Deck 1: The Investment Decision

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/40

العب

ملء الشاشة (f)

Deck 1: The Investment Decision

1

If two normal distributions are multiplied,the outcome distribution is normal.

False

Explanation: The outcome distribution is not normal.A normal distribution has several properties.Firstly,if returns from one normal distribution are mixed with returns from another normal distribution,the resultant distribution is normal.Secondly,when two normal distributions are added together this has the property of additive stability.If two normal distributions are multiplied the outcome distribution is not normal.

Explanation: The outcome distribution is not normal.A normal distribution has several properties.Firstly,if returns from one normal distribution are mixed with returns from another normal distribution,the resultant distribution is normal.Secondly,when two normal distributions are added together this has the property of additive stability.If two normal distributions are multiplied the outcome distribution is not normal.

2

The excess kurtosis of a normal distribution is:

A

Explanation: A normal distribution is defined as having a skewness of 0 and a kurtosis of 3.However,the excess kurtosis measure for a normal distribution is 0.

Explanation: A normal distribution is defined as having a skewness of 0 and a kurtosis of 3.However,the excess kurtosis measure for a normal distribution is 0.

3

An advantage of using discrete returns is to reduce the distorting effect a low share price may have on returns.

False

Explanation: The answer is false.As returns are calculated as the relative change in price,shares with low prices may appear to have relatively large returns.However,since continuously compounded returns are always less than discrete returns,the distorting effect of low prices is reduced by using compounding.For example,an investment that changes in value from $0.02 to $0.03 will have a discrete return of 50% [i.e.(0.03 - 0.02)/2],whereas the continuously compounded return will be approximately 41% [i.e.ln(0.03/0.02)].So,in fact it is the use of continuous compounding returns rather than discrete returns that will reduce the low price effect.Therefore,the answer is false.

Explanation: The answer is false.As returns are calculated as the relative change in price,shares with low prices may appear to have relatively large returns.However,since continuously compounded returns are always less than discrete returns,the distorting effect of low prices is reduced by using compounding.For example,an investment that changes in value from $0.02 to $0.03 will have a discrete return of 50% [i.e.(0.03 - 0.02)/2],whereas the continuously compounded return will be approximately 41% [i.e.ln(0.03/0.02)].So,in fact it is the use of continuous compounding returns rather than discrete returns that will reduce the low price effect.Therefore,the answer is false.

4

A risk-averse investor will,all other things being equal,prefer investing in which of the following asset classes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

5

A continuously compounded return is always less than the equivalent discrete return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following holding periods is an active investor more likely to invest in?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

7

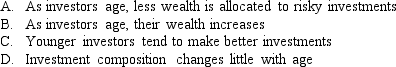

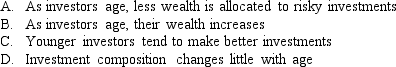

Which of the following best describes the changes in asset class composition that occur with increased age,according to the investor life cycle theory of Seigal (1991)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

8

A geometric return is always less than the corresponding arithmetic return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

9

The use of discrete returns ignores compounding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is true regarding the investor's life cycle of Seigal (1991)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under a normal distribution,what proportion of observations fall within two standard deviations of the mean?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

12

Steps involved in the asset allocation decision are considered to be:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

13

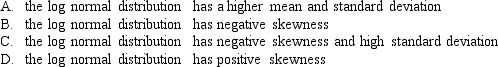

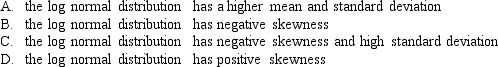

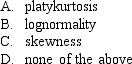

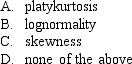

Which of the following statements is true when comparing the log normal distribution to the normal distribution?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

14

An advantage of covariance over correlation is that it is bound to be between positive and negative 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

15

Generally speaking,equity is the least risky of the asset classes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

16

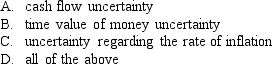

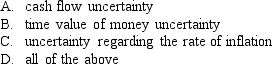

Investment assets differ in risk because of:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not a documented feature of equity returns in Australia?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

18

Zero volatility in returns results in identical arithmetic and geometric returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

19

Investment returns are received from two sources;interest and dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

20

The lognormal distribution is symmetrical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

21

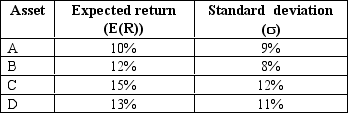

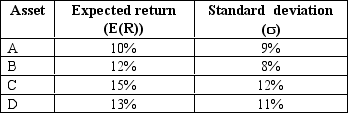

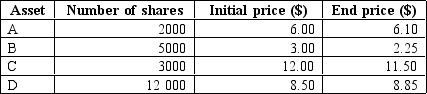

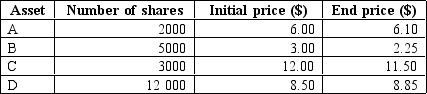

Which of the four investments has the highest coefficient of variation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

22

The price at the start of the period for asset A is $5 and for asset B is $6.At the end of the period,asset A has fallen to $4 and asset B has risen to $6.50.Calculate the continuously compounded return on a price-weighted portfolio consisting of shares A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

23

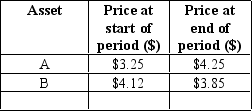

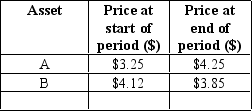

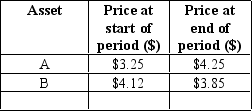

Given the prices for A and B at the start and end of the period,calculate the continuously compounded return on an equally weighted portfolio consisting of assets A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

24

Given no other information other than the expected returns and risk,which asset would a risk-averse investor prefer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

25

The returns for two assets,A and B,are 5% and 8% respectively.If an investor holds 25% of her wealth in asset A,what is the continuously compounded return of a value-weighted portfolio comprising assets A and B?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

26

Given the prices for A and B at the start and end of the period,calculate the price-weighted return on a portfolio consisting of assets A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

27

An investor purchased an asset for $32 000 at the beginning of the year.This investment is worth $36 000 at the end of the year.What is the return for the year on the investment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

28

An investor purchased the investment above.What is the value-weighted return on the portfolio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

29

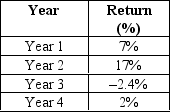

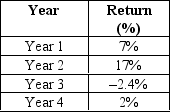

The value of an investment at the end of each of four years is shown above.What is the arithmetic cumulative return over the four years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

30

The value of an investment at the end of each of four years is shown above.What is the geometric cumulative return over the four years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

31

An investor purchased an asset for $1675.This investment is worth $1742 after three months.What is the effective annualised return for the investment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

32

An investor purchased an asset for $1675.This investment is worth $1742 after three months.What is the simple annualised return for the investment (simple annual return)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

33

An investment was purchased for $2985.After seven months this investment was worth $3245.What is the continuously compounded return on the investment over the seven-month period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

34

The returns for two assets,A and B,are 5% and 8% respectively.If a price-weighted portfolio were formed when shares in A were $9 and shares in B were $3,what is the continuously compounded price-weighted return for the portfolio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

35

The value of an investment at the end of each of four years is shown above.What is the geometric average return over the four years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

36

Given the prices for A and B at the start and end of the period,if an investor holds 1000 shares in asset A and 5000 in asset B,what is her value-weighted return on the portfolio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

37

An investor purchased the investment above.If continuously compounded returns are used,what is the equal-weighted return on the portfolio?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

38

The value of an investment at the end of each of four years is shown above.What is the arithmetic average return over the four years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

39

Charles invests in a price-weighted portfolio of two shares,ABC and XYZ.His funds manager sends him a statement of his performance at the end of each year for his tax return.Unfortunately,some of the form was illegible,and all he could discern was that the price-weighted portfolio return was 10%,the returns on ABC and XYZ were 8% and 16%,respectively and that the purchase price of ABC was $10.Given this information,at what price did Charles purchase the shares in company XYZ?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

40

Loredana has invested equal amounts in each of the shares of company A,company B and company C,which she purchased one year ago at prices of $10,$2 and $1,respectively.Loredana has recently sold her shares in company B for $2.50 and in company C for $1.15.If Loredana wishes to earn a continuously compounded return of 20% for the year,on her equally weighted portfolio,at what price will she need to sell her shares in company A?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck