Deck 12: Derivatives and Foreign Currency: Concepts and Common Transactions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/40

العب

ملء الشاشة (f)

Deck 12: Derivatives and Foreign Currency: Concepts and Common Transactions

1

Gains or losses on foreign currency transactions are recorded before the related receivable or payable is settled when

A)the government cannot set an exchange rate for the foreign currency.

B)the foreign currency is unknown.

C)the fiscal year ends after the settlement of the receivable or payable.

D)the fiscal year ends before the settlement of the receivable or payable.

A)the government cannot set an exchange rate for the foreign currency.

B)the foreign currency is unknown.

C)the fiscal year ends after the settlement of the receivable or payable.

D)the fiscal year ends before the settlement of the receivable or payable.

D

2

If a sale on account by a U.S.company is made with a foreign company,and the U.S.company has no foreign currency risk,then

A)the U.S.company has measured the transaction in US dollars.

B)the U.S.company has denominated the transaction in US dollars.

C)the foreign company has measured the transaction in their own currency.

D)the foreign company has denominated the transaction in their own currency.

A)the U.S.company has measured the transaction in US dollars.

B)the U.S.company has denominated the transaction in US dollars.

C)the foreign company has measured the transaction in their own currency.

D)the foreign company has denominated the transaction in their own currency.

B

3

With respect to exchange rates,which of the following statements is true?

A)An official exchange rate is the "market" rate resulting from the supply and demand for a currency.

B)A floating exchange rate is the "market" rate resulting from the supply and demand for a currency.

C)A government cannot set an exchange rate for their currency that is higher (weakens their currency)than the quoted interbank market rate.

D)A government cannot set an exchange rate for their currency that is lower (strengthens their currency)than the quoted interbank market rate.

A)An official exchange rate is the "market" rate resulting from the supply and demand for a currency.

B)A floating exchange rate is the "market" rate resulting from the supply and demand for a currency.

C)A government cannot set an exchange rate for their currency that is higher (weakens their currency)than the quoted interbank market rate.

D)A government cannot set an exchange rate for their currency that is lower (strengthens their currency)than the quoted interbank market rate.

B

4

Use the following information to answer the question(s)below.

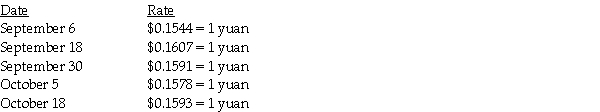

On October 4,2010,Sooty Corporation borrowed 250,000 British pounds from a London bank,evidenced by an interest-bearing note payable due in one year.The note was payable in pounds.Exchange rates for pounds were:

What exchange gain or loss appeared on Sooty's 2010 income statement?

A)a loss of $10,000

B)a loss of $15,000

C)a gain of $10,000

D)a gain of $15,000

On October 4,2010,Sooty Corporation borrowed 250,000 British pounds from a London bank,evidenced by an interest-bearing note payable due in one year.The note was payable in pounds.Exchange rates for pounds were:

What exchange gain or loss appeared on Sooty's 2010 income statement?

A)a loss of $10,000

B)a loss of $15,000

C)a gain of $10,000

D)a gain of $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

5

On November 14,2011,Scuby Company (a U.S.corporation)enters into a transaction which is denominated in the Canadian dollar.Assume the exchange rate at November 14 is $1.03,and at the December 31 year-end reporting date,the exchange rate is $1.07.On January 27,2012,when the transaction is settled,the exchange rate is $1.05.At the date of settlement,which of the following is correct?

A)The historical rate = $1.05,and the spot rate at which it is settled is the same as the current rate at $1.07.

B)The historical rate = $1.03,and the spot rate at which it is settled is the same as the current rate at $1.06.

C)The historical rate = $1.05,the current rate for reporting at December 31,2011 is $1.07,and the spot rate at which it is settled is $1.03.

D)The historical rate = $1.03,the current rate for reporting at December 31,2011 is $1.07,and the spot rate at which it is settled is $1.05.

A)The historical rate = $1.05,and the spot rate at which it is settled is the same as the current rate at $1.07.

B)The historical rate = $1.03,and the spot rate at which it is settled is the same as the current rate at $1.06.

C)The historical rate = $1.05,the current rate for reporting at December 31,2011 is $1.07,and the spot rate at which it is settled is $1.03.

D)The historical rate = $1.03,the current rate for reporting at December 31,2011 is $1.07,and the spot rate at which it is settled is $1.05.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is a true statement regarding the recording of a transaction which involves foreign currency?

A)A transaction is always settled in the currency in which it is denominated.

B)A transaction is always measured in the currency in which it is denominated.

C)A transaction is always settled in the currency in which it is measured.

D)A transaction is always recorded in the currency in which it is denominated.

A)A transaction is always settled in the currency in which it is denominated.

B)A transaction is always measured in the currency in which it is denominated.

C)A transaction is always settled in the currency in which it is measured.

D)A transaction is always recorded in the currency in which it is denominated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

7

Use the following information to answer the question(s)below.

On November 1,2010,Rolleks Corporation sold merchandise to Watchem Corporation,a Swiss firm.Rolleks measured and recorded the account receivable from the sale at $107,100.Watchem paid for this account on November 30,2010.Spot rates for Swiss francs on November 1 and November 30,respectively,were $1.05 and $1.02.

If the sale of the merchandise was denominated in Swiss francs,the November 30 entry to record the receipt of payment from Watchem included a

A)credit to Accounts Receivable for $104,040.

B)credit to Exchange Gain for $3,060.

C)debit to Cash for $107,100.

D)debit to Exchange Loss for $3,060.

On November 1,2010,Rolleks Corporation sold merchandise to Watchem Corporation,a Swiss firm.Rolleks measured and recorded the account receivable from the sale at $107,100.Watchem paid for this account on November 30,2010.Spot rates for Swiss francs on November 1 and November 30,respectively,were $1.05 and $1.02.

If the sale of the merchandise was denominated in Swiss francs,the November 30 entry to record the receipt of payment from Watchem included a

A)credit to Accounts Receivable for $104,040.

B)credit to Exchange Gain for $3,060.

C)debit to Cash for $107,100.

D)debit to Exchange Loss for $3,060.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

8

The exchange rates between the Australian dollar and the U.S.dollar were as follows:  This chart shows a

This chart shows a

A)strengthening Australian Dollar which makes it less expensive for Americans to buy Australian goods.

B)weakening Australian dollar which makes it less expensive for Americans to buy Australian goods.

C)strengthening Australian dollar which makes it more expensive for Americans to buy Australian goods.

D)weakening Australian dollar which makes it more expensive for Americans to buy Australian goods.

This chart shows a

This chart shows aA)strengthening Australian Dollar which makes it less expensive for Americans to buy Australian goods.

B)weakening Australian dollar which makes it less expensive for Americans to buy Australian goods.

C)strengthening Australian dollar which makes it more expensive for Americans to buy Australian goods.

D)weakening Australian dollar which makes it more expensive for Americans to buy Australian goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the following information to answer the question(s)below.

On November 1,2010,Rolleks Corporation sold merchandise to Watchem Corporation,a Swiss firm.Rolleks measured and recorded the account receivable from the sale at $107,100.Watchem paid for this account on November 30,2010.Spot rates for Swiss francs on November 1 and November 30,respectively,were $1.05 and $1.02.

If the sale of merchandise is denominated in dollars,the November 30 entry to record receipt of the payment from Watchem included a

A)credit to Accounts Receivable for $104,040.

B)credit to Exchange Gain for $3,060.

C)debit to Cash for $107,100.

D)debit to Exchange Loss for $3,060.

On November 1,2010,Rolleks Corporation sold merchandise to Watchem Corporation,a Swiss firm.Rolleks measured and recorded the account receivable from the sale at $107,100.Watchem paid for this account on November 30,2010.Spot rates for Swiss francs on November 1 and November 30,respectively,were $1.05 and $1.02.

If the sale of merchandise is denominated in dollars,the November 30 entry to record receipt of the payment from Watchem included a

A)credit to Accounts Receivable for $104,040.

B)credit to Exchange Gain for $3,060.

C)debit to Cash for $107,100.

D)debit to Exchange Loss for $3,060.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

10

When the billing for a U.S.company's sale to a company in a foreign country is denominated in U.S.dollars,________ is required when preparing journal entries for the sale.

A)translation to a foreign currency

B)conversion to a foreign currency

C)translation to U.S.dollars

D)no translation

A)translation to a foreign currency

B)conversion to a foreign currency

C)translation to U.S.dollars

D)no translation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

11

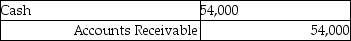

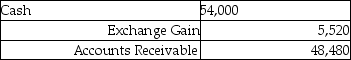

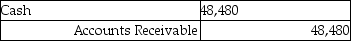

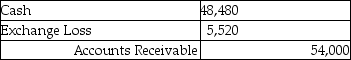

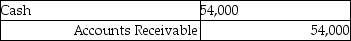

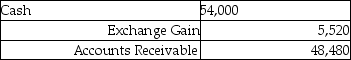

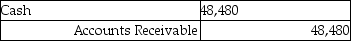

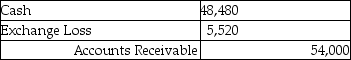

Cass Corporation's balance sheet at December 31,2011 included a $48,480 account receivable from Redmun Corporation of Mexico.The account receivable was denominated as 600,000 Mexican pesos.What entry did Cass make on January 16,2012 when the account receivable was collected and the exchange rate for the peso was $.09?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

12

Use the following information to answer the question(s)below.

On October 4,2010,Sooty Corporation borrowed 250,000 British pounds from a London bank,evidenced by an interest-bearing note payable due in one year.The note was payable in pounds.Exchange rates for pounds were:

What exchange gain or loss appeared on Sooty's 2011 income statement?

A)a loss of $15,000

B)a loss of $5,000

C)a gain of $15,000

D)a gain of $5,000

On October 4,2010,Sooty Corporation borrowed 250,000 British pounds from a London bank,evidenced by an interest-bearing note payable due in one year.The note was payable in pounds.Exchange rates for pounds were:

What exchange gain or loss appeared on Sooty's 2011 income statement?

A)a loss of $15,000

B)a loss of $5,000

C)a gain of $15,000

D)a gain of $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

13

On May 1,2011,Deerfield Corporation purchased merchandise from a German firm for 78,000 euros when the spot rate for the euro was 1.48 euro per dollar.The account payable was denominated in the euro.Deerfield settled the account on August 1 when the spot rate for the euro was 1.39 euro per dollar.How much cash will Deerfield have to disburse to settle the account?

A)$ 52,702.72

B)$ 56,115.11

C)$108,420.00

D)$115,440.00

A)$ 52,702.72

B)$ 56,115.11

C)$108,420.00

D)$115,440.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

14

A U.S.importer that purchased merchandise from a South Korean firm would be exposed to a net exchange gain on the unpaid balance if the

A)dollar weakened relative to the Korean won and the won was the denominated currency.

B)dollar weakened relative to the Korean won and the dollar was the denominated currency.

C)dollar strengthened relative to the Korean won and the won was the denominated currency.

D)dollar strengthened relative to the Korean won and the dollar was the denominated currency.

A)dollar weakened relative to the Korean won and the won was the denominated currency.

B)dollar weakened relative to the Korean won and the dollar was the denominated currency.

C)dollar strengthened relative to the Korean won and the won was the denominated currency.

D)dollar strengthened relative to the Korean won and the dollar was the denominated currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

15

Use the following information to answer the question(s)below.

On November 1,2010,Rolleks Corporation sold merchandise to Watchem Corporation,a Swiss firm.Rolleks measured and recorded the account receivable from the sale at $107,100.Watchem paid for this account on November 30,2010.Spot rates for Swiss francs on November 1 and November 30,respectively,were $1.05 and $1.02.

On December 5,2010,Unca Corporation,a U.S.firm,bought inventory items from Skagerrak Corporation of Norway for 1,000,000 Norwegian kroner when the spot rate for kroner was $0.166.The purchase was denominated in kroner.At Unca's fiscal year end,December 31,2010,the spot rate was $0.171.On January 4,2011,Unca purchased 1,000,000 kroner for $167,500 and paid the invoice.How much gain or (loss)did Unca report in its 2010 and 2011 income statements,respectively?

A)$(5,000)and $1,500

B)$0 and ($1,500)

C)($5,000)and $3,500

D)$0 and ($3,500)

On November 1,2010,Rolleks Corporation sold merchandise to Watchem Corporation,a Swiss firm.Rolleks measured and recorded the account receivable from the sale at $107,100.Watchem paid for this account on November 30,2010.Spot rates for Swiss francs on November 1 and November 30,respectively,were $1.05 and $1.02.

On December 5,2010,Unca Corporation,a U.S.firm,bought inventory items from Skagerrak Corporation of Norway for 1,000,000 Norwegian kroner when the spot rate for kroner was $0.166.The purchase was denominated in kroner.At Unca's fiscal year end,December 31,2010,the spot rate was $0.171.On January 4,2011,Unca purchased 1,000,000 kroner for $167,500 and paid the invoice.How much gain or (loss)did Unca report in its 2010 and 2011 income statements,respectively?

A)$(5,000)and $1,500

B)$0 and ($1,500)

C)($5,000)and $3,500

D)$0 and ($3,500)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

16

A direct quote for the U.S.dollar is given at $1.45 per 1 foreign currency unit (fcu).The respective indirect quote for the U.S.dollar would be reported as

A)1)45 fcu = $1.00.

B)1)45 fcu = $.6897.

C))6897 fcu = $1.00.

D)1)00 fcu = $1.45.

A)1)45 fcu = $1.00.

B)1)45 fcu = $.6897.

C))6897 fcu = $1.00.

D)1)00 fcu = $1.45.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

17

Use the following information to answer the question(s)below.

On October 4,2010,Sooty Corporation borrowed 250,000 British pounds from a London bank,evidenced by an interest-bearing note payable due in one year.The note was payable in pounds.Exchange rates for pounds were:

What is the final amount of the loan payable that Sooty repaid?

A)$250,000

B)$287,500

C)$397,500

D)$402,500

On October 4,2010,Sooty Corporation borrowed 250,000 British pounds from a London bank,evidenced by an interest-bearing note payable due in one year.The note was payable in pounds.Exchange rates for pounds were:

What is the final amount of the loan payable that Sooty repaid?

A)$250,000

B)$287,500

C)$397,500

D)$402,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

18

Ulysses Company purchases goods from China amounting to 372,372 Yuan (the transaction is denominated in the Chinese Yuan).Assume the Yuan is trading at $0.154 at the date the goods are ordered,and the Yuan is trading at $0.155 at the date the goods are received,and when the invoice is paid a month later,the Yuan is trading at $.156.Assume all three dates are in the same fiscal year.Which of the following is true?

A)The entry to record the payment will include a gain of $744.74.

B)The entry to record the payment will include a gain of $372.37.

C)The entry to record the purchase will include a credit to Accounts Payable of $57,345.29.

D)The entry to record the purchase will include a credit to Accounts Payable of $57,717.66.

A)The entry to record the payment will include a gain of $744.74.

B)The entry to record the payment will include a gain of $372.37.

C)The entry to record the purchase will include a credit to Accounts Payable of $57,345.29.

D)The entry to record the purchase will include a credit to Accounts Payable of $57,717.66.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a U.S.company is preparing a journal entry for a recent purchase,foreign-currency-denominated purchases must be measured in ________ at the purchase date using the foreign currency ________ rate on the purchase date.

A)foreign currency;spot

B)foreign currency;future

C)U)S.dollars;forward

D)U)S.dollars;spot

A)foreign currency;spot

B)foreign currency;future

C)U)S.dollars;forward

D)U)S.dollars;spot

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements is true regarding forward contracts,futures contracts,options and swaps?

A)A forward contract can be purchased on the open market and is recorded at its historical cost,then adjusted for changes in the market.

B)A futures contract is negotiated between two parties who are betting in the opposite direction on the movement of the underlying price.

C)An option is a contract requiring the holder to either "put" or "call" an underlying asset at a specified point in time.

D)A swap is a contract between two parties to exchange an ongoing stream of cash flows.

A)A forward contract can be purchased on the open market and is recorded at its historical cost,then adjusted for changes in the market.

B)A futures contract is negotiated between two parties who are betting in the opposite direction on the movement of the underlying price.

C)An option is a contract requiring the holder to either "put" or "call" an underlying asset at a specified point in time.

D)A swap is a contract between two parties to exchange an ongoing stream of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

21

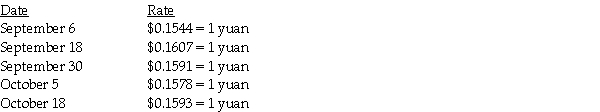

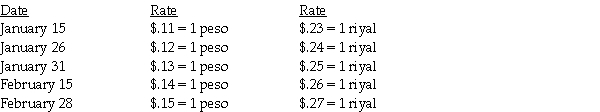

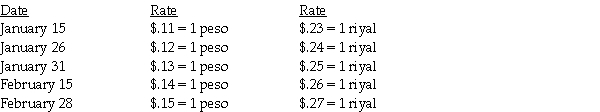

Plymouth Corporation (a U.S.company)began operations on September 1,2011,when the owner borrowed $250,000 to establish the business.Plymouth then had the following import and export transactions with unaffiliated Chinese companies:

September 6,2011 Bought material inventory for 100,000 yuan on account.Invoice denominated in yuan.

September 18,2011 Sold 80% of inventory acquired on 9/6/11 for 110,000 yuan on account.Invoice denominated in yuan.

October 5,2011 Acquired and paid the 100,000 yuan owed to the Chinese supplier

October 18,2011 Collected the 110,000 yuan from the Chinese customer and immediately converted them into U.S.dollars

The following exchange rates apply:

Required:

Required:

1.What were Sales in the September month-end income statement?

2.What was the COGS associated with these sales?

3.What is the Accounts Receivable balance in the balance sheet at September 30,2011?

4.What is the Inventory balance in the balance sheet at September 30,2011?

5.What is the Exchange gain or loss that will be reported for the month of September?

September 6,2011 Bought material inventory for 100,000 yuan on account.Invoice denominated in yuan.

September 18,2011 Sold 80% of inventory acquired on 9/6/11 for 110,000 yuan on account.Invoice denominated in yuan.

October 5,2011 Acquired and paid the 100,000 yuan owed to the Chinese supplier

October 18,2011 Collected the 110,000 yuan from the Chinese customer and immediately converted them into U.S.dollars

The following exchange rates apply:

Required:

Required:1.What were Sales in the September month-end income statement?

2.What was the COGS associated with these sales?

3.What is the Accounts Receivable balance in the balance sheet at September 30,2011?

4.What is the Inventory balance in the balance sheet at September 30,2011?

5.What is the Exchange gain or loss that will be reported for the month of September?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

22

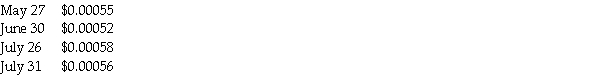

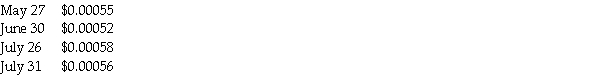

Tank Corporation,a U.S.manufacturer,has a June 30 fiscal year end.Tank sold goods to their customer in Columbia on May 27,2011 for 18,000,000 Columbian pesos.The customer agreed to pay pesos in 60 days.When the customer wired the funds to Tank on July 26,Tank held them in their bank account until July 31 before selling them and converting them to U.S.dollars.The following exchange rates apply:

Required:

Required:

Record the journal entries related to the dates listed above.If no entry is required,state "no entry."

Required:

Required:Record the journal entries related to the dates listed above.If no entry is required,state "no entry."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

23

On October 15,2011,Napole Corporation,a French company,ordered merchandise listed on the internet for 20,000 Euros from Adams Corporation,a U.S.corporation.The euro rate was $1.20 (U.S.dollars)on October 15.On November 15,2011 Adams shipped the goods and billed Napole the purchase price of 20,000 Euros when the euro rate was $1.30.Napole paid the bill on December 10,2011,and Adams immediately exchanged the 20,000 Euros for US dollars when the Euro rate was $1.28 on December 10,2011.

Required:

Compute the foreign currency gain or loss on the December 31,2011 financial statements of Adams and show the related journal entries.

Required:

Compute the foreign currency gain or loss on the December 31,2011 financial statements of Adams and show the related journal entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

24

Johnson Corporation (a U.S.company)began operations on December 1,2010,when the owner contributed $100,000 of his own money to establish the business.Johnson then had the following import and export transactions with unaffiliated Mexican companies:

December 12,2011 Bought inventory for 150,000 pesos on account.

Invoice denominated in pesos.

December 15,2011 Sold 60% of inventory acquired on 12/12/11 for 120,000 pesos on account.Invoice denominated in pesos.

January 1,2012 Acquired and paid the 150,000 pesos owed to the Mexican supplier

January 15,2012 Collected the 120,000 pesos from the Mexican customer and immediately converted them into U.S.dollars

The following exchange rates apply:

Required:

Required:

1.What were Sales in the income statement for the year ended December 31,2011?

2.What was the COGS associated with these sales?

3.What is the Accounts Payable balance in the balance sheet at December 31,2011?

4.What is the Inventory balance in the balance sheet at December 31,2011?

December 12,2011 Bought inventory for 150,000 pesos on account.

Invoice denominated in pesos.

December 15,2011 Sold 60% of inventory acquired on 12/12/11 for 120,000 pesos on account.Invoice denominated in pesos.

January 1,2012 Acquired and paid the 150,000 pesos owed to the Mexican supplier

January 15,2012 Collected the 120,000 pesos from the Mexican customer and immediately converted them into U.S.dollars

The following exchange rates apply:

Required:

Required:1.What were Sales in the income statement for the year ended December 31,2011?

2.What was the COGS associated with these sales?

3.What is the Accounts Payable balance in the balance sheet at December 31,2011?

4.What is the Inventory balance in the balance sheet at December 31,2011?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

25

Charin Corporation,a U.S.corporation,imports and exports small electronics.On December 1,2011,Charin purchased components from an Egyptian manufacturer amounting to 500,000 Egyptian pounds.The purchase is payable in Egyptian pounds.At December 30,Charin wanted to take advantage of favorable exchange rates,but did not have the full amount required to pay off the entire amount.Charin wired the funds to pay off half of the balance owed,and expected to pay the remaining balance on January 3,2012.Charin paid the remaining balance on January 3,2012.

The respective exchange rates were as follows:

Required:

Required:

Document the journal entries related to these transactions for the four dates shown.If no entry is required,record "no entry."

The respective exchange rates were as follows:

Required:

Required:Document the journal entries related to these transactions for the four dates shown.If no entry is required,record "no entry."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

26

On November 1,2010,the Yankee Corporation,a US corporation,purchased and received an extruding machine from Wales Corporation,a UK company.The purchase price was $10,000(U.S.dollars)and Yankee agreed to pay in pounds on February 1,2011.Both corporations are on a calendar year accounting period.Assume that the spot rates for the British pound on November 1,2010,December 31,2010,and February 1,2011,are $1.60,$1.62,and $1.66,respectively.

Required:

Record the November 1,December 31,and February 1 transactions in the General Journals of Yankee Corporation and Wales Corporation.If no entry is required on a particular date,indicate "No entry" in the General Journal.

Required:

Record the November 1,December 31,and February 1 transactions in the General Journals of Yankee Corporation and Wales Corporation.If no entry is required on a particular date,indicate "No entry" in the General Journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

27

Blue Corporation,a U.S.manufacturer,sold goods to their customer in Hungary on December 12,2011 for 6,000,000 Hungarian forints.The customer agreed to pay in Hungarian forints in 30 days.When the customer wired the foreign currency to Blue on January 11,2012,Blue held them in their bank account until January 15 before selling them and converting them to U.S.dollars.The following exchange rates apply:

Required:

Required:

Record the journal entries that Blue would need related to the dates listed above.If no entry is required,state "no entry."

Required:

Required:Record the journal entries that Blue would need related to the dates listed above.If no entry is required,state "no entry."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

28

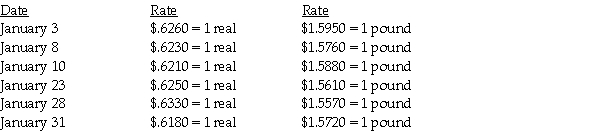

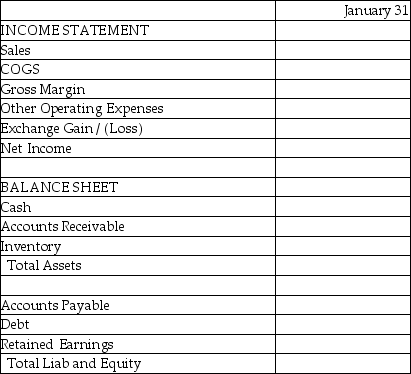

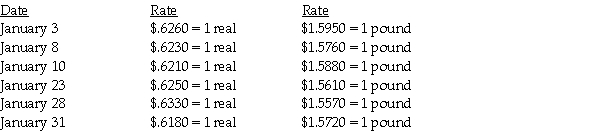

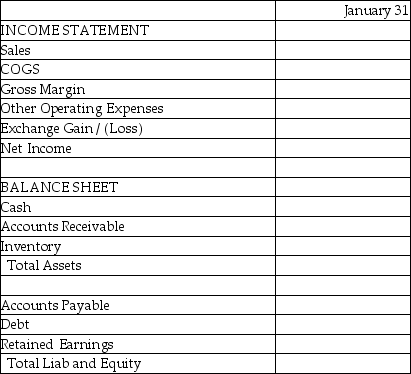

Meric Corporation (a U.S.company)began operations on January 1,2011,when the owner borrowed $150,000 to start the company.In the first month of operations,Meric had the following transactions:

January 3,2011 Bought inventory for 100,000 Brazilian real on account.Must be paid with Brazilian real.

January 8,2011 Sold 60% of inventory acquired on 1/3/11 for 32,000 British pounds on account.Invoice denominated in British pounds.

January 10,2011 Paid $3,000 in other operating expenses

January 23,2011 Acquired and paid half of the Brazilian real owed to the Brazilian supplier

January 28,2011 Collected half of the 32,000 pounds from the customer in Great Britain and immediately converted them into U.S.dollars

The following exchange rates apply:

Required: Complete the summary income statement and balance sheet for the month ended January 31,2011 assuming there were no other transactions.

Required: Complete the summary income statement and balance sheet for the month ended January 31,2011 assuming there were no other transactions.

January 3,2011 Bought inventory for 100,000 Brazilian real on account.Must be paid with Brazilian real.

January 8,2011 Sold 60% of inventory acquired on 1/3/11 for 32,000 British pounds on account.Invoice denominated in British pounds.

January 10,2011 Paid $3,000 in other operating expenses

January 23,2011 Acquired and paid half of the Brazilian real owed to the Brazilian supplier

January 28,2011 Collected half of the 32,000 pounds from the customer in Great Britain and immediately converted them into U.S.dollars

The following exchange rates apply:

Required: Complete the summary income statement and balance sheet for the month ended January 31,2011 assuming there were no other transactions.

Required: Complete the summary income statement and balance sheet for the month ended January 31,2011 assuming there were no other transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

29

Jefferson Company entered into a forward contract with Washington Company on October 1,2011,under which Jefferson agreed to buy (and Washington agreed to sell)10,000 tons of coal at $80.00 per ton in 90 days.On October 1,2011,the price of coal is $82.00 per ton.On December 29,2011,the price of coal is $85.00 per ton.The contract allows for net settlement.

Required:

Determine the net settlement on the forward contract.

Required:

Determine the net settlement on the forward contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

30

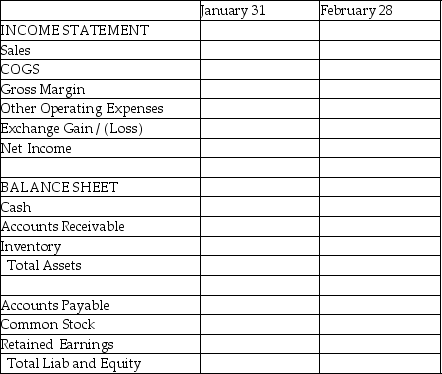

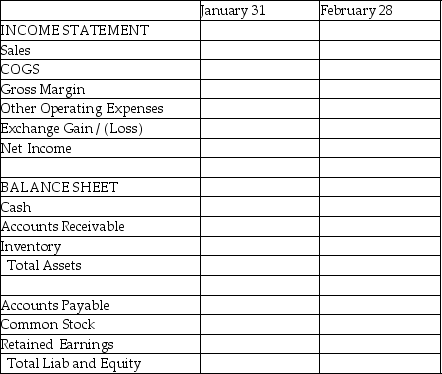

Piel Corporation (a U.S.company)began operations on January 1,2011,when common stock was issued for $250,000.In the first two months of operations,Piel had the following transactions:

January 15,2011 Bought inventory for 100,000 Mexican pesos on account

January 26,2011 Sold 70% of inventory acquired on 1/15/11 for 44,000 Saudi riyals on account

January 27,2011 Paid $1,000 in other operating expenses

February 2,2011 Sold additional inventory that cost $1,000 for $3,000 cash to a U.S.company.

February 15,2011 Acquired and paid the 100,000 pesos owed to the Mexican supplier

February 21,2011 Paid $1,500 in other operating expenses

February 28,2011 Collected the 44,000 riyals from the Saudi customer and immediately converted them into U.S.dollars

The following exchange rates apply:

Required:

Required:

Complete the summary income statement and balance sheet for the month ended January 31,2011 and February 28,2011,assuming there were no other transactions.

January 15,2011 Bought inventory for 100,000 Mexican pesos on account

January 26,2011 Sold 70% of inventory acquired on 1/15/11 for 44,000 Saudi riyals on account

January 27,2011 Paid $1,000 in other operating expenses

February 2,2011 Sold additional inventory that cost $1,000 for $3,000 cash to a U.S.company.

February 15,2011 Acquired and paid the 100,000 pesos owed to the Mexican supplier

February 21,2011 Paid $1,500 in other operating expenses

February 28,2011 Collected the 44,000 riyals from the Saudi customer and immediately converted them into U.S.dollars

The following exchange rates apply:

Required:

Required:Complete the summary income statement and balance sheet for the month ended January 31,2011 and February 28,2011,assuming there were no other transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

31

On April 1,2012,Button Industries enters into an agreement with Bows Incorporated to lock in the price of cotton.Button agrees to purchase (and Bows agrees to sell)100,000 pounds of cotton at $1.19 per pound,six months from the date of agreement.On October 1,2012,the price of cotton is $1.17 per pound.The contract allows for net settlement.

Required:

Determine the net settlement on the forward contract.

Required:

Determine the net settlement on the forward contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

32

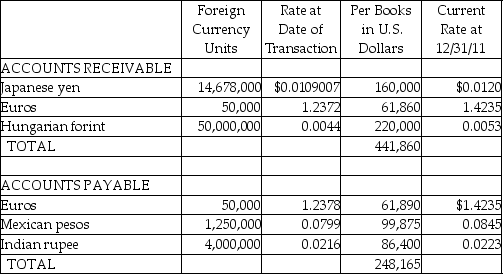

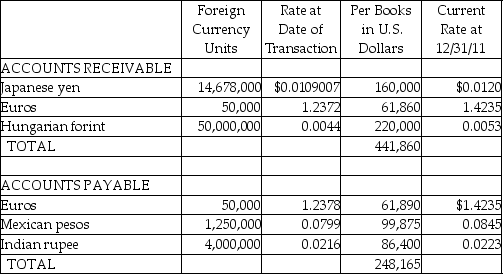

Lincoln Corporation,a U.S.manufacturer,both imports needed materials and exports finished products.Their receivables and payables are listed below,prior to year-end adjustments or preparation of the closing entries.

Required:

Required:

Determine the amount at which receivables and payables should be reported on December 31,2011,and the net exchange gain or loss that would be reported as a result of year-end adjustments.

Required:

Required:Determine the amount at which receivables and payables should be reported on December 31,2011,and the net exchange gain or loss that would be reported as a result of year-end adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

33

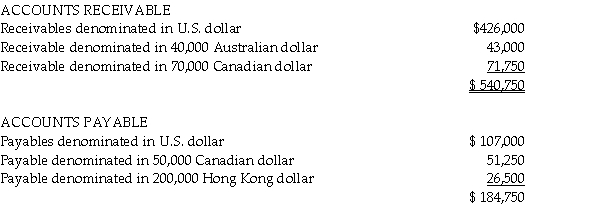

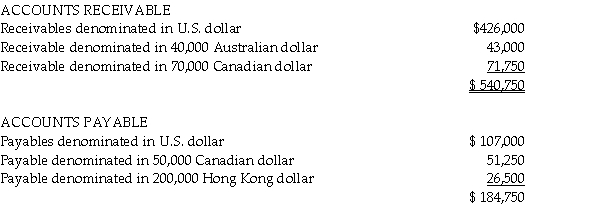

A review of Ace Industries,a U.S.corporation,shows the following balances in accounts receivable and accounts payable detail at September 30,2011,their fiscal year end.

As Ace prepared to close their books,they noted that the September 30 exchange rates for the Australian dollar,Canadian dollar and Hong Kong dollar were $1.0366,$1.0301 and $0.1284,respectively.

As Ace prepared to close their books,they noted that the September 30 exchange rates for the Australian dollar,Canadian dollar and Hong Kong dollar were $1.0366,$1.0301 and $0.1284,respectively.

Required:

Determine the exchange gain or loss to be included in the 2011 financial statements,and the amount of Accounts Receivable and Accounts Payable that will be included on the September 30,2011 balance sheet.

As Ace prepared to close their books,they noted that the September 30 exchange rates for the Australian dollar,Canadian dollar and Hong Kong dollar were $1.0366,$1.0301 and $0.1284,respectively.

As Ace prepared to close their books,they noted that the September 30 exchange rates for the Australian dollar,Canadian dollar and Hong Kong dollar were $1.0366,$1.0301 and $0.1284,respectively.Required:

Determine the exchange gain or loss to be included in the 2011 financial statements,and the amount of Accounts Receivable and Accounts Payable that will be included on the September 30,2011 balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

34

On November 4,2011,the Oak Corporation,a U.S.corporation,purchased components for an assembly machine from Maple Industries,a Canadian Company,which were put into Parts Inventory.The purchase price was 80,000 Canadian dollars and Oak agreed to pay in Canadian dollars in 90 days.Both corporations are on a calendar year accounting period.Assume that the spot rates for the Canadian dollar on November 4,2011,December 31,2011,and February 2,2012,are $0.9985,$1.0191,and $1.0064,respectively.

Required:

Record the November 4,December 31,and February 2 transactions in the General Journals of Oak Corporation and Maple Industries.If no entry is required on a particular date,indicate "No entry" in the General Journal.

Required:

Record the November 4,December 31,and February 2 transactions in the General Journals of Oak Corporation and Maple Industries.If no entry is required on a particular date,indicate "No entry" in the General Journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

35

Crabby Industries,a U.S.corporation,purchased inventory from a company in Sweden on November 18,2011 when the Swedish krona was trading at 1 krona = $0.161.The transaction was for 600,000 krona,and was to be paid in krona in 90 days.Crabby closed their books at December 31 for financial reporting purposes when the krona was trading at $0.167.On February 16,2012,Crabby paid the invoice when the krona was trading at $0.156.

Required:

Show the journal entries recorded by Crabby on November 18,2011,December 31,2011,and February 16,2012.

Required:

Show the journal entries recorded by Crabby on November 18,2011,December 31,2011,and February 16,2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

36

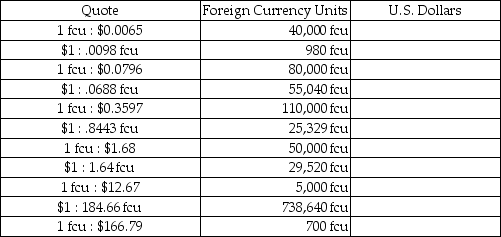

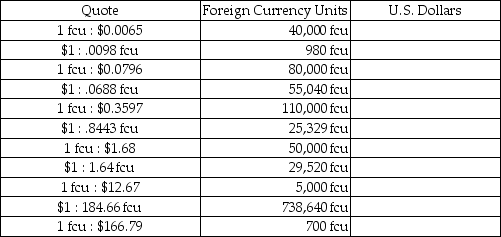

The table below provides either a direct or indirect quote for a given foreign currency unit,and the related units of that foreign currency.

Required:

Required:

Complete the table,indicating the amount of U.S.Dollars that is the equivalent of the foreign currency shown,based on the direct or indirect quote provided.

Required:

Required:Complete the table,indicating the amount of U.S.Dollars that is the equivalent of the foreign currency shown,based on the direct or indirect quote provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

37

Behd Company,a U.S.firm,sold some of its inventory to Edinburgo Company,a company based in Scotland,on November 27,2011,when the local currency unit (the pound Sterling,"GBP")was trading at $1.64 : 1 GBP.The sales agreement called for Edinburgo to pay 140,000 GBP on January 26,2012.Additional exchange rates are shown below:

Required:

Required:

Show all related journal entries for Behd Company.

Required:

Required:Show all related journal entries for Behd Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

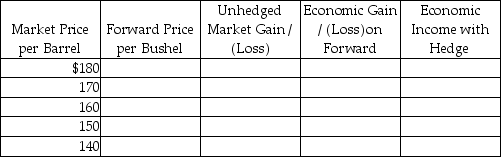

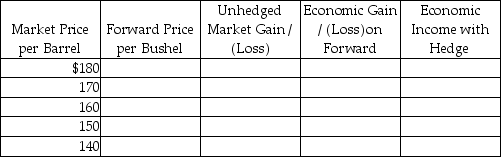

38

In September of 2011,Gunny Corporation anticipates that the price of heating oil will increase soon,and wishes to lock in a firm price for the winter months.They enter into a forward contract with Selton Industries to buy 100,000 barrels of oil at $160 per barrel in December 2011.Selton's cost of production of the heating oil is $120 per barrel.

Required:

Determine the economic impact of the transaction to Selton (the seller of the heating oil)at the market price levels indicated in the table below,with and without the hedge.

Required:

Determine the economic impact of the transaction to Selton (the seller of the heating oil)at the market price levels indicated in the table below,with and without the hedge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

39

On September 1,2011,Bylin Company purchased merchandise from Himeji Company of Japan for 20,000,000 yen payable on October 1,2011.The spot rate for yen was $0.0079 on September 1 and the spot rate was $0.0077 on October 1.The purchase was paid on October 1,2011.

Required:

1.Did the U.S.dollar strengthen or weaken from September to October and what are the implications for Bylin's business?

2.What journal entry did Bylin record on September 1,2011?

3.What journal entry did Bylin record on October 1,2011?

Required:

1.Did the U.S.dollar strengthen or weaken from September to October and what are the implications for Bylin's business?

2.What journal entry did Bylin record on September 1,2011?

3.What journal entry did Bylin record on October 1,2011?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

40

Slade Corporation,a U.S.company,purchased materials on account from a manufacturer in Mexico on June 15.The invoice was denominated in the shipper's currency for 480,000 pesos.The goods were paid for on July 18.Slade closes their fiscal year on June 30,and used the following indirect quotes to measure the amounts related to the transactions.

June 15 $1.00 = 12.50 pesos

June 30 $1.00 = 12.80 pesos

July 18 $1.00 = 12.00 pesos

Required:

Show all related journal entries for Slade Company.

June 15 $1.00 = 12.50 pesos

June 30 $1.00 = 12.80 pesos

July 18 $1.00 = 12.00 pesos

Required:

Show all related journal entries for Slade Company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck