Deck 1: A: the Equity Method of Accounting for Investments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

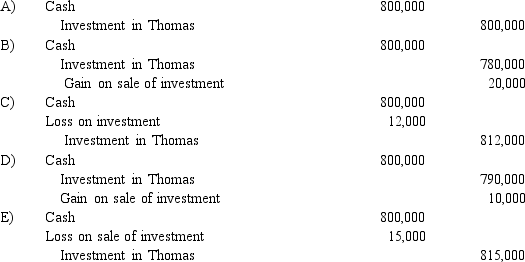

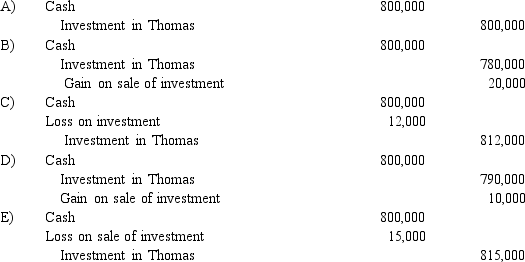

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

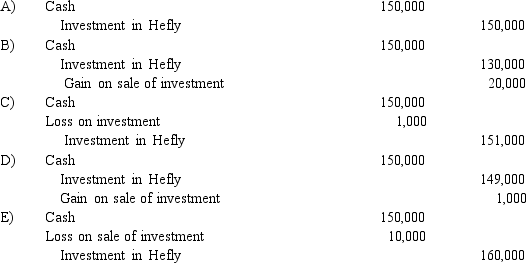

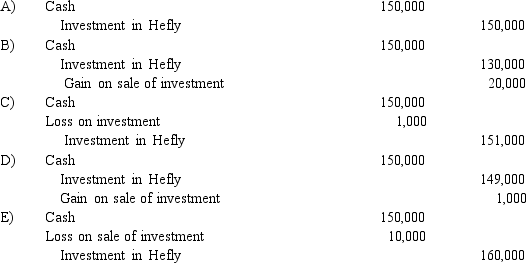

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/121

العب

ملء الشاشة (f)

Deck 1: A: the Equity Method of Accounting for Investments

1

On January 1, 2018, Jordan Inc.acquired 30% of Nico Corp.Jordan used the equity method to account for the investment.On January 1, 2019, Jordan sold two-thirds of its investment in Nico.It no longer had the ability to exercise significant influence over the operations of Nico.How should Jordan account for this change?

A) Jordan should continue to use the equity method to maintain consistency in its financial statements.

B) Jordan should restate the prior years' financial statements and change the balance in the investment account as if the fair-value method had been used since 2018.

C) Jordan has the option of using either the equity method or the fair-value method for 2018 and future years.

D) Jordan should report the effect of the change from the equity to the fair-value method as a retrospective change in accounting principle.

E) Jordan should use the fair-value method for 2019 and future years, but should not make a retrospective adjustment to the investment account.

A) Jordan should continue to use the equity method to maintain consistency in its financial statements.

B) Jordan should restate the prior years' financial statements and change the balance in the investment account as if the fair-value method had been used since 2018.

C) Jordan has the option of using either the equity method or the fair-value method for 2018 and future years.

D) Jordan should report the effect of the change from the equity to the fair-value method as a retrospective change in accounting principle.

E) Jordan should use the fair-value method for 2019 and future years, but should not make a retrospective adjustment to the investment account.

E

2

An investor should always use the equity method to account for an investment if:

A) It has the ability to exercise significant influence over the operating policies of the investee.

B) It owns 30% of an investee's stock.

C) It has a controlling interest (more than 50%) of an investee's stock.

D) The investment was made primarily to earn a return on excess cash.

E) It does not have the ability to exercise significant influence over the operating policies of the investee.

A) It has the ability to exercise significant influence over the operating policies of the investee.

B) It owns 30% of an investee's stock.

C) It has a controlling interest (more than 50%) of an investee's stock.

D) The investment was made primarily to earn a return on excess cash.

E) It does not have the ability to exercise significant influence over the operating policies of the investee.

A

3

An upstream sale of inventory is a sale:

A) Between subsidiaries owned by a common parent.

B) With the transfer of goods scheduled by contract to occur on a specified future date.

C) In which the goods are physically transported by boat from a subsidiary to its parent.

D) Made by the investor to the investee.

E) Made by the investee to the investor.

A) Between subsidiaries owned by a common parent.

B) With the transfer of goods scheduled by contract to occur on a specified future date.

C) In which the goods are physically transported by boat from a subsidiary to its parent.

D) Made by the investor to the investee.

E) Made by the investee to the investor.

E

4

On January 1, 2018, Bangle Company purchased 30% of the voting common stock of Sleat Corp.for $1,000,000.Any excess of cost over book value was assigned to goodwill.During 2018, Sleat paid dividends of $24,000 and reported a net loss of $140,000.What is the balance in the investment account on December 31, 2018?

A) $950,800.

B) $958,000.

C) $836,000.

D) $990,100.

E) $956,400.

A) $950,800.

B) $958,000.

C) $836,000.

D) $990,100.

E) $956,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

5

Club Co.appropriately uses the equity method to account for its investment in Chip Corp.As of the end of 2018, Chip's common stock had suffered a significant decline in fair value, which is expected to recover over the next several months.How should Club account for the decline in value?

A) Club should switch to the fair-value method.

B) No accounting because the decline in fair value is temporary.

C) Club should decrease the balance in the investment account to the current value and recognize a loss on the income statement.

D) Club should not record its share of Chip's 2018 earnings until the decline in the fair value of the stock has been recovered.

E) Club should decrease the balance in the investment account to the current value and recognize an unrealized loss on the balance sheet.

A) Club should switch to the fair-value method.

B) No accounting because the decline in fair value is temporary.

C) Club should decrease the balance in the investment account to the current value and recognize a loss on the income statement.

D) Club should not record its share of Chip's 2018 earnings until the decline in the fair value of the stock has been recovered.

E) Club should decrease the balance in the investment account to the current value and recognize an unrealized loss on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

6

What was the balance in the Investment in Ticker Co.account at the end of 2018?

A) $401,136.

B) $413,872.

C) $418,840.

D) $412,432.

E) $410,148.

A) $401,136.

B) $413,872.

C) $418,840.

D) $412,432.

E) $410,148.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

7

What is the amount of goodwill associated with the investment?

A) $500,000.

B) $200,000.

C) $0.

D) $300,000.

E) $400,000.

A) $500,000.

B) $200,000.

C) $0.

D) $300,000.

E) $400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

8

What amount of equity income should Deuce have reported for 2019?

A) $30,000.

B) $16,420.

C) $38,340.

D) $18,000.

E) $32,840.

A) $30,000.

B) $16,420.

C) $38,340.

D) $18,000.

E) $32,840.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

9

What amount of equity income would Atlarge have recognized in 2018 from its ownership interest in Ticker?

A) $19,792.

B) $27,640.

C) $22,672.

D) $24,400.

E) $21,748.

A) $19,792.

B) $27,640.

C) $22,672.

D) $24,400.

E) $21,748.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

10

During January 2017, Wells, Inc.acquired 30% of the outstanding common stock of Wilton Co.for $1,400,000.This investment gave Wells the ability to exercise significant influence over Wilton.Wilton's assets on that date were recorded at $6,400,000 with liabilities of $3,000,000.Any excess of cost over book value of Wells' investment was attributed to unrecorded patents having a remaining useful life of ten years. In 2017, Wilton reported net income of $600,000.For 2018, Wilton reported net income of $750,000.Dividends of $200,000 were paid in each of these two years.What was the reported balance of Wells' Investment in Wilson Co.at December 31, 2018?

A) $1,609,000.

B) $1,485,000.

C) $1,685,000.

D) $1,647,000.

E) $1,054,300.

A) $1,609,000.

B) $1,485,000.

C) $1,685,000.

D) $1,647,000.

E) $1,054,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

11

Gaw Company owns 15% of the common stock of Trace Corporation and used the fair-value method to account for this investment.Trace reported net income of $110,000 for 2018 and paid dividends of $60,000 on October 1, 2018.How much income should Gaw recognize on this investment in 2018?

A) $16,500.

B) $ 9,000.

C) $25,500.

D) $ 7,500.

E) $50,000.

A) $16,500.

B) $ 9,000.

C) $25,500.

D) $ 7,500.

E) $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

12

Tower Inc.owns 30% of Yale Co.and applies the equity method.During the current year, Tower bought inventory costing $66,000 and then sold it to Yale for $120,000.At year-end, only $24,000 of merchandise was still being held by Yale.What amount of intra-entity gross profit must be deferred by Tower?

A) $ 6,480.

B) $ 3,240.

C) $10,800.

D) $16,200.

E) $ 6,610.

A) $ 6,480.

B) $ 3,240.

C) $10,800.

D) $16,200.

E) $ 6,610.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a situation where the investor exercises significant influence over the investee, which of the following entries is not actually posted to the books of the investor? (I) Debit to the Investment account, and a Credit to the Equity in Investee Income account.

(II) Debit to Cash (for dividends received from the investee), and a Credit to Investment Income account .

(III) Debit to Cash (for dividends received from the investee), and a Credit to the Dividend Receivable.

A) Entries I and II.

B) Entries II and III.

C) Entry I only.

D) Entry II only.

E) Entry III only.

(II) Debit to Cash (for dividends received from the investee), and a Credit to Investment Income account .

(III) Debit to Cash (for dividends received from the investee), and a Credit to the Dividend Receivable.

A) Entries I and II.

B) Entries II and III.

C) Entry I only.

D) Entry II only.

E) Entry III only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

14

For 2018, what is the total amount of excess amortization for Austin's 25% investment in Gainsville?

A) $ 27,500.

B) $ 20,000.

C) $ 30,000.

D) $120,000.

E) $ 70,000.

A) $ 27,500.

B) $ 20,000.

C) $ 30,000.

D) $120,000.

E) $ 70,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

15

On Deuce's December 31, 2019 balance sheet, what balance was reported for the Investment in Wiz Co.account?

A) $117,000.

B) $143,400.

C) $152,000.

D) $134,400.

E) $141,200.

A) $117,000.

B) $143,400.

C) $152,000.

D) $134,400.

E) $141,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

16

All of the following would require use of the equity method for investments except:

A) Material intra-entity transactions.

B) Investor participation in the policy-making process of the investee.

C) Valuation at fair value.

D) Technological dependency.

E) Interchange of managerial personnel.

A) Material intra-entity transactions.

B) Investor participation in the policy-making process of the investee.

C) Valuation at fair value.

D) Technological dependency.

E) Interchange of managerial personnel.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

17

On January 1, 2016, Dermot Company purchased 15% of the voting common stock of Horne Corp.On January 1, 2018, Dermot purchased 28% of Horne's voting common stock.If Dermot achieves significant influence with this new investment, how must Dermot account for the change to the equity method?

A) It must use the equity method for 2018 but should make no changes in its financial statements for 2017 and 2016.

B) It should prepare consolidated financial statements for 2018.

C) It must restate the financial statements for 2017 and 2016 as if the equity method had been used for those two years.

D) It should record a prior period adjustment at the beginning of 2018 but should not restate the financial statements for 2017 and 2016.

E) It must restate the financial statements for 2017 as if the equity method had been used then.

A) It must use the equity method for 2018 but should make no changes in its financial statements for 2017 and 2016.

B) It should prepare consolidated financial statements for 2018.

C) It must restate the financial statements for 2017 and 2016 as if the equity method had been used for those two years.

D) It should record a prior period adjustment at the beginning of 2018 but should not restate the financial statements for 2017 and 2016.

E) It must restate the financial statements for 2017 as if the equity method had been used then.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

18

Yaro Company owns 30% of the common stock of Dew Co.and uses the equity method to account for the investment.During 2018, Dew reported income of $250,000 and paid dividends of $80,000.There is no amortization associated with the investment.During 2018, how much income should Yaro recognize related to this investment?

A) $24,000.

B) $75,000.

C) $99,000.

D) $51,000.

E) $80,000.

A) $24,000.

B) $75,000.

C) $99,000.

D) $51,000.

E) $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

19

On January 1, 2018, Pacer Company paid $1,920,000 for 60,000 shares of Lennon Co.'s voting common stock which represents a 45% investment.No allocation to goodwill or other specific account was necessary.Significant influence over Lennon was achieved by this acquisition.Lennon distributed a dividend of $2.50 per share during 2018 and reported net income of $670,000.What was the balance in the Investment in Lennon Co.account found in the financial records of Pacer as of December 31, 2018?

A) $2,040,500.

B) $2,212,500.

C) $2,260,500.

D) $2,171,500.

E) $2,071,500.

A) $2,040,500.

B) $2,212,500.

C) $2,260,500.

D) $2,171,500.

E) $2,071,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

20

On January 4, 2018, Watts Co.purchased 40,000 shares (40%) of the common stock of Adams Corp., paying $800,000.There was no goodwill or other cost allocation associated with the investment.Watts has significant influence over Adams.During 2018, Adams reported income of $200,000 and paid dividends of $80,000.On January 2, 2019, Watts sold 5,000 shares for $125,000.What was the balance in the investment account after the shares had been sold?

A) $848,000.

B) $742,000.

C) $723,000.

D) $761,000.

E) $925,000.

A) $848,000.

B) $742,000.

C) $723,000.

D) $761,000.

E) $925,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

21

A company has been using the equity method to account for its investment.The company sells shares and does not continue to have significant influence.Which of the following statements is true?

A) A cumulative effect change in accounting principle must occur.

B) A prospective change in accounting principle must occur.

C) A retrospective change in accounting principle must occur.

D) The investor will not receive future dividends from the investee.

E) Future dividends will continue to reduce the investment account.

A) A cumulative effect change in accounting principle must occur.

B) A prospective change in accounting principle must occur.

C) A retrospective change in accounting principle must occur.

D) The investor will not receive future dividends from the investee.

E) Future dividends will continue to reduce the investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

22

The equity in income of Sacco for 2018, is

A) $22,500.

B) $21,000.

C) $12,000.

D) $13,500.

E) $75,000.

A) $22,500.

B) $21,000.

C) $12,000.

D) $13,500.

E) $75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

23

After allocating cost in excess of book value, which asset or liability would not be amortized over a useful life?

A) Cost of goods sold.

B) Property, plant, & equipment.

C) Patents.

D) Goodwill.

E) Bonds payable.

A) Cost of goods sold.

B) Property, plant, & equipment.

C) Patents.

D) Goodwill.

E) Bonds payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

24

The income reported by Dodge for 2018 with regard to the Gates investment is

A) $80,000.

B) $30,000.

C) $50,000.

D) $15,000.

E) $75,000.

A) $80,000.

B) $30,000.

C) $50,000.

D) $15,000.

E) $75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

25

The balance in the Investment in Sacco account at December 31, 2017, is

A) $100,000.

B) $112,000.

C) $106,000.

D) $107,500.

E) $140,000.

A) $100,000.

B) $112,000.

C) $106,000.

D) $107,500.

E) $140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

26

All of the following statements regarding the investment account using the equity method are true except:

A) The investment is recorded at cost.

B) Dividends received are reported as revenue.

C) Net income of investee increases the investment account.

D) Dividends received reduce the investment account.

E) Amortization of fair value over cost reduces the investment account.

A) The investment is recorded at cost.

B) Dividends received are reported as revenue.

C) Net income of investee increases the investment account.

D) Dividends received reduce the investment account.

E) Amortization of fair value over cost reduces the investment account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which statement is true concerning unrecognized profits in intra-entity inventory sales when an investor uses the equity method?

A) The investee must defer upstream ending inventory profits.

B) The investee must defer upstream beginning inventory profits.

C) The investor must defer downstream ending inventory profits.

D) The investor must defer downstream beginning inventory profits.

E) The investor must defer upstream beginning inventory profits.

A) The investee must defer upstream ending inventory profits.

B) The investee must defer upstream beginning inventory profits.

C) The investor must defer downstream ending inventory profits.

D) The investor must defer downstream beginning inventory profits.

E) The investor must defer upstream beginning inventory profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

28

The income reported by Dodge for 2017 with regard to the Gates investment is

A) $ 7,500.

B) $ 22,500.

C) $ 15,000.

D) $100,000.

E) $150,000.

A) $ 7,500.

B) $ 22,500.

C) $ 15,000.

D) $100,000.

E) $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is true regarding the change from the fair-value method to the equity method?

A) Dodge must record a debit to additional paid-in capital in the amount of $200,000.

B) Dodge must record a debit to additional paid-in capital for $15,000.

C) Dodge must retrospectively apply the equity method to interests reported under the fair-value method.

D) Dodge must record a debit of $200,000 to the Gates Investment Account.

E) Dodge must record a credit of $15,000 to the Gates Investment Account.

A) Dodge must record a debit to additional paid-in capital in the amount of $200,000.

B) Dodge must record a debit to additional paid-in capital for $15,000.

C) Dodge must retrospectively apply the equity method to interests reported under the fair-value method.

D) Dodge must record a debit of $200,000 to the Gates Investment Account.

E) Dodge must record a credit of $15,000 to the Gates Investment Account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

30

When applying the equity method, how is the excess of cost over book value calculated and accounted for?

A) The excess is allocated to the difference between fair value and book value multiplied by the percent ownership of current assets.

B) The excess is allocated to the difference between fair value and book value multiplied by the percent ownership of total assets.

C) The excess is allocated to the difference between fair value and book value multiplied by the percent ownership of net assets.

D) The excess is allocated to goodwill.

E) The excess is ignored.

A) The excess is allocated to the difference between fair value and book value multiplied by the percent ownership of current assets.

B) The excess is allocated to the difference between fair value and book value multiplied by the percent ownership of total assets.

C) The excess is allocated to the difference between fair value and book value multiplied by the percent ownership of net assets.

D) The excess is allocated to goodwill.

E) The excess is ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

31

Under the equity method, when the company's share of cumulative losses equals its investment and the company has no obligation or intention to fund such additional losses, which of the following statements is true?

A) The investor should change to the fair-value method to account for its investment.

B) The investor should suspend applying the equity method until the investee reports income.

C) The investor should suspend applying the equity method and not record any equity in income of investee until its share of future profits is sufficient to recover losses that have not previously been recorded.

D) The cumulative losses should be reported as a prior period adjustment.

E) The investor should report these as equity method losses in its income statement.

A) The investor should change to the fair-value method to account for its investment.

B) The investor should suspend applying the equity method until the investee reports income.

C) The investor should suspend applying the equity method and not record any equity in income of investee until its share of future profits is sufficient to recover losses that have not previously been recorded.

D) The cumulative losses should be reported as a prior period adjustment.

E) The investor should report these as equity method losses in its income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

32

How should a permanent loss in value of an investment using the equity method be treated?

A) The equity in investee income is reduced.

B) A loss is reported in the same manner as a loss in value of other long-term assets.

C) The investor's stockholders' equity is reduced.

D) No adjustment is necessary.

E) Record an offset to cash.

A) The equity in investee income is reduced.

B) A loss is reported in the same manner as a loss in value of other long-term assets.

C) The investor's stockholders' equity is reduced.

D) No adjustment is necessary.

E) Record an offset to cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

33

When an investor sells shares of its investee company, which of the following statements is true?

A) A recognized gain or loss is reported as the difference between selling price and original cost.

B) An recognized gain or loss is reported as the difference between selling price and original cost.

C) A recognized gain or loss is reported as the difference between selling price and carrying value.

D) An unrealized gain or loss is reported as the difference between selling price and carrying value.

E) Any gain or loss is reported as part of comprehensive income.

A) A recognized gain or loss is reported as the difference between selling price and original cost.

B) An recognized gain or loss is reported as the difference between selling price and original cost.

C) A recognized gain or loss is reported as the difference between selling price and carrying value.

D) An unrealized gain or loss is reported as the difference between selling price and carrying value.

E) Any gain or loss is reported as part of comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

34

The balance in the Investment in Sacco account at December 31, 2018, is

A) $119,500.

B) $125,500.

C) $116,500.

D) $118,000.

E) $100,000.

A) $119,500.

B) $125,500.

C) $116,500.

D) $118,000.

E) $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

35

The balance in the investment account at December 31, 2018, is

A) $335,000.

B) $355,000.

C) $400,000.

D) $412,500.

E) $480,000.

A) $335,000.

B) $355,000.

C) $400,000.

D) $412,500.

E) $480,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which statement is true concerning unrecognized profits in intra-entity inventory sales when an investor uses the equity method?

A) The investor and investee make reciprocal entries to defer and recognize inventory profits.

B) The same adjustments are made for upstream and downstream sales.

C) Different adjustments are made for upstream and downstream sales.

D) No adjustments are necessary.

E) Adjustments will be made only when profits are known upon sale to outsiders.

A) The investor and investee make reciprocal entries to defer and recognize inventory profits.

B) The same adjustments are made for upstream and downstream sales.

C) Different adjustments are made for upstream and downstream sales.

D) No adjustments are necessary.

E) Adjustments will be made only when profits are known upon sale to outsiders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

37

The equity in income of Sacco for 2017, is

A) $ 9,000.

B) $13,500.

C) $15,000.

D) $ 7,500.

E) $50,000.

A) $ 9,000.

B) $13,500.

C) $15,000.

D) $ 7,500.

E) $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company has been using the fair-value method to account for its investment.The company now has the ability to significantly influence the investee and the equity method has been deemed appropriate.Which of the following statements is true?

A) A cumulative effect change in accounting principle must occur.

B) A prospective change in accounting principle must occur.

C) A retrospective change in accounting principle must occur.

D) The investor will not receive future dividends from the investee.

E) Future dividends will continue to be recorded as revenue.

A) A cumulative effect change in accounting principle must occur.

B) A prospective change in accounting principle must occur.

C) A retrospective change in accounting principle must occur.

D) The investor will not receive future dividends from the investee.

E) Future dividends will continue to be recorded as revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

39

When an investor appropriately applies the equity method, how should it account for any investee Other Comprehensive Income (OCI)?

A) Under the equity method, the investor only recognizes its share of investee's income from continuing operations.

B) The OCI would reduce the investment.

C) The OCI would increase the investment.

D) The OCI would not appear on the investor's income statement but would be a component of comprehensive income.

E) The OCI would be ignored but shown in the investor's notes to the financial statements.

A) Under the equity method, the investor only recognizes its share of investee's income from continuing operations.

B) The OCI would reduce the investment.

C) The OCI would increase the investment.

D) The OCI would not appear on the investor's income statement but would be a component of comprehensive income.

E) The OCI would be ignored but shown in the investor's notes to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

40

The amount allocated to goodwill at January 1, 2017, is

A) $25,000.

B) $13,000

C) $ 9,000.

D) $16,000.

E) $10,000.

A) $25,000.

B) $13,000

C) $ 9,000.

D) $16,000.

E) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

41

Luffman Inc.owns 30% of Bruce Inc.and appropriately applies the equity method.During the current year, Bruce bought inventory costing $52,000 and then sold it to Luffman for $80,000.At year-end, all of the merchandise had been sold by Luffman to other customers.What amount of gross profit on intra-entity sales must be deferred by Luffman?

A) $ 0.

B) $ 8,400.

C) $28,000.

D) $52,000.

E) $80,000.

A) $ 0.

B) $ 8,400.

C) $28,000.

D) $52,000.

E) $80,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

42

What was the balance in the investment account at December 31, 2018?

A) $517,500.

B) $537,500.

C) $520,000.

D) $540,000.

E) $211,250.

A) $517,500.

B) $537,500.

C) $520,000.

D) $540,000.

E) $211,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

43

What is the balance in the investment account after the sale of the 15,000 shares?

A) $750,000.

B) $760,000.

C) $780,000.

D) $790,000.

E) $800,000.

A) $750,000.

B) $760,000.

C) $780,000.

D) $790,000.

E) $800,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

44

What is the gain/loss on the sale of the 15,000 shares?

A) $ 0

B) $10,000 gain.

C) $12,000 loss.

D) $15,000 loss.

E) $20,000 gain.

A) $ 0

B) $10,000 gain.

C) $12,000 loss.

D) $15,000 loss.

E) $20,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

45

What amount of equity income would Anderson recognize in 2018 from its ownership interest in Barney?

A) $12,000 income.

B) $12,000 loss.

C) $16,000 loss.

D) $28,000 income.

E) $28,000 loss.

A) $12,000 income.

B) $12,000 loss.

C) $16,000 loss.

D) $28,000 income.

E) $28,000 loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

46

What was the reported balance of Harley's Investment in Bike Co.at December 31, 2018?

A) $2,400,000.

B) $2,480,000.

C) $2,500,000.

D) $2,600,000.

E) $2,680,000.

A) $2,400,000.

B) $2,480,000.

C) $2,500,000.

D) $2,600,000.

E) $2,680,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

47

What was the balance in the investment account at April 1, 2019 just before the sale of shares?

A) $447,500.

B) $468,750.

C) $535,875.

D) $555,000.

E) $624,375.

A) $447,500.

B) $468,750.

C) $535,875.

D) $555,000.

E) $624,375.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

48

How much income did Harley report from Bike for 2018?

A) $120,000.

B) $200,000.

C) $300,000.

D) $320,000.

E) $500,000.

A) $120,000.

B) $200,000.

C) $300,000.

D) $320,000.

E) $500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

49

What was the reported balance of Harley's Investment in Bike Co.at December 31, 2017?

A) $880,000.

B) $2,400,000.

C) $2,480,000.

D) $2,600,000.

E) $2,900,000.

A) $880,000.

B) $2,400,000.

C) $2,480,000.

D) $2,600,000.

E) $2,900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

50

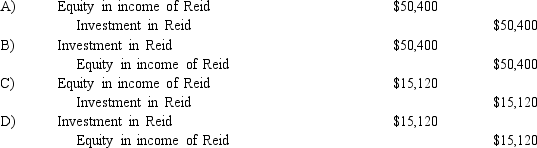

What journal entry will be recorded at the end of 2018 to defer the recognition of the investor's share of the intra-entity gross profits?

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) No entry is necessary.

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) No entry is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

51

How much income did Mehan report from Cook during 2017?

A) $30,000.

B) $22,500.

C) $ 7,500.

D) $ 0.

E) $50,000.

A) $30,000.

B) $22,500.

C) $ 7,500.

D) $ 0.

E) $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

52

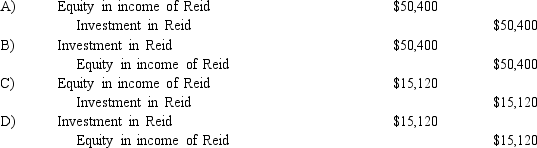

What journal entry will be recorded in 2019 to recognize its share of the intra-entity gross profit that was deferred in 2018?

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) No entry is necessary.

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) No entry is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

53

How much income did Mehan report from Cook during 2018?

A) $90,000.

B) $110,000.

C) $67,500.

D) $87,500.

E) $78,750.

A) $90,000.

B) $110,000.

C) $67,500.

D) $87,500.

E) $78,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is the balance in the investment account on December 31, 2018?

A) $1,900,000.

B) $1,960,000.

C) $2,000,000.

D) $2,016,000.

E) $2,028,000.

A) $1,900,000.

B) $1,960,000.

C) $2,000,000.

D) $2,016,000.

E) $2,028,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

55

What was the balance in the investment account before the shares were sold?

A) $1,560,000.

B) $1,600,000.

C) $1,700,000.

D) $1,800,000.

E) $1,860,000.

A) $1,560,000.

B) $1,600,000.

C) $1,700,000.

D) $1,800,000.

E) $1,860,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

56

How much income did Harley report from Bike for 2017?

A) $120,000.

B) $200,000.

C) $300,000.

D) $320,000.

E) $500,000.

A) $120,000.

B) $200,000.

C) $300,000.

D) $320,000.

E) $500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

57

How much of Cook's net income did Mehan report for the year 2019?

A) $61,750.

B) $81,250.

C) $72,500.

D) $59,250.

E) $75,000.

A) $61,750.

B) $81,250.

C) $72,500.

D) $59,250.

E) $75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

58

What is the balance in the investment account for the 15% ownership interest, at January 1, 2018?

A) $150,000.

B) $172,500.

C) $180,000.

D) $157,500.

E) $170,000

A) $150,000.

B) $172,500.

C) $180,000.

D) $157,500.

E) $170,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

59

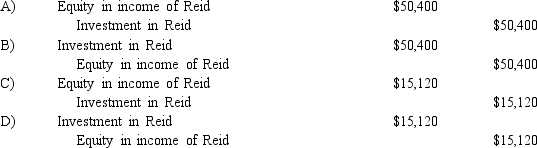

What is the appropriate journal entry to record the sale of the 15,000 shares?

A) A Above.

B) B Above.

C) C Above.

D) D Above.

E) E Above.

A) A Above.

B) B Above.

C) C Above.

D) D Above.

E) E Above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

60

What was the balance in the investment account before the shares were sold?

A) $520,000.

B) $544,000.

C) $560,000.

D) $604,000.

E) $620,000.

A) $520,000.

B) $544,000.

C) $560,000.

D) $604,000.

E) $620,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is the amount of excess amortization expense for Jackie Corp's investment in Rob Co.for year 2018?

A) $ 0.

B) $30,000.

C) $40,000.

D) $55,000.

E) $60,000.

A) $ 0.

B) $30,000.

C) $40,000.

D) $55,000.

E) $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

62

What is the Equity in Howell Income that should be reported by Acker in 2018?

A) $32,000.

B) $41,600.

C) $48,000.

D) $49,600.

E) $50,600.

A) $32,000.

B) $41,600.

C) $48,000.

D) $49,600.

E) $50,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

63

What is the amount of excess amortization expense for Bailey's investment in Emery for the first year?

A) $ 0.

B) $ 84,000.

C) $100,000.

D) $160,000.

E) $400,000.

A) $ 0.

B) $ 84,000.

C) $100,000.

D) $160,000.

E) $400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is the balance in Acker's Investment in Howell account at December 31, 2018?

A) $624,000.

B) $636,000.

C) $646,000.

D) $656,000.

E) $666,000.

A) $624,000.

B) $636,000.

C) $646,000.

D) $656,000.

E) $666,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

65

How much goodwill is associated with this investment?

A) $(500,000.)

B) $ 0.

C) $ 650,000.

D) $1,000,000.

E) $2,000,000.

A) $(500,000.)

B) $ 0.

C) $ 650,000.

D) $1,000,000.

E) $2,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is the balance in Cayman's Investment in Maya account at December 31, 2018?

A) $463,500.

B) $467,100.

C) $468,000.

D) $468,900.

E) $480,000.

A) $463,500.

B) $467,100.

C) $468,000.

D) $468,900.

E) $480,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

67

What is the balance in Acker's Investment in Howell account at December 31, 2017?

A) $576,000.

B) $598,400.

C) $614,400.

D) $606,000.

E) $616,000.

A) $576,000.

B) $598,400.

C) $614,400.

D) $606,000.

E) $616,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

68

What is Acker's share of the intra-entity inventory gross profit that should be deferred on December 31, 2017?

A) $ 1,600.

B) $ 4,000.

C) $ 8,000.

D) $15,000.

E) $20,000.

A) $ 1,600.

B) $ 4,000.

C) $ 8,000.

D) $15,000.

E) $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

69

What is the amount of the excess of purchase price over book value?

A) $(2,000,000).

B) $ 800,000.

C) $1,000,000.

D) $2,000,000.

E) $3,000,000.

A) $(2,000,000).

B) $ 800,000.

C) $1,000,000.

D) $2,000,000.

E) $3,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

70

What is the balance in the investment account after the sale of the 10,000 shares?

A) $390,000.

B) $420,000.

C) $453,000.

D) $454,000.

E) $465,000.

A) $390,000.

B) $420,000.

C) $453,000.

D) $454,000.

E) $465,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

71

What is Acker's share of the intra-entity inventory gross profit that should be deferred on December 31, 2018?

A) $ 1,600.

B) $ 8,000.

C) $15,000.

D) $20,000.

E) $40,000

A) $ 1,600.

B) $ 8,000.

C) $15,000.

D) $20,000.

E) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

72

What is the balance in Jackie Corp's Investment in Rob Co.account at December 31, 2018?

A) $2,000,000.

B) $2,005,000.

C) $2,060,000.

D) $2,090,000.

E) $2,200,000.

A) $2,000,000.

B) $2,005,000.

C) $2,060,000.

D) $2,090,000.

E) $2,200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

73

What is the gain/loss on the sale of the 10,000 shares?

A) $20,000 gain.

B) $10,000 gain.

C) $1,000 gain.

D) $1,000 loss.

E) $10,000 loss.

A) $20,000 gain.

B) $10,000 gain.

C) $1,000 gain.

D) $1,000 loss.

E) $10,000 loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

74

How much goodwill is associated with this investment?

A) $(500,000).

B) $ 0.

C) $ 100,000.

D) $ 200,000.

E) $2,000,000.

A) $(500,000).

B) $ 0.

C) $ 100,000.

D) $ 200,000.

E) $2,000,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

75

What is the amount of the excess of purchase price over book value?

A) $(1,000,000.)

B) $ 400,000.

C) $ 800,000.

D) $ 1,000,000.

E) $ 1,100,000.

A) $(1,000,000.)

B) $ 400,000.

C) $ 800,000.

D) $ 1,000,000.

E) $ 1,100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

76

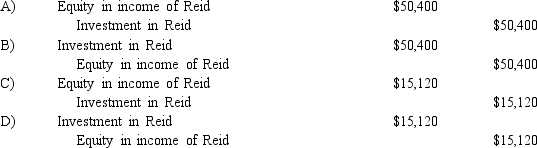

What is the appropriate journal entry to record the sale of the 10,000 shares?

A) A Above

B) B Above

C) C Above

D) D Above

E) E Above

A) A Above

B) B Above

C) C Above

D) D Above

E) E Above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

77

What is the Equity in Howell Income that should be reported by Acker in 2017?

A) $10,000.

B) $24,000.

C) $36,000.

D) $38,400.

E) $40,000.

A) $10,000.

B) $24,000.

C) $36,000.

D) $38,400.

E) $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

78

What is the Equity in Maya Income that should be reported by Cayman in 2018?

A) $17,100.

B) $18,000.

C) $25,500.

D) $29,100.

E) $30,900.

A) $17,100.

B) $18,000.

C) $25,500.

D) $29,100.

E) $30,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

79

What is the investor's share of gross profit on intra-entity inventory sales that should be deferred on December 31, 2018?

A) $ 900.

B) $3,000.

C) $4,500.

D) $6,000.

E) $9,000.

A) $ 900.

B) $3,000.

C) $4,500.

D) $6,000.

E) $9,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck

80

What is the investor's share of gross profit on intra-entity inventory sales that should be deferred on December 31, 2019?

A) $1,500.

B) $2,400.

C) $3,600.

D) $4,000.

E) $8,000.

A) $1,500.

B) $2,400.

C) $3,600.

D) $4,000.

E) $8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 121 في هذه المجموعة.

فتح الحزمة

k this deck