Deck 4: Income Tax Withholding

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/56

العب

ملء الشاشة (f)

Deck 4: Income Tax Withholding

1

In the IRA form of the Simple Retirement Account,employers must match the employee's contribution,dollar-for-dollar,up to 3% of the employee's compensation.

True

2

After completion of Form W-4,an employer must copy the employee's social security card and place it in the employee's employment file.

False

3

All taxable noncash fringe benefits received during the year can only be added to the employees' taxable pay on the last payday of the year.

False

4

Before any federal income taxes may be withheld,there must be,or must have been,an employer-employee relationship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

5

In the case of a 401(k)plan,employees age 50 or over can shelter an extra $10,000 of their wages from federal income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

6

An employer must withhold federal income taxes on both the tips reported by tipped employees and the tips that the employer allocates to the employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

7

Persons eligible for deductible IRA contributions may put aside a specified amount of their compensation without paying federal income taxes on that amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

8

There is no limit to the amount of educational assistance that is exempt from federal income tax withholdings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

9

The withholding of federal income and FICA taxes from a tipped employee is made from the employee's wages that are under the employer's control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

10

The payments to a cook employed by a college fraternity are excluded from federal income tax withholding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

11

A waiter receives cash tips amounting to $120 in a month.The waiter must report the amount of the cash tips to the employer by the 10th of the month following the month they receive the tips.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

12

Cash tips of $20 or more received by a tipped employee in a calendar month are treated as remuneration subject to federal income tax withholding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

13

Under the federal income tax withholding law,income taxes are not withheld from the value of meals that employers furnish workers on the employers' premises for the employers' convenience.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

14

There is no limit to the amount that an employer can contribute in an employee's SIMPLE retirement account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under the federal income tax withholding law,a definition of employee excludes partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

16

Since not-for-profit corporations are exempt from federal income taxes,they are not defined as employers under the federal income tax withholding law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

17

The amount of federal income taxes to be withheld is determined after subtracting from the employee's gross wages any local and state taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

18

Evers,who works for two employers,is entitled to three personal allowances.Evers must claim the three allowances with each of the two employers during the entire calendar year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

19

Noncash fringe benefits that are provided employees are treated as nontaxable income and thus are excluded from federal income tax withholding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

20

The IRA format of the SIMPLE plan allows employees to make tax-free contributions of up to $12,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

21

When you pay supplemental wages at the same time as regular wages,the method of calculating the withholding is the same for vacation payments as for semiannual bonuses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

22

On August 2,Hunt filed an amended Form W-4 to show a decrease in the number of allowances claimed.Hunt's employer must put the new withholding allowance certificate into effect before the next weekly payday on August 4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

23

Form W-3 is filed with the Social Security Administration when transmitting information returns on Forms W-2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

24

For which of the following payments is the employer required to withhold federal income taxes?

A) Advances made to sales personnel for traveling expenses

B) Tipped employee's monthly tips of $120

C) Deceased person's wages paid to the estate

D) Minister of Presbyterian church

E) All of the above

A) Advances made to sales personnel for traveling expenses

B) Tipped employee's monthly tips of $120

C) Deceased person's wages paid to the estate

D) Minister of Presbyterian church

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

25

An employee submits an invalid Form W-4 to the employer and does not replace it with a valid form.The employer should withhold federal income taxes at the rate for a single person claiming no exemptions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

26

Under the federal income tax withholding law,which of the following is not defined as an employee?

A) Partner who draws compensation for services rendered the partnership

B) General manager,age 66

C) Payroll clerk hired one week ago

D) Governor of the state of Florida

E) Secretary employed by a not-for-profit corporation

A) Partner who draws compensation for services rendered the partnership

B) General manager,age 66

C) Payroll clerk hired one week ago

D) Governor of the state of Florida

E) Secretary employed by a not-for-profit corporation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

27

Employees must be given Form W-2 on or before January 31 following the close of the calendar year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

28

Of the two main methods of withholding,only the wage-bracket method distinguishes unmarried persons from married persons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

29

The special withholding allowance may be claimed only by those employees who do not itemize deductions on their income tax returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

30

If you,an employer,are filing 550 Forms W-2,you must use electronic filing rather than paper Forms W-2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

31

An employer is required to submit a copy of the employee's Form W-4 to the IRS if the employee has claimed 15 or more withholding allowances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

32

In calculating a "gross-up" amount of a bonus payment,an employer does not use the OASDI/HI tax rates in the formula.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following noncash fringe benefits does not represent taxable income subject to federal income tax withholding?

A) Flight on employer-provided airline

B) Personal use of company car

C) Sick pay

D) Employer-paid membership to a country club

E) All of the above are taxable.

A) Flight on employer-provided airline

B) Personal use of company car

C) Sick pay

D) Employer-paid membership to a country club

E) All of the above are taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

34

The standard deduction varies according to whether the wage-bracket method or the percentage method is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements correctly describes the withholding of federal income taxes and social security taxes on tips?

A) Tips amounting to $10 or more in a calendar month must be reported by tipped employees to their employers.

B) The withholding of federal income taxes on employees' reported tip income is made from the amount of tips reported by employees.

C) When employees report taxable tips in connection with employment in which they also receive regular wages,the amount of tax to be withheld on the tips is computed as if the tips were a supplemental wage payment.

D) Employers do not withhold FICA taxes on the tipped employees' reported tip income.

E) None of the above statements is correct.

A) Tips amounting to $10 or more in a calendar month must be reported by tipped employees to their employers.

B) The withholding of federal income taxes on employees' reported tip income is made from the amount of tips reported by employees.

C) When employees report taxable tips in connection with employment in which they also receive regular wages,the amount of tax to be withheld on the tips is computed as if the tips were a supplemental wage payment.

D) Employers do not withhold FICA taxes on the tipped employees' reported tip income.

E) None of the above statements is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

36

If married employees do not claim their marital status on Form W-4,the employer must withhold according to the withholding tables for single employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

37

For state income tax purposes,all states treat 401(k)plan payroll deductions as nontaxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

38

Gere became the father of triplets on June 20.He must file an amended Form W-4 on or before June 30.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

39

A person holding two jobs may have additional income tax withheld by increasing the number of withholding allowances claimed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

40

By completing Form W-4P,a person can elect to have no income tax withheld from the annuity amounts the person receives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

41

A company must withhold federal income taxes from payments made to independent contractors in which of the following cases?

A) When there is a signed contract between the parties.

B) When the contractor is paid $400.

C) When the contractor is a corporation.

D) When the contractor has not provided a taxpayer identification number and the contract is $600 or more.

E) All of the above.

A) When there is a signed contract between the parties.

B) When the contractor is paid $400.

C) When the contractor is a corporation.

D) When the contractor has not provided a taxpayer identification number and the contract is $600 or more.

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

42

A personal allowance:

A) amounted to $2,000 in 2017.

B) may be claimed to exempt a portion of the employee's earnings from withholding.

C) is indexed for inflation every calendar quarter.

D) may be claimed at the same time with each employer for whom an employee is working during the year.

E) for one person is a different amount for a single versus a married taxpayer.

A) amounted to $2,000 in 2017.

B) may be claimed to exempt a portion of the employee's earnings from withholding.

C) is indexed for inflation every calendar quarter.

D) may be claimed at the same time with each employer for whom an employee is working during the year.

E) for one person is a different amount for a single versus a married taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following cannot be included in a cafeteria plan?

A) Health insurance

B) Group-term life insurance (first $50,000 of coverage)

C) Dependent care assistance (first $5,000)

D) Self-insured medical reimbursement plan

E) Educational assistance

A) Health insurance

B) Group-term life insurance (first $50,000 of coverage)

C) Dependent care assistance (first $5,000)

D) Self-insured medical reimbursement plan

E) Educational assistance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

44

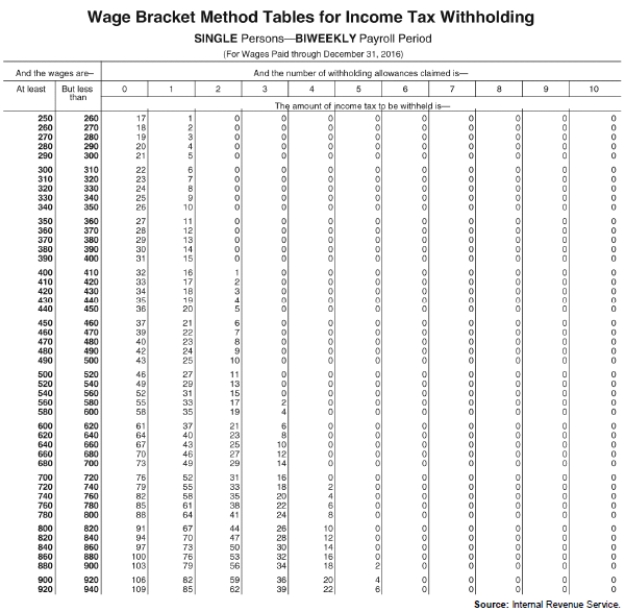

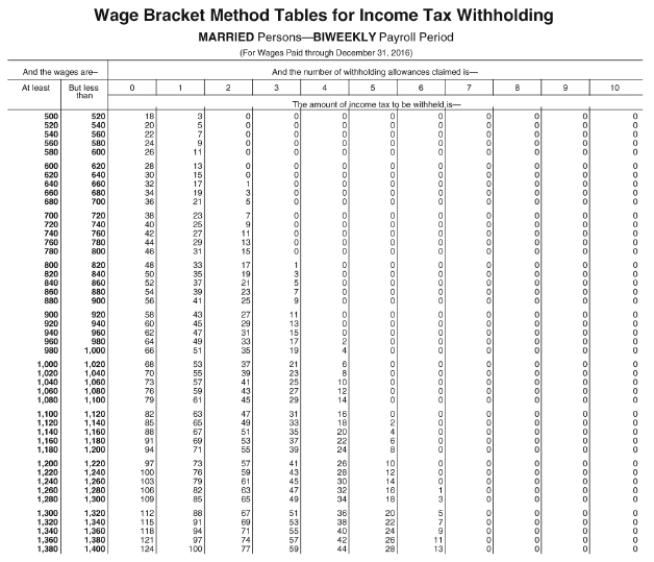

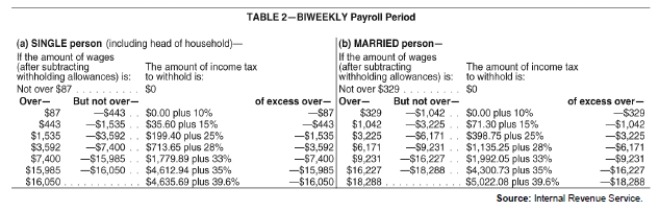

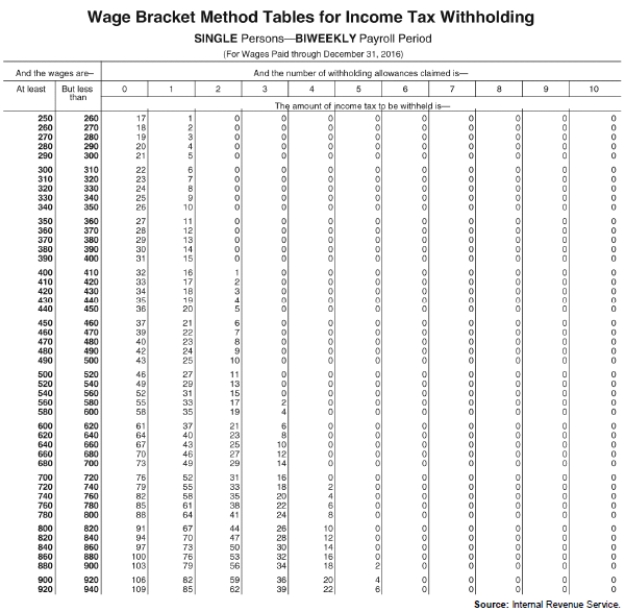

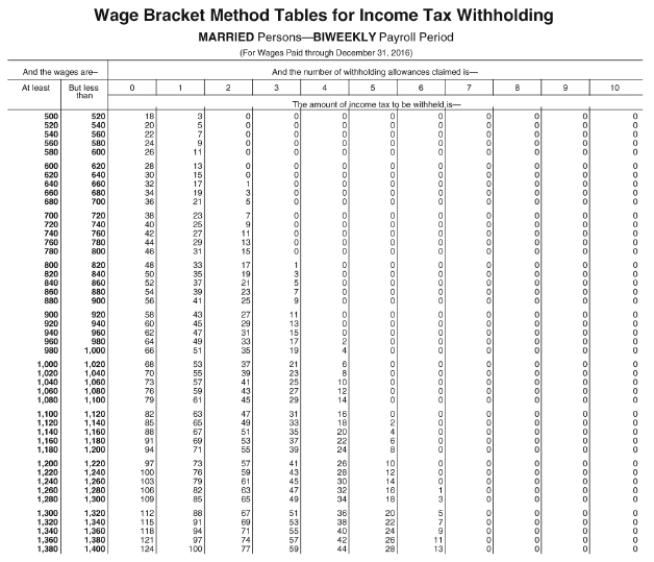

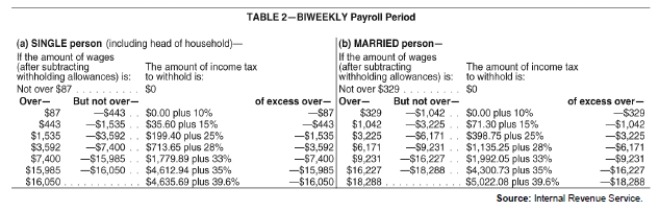

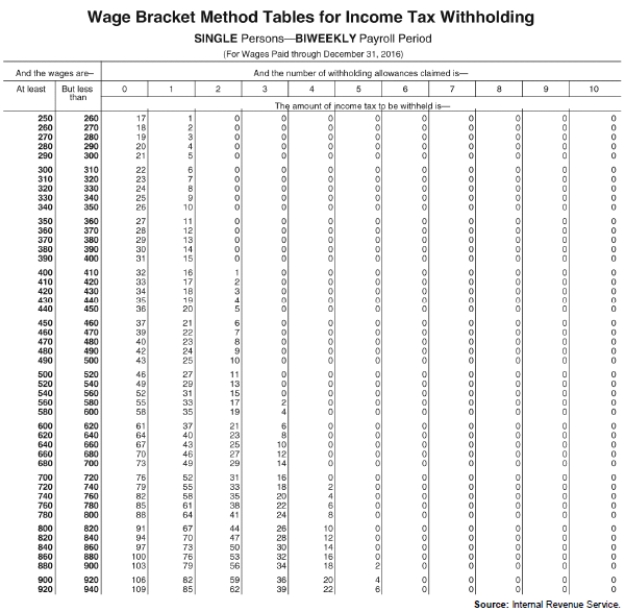

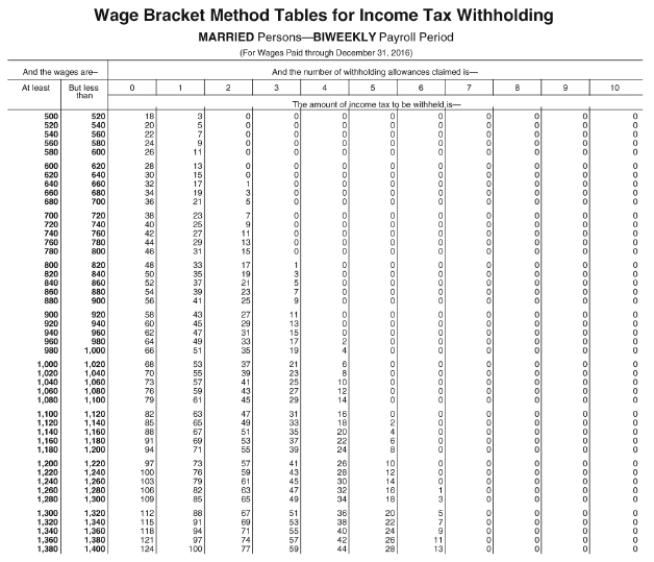

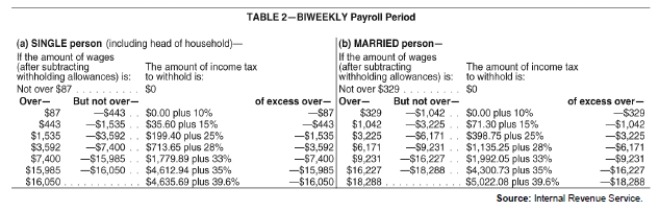

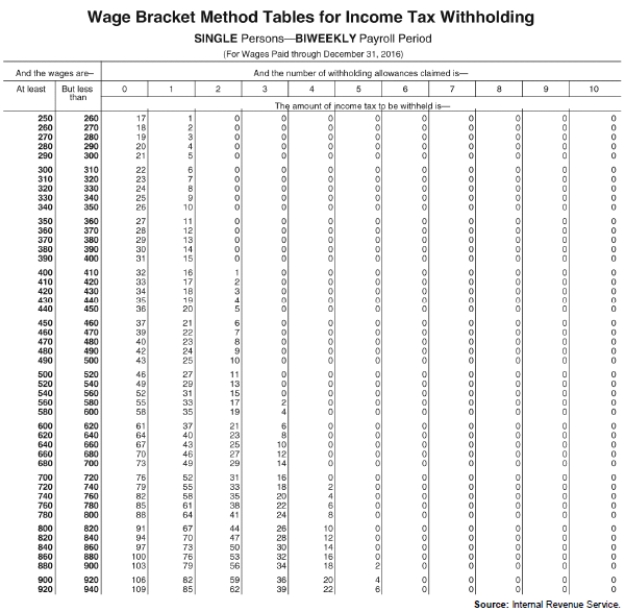

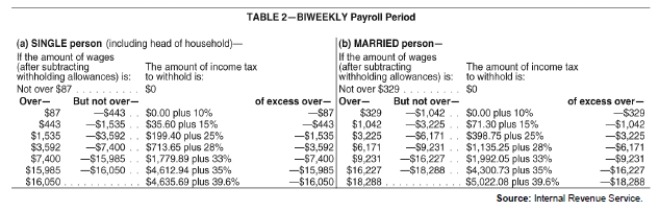

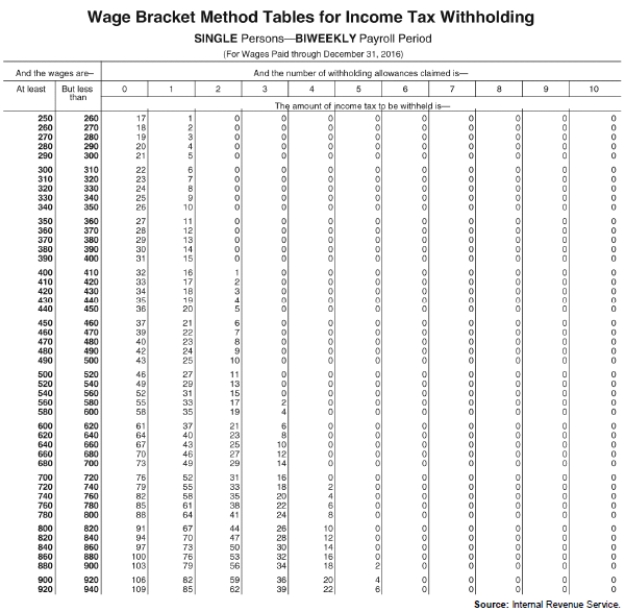

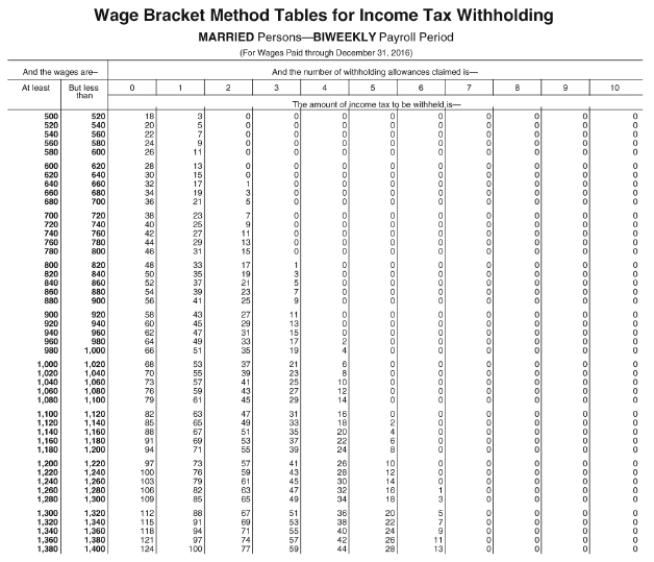

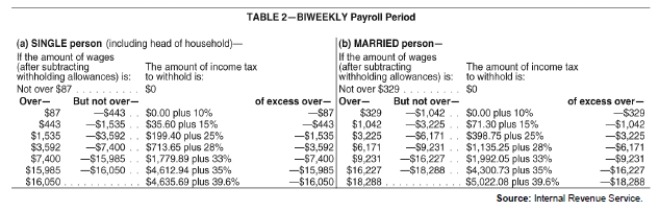

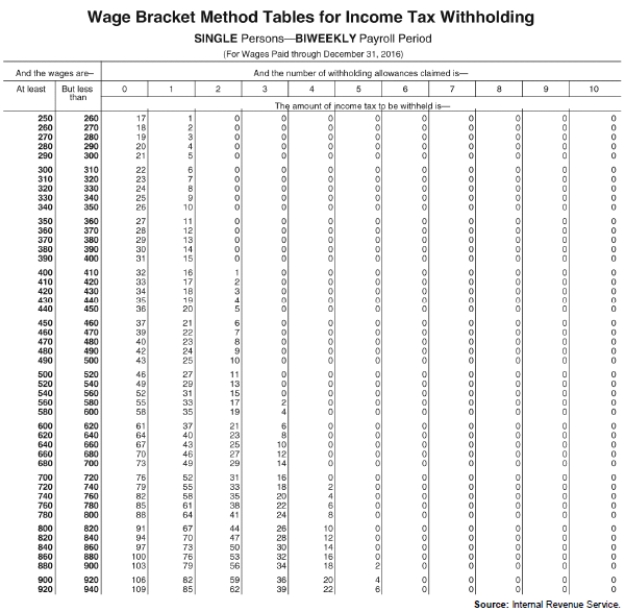

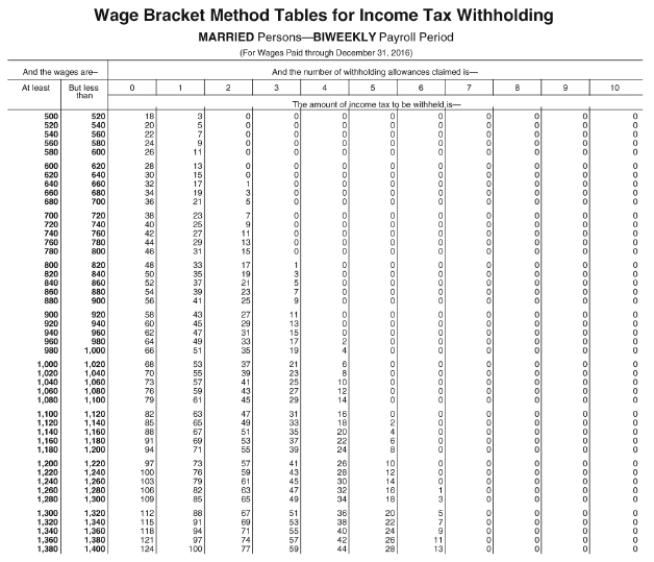

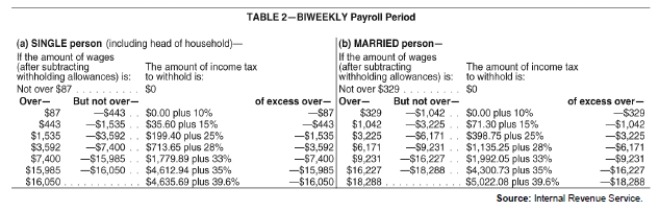

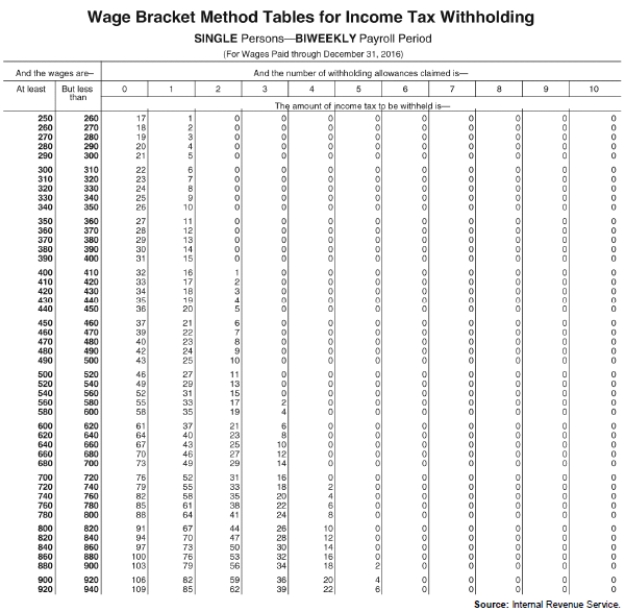

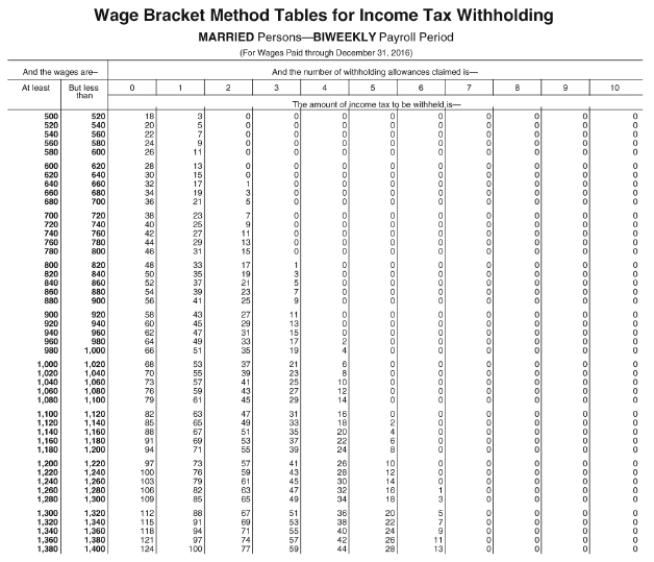

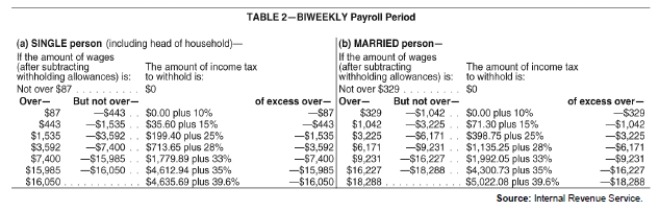

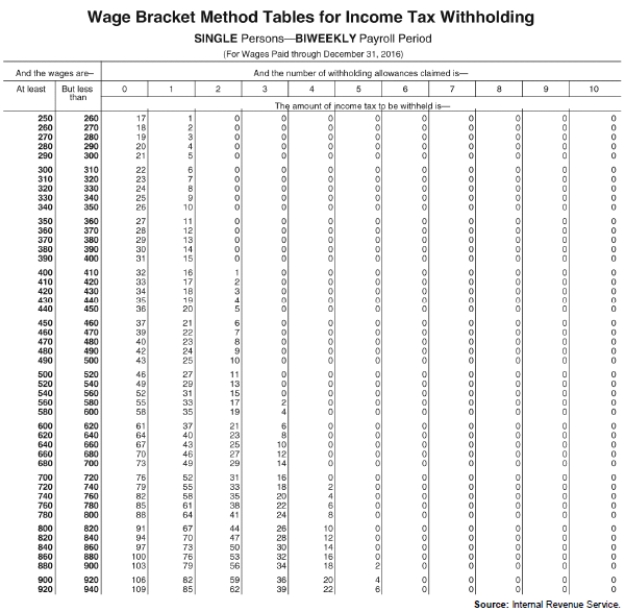

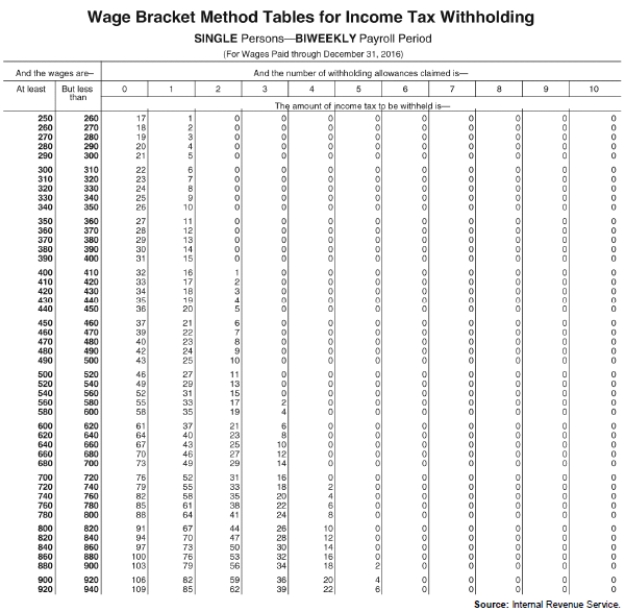

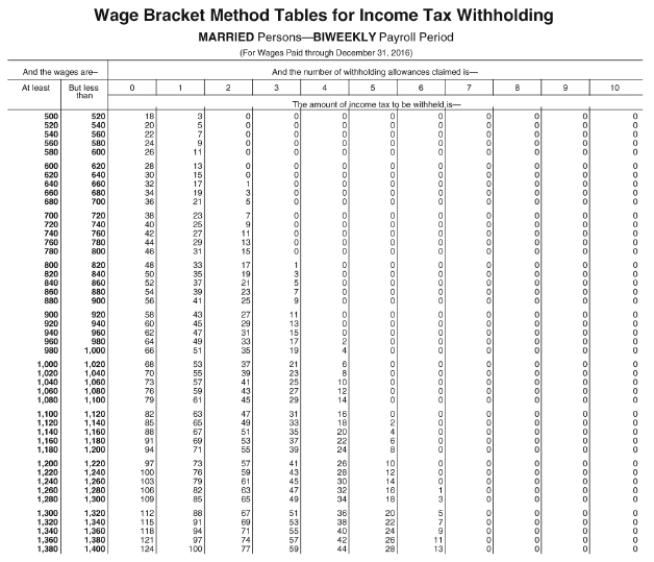

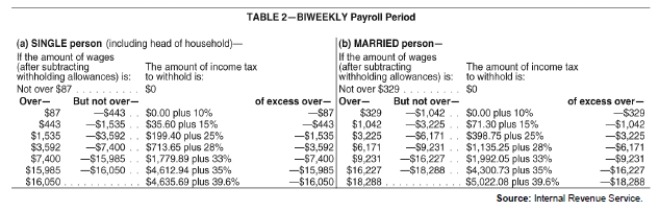

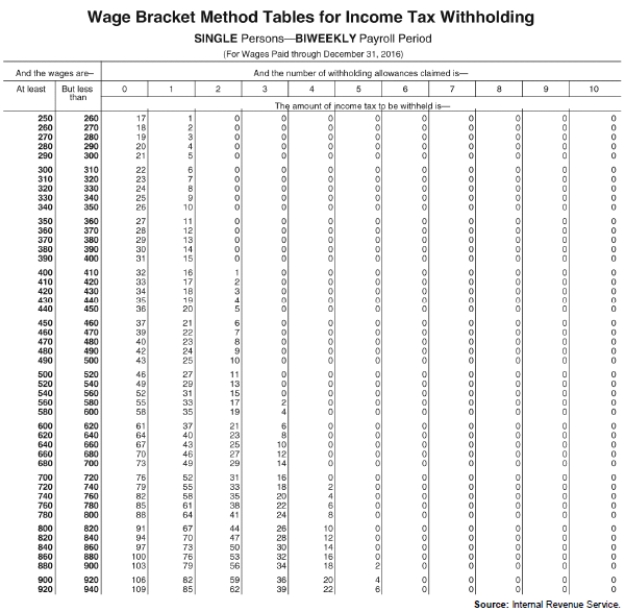

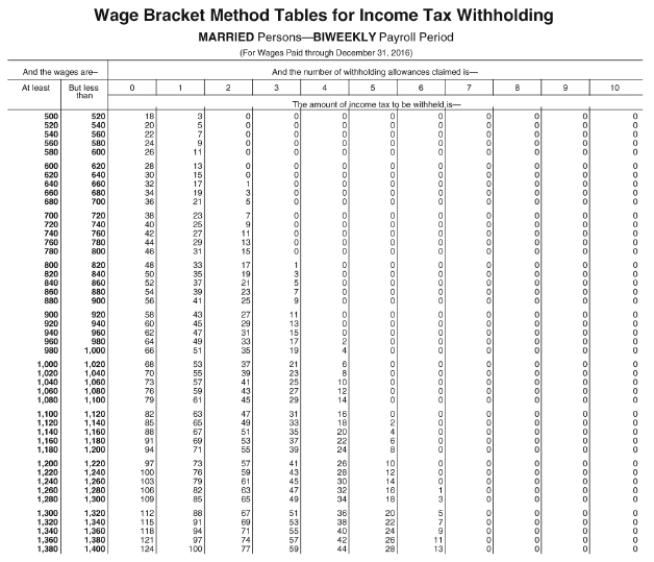

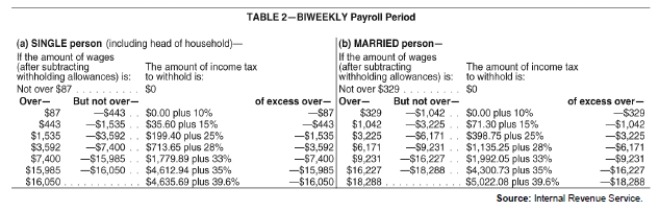

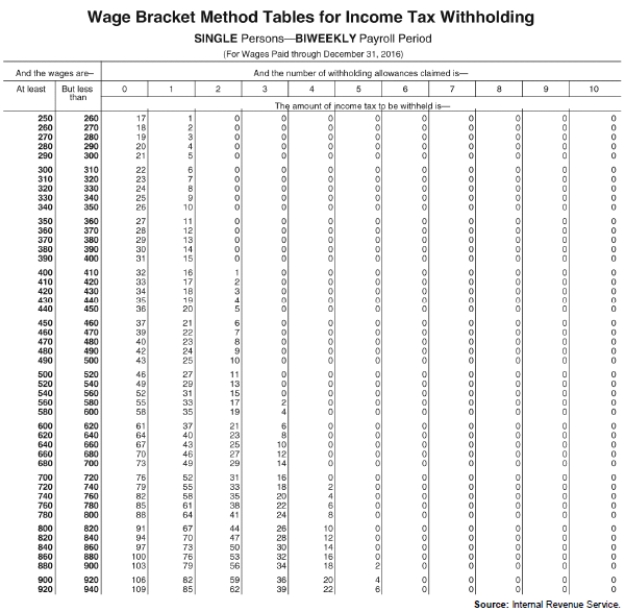

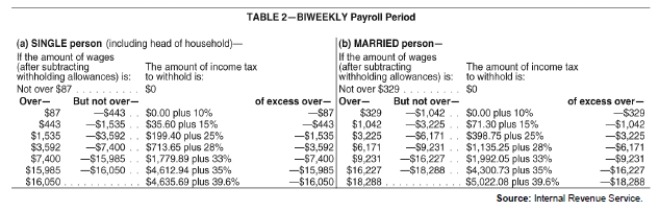

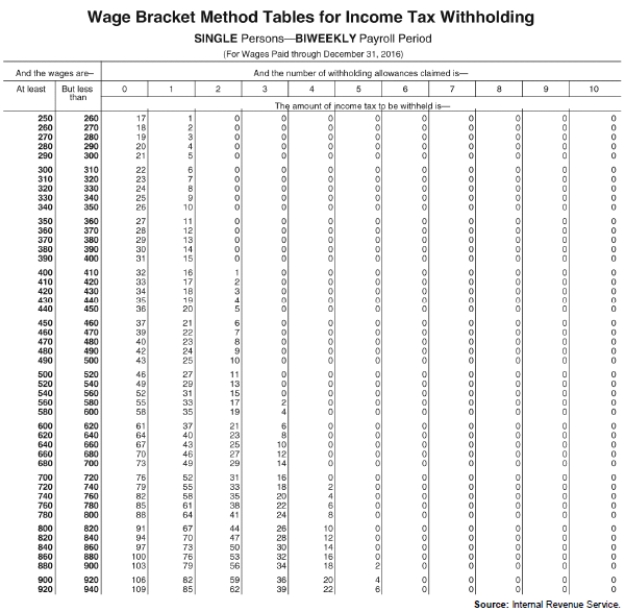

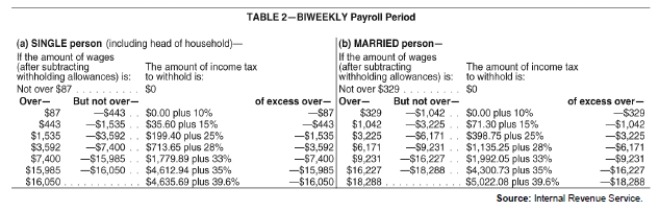

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Edward Dorsey is a part-time employee,and during the biweekly pay period he earned $395.In addition,he is being paid a bonus of $300 along with his regular pay.If Dorsey is single and claims two withholding allowances,how much would be deducted from his pay for FIT? (There are two ways to determine his deduction-do not use table for percentage method. )

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Edward Dorsey is a part-time employee,and during the biweekly pay period he earned $395.In addition,he is being paid a bonus of $300 along with his regular pay.If Dorsey is single and claims two withholding allowances,how much would be deducted from his pay for FIT? (There are two ways to determine his deduction-do not use table for percentage method. )

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following forms is used to report rents paid over $600 to landlords?

A) Form 1099-R

B) Form 1099-INT

C) Form 1099-MISC

D) Form 1099-G

E) Form 8027

A) Form 1099-R

B) Form 1099-INT

C) Form 1099-MISC

D) Form 1099-G

E) Form 8027

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following forms is used to report the amount of distributions from pension and retirement plans?

A) Form W-2c

B) Form 1099-R

C) Form 1099-PEN

D) Form W-3p

E) Form W-4

A) Form W-2c

B) Form 1099-R

C) Form 1099-PEN

D) Form W-3p

E) Form W-4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

47

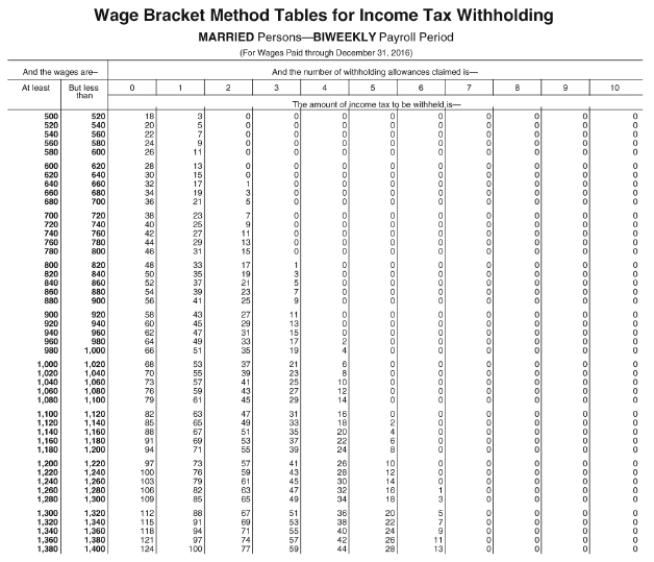

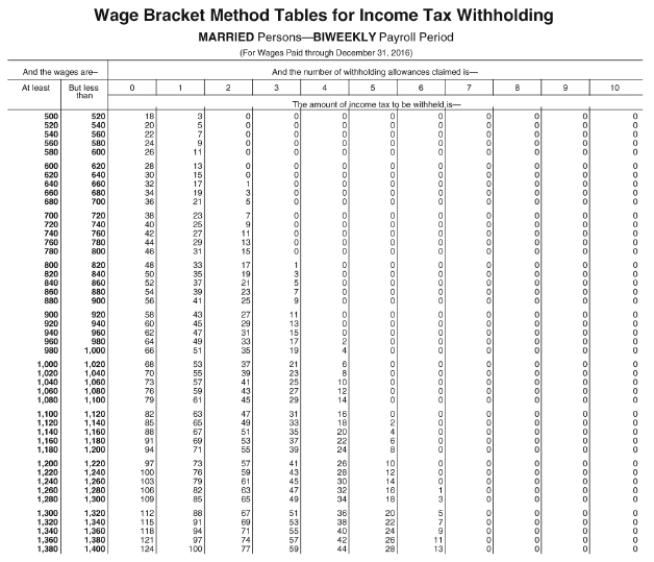

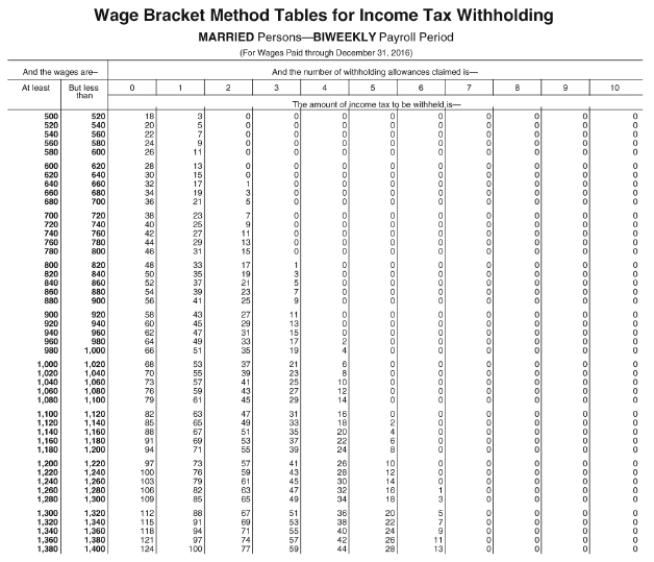

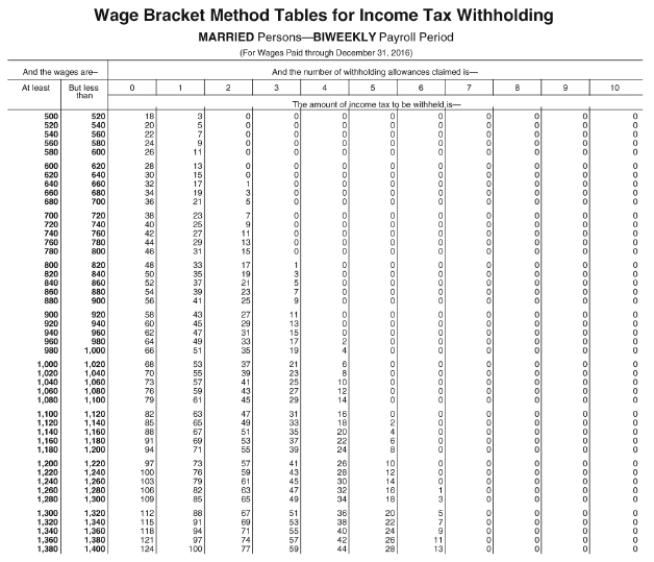

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Ted Duerson,previously unemployed for the calendar year,earned $13,200 during the biweekly period from September 29 to October 13 (20th payroll period).He has made a written request for the part-year employment method of withholding.If Duerson is married and claims zero withholding allowances,how much FIT tax would be withheld from his gross pay using the part-year employment method (using the wage-bracket table)?

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Ted Duerson,previously unemployed for the calendar year,earned $13,200 during the biweekly period from September 29 to October 13 (20th payroll period).He has made a written request for the part-year employment method of withholding.If Duerson is married and claims zero withholding allowances,how much FIT tax would be withheld from his gross pay using the part-year employment method (using the wage-bracket table)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

48

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages (biweekly withholding allowance = $155.80):

Patrick Patrone (single,2 allowances),$925 wages

__________

Carson Leno (married,4 allowances),$1,195 wages

__________

Carli Lintz (single,0 allowances),$700 wages

__________

Gene Hartz (single,1 allowance),$2,500 wages

__________

Mollie Parmer (married,2 allowances),$3,600 wages

__________

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages (biweekly withholding allowance = $155.80):

Patrick Patrone (single,2 allowances),$925 wages

__________

Carson Leno (married,4 allowances),$1,195 wages

__________

Carli Lintz (single,0 allowances),$700 wages

__________

Gene Hartz (single,1 allowance),$2,500 wages

__________

Mollie Parmer (married,2 allowances),$3,600 wages

__________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

49

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Determine the income tax to withhold from the biweekly wages of the following employees (wage-bracket):

Karen Overton (single,0 allowances),$900 wages

__________________

Nancy Haller (married,4 allowances),$1,000 wages

__________________

Alan Glasgow (married,1 allowance),$980 wages

__________________

Joseph Kerr (single,4 allowances),$720 wages

__________________

Ginni Lorenz (single,1 allowance),$580 wages

__________________

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Determine the income tax to withhold from the biweekly wages of the following employees (wage-bracket):

Karen Overton (single,0 allowances),$900 wages

__________________

Nancy Haller (married,4 allowances),$1,000 wages

__________________

Alan Glasgow (married,1 allowance),$980 wages

__________________

Joseph Kerr (single,4 allowances),$720 wages

__________________

Ginni Lorenz (single,1 allowance),$580 wages

__________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

50

To curb the practice of employees filing false Forms W-4,the IRS requires that an employer submit to the agency a copy of each Form W-4:

A) the IRS has requested in writing.

B) on which an employee,usually earning $180 each week at the time Form W-4 was filed,now claims to be exempt from withholding.

C) on which an employee claims to be single but has 9 withholding allowances.

D) on which a married employee claims no withholding allowances.

E) on which a recently divorced employee claims 5 withholding allowances and authorizes an additional $10 to be withheld each week.

A) the IRS has requested in writing.

B) on which an employee,usually earning $180 each week at the time Form W-4 was filed,now claims to be exempt from withholding.

C) on which an employee claims to be single but has 9 withholding allowances.

D) on which a married employee claims no withholding allowances.

E) on which a recently divorced employee claims 5 withholding allowances and authorizes an additional $10 to be withheld each week.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

51

An employer must file an information return under all of the following conditions except:

A) to report $1,000 of compensation paid to an individual who is not an employee.

B) to report the wages totaling $600 paid to an independent contractor during the calendar year.

C) to report dividends totaling $600 paid to an individual during the calendar year.

D) to report commissions of $500 paid to a self-employed salesman.

E) An information return must be filed under each of the above conditions.

A) to report $1,000 of compensation paid to an individual who is not an employee.

B) to report the wages totaling $600 paid to an independent contractor during the calendar year.

C) to report dividends totaling $600 paid to an individual during the calendar year.

D) to report commissions of $500 paid to a self-employed salesman.

E) An information return must be filed under each of the above conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

52

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Carson Smart is paid $1,200 every two weeks plus a taxable lodging allowance of $100.He is a participant in the company 401(k)plan and has $150 deducted from his pay for his contribution to the plan.He is married with two allowances.How much would be deducted from his pay for federal income tax (using the wage-bracket table)?

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Carson Smart is paid $1,200 every two weeks plus a taxable lodging allowance of $100.He is a participant in the company 401(k)plan and has $150 deducted from his pay for his contribution to the plan.He is married with two allowances.How much would be deducted from his pay for federal income tax (using the wage-bracket table)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

53

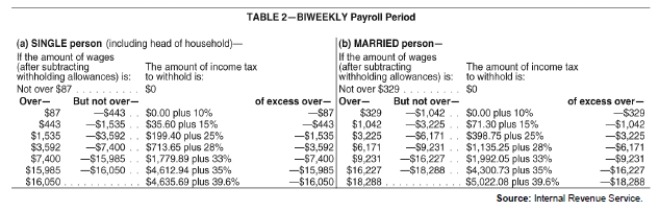

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Calculate the amount to withhold from the following employees using the biweekly table of the percentage method.

Kenneth Karcher (single,1 allowance = $155.80),$895 wages

__________

Mary Kenny (married,2 allowances = $311.60),$1,900 wages

__________

Thomas Carney (single,0 allowances),$1,460 wages

__________

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

Refer to Exhibit 4-1.Calculate the amount to withhold from the following employees using the biweekly table of the percentage method.

Kenneth Karcher (single,1 allowance = $155.80),$895 wages

__________

Mary Kenny (married,2 allowances = $311.60),$1,900 wages

__________

Thomas Carney (single,0 allowances),$1,460 wages

__________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

54

All of the following are properly defined as wages subject to the withholding of federal income taxes except:

A) year-end bonus.

B) kitchen appliances given by manufacturer in lieu of cash wages.

C) dismissal payment.

D) vacation pay.

E) payments made under worker's compensation law.

A) year-end bonus.

B) kitchen appliances given by manufacturer in lieu of cash wages.

C) dismissal payment.

D) vacation pay.

E) payments made under worker's compensation law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

55

Beech refuses to state her marital status on Form W-4 which she gave to you,the payroll manager,when she was hired.You should:

A) tell Beech that it is OK since you know that she was recently divorced and is reluctant to talk about it.

B) inform Beech that she will have to write the IRS and give her reasons for refusing to state her marital status.

C) tell Beech that you will have to withhold income taxes as if she were married and had claimed one allowance.

D) tell Beech that you will have to withhold income taxes according to the withholding table for a single employee with no allowances.

E) advise Beech to write "It is no business of yours." in the margin of her Form W-4.

A) tell Beech that it is OK since you know that she was recently divorced and is reluctant to talk about it.

B) inform Beech that she will have to write the IRS and give her reasons for refusing to state her marital status.

C) tell Beech that you will have to withhold income taxes as if she were married and had claimed one allowance.

D) tell Beech that you will have to withhold income taxes according to the withholding table for a single employee with no allowances.

E) advise Beech to write "It is no business of yours." in the margin of her Form W-4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck

56

Arch gives you an amended Form W-4 dated March 10,2017 on which he claims two additional withholding allowances.He asks you to refund the excess taxes that were deducted from January 1 to March 10 when Arch claimed only one withholding allowance.You should:

A) repay the overwithheld taxes on Arch's next payday.

B) tell Arch that you will spread out a refund of the overwithheld taxes equally over the next six pays.

C) inform Arch that you are unable to repay the overwithheld taxes that were withheld before

March 10 and that the adjustment will have to be made when he files his annual income tax return.

D) tell Arch to write the IRS immediately and ask for a refund of the overwithheld taxes.

E) inform Arch that you will appoint a committee to study his request.

A) repay the overwithheld taxes on Arch's next payday.

B) tell Arch that you will spread out a refund of the overwithheld taxes equally over the next six pays.

C) inform Arch that you are unable to repay the overwithheld taxes that were withheld before

March 10 and that the adjustment will have to be made when he files his annual income tax return.

D) tell Arch to write the IRS immediately and ask for a refund of the overwithheld taxes.

E) inform Arch that you will appoint a committee to study his request.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 56 في هذه المجموعة.

فتح الحزمة

k this deck