Deck 15: A: Partnerships: Termination and Liquidation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

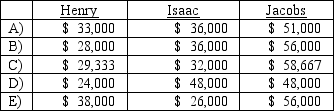

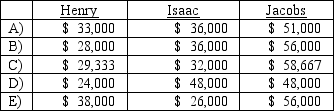

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/69

العب

ملء الشاشة (f)

Deck 15: A: Partnerships: Termination and Liquidation

1

Assuming that, after the payment of liquidation expenses in the amount of $12,000 was made and the noncash assets were sold, if Creighton has a deficit of $8,000, for what amount would the noncash assets have been sold?

A) $170,000.

B) $264,000.

C) $158,000.

D) $146,000.

E) $185,000.

A) $170,000.

B) $264,000.

C) $158,000.

D) $146,000.

E) $185,000.

A

2

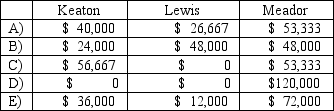

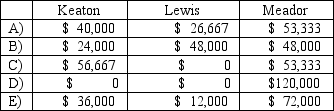

Before liquidating any assets, the partners determined the amount of cash for safe payments and distributed it.The noncash assets were then sold for $120,000.The liquidation expenses of $5,000 were paid prior to the sale of noncashassets.How would the $120,000 be distributed to the partners? (Hint: Either a predistribution plan or a schedule of safe capital balances would be appropriate for solving this item.)

B

3

Assuming that the noncash assets were sold for $134,000, which partner(s) would have been required to contribute assets to the partnership to cover a deficit in his or her capital account, prior to considering the liquidation expenses incurred?

A) Abrams.

B) Bartle.

C) Creighton.

D) Abrams and Creighton.

E) Abrams and Bartle.

A) Abrams.

B) Bartle.

C) Creighton.

D) Abrams and Creighton.

E) Abrams and Bartle.

D

4

If the assets could be sold for $228,000 and there are no liquidation expenses, what is the amount that Laurel would receive from the liquidation?

A) $36,000.

B) $ 0.

C) $ 2,500.

D) $38,250.

E) $67,250.

A) $36,000.

B) $ 0.

C) $ 2,500.

D) $38,250.

E) $67,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

5

For what amount would noncash assets need to be sold to generate enough cash in order that at least one partner would receive some cash upon liquidation?

A) $185,000

B) $170,000

C) $165,000

D) $ 95,000

E) $ 90,000

A) $185,000

B) $170,000

C) $165,000

D) $ 95,000

E) $ 90,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

6

Assuming noncash assets were sold for $60,000, how much will each partner receive in the liquidation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

7

Assume that noncash assets were sold for $58,000 and liquidation expenses in the amount of $10,000 were incurred.If Lewis was personally insolvent and could not contribute any assets to the partnership, and Keaton and Meador were both solvent, what amount of cash would Keaton receive from the distribution of partnership assets?

A) $0.

B) $56,000.

C) $57,600.

D) $59,600.

E) $60,000.

A) $0.

B) $56,000.

C) $57,600.

D) $59,600.

E) $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which one of the following statements is true for a predistribution plan?

A) The first available $16,000 would go to Newman. The next $12,000 would go $8,000 to Dancey and $4,000 to Newman. The following $32,000 would be shared equally between Dancey, Reese, and Newman. A total distribution of $60,000 would be required before all four partners share any further payments equally.

B) The first available $16,000 would go to Newman. The next $12,000 would go $8,000 to Dancey and $4,000 to Newman. The following $32,000 would be shared by Dancey, Reese, and Newman. The total distribution would be $60,000 before all four partners share any further payments in their profit and loss sharing ratios.

C) The first $20,000 would go to Newman. The next $8,000 would go to Dancey. The next $12,000 would be shared equally by Dancey, Reese, and Newman. The total distribution would be $40,000 before all four partners share any further payments equally.

D) The first available $8,000 would go to Newman. The next $4,000 would be split equally between Dancey and Newman. The following $12,000 would be shared by Dancey, Reese, and Newman. The total distribution would be $24,000 before all four partners share any further payments equally.

E) The first available $8,000 would go to Newman. The next $4,000 would be split equally between Dancey and Newman. The following $12,000 would be shared by Dancey, Reese, and Newman. The total distribution would be $24,000 before all four partners share any further payments in their profit and loss sharing ratios.

A) The first available $16,000 would go to Newman. The next $12,000 would go $8,000 to Dancey and $4,000 to Newman. The following $32,000 would be shared equally between Dancey, Reese, and Newman. A total distribution of $60,000 would be required before all four partners share any further payments equally.

B) The first available $16,000 would go to Newman. The next $12,000 would go $8,000 to Dancey and $4,000 to Newman. The following $32,000 would be shared by Dancey, Reese, and Newman. The total distribution would be $60,000 before all four partners share any further payments in their profit and loss sharing ratios.

C) The first $20,000 would go to Newman. The next $8,000 would go to Dancey. The next $12,000 would be shared equally by Dancey, Reese, and Newman. The total distribution would be $40,000 before all four partners share any further payments equally.

D) The first available $8,000 would go to Newman. The next $4,000 would be split equally between Dancey and Newman. The following $12,000 would be shared by Dancey, Reese, and Newman. The total distribution would be $24,000 before all four partners share any further payments equally.

E) The first available $8,000 would go to Newman. The next $4,000 would be split equally between Dancey and Newman. The following $12,000 would be shared by Dancey, Reese, and Newman. The total distribution would be $24,000 before all four partners share any further payments in their profit and loss sharing ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

9

How much of the $31,000 in the cash account should Justice receive?

A) $15,467.

B) $15,533.

C) $17,333.

D) $16,533.

E) $15,867.

A) $15,467.

B) $15,533.

C) $17,333.

D) $16,533.

E) $15,867.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following could result in the termination and liquidation of a partnership? 1) Partners are incompatible and choose to cease operations.

2) There are excessive losses that are expected to continue.

3) Retirement of a partner.

A) 1 only

B) 1 and 2 only

C) 2 and 3 only

D) 3 only

E) 1, 2, and 3

2) There are excessive losses that are expected to continue.

3) Retirement of a partner.

A) 1 only

B) 1 and 2 only

C) 2 and 3 only

D) 3 only

E) 1, 2, and 3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

11

If the assets could be sold for $228,000 and there are no liquidation expenses, what is the minimum amount that Ezzard would receive from the liquidation?

A) $36,000.

B) $ 0.

C) $ 2,500.

D) $38,250.

E) $67,250.

A) $36,000.

B) $ 0.

C) $ 2,500.

D) $38,250.

E) $67,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

12

If the assets could be sold, for $228,000 and there are no liquidation expenses what is the amount that Tillman would receive from the liquidation?

A) $36,000.

B) $ 0.

C) $ 2,500.

D) $38,250.

E) $67,250.

A) $36,000.

B) $ 0.

C) $ 2,500.

D) $38,250.

E) $67,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

13

Before liquidating any assets, the partners determined the amount of cash available for safe payments.How should the amount of safe cash payments be distributed?

A) In a ratio of 2:4:4 among all the partners.

B) $18,333 to Henry and $16,667 to Jacobs.

C) In a ratio of 1:2 between Henry and Jacobs.

D) $15,000 to Henry and $10,000 to Jacobs.

E) $21,667 to Henry and $3,333 to Jacobs.

A) In a ratio of 2:4:4 among all the partners.

B) $18,333 to Henry and $16,667 to Jacobs.

C) In a ratio of 1:2 between Henry and Jacobs.

D) $15,000 to Henry and $10,000 to Jacobs.

E) $21,667 to Henry and $3,333 to Jacobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

14

When a partnership is insolvent and a partner has a deficit capital account balance, that partner is legally required to:

A) Declare personal bankruptcy.

B) Initiate legal proceedings against the partnership.

C) Contribute cash to the partnership.

D) Deliver a note payable to the partnership with specific payment terms.

E) None of these answer choices are correct. The partner has no legal responsibility to cover the capital deficit balance.

A) Declare personal bankruptcy.

B) Initiate legal proceedings against the partnership.

C) Contribute cash to the partnership.

D) Deliver a note payable to the partnership with specific payment terms.

E) None of these answer choices are correct. The partner has no legal responsibility to cover the capital deficit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

15

For what amount would the noncash assets need to be sold in order for Quincy to receive some cash from the liquidation?

A) Any amount in excess of $170,000.

B) Any amount in excess of $190,000.

C) Any amount in excess of $260,000.

D) Any amount in excess of $280,000.

E) Any amount in excess of $300,000.

A) Any amount in excess of $170,000.

B) Any amount in excess of $190,000.

C) Any amount in excess of $260,000.

D) Any amount in excess of $280,000.

E) Any amount in excess of $300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which one of the following statements is true for a predistribution plan?

A) The first available $16,000 would go to Newman.

B) The first available $20,000 would go to Dancey.

C) The first available $8,000 would go to Jahn.

D) The first available $8,000 would go to Newman.

E) The first available $4,000 would go to Jahn.

A) The first available $16,000 would go to Newman.

B) The first available $20,000 would go to Dancey.

C) The first available $8,000 would go to Jahn.

D) The first available $8,000 would go to Newman.

E) The first available $4,000 would go to Jahn.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the noncash assets were sold for $234,000, what amount of the loss would have been allocated to Bartle with respect to the noncash assets?

A) $43,200.

B) $46,800.

C) $40,000.

D) $42,400.

E) $43,100.

A) $43,200.

B) $46,800.

C) $40,000.

D) $42,400.

E) $43,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the assets could be sold for $228,000 and there are no liquidation expenses, what is the amount that Ding would receive from the liquidation?

A) $36,000.

B) $ 0.

C) $ 2,500.

D) $38,720.

E) $67,250.

A) $36,000.

B) $ 0.

C) $ 2,500.

D) $38,720.

E) $67,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

19

What amount of cash was available for safe payments, based on the above information?

A) $30,000.

B) $85,000.

C) $25,000.

D) $35,000.

E) $40,000.

A) $30,000.

B) $85,000.

C) $25,000.

D) $35,000.

E) $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

20

How much of this money should Zobart receive?

A) $15,467.

B) $14,467.

C) $17,333.

D) $15,633.

E) $15,867.

A) $15,467.

B) $14,467.

C) $17,333.

D) $15,633.

E) $15,867.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is the role of the accountant during the liquidation process?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Arnold, Bates, Carlton, and Delbert partnership was liquidating.It had paid all its liabilities and had some assets yet to be sold.The partners had capital account balances of ($50,000), $90,000, $110,000, and $130,000.There was $40,000 cash available for distribution to the partners.What procedures would be followed to determine the amount of cash that could safely be distributed to each partner?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

23

What accounting transactions are not recorded by an accountant during partnership liquidation?

A) The conversion of partnership assets into cash.

B) The allocation of gains and losses from sales of assets.

C) The payment of liabilities and expenses.

D) The initiation of legal action by creditors of the partnership.

E) Write-off of remaining unpaid debts.

A) The conversion of partnership assets into cash.

B) The allocation of gains and losses from sales of assets.

C) The payment of liabilities and expenses.

D) The initiation of legal action by creditors of the partnership.

E) Write-off of remaining unpaid debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

24

Gonda, Herron, and Morse is considering possible liquidation because partner Morse is personally insolvent.The partners have the following capital account balances: $60,000, $70,000, and $40,000, respectively, and share profits and losses 30%, 45%, and 25%, respectively.The partnership has $200,000 in noncash assets that can be sold for $150,000.The partnership has $10,000 cash on hand, and $40,000 in liabilities.What is the minimum that partner Morse's creditors would receive if they have filed a claim for $50,000?

A) $ 0.

B) $27,500.

C) $45,000.

D) $47,500.

E) $50,000.

A) $ 0.

B) $27,500.

C) $45,000.

D) $47,500.

E) $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

25

The partnership of Rayne, Marin, and Fulton was being liquidated by the partners.Rayne was insolvent and did not have enough assets to pay all his personal creditors.Under what conditions might Rayne's personal creditors have claimed some of the partnership assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which one of the following statements is correct?

A) If a partner of a liquidating partnership is unable to pay a capital account deficit, the deficit is absorbed by the other partners in the profit and loss ratio of those partners.

B) Gains and losses from the sale of noncash assets are divided in the ratio of the partners' capital account balances absent an alternate income-sharing plan stated in the partnership agreement.

C) A loan receivable from a partner is added to the partner's capital account balance in the preparation of a cash distribution plan.

D) Partners may not receive any cash before partnership creditors receive cash when liquidating a partnership.

E) All cash payments to partners are made using their profit and loss ratio when liquidating the partnership.

A) If a partner of a liquidating partnership is unable to pay a capital account deficit, the deficit is absorbed by the other partners in the profit and loss ratio of those partners.

B) Gains and losses from the sale of noncash assets are divided in the ratio of the partners' capital account balances absent an alternate income-sharing plan stated in the partnership agreement.

C) A loan receivable from a partner is added to the partner's capital account balance in the preparation of a cash distribution plan.

D) Partners may not receive any cash before partnership creditors receive cash when liquidating a partnership.

E) All cash payments to partners are made using their profit and loss ratio when liquidating the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following statements is false concerning the partnership Statement of Liquidation?

A) Liquidations may take a considerable length of time to complete.

B) Frequent reporting by the accountant is rarely necessary.

C) The Statement of Liquidation provides a listing of transactions to date, current cash, and capital account balances.

D) The Statement of Liquidation provides a listing of property still held by the partnership as well as liabilities remaining unpaid.

E) The Statement of Liquidation keeps creditors and partners apprised of the results of the process of dissolution.

A) Liquidations may take a considerable length of time to complete.

B) Frequent reporting by the accountant is rarely necessary.

C) The Statement of Liquidation provides a listing of transactions to date, current cash, and capital account balances.

D) The Statement of Liquidation provides a listing of property still held by the partnership as well as liabilities remaining unpaid.

E) The Statement of Liquidation keeps creditors and partners apprised of the results of the process of dissolution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

28

What is the preferred method of resolving a partner's deficit balance, according to the Uniform Partnership Act?

A) Partners never have a deficit balance.

B) The other partners must contribute personal assets to cover the deficit balance.

C) The partnership must sell assets in order to cover the deficit balance.

D) The partner with a deficit balance must contribute personal assets to cover the deficit balance.

E) The partner with a deficit balance contributes personal assets only if those personal assets exceed personal liabilities.

A) Partners never have a deficit balance.

B) The other partners must contribute personal assets to cover the deficit balance.

C) The partnership must sell assets in order to cover the deficit balance.

D) The partner with a deficit balance must contribute personal assets to cover the deficit balance.

E) The partner with a deficit balance contributes personal assets only if those personal assets exceed personal liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which item is not shown on the statement of partnership liquidation?

A) Current cash balances.

B) Property owned by the partnership.

C) Liabilities still to be paid.

D) Personal assets of the partners.

E) Current capital account balances of the partners.

A) Current cash balances.

B) Property owned by the partnership.

C) Liabilities still to be paid.

D) Personal assets of the partners.

E) Current capital account balances of the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

30

How would $90,000 be distributed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

31

If the building is sold for $50,000, what amount should Waters receive in the final settlement?

A) $ 5,000.

B) $ 9,000.

C) $18,000.

D) $28,000.

E) $55,000.

A) $ 5,000.

B) $ 9,000.

C) $18,000.

D) $28,000.

E) $55,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

32

How would $200,000 be distributed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

33

Matching

(1.) The statement of liquidation

(2.) Deficit capital account balances

(3.) Safe capital account balances

(4.) Predistribution plan

(A.) A report produced periodically by the accountant to disclose transactions that have occurred during liquidation, the remaining assets and liabilities, and updated capital account balances.

(B) At the start of a liquidation, this document provides guidance for all payments to be made to the partners throughout the liquidation.

(C.) One or more partners may have a negative capital account balance often as a result of losses incurred in disposing of assets.

(D.) A provision for an equitable distribution of assets during liquidation.

(1.) The statement of liquidation

(2.) Deficit capital account balances

(3.) Safe capital account balances

(4.) Predistribution plan

(A.) A report produced periodically by the accountant to disclose transactions that have occurred during liquidation, the remaining assets and liabilities, and updated capital account balances.

(B) At the start of a liquidation, this document provides guidance for all payments to be made to the partners throughout the liquidation.

(C.) One or more partners may have a negative capital account balance often as a result of losses incurred in disposing of assets.

(D.) A provision for an equitable distribution of assets during liquidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

34

If the land is sold for $450,000, how much cash will Mones receive in the final settlement?

A) $ 0.

B) $ 15,000.

C) $300,000.

D) $217,500.

E) $362,500.

A) $ 0.

B) $ 15,000.

C) $300,000.

D) $217,500.

E) $362,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

35

Harding, Jones, and Sandy, a partnership, is in the process of liquidating.The partners have the following capital account balances; $24,000, $24,000, and ($9,000) respectively.The partners share all profits and losses 16%, 48%, and 36%, respectively.Sandy has indicated that the ($9,000) deficit will be covered with a forthcoming contribution.The remaining partners have requested an immediate distribution of $20,000 in cash that is available.How should this cash be distributed?

A) Harding $5,000; Jones $15,000.

B) Harding $17,000; Jones $3,000.

C) Harding $11,154; Jones $8,846.

D) Harding $14,297; Jones $5,703.

E) Harding $12,500; Jones $7,500.

A) Harding $5,000; Jones $15,000.

B) Harding $17,000; Jones $3,000.

C) Harding $11,154; Jones $8,846.

D) Harding $14,297; Jones $5,703.

E) Harding $12,500; Jones $7,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

36

If the land is sold for $450,000, what amount will Roberts receive in the final settlement?

A) $ 0.

B) $ 30,000.

C) $217,500.

D) $362,500.

E) $502,500.

A) $ 0.

B) $ 30,000.

C) $217,500.

D) $362,500.

E) $502,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

37

What is the purpose of a predistribution plan?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements is true concerning the distribution of safe payments?

A) The distribution of safe payments assumes that any capital deficit balances will prove to be a total loss to the partnership.

B) Safe payments are equal to the recorded capital account balances of those partners with capital account balances in excess of $0.

C) The distribution of safe payments may only be made after all liabilities have been paid.

D) In computing safe payments, partners with positive capital account balances are assumed to absorb an equal share of any deficit balance(s).

E) There are no safe payments until the liquidation is complete.

A) The distribution of safe payments assumes that any capital deficit balances will prove to be a total loss to the partnership.

B) Safe payments are equal to the recorded capital account balances of those partners with capital account balances in excess of $0.

C) The distribution of safe payments may only be made after all liabilities have been paid.

D) In computing safe payments, partners with positive capital account balances are assumed to absorb an equal share of any deficit balance(s).

E) There are no safe payments until the liquidation is complete.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

39

Xygote, Yen, and Zen were partners who were liquidating their partnership.Each partner has a deficit balance in their respective capital account.Assuming all assets from the partnership have been liquidated, and all of the liabilities have been paid, how should any additional cash coming into the partnership be distributed to the partners?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

40

If the building is sold for $50,000 and there are no liquidation expenses what amount should Harry receive in the final settlement?

A) $ 5,000.

B) $ 9,000.

C) $18,000.

D) $28,000.

E) $55,000.

A) $ 5,000.

B) $ 9,000.

C) $18,000.

D) $28,000.

E) $55,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

41

How much cash should each partner receive at this time, pursuant to a proposed schedule of liquidation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

42

Prepare a schedule to calculate the safe installment payments to be made to the partners at the end of February.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

43

What events or circumstances might force the termination of a partnership and liquidation of its assets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

44

Prepare a schedule to calculate the safe payments to be made to the partners at the end of March.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

45

Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Albert, Boynton, and Creamer partnership was in the process of liquidating its assets and going out of business.Albert, Boynton, and Creamer had capital account balances of $80,000, $120,000, and $200,000, respectively, and shared profits and losses in the ratio of 1:3:2.Equipment that had cost $90,000 and had a book value of $60,000 was sold for $24,000 cash.

Required:

Prepare the appropriate journal entry to record the sale of the equipment, distributing any gain or loss directly to the partners.

Required:

Prepare the appropriate journal entry to record the sale of the equipment, distributing any gain or loss directly to the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

47

The Amos, Billings, and Cleaver partnership had two assets: (1) cash of $40,000 and (2) an investment with a book value of $110,000.The ratio for sharing profits and losses is 2:1:1.The balances in the capital accounts were:

Amos, capital: $45,000

Billings, capital: $75,000

Cleaver, capital: $30,000

Required:

If the investment was sold for $80,000, how much cash would each partner receive upon liquidation?

Amos, capital: $45,000

Billings, capital: $75,000

Cleaver, capital: $30,000

Required:

If the investment was sold for $80,000, how much cash would each partner receive upon liquidation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

48

What would be the maximum amount Garr might have to contribute to the partnership to eliminate a deficit balance in his account?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

49

Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

50

What should occur when a solvent partner has a deficit balance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

51

Describe the content of a journal entry to record a gain or loss resulting from the liquidation of a partnership asset for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

52

How much of the existing cash balance could be distributed safely to partners at this time?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

53

A partnership had the following account balances: Cash, $91,000; Other Assets, $702,000; Liabilities, $338,000; Polk, Capital (50% of profits and losses), $221,000; Garfield, Capital (30%), $143,000; Arthur, Capital (20%), $91,000.The company liquidated and $10,400 became available to the partners.

Required:

Who would have received the $10,400?

Required:

Who would have received the $10,400?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is a safe cash payment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

55

If the noncash assets are sold for $105,000, what would be the maximum amount of cash that Canton could expect to receive?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

56

What financial report would be prepared for a partnership that has begun liquidation but has not yet completed the process? What is the purpose of this report?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

57

Prepare journal entries to record the actual liquidation transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

58

A partnership held three assets: Cash, $13,000; Land, $45,000; and a Building, $65,000.There were no recorded liabilities.The partners anticipated that expenses required to liquidate their partnership would amount to $6,000.Capital account balances were as follows:

King, Capital: $32,700

Murphy, Capital: 36,400

Madison, Capital: 26,000

Pond, Capital: 27,900

The partners shared profits and losses 30:30:20:20, respectively.

Required:

Prepare a proposed schedule of liquidation, showing how cash could be safely distributed to the partners at this time.

King, Capital: $32,700

Murphy, Capital: 36,400

Madison, Capital: 26,000

Pond, Capital: 27,900

The partners shared profits and losses 30:30:20:20, respectively.

Required:

Prepare a proposed schedule of liquidation, showing how cash could be safely distributed to the partners at this time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

59

Why is a preliminary distribution of partnership assets prepared?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

60

Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

61

Record the journal entry for the cash distribution to the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

62

Determine the cash to be retained and prepare a schedule to distribute $35,000 cash to the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

63

Prepare the journal entry for Donald, Chief & Berry LLP on August 1, 2018, to recognize proceeds from the sale of Other Assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

64

Record the journal entry for the sale of the noncash assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

65

Jones, Marge, and Tate LLP decided to dissolve and liquidate the partnership on September 30, 2018.After realization of a portion of the noncash assets, the capital account balances were Jones $50,000; Marge $40,000; and Tate $15,000.Cash of $35,000 and other assets with a carrying amount of $100,000 were on hand.Creditors' claims totaled $30,000.Jones, Marge, and Tate shared net income and losses in a 2:1:1 ratio, respectively.

Prepare a working paper to compute the amount of cash that may be paid to creditors and to partners at this time, assuming that no partner is solvent.

Prepare a working paper to compute the amount of cash that may be paid to creditors and to partners at this time, assuming that no partner is solvent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

66

Prepare the journal entry for Donald, Chief & Berry LLP on August 1, 2018, to record the offset of the loan receivable from Donald.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

67

Prepare the journal entry for Donald, Chief & Berry LLP on August 1, 2018, to record payment of liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

68

Record the journal entry for payment of outstanding liabilities to the creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

69

Prepare the schedule to compute the cash payments to the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck