Deck 3: Financial Statement and Budgets: Where Are You Now and Where Are You Going

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/115

العب

ملء الشاشة (f)

Deck 3: Financial Statement and Budgets: Where Are You Now and Where Are You Going

1

Which of the following relationships is correct?

A)Liabilities = Net worth - Assets

B)Liabilities = Assets

C)Liabilities = Net worth + Assets

D)Net worth = Assets - Liabilities

A)Liabilities = Net worth - Assets

B)Liabilities = Assets

C)Liabilities = Net worth + Assets

D)Net worth = Assets - Liabilities

Net worth = Assets - Liabilities

2

Dave Scott bought a used car in early 2007 for $12,000.He borrowed $11,000,which he is repaying over four years.During 2007,he made payments of $3,600,of which $800 was interest and $2,800 was repayment of principal.Dave believes the car depreciated about $4,000 in 2007.Given the above data we can say that by the end of 2005 the car had

A)increased Dave's net worth by $8,200.

B)decreased Dave's net worth by $4,800.

C)increased Dave's assets by $12,000,increased his liabilities by $11,000,and increased his net worth by $1,000.

D)decreased Dave's net worth by $200.

A)increased Dave's net worth by $8,200.

B)decreased Dave's net worth by $4,800.

C)increased Dave's assets by $12,000,increased his liabilities by $11,000,and increased his net worth by $1,000.

D)decreased Dave's net worth by $200.

decreased Dave's net worth by $200.

3

Which of the following items would appear on a personal balance sheet?

A)A loan made on a life insurance policy

B)Interest paid on an installment loan

C)Interest received on a savings account

D)Premiums paid on a health insurance policy

A)A loan made on a life insurance policy

B)Interest paid on an installment loan

C)Interest received on a savings account

D)Premiums paid on a health insurance policy

A loan made on a life insurance policy

4

For most individuals,which item below is an example of a lifestyle asset?

A)100 shares of IBM stock

B)$2,000 in a savings account

C)$10,000 vested interest in an employer's retirement plan

D)A new car

A)100 shares of IBM stock

B)$2,000 in a savings account

C)$10,000 vested interest in an employer's retirement plan

D)A new car

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

5

Two kinds of noncurrent liabilities are

A)deferred liabilities and rescheduled obligations.

B)bills payable and credit card balances due.

C)co-signor agreements and bankruptcy judgments.

D)noncurrent portions of loans with repayment schedules and loans without repayment schedules.

A)deferred liabilities and rescheduled obligations.

B)bills payable and credit card balances due.

C)co-signor agreements and bankruptcy judgments.

D)noncurrent portions of loans with repayment schedules and loans without repayment schedules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

6

In relation to the balance sheet,an income statement shows

A)net worth,not the period's savings or dissavings.

B)the period's savings or dissavings,not net worth.

C)activities at a point in time,not over a period of time.

D)financial position,not financial performance.

A)net worth,not the period's savings or dissavings.

B)the period's savings or dissavings,not net worth.

C)activities at a point in time,not over a period of time.

D)financial position,not financial performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

7

Current liabilities are often defined as those

A)payable immediately.

B)payable within one year.

C)payable over the same maturity as the asset they financed.

D)that can be liquidated without decreasing your existing net worth.

A)payable immediately.

B)payable within one year.

C)payable over the same maturity as the asset they financed.

D)that can be liquidated without decreasing your existing net worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

8

The best description of an asset is

A)something you own that has market value.

B)something you either own or control that provides monetary or psychic income.

C)anything of personal value to you.

D)something you own that has market value and is clear of any debt obligation.

A)something you own that has market value.

B)something you either own or control that provides monetary or psychic income.

C)anything of personal value to you.

D)something you own that has market value and is clear of any debt obligation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

9

Funds borrowed on a life insurance policy are shown on the balance sheet as

A)a current liability.

B)a noncurrent liability.

C)an offset to the value of the stock.

D)an offset to net worth.

A)a current liability.

B)a noncurrent liability.

C)an offset to the value of the stock.

D)an offset to net worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

10

At the end of 2005,Phil had a net worth of $10,000.During 2008,he plans to save $2,000 and he also expects the market value of his assets to increase by 5%.If Phil's total liabilities were $4,000 at December 31,2007,his December 31,2008 net worth will be

A)$12,000.

B)$12,500.

C)$12,700.

D)$12,800.

A)$12,000.

B)$12,500.

C)$12,700.

D)$12,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

11

A liquid asset is most appropriately described as one that is

A)cash in a checking account.

B)cash or any other asset that is easily converted to cash with no loss in market value.

C)cash or any other asset that is marketable.

D)cash and all other assets except those specifically designated as retirement assets.

A)cash in a checking account.

B)cash or any other asset that is easily converted to cash with no loss in market value.

C)cash or any other asset that is marketable.

D)cash and all other assets except those specifically designated as retirement assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following items would not appear on a personal balance sheet?

A)Jewelry

B)Credit card balances

C)Rent expense

D)A loan to a friend

A)Jewelry

B)Credit card balances

C)Rent expense

D)A loan to a friend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

13

Kathy charged her groceries on her credit card.The cost of the groceries is now a

A)current liability.

B)noncurrent liability.

C)noncurrent asset.

D)current asset.

A)current liability.

B)noncurrent liability.

C)noncurrent asset.

D)current asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

14

An asset that influences the quality of your life is referred to in the text as a

A)lifestyle asset.

B)liquid asset.

C)current asset.

D)lifelong asset.

A)lifestyle asset.

B)liquid asset.

C)current asset.

D)lifelong asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

15

Your personal balance sheet provides

A)an estimate of your net worth at a point in time.

B)an illustration of how your wealth has changed over time.

C)a summary estimate of your expenses and income over the previous year.

D)a pro forma budget for the coming year.

A)an estimate of your net worth at a point in time.

B)an illustration of how your wealth has changed over time.

C)a summary estimate of your expenses and income over the previous year.

D)a pro forma budget for the coming year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

16

Three years ago,Michelle bought a custom-made bookcase to fit in the corner of her apartment.She paid $1,000 for it.To replace it today would cost $1,500;however,if she had to sell it,she believes she could get only $700.The appropriate balance sheet amount for the bookcase is

A)$1,000.

B)$1,500.

C)$ 700.

D)$1,200.

A)$1,000.

B)$1,500.

C)$ 700.

D)$1,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following relationships is correct?

A)Assets + Net worth = Liabilities

B)Assets + Liabilities = Net Worth

C)Assets - Net Worth = Liabilities

D)Assets - Net Worth + Liabilities = zero

A)Assets + Net worth = Liabilities

B)Assets + Liabilities = Net Worth

C)Assets - Net Worth = Liabilities

D)Assets - Net Worth + Liabilities = zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

18

A personal income statement shows

A)a detailed breakdown of cash income and expenses over a past period of time.

B)a comparison of income and expenses at a point in time.

C)your contribution to savings for the year by following strict accounting rules for determining net income.

D)all revenue,expense,asset,liability,and net worth items.

A)a detailed breakdown of cash income and expenses over a past period of time.

B)a comparison of income and expenses at a point in time.

C)your contribution to savings for the year by following strict accounting rules for determining net income.

D)all revenue,expense,asset,liability,and net worth items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

19

The most appropriate definition of a balance sheet is that it is a statement that shows

A)a balance between one's goals and resources available to achieve them.

B)a realistic balance between income and expenses for an upcoming period.

C)your wealth (net worth)as of a specific date.

D)how to balance your financial books of account.

A)a balance between one's goals and resources available to achieve them.

B)a realistic balance between income and expenses for an upcoming period.

C)your wealth (net worth)as of a specific date.

D)how to balance your financial books of account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

20

To be considered an investment asset,an item

A)must be purchased for the specific purpose of providing additional income or increasing net worth.

B)must be a stock,a bond,or a savings account.

C)must be intangible.

D)must be owned free and unencumbered by a loan.

A)must be purchased for the specific purpose of providing additional income or increasing net worth.

B)must be a stock,a bond,or a savings account.

C)must be intangible.

D)must be owned free and unencumbered by a loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

21

A positive contribution to savings can

A)increase both assets and net worth.

B)increase both assets and liabilities.

C)increase net worth only.

D)increase assets only or liabilities only.

A)increase both assets and net worth.

B)increase both assets and liabilities.

C)increase net worth only.

D)increase assets only or liabilities only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

22

A simple yardstick to measure your annual income performance is to compare the annual inflation rate with your

A)percentage increase in nominal income.

B)percentage increase in real income.

C)percentage increase in nominal expenses.

D)percentage increase in real expenses.

A)percentage increase in nominal income.

B)percentage increase in real income.

C)percentage increase in nominal expenses.

D)percentage increase in real expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

23

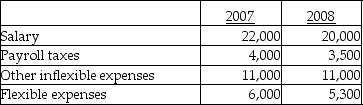

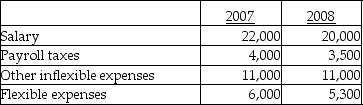

Jan showed the following financial items in 2007 and 2008:

In relation to 2007's savings,Jan's savings in 2008

A)decreased by $800.

B)decreased by $200.

C)increased by $200.

D)increased by $800.

In relation to 2007's savings,Jan's savings in 2008

A)decreased by $800.

B)decreased by $200.

C)increased by $200.

D)increased by $800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

24

Rob's income was $20,000 in 2005 and $22,000 in 2006.If inflation was 6% in 2006,then we can say that Rob's 2006 income

A)simply matched the inflation rate.

B)fell behind the inflation rate.

C)exceeded the inflation rate by 4%.

D)lagged the inflation rate by 2%.

A)simply matched the inflation rate.

B)fell behind the inflation rate.

C)exceeded the inflation rate by 4%.

D)lagged the inflation rate by 2%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

25

In relation to the balance sheet or income statement,the budget

A)requires greater accuracy.

B)requires greater concern for financial goals.

C)is less concerned with planning.

D)is less important.

A)requires greater accuracy.

B)requires greater concern for financial goals.

C)is less concerned with planning.

D)is less important.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

26

People suffering from sticker shock probably have

A)overestimated their real income.

B)underestimated their nominal income.

C)overestimated inflation.

D)underestimated inflation.

A)overestimated their real income.

B)underestimated their nominal income.

C)overestimated inflation.

D)underestimated inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

27

If your take-home pay is $30,000 annually and you have $15,000 in liquid assets and $5,000 in current liabilities,you have about

A)six months' of liquid reserves,which is good.

B)two month's of liquid reserves,which is poor.

C)four month's of liquid reserves,which is fair.

D)six years of liquid reserves,which is excessive.

A)six months' of liquid reserves,which is good.

B)two month's of liquid reserves,which is poor.

C)four month's of liquid reserves,which is fair.

D)six years of liquid reserves,which is excessive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

28

Dissavings can

A)decrease assets and net worth.

B)decrease both assets and liabilities.

C)decrease net worth only.

D)decrease assets only or liabilities only.

A)decrease assets and net worth.

B)decrease both assets and liabilities.

C)decrease net worth only.

D)decrease assets only or liabilities only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

29

If the rate of increase in the dollar value of your net worth equals the rate of inflation,then your

A)real net worth is unchanged.

B)real income is unchanged.

C)nominal net worth is unchanged.

D)nominal income is unchanged.

A)real net worth is unchanged.

B)real income is unchanged.

C)nominal net worth is unchanged.

D)nominal income is unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

30

The current average savings rate for all U.S.families is generally in the range of:

A)10 to 20%.

B)5 to 10%.

C)0 to 5%.

D)0 to - 5%.

A)10 to 20%.

B)5 to 10%.

C)0 to 5%.

D)0 to - 5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following statements might be considered poor advice in budgeting?

A)Set realistic budget goals.

B)Stick to simple procedures.

C)Use the budget primarily as a record-keeping device.

D)Use the budget to direct and control expenses.

A)Set realistic budget goals.

B)Stick to simple procedures.

C)Use the budget primarily as a record-keeping device.

D)Use the budget to direct and control expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

32

Stacey has a debt service coverage ratio of 1.15.This tells us that

A)Stacey's debt service charges are 1.15% of her take-home pay.

B)Stacey has virtually no debt to service.

C)Stacey has poor debt-carrying capacity and much of her future income will be required to service past debt.

D)Stacey's debt reserves are only 1.15 times greater than her actual debts.

A)Stacey's debt service charges are 1.15% of her take-home pay.

B)Stacey has virtually no debt to service.

C)Stacey has poor debt-carrying capacity and much of her future income will be required to service past debt.

D)Stacey's debt reserves are only 1.15 times greater than her actual debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

33

If your liquidity ratio is 1.50,you have

A)$1.50 in liquid assets for $1.00 of take-home pay.

B)$1.50 in liquid assets for $1.00 of current liabilities.

C)$1.50 in liquid assets for $1.00 of total liabilities.

D)$1.50 in liquid assets for $1.00 of total assets.

A)$1.50 in liquid assets for $1.00 of take-home pay.

B)$1.50 in liquid assets for $1.00 of current liabilities.

C)$1.50 in liquid assets for $1.00 of total liabilities.

D)$1.50 in liquid assets for $1.00 of total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

34

Among other things,a well-planned budget

A)forces you to choose among competing activities.

B)plans for savings of at least 20% of your after-tax income.

C)must include many categories of income and expense items.

D)assures a positive savings each month.

A)forces you to choose among competing activities.

B)plans for savings of at least 20% of your after-tax income.

C)must include many categories of income and expense items.

D)assures a positive savings each month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

35

Your income less your expenses over the previous period represents

A)your contribution to savings

B)your net worth.

C)the reduction in your net worth.

D)your total savings.

A)your contribution to savings

B)your net worth.

C)the reduction in your net worth.

D)your total savings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which item below contains all inflexible expenses?

A)Rent,dining out,payroll taxes

B)Hobbies,clothing,vacations

C)Life insurance,health insurance,utilities

D)Auto loan payments,mortgage payments,auto insurance

A)Rent,dining out,payroll taxes

B)Hobbies,clothing,vacations

C)Life insurance,health insurance,utilities

D)Auto loan payments,mortgage payments,auto insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

37

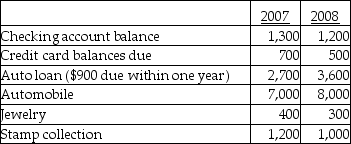

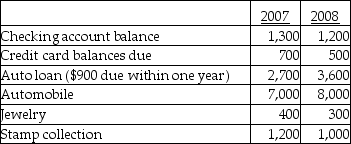

Jan showed the following financial items at the ends of 2007 and 2085:

Jan's net worth changed in 2008 by

A)+ $100.

B)- $700.

C)+ $400.

D)+ $800.

Jan's net worth changed in 2008 by

A)+ $100.

B)- $700.

C)+ $400.

D)+ $800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is an example of an inflexible expense?

A)Mortgage payments

B)Entertainment

C)Home maintenance

D)Newspapers and magazines

A)Mortgage payments

B)Entertainment

C)Home maintenance

D)Newspapers and magazines

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

39

Juanita has the following three ratios: (1)debt service coverage = 2.5, (2)debt ratio = 0.5,and (3)liquidity ratio = 0.8.We can say that Juanita has

A)poor solvency and poor liquidity.

B)strong solvency and strong liquidity.

C)strong liquidity but poor solvency.

D)strong solvency but poor liquidity.

A)poor solvency and poor liquidity.

B)strong solvency and strong liquidity.

C)strong liquidity but poor solvency.

D)strong solvency but poor liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

40

John Davis has a debt ratio of 0.25,which tells us that John

A)is insolvent since the ratio is less than 1.0.

B)could have $10,000 in total assets and $7,500 in net worth.

C)has 25% of his income allocated to reducing debt.

D)might have $2,500 in liquid assets and $10,000 in current debts.

A)is insolvent since the ratio is less than 1.0.

B)could have $10,000 in total assets and $7,500 in net worth.

C)has 25% of his income allocated to reducing debt.

D)might have $2,500 in liquid assets and $10,000 in current debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

41

In extending an expense item for the current budget year,an often-used and useful approach is to

A)use last year's figure.

B)use the average of the last three years.

C)use last year's figure plus a usual 10% "fudge factor."

D)adjust last year's figure upwards by this year's expected inflation.

A)use last year's figure.

B)use the average of the last three years.

C)use last year's figure plus a usual 10% "fudge factor."

D)adjust last year's figure upwards by this year's expected inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

42

The primary purpose of the monthly review and control is

A)to indicate future revised spending amounts,assuming some prior variances.

B)to revise action plans.

C)to identify family members causing unfavorable variances.

D)make sure the previous month's budget is balanced.

A)to indicate future revised spending amounts,assuming some prior variances.

B)to revise action plans.

C)to identify family members causing unfavorable variances.

D)make sure the previous month's budget is balanced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

43

The following two items are from Marcia White's "Dining Out" expense category:

(1)January monthly variance = $25 (favorable);

(2)February cumulative variance = -$10 (unfavorable).

If Marcia budgeted $85 a month for this activity,we know that she

A)spent $60 in January and $95 in February.

B)spent $60 in January and $120 in February.

C)can bring the activity back within budget by spending $85 in March.

D)has not budgeted properly.

(1)January monthly variance = $25 (favorable);

(2)February cumulative variance = -$10 (unfavorable).

If Marcia budgeted $85 a month for this activity,we know that she

A)spent $60 in January and $95 in February.

B)spent $60 in January and $120 in February.

C)can bring the activity back within budget by spending $85 in March.

D)has not budgeted properly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

44

An asset is anything you own that has market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

45

For purposes of annual budgeting,it is better to

A)express goals very broadly to allow for flexibility.

B)ignore goals altogether and focus instead on savings.

C)express income goals concretely and expense goals broadly;this usually assures adequate savings.

D)express all goals concretely,which then reduces all goals to yearly consumption and savings targets.

A)express goals very broadly to allow for flexibility.

B)ignore goals altogether and focus instead on savings.

C)express income goals concretely and expense goals broadly;this usually assures adequate savings.

D)express all goals concretely,which then reduces all goals to yearly consumption and savings targets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

46

The master budget worksheet shows

A)forecasted income and expenses for the budget year.

B)month-to-month budget variances.

C)a reconciliation of this year's budget to last year's balance sheet.

D)all balance sheet and income statement accounts that relate to the annual budget.

A)forecasted income and expenses for the budget year.

B)month-to-month budget variances.

C)a reconciliation of this year's budget to last year's balance sheet.

D)all balance sheet and income statement accounts that relate to the annual budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

47

If some expense items are related to your income,and your income increases above budgeted amounts,you can expect

A)favorable variances in both income and expense accounts.

B)budgeted savings to remain about the same.

C)favorable income variances and unfavorable variances in related expenses.

D)savings will decrease.

A)favorable variances in both income and expense accounts.

B)budgeted savings to remain about the same.

C)favorable income variances and unfavorable variances in related expenses.

D)savings will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

48

The main function of a balance sheet is to show your net worth at a point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

49

A favorable income variance indicates a monthly income

A)equal to the budgeted monthly income.

B)greater than budgeted monthly expenses.

C)greater than budgeted monthly income.

D)greater than accumulated income variances.

A)equal to the budgeted monthly income.

B)greater than budgeted monthly expenses.

C)greater than budgeted monthly income.

D)greater than accumulated income variances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

50

A liquid asset is any asset that can be sold quickly,even if such a sale results in a loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

51

Adding together all 12-month cumulative income and expense variances should equal

A)zero.

B)actual savings (or dissavings).

C)planned savings (or dissavings).

D)the difference between planned saving and actual saving.

A)zero.

B)actual savings (or dissavings).

C)planned savings (or dissavings).

D)the difference between planned saving and actual saving.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

52

A savings account is an example of a liquid asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which item is not true with respect to simplifying the recording of income and expenses?

A)Use cash to pay bills whenever possible.

B)Code income and expense items on your check stubs and bank deposits.

C)Use bank-provided bookkeeping services,if they are available and reasonably priced.

D)Use a personal computer,if you own one.

A)Use cash to pay bills whenever possible.

B)Code income and expense items on your check stubs and bank deposits.

C)Use bank-provided bookkeeping services,if they are available and reasonably priced.

D)Use a personal computer,if you own one.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

54

If a balance sheet is prepared correctly,assets plus liabilities equals net worth plus savings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

55

If your assets increase from one year to the next,so must your net worth by an equal amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

56

Asset values on the balance sheet should reflect their acquisition costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following statements is not true concerning the monthly income and expense plan?

A)Each month's expenses are planned not to exceed the month's income.

B)The year's expenses and income are detailed by each month.

C)Some monthly allocations are made by simply dividing the annual estimate by 12.

D)It may indicate the need for effective cash management.

A)Each month's expenses are planned not to exceed the month's income.

B)The year's expenses and income are detailed by each month.

C)Some monthly allocations are made by simply dividing the annual estimate by 12.

D)It may indicate the need for effective cash management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

58

In preparing a balance sheet,you should list only those assets that you own outright;that is,free of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

59

From a budgeting view,which of the following statements is not true concerning variances?

A)A favorable expense variance means the budgeted amount was more than actual.

B)Cumulative variance = current month's variance + variances of previous months.

C)Ideally,cumulative variances for the year will equal zero.

D)Ideally,cumulative variances for the year should have a positive value.

A)A favorable expense variance means the budgeted amount was more than actual.

B)Cumulative variance = current month's variance + variances of previous months.

C)Ideally,cumulative variances for the year will equal zero.

D)Ideally,cumulative variances for the year should have a positive value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

60

The cumulative variable is equal to

A)favorable variances less unfavorable variances over the previous months.

B)favorable variances plus unfavorable variances over the previous months.

C)this months planned expenses less actual expenses.

D)this months actual expenses less planned expenses.

A)favorable variances less unfavorable variances over the previous months.

B)favorable variances plus unfavorable variances over the previous months.

C)this months planned expenses less actual expenses.

D)this months actual expenses less planned expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

61

A noncurrent liability is a debt obligation extending beyond one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

62

Funds invested in retirement plans are shown as liquid assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

63

Financial progress is measured more appropriately by an increase in net worth rather than by an increase in total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

64

A loan associated with a margin account is classified as a current liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

65

A positive contribution to savings must lead to an increase in assets,a decrease in liabilities,or a combination of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

66

A loan on a life insurance policy is shown as a noncurrent liability even though the debt has no due date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

67

For balance sheet purposes,the best definition of a liability is anything that impedes your financial progress.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

68

Liquid assets are less risky than investment assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

69

An automobile is usually an example of a lifestyle asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

70

Rent and life insurance expenses are examples of flexible expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

71

Current liabilities are defined as past-due debt obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

72

Cash flow changes in net worth can be positive or negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

73

Overdue bills are noncurrent liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

74

The sum of current and noncurrent liabilities is net worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

75

Flexible expenses are best understood as those expenses over which you have little or no control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

76

The "bottom line" to a personal income statement is the contribution to savings figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

77

By definition,a lifestyle asset must depreciate over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

78

The primary functions of an investment asset are to increase your net worth and/or provide additional income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

79

Common stocks are good examples of liquid assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

80

Market value changes in net worth arise from current period savings or dissavings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck