have enough money to attend graduate school,you decide to start saving TODAY by investing in a money market fund that pays 4% APR with monthly compounding.You will make monthly deposits into the account starting TODAY for the next five years.How much will you need to deposit each month to have enough savings for graduate school? (Assume that money that is not withdrawn remains in the account during graduate school and the MBA will take two years to complete.)

A) $438.15

B) $440.26

C) $442.16

D) $443.64

A) $438.15

B) $440.26

C) $442.16

D) $443.64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

74

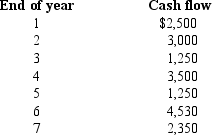

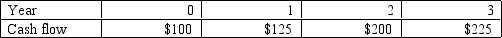

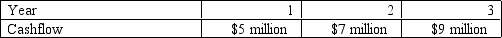

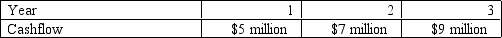

An athlete was offered the following contract for the next three years:  The athlete would rather have his salary in equal amounts at the END of each of the three years.If the discount rate for the athlete is 10%,what yearly amount would she consider EQUIVALENT to the offered contract?

The athlete would rather have his salary in equal amounts at the END of each of the three years.If the discount rate for the athlete is 10%,what yearly amount would she consider EQUIVALENT to the offered contract?

A) $5.37 million per year

B) $5.70 million per year

C) $6.71 million per year

D) $6.87 million per year

The athlete would rather have his salary in equal amounts at the END of each of the three years.If the discount rate for the athlete is 10%,what yearly amount would she consider EQUIVALENT to the offered contract?

The athlete would rather have his salary in equal amounts at the END of each of the three years.If the discount rate for the athlete is 10%,what yearly amount would she consider EQUIVALENT to the offered contract?A) $5.37 million per year

B) $5.70 million per year

C) $6.71 million per year

D) $6.87 million per year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

75

Suppose you take out a loan from the local mob boss for $10,000.Being a generous banker,the mob boss offers you an APR of 60% with monthly compounding.The length of the loan is 3 years with monthly payments.However,you want to get out of this arrangement as quickly as possible.You decide to pay off whatever balance remains after the first year of payments.What is your remaining balance after one year?

A) $8,124.46

B) $8,339.13

C) $9,233.06

D) $9,342.47

A) $8,124.46

B) $8,339.13

C) $9,233.06

D) $9,342.47

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following investments would have the highest future value (in year 5)if the discount rate is 12%?

A) A five year ordinary annuity of $100 per year.

B) A five year annuity due of $100 per year.

C) $700 to be received at year 5

D) $500 to be received TODAY (year 0)

A) A five year ordinary annuity of $100 per year.

B) A five year annuity due of $100 per year.

C) $700 to be received at year 5

D) $500 to be received TODAY (year 0)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

77

As a young graduate,you have plans on buying your dream car in three years.You believe the car will cost $50,000.You have two sources of money to reach your goal of $50,000.First,you will save money for the next three years in a money market fund that will return 8% annually.You plan on making $5,000 annual payments to this fund.You will make yearly investments at the BEGINNING of the year.The second source of money will be a car loan that you will take out on the day you buy the car.You anticipate the car dealer to offer you a 6% APR loan with monthly compounding for a term of 60 months.To buy your dream car,what monthly car payment will you anticipate?

A) $483.99

B) $540.15

C) $627.73

D) $652.83

A) $483.99

B) $540.15

C) $627.73

D) $652.83

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

78

Cozmo Costanza just took out a $24,000 bank loan to help purchase his dream car.The bank offered a 5-year loan at a 6% APR.The loan will feature monthly payments and monthly compounding of interest.What is the monthly payment for this car loan?

A) $400.00

B) $463.99

C) $470.25

D) $474.79

A) $400.00

B) $463.99

C) $470.25

D) $474.79

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

79

An electric company has offered the following perpetuity to investors to raise capital for the firm.The perpetuity will pay $1 next year,and it is promised to grow at 5% per year thereafter.If you can earn 10% on invested money,how much would you pay today for this perpetuity?

A) $100

B) $50

C) $40

D) $20

A) $100

B) $50

C) $40

D) $20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

80

Suppose you are ready to buy your first house.To buy the house,you will take out a $140,000 mortgage from the bank.The bank offers you the mortgage for 30 years at an APR of 6.0% with interest compounded monthly.For your tenth monthly payment,what is the reduction in principal?

A) $145.77

B) $156.18

C) $327.24

D) $359.64

A) $145.77

B) $156.18

C) $327.24

D) $359.64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck