Deck 4: Gross Income: Exclusions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/116

العب

ملء الشاشة (f)

Deck 4: Gross Income: Exclusions

1

Which of the following items will result in an increase in gross income?

A) Receipt of a $10,000 check from the bank. The check is for a student loan.

B) Receiving a $10,000 award from a university for high grades and high SAT scores. The award is used to pay tuition.

C) Preparing a mechanic's tax return in exchange for the mechanic replacing the muffler on your car.

D) None of the above will be included in gross income.

A) Receipt of a $10,000 check from the bank. The check is for a student loan.

B) Receiving a $10,000 award from a university for high grades and high SAT scores. The award is used to pay tuition.

C) Preparing a mechanic's tax return in exchange for the mechanic replacing the muffler on your car.

D) None of the above will be included in gross income.

C

Explanation: C) This is a taxable exchange of services, and both parties will realize income equal to the value of services received.

Explanation: C) This is a taxable exchange of services, and both parties will realize income equal to the value of services received.

2

Awards for emotional distress attributable to a physical injury are excluded from gross income.

True

Explanation: Damage payments are excluded if due to physical injury and are not punitive damages.

Explanation: Damage payments are excluded if due to physical injury and are not punitive damages.

3

Upon the sale of property,a portion of the selling price equal to the basis in the property is considered a return of capital to the seller and is,therefore,not taxable.

True

Explanation: Only net gains or losses on property transactions are taken in account, not gross proceeds.

Explanation: Only net gains or losses on property transactions are taken in account, not gross proceeds.

4

Sam received a scholarship for room and board.This scholarship is excludible from income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

5

Loan proceeds are taxable in the year received in cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

6

Amounts collected under accident and health insurance policies purchased by the taxpayer are excludible from income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

7

Punitive damages are taxable unless they are awarded for physical injuries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

8

Accelerated death benefits from a life insurance policy received by a terminally ill person may be excluded from taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

9

An individual is considered terminally ill for purposes of the exclusion for accelerated death benefits if a physician certifies that he is reasonably likely to die within 36 months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

10

Any distribution from a qualified tuition plan not used for qualified higher education expenses is both included in income and subject to a 10% penalty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

11

Amounts withdrawn from qualified tuition plans are tax-free if the amounts are used for qualified higher education expenses including tuition,fees,books,and room and board for students attending on at least a half-time basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

12

Sumedha is the beneficiary of her mother's $500,000 life insurance policy.She receives $54,000 per year over ten years in settlement of her mother's policy.Sumedha will exclude the $54,000 proceeds received each year from the life insurance company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

13

Dividends on life insurance policies are generally excludible income because they are considered a return of premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

14

A taxpayer may avoid tax on income by having the payment made to another taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

15

Many exclusions exist due to the benevolence of Congress or as a result of the government's attempts to encourage particular social behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

16

John,an employee of a manufacturing company,suffered a heart attack and was unable to work for six months.He received $1,500 per month of disability benefits as a result of an employer-provided group policy.The benefits are includible in John's gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

17

Each year a taxpayer must include in gross income the rental value of his or her personal residence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

18

Except in the case of qualifying accelerated death benefits,if a life insurance policy is sold or surrendered for a lump sum before the death of the insured,the amount received is taxable to the extent it exceeds the premiums paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

19

While payments received because a person has been physically injured are excluded from gross income,payments on account of non-physical injury must be included in gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

20

Katie,a self-employed CPA,purchased an accident & disability insurance policy.As the result of an auto accident,Katie was unable to work and received $3,000 of disability benefits per month for seven months.The benefits were based on her estimated monthly income and should be reported as gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

21

Meals may be excluded from an employee's gross income provided they are furnished on the employer's business premises and are for the convenience of the employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

22

The value of health,accident,and disability insurance premiums paid by an employer are generally not included in an employee's gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

23

The amount of cash fringe benefits received under a cafeteria plan is taxable to an employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

24

Mattie has group term life insurance coverage of $120,000 provided by her employer on a nondiscriminatory basis.She must include premiums for $120,000 of coverage in gross income,determined by using IRS tables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

25

Kelly was sent by her employer to work on a special assignment in Paris for six months.Kelly will be able to exclude some of her income earned in Paris.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

26

Ming,who has been employed by the Frostine Corporation for five years,receives a $400 Amazon.com gift card for his years of hard work.The employee service award is taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

27

Premiums paid by an employer for employee disability coverage are excluded from the employee's gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

28

The fair value of lodging cannot be excluded from gross income unless the employee is required to accept the lodging as a condition of employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

29

A business provides $45,000 of group-term life insurance to all workers,including the partners who work in the business.All of the workers can exclude the value of this fringe benefit from their gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

30

During the year,Cathy received the following:

• Dividends of $4,000 from Lindsay Corporation.Cathy's father owns the stock and directed the corporation to send the dividends to Cathy.

• A car worth $30,000 for being the 1,000th customer at a car dealership.

• $5,500 cash gift from her uncle.

• $10,000 inheritance from her grandmother.

What amount must Cathy include in gross income?

A) $30,000

B) $34,000

C) $39,500

D) $49,500

• Dividends of $4,000 from Lindsay Corporation.Cathy's father owns the stock and directed the corporation to send the dividends to Cathy.

• A car worth $30,000 for being the 1,000th customer at a car dealership.

• $5,500 cash gift from her uncle.

• $10,000 inheritance from her grandmother.

What amount must Cathy include in gross income?

A) $30,000

B) $34,000

C) $39,500

D) $49,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

31

The exclusion for employee discounts on services is limited to 30% of the price charged regular customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

32

A nursing home maintains a cafeteria that is used by employees,patients,and visitors.The value of free meals provided to employees while on duty so that they may be available for emergency calls is not taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

33

Nondiscrimination requirements do not apply to working condition fringe benefits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

34

"No additional cost" benefits are excluded from an employee's gross income if the services are the same type that are sold to customers and in the line of business in which the employee works.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

35

Payments received from a workers' compensation plan funded by employer contributions are taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

36

Martina,who has been employed by the Smythe Corporation for ten years,receives a $400 watch as a length of service award in a meaningful presentation.The fair value of the watch is taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

37

All payments made by an employer to the family of a deceased employee are excluded from the recipient's gross income regardless of the reason for payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

38

In the case of foreign-earned income,U.S.citizens may avoid double taxation of income by both the United States and the host country by utilizing a foreign tax credit or by electing the foreign earned income exclusion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

39

"Working condition fringe benefits," such as memberships in professional organizations paid for by the employer,are generally excluded from the employee's gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is not excluded from income?

A) public assistance payments

B) fair market value of prize won on a game show

C) gifts and inheritances

D) life insurance proceeds paid by reason of death

A) public assistance payments

B) fair market value of prize won on a game show

C) gifts and inheritances

D) life insurance proceeds paid by reason of death

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

41

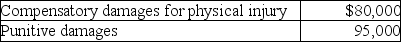

Derrick was in an automobile accident while he was going to work.The doctor advised him to stay home for eight months due to his physical injuries.The resulting lawsuit was settled and Derrick received the following amounts:

How much of the settlement must Derrick include in ordinary income on his tax return?

A) $0

B) $80,000

C) $95,000

D) $175,000

How much of the settlement must Derrick include in ordinary income on his tax return?

A) $0

B) $80,000

C) $95,000

D) $175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements regarding qualified tuition programs is incorrect?

A) Distributions from income earned by a qualified tuition program are tax-free if used for qualified higher education expenses.

B) Distributions of income are taxed to the donor if the proceeds are not used for higher education expenses.

C) A qualified tuition program may be established by parents or grandparents.

D) Contributions to a qualified tuition program are distributed tax-free.

A) Distributions from income earned by a qualified tuition program are tax-free if used for qualified higher education expenses.

B) Distributions of income are taxed to the donor if the proceeds are not used for higher education expenses.

C) A qualified tuition program may be established by parents or grandparents.

D) Contributions to a qualified tuition program are distributed tax-free.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

43

Elisa sued her former employer for discrimination.She was awarded $200,000 for lost wages,$30,000 for medical expenses related to emotional distress resulting from the discrimination,and $300,000 in punitive damages.The amount taxable is

A) $0.

B) $200,000.

C) $500,000.

D) $530,000.

A) $0.

B) $200,000.

C) $500,000.

D) $530,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

44

Tonya's employer pays the full premium on a disability income policy from an insurance company on behalf of all employees.After a skiing accident,Tonya was out of work for three months and collected $2,000 per month ($6,000 total) of disability benefits from this policy.In addition,Tonya received another $1,000 per month ($3,000 total) from a disability policy she had purchased herself.Tonya had paid a total of $1,300 in premiums on her policy.How much of the $9,000 total received is taxable?

A) $9,000

B) $6,000

C) $7,700

D) $3,000

A) $9,000

B) $6,000

C) $7,700

D) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

45

Greg is the owner and beneficiary of a $100,000 policy on the life of his mother.Greg gives the policy to his brother,Don.Don subsequently pays premiums of $40,000.Upon his mother's death,how much of the insurance proceeds must Don include in income?

A) $0

B) $40,000

C) $60,000

D) $100,000

A) $0

B) $40,000

C) $60,000

D) $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following statements regarding the qualified tuition plans (QTP) is incorrect?

A) Distributions can be made tax-free to pay for room and board at college.

B) Distributions made from a QTP for college tuition will be tax-free in addition to qualifying for the American Opportunity credit or lifetime learning credit.

C) Katie's parents had established a QTP for Katie, but she has received a "full-ride" scholarship. Katie's parents can name her sister as a replacement beneficiary of the QTP.

D) Distributions of income not used for qualified higher education expenses are taxable and subject to a 10% penalty.

A) Distributions can be made tax-free to pay for room and board at college.

B) Distributions made from a QTP for college tuition will be tax-free in addition to qualifying for the American Opportunity credit or lifetime learning credit.

C) Katie's parents had established a QTP for Katie, but she has received a "full-ride" scholarship. Katie's parents can name her sister as a replacement beneficiary of the QTP.

D) Distributions of income not used for qualified higher education expenses are taxable and subject to a 10% penalty.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

47

Over the years Rianna paid $65,000 in premiums on a life insurance policy with a face value of $100,000.Upon reaching 65,while still in good health,Rianna surrendered the policy and collected $95,000.In the year of collection,Rianna will report

A) no income.

B) $30,000 of taxable income.

C) $5,000 of tax loss.

D) $95,000 of taxable income.

A) no income.

B) $30,000 of taxable income.

C) $5,000 of tax loss.

D) $95,000 of taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

48

Rebecca is the beneficiary of a $500,000 insurance policy on her husband's life.She elects to receive $52,000 per year for 10 years rather than receive the entire amount in a lump sum.Of the amount received each year

A) $2,000 is taxable income.

B) $50,000 is taxable income.

C) $52,000 is taxable income.

D) $5,000 per year is tax free as a death benefit.

A) $2,000 is taxable income.

B) $50,000 is taxable income.

C) $52,000 is taxable income.

D) $5,000 per year is tax free as a death benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

49

Amanda,who lost her modeling job,sued her employer for age discrimination.She was awarded $75,000 in lost wages,$25,000 for emotional distress,and $150,000 punitive damages.The amount taxable is

A) $0.

B) $150,000.

C) $225,000.

D) $250,000.

A) $0.

B) $150,000.

C) $225,000.

D) $250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

50

Hope receives an $18,500 scholarship from State University.The university specifies that $8,500 is for tuition,books,supplies,and equipment,while $10,000 is for room and board.In addition,Hope works part-time at the campus library and earns $5,000.Hope's gross income is

A) $5,000.

B) $15,000.

C) $18,500.

D) $23,500.

A) $5,000.

B) $15,000.

C) $18,500.

D) $23,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

51

Mae Li is beneficiary of a $70,000 insurance policy on her father's life.Upon his death,she elects to receive the proceeds in installments from the insurance company that carries the policy.She will receive $16,000 per year for five years.What are the tax consequences each year?

A) All $16,000 each year is taxable.

B) $10,000 interest is taxable in the first year.

C) There is no taxable income.

D) $2,000 of the $16,000 payment is taxable each year.

A) All $16,000 each year is taxable.

B) $10,000 interest is taxable in the first year.

C) There is no taxable income.

D) $2,000 of the $16,000 payment is taxable each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

52

Sarah receives a $15,000 scholarship from City University.The university specifies that $8,000 is for tuition,books,supplies,and equipment for classes.The other $7,000 is for room and board.Sarah works ten hours per week as a grader,for which she is paid $7,500 for the year.Of the total amount received,Sarah must include the following amount in gross income

A) $7,000.

B) $7,500.

C) $14,500.

D) $22,500.

A) $7,000.

B) $7,500.

C) $14,500.

D) $22,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

53

Britney is beneficiary of a $150,000 insurance policy on her father's life.Upon his death,she may elect to receive the proceeds in five yearly installments of $32,000 or may take the $150,000 lump sum.She elects to take the lump sum payment.What are the tax consequences in year one?

A) All $32,000 each year is taxable.

B) $10,000 interest is taxable in the first year.

C) There is no taxable income.

D) The lump sum payment is taxable.

A) All $32,000 each year is taxable.

B) $10,000 interest is taxable in the first year.

C) There is no taxable income.

D) The lump sum payment is taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

54

Cameron is the owner and beneficiary of a $300,000 policy on the life of his mother.Cameron sells the policy to his brother,Parker,for $100,000.Parker subsequently pays premiums of $55,000.Upon his mother's death,how much of the insurance proceeds must Parker include in income?

A) $0

B) $55,000

C) $145,000

D) $300,000

A) $0

B) $55,000

C) $145,000

D) $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

55

David has been diagnosed with cancer and is expected to live less than 18 months.David is covered by a life insurance policy with a $400,000 face amount.David cashes in the policy early under a special option and receives 80% of the face amount or $320,000.In the year of collection,David will report

A) no income.

B) $80,000.

C) $320,000.

D) $400,000.

A) no income.

B) $80,000.

C) $320,000.

D) $400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

56

Brad suffers from congestive heart failure and has been admitted to a nursing home where he is expected to spend the remainder of his life.His doctor has certified him as chronically ill.In 2017,Brad receives $320 per day from his life insurance policy for 100 days ($32,000) as accelerated death benefits.Brad's nursing home care costs $300 per day ($30,000 for the 100 days of care).Brad will be allowed to exclude

A) $0.

B) $30,000.

C) $32,000.

D) $2,000.

A) $0.

B) $30,000.

C) $32,000.

D) $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

57

John is injured and receives $16,000 of income from a disability policy.John's employer paid 75% of the disability policy premiums and John paid the remainder.In addition,John's employer has paid all the $3,000 of premiums on a health policy that paid John's doctor bills of $10,000.How much of the benefits must John include in income?

A) $3,000

B) $10,000

C) $12,000

D) $16,000

A) $3,000

B) $10,000

C) $12,000

D) $16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

58

Bret carries a $200,000 insurance policy on his life and has paid premiums of $10,000 over the years.Dividends on the policy have totaled $8,500.Each year Bret has left the dividends with the insurance company.In the current year,the insurance company credited $800 of interest on the accumulated dividends to Bret's account.In addition,$600 of dividends was added by the insurance company.In the current year,Bret must report income of

A) $0.

B) $600.

C) $800.

D) $1,400.

A) $0.

B) $600.

C) $800.

D) $1,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

59

Linda was injured in an automobile accident caused by another driver.Her son,Matthew,was in the automobile but not physically injured.The other driver's insurance company was required by a court to pay Linda $75,000 to cover medical bills relating to her injuries,$30,000 to compensate her for emotional distress attributable to the injuries and $40,000 of punitive damages.Matthew was paid $15,000 to compensate him for emotional distress attributable to his witnessing his mother's injuries.What is the amount taxable to Linda?

A) $30,000

B) $40,000

C) $105,000

D) $145,000

A) $30,000

B) $40,000

C) $105,000

D) $145,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

60

Julia suffered a severe stroke and has been admitted to a private hospital where she is expected to remain for the rest of her life.She is certified by a licensed health care practitioner as being a "chronically ill individual." Her hospital expenses amount to $350 per day.She will receive $340 per day from a $500,000 life insurance policy as an accelerated death benefit.In 2017,she was in the hospital for 10 days and received $3,400.How much of this amount is taxable?

A) $0

B) $500

C) $100

D) $3,400

A) $0

B) $500

C) $100

D) $3,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

61

Nelda suffered a serious stroke and was admitted to a nursing home for 140 days.Nursing home charges,including physician fees and other related expenses were $33,000.Under Nelda's long-term care insurance contract,she received reimbursements of $36,000.How much of the $36,000 reimbursement must be included in Nelda's gross income in 2017?

A) $0

B) $1,400

C) $36,000

D) $3,000

A) $0

B) $1,400

C) $36,000

D) $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

62

Michael is an employee of StayHere Hotels,Inc.in Washington,DC.On his vacation,Michael travels to San Francisco and stays at a StayHere Hotel for six nights free of charge.The regular rate for a hotel room at StayHere in San Francisco is $300 a night.His ability to stay in the hotel without charge is based on the availability of empty rooms.How much income must Michael report due to the use of the San Francisco hotel room?

A) $0

B) $300

C) $360

D) $1,800

A) $0

B) $300

C) $360

D) $1,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

63

Benefits covered by Section 132 which may be excluded from an employee's gross income do not include

A) employee's use of an employer-owned health club.

B) membership fees in professional organizations.

C) employer-provided vehicle for personal use.

D) hotel employee's use of a vacant hotel room.

A) employee's use of an employer-owned health club.

B) membership fees in professional organizations.

C) employer-provided vehicle for personal use.

D) hotel employee's use of a vacant hotel room.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

64

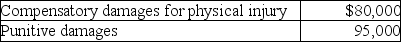

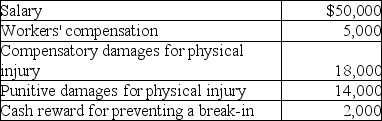

Joe Black,a police officer,was injured in the line of duty.He received the following during the current year:

What is the amount that is taxable?

A) $57,000

B) $66,000

C) $71,000

D) $84,000

What is the amount that is taxable?

A) $57,000

B) $66,000

C) $71,000

D) $84,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

65

Lindsay Corporation made the following payments to the family of Luke Marshall,an employee who died during the year.

$5,000 for Luke's final paycheck that he failed to collect

$10,000 for accrued vacation days as required by the employment contract

$25,000 in admiration of Luke's outstanding service to the community

What is the total amount that Luke's family must include in income?

A) $0

B) $5,000

C) $15,000

D) $40,000

$5,000 for Luke's final paycheck that he failed to collect

$10,000 for accrued vacation days as required by the employment contract

$25,000 in admiration of Luke's outstanding service to the community

What is the total amount that Luke's family must include in income?

A) $0

B) $5,000

C) $15,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

66

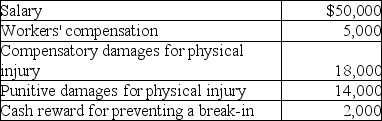

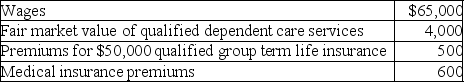

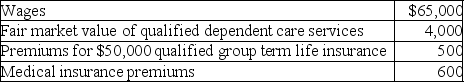

Carl filed his tax return,properly claiming the head of household filing status.Carl's employer paid or provided the following to Carl:

How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis)?

A) $65,000

B) $69,000

C) $69,500

D) $70,100

How much of this income should Carl report (assume benefits are provided on a nondiscriminatory basis)?

A) $65,000

B) $69,000

C) $69,500

D) $70,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

67

Chad and Jaqueline are married and have AGI of $150,000.In 2017 they adopted a child,while taking advantage of their employer's written adoption assistance program.The adoption cost $9,500,all of which was paid by the employer in accordance with the adoption plan.How much of the employer-paid adoption costs may be excluded from their income?

A) $0

B) $5,000

C) $5,250

D) $9,500

A) $0

B) $5,000

C) $5,250

D) $9,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

68

Fatima's employer funds child care for all employees' children.She pays nothing for this service.The cost of Fatima's child care is $7,200 a year.How much of the child care benefits are taxable to Fatima?

A) $0

B) $2,200

C) $5,000

D) $7,200

A) $0

B) $2,200

C) $5,000

D) $7,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following item(s) must be included in the income of the respective employees?

A) ABC Hospital Corporation provides free meals in the hospital cafeteria to employees while on duty in order that they be available for emergency calls.

B) The state of California highway patrol organization provides its officers with a daily meal allowance to compensate them for meals eaten at any location while they are on duty.

C) IBX Corporation requires its employees to work overtime three evenings each year when the company takes inventory. The corporation pays to provide catered dinners on its premises on these evenings.

D) A hotel requires its hotel manager to live in a suite without charge in order to be on call outside her normal work hours.

A) ABC Hospital Corporation provides free meals in the hospital cafeteria to employees while on duty in order that they be available for emergency calls.

B) The state of California highway patrol organization provides its officers with a daily meal allowance to compensate them for meals eaten at any location while they are on duty.

C) IBX Corporation requires its employees to work overtime three evenings each year when the company takes inventory. The corporation pays to provide catered dinners on its premises on these evenings.

D) A hotel requires its hotel manager to live in a suite without charge in order to be on call outside her normal work hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

70

Richard is a key employee of Winn Corporation.The corporation provides Richard with $120,000 of group-term life insurance coverage.Only company executives receive life insurance coverage.The premium attributable to the coverage is $1,600.The uniform one-month group-term premium is one dollar per $1,000 of coverage.How much must Richard include in income due to the policy?

A) $0

B) $840

C) $1,440

D) $1,600

A) $0

B) $840

C) $1,440

D) $1,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

71

All of the following items are excluded from gross income except

A) working condition benefits.

B) de minimis benefits.

C) no additional cost benefits for employees.

D) disability income from an employer-financed policy.

A) working condition benefits.

B) de minimis benefits.

C) no additional cost benefits for employees.

D) disability income from an employer-financed policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

72

An electronics store sold a home theater system to an employee for $300,even though the retail price was $500.The gross profit percentage is 40%.Such discounts are available to all employees.How much income should be recognized by the employee from these transactions?

A) $0

B) $100

C) $120

D) $200

A) $0

B) $100

C) $120

D) $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

73

Healthwise Ambulance requires its employees to be on 24-hour call and consequently gives them $800 per month housing allowance and a $200 per month food allowance.Ron,an employee of Healthwise,receives a salary of $40,000 per year (this does not include the allowances).Ron will be taxed each year on

A) $40,000.

B) $42,400.

C) $49,600.

D) $52,000.

A) $40,000.

B) $42,400.

C) $49,600.

D) $52,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

74

All of the following are requirements for excluding employee achievement awards except for

A) tangible personal property other than cash.

B) based on safety records or length of service.

C) part of a meaningful presentation.

D) if paid in cash, must be less than $400.

A) tangible personal property other than cash.

B) based on safety records or length of service.

C) part of a meaningful presentation.

D) if paid in cash, must be less than $400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which one of the following fringe benefits allows for discrimination between highly compensated employees and other employees to be present?

A) no-additional cost

B) qualified employee discounts

C) recreation and athletic facilities

D) working condition

A) no-additional cost

B) qualified employee discounts

C) recreation and athletic facilities

D) working condition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

76

Rick chose the following fringe benefits under his employer's cafeteria plan.Which of his chosen benefits will be taxable?

A) $150 cash per pay period

B) medical insurance on his family

C) dental insurance

D) group term life insurance coverage of $20,000

A) $150 cash per pay period

B) medical insurance on his family

C) dental insurance

D) group term life insurance coverage of $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

77

Ahmad's employer pays $10,000 in tuition this year for Ahmad to attend a graduate business program.How much of the employer-provided tuition is taxable to Ahmad?

A) $0

B) $4,750

C) $5,250

D) $10,000

A) $0

B) $4,750

C) $5,250

D) $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

78

All of the following fringe benefits paid for by the employer may be excluded from an employee's gross income except

A) discounts on services of 25 percent.

B) subscriptions to professional publications.

C) recreational facilities on employer's premises.

D) company-paid parking costing $225 per month to non-employees.

A) discounts on services of 25 percent.

B) subscriptions to professional publications.

C) recreational facilities on employer's premises.

D) company-paid parking costing $225 per month to non-employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

79

Miranda is not a key employee of AB Corporation.AB provides Miranda with group term life insurance coverage of $140,000.The premiums attributable to the excess coverage are $1,300.The uniform one-month group-term premium is one dollar per $1,000 of coverage.How much must Miranda include in income?

A) $0

B) $1,080

C) $1,300

D) $1,680

A) $0

B) $1,080

C) $1,300

D) $1,680

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

80

Sharisma suffered a serious stroke and was admitted to a nursing home for 140 days.Nursing home charges,including physician fees and other related expenses were $63,000.Under Sharisma's long-term care insurance contract,she received reimbursements of $56,000.How much of the $56,000 reimbursement must be included in Sharisma's gross income in 2017?

A) $0

B) $5,600

C) $56,000

D) $7,000

A) $0

B) $5,600

C) $56,000

D) $7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck