Deck 15: The Human Resources Management and Payroll Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

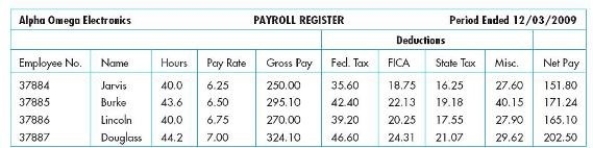

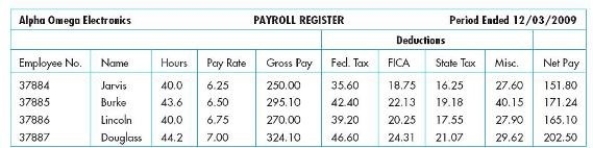

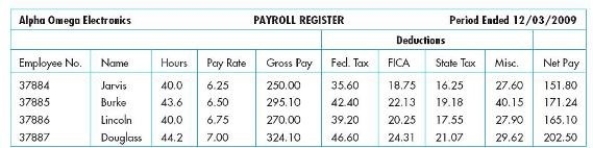

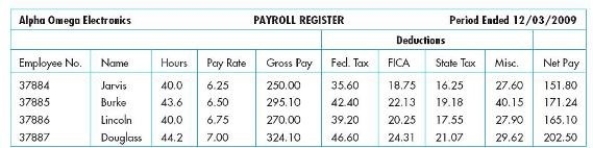

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/86

العب

ملء الشاشة (f)

Deck 15: The Human Resources Management and Payroll Cycle

1

Experts estimate that,on average,the costs associated with replacing an employee are about ________ the employee's annual salary.

A)0.5 time

B)1 time

C)1.5 times

D)2 times

A)0.5 time

B)1 time

C)1.5 times

D)2 times

C

2

Many companies offer their employees a "cafeteria" approach to voluntary benefits in which employees can pick and choose the benefits they want.This plan is normally called a(n)

A)elective plan.

B)menu options benefit plan.

C)flexible benefit plan.

D)buffet plan.

A)elective plan.

B)menu options benefit plan.

C)flexible benefit plan.

D)buffet plan.

C

3

The payroll transaction file should contain

A)entries to add new hires.

B)time card data.

C)changes in tax rates.

D)All of the above are correct.

A)entries to add new hires.

B)time card data.

C)changes in tax rates.

D)All of the above are correct.

B

4

Which of the following is generally not a major source of input to a payroll system?

A)Payroll rate changes.

B)Time and attendance data.

C)Checks to insurance and benefits providers.

D)Withholdings and deduction requests from employees.

A)Payroll rate changes.

B)Time and attendance data.

C)Checks to insurance and benefits providers.

D)Withholdings and deduction requests from employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

5

Pay rate information should be stored in

A)employees' personnel files.

B)employee subsidiary ledgers.

C)the payroll master file.

D)electronic time cards.

A)employees' personnel files.

B)employee subsidiary ledgers.

C)the payroll master file.

D)electronic time cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

6

________ are used to transmit time and attendance data directly to the payroll processing system.

A)Badge readers

B)Electronic time clocks

C)Magnetic cards

D)RFID tags

A)Badge readers

B)Electronic time clocks

C)Magnetic cards

D)RFID tags

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements is false regarding the use of incentives,commissions and bonuses in the payroll system?

A)Using incentives, commissions, and bonuses requires linking the payroll system and the information systems of sales and other cycles in order to collect the data used to calculate bonuses.

B)Bonus/incentive schemes must be properly designed with realistic, attainable goals that can be objectively measured.

C)Incentive schemes can result in undesirable behavior.

D)Incentive schemes can create fraud.

A)Using incentives, commissions, and bonuses requires linking the payroll system and the information systems of sales and other cycles in order to collect the data used to calculate bonuses.

B)Bonus/incentive schemes must be properly designed with realistic, attainable goals that can be objectively measured.

C)Incentive schemes can result in undesirable behavior.

D)Incentive schemes can create fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which type of payroll report includes the details of the current paycheck and deductions as well as year-to-date totals?

A)Payroll register.

B)Deduction register.

C)Employee earnings statement.

D)Federal W-4 form.

A)Payroll register.

B)Deduction register.

C)Employee earnings statement.

D)Federal W-4 form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

9

Identify the item below that is not a desired result of an employee bonus system.

A)Employees may recommend unnecessary services to customers in order to exceed set sales quotas and earn a bonus.

B)Employees may look for ways to improve service.

C)Employees may analyze their work environment and find ways to cut costs.

D)Employees may work harder and may be more motivated to exceed target goals to earn a bonus.

A)Employees may recommend unnecessary services to customers in order to exceed set sales quotas and earn a bonus.

B)Employees may look for ways to improve service.

C)Employees may analyze their work environment and find ways to cut costs.

D)Employees may work harder and may be more motivated to exceed target goals to earn a bonus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

10

The document that lists each employee's gross pay,payroll deductions,and net pay in a multicolumn format is called

A)an employee earnings statement.

B)the payroll register.

C)a deduction register.

D)an employee time sheet summary.

A)an employee earnings statement.

B)the payroll register.

C)a deduction register.

D)an employee time sheet summary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which type of payroll report contains information such as the employees' gross pay,payroll deductions,and net pay in a multicolumn format?

A)Payroll register.

B)Deduction register.

C)Employee earnings statement.

D)Federal W-4 form.

A)Payroll register.

B)Deduction register.

C)Employee earnings statement.

D)Federal W-4 form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which type of payroll report lists the voluntary deductions for each employee?

A)Payroll register.

B)Deduction register.

C)Employee earnings statement.

D)Federal W-4 form.

A)Payroll register.

B)Deduction register.

C)Employee earnings statement.

D)Federal W-4 form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which activity below is not performed by Human Resources management (HRM)?

A)Product design.

B)Training.

C)Job assignment.

D)Recruitment and hiring.

A)Product design.

B)Training.

C)Job assignment.

D)Recruitment and hiring.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is not classified as a voluntary deduction?

A)Pension plan contributions.

B)FICA.

C)Health insurance premiums .

D)Deductions for a charity organization

A)Pension plan contributions.

B)FICA.

C)Health insurance premiums .

D)Deductions for a charity organization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

15

As each payroll transaction is processed,the system should also

A)allocate labor costs to appropriate general ledger accounts

B)use cumulative totals generated from a payroll to create a summary journal entry to be posted to the general ledger

C)both A and B above

D)The HRM system should not perform either activity A or B.

A)allocate labor costs to appropriate general ledger accounts

B)use cumulative totals generated from a payroll to create a summary journal entry to be posted to the general ledger

C)both A and B above

D)The HRM system should not perform either activity A or B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

16

Payroll deductions fall into the broad categories of ________ and ________.

A)payroll tax withholdings; voluntary deductions

B)unemployment; social security taxes

C)unemployment taxes; income taxes

D)voluntary deductions; income taxes

A)payroll tax withholdings; voluntary deductions

B)unemployment; social security taxes

C)unemployment taxes; income taxes

D)voluntary deductions; income taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

17

An effective way an organization can eliminate paper paychecks while maintaining adequate accounting records is to

A)pay in cash only.

B)pay with money orders.

C)use direct deposit.

D)use Electronic Funds Transfer.

A)pay in cash only.

B)pay with money orders.

C)use direct deposit.

D)use Electronic Funds Transfer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

18

Who does the payroll system issue checks to?

A)Employees and to banks participating in direct deposit.

B)The company's payroll bank account.

C)Insurance companies.

D)All of the above are correct.

A)Employees and to banks participating in direct deposit.

B)The company's payroll bank account.

C)Insurance companies.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

19

For recording time spent on specific work projects,manufacturing companies usually use a

A)job time ticket.

B)time card.

C)time clock.

D)labor time card.

A)job time ticket.

B)time card.

C)time clock.

D)labor time card.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which department should have the sole ability to provide information to the AIS about hiring,terminations,and pay rate changes?

A)Accounting.

B)Benefit.

C)Production.

D)HRM.

A)Accounting.

B)Benefit.

C)Production.

D)HRM.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

21

A growing number of companies require some of their upper level executives to spend time performing job duties of rank-and-file employees.When the CEO of Loews Hotels assumed the role of bellman,he discovered

A)that the company's polyester uniform caused him to sweat a great deal.

B)evidence of fraud in several hotel locations.

C)instances where company employees fell asleep on the job.

D)situations where employees were not treating customers properly.

A)that the company's polyester uniform caused him to sweat a great deal.

B)evidence of fraud in several hotel locations.

C)instances where company employees fell asleep on the job.

D)situations where employees were not treating customers properly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

22

A growing number of companies require some of their upper level executives to spend time performing job duties of rank-and-file employees.When the vice president of DaVita Inc.,a major provider of dialysis treatment,spent three days working in one of the company's clinics,she understood

A)that the company's polyester uniform caused her to sweat a great deal.

B)evidence of fraud in several clinic locations.

C)how the need to respond to life-threatening emergencies can result in delays in completing corporate-mandated reports.

D)situations where employees were treating customers properly.

A)that the company's polyester uniform caused her to sweat a great deal.

B)evidence of fraud in several clinic locations.

C)how the need to respond to life-threatening emergencies can result in delays in completing corporate-mandated reports.

D)situations where employees were treating customers properly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

23

Involving accountants in executive compensation plans is often especially helpful

A)in keeping track of the executive compensation plan.

B)in identifying the appropriate metrics to use when linking compensation to performance.

C)in reducing the total amount of compensation paid to executives.

D)in suggesting the appropriate amount of compensation executives should be paid.

A)in keeping track of the executive compensation plan.

B)in identifying the appropriate metrics to use when linking compensation to performance.

C)in reducing the total amount of compensation paid to executives.

D)in suggesting the appropriate amount of compensation executives should be paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

24

Describe the basic activities in an HRM/payroll cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

25

Discuss the various types and sources of input into the HRM/payroll cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

26

Why are accurate cumulative earnings records important?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following controls can minimize the threat of theft or fraudulent distribution of paychecks?

A)Redepositing unclaimed paychecks and investigating cause.

B)Issuing earnings statements to employees.

C)Using biometric authentication.

D)Conducting criminal background investigation checks of all applicants for finance related positions.

A)Redepositing unclaimed paychecks and investigating cause.

B)Issuing earnings statements to employees.

C)Using biometric authentication.

D)Conducting criminal background investigation checks of all applicants for finance related positions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following controls can minimize the threat of inaccurate time and attendance data?

A)Redepositing unclaimed paychecks and investigating cause.

B)Issuing earnings statements to employees.

C)Using biometric authentication.

D)Conducting criminal background investigation checks of all applicants for finance related positions.

A)Redepositing unclaimed paychecks and investigating cause.

B)Issuing earnings statements to employees.

C)Using biometric authentication.

D)Conducting criminal background investigation checks of all applicants for finance related positions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

29

Identify the following item that should contribute to the efficiency of a payroll system.

A)Segregation of check distribution from payroll duties.

B)Prompt redeposit of unclaimed paychecks.

C)Use a separate payroll bank account.

D)Direct deposit of checks.

A)Segregation of check distribution from payroll duties.

B)Prompt redeposit of unclaimed paychecks.

C)Use a separate payroll bank account.

D)Direct deposit of checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

30

Executive immersion experiences are important because

A)CEOs often have no idea what rank-and-file employees do on a daily basis.

B)employees who have positive attitudes contribute to increasing company profits.

C)many employees feel upper management is out of touch.

D)it is important for organizations to take social responsibility seriously.

A)CEOs often have no idea what rank-and-file employees do on a daily basis.

B)employees who have positive attitudes contribute to increasing company profits.

C)many employees feel upper management is out of touch.

D)it is important for organizations to take social responsibility seriously.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

31

Identify the two types of payroll deductions and give two examples of each type.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

32

Explain the functions of the payroll register,deduction register,and earnings statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

33

The employer pays a portion of some payroll taxes and employee benefits.Both the employee and employer pay which benefit or tax listed below?

A)Social security taxes.

B)Federal income taxes.

C)State income taxes.

D)Municipal taxes.

A)Social security taxes.

B)Federal income taxes.

C)State income taxes.

D)Municipal taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

34

Accountants can help executive compensation plan boards

A)comply with legal and regulatory requirements.

B)by identifying the best ways to keep the details of compensation plans out of the hands of external parties.

C)avoid paying excessive amounts of "perks" to executives.

D)distribute information regarding how well each executive is performing their job.

A)comply with legal and regulatory requirements.

B)by identifying the best ways to keep the details of compensation plans out of the hands of external parties.

C)avoid paying excessive amounts of "perks" to executives.

D)distribute information regarding how well each executive is performing their job.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

35

Direct deposit of employee paychecks is one way an organization can improve efficiency and reduce payroll-processing costs.Which statement regarding direct deposit is false?

A)The cashier does not authorize the transfer of funds from the organization's checking account to a payroll checking account.

B)The cashier does not have to sign employee paychecks.

C)Employees who are part of a direct deposit program receive a copy of their paycheck indicating the amount deposited.

D)Employees who are part of a direct deposit program receive an earnings statement on payday rather than a paper check.

A)The cashier does not authorize the transfer of funds from the organization's checking account to a payroll checking account.

B)The cashier does not have to sign employee paychecks.

C)Employees who are part of a direct deposit program receive a copy of their paycheck indicating the amount deposited.

D)Employees who are part of a direct deposit program receive an earnings statement on payday rather than a paper check.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following documents would be likely to yield the greatest cost saving by converting from paper to electronic?

A)Payroll register.

B)Employee's earnings statement.

C)Deduction register.

D)Time card.

A)Payroll register.

B)Employee's earnings statement.

C)Deduction register.

D)Time card.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

37

The sales department administrative assistant has been assigning phone order sales to her brother-in-law,a company sales person.Company policy is to pay commissions only on orders directly received by sales people,not on orders received over the phone.The resulting fraudulent commission payments might best have been prevented by requiring that

A)sales commission statements be supported by sales order forms signed by the customer and approved by the sales manager.

B)sales order forms be prenumbered and accounted for by the sales department manager.

C)sales orders and commission statements be approved by the accounting department.

D)disbursement vouchers for commission payments be reviewed by the internal audit department and compared to sales commission statements and sales orders.

A)sales commission statements be supported by sales order forms signed by the customer and approved by the sales manager.

B)sales order forms be prenumbered and accounted for by the sales department manager.

C)sales orders and commission statements be approved by the accounting department.

D)disbursement vouchers for commission payments be reviewed by the internal audit department and compared to sales commission statements and sales orders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

38

The HRM department should immediately delete records of employees who quit to prevent other employees from assuming their identities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following controls can minimize the threat of errors in processing payroll?

A)Redepositing unclaimed paychecks and investigating cause.

B)Issuing earnings statements to employees.

C)Using biometric authentication.

D)Conducting criminal background investigation checks of all applicants for finance related positions.

A)Redepositing unclaimed paychecks and investigating cause.

B)Issuing earnings statements to employees.

C)Using biometric authentication.

D)Conducting criminal background investigation checks of all applicants for finance related positions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following controls can minimize the threat of hiring unqualified or larcenous employees?

A)Redepositing unclaimed paychecks and investigating cause.

B)Issuing earnings statements to employees.

C)Using biometric authentication.

D)Conducting criminal background investigation checks of all applicants for finance related positions.

A)Redepositing unclaimed paychecks and investigating cause.

B)Issuing earnings statements to employees.

C)Using biometric authentication.

D)Conducting criminal background investigation checks of all applicants for finance related positions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

41

The purpose of a general ledger payroll clearing account is

A)to check the accuracy and completeness of payroll recording and its allocation to cost centers.

B)to make the bank reconciliation easier.

C)to make sure that all employees are paid correctly each week.

D)to prevent the cashier from having complete control of the payroll cycle.

A)to check the accuracy and completeness of payroll recording and its allocation to cost centers.

B)to make the bank reconciliation easier.

C)to make sure that all employees are paid correctly each week.

D)to prevent the cashier from having complete control of the payroll cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

42

The threat of violation of employment laws relates directly to which activity?

A)Payroll processing.

B)The collection employee time data.

C)Hiring and recruiting.

D)Benefit processing.

A)Payroll processing.

B)The collection employee time data.

C)Hiring and recruiting.

D)Benefit processing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following will limit a firm's potential loss exposure from paycheck forgery?

A)Segregation of check distribution from payroll duties.

B)Prompt redeposit of unclaimed paychecks.

C)A separate payroll bank account.

D)Direct deposit of checks.

A)Segregation of check distribution from payroll duties.

B)Prompt redeposit of unclaimed paychecks.

C)A separate payroll bank account.

D)Direct deposit of checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

44

Because many HRM / payroll master databases typically contain only descriptive information (such as which employees possess which skills),many firms have deployed ________ to more effectively leverage employees knowledge and skills.

A)relational databases

B)knowledge management systems

C)talent management systems

D)cardinality systems

A)relational databases

B)knowledge management systems

C)talent management systems

D)cardinality systems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is a control that can be implemented to help prevent paychecks being issued to a "phantom" or "ghost" employee?

A)The cashier should sign all payroll checks.

B)Sequentially prenumber all payroll checks.

C)Use an imprest account to clear payroll checks.

D)Paychecks should be physically distributed by someone who does not authorize time data or record payroll.

A)The cashier should sign all payroll checks.

B)Sequentially prenumber all payroll checks.

C)Use an imprest account to clear payroll checks.

D)Paychecks should be physically distributed by someone who does not authorize time data or record payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

46

Identify the firm below where employees' knowledge is likely to be more valuable than the value of a company's tangible assets.

A)An international airline company.

B)A law firm.

C)An automobile manufacturer.

D)A grocery store.

A)An international airline company.

B)A law firm.

C)An automobile manufacturer.

D)A grocery store.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

47

The results of an internal audit finds that there is a problem with inaccurate time data being entered into the payroll system.What is an applicable control that can help prevent this event from occurring in the future?

A)Proper segregation of duties.

B)Automation of data collection.

C)Sound hiring procedures.

D)Review of appropriate performance metrics.

A)Proper segregation of duties.

B)Automation of data collection.

C)Sound hiring procedures.

D)Review of appropriate performance metrics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

48

The most vital control in preventing unauthorized changes to the payroll master file is

A)segregation of duties between the preparation of paychecks and their review.

B)segregation of duties between the preparation of paychecks and their distribution.

C)segregation of duties between the authorization of changes and the physical handling of paychecks.

D)having the controller closely review and then approve any changes to the master file.

A)segregation of duties between the preparation of paychecks and their review.

B)segregation of duties between the preparation of paychecks and their distribution.

C)segregation of duties between the authorization of changes and the physical handling of paychecks.

D)having the controller closely review and then approve any changes to the master file.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following control can reduce the distribution of fraudulent paychecks?

A)Have internal audit investigate unclaimed paychecks.

B)Allow department managers to investigate unclaimed paychecks.

C)Immediately mark "void" across all unclaimed paychecks.

D)Match up all paychecks with time cards.

A)Have internal audit investigate unclaimed paychecks.

B)Allow department managers to investigate unclaimed paychecks.

C)Immediately mark "void" across all unclaimed paychecks.

D)Match up all paychecks with time cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

50

What is the best control to reduce the risk of losing payroll data?

A)Passwords.

B)Physical security controls.

C)Backup and disaster recovery procedures.

D)Supervisory review.

A)Passwords.

B)Physical security controls.

C)Backup and disaster recovery procedures.

D)Supervisory review.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

51

Batch processing continues to be widely used to process payroll transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

52

A "zero balance check" refers to which of the following control procedures?

A)The ACH clearing account shows a zero balance once all entries are posted.

B)cross-footing the payroll register

C)The payroll clearing account shows a zero balance once all entries are posted.

D)trial balance showing that debits equal credits

A)The ACH clearing account shows a zero balance once all entries are posted.

B)cross-footing the payroll register

C)The payroll clearing account shows a zero balance once all entries are posted.

D)trial balance showing that debits equal credits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is not a potential effect of inaccurate data on employee time cards?

A)Increased labor expenses.

B)Erroneous labor expense reports.

C)Damaged employee morale.

D)Inaccurate calculation of overhead costs.

A)Increased labor expenses.

B)Erroneous labor expense reports.

C)Damaged employee morale.

D)Inaccurate calculation of overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

54

Why is a separate payroll account used to clear payroll checks?

A)For internal control purposes, to help limit any exposure to loss by the company.

B)To make bank reconciliation easier.

C)To separate payroll and expense checks.

D)All of the above are correct.

A)For internal control purposes, to help limit any exposure to loss by the company.

B)To make bank reconciliation easier.

C)To separate payroll and expense checks.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

55

What is a potential threat to the specific activity of payroll processing?

A)Hiring unqualified employees.

B)Poor system performance.

C)Violations of employment laws.

D)Unauthorized changes to the payroll master file.

A)Hiring unqualified employees.

B)Poor system performance.

C)Violations of employment laws.

D)Unauthorized changes to the payroll master file.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

56

Knowledge management systems (KMS)permit organizations to

A)store employee solutions to specific problems in a shared database.

B)learn from individuals external to the organization.

C)perform background checks on potential employees.

D)gain competitive business intelligence on competitors.

A)store employee solutions to specific problems in a shared database.

B)learn from individuals external to the organization.

C)perform background checks on potential employees.

D)gain competitive business intelligence on competitors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which control would be most appropriate to address the problem of inaccurate payroll processing?

A)Segregation of duties: HRM department updates master data, but only payroll department issues paychecks.

B)Redepositing unclaimed paychecks and investigating cause.

C)Cross-footing of the payroll register.

D)An imprest payroll checking account.

A)Segregation of duties: HRM department updates master data, but only payroll department issues paychecks.

B)Redepositing unclaimed paychecks and investigating cause.

C)Cross-footing of the payroll register.

D)An imprest payroll checking account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

58

All of the following are controls that should be implemented in a payroll process,except

A)supervisors distribute paychecks since they should know all employees in their department.

B)someone independent of the payroll process should reconcile the payroll bank account.

C)sequential numbering of paychecks and accounting for the numbers.

D)restrict access to blank payroll checks and documents.

A)supervisors distribute paychecks since they should know all employees in their department.

B)someone independent of the payroll process should reconcile the payroll bank account.

C)sequential numbering of paychecks and accounting for the numbers.

D)restrict access to blank payroll checks and documents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

59

When using electronic documents,________ increase(s)the accuracy of data entry.

A)access controls

B)separation of duties

C)general controls

D)application controls

A)access controls

B)separation of duties

C)general controls

D)application controls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

60

The average annual management salary at Iyov Management is $100,000.If the average turnover rate for employees is six per year,what is the approximate average annual cost of turnover?

A)$100,000.

B)$400,000

C)$600,000.

D)$900,000.

A)$100,000.

B)$400,000

C)$600,000.

D)$900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

61

A workforce inventory report

A)is filed each quarter to reconcile monthly tax payments with total tax liability for the quarter.

B)is used in preparing labor-related reports for government agencies.

C)is used for employee information and annual payroll reports.

D)is used to document compliance with applicable regulations.

A)is filed each quarter to reconcile monthly tax payments with total tax liability for the quarter.

B)is used in preparing labor-related reports for government agencies.

C)is used for employee information and annual payroll reports.

D)is used to document compliance with applicable regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

62

Falk Noam is the internal auditor for Matan Incorporated.Before investigating the HRM / payroll cycle at Matan,Falk decided to read up on the proper segregation of duties regarding payroll disbursement processes.For strongest segregation of duties,the ________ should periodically observe the paycheck distribution process.

A)accounts payable department

B)cashier

C)internal audit department

D)external auditor

A)accounts payable department

B)cashier

C)internal audit department

D)external auditor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

63

Source data automation is often effective in reducing

A)unintentional errors.

B)intentional errors.

C)accuracy.

D)theft.

A)unintentional errors.

B)intentional errors.

C)accuracy.

D)theft.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

64

For the payroll register below,all the following processing controls would be useful except

A)Concurrent update control.

B)Cross-footing balance test.

C)Mathematical accuracy test.

D)Hash total on Employee No.

A)Concurrent update control.

B)Cross-footing balance test.

C)Mathematical accuracy test.

D)Hash total on Employee No.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following is a control that addresses the threat of unauthorized changes to the payroll master file?

A)Restriction of access to the EFT system.

B)Biometric authentication.

C)Segregation of duties.

D)Sound hiring procedures.

A)Restriction of access to the EFT system.

B)Biometric authentication.

C)Segregation of duties.

D)Sound hiring procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

66

Falk Noam is the internal auditor for Matan Incorporated.Before investigating the HRM / payroll cycle at Matan,Falk decided to read up on the proper segregation of duties regarding payroll disbursement processes.For strongest segregation of duties,the ________ should record payroll.

A)accounts payable department

B)cashier

C)internal audit department

D)external auditor

A)accounts payable department

B)cashier

C)internal audit department

D)external auditor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

67

A report of employer's quarterly federal tax return (showing all wages subject to tax and amounts withheld for income tax and FICA)is called

A)form W-2.

B)form W-3.

C)form 1099-Misc.

D)form 941.

A)form W-2.

B)form W-3.

C)form 1099-Misc.

D)form 941.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

68

Falk Noam is the internal auditor for Matan Incorporated.Before investigating the HRM / payroll cycle at Matan,Falk decided to read up on the proper segregation of duties regarding payroll disbursement processes.For strongest segregation of duties,the ________ should distribute paychecks.

A)accounts payable department

B)cashier

C)internal audit department

D)external auditor

A)accounts payable department

B)cashier

C)internal audit department

D)external auditor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

69

Using financial incentives requires organizations to

A)pay employees less than they would have to if pay was a fixed salary.

B)better monitor employee attendance.

C)link the payroll system to other cycles to calculate incentive payments.

D)better monitor employee effort.

A)pay employees less than they would have to if pay was a fixed salary.

B)better monitor employee attendance.

C)link the payroll system to other cycles to calculate incentive payments.

D)better monitor employee effort.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

70

What factors should be considered in outsourcing payroll to a payroll service bureau? Discuss the advantages and disadvantages of using a payroll service bureau to process a payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

71

A payroll clearing account is used to

A)check the accuracy of payroll costs.

B)speed up payroll transaction processing.

C)reduce the transaction costs associated with payroll transaction processing.

D)eliminate the need to manually record payroll transactions.

A)check the accuracy of payroll costs.

B)speed up payroll transaction processing.

C)reduce the transaction costs associated with payroll transaction processing.

D)eliminate the need to manually record payroll transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

72

All of the following regarding payroll checks is correct except

A)access to payroll checks should be restricted.

B)payroll checks should be sequentially pre-numbered.

C)payroll checks should be drawn on the organization's regular bank account(s).

D)the cashier should sign payroll checks.

A)access to payroll checks should be restricted.

B)payroll checks should be sequentially pre-numbered.

C)payroll checks should be drawn on the organization's regular bank account(s).

D)the cashier should sign payroll checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

73

A report of income paid to independent contractors is called

A)form W-2.

B)form W-3.

C)form 1099-Misc.

D)form 941.

A)form W-2.

B)form W-3.

C)form 1099-Misc.

D)form 941.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

74

Describe benefits and threats of incentive and bonus programs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

75

Form 941

A)is filed each quarter to reconcile monthly tax payments with total tax liability for the quarter.

B)is used in preparing labor-related reports for government agencies.

C)is used for employee information and annual payroll reports.

D)is used to document compliance with applicable regulations.

A)is filed each quarter to reconcile monthly tax payments with total tax liability for the quarter.

B)is used in preparing labor-related reports for government agencies.

C)is used for employee information and annual payroll reports.

D)is used to document compliance with applicable regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

76

Explain benefits to companies and to employees using electronic direct deposit for payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

77

A report of wages and withholdings for each employee is called

A)form W-2.

B)form W-3.

C)form 1099-Misc.

D)form 941.

A)form W-2.

B)form W-3.

C)form 1099-Misc.

D)form 941.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

78

What controls are available to address the threat of payroll errors?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

79

Discuss the threat of unauthorized changes to the payroll master file and its consequences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

80

For the payroll register below,all the following data entry controls would be useful except

A)Validity check on Fed. Tax.

B)Sequence check on Employee No.

C)Limit check on Hours.

D)Field check on Pay Rate.

A)Validity check on Fed. Tax.

B)Sequence check on Employee No.

C)Limit check on Hours.

D)Field check on Pay Rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck