Deck 17: Partnerships and S Corporations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

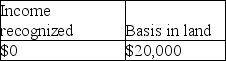

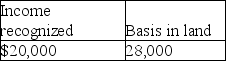

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

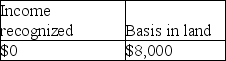

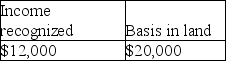

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/150

العب

ملء الشاشة (f)

Deck 17: Partnerships and S Corporations

1

S corporations are a common form for small businesses because they offer more flexibility than partnerships in terms of ownership structure and allocation of income.

False

Explanation: Provisions relating to ownership structures and allocation of income for S corporations are much more strict than those governing the partnership form.

Explanation: Provisions relating to ownership structures and allocation of income for S corporations are much more strict than those governing the partnership form.

2

In a limited partnership,the limited partners are liable for partnership debts only to the extent of their investment in the partnership plus any amount they commit to contribute to the partnership if called upon.

True

Explanation: Limited partners are not generally engaged in management and want to limit losses in a manner similar to corporate shareholders. State limited partnership statutes provide this protection.

Explanation: Limited partners are not generally engaged in management and want to limit losses in a manner similar to corporate shareholders. State limited partnership statutes provide this protection.

3

If a partner contributes property to a partnership,and that property is subject to a liability,the noncontributing partners increase the basis of their partnership interests by their share of the partnership liabilities that were transferred to the partnership.

True

Explanation: The increase in a partner's share of liability is treated as a cash contribution.

Explanation: The increase in a partner's share of liability is treated as a cash contribution.

4

The transfer of property to a partnership in exchange for a partnership interest will generally be a nontaxable event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

5

Etta transfers property with an adjusted basis of $60,000 in exchange for a 50% partnership interest.The property is subject to a $70,000 mortgage which the partnership will assume.The partnership has no other liabilities.Etta will recognize a $10,000 gain on the exchange due to the negative basis limitation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

6

A contribution of services to a partnership will result in recognition of compensation to the contributing partner equal to the fair market value of the services as well as an increase in partnership basis to the extent of the income recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

7

The income of a single member LLC is taxed to its owner under the sole proprietorship rules if no election to be taxed as a corporation is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

8

When capital or Sec.1231 assets are transferred to a partnership in exchange for a partnership interest qualifying under Sec.721,the holding period for the partnership interest includes the holding period of the contributed property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

9

All of the following could file partnership tax returns except

A) general partnership.

B) limited liability partnership.

C) limited liability company.

D) single member limited liability company.

A) general partnership.

B) limited liability partnership.

C) limited liability company.

D) single member limited liability company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

10

If a partner contributes inventory to the partnership in exchange for a partnership interest,the holding period for the partnership interest begins on the date the inventory was acquired by the transferor partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

11

All the following are types of pass-through entities except

A) LLP.

B) LLC.

C) C corporations.

D) S corporations.

A) LLP.

B) LLC.

C) C corporations.

D) S corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

12

An LLC that elects to be taxed like a partnership is also classified as a partnership for legal purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

13

Charlie Company is a partnership with two owners,Charlie and Robert.Each owner has a $20,000 original basis in the entity having contributed cash to the partnership at its formation.In the first year of operations,the partnership reported $50,000 of income which is allocated to each partner equally.The partnership has no liabilities.If Charlie sells his partnership interest to Jody for $55,000,what is the amount of gain or loss on the transaction?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

14

Pass-through entities are taxed at only one level-the ownership level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

15

The basis of a partnership interest is equal to the sum of money contributed plus the FMV of the property transferred to the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

16

Limited liability of partners or members is an advantage of all the following with the exception of

A) LLP.

B) LLC.

C) limited partnerships.

D) general partnerships.

A) LLP.

B) LLC.

C) limited partnerships.

D) general partnerships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

17

Many professional service partnerships have adopted the LLP form primarily because it

A) limits legal liability.

B) limits the number of members.

C) allows for the transfer of partners' interests.

D) assures the continuity of life.

A) limits legal liability.

B) limits the number of members.

C) allows for the transfer of partners' interests.

D) assures the continuity of life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

18

The partnership's assumption of a liability from a partner is treated as a cash distribution to the partner whose liability is assumed,which decreases his basis in the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

19

Because a partnership is a pass-through entity rather than a taxable entity,partnerships need not file tax returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

20

Under the "check-the-box" Treasury Regulations,an LLC with more than one member is treated as a partnership unless the LLC affirmatively elects to be classified as a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

21

A partnership sells equipment and recognizes depreciation recapture under Sec.1245.In reporting its results for the year,the partnership will separately state the Sec.1245 depreciation recapture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

22

All costs of organizing a partnership can be deducted in the year in which the partnership begins business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

23

Losses are disallowed on sales or exchanges between a partner and the partnership if the partner owns directly or indirectly more than a 50% interest in the capital or profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

24

When property is contributed to a partnership,the partnership's basis in the property is the same as that of the transferor partner even if gain is recognized on the transfer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

25

A partnership is generally required to use the tax year of one or more partners who own more than a 50% interest in partnership profits and capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

26

If a partner contributes depreciable property to a partnership in exchange for a partnership interest,the depreciation recapture potential of the contributed assets does not carry over to the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

27

When a partnership interest is sold,ordinary income may result if a partnership has unrealized receivables or inventory items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

28

A CPA firm,operating as a partnership,can become an electing large partnership as long as it has at least 100 partners and files the appropriate election.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

29

A partnership sells an asset for a gain.The asset had been transferred to the partnership two years ago by Partner J in exchange for a partnership interest.The asset was worth substantially more than its cost as of the transfer date.The partnership gain will be allocated to all of the partners in accordance with their profit and loss sharing ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

30

The primary purpose of a partnership tax return is to determine the income,deduction,loss and credit items of the partnership and thus the amounts that should be reported by the individual partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

31

A nonliquidating distribution of cash or property from the partnership to a partner is generally treated as a tax-free return of capital to the extent of a partner's basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

32

A partnership's liabilities have increased by year-end.As a result,partners' bases in their partnership interests will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

33

The expenses associated with promoting and marketing partnership interests can be currently deducted if $5,000 or less.Expenses in excess of $5,000 are amortized over 180 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

34

Guaranteed payments are not deductible by the partnership in arriving at partnership ordinary income but are included in the receiving partner's income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

35

Although a partner's distributive share of income,deductions,losses,and credits is generally determined by partnership agreement,special allocation provisions restrict the partners' freedom to shift some tax benefits among partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

36

Tess buys Harry's partnership interest in Oval Partnership.Oval holds several highly appreciated assets,and this appreciation is reflected in the price Tess paid for the partnership interest.Tess can make a Sec.754 election to increase the basis of her share of partnership assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

37

Ordinary losses and separately stated deduction and loss items that exceed a partner's basis carry over indefinitely until the partner has a positive partnership basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

38

Gains on sales or exchanges between a partner and the partnership are treated as ordinary income if the partner owns more than a 50% interest in the capital or profits and the asset that is exchanged is not a capital asset in the transferee's hands.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

39

The basis of a partner's interest in a partnership is adjusted to reflect each partner's share of income and deduction items only if a distribution is made to the partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

40

A liquidating distribution is treated as a sale or exchange of a partnership interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

41

Kuda exchanges property with a FMV of $630,000 and an adjusted basis of $450,000 in exchange for a one-third interest in a partnership.The property is subject to a mortgage with a principal balance of $300,000 which the partnership assumes.As a result of Kuda joining the partnership,Alejandro,a pre-existing partner,now has a one-third interest in the partnership.Alejandro will adjust his basis to

A) increase it by $150,000.

B) increase it by $210,000.

C) decrease by $100,000.

D) increase it by $100,000.

A) increase it by $150,000.

B) increase it by $210,000.

C) decrease by $100,000.

D) increase it by $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

42

Scott provides accounting services worth $40,000 to the ABC Partnership in exchange for a 20% interest in the capital and profits of the partnership.The tax result to Scott is

A) a partnership interest with a zero basis and no gain or loss.

B) a partnership interest with a zero basis and $40,000 of ordinary income.

C) a partnership interest with a $40,000 basis and $40,000 capital gain.

D) a partnership interest with a $40,000 basis and $40,000 ordinary income.

A) a partnership interest with a zero basis and no gain or loss.

B) a partnership interest with a zero basis and $40,000 of ordinary income.

C) a partnership interest with a $40,000 basis and $40,000 capital gain.

D) a partnership interest with a $40,000 basis and $40,000 ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

43

In 2017,Phuong transferred land having a $150,000 FMV and a $120,000 adjusted basis,which is subject to a $110,000 mortgage in exchange for a one-third interest in the DSF Partnership.Phuong had purchased the land in 2013,but the mortgage was not received until 2014.The partnership owes no other liabilities.Phuong,Austin,and Alison share profits and losses equally and each has a one-third interest in partnership capital.The partnership's holding period for the land transferred by partner Phuong commences in

A) 2013.

B) 2014.

C) 2017.

D) The holding period is the same number of years that the partnership has been in existence.

A) 2013.

B) 2014.

C) 2017.

D) The holding period is the same number of years that the partnership has been in existence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

44

A partnership may elect to use a fiscal year if the business recognizes 25% or more of its annual gross receipts in the last two months of the fiscal year for three consecutive 12-month periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

45

Martha transferred property with a FMV of $60,000 (adjusted basis $30,000),which is subject to a $40,000 mortgage in exchange for a one-third interest in a partnership.The partnership has no other liabilities.The partners of MNO own the partnership equally.The partnership's basis in the property contributed is

A) $0.

B) $40,000.

C) $30,000.

D) $60,000.

A) $0.

B) $40,000.

C) $30,000.

D) $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

46

If partners having a majority interest in the partnership do not have the same tax year,the partnership uses the same tax year as all of its principal partners.Principal partners are those with 10% or greater interest in the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

47

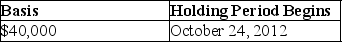

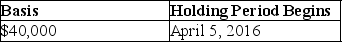

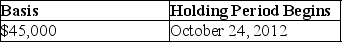

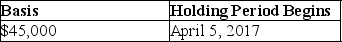

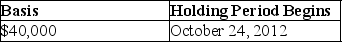

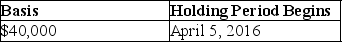

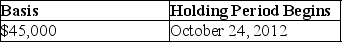

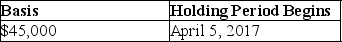

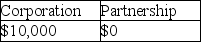

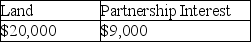

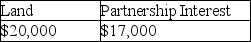

On April 4,2017,Joan contributes business equipment (she had purchased on October 23,2012) having a $45,000 FMV and a $40,000 adjusted basis to the EJK Partnership in exchange for a 25% interest in the capital and profits.The basis of the property and the date the holding period begins for the partnership is

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

48

Patrick acquired a 50% interest in a partnership by contributing property that had an adjusted basis of $8,000 and a fair market value of $29,000.The property was subject to a liability of $22,000,which the partnership assumed for legitimate business purposes.Which of the following statements is correct?

A) Patrick will be required to recognize a $3,000 gain due to the negative basis rules and will have a basis in his partnership interest of zero.

B) Patrick will not be required to recognize a gain on his return and will have a basis in his partnership interest of negative $3,000.

C) Patrick will be required to recognize a $21,000 gain due to the negative basis rules and will have a basis in his partnership interest of zero.

D) Patrick will be required to recognize a $14,000 gain due to the negative basis rules and will have a basis in his partnership interest of zero.

A) Patrick will be required to recognize a $3,000 gain due to the negative basis rules and will have a basis in his partnership interest of zero.

B) Patrick will not be required to recognize a gain on his return and will have a basis in his partnership interest of negative $3,000.

C) Patrick will be required to recognize a $21,000 gain due to the negative basis rules and will have a basis in his partnership interest of zero.

D) Patrick will be required to recognize a $14,000 gain due to the negative basis rules and will have a basis in his partnership interest of zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

49

Hunter contributes property having a $75,000 FMV and a $65,000 adjusted basis which is subject to a $36,000 mortgage in exchange for a one-fourth interest in the ABC Partnership.The partnership owes no other debts,but does assume this mortgage.Profits and losses are shared equally and each partner has a one-fourth interest in partnership capital.Hunter's basis in the partnership is

A) $38,000.

B) $48,000.

C) $74,000.

D) $84,000.

A) $38,000.

B) $48,000.

C) $74,000.

D) $84,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

50

On July 1,Alexandra contributes business equipment (which she had purchased two years ago) having a $45,000 FMV and a $40,000 adjusted basis to the AX Partnership in exchange for a 25% interest in the capital and profits.The basis of Alexandra's partnership interest is

A) $5,000.

B) $40,000.

C) $45,000.

D) None of the above.

A) $5,000.

B) $40,000.

C) $45,000.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

51

George transferred land having a $170,000 FMV and a $60,000 adjusted basis,which is subject to a $150,000 mortgage in exchange for a one-third interest in the GEF Partnership.The partnership owes no other liabilities.George,Elena,and Franz share profits and losses equally and each has a one-third interest in partnership capital.The basis to the partnership of the land transferred by George is

A) $20,000.

B) $60,000.

C) $110,000.

D) $170,000.

A) $20,000.

B) $60,000.

C) $110,000.

D) $170,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

52

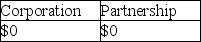

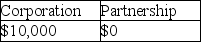

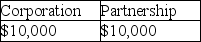

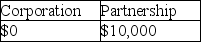

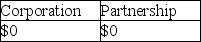

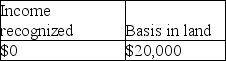

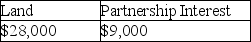

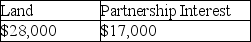

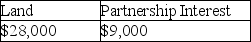

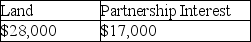

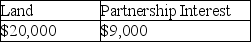

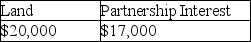

Ezinne transfers land with an adjusted basis of $50,000 and a FMV of $95,000 to a new business in exchange for a 50% ownership interest.The land is subject to a $60,000 mortgage which the business will assume.The business has no other liabilities outstanding.Indicate the amount of gain recognized by Ezinne due to this exchange if the building is (1) a corporation and (2) a partnership.Assume Sec.351 is satisfied in the case of the corporation and Sec.721 is satisfied in the case of the partnership.

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

53

Hal transferred land having a $160,000 FMV and a $75,000 adjusted basis which is subject to a $150,000 mortgage in exchange for a one-third interest in the HEF Partnership.Hal acquired the land ten years ago.The partnership owes no other liabilities.Hal,Ellen,and Felix share profits and losses equally and each has a one-third interest in partnership capital.Hal's basis in the one-third partnership interest is

A) $0.

B) ($25,000).

C) $75,000.

D) $85,000.

A) $0.

B) ($25,000).

C) $75,000.

D) $85,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

54

In the syndication of a partnership,brokerage and registration fees,printing fees,and legal fees of the underwriter total $50,000.With respect to these fees,the partnership must

A) capitalize the fees, which are not amortizable.

B) deduct $5,000 of the expenses in the accounting period incurred and permanently capitalize the remainder.

C) capitalize and amortize the fees over a period of not less than 60 months.

D) deduct $5,000 of the expenses in the accounting period incurred and amortize the remaining amount over 180 months.

A) capitalize the fees, which are not amortizable.

B) deduct $5,000 of the expenses in the accounting period incurred and permanently capitalize the remainder.

C) capitalize and amortize the fees over a period of not less than 60 months.

D) deduct $5,000 of the expenses in the accounting period incurred and amortize the remaining amount over 180 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

55

Edith contributes land having $100,000 FMV and a $85,000 adjusted basis,which is subject to a $66,000 mortgage in exchange for a one-third interest in the EHK Partnership.The partnership owes no other liabilities.After the contribution,Kate,Edith,and Helen share profits and losses equally and each has a one-third interest in the partnership capital.Assume that Kate has a basis in her partnership interest of $50,000 before Edith's contribution to the partnership.The effect of Edith's contribution on partner Kate's basis is to

A) decrease Kate's basis to $28,000.

B) increase Kate's basis to $72,000.

C) increase Kate's basis to $77,000.

D) No effect on Kate's basis.

A) decrease Kate's basis to $28,000.

B) increase Kate's basis to $72,000.

C) increase Kate's basis to $77,000.

D) No effect on Kate's basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

56

Emma contributes property having a $24,000 FMV and a $15,000 adjusted basis and also renders legal services valued at $22,000 in exchange for a 30% interest in the capital and profits of the ABC partnership.The tax results to Emma will be

A) no income is recognized and a partnership basis of $37,000.

B) ordinary income of $22,000 and a partnership basis of $37,000.

C) ordinary income of $22,000 and a partnership basis of $46,000.

D) no income is recognized and a partnership basis of $46,000.

A) no income is recognized and a partnership basis of $37,000.

B) ordinary income of $22,000 and a partnership basis of $37,000.

C) ordinary income of $22,000 and a partnership basis of $46,000.

D) no income is recognized and a partnership basis of $46,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

57

Lance transferred land having a $180,000 FMV and a $105,000 adjusted basis,which is subject to a $150,000 mortgage in exchange for a one-third interest in the Trois Partnership.Lance acquired the land in 2010.The partnership owes no other liabilities.Lance,Rhonda,and Zach share profits and losses equally and each has a one-third interest in partnership capital.The tax effect to Lance is

A) no gain or loss recognized.

B) recognized gain of $45,000 on the transfer.

C) recognized gain of $75,000 on the transfer.

D) recognized loss of $45,000 on the transfer.

A) no gain or loss recognized.

B) recognized gain of $45,000 on the transfer.

C) recognized gain of $75,000 on the transfer.

D) recognized loss of $45,000 on the transfer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

58

Chen contributes a building worth $160,000 (adjusted basis $180,000) and $40,000 in services to a partnership for a partnership interest.Chen's basis in the partnership interest is

A) $160,000.

B) $180,000.

C) $200,000.

D) $220,000.

A) $160,000.

B) $180,000.

C) $200,000.

D) $220,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

59

John contributes land having $110,000 FMV and a $90,000 adjusted basis which is subject to a $60,000 mortgage in exchange for a one-third interest in the AJK Partnership.The partnership owes no other liabilities.After the contribution,Abby,John,and Kent share profits and losses equally and each has a one-third interest in the partnership capital.John's basis in the partnership interest is

A) $50,000.

B) $90,000.

C) $110,000.

D) $150,000.

A) $50,000.

B) $90,000.

C) $110,000.

D) $150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

60

Sari transferred an office building with a $500,000 FMV and a $300,000 adjusted basis to the Oak Partnership in exchange for a one-quarter ownership interest.Sari had acquired the building three years earlier and had used it in her sole proprietorship.Sari's holding period for her partnership interest

A) will begin the day after she acquires the partnership interest.

B) will include the holding period of the transferred building.

C) will depend on the election she files.

D) None of the above.

A) will begin the day after she acquires the partnership interest.

B) will include the holding period of the transferred building.

C) will depend on the election she files.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

61

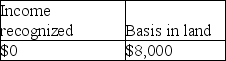

Ariel receives from her partnership a nonliquidating distribution of $9,000 cash plus a parcel of land.The partnership had purchased the land five years ago for $20,000,but it is worth $28,000 at the time of the distribution.Ariel's predistribution basis is $17,000.How much income will Ariel recognize due to the distribution,and what is her basis in the land?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

62

Jamahl has a 65% interest in a partnership.Jamahl sells land to the partnership for $70,000.Prior to the sale,the land had a FMV of $70,000 and an adjusted basis of $90,000 to Jamahl.Due to the sale,Jamahl will recognize

A) a gain of $20,000.

B) a loss of $20,000.

C) $0, but he will have a carryover loss of $20,000.

D) $0, and he will not have any carryover loss.

A) a gain of $20,000.

B) a loss of $20,000.

C) $0, but he will have a carryover loss of $20,000.

D) $0, and he will not have any carryover loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

63

Mia is a 50% partner in a partnership with a beginning of the year adjusted basis in her partnership interest of $50,000.For the current year,no distributions are made to partners,and there is no change in partnership liabilities.The partnership incurred a $140,000 ordinary loss for the year.How does Mia treat her loss in excess of basis?

A) She will recognize $3,000 this year and carry forward the balance.

B) She will first carry back the excess loss for two years and then carry forward the balance up to 20 years.

C) She will carry over the excess loss indefinitely until a subsequent year when she again has a positive basis in her partnership interest.

D) She will first carry back the excess loss three years and then carry forward the balance up to five years.

A) She will recognize $3,000 this year and carry forward the balance.

B) She will first carry back the excess loss for two years and then carry forward the balance up to 20 years.

C) She will carry over the excess loss indefinitely until a subsequent year when she again has a positive basis in her partnership interest.

D) She will first carry back the excess loss three years and then carry forward the balance up to five years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

64

Rowan and Sanjay are equal partners in a partnership,which uses the calendar year as its tax year.On September 1,this year,Hailley contributed $60,000 cash for a one-third interest in the partnership.The partnership reports $72,000 of ordinary income for the tax year ending on December 31 of this year.The income allocation to Hailley is (assume the elective proration method with a monthly convention)

A) $24,000.

B) $12,000.

C) $0.

D) $8,000.

A) $24,000.

B) $12,000.

C) $0.

D) $8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

65

Ben is a 30% partner in a partnership.The partnership guarantees Ben payments of $25,000 for the year.If the partnership has ordinary income of $15,000 before adjustment for the guaranteed payment,Ben must report

A) ordinary income of $22,000.

B) an ordinary loss of $3,000.

C) ordinary income of $25,000 and a partnership income of $4,500.

D) ordinary income of $25,000 and a partnership loss of $3,000.

A) ordinary income of $22,000.

B) an ordinary loss of $3,000.

C) ordinary income of $25,000 and a partnership income of $4,500.

D) ordinary income of $25,000 and a partnership loss of $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

66

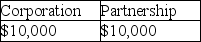

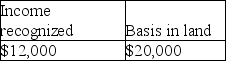

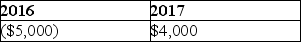

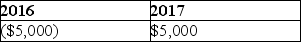

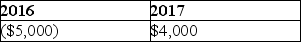

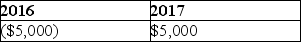

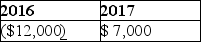

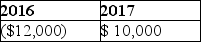

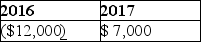

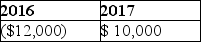

Joey and Bob each have 50% interest in a Partnership.Both Joey and the partnership file returns on a calendar-year basis.Partnership Q had a $12,000 loss in 2016.Joey's adjusted basis in his partnership interest on January 1,2016,was $5,000.In 2017,the partnership had a profit of $10,000.Assuming there were no other adjustments to Joey's basis in the partnership,what amount of partnership income (loss) should Joey show on his 2016 and 2017 individual income tax returns?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

67

Joy is a material participant in a partnership.Her basis in her partnership interest is $250,000.Due to a major expansion,the partnership will generate a significant loss this year,and Joy's share is expected to be $300,000.The partners expect the partnership to report a large profit next year.Joy is in the top tax bracket this year,and she expects to be in a lower tax bracket next year.Due to her higher marginal tax rate this year,Joy would like to deduct her full share of the partnership loss this year.What strategies can she employ before year-end to assure full deduction of this year's loss?

A) As a material participant, Joy will be entitled to deduct her full share of the partnership loss this year.

B) Joy can make a loan to the partnership before year-end.

C) Joy can contribute capital to the partnership before year-end.

D) Either Response B or Response C will allow Joy to deduct her full share of the loss.

A) As a material participant, Joy will be entitled to deduct her full share of the partnership loss this year.

B) Joy can make a loan to the partnership before year-end.

C) Joy can contribute capital to the partnership before year-end.

D) Either Response B or Response C will allow Joy to deduct her full share of the loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

68

All of the following statements are true regarding nonliquidating distributions of a partnership except

A) if money is distributed in excess of the partnership interest, the partner receiving the distribution has capital gain.

B) in no circumstances will the partner or the partnership recognize gain or loss from a nonliquidating distribution.

C) in no circumstances may the partner's basis in the partnership interest be reduced below zero as a result of a nonliquidating distribution.

D) if, after money distributions reduce the partnership basis, the adjusted basis of distributed property does not exceed the partner's basis in the partnership interest, the basis of the distributed property carries over to the partner.

A) if money is distributed in excess of the partnership interest, the partner receiving the distribution has capital gain.

B) in no circumstances will the partner or the partnership recognize gain or loss from a nonliquidating distribution.

C) in no circumstances may the partner's basis in the partnership interest be reduced below zero as a result of a nonliquidating distribution.

D) if, after money distributions reduce the partnership basis, the adjusted basis of distributed property does not exceed the partner's basis in the partnership interest, the basis of the distributed property carries over to the partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

69

Richard has a 50% interest in a partnership,and he materially participates in the partnership's business.Richard's adjusted basis in the partnership was $60,000 at the beginning of the year,including his share of partnership liabilities.There were no distributions to Richard during the year.During the current year,the partnership borrowed $160,000 from a local bank to purchase equipment needed in the business.All of the partners are personally liable for all partnership debts.The partnership incurred a $320,000 loss this year.What amount can Richard claim as a loss from the partnership on his individual tax return this year?

A) $60,000

B) $80,000

C) $140,000

D) $160,000

A) $60,000

B) $80,000

C) $140,000

D) $160,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

70

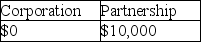

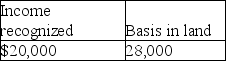

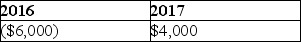

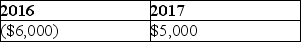

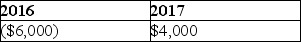

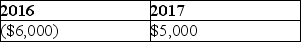

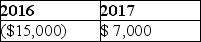

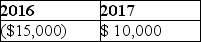

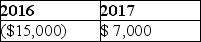

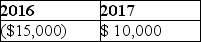

Sandy and Larry each have a 50% interest in SL Partnership.The partnership and the individuals file on a calendar-year basis.In 2016,SL Partnership had a $30,000 ordinary loss.Sandy's adjusted basis in her partnership interest on January 1,2016,was $12,000.In 2017,SL Partnership had ordinary income of $20,000.Assuming there were no other adjustments to Sandy's basis in the partnership,what amount of partnership income (loss) would Sandy show on her 2016 and 2017 individual income tax returns?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following will be separately stated by a partnership reporting its operations for the year to the IRS?

A) interest income

B) Sec. 1245 depreciation recapture

C) bad debt expense

D) None of the items will be separately stated.

A) interest income

B) Sec. 1245 depreciation recapture

C) bad debt expense

D) None of the items will be separately stated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

72

At the beginning of this year,Edmond and Samuel were equal partners in a partnership that uses the calendar year as its tax year.On October 1,this year,Joan contributed $48,000 cash for a one-third interest in the partnership.The interests of both Edmond and Samuel drop to one-third.The partnership reports a $36,000 ordinary loss for the current tax year ending December 31.The loss allocation to Samuel is (assume the elective proration method with a monthly convention)

A) $12,000.

B) $13,500.

C) $16,500.

D) $18,000.

A) $12,000.

B) $13,500.

C) $16,500.

D) $18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

73

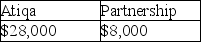

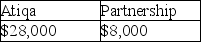

Atiqa receives a nonliquidating distribution of land from her partnership.The partnership purchased the land five years ago for $20,000.At the time of the distribution,it is worth $28,000.Prior to the distribution,Atiqa's basis in her partnership interest is $37,000.Due to the distribution Atiqa and the partnership will recognize income of

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

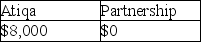

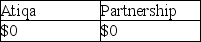

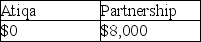

74

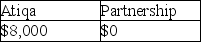

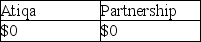

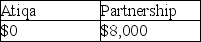

Atiqa receives a nonliquidating distribution of land from her partnership.The partnership purchased the land five years ago for $20,000.At the time of the distribution,it is worth $28,000.Prior to the distribution,Atiqa's basis in her partnership interest is $37,000.Atiqa's basis in the distributed land and her post-distribution basis in her partnership interest are

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

75

David and Joycelyn form an equal partnership in the current year.No special allocation is provided for in the partnership agreement.During the year David contributes land having a $90,000 basis and a $100,000 FMV in exchange for the initial partnership interest.In addition,the partnership earns $50,000 of ordinary income while partnership liabilities increase from zero to $30,000 by the end of the tax year.The partnership earns $20,000 of tax-exempt interest during the year.David's basis at the end of the current year is

A) $115,000.

B) $125,000.

C) $130,000.

D) $140,000.

A) $115,000.

B) $125,000.

C) $130,000.

D) $140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

76

Jamahl has a 65% interest in a partnership.Jamahl sells land to the JK partnership for $70,000.Prior to the sale,the land had a FMV of $70,000 and an adjusted basis of $90,000 to Jamahl.Two years later the partnership sells the land for $123,000.Due to the sale,the partnership will recognize

A) a gain of $13,000.

B) a loss of $53,000.

C) a gain of $33,000.

D) a loss of $20,000.

A) a gain of $13,000.

B) a loss of $53,000.

C) a gain of $33,000.

D) a loss of $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

77

All of the following are separately stated items that pass through from the partnership to the partners except

A) 1231 gains or losses.

B) charitable contributions.

C) capital gains and losses.

D) 1245 and 1250 recapture.

A) 1231 gains or losses.

B) charitable contributions.

C) capital gains and losses.

D) 1245 and 1250 recapture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

78

Clark and Lois formed an equal partnership three years ago.Clark contributed cash of $160,000 while Lois contributed land with a $90,000 adjusted basis and a $160,000 FMV.Three years later the land is sold for $210,000.The tax results to Clark and Lois are

A) $25,000 of gain to both Clark and Lois.

B) $60,000 of gain to both Clark and Lois.

C) $25,000 of gain to Clark and $70,000 gain to Lois.

D) $25,000 of gain to Clark and $95,000 gain to Lois.

A) $25,000 of gain to both Clark and Lois.

B) $60,000 of gain to both Clark and Lois.

C) $25,000 of gain to Clark and $70,000 gain to Lois.

D) $25,000 of gain to Clark and $95,000 gain to Lois.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

79

Brittany receives a nonliquidating distribution of $48,000 cash from her partnership.Brittany's basis in her partnership interest prior to the distribution is $25,000.What are the tax consequences of the distribution?

A) $48,000 ordinary income; $25,000 partnership basis

B) $48,000 nontaxable return of capital, ($23,000) partnership basis

C) $25,000 nontaxable return of capital, capital gain of $23,000, $0 partnership basis

D) $25,000 nontaxable return of capital, ordinary income of $23,000, $0 partnership basis

A) $48,000 ordinary income; $25,000 partnership basis

B) $48,000 nontaxable return of capital, ($23,000) partnership basis

C) $25,000 nontaxable return of capital, capital gain of $23,000, $0 partnership basis

D) $25,000 nontaxable return of capital, ordinary income of $23,000, $0 partnership basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

80

All of the following statements are true with regard to the formation of a partnership except

A) the partnership's basis in the transferred property carries over from the transferor partners.

B) with regard to capital assets and 1231 assets, the partnership's holding period for the transferred property includes the contributing partner's holding period.

C) the nonrecognition rules apply to both property and services contributed to a partnership.

D) a transfer of property in exchange for a partnership interest causes nonrecognition of gain or loss treatment.

A) the partnership's basis in the transferred property carries over from the transferor partners.

B) with regard to capital assets and 1231 assets, the partnership's holding period for the transferred property includes the contributing partner's holding period.

C) the nonrecognition rules apply to both property and services contributed to a partnership.

D) a transfer of property in exchange for a partnership interest causes nonrecognition of gain or loss treatment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck