Deck 4: Financial Management: Derivative Instruments and Information Sources

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/40

العب

ملء الشاشة (f)

Deck 4: Financial Management: Derivative Instruments and Information Sources

1

Contracts for difference (CFDs)enable traders to participate in either bull or bear markets.

True

Explanation: CFDs are exchange-traded leveraged investments that allow exposure to shares,indices,commodities and currencies.Traders can take positions in either rising or falling markets.

Explanation: CFDs are exchange-traded leveraged investments that allow exposure to shares,indices,commodities and currencies.Traders can take positions in either rising or falling markets.

2

ASX 24 operates 24-hour per-day,seven days per week.

False

Explanation: The trading platform for the ASX 24 market is called ASX Trade 24.It operates 24-hours per day,six-days per week,from Monday to Saturday.

Explanation: The trading platform for the ASX 24 market is called ASX Trade 24.It operates 24-hours per day,six-days per week,from Monday to Saturday.

3

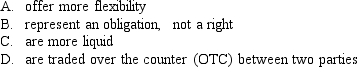

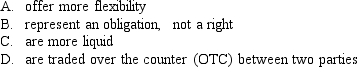

Options contracts mainly differ from futures contracts in that they:

B

Explanation: Put options provide the right to sell shares of a particular company on or before some future expiry date.Call options provide the right to buy shares of a particular company on or before some future expiry date.Futures contracts,on the other hand,provide an obligation to sell or buy on some future expiry date.

Explanation: Put options provide the right to sell shares of a particular company on or before some future expiry date.Call options provide the right to buy shares of a particular company on or before some future expiry date.Futures contracts,on the other hand,provide an obligation to sell or buy on some future expiry date.

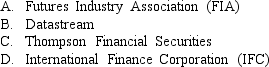

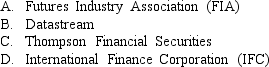

4

Which of the following corporations has maintained databases on individual shares and market indices since the 70s?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is not a provider of share price information?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is an average of a basket of currencies measured against the Australian dollar?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is often used as a market indicator,rather than the S&P/ASX 200?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

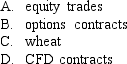

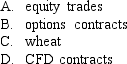

8

Which of the following securities are not traded on ASX 24?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

9

The Consumer Price Index (CPI)is designed to capture price movements in the general economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

10

Forward rate agreements (FRA)allow parties to exchange interest rate exposures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

11

With futures the All Ordinaries Index (AOI)can be traded as separate security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

12

Much of the security-specific information is publicly available through sources such as the ASX and the world wide web.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

13

Equity futures contracts,warrant contracts and option contracts are all forms of non-standardised forms of derivatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

14

The Trade-weighted Index (TWI)is a weighted average of a basket of currencies measured against the Australian dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

15

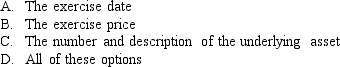

Please see the Table 4.2 Warrants are traded on the ASX market.

Which information is specified for those highly standardised contracts?

Which information is specified for those highly standardised contracts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

16

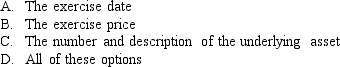

Please see the Table 4.2 Warrants are traded on the ASX market.

In which year did option trading begin in Australia?

In which year did option trading begin in Australia?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

17

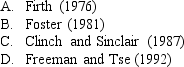

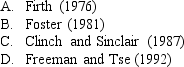

Earnings information released by companies in Australia has evidence suggesting the existence of intra-industry information transfers.This research has been confirmed by the Australian researches:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

18

Capital expenditure is an example of market information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following indices is designed to capture price movements in the general economy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

20

The OTC market is much more formal than the exchange-based markets such as the SFE and CME.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

21

See Table 4.6.

Which information source specialises in emerging market data?

Which information source specialises in emerging market data?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

22

See Table 4.6.

Which futures contract is generally used as an indicator of long-term interest rates?

Which futures contract is generally used as an indicator of long-term interest rates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

23

How could investors obtain private information?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which is the largest market for currency futures trading?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

25

Repurchase agreements are traded:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

26

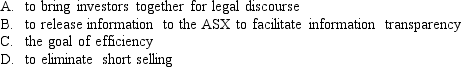

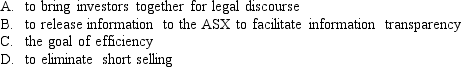

One of the objectives of the Corporations Act is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

27

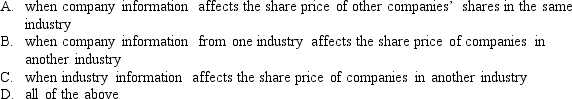

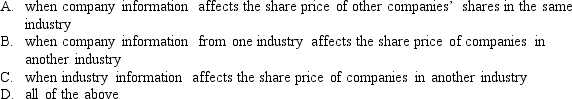

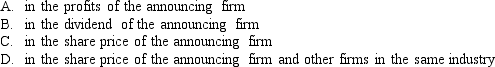

An intra-industry information transfer occurs:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

28

See Table 4.6.

What is the most heavily traded derivative on the ASX?

What is the most heavily traded derivative on the ASX?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

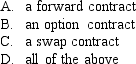

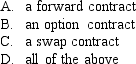

29

The main derivative contract used for foreign exchange is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

30

See Table 4.6.

Security-specific information does not include:

Security-specific information does not include:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

31

Refer Table 4.1,options are the most heavily traded derivatives over the period.

Non-exchange-traded derivatives are said to be traded:

Non-exchange-traded derivatives are said to be traded:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

32

See Table 4.6.

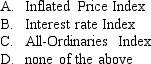

The existence of intra-industry information transfer means that unexpected bad news is associated with a relative decline:

The existence of intra-industry information transfer means that unexpected bad news is associated with a relative decline:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

33

See Table 4.6.

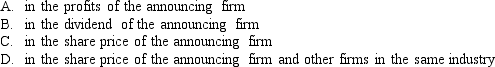

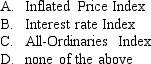

Which index is a measure of the level of inflation in an economy?

Which index is a measure of the level of inflation in an economy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

34

See Table 4.6.

Why is it difficult to compute the unrealised return on a futures contract?

Why is it difficult to compute the unrealised return on a futures contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

35

See Table 4.6.

Which organisation has been established to work with derivative exchanges to reduce costs and incidences of fraud?

Which organisation has been established to work with derivative exchanges to reduce costs and incidences of fraud?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

36

See Table 4.6.

Which source of share price information provides access to tick data on both formal and OTC exchanges?

Which source of share price information provides access to tick data on both formal and OTC exchanges?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which type of contract is highly standardised?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

38

In the year ended December 2012,the largest exchange was .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

39

The second party to a 'swap' is known as a:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck

40

In a 'plain vanilla' swap,the variable reference rate is generally the:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 40 في هذه المجموعة.

فتح الحزمة

k this deck