Deck 2: Accounting for Accruals

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

الفرضيات:

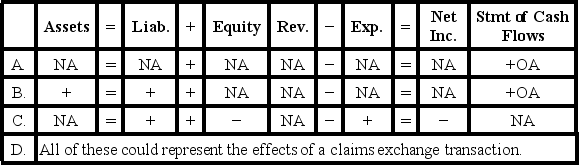

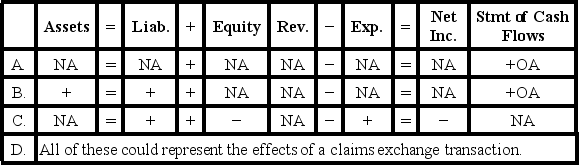

الردود:

False

True

False

True

False

True

False

True

False

True

سؤال

Match between columns

الفرضيات:

الردود:

False

True

False

True

False

True

False

True

False

True

سؤال

سؤال

سؤال

سؤال

Match between columns

الفرضيات:

الردود:

False

True

False

True

False

True

False

True

False

True

False

True

سؤال

سؤال

سؤال

Match between columns

الفرضيات:

الردود:

True

False

True

False

True

False

True

False

True

False

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

الفرضيات:

Payment of the salaries in Year 2 increased a liability.

Payment of the salaries in Year 2 increased a liability.

The income statement for Year 2 is not affected because the salaries expense had been recognized at the end of December,Year 1.

The income statement for Year 2 is not affected because the salaries expense had been recognized at the end of December,Year 1.

الردود:

True

False

True

False

True

False

True

False

True

False

سؤال

سؤال

سؤال

Match between columns

الفرضيات:

الردود:

True

False

True

False

True

False

True

False

True

False

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/84

العب

ملء الشاشة (f)

Deck 2: Accounting for Accruals

1

Revenue on account amounted to $5,000.Cash collections of accounts receivable amounted to $2,300.Expenses for the period were $2,100.The company paid dividends of $450.What was net income for the period?

A) $1,200

B) $2,900

C) $2,850

D) $2,450

A) $1,200

B) $2,900

C) $2,850

D) $2,450

$2,900

2

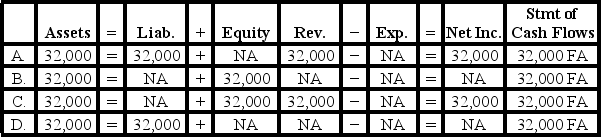

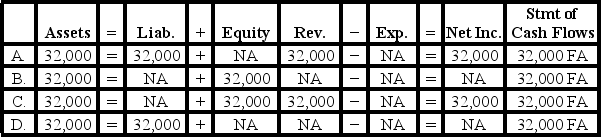

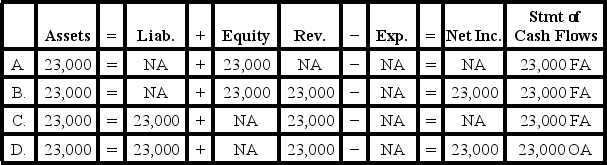

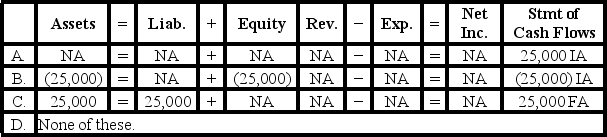

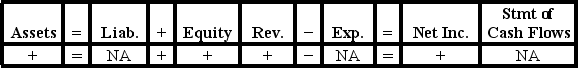

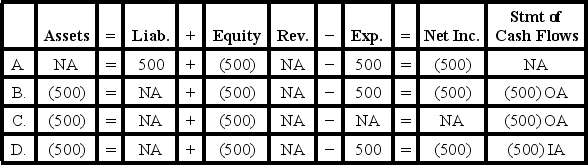

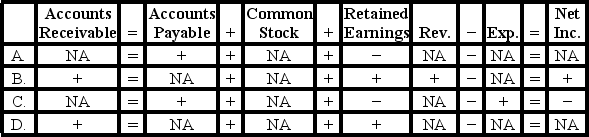

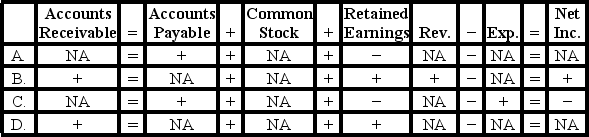

Tandem Company borrowed $32,000 of cash from a local bank.Which of the following accurately reflects how this event affects the company's horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Option D

3

Revenue on account amounted to $9,000.Cash collections of accounts receivable amounted to $8,100.Cash paid for operating expenses was $7,500.The amount of employee salaries accrued at the end of the year was $900.What was the net cash flow from operating activities?

A) $900

B) $600

C) $1,500

D) $8,700

A) $900

B) $600

C) $1,500

D) $8,700

$600

4

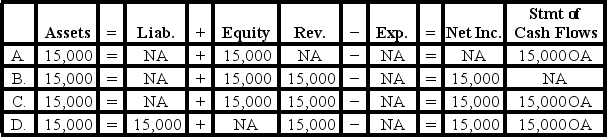

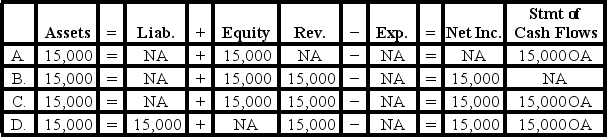

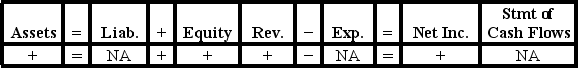

Frank Company earned $15,000 of cash revenue.Which of the following accurately reflects how this event affects the company's horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

5

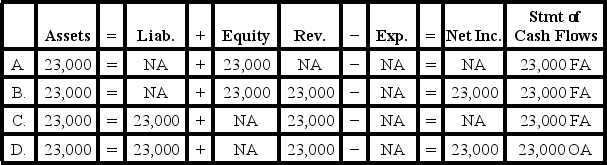

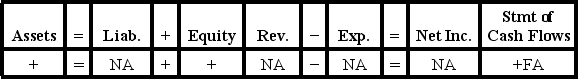

Garrison Company acquired $23,000 by issuing common stock.Which of the following accurately reflects how this event affects the company's horizontal financial statements model?

A) Option C

B) Option A

C) Option D

D) Option B

A) Option C

B) Option A

C) Option D

D) Option B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

6

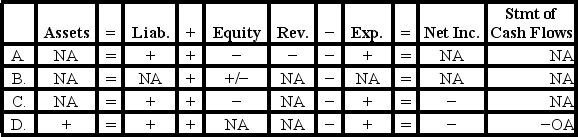

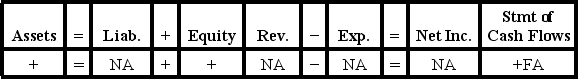

Janzen Company recorded employee salaries earned but not yet paid.Which of the following represents the effect of this transaction on the horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

7

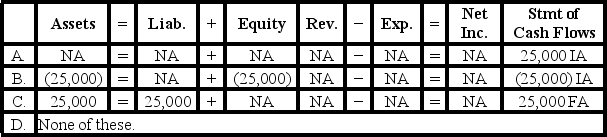

Zimmerman Company sold land for $25,000 cash.The original cost of the land was $25,000.Which of the following accurately reflects how this event affects the company's horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

8

Bledsoe Company acquired $17,000 cash by issuing common stock on January 1,Year 1.During Year 1,Bledsoe earned $8,500 of revenue on account.The company collected $6,000 cash from customers in partial settlement of its accounts receivable and paid $5,400 cash for operating expenses.Based on this information alone,what was the impact on total assets during Year 1?

A) Total assets increased by $20,100.

B) Total assets increased by $600.

C) Total assets increased by $26,100.

D) Total assets did not change.

A) Total assets increased by $20,100.

B) Total assets increased by $600.

C) Total assets increased by $26,100.

D) Total assets did not change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

9

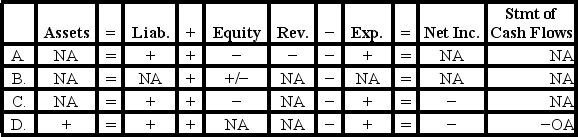

Which of the following choices accurately reflects how the recording of accrued salary expense affects the financial statements of a business?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

10

Warren Enterprises began operations during Year 1.The company had the following events during Year 1:

1)The business issued $40,000 of common stock to its stockholders.

2)The business purchased land for $24,000 cash.

3)Services were provided to customers for $32,000 cash.

4)Services were provided to customers for $10,000 on account.

5)The company borrowed $32,000 from the bank.

6)Operating expenses of $24,000 were incurred and paid in cash.

7)Salary expense of $1,600 was accrued.

"8)A dividend of $8,000 was paid to the stockholders of Warren Enterprises.

After closing,what is the balance of the Retained Earnings account as of December 31,Year 1?"

A) $10,000

B) $8,400

C) $16,400

D) $42,000

1)The business issued $40,000 of common stock to its stockholders.

2)The business purchased land for $24,000 cash.

3)Services were provided to customers for $32,000 cash.

4)Services were provided to customers for $10,000 on account.

5)The company borrowed $32,000 from the bank.

6)Operating expenses of $24,000 were incurred and paid in cash.

7)Salary expense of $1,600 was accrued.

"8)A dividend of $8,000 was paid to the stockholders of Warren Enterprises.

After closing,what is the balance of the Retained Earnings account as of December 31,Year 1?"

A) $10,000

B) $8,400

C) $16,400

D) $42,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

11

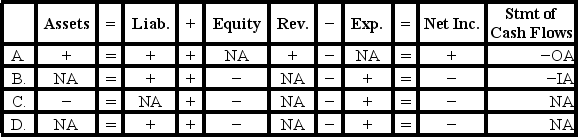

Addison Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on Addison's statements?

A) Issued common stock

B) Earned revenue on account

C) Earned cash revenue

D) Collected cash from customers in partial settlement of its accounts receivable.

Which of the following accounting events could have caused these effects on Addison's statements?

A) Issued common stock

B) Earned revenue on account

C) Earned cash revenue

D) Collected cash from customers in partial settlement of its accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

12

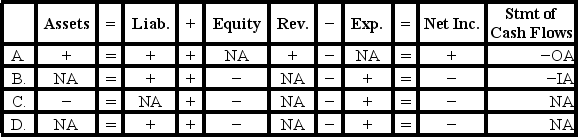

Delta Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on the elements of Delta's statements?

A) Paid a cash dividend

B) Incurred a cash expense

C) Borrowed money from a bank

D) Earned cash revenue

Which of the following accounting events could have caused these effects on the elements of Delta's statements?

A) Paid a cash dividend

B) Incurred a cash expense

C) Borrowed money from a bank

D) Earned cash revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

13

Chico Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on the elements of Chico's financial statements?

A) Issued common stock

B) Earned cash revenue

C) Borrowed money from a bank

Which of the following accounting events could have caused these effects on the elements of Chico's financial statements?

A) Issued common stock

B) Earned cash revenue

C) Borrowed money from a bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

14

Reynolds Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on the elements of Reynolds' statements?

A) Paid a cash dividend.

B) Earned cash revenue.

C) Borrowed money from a bank.

D) The information provided does not represent a completed event.

Which of the following accounting events could have caused these effects on the elements of Reynolds' statements?

A) Paid a cash dividend.

B) Earned cash revenue.

C) Borrowed money from a bank.

D) The information provided does not represent a completed event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

15

Mize Company provided $45,500 of services on account,and collected $38,000 from customers during the year.The company also incurred $37,000 of expenses on account,and paid $32,400 against its payables.How do these events impact the elements of the horizontal financial statements model?

A) Total assets would increase.

B) Total liabilities would increase.

C) Total equity would increase.

D) All of these answer choices are correct.

A) Total assets would increase.

B) Total liabilities would increase.

C) Total equity would increase.

D) All of these answer choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

16

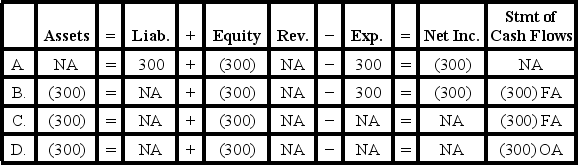

Perez Company paid a $300 cash dividend.Which of the following accurately reflects how this event affects the company's horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

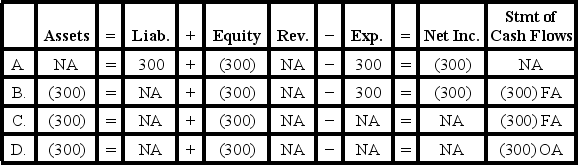

17

Jackson Company paid $500 cash for salary expenses.Which of the following accurately reflects how this event affects the company's horizontal financial statements model?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

18

Recognizing an expense may be accompanied by which of the following?

A) An increase in liabilities

B) A decrease in liabilities

C) A decrease in revenue

D) An increase in assets

A) An increase in liabilities

B) A decrease in liabilities

C) A decrease in revenue

D) An increase in assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

19

The following account balances were drawn from the Year 1 financial statements of Grayson Company:

What is the balance of the Common Stock account?

A) $15,400

B) $19,900

C) $900

D) $20,800

What is the balance of the Common Stock account?

A) $15,400

B) $19,900

C) $900

D) $20,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements is true regarding accrual accounting?

A) Revenue is recorded only when cash is collected.

B) Expenses are recorded when they are incurred.

C) Revenue is recorded in the period when it is earned.

D) Revenue is recorded in the period when it is earned and expenses are recorded when they are incurred.

A) Revenue is recorded only when cash is collected.

B) Expenses are recorded when they are incurred.

C) Revenue is recorded in the period when it is earned.

D) Revenue is recorded in the period when it is earned and expenses are recorded when they are incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following financial statements is impacted most significantly by the matching concept?

A) Balance sheet

B) Income statement

C) Statement of changes in stockholders' equity

D) Statement of cash flows

A) Balance sheet

B) Income statement

C) Statement of changes in stockholders' equity

D) Statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

22

Rushmore Company provided services for $45,000 cash during Year 1.Rushmore incurred $36,000 of operating expenses on account during Year 1,and by the end of the year,$9,000 of that amount had been paid with cash.If these are the only accounting events that affected Rushmore during Year 1,which of the following statements is true?

A) The amount of net loss shown on the income statement is $9,000.

B) The amount of net income shown on the income statement is $27,000.

C) The amount of net income shown on the income statement is $9,000.

D) The amount of net cash flow from operating activities shown on the statement of cash flows is $18,000.

A) The amount of net loss shown on the income statement is $9,000.

B) The amount of net income shown on the income statement is $27,000.

C) The amount of net income shown on the income statement is $9,000.

D) The amount of net cash flow from operating activities shown on the statement of cash flows is $18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not one of the common elements that are typically present when fraud occurs?

A) The capacity to rationalize

B) The existence of pressure leading to an incentive

C) The assistance of others

D) The presence of an opportunity

A) The capacity to rationalize

B) The existence of pressure leading to an incentive

C) The assistance of others

D) The presence of an opportunity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

24

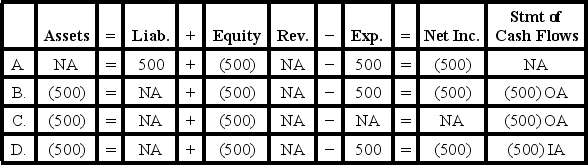

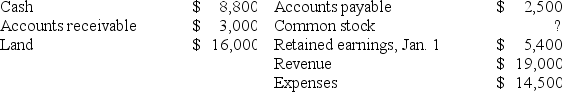

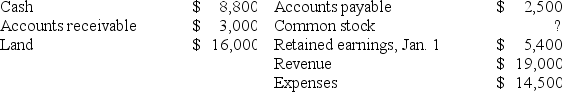

[The following information applies to the questions displayed below.]

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:

![<strong>[The following information applies to the questions displayed below.] The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1: -What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?</strong> A) $12,600 B) $13,800 C) $7,200 D) $10,600](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f78_5f10_ace2_2bc3a8ec47f8_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg)

-What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?

A) $12,600

B) $13,800

C) $7,200

D) $10,600

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:

![<strong>[The following information applies to the questions displayed below.] The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1: -What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?</strong> A) $12,600 B) $13,800 C) $7,200 D) $10,600](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f78_5f10_ace2_2bc3a8ec47f8_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg)

-What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?

A) $12,600

B) $13,800

C) $7,200

D) $10,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

25

[The following information applies to the questions displayed below.]

Nelson Company experienced the following transactions during Year 1, its first year in operation.

1) Acquired $12,000 cash by issuing common stock

2) Provided $4,600 of services on account

3) Paid $3,200 cash for operating expenses

4) Collected $3,800 of cash from customers in partial settlement of its accounts receivable

5) Paid a $200 cash dividend to stockholders

-What is the balance of the retained earnings that will be reported on the balance sheet as of December 31,Year 1?

A) $1,200

B) $1,000

C) $1,400

D) $13,200

Nelson Company experienced the following transactions during Year 1, its first year in operation.

1) Acquired $12,000 cash by issuing common stock

2) Provided $4,600 of services on account

3) Paid $3,200 cash for operating expenses

4) Collected $3,800 of cash from customers in partial settlement of its accounts receivable

5) Paid a $200 cash dividend to stockholders

-What is the balance of the retained earnings that will be reported on the balance sheet as of December 31,Year 1?

A) $1,200

B) $1,000

C) $1,400

D) $13,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

26

On December 31,Year 1,Gaskins Co.owed $4,500 in salaries to employees who had worked during December but will not be paid until January,Year 2.If the year-end adjustment is properly recorded on December 31,Year 1,what will be the effect of this accrual on net income and cash flows from operating activities reported for Year 1?

A) No effect on net income; no effect on cash flow from operating activities

B) Decrease in net income; no effect on cash flow from operating activities

C) Increase in net income; decrease in cash flow from operating activities

D) No effect on net income; decrease in cash flow from operating activities

A) No effect on net income; no effect on cash flow from operating activities

B) Decrease in net income; no effect on cash flow from operating activities

C) Increase in net income; decrease in cash flow from operating activities

D) No effect on net income; decrease in cash flow from operating activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is not an element of the fraud triangle?

A) Reliance

B) Rationalization

C) Opportunity

D) Pressure

A) Reliance

B) Rationalization

C) Opportunity

D) Pressure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is not a principle of the AICPA Code of Professional Conduct?

A) Integrity

B) Due Care

C) Internal Controls

D) Objectivity and Independence

A) Integrity

B) Due Care

C) Internal Controls

D) Objectivity and Independence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

29

If retained earnings decreased during the year,and no dividends were paid,which of the following statements must be true?

A) Expenses for the year exceeded revenues.

B) The company did not have enough cash to pay its expenses.

C) Total equity decreased.

D) Liabilities increased during the year.

A) Expenses for the year exceeded revenues.

B) The company did not have enough cash to pay its expenses.

C) Total equity decreased.

D) Liabilities increased during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

30

[The following information applies to the questions displayed below.]

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:

![<strong>[The following information applies to the questions displayed below.] The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1: -The amount of Carolina's retained earnings on December 31,Year 1 was:</strong> A) $5,900 B) $7,200 C) $3,900 D) $4,900](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f78_5f10_ace2_2bc3a8ec47f8_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg)

-The amount of Carolina's retained earnings on December 31,Year 1 was:

A) $5,900

B) $7,200

C) $3,900

D) $4,900

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:

![<strong>[The following information applies to the questions displayed below.] The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1: -The amount of Carolina's retained earnings on December 31,Year 1 was:</strong> A) $5,900 B) $7,200 C) $3,900 D) $4,900](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f78_5f10_ace2_2bc3a8ec47f8_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg)

-The amount of Carolina's retained earnings on December 31,Year 1 was:

A) $5,900

B) $7,200

C) $3,900

D) $4,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

31

[The following information applies to the questions displayed below.]

Nelson Company experienced the following transactions during Year 1, its first year in operation.

1) Acquired $12,000 cash by issuing common stock

2) Provided $4,600 of services on account

3) Paid $3,200 cash for operating expenses

4) Collected $3,800 of cash from customers in partial settlement of its accounts receivable

5) Paid a $200 cash dividend to stockholders

-What is the amount of net income that will be reported on the Year 1 income statement?

A) $1,400

B) $800

C) $1,000

D) $1,200

Nelson Company experienced the following transactions during Year 1, its first year in operation.

1) Acquired $12,000 cash by issuing common stock

2) Provided $4,600 of services on account

3) Paid $3,200 cash for operating expenses

4) Collected $3,800 of cash from customers in partial settlement of its accounts receivable

5) Paid a $200 cash dividend to stockholders

-What is the amount of net income that will be reported on the Year 1 income statement?

A) $1,400

B) $800

C) $1,000

D) $1,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

32

On September 1,Year 1,Gomez Company collected $9,000 in advance from a customer for services to be provided over a one-year period beginning on that date.How much revenue would Gomez Company report related to this contract on its income statement for the year ended December 31,Year 1? How much would the company report as net cash flows from operating activities for Year 1?

A) $3,000; $3,000

B) $9,000; $9,000

C) $3,000; $9,000

D) $0; $9,000

A) $3,000; $3,000

B) $9,000; $9,000

C) $3,000; $9,000

D) $0; $9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

33

[The following information applies to the questions displayed below.]

Nelson Company experienced the following transactions during Year 1, its first year in operation.

1) Acquired $12,000 cash by issuing common stock

2) Provided $4,600 of services on account

3) Paid $3,200 cash for operating expenses

4) Collected $3,800 of cash from customers in partial settlement of its accounts receivable

5) Paid a $200 cash dividend to stockholders

-What is the amount of net cash flows from operating activities that will be reported on the Year 1 statement of cash flows?

A) $400

B) $600

C) $1,400

D) $1,200

Nelson Company experienced the following transactions during Year 1, its first year in operation.

1) Acquired $12,000 cash by issuing common stock

2) Provided $4,600 of services on account

3) Paid $3,200 cash for operating expenses

4) Collected $3,800 of cash from customers in partial settlement of its accounts receivable

5) Paid a $200 cash dividend to stockholders

-What is the amount of net cash flows from operating activities that will be reported on the Year 1 statement of cash flows?

A) $400

B) $600

C) $1,400

D) $1,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

34

[The following information applies to the questions displayed below.]

Nelson Company experienced the following transactions during Year 1, its first year in operation.

1) Acquired $12,000 cash by issuing common stock

2) Provided $4,600 of services on account

3) Paid $3,200 cash for operating expenses

4) Collected $3,800 of cash from customers in partial settlement of its accounts receivable

5) Paid a $200 cash dividend to stockholders

-What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?

A) $12,400

B) $12,600

C) $13,400

D) $13,200

Nelson Company experienced the following transactions during Year 1, its first year in operation.

1) Acquired $12,000 cash by issuing common stock

2) Provided $4,600 of services on account

3) Paid $3,200 cash for operating expenses

4) Collected $3,800 of cash from customers in partial settlement of its accounts receivable

5) Paid a $200 cash dividend to stockholders

-What is the amount of total assets that will be reported on the balance sheet as of December 31,Year 1?

A) $12,400

B) $12,600

C) $13,400

D) $13,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is the purpose of the accrual basis of accounting?

A) Recognize revenue when it is collected from customers.

B) Match assets with liabilities during the proper accounting period.

C) Recognize expenses when cash disbursements are made.

D) Recognizing revenue when it is earned and expenses when they are incurred, regardless of when cash changes hands.

A) Recognize revenue when it is collected from customers.

B) Match assets with liabilities during the proper accounting period.

C) Recognize expenses when cash disbursements are made.

D) Recognizing revenue when it is earned and expenses when they are incurred, regardless of when cash changes hands.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is the term used to describe the policies and procedures that are designed to reduce the opportunities for fraud?

A) Internal controls

B) Asset source transactions

C) Accounting standards

D) Financial systems

A) Internal controls

B) Asset source transactions

C) Accounting standards

D) Financial systems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

37

[The following information applies to the questions displayed below.]

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:

![<strong>[The following information applies to the questions displayed below.] The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1: -What is the amount of net income that will be reported on the Year 1 income statement?</strong> A) $2,200 B) $3,200 C) $1,000 D) $200](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f78_5f10_ace2_2bc3a8ec47f8_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg)

-What is the amount of net income that will be reported on the Year 1 income statement?

A) $2,200

B) $3,200

C) $1,000

D) $200

The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1:

![<strong>[The following information applies to the questions displayed below.] The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1: -What is the amount of net income that will be reported on the Year 1 income statement?</strong> A) $2,200 B) $3,200 C) $1,000 D) $200](https://d2lvgg3v3hfg70.cloudfront.net/TB1323/11ea7eef_7f78_5f10_ace2_2bc3a8ec47f8_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00_TB1323_00.jpg)

-What is the amount of net income that will be reported on the Year 1 income statement?

A) $2,200

B) $3,200

C) $1,000

D) $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

38

What action did the U.S.Congress take because of the audit failures at Enron,WorldCom and other companies?

A) Required publicly-traded companies to be audited by a government agency

B) Passed the Sarbanes-Oxley Act

C) Required companies to begin preparing an additional financial statement

D) Passed an amendment to the Securities and Exchange Act

A) Required publicly-traded companies to be audited by a government agency

B) Passed the Sarbanes-Oxley Act

C) Required companies to begin preparing an additional financial statement

D) Passed an amendment to the Securities and Exchange Act

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is frequently used to describe the expenses that are matched in the same accounting period in which they are incurred?

A) Market expenses

B) Matching expenses

C) Period costs

D) Working costs

A) Market expenses

B) Matching expenses

C) Period costs

D) Working costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following are "matched" under the matching concept?

A) Expenses and revenues

B) Expenses and liabilities

C) Assets and equity

D) Assets and liabilities

A) Expenses and revenues

B) Expenses and liabilities

C) Assets and equity

D) Assets and liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

41

Match between columns

الفرضيات:

الردود:

False

True

False

True

False

True

False

True

False

True

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

42

Match between columns

الفرضيات:

الردود:

False

True

False

True

False

True

False

True

False

True

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

43

Companies that use accrual accounting recognize revenues and expenses at the time that cash is received or paid,respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following describes the effects of a claims exchange transaction on a company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

45

During Year 3,Fancy Foods Incorporated earned $54,000 of revenue on account.The beginning balance in accounts receivable was $5,000,and the ending balance was $10,000.Also,Fancy Foods Incorporated started the year with a beginning balance in accounts payable of $5,000.Fancy Foods' ending balance in account payable was $4,000.The company incurred $12,000 of operating expenses on account.Determine the amount of cash paid to settle accounts payable.

A) $13,000

B) $24,000

C) $96,000

D) $156,000

A) $13,000

B) $24,000

C) $96,000

D) $156,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

46

Match between columns

الفرضيات:

الردود:

False

True

False

True

False

True

False

True

False

True

False

True

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

47

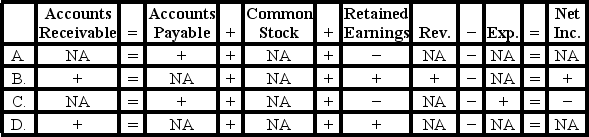

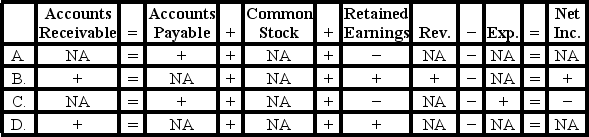

The Merry Maids provided cleaning services to Orange Company on account.Which of the following would describe the transaction's effect on Orange Company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Merry Maids provided cleaning services to Orange Company on account.Which of the following would describe the transaction's effect on the Merry Maids' financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

49

Match between columns

الفرضيات:

الردود:

True

False

True

False

True

False

True

False

True

False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following would be included in the "cash flow from operating activities" section of the statement of cash flows?

A) Accrual of salary expense at year-end.

B) Purchase of land for cash.

C) Payments of cash dividends to the owners of the business.

D) Cash paid for interest on a note payable.

A) Accrual of salary expense at year-end.

B) Purchase of land for cash.

C) Payments of cash dividends to the owners of the business.

D) Cash paid for interest on a note payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is an asset use transaction?

A) Purchased land for cash

B) Paid cash for salary expense

C) Invested cash in an interest earning account

D) Accrued salary expense at the end of the period

A) Purchased land for cash

B) Paid cash for salary expense

C) Invested cash in an interest earning account

D) Accrued salary expense at the end of the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

52

If a company provides services to clients but has not yet collected any cash,how should that transaction be classified?

A) Claims exchange transaction

B) Asset use transaction

C) Asset source transaction

D) Asset exchange transaction

A) Claims exchange transaction

B) Asset use transaction

C) Asset source transaction

D) Asset exchange transaction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is an asset source transaction?

A) Issued common stock

B) Paid a cash dividend to stockholders

C) Collected cash from customers in settlement of accounts receivable

D) Accrued salary expense

A) Issued common stock

B) Paid a cash dividend to stockholders

C) Collected cash from customers in settlement of accounts receivable

D) Accrued salary expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

54

Match between columns

الفرضيات:

Payment of the salaries in Year 2 increased a liability.

Payment of the salaries in Year 2 increased a liability.

The income statement for Year 2 is not affected because the salaries expense had been recognized at the end of December,Year 1.

The income statement for Year 2 is not affected because the salaries expense had been recognized at the end of December,Year 1.

الردود:

True

False

True

False

True

False

True

False

True

False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

55

Fancy Foods Incorporated had an ending balance in accounts payable of $6,000.The company incurred $72,000 of operating expenses on account and paid $90,000 cash to settle accounts payable.Determine the beginning balance in accounts payable.

A) $12,000

B) $24,000

C) $96,000

D) $156,000

A) $12,000

B) $24,000

C) $96,000

D) $156,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is an asset exchange transaction?

A) Issued common stock

B) Accrued salary expense at the end of the accounting period

C) Collected cash on accounts receivable

D) Earned cash revenue for services provided

A) Issued common stock

B) Accrued salary expense at the end of the accounting period

C) Collected cash on accounts receivable

D) Earned cash revenue for services provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

57

Match between columns

الفرضيات:

الردود:

True

False

True

False

True

False

True

False

True

False

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

58

During Year 2,Fancy Foods Incorporated earned $104,000 of revenue on account.The beginning balance in accounts receivable was $26,000,and the ending balance was $4,000.Based solely on this information,what was the amount of cash collected from accounts receivable?

A) $74,000

B) $82,000

C) $126,000

D) $134,000

A) $74,000

B) $82,000

C) $126,000

D) $134,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

59

Chester Company began Year 2 with a note payable of $20,000 and interest payable of $800.During the year,the company accrued an additional $400 of interest expense,and paid off the note with interest.On the company's Year 2 statement of cash flows,cash flows for financing activities related to the note would be:

A) $1,200 outflow

B) $20,000 outflow

C) $20,400 outflow

D) $21,200 outflow

A) $1,200 outflow

B) $20,000 outflow

C) $20,400 outflow

D) $21,200 outflow

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

60

The term "recognition" means to report an economic event in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

61

The cash payment of interest is classified as a financing activity on the statement of cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

62

Some claims exchange transactions increase liabilities and decrease stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

63

Accrual accounting usually fails to match expenses with revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

64

The primary difference between notes payable and accounts payable is that notes payable generally have longer terms and usually require interest charges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

65

The governance of a corporation includes the roles and responsibilities of the board of directors,managers,shareholders,and auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

66

A payment to an employee in settlement of salaries payable decreases an asset and decreases equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

67

The ethical standards for certified public accountants only require that such accountants comply with applicable laws and regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

68

Accrued interest expense is an asset use transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

69

The balance in accounts receivable represents the amount of cash the company is required to pay in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

70

A company may recognize a revenue or expense without a corresponding cash collection or payment in the same accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

71

The matching concept leads accountants to select the recognition alternative that produces the lowest amount of net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

72

Issuing a note is an asset use transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

73

The collection of an account receivable is a claims exchange transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

74

The term "accrual" describes an earnings event that is recognized before cash is received or paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

75

The internal controls of a business are designed to reduce the probability of occurrence of fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

76

The Sarbanes-Oxley Act includes several significant reforms that affect the auditing profession,but it did not reduce an audit firm's ability to provide nonaudit services to its audit clients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

77

The bankruptcies of Enron and WorldCom both indicated the occurrence of major audit failures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

78

Providing services to customers on account is an asset exchange transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

79

An increase in an expense may be accompanied by a decrease in a liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

80

Certified public accountants are obligated to act in a way that serves the public interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck