Deck 5: Money Market Securities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/41

العب

ملء الشاشة (f)

Deck 5: Money Market Securities

1

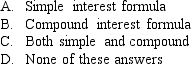

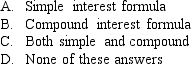

In Australia, is used to calculate interest.

A

Explanation: Simple discount is used in countries like Australia,USA,Malaysia and Singapore.

Explanation: Simple discount is used in countries like Australia,USA,Malaysia and Singapore.

2

The liquidity premium theory is consistent with the observed concentration of investors in particular segments of the term structure.

False

Explanation: The segmented market theory is consistent with the observed concentration of investors in particular segments of the term structure.For example,superannuation funds,and to some extent insurance companies,may focus on the longer end of the yield curve in line with expected future cash demands.

Explanation: The segmented market theory is consistent with the observed concentration of investors in particular segments of the term structure.For example,superannuation funds,and to some extent insurance companies,may focus on the longer end of the yield curve in line with expected future cash demands.

3

The preferred habitat theory of term structure generally implies an upward-sloping yield curve.

False

Explanation: The preferred habitat theory implies that participants match asset life and liability life to establish the lowest possible risk position.a substantial premium may be required to encourage participants to invest in other than the preferred habitat,and so this premium tends to be greatest where demand is least.

Explanation: The preferred habitat theory implies that participants match asset life and liability life to establish the lowest possible risk position.a substantial premium may be required to encourage participants to invest in other than the preferred habitat,and so this premium tends to be greatest where demand is least.

4

A bank-accepted bill with a face value of $100 000 currently has 30 days to expiry.If the current price of the bank-accepted bill is $93 809,what is the implied annual yield?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

5

Interest rate risk arises due to the possibility that the RBA will change rates to stay within its inflation targets that are set from time to time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

6

Assume that the current yield for a 90-day $100 000 bill is 6.5%.This yield is expected to decrease to 5%.If an investor traded on this information,what would be the profit on this information trading?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

7

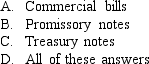

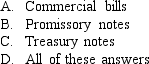

Securities traded on the money market include

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

8

Inflation risk does not affect security investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

9

A bill with 90 days to maturity initially has a yield of 8% p.a.and a face value of $100 000.This bill is held for 45 days and sold as a 45-day bill at a yield of 6%.What is the continuously compounding holding period rate of returns over the 45 days?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

10

The yield curve plots the relationship between time to maturity and yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

11

Assume that the current yield for a 90-day $100 000 bill is 7.0%.This yield is expected to decrease to 6.15%.If an investor traded on this information,what would be the profit on this information trading?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

12

Those who trade in the money market can deal only in cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

13

The elasticity of commercial bill changes in the yield is the time to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

14

The value of a bank-accepted bill with a face value of $100 000,180 days to maturity and a current yield of 4% p.a.is $98 066.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

15

What would be the maturity price of a promissory note with a term of 90 days,interest rate of 5.7% and a face value of $100 000?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

16

Default risk is not important for money market securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

17

Given that the quoted yield for a 90-day dealer's bill is 4.14%,what is the price of the bill,if it has a face value of $100 000?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the nominal interest rate is 5.05% per annum,what is the interest rate for a 180-day period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

19

A 90-day bill was purchased at a price of $98 520 and sold 30 days later at a price of $99 882.Given this information,calculate the continuously compounding holding period rate of return over the 30-day period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

20

The expectations theory implies that short-term yields are a function of the current interest rates and the expected future interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

21

A $500 000 180-day note is purchased with a yield of 6% and sold 90 days later with a yield of 4.5%.Calculate the continuously compounded holding period return for this note over the 90 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

22

The yield of a $100 000 180-day bill decreases from 6% to 7%.What is the effect on the price of the bill?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

23

A $100 000 90-day bill with yield of 5% is purchased now.Assuming the term structure is flat at 5% and does not change,by how much will the price of the bill change in the next in 30 days?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

24

The yield of a $50 000 45-day bill decreases from 4% to 5%.What is the change in price of the bill?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

25

Say the current one-month interest rate is 3.75%.Further,the three-month rate is 6.25%.According to the expectation theory,what is the predicted rate for the coming two-month period?

S

S

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

26

For a market security,if the yield curve and time to maturity is known:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

27

Provided the return on a security is 5% p.a.and the inflation rate is 3.5%,what is the real rate of return on this security per year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

28

The yield of a $50 000 45-day bill is currently 4%.If over the next 15 days the yield changes to 6%,the change in price will have both a time component and a yield component.In discrete percentage terms over the 15 days,calculate the amount by which the time component exceeds the yield component.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

29

The risk that is associated with the difficulty to find a buyer or seller when it is necessary to buy or sell securities is known as:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

30

A $100 000,90-day bill with a yield of 6.5% is purchased now.Assuming the term structure is flat at 6.5% and does not change,in 30 days' time the price of the bill will be:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

31

Suppose the expected one-month rates of return are 3% p.a. ,4.5% p.a.and 7% p.a.for the month ending in one,two and three months' time respectively.Further,it is found that the liquidity premium for the second and third month is 1.75% and 2.40% respectively.According to the liquidity premium theory,what is the three-month yield?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

32

The yield of a $50,000 45 day bill is currently 5%.If over the next 15 days the yield changes to 6%,the change in price will have both a time component and a yield component.What is the size of the yield component expressed in dollars?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

33

Using the elasticity approach,estimate the change in the price of a $500 000 90-day bank-accepted bill when the yield increases from 5% to 6%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which theory is consistent with an observed concentration of investors in particular segments of the term structure?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

35

The major risks of money market securities are interest rate risk,default risk and

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following term structure theories predicts an upward-sloping yield curve?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

37

According to which theory do participants match asset and liability lives in order to establish the lowest possible risk position?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

38

Using the elasticity approach,estimate the new price of a $100 000 90-day bank-accepted bill when the yield decreases from 9% to 7% p.a.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

39

A $500 000 180-day note is purchased with a yield of 8% and sold 90 days later with a yield of 6%.Calculate the discrete holding period return for this note expressed as an annual nominal return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

40

Suppose the expected one-month rates of return are 3% p.a. ,4.5% p.a.and 7% p.a.for the month ending in one,two and three months' time respectively.According to the expectations theory,what is the three-month nominal yield?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

41

As an inquisitive student of finance,you were sceptical when your lecturer told you that the price changes of bills could be accurately measured using the elasticity approach.Assuming a $100 000 face value 180-day bill with 45 days to maturity,calculate the pricing error from using the elasticity approach if the yield changes from 7% to 8.5% p.a.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck