Deck 10: Capital Markets and the Pricing of Risk

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/101

العب

ملء الشاشة (f)

Deck 10: Capital Markets and the Pricing of Risk

1

Which of the following statements is FALSE?

A) The standard error provides an indication of how far the sample average might deviate from the expected return.

B) The 95% confidence interval for the expected return is defined as the Historical Average Return plus or minus three standard errors.

C) We can use a security's historical average return to estimate its actual expected return.

D) The standard error is the standard deviation of the average return.

A) The standard error provides an indication of how far the sample average might deviate from the expected return.

B) The 95% confidence interval for the expected return is defined as the Historical Average Return plus or minus three standard errors.

C) We can use a security's historical average return to estimate its actual expected return.

D) The standard error is the standard deviation of the average return.

B

Explanation: B) The 95% confidence interval for the expected return is defined as the Historical Average Return plus or minus two standard errors.

Explanation: B) The 95% confidence interval for the expected return is defined as the Historical Average Return plus or minus two standard errors.

2

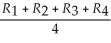

If a stock pays dividends at the end of each quarter,with realized returns of R1,R2,R3,and R4 each quarter,then the annual realized return is calculated as:

A) Rannual =

B) Rannual = (1 + R1)(1 + R2)(1 + R3)(1 + R4)

C) Rannual = (1 + R1)(1 + R2)(1 + R3)(1 + R4) - 1

D) Rannual = R1 + R2 + R3 + R4

A) Rannual =

B) Rannual = (1 + R1)(1 + R2)(1 + R3)(1 + R4)

C) Rannual = (1 + R1)(1 + R2)(1 + R3)(1 + R4) - 1

D) Rannual = R1 + R2 + R3 + R4

C

3

Which of the following statements is FALSE?

A) The compounded geometric average return is most often used for comparative purposes.

B) We should use the arithmetic average return when we are trying to estimate an investment's expected return over a future horizon based on its past performance.

C) The geometric average return will always be above the arithmetic average return and the difference grows with the volatility of the annual returns.

D) The geometric average return is a better description of the long-run historical performance of an investment.

A) The compounded geometric average return is most often used for comparative purposes.

B) We should use the arithmetic average return when we are trying to estimate an investment's expected return over a future horizon based on its past performance.

C) The geometric average return will always be above the arithmetic average return and the difference grows with the volatility of the annual returns.

D) The geometric average return is a better description of the long-run historical performance of an investment.

C

Explanation: C) The geometric average return will always be below the arithmetic average return and the difference grows with the volatility of the annual returns.

Explanation: C) The geometric average return will always be below the arithmetic average return and the difference grows with the volatility of the annual returns.

4

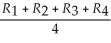

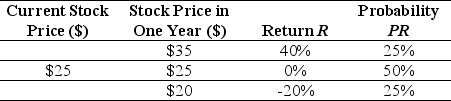

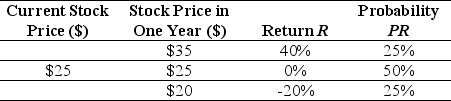

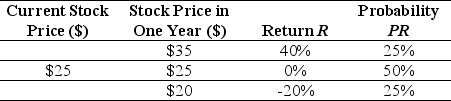

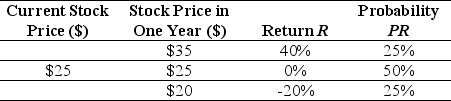

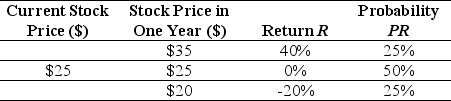

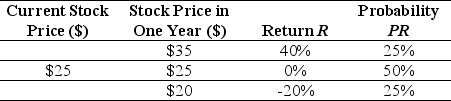

Use the table for the question(s) below.

Consider the following probability distribution of returns for Alpha Corporation:

The expected return for Alpha Corporation is closest to:

A) 6.67%

B) 5.00%

C) 10%

D) 0.00%

Consider the following probability distribution of returns for Alpha Corporation:

The expected return for Alpha Corporation is closest to:

A) 6.67%

B) 5.00%

C) 10%

D) 0.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

5

Use the table for the question(s) below.

Consider the following probability distribution of returns for Alpha Corporation:

The variance of the return on Alpha Corporation is closest to:

A) 5.00%

B) 4.75%

C) 3.625%

D) 3.75%

Consider the following probability distribution of returns for Alpha Corporation:

The variance of the return on Alpha Corporation is closest to:

A) 5.00%

B) 4.75%

C) 3.625%

D) 3.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following statements is FALSE?

A) The expected return is the return is the return that actually occurs over a particular time period.

B) If you hold the stock beyond the date of the first dividend, then to compute you return you must specify how you invest any dividends you receive in the interim.

C) The average annual return of an investment during some historical period is simply the average of the realized returns for each year.

D) The realized return is the total return we earn from dividends and capital gains, expressed as a percentage of the initial stock price.

A) The expected return is the return is the return that actually occurs over a particular time period.

B) If you hold the stock beyond the date of the first dividend, then to compute you return you must specify how you invest any dividends you receive in the interim.

C) The average annual return of an investment during some historical period is simply the average of the realized returns for each year.

D) The realized return is the total return we earn from dividends and capital gains, expressed as a percentage of the initial stock price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements is FALSE?

A) The standard deviation is the square root of the variance.

B) Because investors dislike only negative resolutions of uncertainty, alternative measures that focus solely on downside risk have been developed, such as the semi-variance and the expected tail loss.

C) While the variance and the standard deviation are the most common measures of risk, they do not differentiate between upside and downside risk.

D) While the variance and the standard deviation both measure the variability of the returns, the variance is easier to interpret because it is in the same units as the returns themselves.

A) The standard deviation is the square root of the variance.

B) Because investors dislike only negative resolutions of uncertainty, alternative measures that focus solely on downside risk have been developed, such as the semi-variance and the expected tail loss.

C) While the variance and the standard deviation are the most common measures of risk, they do not differentiate between upside and downside risk.

D) While the variance and the standard deviation both measure the variability of the returns, the variance is easier to interpret because it is in the same units as the returns themselves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is FALSE?

A) When an investment is risky, there are different returns it may earn.

B) In finance, the variance of a return is also referred to as its volatility.

C) The expected or mean return is calculated as a weighted average of the possible returns, where the weights correspond to the probabilities.

D) The variance is a measure of how "spread out" the distribution of the return is.

A) When an investment is risky, there are different returns it may earn.

B) In finance, the variance of a return is also referred to as its volatility.

C) The expected or mean return is calculated as a weighted average of the possible returns, where the weights correspond to the probabilities.

D) The variance is a measure of how "spread out" the distribution of the return is.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

9

Suppose an investment is equally likely to have a 35% return or a - 20% return.The expected return for this investment is closest to:

A) 7.5%

B) 15%

C) 5%

D) 10%

A) 7.5%

B) 15%

C) 5%

D) 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following equations is INCORRECT?

A) Var(R) =![<strong>Which of the following equations is INCORRECT?</strong> A) Var(R) = B) SD(R) = C) Var(R) = P<sub>R</sub> × (R - E[R])<sup>2</sup> D) E[R] = P<sub>R</sub> × R](https://d2lvgg3v3hfg70.cloudfront.net/TB1624/11ea7e60_15a4_2381_ba34_69dc20a1b374_TB1624_11.jpg)

B) SD(R) =![<strong>Which of the following equations is INCORRECT?</strong> A) Var(R) = B) SD(R) = C) Var(R) = P<sub>R</sub> × (R - E[R])<sup>2</sup> D) E[R] = P<sub>R</sub> × R](https://d2lvgg3v3hfg70.cloudfront.net/TB1624/11ea7e60_15a4_2382_ba34_dbf281cda943_TB1624_11.jpg)

C) Var(R) =![<strong>Which of the following equations is INCORRECT?</strong> A) Var(R) = B) SD(R) = C) Var(R) = P<sub>R</sub> × (R - E[R])<sup>2</sup> D) E[R] = P<sub>R</sub> × R](https://d2lvgg3v3hfg70.cloudfront.net/TB1624/11ea7e60_15a4_2383_ba34_c58ba2fb4c42_TB1624_11.jpg) PR × (R - E[R])2

PR × (R - E[R])2

D) E[R] =![<strong>Which of the following equations is INCORRECT?</strong> A) Var(R) = B) SD(R) = C) Var(R) = P<sub>R</sub> × (R - E[R])<sup>2</sup> D) E[R] = P<sub>R</sub> × R](https://d2lvgg3v3hfg70.cloudfront.net/TB1624/11ea7e60_15a4_2384_ba34_25dc6c675b5d_TB1624_11.jpg) PR × R

PR × R

A) Var(R) =

![<strong>Which of the following equations is INCORRECT?</strong> A) Var(R) = B) SD(R) = C) Var(R) = P<sub>R</sub> × (R - E[R])<sup>2</sup> D) E[R] = P<sub>R</sub> × R](https://d2lvgg3v3hfg70.cloudfront.net/TB1624/11ea7e60_15a4_2381_ba34_69dc20a1b374_TB1624_11.jpg)

B) SD(R) =

![<strong>Which of the following equations is INCORRECT?</strong> A) Var(R) = B) SD(R) = C) Var(R) = P<sub>R</sub> × (R - E[R])<sup>2</sup> D) E[R] = P<sub>R</sub> × R](https://d2lvgg3v3hfg70.cloudfront.net/TB1624/11ea7e60_15a4_2382_ba34_dbf281cda943_TB1624_11.jpg)

C) Var(R) =

![<strong>Which of the following equations is INCORRECT?</strong> A) Var(R) = B) SD(R) = C) Var(R) = P<sub>R</sub> × (R - E[R])<sup>2</sup> D) E[R] = P<sub>R</sub> × R](https://d2lvgg3v3hfg70.cloudfront.net/TB1624/11ea7e60_15a4_2383_ba34_c58ba2fb4c42_TB1624_11.jpg) PR × (R - E[R])2

PR × (R - E[R])2D) E[R] =

![<strong>Which of the following equations is INCORRECT?</strong> A) Var(R) = B) SD(R) = C) Var(R) = P<sub>R</sub> × (R - E[R])<sup>2</sup> D) E[R] = P<sub>R</sub> × R](https://d2lvgg3v3hfg70.cloudfront.net/TB1624/11ea7e60_15a4_2384_ba34_25dc6c675b5d_TB1624_11.jpg) PR × R

PR × R

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements is FALSE?

A) We measure the degree of estimation error statistically through the standard error of the estimate.

B) When focusing on the returns of a single security, its common practice to assume that all dividends are immediately invested at the risk-free rate.

C) We estimate the standard deviation or volatility as the square root of the variance.

D) We estimate the variance by computing the average squared deviation from the average realized return.

A) We measure the degree of estimation error statistically through the standard error of the estimate.

B) When focusing on the returns of a single security, its common practice to assume that all dividends are immediately invested at the risk-free rate.

C) We estimate the standard deviation or volatility as the square root of the variance.

D) We estimate the variance by computing the average squared deviation from the average realized return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

12

Use the table for the question(s) below.

Consider the following Price and Dividend data for General Electric Company:

Assume that you purchased General Electric Company stock at the closing price on December 31,2008 and sold it after the dividend had been paid at the closing price on January 26,2009.Your dividend yield for this period is closest to:

A) -8.15%

B) 0.75%

C) 0.70%

D) -8.80%

Consider the following Price and Dividend data for General Electric Company:

Assume that you purchased General Electric Company stock at the closing price on December 31,2008 and sold it after the dividend had been paid at the closing price on January 26,2009.Your dividend yield for this period is closest to:

A) -8.15%

B) 0.75%

C) 0.70%

D) -8.80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following statements is FALSE?

A) The variance increases with the magnitude of the deviations from the mean.

B) The variance is the expected squared deviation from the mean.

C) Two common measures of the risk of a probability distribution are its variance and standard deviation.

D) If the return is riskless and never deviates from its mean, the variance is equal to one.

A) The variance increases with the magnitude of the deviations from the mean.

B) The variance is the expected squared deviation from the mean.

C) Two common measures of the risk of a probability distribution are its variance and standard deviation.

D) If the return is riskless and never deviates from its mean, the variance is equal to one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following investments had the largest fluctuations overall return over the past eighty years?

A) Small stocks

B) S&P 500

C) Corporate bonds

D) Treasury Bills

A) Small stocks

B) S&P 500

C) Corporate bonds

D) Treasury Bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

15

Use the table for the question(s) below.

Consider the following probability distribution of returns for Alpha Corporation:

The standard deviation of the return on Alpha Corporation is closest to:

A) 22.4%

B) 19.0%

C) 21.8%

D) 19.4%

Consider the following probability distribution of returns for Alpha Corporation:

The standard deviation of the return on Alpha Corporation is closest to:

A) 22.4%

B) 19.0%

C) 21.8%

D) 19.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following investments offered the highest overall return over the past eighty years?

A) Treasury Bills

B) S&P 500

C) Small stocks

D) Corporate bonds

A) Treasury Bills

B) S&P 500

C) Small stocks

D) Corporate bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

17

Use the table for the question(s) below.

Consider the following Price and Dividend data for General Electric Company:

Assume that you purchased General Electric Company stock at the closing price on December 31,2008 and sold it after the dividend had been paid at the closing price on January 26,2009.Your capital gains rate (yield)for this period is closest to:

A) 0.75%

B) 0.70%

C) -8.80%

D) -8.15%

Consider the following Price and Dividend data for General Electric Company:

Assume that you purchased General Electric Company stock at the closing price on December 31,2008 and sold it after the dividend had been paid at the closing price on January 26,2009.Your capital gains rate (yield)for this period is closest to:

A) 0.75%

B) 0.70%

C) -8.80%

D) -8.15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following investments offered the lowest overall return over the past eighty years?

A) Small stocks

B) Treasury Bills

C) S&P 500

D) Corporate bonds

A) Small stocks

B) Treasury Bills

C) S&P 500

D) Corporate bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

19

Suppose an investment is equally likely to have a 35% return or a - 20% return.The variance on the return for this investment is closest to:

A) )151

B) )0378

C) 0

D) )075

A) )151

B) )0378

C) 0

D) )075

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

20

Suppose an investment is equally likely to have a 35% return or a -20% return.The standard deviation on the return for this investment is closest to:

A) 38.9%

B) 0%

C) 19.4%

D) 27.5%

A) 38.9%

B) 0%

C) 19.4%

D) 27.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

21

The variance of the returns on the Index from 2000 to 2009 is closest to:

A) )0450

B) )3400

C) )1935

D) )0375

A) )0450

B) )3400

C) )1935

D) )0375

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

22

Suppose that you want to use the 10 year historical average return on the Index to forecast the expected future return on the Index.The 95% confidence interval for your estimate of the expect return is closest to:

A) -9.6% to 27.3%

B) 6.8% to 10.7%

C) -3.5% to 21.1%

D) 4.9% to 12.7%

A) -9.6% to 27.3%

B) 6.8% to 10.7%

C) -3.5% to 21.1%

D) 4.9% to 12.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the table for the question(s) below.

Consider the following realized annual returns:

Using the data provided in the table,calculate the average annual return,the variance of the annual returns,and the standard deviation of the average returns for Stock B from 2000 to 2009.

Consider the following realized annual returns:

Using the data provided in the table,calculate the average annual return,the variance of the annual returns,and the standard deviation of the average returns for Stock B from 2000 to 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

24

Use the table for the question(s) below.

Consider the following realized annual returns:

Suppose that you want to use the 10 year historical average return on Stock B to forecast the expected future return on Stock B.Calculate the 95% confidence interval for your estimate of the expect return.

Consider the following realized annual returns:

Suppose that you want to use the 10 year historical average return on Stock B to forecast the expected future return on Stock B.Calculate the 95% confidence interval for your estimate of the expect return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

25

The geometric average annual return on Stock A from 2000 to 2009 is closest to:

A) 12.4%

B) 16.7%

C) 13.2%

D) 17.8%

A) 12.4%

B) 16.7%

C) 13.2%

D) 17.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the table for the question(s) below.

Consider the following realized annual returns:

Using the data provided in the table,calculate the average annual return,the variance of the annual returns,and the standard deviation of the average returns for the market from 2000 to 2009.

Consider the following realized annual returns:

Using the data provided in the table,calculate the average annual return,the variance of the annual returns,and the standard deviation of the average returns for the market from 2000 to 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

27

The geometric average annual return on the Index from 2000 to 2009 is closest to:

A) 9.75%

B) 8.75%

C) 7.10%

D) 8.35%

A) 9.75%

B) 8.75%

C) 7.10%

D) 8.35%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

28

The excess return if the difference between the average return on a security and the average return for:

A) Treasury Bonds.

B) a portfolio of securities with similar risk.

C) a broad based market portfolio like the S&P 500 index.

D) Treasury Bills.

A) Treasury Bonds.

B) a portfolio of securities with similar risk.

C) a broad based market portfolio like the S&P 500 index.

D) Treasury Bills.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

29

Use the table for the question(s) below.

Consider the following realized annual returns:

The average annual return on the Index from 2000 to 2009 is closest to:

A) 7.10%

B) 4.00%

C) 9.75%

D) 8.75%

Consider the following realized annual returns:

The average annual return on the Index from 2000 to 2009 is closest to:

A) 7.10%

B) 4.00%

C) 9.75%

D) 8.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

30

Suppose that you want to use the 10 year historical average return on Stock A to forecast the expected future return on Stock A.The 95% confidence interval for your estimate of the expect return is closest to:

A) 13.2% to 19.5%

B) -4.5% to 37.4%

C) 6.5% to 26.3%

D) -15.0% to 47.9%

A) 13.2% to 19.5%

B) -4.5% to 37.4%

C) 6.5% to 26.3%

D) -15.0% to 47.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

31

The standard deviation of the returns on Stock A from 2000 to 2009 is closest to:

A) 33.2%

B) 16.4%

C) 31.5%

D) 11.0%

A) 33.2%

B) 16.4%

C) 31.5%

D) 11.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the table for the question(s) below.

Consider the following Price and Dividend data for General Electric Company:

Assume that you purchased Ford Motor Company stock at the closing price on December 31,2008 and sold it at the closing price on December 30,2009.Your realized annual return for the year 2009 is closest to:

A) -45.1%

B) -44.5%

C) -48.5%

D) -47.3%

Consider the following Price and Dividend data for General Electric Company:

Assume that you purchased Ford Motor Company stock at the closing price on December 31,2008 and sold it at the closing price on December 30,2009.Your realized annual return for the year 2009 is closest to:

A) -45.1%

B) -44.5%

C) -48.5%

D) -47.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the table for the question(s) below.

Consider the following realized annual returns:

The average annual return on Stock A from 2000 to 2009 is closest to:

A) 29.9%

B) 16.40%

C) 18.2%

D) 18.7%

Consider the following realized annual returns:

The average annual return on Stock A from 2000 to 2009 is closest to:

A) 29.9%

B) 16.40%

C) 18.2%

D) 18.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

34

The standard deviation of the returns on the Index from 2000 to 2009 is closest to:

A) 19.5%

B) 20.5%

C) 3.8%

D) 8.8%

A) 19.5%

B) 20.5%

C) 3.8%

D) 8.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

35

The variance of the returns on Stock A from 2000 to 2009 is closest to:

A) )3145

B) )0990

C) )1100

D) )9890

A) )3145

B) )0990

C) )1100

D) )9890

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the table for the question(s) below.

Consider the following Price and Dividend data for J. P. Morgan Chase:

Assume that you purchased J.P.Morgan Chase stock at the closing price on December 31,2008 and sold it at the closing price on December 30,2009.Calculate your realized annual return is for the year 2005.

Consider the following Price and Dividend data for J. P. Morgan Chase:

Assume that you purchased J.P.Morgan Chase stock at the closing price on December 31,2008 and sold it at the closing price on December 30,2009.Calculate your realized annual return is for the year 2005.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

37

Suppose that you want to use the 10 year historical average return on the Index to forecast the expected future return on the Index.The standard error of your estimate of the expected return is closest to:

A) 19.4%

B) 3.8%

C) 6.2%

D) 1.95%

A) 19.4%

B) 3.8%

C) 6.2%

D) 1.95%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the table for the question(s) below.

Consider the following Price and Dividend data for General Electric Company:

Assume that you purchased General Electric Company stock at the closing price on December 31,2008 and sold it after the dividend had been paid at the closing price on January 26,2009.Your total return rate (yield)for this period is closest to:

A) 0.75%

B) -8.80%

C) 0.70%

D) -8.15%

Consider the following Price and Dividend data for General Electric Company:

Assume that you purchased General Electric Company stock at the closing price on December 31,2008 and sold it after the dividend had been paid at the closing price on January 26,2009.Your total return rate (yield)for this period is closest to:

A) 0.75%

B) -8.80%

C) 0.70%

D) -8.15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

39

Suppose that you want to use the 10 year historical average return on Stock A to forecast the expected future return on Stock A.The standard error of your estimate of the expected return is closest to:

A) 16.4%

B) 3.32%

C) 10.49%

D) 33.20%

A) 16.4%

B) 3.32%

C) 10.49%

D) 33.20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the table for the question(s) below.

Consider the following realized annual returns:

Suppose that you want to use the 10 year historical average return on the Market to forecast the expected future return on the Market.Calculate the 95% confidence interval for your estimate of the expect return.

Consider the following realized annual returns:

Suppose that you want to use the 10 year historical average return on the Market to forecast the expected future return on the Market.Calculate the 95% confidence interval for your estimate of the expect return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the table for the question(s) below.

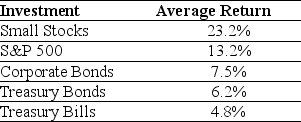

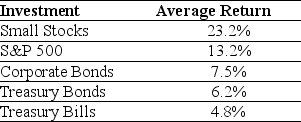

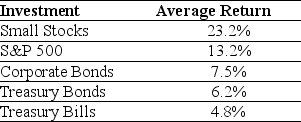

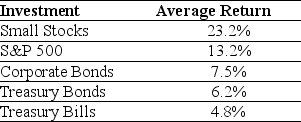

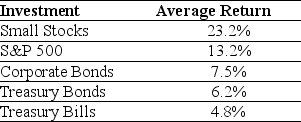

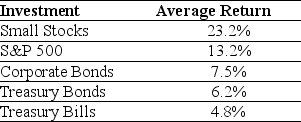

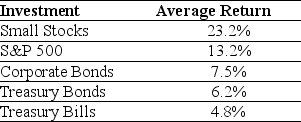

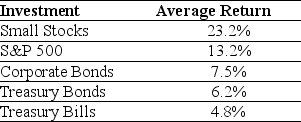

Consider the following average annual returns:

What is the excess return for corporate bonds?

A) 2.7%

B) 1.3%

C) -5.7%

D) 0%

Consider the following average annual returns:

What is the excess return for corporate bonds?

A) 2.7%

B) 1.3%

C) -5.7%

D) 0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the information for the question(s) below.

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential "blockbuster" drug before the Food and Drug Administration (FDA) waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate less important drugs before the FDA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the FDA approving a drug is 50%.

What is the expected payoff for Big Cure's Blockbuster drug?

A) $100 million

B) $0

C) $1 billion

D) $500 million

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential "blockbuster" drug before the Food and Drug Administration (FDA) waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate less important drugs before the FDA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the FDA approving a drug is 50%.

What is the expected payoff for Big Cure's Blockbuster drug?

A) $100 million

B) $0

C) $1 billion

D) $500 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which pharmaceutical company faces less risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

44

Common risk is also called:

A) diversifiable risk.

B) correlated risk.

C) uncorrelated risk.

D) independent risk.

A) diversifiable risk.

B) correlated risk.

C) uncorrelated risk.

D) independent risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the information for the question(s) below.

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential "blockbuster" drug before the Food and Drug Administration (FDA) waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate less important drugs before the FDA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the FDA approving a drug is 50%.

What is the expected payoff for Little Cure's ten drugs?

A) $500 million

B) $100 million

C) $1 billion

D) $0

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential "blockbuster" drug before the Food and Drug Administration (FDA) waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate less important drugs before the FDA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the FDA approving a drug is 50%.

What is the expected payoff for Little Cure's ten drugs?

A) $500 million

B) $100 million

C) $1 billion

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the table for the question(s) below.

Consider the following average annual returns:

What is the excess return for the S&P 500?

A) 5.7%

B) 7.0%

C) 0%

D) 8.4%

Consider the following average annual returns:

What is the excess return for the S&P 500?

A) 5.7%

B) 7.0%

C) 0%

D) 8.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

47

Use the following information to answer the problems below.

Consider two banks. Bank A has 1000 loans outstanding each for $100,000, that it expects to be fully repaid today. Each of Bank A's loans have a 6% probability of default, in which case the bank will receive $0 for each of the defaulting loans. Bank B has 100 loans of $1 million outstanding, which it also expects to be fully repaid today. Each of Bank B's loans have a 5% probability of default, in which case the bank will receive $0 for each of the defaulting loans. The chance of default is independent across all the loans.

The expected overall payoff to Bank B is:

A) $5,000,000

B) $6,000,000

C) $94,000,000

D) $95,000,000

Consider two banks. Bank A has 1000 loans outstanding each for $100,000, that it expects to be fully repaid today. Each of Bank A's loans have a 6% probability of default, in which case the bank will receive $0 for each of the defaulting loans. Bank B has 100 loans of $1 million outstanding, which it also expects to be fully repaid today. Each of Bank B's loans have a 5% probability of default, in which case the bank will receive $0 for each of the defaulting loans. The chance of default is independent across all the loans.

The expected overall payoff to Bank B is:

A) $5,000,000

B) $6,000,000

C) $94,000,000

D) $95,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is NOT a systematic risk?

A) The risk that oil prices rise, increasing production costs

B) The risk that the Federal Reserve raises interest rates

C) The risk that the economy slows, reducing demand for your firm's products

D) The risk that your new product will not receive regulatory approval

A) The risk that oil prices rise, increasing production costs

B) The risk that the Federal Reserve raises interest rates

C) The risk that the economy slows, reducing demand for your firm's products

D) The risk that your new product will not receive regulatory approval

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the table for the question(s) below.

Consider the following average annual returns:

What is the excess return for the portfolio of small stocks?

A) 10.0%

B) 15.7%

C) 18.4%

D) 17.0%

Consider the following average annual returns:

What is the excess return for the portfolio of small stocks?

A) 10.0%

B) 15.7%

C) 18.4%

D) 17.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the information for the question(s) below.

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential "blockbuster" drug before the Food and Drug Administration (FDA) waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate less important drugs before the FDA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the FDA approving a drug is 50%.

What is the standard deviation of Big Cure's average net income for their new blockbuster drug?

A) $0

B) $1 billion

C) $100 million

D) $500 million

Big Cure and Little Cure are both pharmaceutical companies. Big Cure presently has a potential "blockbuster" drug before the Food and Drug Administration (FDA) waiting for approval. If approved, Big Cure's blockbuster drug will produce $1 billion in net income for Big Cure. Little Cure has 10 separate less important drugs before the FDA waiting for approval. If approved, each of Little Cure's drugs would produce $100 million in net income for Little Cure. The probability of the FDA approving a drug is 50%.

What is the standard deviation of Big Cure's average net income for their new blockbuster drug?

A) $0

B) $1 billion

C) $100 million

D) $500 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the table for the question(s) below.

Consider the following average annual returns:

What is the excess return for Treasury Bills?

A) 0%

B) -8.4%

C) -2.7%

D) -1.4%

Consider the following average annual returns:

What is the excess return for Treasury Bills?

A) 0%

B) -8.4%

C) -2.7%

D) -1.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following types of risk doesn't belong?

A) Market risk

B) Unique risk

C) Idiosyncratic risk

D) Unsystematic risk

A) Market risk

B) Unique risk

C) Idiosyncratic risk

D) Unsystematic risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the following information to answer the problems below.

Consider two banks. Bank A has 1000 loans outstanding each for $100,000, that it expects to be fully repaid today. Each of Bank A's loans have a 6% probability of default, in which case the bank will receive $0 for each of the defaulting loans. Bank B has 100 loans of $1 million outstanding, which it also expects to be fully repaid today. Each of Bank B's loans have a 5% probability of default, in which case the bank will receive $0 for each of the defaulting loans. The chance of default is independent across all the loans.

The expected overall payoff to Bank A is:

A) $5,000,000

B) $6,000,000

C) $94,000,000

D) $95,000,000

Consider two banks. Bank A has 1000 loans outstanding each for $100,000, that it expects to be fully repaid today. Each of Bank A's loans have a 6% probability of default, in which case the bank will receive $0 for each of the defaulting loans. Bank B has 100 loans of $1 million outstanding, which it also expects to be fully repaid today. Each of Bank B's loans have a 5% probability of default, in which case the bank will receive $0 for each of the defaulting loans. The chance of default is independent across all the loans.

The expected overall payoff to Bank A is:

A) $5,000,000

B) $6,000,000

C) $94,000,000

D) $95,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

54

The standard deviation of Little Cure's average net income for their ten new drugs is closest to:

A) $50 million

B) $25 million

C) $16 million

D) $500 million

A) $50 million

B) $25 million

C) $16 million

D) $500 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following statements is FALSE?

A) Investments with higher volatility have rewarded investors with higher average returns.

B) Investments with higher volatility should have a higher risk premium and therefore higher returns.

C) Volatility seems to be a reasonable measure of risk when evaluating returns on large portfolios and the returns of individual securities.

D) Riskier investments must offer investors higher average returns to compensate them for the extra risk they are taking on.

A) Investments with higher volatility have rewarded investors with higher average returns.

B) Investments with higher volatility should have a higher risk premium and therefore higher returns.

C) Volatility seems to be a reasonable measure of risk when evaluating returns on large portfolios and the returns of individual securities.

D) Riskier investments must offer investors higher average returns to compensate them for the extra risk they are taking on.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is NOT a diversifiable risk?

A) The risk that oil prices rise, increasing production costs

B) The risk of a product liability lawsuit

C) The risk that the CEO is killed in a plane crash

D) The risk of a key employee being hired away by a competitor

A) The risk that oil prices rise, increasing production costs

B) The risk of a product liability lawsuit

C) The risk that the CEO is killed in a plane crash

D) The risk of a key employee being hired away by a competitor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the following information to answer the problems below.

Consider two banks. Bank A has 1000 loans outstanding each for $100,000, that it expects to be fully repaid today. Each of Bank A's loans have a 6% probability of default, in which case the bank will receive $0 for each of the defaulting loans. Bank B has 100 loans of $1 million outstanding, which it also expects to be fully repaid today. Each of Bank B's loans have a 5% probability of default, in which case the bank will receive $0 for each of the defaulting loans. The chance of default is independent across all the loans.

The standard deviation of the overall payoff to Bank B is closest to:

A) $751,000

B) $2,179,000

C) $2,375,000

D) $21,794,000

Consider two banks. Bank A has 1000 loans outstanding each for $100,000, that it expects to be fully repaid today. Each of Bank A's loans have a 6% probability of default, in which case the bank will receive $0 for each of the defaulting loans. Bank B has 100 loans of $1 million outstanding, which it also expects to be fully repaid today. Each of Bank B's loans have a 5% probability of default, in which case the bank will receive $0 for each of the defaulting loans. The chance of default is independent across all the loans.

The standard deviation of the overall payoff to Bank B is closest to:

A) $751,000

B) $2,179,000

C) $2,375,000

D) $21,794,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the following information to answer the problems below.

Consider two banks. Bank A has 1000 loans outstanding each for $100,000, that it expects to be fully repaid today. Each of Bank A's loans have a 6% probability of default, in which case the bank will receive $0 for each of the defaulting loans. Bank B has 100 loans of $1 million outstanding, which it also expects to be fully repaid today. Each of Bank B's loans have a 5% probability of default, in which case the bank will receive $0 for each of the defaulting loans. The chance of default is independent across all the loans.

The standard deviation of the overall payoff to Bank A is closest to:

A) $689,000

B) $751,000

C) $2,179,000

D) $2,375,000

Consider two banks. Bank A has 1000 loans outstanding each for $100,000, that it expects to be fully repaid today. Each of Bank A's loans have a 6% probability of default, in which case the bank will receive $0 for each of the defaulting loans. Bank B has 100 loans of $1 million outstanding, which it also expects to be fully repaid today. Each of Bank B's loans have a 5% probability of default, in which case the bank will receive $0 for each of the defaulting loans. The chance of default is independent across all the loans.

The standard deviation of the overall payoff to Bank A is closest to:

A) $689,000

B) $751,000

C) $2,179,000

D) $2,375,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following statements is FALSE?

A) Expected return should rise proportionately with volatility.

B) Investors would not choose to hold a portfolio that is more volatile unless they expected to earn a higher return.

C) Smaller stocks have lower volatility than larger stocks.

D) The largest stocks are typically more volatile than a portfolio of large stocks.

A) Expected return should rise proportionately with volatility.

B) Investors would not choose to hold a portfolio that is more volatile unless they expected to earn a higher return.

C) Smaller stocks have lower volatility than larger stocks.

D) The largest stocks are typically more volatile than a portfolio of large stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

60

Do expected returns for individual stocks increase proportionately with volatility?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

61

Consider a portfolio that consists of an equal investment in 20 firms.For each of these firms,there is a 70% probability that the firms will have a 16% return and a 30% that they will have a - 8% return.Each of these firms' returns is independent of all others.The standard deviation of this portfolio is closest to:

A) 2.5%

B) 4.2%

C) 8.8%

D) 11.0%

A) 2.5%

B) 4.2%

C) 8.8%

D) 11.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

62

The expected return on security with a beta of 1.2 is closest to:

A) 4.8%

B) 8.0%

C) 8.8%

D) 9.6%

A) 4.8%

B) 8.0%

C) 8.8%

D) 9.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

63

Use the information for the question(s) below.

Consider an economy with two types of firms, S and I. S firms always move together, but I firms move independently of each other. For both types of firm there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on a portfolio of 20 type S firms is closest to:

A) 5.10%

B) 23.0%

C) 15.0%

D) 5.25%

Consider an economy with two types of firms, S and I. S firms always move together, but I firms move independently of each other. For both types of firm there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on a portfolio of 20 type S firms is closest to:

A) 5.10%

B) 23.0%

C) 15.0%

D) 5.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements is FALSE?

A) Because investors are risk averse, they will demand a risk premium to hold unsystematic risk.

B) Over any given period, the risk of holding a stock is that the dividends plus the final stock price will be higher or lower than expected, which makes the realized return risky.

C) The risk premium for diversifiable risk is zero, so investors are not compensated for holding firm-specific risk.

D) Because investors can eliminate firm-specific risk "for free" by diversifying their portfolios, they will not require a reward or risk premium for holding it.

A) Because investors are risk averse, they will demand a risk premium to hold unsystematic risk.

B) Over any given period, the risk of holding a stock is that the dividends plus the final stock price will be higher or lower than expected, which makes the realized return risky.

C) The risk premium for diversifiable risk is zero, so investors are not compensated for holding firm-specific risk.

D) Because investors can eliminate firm-specific risk "for free" by diversifying their portfolios, they will not require a reward or risk premium for holding it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the following information to answer the question(s) below.

Suppose that the market portfolio is equally likely to increase by 24% or decrease by 8%. Security "X" goes up on average by 29% when the market goes up and goes down by 11% when the market goes down. Security "Y" goes down on average by 16% when the market goes up and goes up by 16% when the market goes down. Security "Z" goes up on average by 4% when the market goes up and goes up by 4% when the market goes down.

The beta for security "X" is closest to:

A) 0

B) 0.80

C) 1.00

D) 1.25

Suppose that the market portfolio is equally likely to increase by 24% or decrease by 8%. Security "X" goes up on average by 29% when the market goes up and goes down by 11% when the market goes down. Security "Y" goes down on average by 16% when the market goes up and goes up by 16% when the market goes down. Security "Z" goes up on average by 4% when the market goes up and goes up by 4% when the market goes down.

The beta for security "X" is closest to:

A) 0

B) 0.80

C) 1.00

D) 1.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

66

The risk-free rate is closest to:

A) 0%

B) 4%

C) 8%

D) 16%

A) 0%

B) 4%

C) 8%

D) 16%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

67

The expected return on security with a beta of 0 is closest to:

A) -4.0%

B) 0.0%

C) 3.2%

D) 4.0%

A) -4.0%

B) 0.0%

C) 3.2%

D) 4.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use the information for the question(s) below.

Consider an economy with two types of firms, S and I. S firms always move together, but I firms move independently of each other. For both types of firm there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on an individual firm is closest to:

A) 23.0%

B) 5.25%

C) 15.0%

D) 10.0%

Consider an economy with two types of firms, S and I. S firms always move together, but I firms move independently of each other. For both types of firm there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on an individual firm is closest to:

A) 23.0%

B) 5.25%

C) 15.0%

D) 10.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements is FALSE?

A) In exchange for bearing systematic risk, investors want to be compensated by earning a higher return.

B) A key step to measuring systematic risk is finding a portfolio that contains only unsystematic risk.

C) When evaluating the risk of an investment, an investor will care about its systematic risk, which cannot be eliminated through diversification.

D) To measure the systematic risk of a stock, we must determine how much of the variability of its return is due to systematic, market-wide risks versus diversifiable, firm specific risks.

A) In exchange for bearing systematic risk, investors want to be compensated by earning a higher return.

B) A key step to measuring systematic risk is finding a portfolio that contains only unsystematic risk.

C) When evaluating the risk of an investment, an investor will care about its systematic risk, which cannot be eliminated through diversification.

D) To measure the systematic risk of a stock, we must determine how much of the variability of its return is due to systematic, market-wide risks versus diversifiable, firm specific risks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following statements is FALSE?

A) Fluctuations of a stock's returns that are due to firm-specific news are common risks.

B) The volatility in a large portfolio will decline until only the systematic risk remains.

C) When we combine many stocks in a large portfolio, the firm-specific risks for each stock will average out and be diversified.

D) The risk premium of a security is determined by its systematic risk and does not depend on its diversifiable risk.

A) Fluctuations of a stock's returns that are due to firm-specific news are common risks.

B) The volatility in a large portfolio will decline until only the systematic risk remains.

C) When we combine many stocks in a large portfolio, the firm-specific risks for each stock will average out and be diversified.

D) The risk premium of a security is determined by its systematic risk and does not depend on its diversifiable risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

71

Use the information for the question(s) below.

Consider an economy with two types of firms, S and I. S firms always move together, but I firms move independently of each other. For both types of firm there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

What is the expected return for an individual firm?

A) 14%

B) 3%

C) 5%

D) -5%

Consider an economy with two types of firms, S and I. S firms always move together, but I firms move independently of each other. For both types of firm there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

What is the expected return for an individual firm?

A) 14%

B) 3%

C) 5%

D) -5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

72

Use the following information to answer the question(s) below.

Suppose that the market portfolio is equally likely to increase by 24% or decrease by 8%. Security "X" goes up on average by 29% when the market goes up and goes down by 11% when the market goes down. Security "Y" goes down on average by 16% when the market goes up and goes up by 16% when the market goes down. Security "Z" goes up on average by 4% when the market goes up and goes up by 4% when the market goes down.

The beta for security "Y" is closest to:

A) -1.00

B) -0.25

C) 0.00

D) 0.25

Suppose that the market portfolio is equally likely to increase by 24% or decrease by 8%. Security "X" goes up on average by 29% when the market goes up and goes down by 11% when the market goes down. Security "Y" goes down on average by 16% when the market goes up and goes up by 16% when the market goes down. Security "Z" goes up on average by 4% when the market goes up and goes up by 4% when the market goes down.

The beta for security "Y" is closest to:

A) -1.00

B) -0.25

C) 0.00

D) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the following information to answer the question(s) below.

Suppose that the market portfolio is equally likely to increase by 24% or decrease by 8%. Security "X" goes up on average by 29% when the market goes up and goes down by 11% when the market goes down. Security "Y" goes down on average by 16% when the market goes up and goes up by 16% when the market goes down. Security "Z" goes up on average by 4% when the market goes up and goes up by 4% when the market goes down.

The beta for security "Z" is closest to:

A) -1.00

B) -0.25

C) 0.00

D) 0.25

Suppose that the market portfolio is equally likely to increase by 24% or decrease by 8%. Security "X" goes up on average by 29% when the market goes up and goes down by 11% when the market goes down. Security "Y" goes down on average by 16% when the market goes up and goes up by 16% when the market goes down. Security "Z" goes up on average by 4% when the market goes up and goes up by 4% when the market goes down.

The beta for security "Z" is closest to:

A) -1.00

B) -0.25

C) 0.00

D) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

74

The expected return on security with a beta of 1 is closest to:

A) -4.0%

B) 3.2%

C) 4.0%

D) 8.0%

A) -4.0%

B) 3.2%

C) 4.0%

D) 8.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the information for the question(s) below.

Consider an economy with two types of firms, S and I. S firms always move together, but I firms move independently of each other. For both types of firm there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on an portfolio of 20 type I firms is closest to:

A) 5.25%

B) 5.10%

C) 15.0%

D) 23.0%

Consider an economy with two types of firms, S and I. S firms always move together, but I firms move independently of each other. For both types of firm there is a 70% probability that the firm will have a 20% return and a 30% probability that the firm will have a -30% return.

The standard deviation for the return on an portfolio of 20 type I firms is closest to:

A) 5.25%

B) 5.10%

C) 15.0%

D) 23.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following types of risk doesn't belong?

A) Idiosyncratic risk

B) Undiversifiable risk

C) Market risk

D) Systematic risk

A) Idiosyncratic risk

B) Undiversifiable risk

C) Market risk

D) Systematic risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

77

The expected return on the market portfolio is closest to:

A) 0%

B) 4%

C) 8%

D) 16%

A) 0%

B) 4%

C) 8%

D) 16%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

78

The expected return on security with a beta of 0.8 is closest to:

A) 0.0%

B) 3.2%

C) 6.4%

D) 7.2%

A) 0.0%

B) 3.2%

C) 6.4%

D) 7.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

79

The expected return on security "Y" is closest to:

A) 0%

B) 4%

C) 10%

D) 15%

A) 0%

B) 4%

C) 10%

D) 15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following statements is FALSE?

A) Firm specific news is good or bad news about the company itself.

B) Firms are affected by both systematic and firm-specific risk.

C) When firms carry both types of risk, only the firm-specific risk will be diversified when we combine many firms' stocks into a portfolio.

D) The risk premium for a stock is affected by its idiosyncratic risk.

A) Firm specific news is good or bad news about the company itself.

B) Firms are affected by both systematic and firm-specific risk.

C) When firms carry both types of risk, only the firm-specific risk will be diversified when we combine many firms' stocks into a portfolio.

D) The risk premium for a stock is affected by its idiosyncratic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck