Deck 4: A: Consolidated Financial Statements and Outside Ownership

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/117

العب

ملء الشاشة (f)

Deck 4: A: Consolidated Financial Statements and Outside Ownership

1

What is the amount of excess land allocation attributed to the noncontrolling interest at the acquisition date?

A) $ 0.

B) $30,000.

C) $22,500.

D) $ 7,500.

E) $17,500.

A) $ 0.

B) $30,000.

C) $22,500.

D) $ 7,500.

E) $17,500.

D

2

What is the dollar amount of noncontrolling interest that should appear in a consolidated balance sheet prepared at the date of acquisition?

A) $350,000.

B) $300,000.

C) $400,000.

D) $370,000.

E) $0.

A) $350,000.

B) $300,000.

C) $400,000.

D) $370,000.

E) $0.

C

3

What is the amount of excess land allocation attributed to the controlling interest at the acquisition date?

A) $ 0.

B) $30,000.

C) $22,500.

D) $25,000.

E) $17,500.

A) $ 0.

B) $30,000.

C) $22,500.

D) $25,000.

E) $17,500.

C

4

What is the total amount of goodwill recognized at the date of acquisition?

A) $150,000.

B) $250,000.

C) $ 0.

D) $120,000.

E) $170,000.

A) $150,000.

B) $250,000.

C) $ 0.

D) $120,000.

E) $170,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

5

In consolidation, the total amount of expenses related to Kailey, and to Denber's acquisition of Kailey, for 2019 is determined to be

A) $153,750.

B) $161,250.

C) $205,000.

D) $210,000.

E) $215,000.

A) $153,750.

B) $161,250.

C) $205,000.

D) $210,000.

E) $215,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

6

What amount of goodwill should be attributed to the noncontrolling interest at the date of acquisition?

A) $ 0.

B) $ 20,000.

C) $ 30,000.

D) $100,000.

E) $120,000.

A) $ 0.

B) $ 20,000.

C) $ 30,000.

D) $100,000.

E) $120,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

7

What is the amount of the noncontrolling interest's share of Kailey's income for 2019?

A) $22,000.

B) $24,000.

C) $48,000.

D) $66,000.

E) $72,000.

A) $22,000.

B) $24,000.

C) $48,000.

D) $66,000.

E) $72,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

8

What amount of goodwill should be attributed to Perch at the date of acquisition?

A) $150,000.

B) $250,000.

C) $ 0.

D) $120,000.

E) $170,000.

A) $150,000.

B) $250,000.

C) $ 0.

D) $120,000.

E) $170,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

9

What amount should have been reported for the land in a consolidated balance sheet at the acquisition date?

A) $ 52,500.

B) $ 70,000.

C) $ 75,000.

D) $ 92,500.

E) $100,000.

A) $ 52,500.

B) $ 70,000.

C) $ 75,000.

D) $ 92,500.

E) $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

10

What is the amount of Kailey's net income to the controlling interest for 2019?

A) $31,000.

B) $33,000.

C) $55,000.

D) $60,000.

E) $39,000.

A) $31,000.

B) $33,000.

C) $55,000.

D) $60,000.

E) $39,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

11

What amount of consolidated net income for 2019 should be allocated to Femur's controlling interest in Harbor?

A) $ 582,000

B) $1,050,000

C) $1,358,000

D) $1,808,000

E) $2,140,000

A) $ 582,000

B) $1,050,000

C) $1,358,000

D) $1,808,000

E) $2,140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

12

MacHeath Inc.bought 60% of the outstanding common stock of Nomes Inc.in an acquisition that resulted in the recognition of goodwill.Nomes owned a piece of land that cost $250,000 but was worth $600,000 at the date of acquisition.What value would be attributed to this land in a consolidated balance sheet at the date of acquisition?

A) $250,000.

B) $150,000.

C) $600,000.

D) $360,000.

E) $460,000.

A) $250,000.

B) $150,000.

C) $600,000.

D) $360,000.

E) $460,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

13

The noncontrolling interest's share of the earnings of Harbor Corp.for 2019 is calculated to be

A) $132,000.

B) $150,000.

C) $168,000.

D) $160,000.

E) $0.

A) $132,000.

B) $150,000.

C) $168,000.

D) $160,000.

E) $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the dollar amount of fair value over book value differences attributed to Perch at the date of acquisition?

A) $120,000.

B) $150,000.

C) $280,000.

D) $350,000.

E) $370,000.

A) $120,000.

B) $150,000.

C) $280,000.

D) $350,000.

E) $370,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following methods is not used to value a noncontrolling interest under circumstances where a control premium is applied to determine the appropriate value for such interest?

A) Valuation models based on subsidiary discounted cash flows.

B) Valuation models based on subsidiary residual income projections.

C) Comparison with comparable investments.

D) The application of a safe harbor discount rate.

E) Fair value based on market trades.

A) Valuation models based on subsidiary discounted cash flows.

B) Valuation models based on subsidiary residual income projections.

C) Comparison with comparable investments.

D) The application of a safe harbor discount rate.

E) Fair value based on market trades.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

16

For business combinations involving less than 100 percent ownership, the acquirer recognizes and measures all of the following at the acquisition date except:

A) Identifiable assets acquired, at fair value.

B) Liabilities assumed, at book value.

C) Non-controlling interest, at fair value.

D) Goodwill, or a gain from bargain purchase.

E) None of these choices is correct.

A) Identifiable assets acquired, at fair value.

B) Liabilities assumed, at book value.

C) Non-controlling interest, at fair value.

D) Goodwill, or a gain from bargain purchase.

E) None of these choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is the total amount of excess land allocation at the acquisition date?

A) $ 0.

B) $30,000.

C) $22,500.

D) $25,000.

E) $17,500.

A) $ 0.

B) $30,000.

C) $22,500.

D) $25,000.

E) $17,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

18

What amount would Femur Co.report as consolidated net income for 2019?

A) $440,000.

B) $500,000.

C) $1,500,000.

D) $1,940,000.

E) $2,000,000.

A) $440,000.

B) $500,000.

C) $1,500,000.

D) $1,940,000.

E) $2,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

19

What is the dollar amount of Float Corp.'s net assets that would be represented in a consolidated balance sheet prepared at the date of acquisition?

A) $1,600,000.

B) $1,480,000.

C) $1,200,000.

D) $1,780,000.

E) $1,850,000.

A) $1,600,000.

B) $1,480,000.

C) $1,200,000.

D) $1,780,000.

E) $1,850,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

20

What is the effect of including Kailey in consolidated net income for 2019?

A) $31,000.

B) $33,000.

C) $55,000.

D) $60,000.

E) $39,000.

A) $31,000.

B) $33,000.

C) $55,000.

D) $60,000.

E) $39,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following statements is false regarding multiple acquisitions of a subsidiary's existing common stock?

A) The parent recognizes a larger percent of subsidiary income.

B) A step acquisition resulting in control may result in a parent recognizing a gain on revaluation.

C) The book value of the subsidiary will increase.

D) The parent's percent ownership in subsidiary will increase.

E) Noncontrolling interest in subsidiary's net income will decrease.

A) The parent recognizes a larger percent of subsidiary income.

B) A step acquisition resulting in control may result in a parent recognizing a gain on revaluation.

C) The book value of the subsidiary will increase.

D) The parent's percent ownership in subsidiary will increase.

E) Noncontrolling interest in subsidiary's net income will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a parent uses the initial value method throughout the year to account for its 80% investment in an acquired subsidiary, which of the following statements is true at the date immediately preceding the date on which adjustments are made on the consolidated worksheet?

A) Parent company net income equals consolidated net income.

B) Parent company retained earnings equals consolidated retained earnings.

C) Parent company total assets equals consolidated total assets.

D) Parent company dividends equal consolidated dividends.

E) Goodwill is recorded on the parent's books.

A) Parent company net income equals consolidated net income.

B) Parent company retained earnings equals consolidated retained earnings.

C) Parent company total assets equals consolidated total assets.

D) Parent company dividends equal consolidated dividends.

E) Goodwill is recorded on the parent's books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

23

What is the consolidated balance of the Equipment account at December 31, 2020?

A) $644,400.

B) $784,000.

C) $719,600.

D) $770,000.

E) $775,600.

A) $644,400.

B) $784,000.

C) $719,600.

D) $770,000.

E) $775,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

24

Kordel Inc.acquired 75% of the outstanding common stock of Raxston Corp.Raxston currently owes Kordel $500,000 for inventory acquired over the past few months.In preparing consolidated financial statements, what amount of Raxston's liability should be eliminated?

A) $375,000

B) $125,000

C) $300,000

D) $500,000

E) $0.

A) $375,000

B) $125,000

C) $300,000

D) $500,000

E) $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

25

What is the amount attributable to consolidated noncurrent assets at January 2, 2019?

A) $195,000.

B) $192,200.

C) $186,600.

D) $181,000.

E) $169,800.

A) $195,000.

B) $192,200.

C) $186,600.

D) $181,000.

E) $169,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

26

In a step acquisition, which of the following statements is false?

A) The acquisition method views a step acquisition essentially the same as a single step acquisition.

B) Income from subsidiary is computed by applying a partial year for a new purchase acquired during the year.

C) Income from subsidiary is computed for the entire year for a new purchase acquired during the year.

D) Obtaining control through a step acquisition is a significant measurement event.

E) Pre-acquisition earnings are not included in the consolidated income statement.

A) The acquisition method views a step acquisition essentially the same as a single step acquisition.

B) Income from subsidiary is computed by applying a partial year for a new purchase acquired during the year.

C) Income from subsidiary is computed for the entire year for a new purchase acquired during the year.

D) Obtaining control through a step acquisition is a significant measurement event.

E) Pre-acquisition earnings are not included in the consolidated income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

27

What is the noncontrolling interest's share of the subsidiary's net income for the year ended December 31, 2020 and what is the ending balance of the noncontrolling interest in the subsidiary at December 31, 2020?

A) $56,000 and $280,000.

B) $50,400 and $218,400.

C) $56,000 and $224,000.

D) $56,000 and $336,000.

E) $50,400 and $330,400.

A) $56,000 and $280,000.

B) $50,400 and $218,400.

C) $56,000 and $224,000.

D) $56,000 and $336,000.

E) $50,400 and $330,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

28

When a parent uses the partial equity method throughout the year to account for its 80% investment in an acquired subsidiary, which of the following statements is true at the date immediately preceding the date on which adjustments are made on the consolidated worksheet?

A) Parent company net income equals consolidated net income.

B) Parent company retained earnings equals consolidated retained earnings.

C) Parent company total assets equals consolidated total assets.

D) Parent company dividends equal consolidated dividends.

E) Goodwill is recorded on the parent's books.

A) Parent company net income equals consolidated net income.

B) Parent company retained earnings equals consolidated retained earnings.

C) Parent company total assets equals consolidated total assets.

D) Parent company dividends equal consolidated dividends.

E) Goodwill is recorded on the parent's books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

29

When a subsidiary is acquired sometime after the first day of the fiscal year, which of the following statements is true?

A) Income from subsidiary is not recognized until there is an entire year of consolidated operations.

B) Income from subsidiary is recognized from date of acquisition to year-end.

C) Excess cost over acquisition value is recognized at the beginning of the fiscal year.

D) No goodwill can be recognized.

E) Income from subsidiary is recognized for the entire year.

A) Income from subsidiary is not recognized until there is an entire year of consolidated operations.

B) Income from subsidiary is recognized from date of acquisition to year-end.

C) Excess cost over acquisition value is recognized at the beginning of the fiscal year.

D) No goodwill can be recognized.

E) Income from subsidiary is recognized for the entire year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

30

What are the total consolidated current liabilities at January 2, 2019?

A) $53,200.

B) $56,000.

C) $64,400.

D) $42,000.

E) $70,000.

A) $53,200.

B) $56,000.

C) $64,400.

D) $42,000.

E) $70,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

31

When a parent uses the acquisition method for business combinations and sells shares of its subsidiary, which of the following statements is false?

A) If majority control is still maintained, consolidated financial statements are still required.

B) If majority control is not maintained but significant influence exists, the equity method to account for the investment is still used but consolidated financial statements are not required.

C) If majority control is not maintained but significant influence exists, the equity method is still used to account for the investment and consolidated financial statements are still required.

D) If majority control is not maintained and significant influence no longer exists, a prospective change in accounting principle to the fair value method is required.

E) A gain or loss calculation must be prepared if control is lost.

A) If majority control is still maintained, consolidated financial statements are still required.

B) If majority control is not maintained but significant influence exists, the equity method to account for the investment is still used but consolidated financial statements are not required.

C) If majority control is not maintained but significant influence exists, the equity method is still used to account for the investment and consolidated financial statements are still required.

D) If majority control is not maintained and significant influence no longer exists, a prospective change in accounting principle to the fair value method is required.

E) A gain or loss calculation must be prepared if control is lost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

32

When consolidating a subsidiary that was acquired on a date other than the first day of the fiscal year, which of the following statements is true of the subsidiary with respect to the presentation of consolidated financial statement information?

A) Pre-acquisition earnings are deducted from consolidated revenues and expenses.

B) Pre-acquisition earnings are added to consolidated revenues and expenses.

C) Pre-acquisition earnings are deducted from the beginning consolidated stockholders' equity.

D) Pre-acquisition earnings are added to the beginning consolidated stockholders' equity.

E) Pre-acquisition earnings are ignored in the consolidated income statement.

A) Pre-acquisition earnings are deducted from consolidated revenues and expenses.

B) Pre-acquisition earnings are added to consolidated revenues and expenses.

C) Pre-acquisition earnings are deducted from the beginning consolidated stockholders' equity.

D) Pre-acquisition earnings are added to the beginning consolidated stockholders' equity.

E) Pre-acquisition earnings are ignored in the consolidated income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

33

What is consolidated stockholders' equity at January 2, 2019?

A) $112,000.

B) $133,000.

C) $168,000.

D) $182,000.

E) $203,000.

A) $112,000.

B) $133,000.

C) $168,000.

D) $182,000.

E) $203,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

34

Jax Company used the acquisition method when it acquired its investment in Saxton Company.Jax now sells some of its shares of Saxton such that neither control nor significant influence exists.Which of the following statements is true?

A) The difference between selling price and acquisition value is recorded as a realized gain or loss.

B) The difference between selling price and acquisition value is recorded as an unrealized gain or loss.

C) The difference between selling price and carrying value is recorded as a realized gain or loss.

D) The difference between selling price and carrying value is recorded as an unrealized gain or loss.

E) The difference between selling price and carrying value is recorded as an adjustment to retained earnings.

A) The difference between selling price and acquisition value is recorded as a realized gain or loss.

B) The difference between selling price and acquisition value is recorded as an unrealized gain or loss.

C) The difference between selling price and carrying value is recorded as a realized gain or loss.

D) The difference between selling price and carrying value is recorded as an unrealized gain or loss.

E) The difference between selling price and carrying value is recorded as an adjustment to retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

35

All of the following statements regarding the sale of subsidiary shares are true except which of the following?

A) The use of specific identification based on serial number is acceptable.

B) The use of the FIFO assumption is acceptable.

C) The use of the averaging assumption is acceptable.

D) The use of specific LIFO assumption is acceptable.

E) The parent company must determine whether consolidation is still appropriate for the remaining shares owned.

A) The use of specific identification based on serial number is acceptable.

B) The use of the FIFO assumption is acceptable.

C) The use of the averaging assumption is acceptable.

D) The use of specific LIFO assumption is acceptable.

E) The parent company must determine whether consolidation is still appropriate for the remaining shares owned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

36

In measuring the noncontrolling interest immediately following the date of acquisition, which of the following would not be indicative of the value attributed to the noncontrolling interest?

A) Fair value based on stock trades of the acquired company.

B) Subsidiary cash flows discounted to present value.

C) Book value of subsidiary net assets.

D) Projections of residual income.

E) Consideration transferred by the parent company that implies a total subsidiary value.

A) Fair value based on stock trades of the acquired company.

B) Subsidiary cash flows discounted to present value.

C) Book value of subsidiary net assets.

D) Projections of residual income.

E) Consideration transferred by the parent company that implies a total subsidiary value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

37

What amount represents consolidated current assets at January 2, 2019?

A) $127,000.

B) $129,800.

C) $143,800.

D) $148,000.

E) $135,400.

A) $127,000.

B) $129,800.

C) $143,800.

D) $148,000.

E) $135,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

38

When a parent uses the equity method throughout the year to account for its 80% investment in an acquired subsidiary, which of the following statements is false at the date immediately preceding the date on which adjustments are made on the consolidated worksheet?

A) Parent company net income equals controlling interest in consolidated net income.

B) Parent company retained earnings equals consolidated retained earnings.

C) Parent company total assets equals consolidated total assets.

D) Parent company dividends equals consolidated dividends.

E) Goodwill is not recorded on the parent's books.

A) Parent company net income equals controlling interest in consolidated net income.

B) Parent company retained earnings equals consolidated retained earnings.

C) Parent company total assets equals consolidated total assets.

D) Parent company dividends equals consolidated dividends.

E) Goodwill is not recorded on the parent's books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

39

What amount of consolidated net income for 2020 is attributable to Royce's controlling interest?

A) $686,000.

B) $560,000.

C) $644,000.

D) $635,600.

E) $691,600.

A) $686,000.

B) $560,000.

C) $644,000.

D) $635,600.

E) $691,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following statements is true regarding the sale of subsidiary shares when using the acquisition method for accounting for business combinations?

A) If control continues, the difference between selling price and acquisition value is recorded as a realized gain or loss.

B) If control continues, the difference between selling price and acquisition value is an unrealized gain or loss.

C) If control continues, the difference between selling price and carrying value is recorded as an adjustment to additional paid-in capital.

D) If control continues, the difference between selling price and carrying value is recorded as a realized gain or loss.

E) If control continues, the difference between selling price and carrying value is recorded as an adjustment to retained earnings.

A) If control continues, the difference between selling price and acquisition value is recorded as a realized gain or loss.

B) If control continues, the difference between selling price and acquisition value is an unrealized gain or loss.

C) If control continues, the difference between selling price and carrying value is recorded as an adjustment to additional paid-in capital.

D) If control continues, the difference between selling price and carrying value is recorded as a realized gain or loss.

E) If control continues, the difference between selling price and carrying value is recorded as an adjustment to retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

41

In consolidation at December 31, 2019, what adjustment is necessary for Hogan's Buildings account?

A) $1,620 increase.

B) $1,620 decrease.

C) $1,800 increase.

D) $1,800 decrease.

E) No adjustment is necessary.

A) $1,620 increase.

B) $1,620 decrease.

C) $1,800 increase.

D) $1,800 decrease.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

42

In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Patent account?

A) $7,000.

B) $6,300.

C) $11,000.

D) $9,900.

E) No adjustment is necessary.

A) $7,000.

B) $6,300.

C) $11,000.

D) $9,900.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

43

Compute Pell's Investment in Demers account balance at December 31, 2019.

A) $580,000.

B) $574,400.

C) $548,000.

D) $542,400.

E) $541,000.

A) $580,000.

B) $574,400.

C) $548,000.

D) $542,400.

E) $541,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

44

Compute Pell's income from Demers for the year ended December 31, 2020.

A) $90,400.

B) $89,000.

C) $50,400.

D) $56,000.

E) $96,000.

A) $90,400.

B) $89,000.

C) $50,400.

D) $56,000.

E) $96,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

45

In consolidation at December 31, 2020, what adjustment is necessary for Hogan's Land account?

A) $7,000 decrease.

B) $7,000 increase.

C) $6,300 increase.

D) $6,300 decrease.

E) No adjustment is necessary.

A) $7,000 decrease.

B) $7,000 increase.

C) $6,300 increase.

D) $6,300 decrease.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

46

In consolidation at December 31, 2020, what adjustment is necessary for Hogan's Equipment account?

A) $2,000 increase.

B) $2,000 decrease.

C) $1,800 increase.

D) $1,800 decrease.

E) No adjustment is necessary.

A) $2,000 increase.

B) $2,000 decrease.

C) $1,800 increase.

D) $1,800 decrease.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

47

In consolidation at December 31, 2019, what adjustment is necessary for Hogan's Equipment account?

A) $3,000 increase.

B) $3,000 decrease.

C) $2,700 increase.

D) $2,700 decrease.

E) No adjustment is necessary.

A) $3,000 increase.

B) $3,000 decrease.

C) $2,700 increase.

D) $2,700 decrease.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

48

The acquisition value attributable to the noncontrolling interest at January 1, 2019 is:

A) $23,400.

B) $24,000.

C) $24,900.

D) $26,000.

E) $20,000.

A) $23,400.

B) $24,000.

C) $24,900.

D) $26,000.

E) $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

49

In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Equipment account?

A) $4,000 increase.

B) $4,000 decrease.

C) $3,600 increase.

D) $3,600 decrease.

E) No adjustment is necessary.

A) $4,000 increase.

B) $4,000 decrease.

C) $3,600 increase.

D) $3,600 decrease.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

50

In consolidation at December 31, 2020, what net adjustment is necessary for Hogan's Patent account?

A) $4,200.

B) $5,500.

C) $8,000.

D) $6,600.

E) No adjustment is necessary.

A) $4,200.

B) $5,500.

C) $8,000.

D) $6,600.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

51

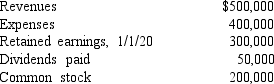

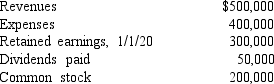

Keefe, Inc., a calendar-year corporation, acquires 70% of George Company on September 1, 2019, and an additional 10% on January 1, 2020.Total annual amortization of $6,000 relates to the first acquisition.George reports the following figures for 2020:  Without regard for this investment, Keefe independently earns $300,000 in net income during 2020.

Without regard for this investment, Keefe independently earns $300,000 in net income during 2020.

All net income is earned evenly throughout the year.

What is the controlling interest in consolidated net income for 2020?

A) $380,000.

B) $375,200.

C) $375,800.

D) $376,000.

E) $400,000.

Without regard for this investment, Keefe independently earns $300,000 in net income during 2020.

Without regard for this investment, Keefe independently earns $300,000 in net income during 2020.All net income is earned evenly throughout the year.

What is the controlling interest in consolidated net income for 2020?

A) $380,000.

B) $375,200.

C) $375,800.

D) $376,000.

E) $400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

52

Compute Pell's investment account balance in Demers at December 31, 2020.

A) $577,200.

B) $604,000.

C) $592,800.

D) $632,800.

E) $572,000.

A) $577,200.

B) $604,000.

C) $592,800.

D) $632,800.

E) $572,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

53

Compute Pell's investment account balance in Demers at December 31, 2021.

A) $639,000.

B) $643,200.

C) $763,200.

D) $676,000.

E) $620,000.

A) $639,000.

B) $643,200.

C) $763,200.

D) $676,000.

E) $620,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

54

In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Buildings account?

A) $2,000 increase.

B) $2,000 decrease.

C) $1,800 increase.

D) $1,800 decrease.

E) No change.

A) $2,000 increase.

B) $2,000 decrease.

C) $1,800 increase.

D) $1,800 decrease.

E) No change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

55

Compute Pell's income from Demers for the year ended December 31, 2019.

A) $74,400.

B) $73,000.

C) $42,400.

D) $41,000.

E) $80,000.

A) $74,400.

B) $73,000.

C) $42,400.

D) $41,000.

E) $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

56

Compute Pell's income from Demers for the year ended December 31, 2021.

A) $50,400.

B) $56,000.

C) $98,400.

D) $97,000.

E) $104,000.

A) $50,400.

B) $56,000.

C) $98,400.

D) $97,000.

E) $104,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

57

In consolidation at December 31, 2019, what net adjustment is necessary for Hogan's Patent account?

A) $5,600.

B) $8,800.

C) $7,000.

D) $7,700.

E) No adjustment is necessary.

A) $5,600.

B) $8,800.

C) $7,000.

D) $7,700.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

58

In consolidation at January 1, 2019, what adjustment is necessary for Hogan's Land account?

A) $7,000 increase.

B) $7,000 decrease.

C) $6,300 increase.

D) $6,300 decrease.

E) No adjustment is necessary.

A) $7,000 increase.

B) $7,000 decrease.

C) $6,300 increase.

D) $6,300 decrease.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

59

In consolidation at December 31, 2019, what adjustment is necessary for Hogan's Land account?

A) $8,000 decrease .

B) $7,000 increase.

C) $6,300 increase.

D) $6,300 decrease.

E) No adjustment is necessary.

A) $8,000 decrease .

B) $7,000 increase.

C) $6,300 increase.

D) $6,300 decrease.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

60

In consolidation at December 31, 2020, what adjustment is necessary for Hogan's Buildings account?

A) $1,440 increase.

B) $1,440 decrease.

C) $1,600 increase.

D) $1,600 decrease.

E) No adjustment is necessary.

A) $1,440 increase.

B) $1,440 decrease.

C) $1,600 increase.

D) $1,600 decrease.

E) No adjustment is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

61

Compute Pell's investment in Demers at December 31, 2020.

A) $625,000.

B) $664,800.

C) $592,400.

D) $500,000.

E) $572,000.

A) $625,000.

B) $664,800.

C) $592,400.

D) $500,000.

E) $572,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

62

Compute the noncontrolling interest in Demers at December 31, 2020.

A) $107,000.

B) $126,000.

C) $109,200.

D) $149,600.

E) $148,200.

A) $107,000.

B) $126,000.

C) $109,200.

D) $149,600.

E) $148,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

63

Compute the noncontrolling interest in the net income of Demers at December 31, 2021.

A) $20,400.

B) $24,600.

C) $26,000.

D) $14,000.

E) $12,600.

A) $20,400.

B) $24,600.

C) $26,000.

D) $14,000.

E) $12,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

64

How much does Pell record as Income from Demers for the year ended December 31, 2021?

A) $48,000.

B) $56,000.

C) $98,400.

D) $97,000.

E) $50,400.

A) $48,000.

B) $56,000.

C) $98,400.

D) $97,000.

E) $50,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

65

Compute the noncontrolling interest in Demers at December 31, 2020.

A) $126,000.

B) $106,000.

C) $109,200.

D) $149,600.

E) $148,200.

A) $126,000.

B) $106,000.

C) $109,200.

D) $149,600.

E) $148,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

66

Compute the noncontrolling interest in Demers at December 31, 2019.

A) $135,600.

B) $137,000.

C) $112,000.

D) $100,000.

E) $118,600.

A) $135,600.

B) $137,000.

C) $112,000.

D) $100,000.

E) $118,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

67

Compute the noncontrolling interest in the net income of Demers at December 31, 2019.

A) $12,000.

B) $10,600.

C) $18,600.

D) $20,000.

E) $14,400.

A) $12,000.

B) $10,600.

C) $18,600.

D) $20,000.

E) $14,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

68

Compute the noncontrolling interest in the net income of Demers at December 31, 2019.

A) $20,000.

B) $12,000.

C) $18,600.

D) $10,600.

E) $14,400.

A) $20,000.

B) $12,000.

C) $18,600.

D) $10,600.

E) $14,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

69

Compute the noncontrolling interest in Demers at December 31, 2019.

A) $135,600.

B) $ 80,000.

C) $117,000.

D) $100,000.

E) $110,600.

A) $135,600.

B) $ 80,000.

C) $117,000.

D) $100,000.

E) $110,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

70

Compute Pell's investment in Demers at December 31, 2020.

A) $676,000.

B) $629,000.

C) $580,000.

D) $604,000.

E) $572,000.

A) $676,000.

B) $629,000.

C) $580,000.

D) $604,000.

E) $572,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

71

Compute Pell's investment in Demers at December 31, 2019.

A) $500,000.

B) $574,400.

C) $625,000.

D) $542,400.

E) $532,000.

A) $500,000.

B) $574,400.

C) $625,000.

D) $542,400.

E) $532,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

72

Compute the noncontrolling interest in the net income of Demers at December 31, 2021.

A) $24,600.

B) $14,000.

C) $26,000.

D) $20,400.

E) $12,600.

A) $24,600.

B) $14,000.

C) $26,000.

D) $20,400.

E) $12,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

73

Compute the noncontrolling interest in Demers at December 31, 2021.

A) $107,800.

B) $140,000.

C) $ 80,000.

D) $ 50,000.

E) $160,800.

A) $107,800.

B) $140,000.

C) $ 80,000.

D) $ 50,000.

E) $160,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

74

Compute Pell's investment in Demers at December 31, 2019.

A) $625,000.

B) $574,400.

C) $548,000.

D) $542,400.

E) $532,000.

A) $625,000.

B) $574,400.

C) $548,000.

D) $542,400.

E) $532,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

75

Compute the noncontrolling interest in Demers at December 31, 2021.

A) $107,800.

B) $140,000.

C) $165,200.

D) $160,800.

E) $146,800.

A) $107,800.

B) $140,000.

C) $165,200.

D) $160,800.

E) $146,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

76

Compute the noncontrolling interest in the net income of Demers at December 31, 2020.

A) $18,400.

B) $14,000.

C) $22,600.

D) $24,000.

E) $12,600.

A) $18,400.

B) $14,000.

C) $22,600.

D) $24,000.

E) $12,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

77

Compute Pell's investment in Demers at December 31, 2021.

A) $592,400.

B) $500,000.

C) $625,000.

D) $676,000.

E) $620,000.

A) $592,400.

B) $500,000.

C) $625,000.

D) $676,000.

E) $620,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

78

How much does Pell record as Income from Demers for the year ended December 31, 2019?

A) $32,000.

B) $74,400.

C) $73,000.

D) $42,400.

E) $41,000.

A) $32,000.

B) $74,400.

C) $73,000.

D) $42,400.

E) $41,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

79

Compute the noncontrolling interest in the net income of Demers at December 31, 2020.

A) $18,400.

B) $14,400.

C) $22,600.

D) $24,000.

E) $12,600.

A) $18,400.

B) $14,400.

C) $22,600.

D) $24,000.

E) $12,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck

80

How much does Pell record as Income from Demers for the year ended December 31, 2020?

A) $90,400.

B) $40,000.

C) $89,000.

D) $50,400.

E) $56,000.

A) $90,400.

B) $40,000.

C) $89,000.

D) $50,400.

E) $56,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 117 في هذه المجموعة.

فتح الحزمة

k this deck