Deck 36: Translation of the Accounts of Foreign Operations

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/41

العب

ملء الشاشة (f)

Deck 36: Translation of the Accounts of Foreign Operations

1

When consolidating financial statements of foreign operations,we use the same rate each year for goodwill,so that the amount recognised on consolidation will not fluctuate from year to year:

True

2

If the exchange rate for US dollars relative to Australian dollars goes from US$1 = $A2.10 to US$1 = $A2.20,the Australian dollar has strengthened.

False

3

The 'spot rate' is:

A) The rate for delivery the next day of currencies to be exchanged.

B) The exchange rate for immediate delivery of currencies to be exchanged.

C) Only used in relation to metals - i.e., the spot metal price.

D) Can never be used in translating the accounts of foreign operations.

E) The exchange rate pre-specified in a forward rate agreement.

A) The rate for delivery the next day of currencies to be exchanged.

B) The exchange rate for immediate delivery of currencies to be exchanged.

C) Only used in relation to metals - i.e., the spot metal price.

D) Can never be used in translating the accounts of foreign operations.

E) The exchange rate pre-specified in a forward rate agreement.

B

4

Exchange differences arising from translation to the presentation currency are not recognised in profit or loss because the changes in exchange rates have little or no direct effect on the present and future cash flows from operations:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

5

The amount of a foreign operation's post-acquisition retained earnings as translated into Australian dollars will depend on the amount translated from the income statement:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

6

As prescribed in AASB 121,translation of the accounts of foreign operations to the presentation currency requires any gains or losses on translation be taken directly to reserves:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

7

The translation approach required by AASB 121 in translating to presentation currency is similar to the "current rate" method required under the former AASB 1012:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

8

As prescribed in AASB 121,in translating the accounts of a foreign operation from functional to presentation currency,the exchange rate to use for inventory is the average rate during the period the inventory was purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

9

AASB 121 requires foreign currency transactions to be recorded on initial recognition in the local currency,by applying to the foreign currency amount the spot exchange rate between the local currency and the foreign currency at the date of the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

10

On the disposal of a foreign operation,AASB 121 prescribed that the cumulative amount of the exchange differences deferred in equity be reclassified to retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

11

AASB 121 requires foreign currency transactions to be recorded on initial recognition in the functional currency,by applying to the foreign currency amount the spot exchange rate between the functional currency and the foreign currency at the reporting date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

12

The foreign exchange exposure of the parent entity in relation to its foreign operation relates to the net cash flows of the investment in the operation:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

13

'Exchange rate' is:

A) Not defined in AASB 121.

B) Only defined in AASB 139.

C) Defined as 'the ratio of exchange for two currencies' in AASB 121.

D) All of the given answers.

E) None of the given answers.

A) Not defined in AASB 121.

B) Only defined in AASB 139.

C) Defined as 'the ratio of exchange for two currencies' in AASB 121.

D) All of the given answers.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under the former AASB 1012 there were two methods of translation of the accounts of foreign operations; the method being used being dependent upon the whether these operations are integrated or self-sustaining:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

15

The exchange rate used for the translation of the payment of dividends is the spot rate at the date when the retained earnings or reserves,from which the dividends were drawn,were createD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

16

Exchange differences resulting from the translation of foreign operations to presentation currency are shown:

A) In the 'Retained Earnings' section of equity.

B) In the 'General Reserve' section of equity.

C) In the 'Asset Revaluation Reserve' section of equity.

D) Any of the given answers, at the discretion of entity management.

E) None of the given answers.

A) In the 'Retained Earnings' section of equity.

B) In the 'General Reserve' section of equity.

C) In the 'Asset Revaluation Reserve' section of equity.

D) Any of the given answers, at the discretion of entity management.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

17

In translating the accounts of a foreign operation from functional to presentation currency,resulting exchange differences is recognised in other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

18

When translating the financial statements of a foreign operation to presentation currency,AASB 121 requires any gain or loss on translation of the accounts to be:

A) Recognised as a revenue or expense in the income statement.

B) Transferred to a reserve in the equity section of the balance sheet.

C) Deferred and amortised over a period of not greater than 20 years.

D) Written off against the non-monetary assets of the foreign operation with any balance remaining recognised as a revenue or expense in the period.

E) None of the given answers.

A) Recognised as a revenue or expense in the income statement.

B) Transferred to a reserve in the equity section of the balance sheet.

C) Deferred and amortised over a period of not greater than 20 years.

D) Written off against the non-monetary assets of the foreign operation with any balance remaining recognised as a revenue or expense in the period.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

19

As prescribed in AASB 121,in translating the accounts of a foreign operation from local currency to functional currency,the exchange rate to use for land is the exchange rate at the date of the transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

20

AASB 121 prescribes alternative methods for the translation of the accounts of foreign operations.It depends upon whether these operations are integrated or self-sustaining:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

21

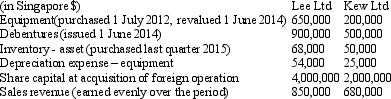

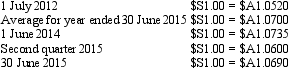

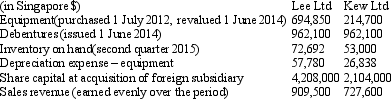

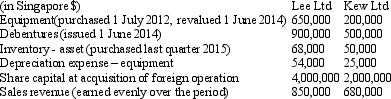

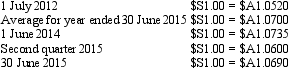

Rudd Ltd,an Australian entity purchased Lee Ltd and Kew Ltd on 1 July 2012.Both entities are considered foreign operations of Rudd Ltd based in Singapore.The following information was extracted from the foreign operation's accounts for the period ended 30 June 2015:  Exchange rate information is:

Exchange rate information is:

The translation from Singapore dollars to Australian dollars resulted to the following balances:

The translation from Singapore dollars to Australian dollars resulted to the following balances:

Which of the following translation processes were applied to Lee Ltd and Kew Ltd,respectively,for the year ended 30 June 2015?

Which of the following translation processes were applied to Lee Ltd and Kew Ltd,respectively,for the year ended 30 June 2015?

A) Functional currency; Presentation currency;

B) Functional currency; Functional currency;

C) Presentation currency; Functional currency;

D) Presentation currency; Presentation currency;

E) None of the given answers.

Exchange rate information is:

Exchange rate information is: The translation from Singapore dollars to Australian dollars resulted to the following balances:

The translation from Singapore dollars to Australian dollars resulted to the following balances: Which of the following translation processes were applied to Lee Ltd and Kew Ltd,respectively,for the year ended 30 June 2015?

Which of the following translation processes were applied to Lee Ltd and Kew Ltd,respectively,for the year ended 30 June 2015?A) Functional currency; Presentation currency;

B) Functional currency; Functional currency;

C) Presentation currency; Functional currency;

D) Presentation currency; Presentation currency;

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

22

Under the translation method required by AASB 121,the approach to translating a foreign operation's accounts includes:

A) Translating post-acquisition changes in equity at the exchange rate current at the date of the change.

B) Translating non-monetary assets at the spot exchange rate at the date of the purchase transaction.

C) Translating revenue and expense items at the exchange rate current at reporting date where the revenues and expense transactions have been evenly distributed over the period.

D) Translating proposed distributions from retained profits at the exchange rate current when the distributions are completed in cash.

E) All of the given answers.

A) Translating post-acquisition changes in equity at the exchange rate current at the date of the change.

B) Translating non-monetary assets at the spot exchange rate at the date of the purchase transaction.

C) Translating revenue and expense items at the exchange rate current at reporting date where the revenues and expense transactions have been evenly distributed over the period.

D) Translating proposed distributions from retained profits at the exchange rate current when the distributions are completed in cash.

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

23

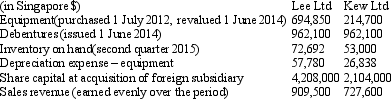

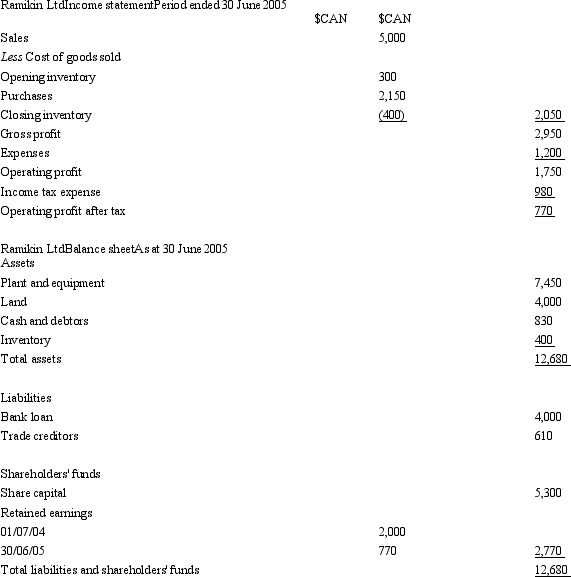

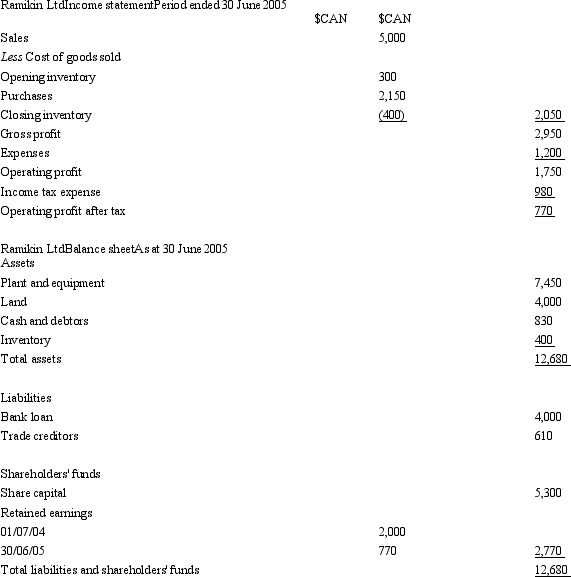

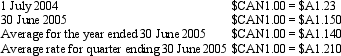

Ramikin Co is a fully owned subsidiary of Bobbin Ltd,an Australian company.Bobbin Ltd purchased all the issued capital of Ramikin Ltd on 1 July 2004.Ramikin Ltd is based in Canada.The following information is summarised from the foreign currency accounts of Ramikin Ltd for the period ended 30 June 2005.  Additional information:

Additional information:

All revenues and expenses were earned or incurred evenly throughout the year.

Inventory was purchased evenly over the period,with the inventory on hand at the end of the period purchased over the quarter ending on 30 June and trade creditors were accrued evenly over the period.

Exchange rate information:

Based on the information provided.What is the gain (loss)on foreign currency translation for Ramikin Ltd for the period?

Based on the information provided.What is the gain (loss)on foreign currency translation for Ramikin Ltd for the period?

A) Gain $A385

B) Loss $A28

C) Loss $A612

D) Gain $A376

E) None of the given answers.

Additional information:

Additional information:All revenues and expenses were earned or incurred evenly throughout the year.

Inventory was purchased evenly over the period,with the inventory on hand at the end of the period purchased over the quarter ending on 30 June and trade creditors were accrued evenly over the period.

Exchange rate information:

Based on the information provided.What is the gain (loss)on foreign currency translation for Ramikin Ltd for the period?

Based on the information provided.What is the gain (loss)on foreign currency translation for Ramikin Ltd for the period?A) Gain $A385

B) Loss $A28

C) Loss $A612

D) Gain $A376

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

24

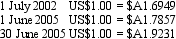

The net assets of a foreign operation at 30 June 2005 are constituted as assets of US$400,000 and liabilities of US$250,000.The parent entity purchased the foreign subsidiary on 1 July 2002.Exchange rate information is as follows:  The foreign operation has not traded during the year ended 30 June 2005,so the net assets remained unchanged during the period.What is the parent entity's foreign currency exposure for the year ended 30 June 2005?

The foreign operation has not traded during the year ended 30 June 2005,so the net assets remained unchanged during the period.What is the parent entity's foreign currency exposure for the year ended 30 June 2005?

A) Foreign exchange gain $A197,185.

B) Foreign exchange gain $A20,610.

C) Foreign exchange gain $A342,310.

D) Foreign exchange loss $A6,002.

E) None of the given answers.

The foreign operation has not traded during the year ended 30 June 2005,so the net assets remained unchanged during the period.What is the parent entity's foreign currency exposure for the year ended 30 June 2005?

The foreign operation has not traded during the year ended 30 June 2005,so the net assets remained unchanged during the period.What is the parent entity's foreign currency exposure for the year ended 30 June 2005?A) Foreign exchange gain $A197,185.

B) Foreign exchange gain $A20,610.

C) Foreign exchange gain $A342,310.

D) Foreign exchange loss $A6,002.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

25

Under the translation method required by AASB 121,the approach to translating a foreign operation's accounts includes:

A) Translating monetary items at the rate of exchange current on the transaction date.

B) Translating non-monetary assets at the average exchange rate since the date of purchase of the asset.

C) Translating transfers of post-acquisition equity items within the equity category at the rate of exchange current at the date the original equity item was first included in equity.

D) Translating revenues and expenses at the average rate of exchange applied to equity items.

E) All of the given answers.

A) Translating monetary items at the rate of exchange current on the transaction date.

B) Translating non-monetary assets at the average exchange rate since the date of purchase of the asset.

C) Translating transfers of post-acquisition equity items within the equity category at the rate of exchange current at the date the original equity item was first included in equity.

D) Translating revenues and expenses at the average rate of exchange applied to equity items.

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

26

Yarra Manufacturing Ltd is an Australian registered entity that has a branch in Singapore,Kew Ltd.The Singapore branch has a foreign operation in China.The foreign operation maintains its accounting records in Chinese Yuan.The functional currency of the Chinese operation is Singapore dollar.The presentation currency of Kew Ltd is Australian dollar. At reporting date,the translation of the financial statements of the Chinese foreign operation resulted to a loss of S$6 500 and the translation of the financial statements of Kew Ltd to its presentation currency resulted to a gain of A$4 500.

Which of the following results is consistent with AASB 121 with respect to Kew Ltd?

A) Loss of S$6 500 should be recognised in profit and loss.

B) Loss of S$6 500 should be recognised in comprehensive income.

C) Gain of A$4 500 should be recognised in profit and loss.

D) Gain of A$4 500 should be recognised in comprehensive income.

E) None of the given answers.

Which of the following results is consistent with AASB 121 with respect to Kew Ltd?

A) Loss of S$6 500 should be recognised in profit and loss.

B) Loss of S$6 500 should be recognised in comprehensive income.

C) Gain of A$4 500 should be recognised in profit and loss.

D) Gain of A$4 500 should be recognised in comprehensive income.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

27

AASB 121 specifies that post-acquisition movements in equity other than retained profits or accumulated losses are translated at

A) The 'spot rate'.

B) The 'forward rate'.

C) The 'market rate'.

D) The 'closing rate'.

E) None of the given answers

A) The 'spot rate'.

B) The 'forward rate'.

C) The 'market rate'.

D) The 'closing rate'.

E) None of the given answers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

28

In the process of consolidating the translated financial accounts of a foreign operation,the calculation of minority interests will be affected by the translation process in what way?

A) The minority interests will be allocated a portion of the gain or loss on translation from the income statement.

B) The effect of transactions between the subsidiary and the minority interests will be eliminated after calculating the unrealised foreign exchange gain or loss implicit in the unrealised profit on the inter-company transaction.

C) The minority interests will be allocated a portion of the foreign currency translation reserve.

D) The minority interests calculation is not affected.

E) None of the given answers.

A) The minority interests will be allocated a portion of the gain or loss on translation from the income statement.

B) The effect of transactions between the subsidiary and the minority interests will be eliminated after calculating the unrealised foreign exchange gain or loss implicit in the unrealised profit on the inter-company transaction.

C) The minority interests will be allocated a portion of the foreign currency translation reserve.

D) The minority interests calculation is not affected.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

29

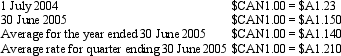

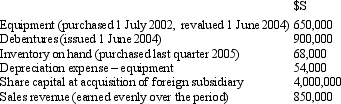

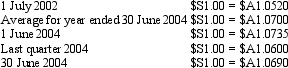

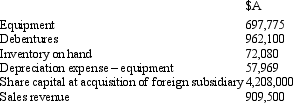

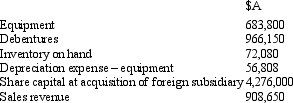

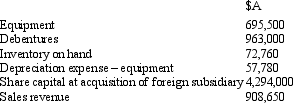

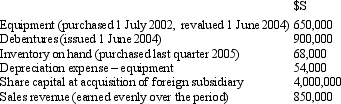

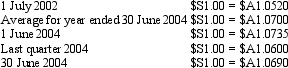

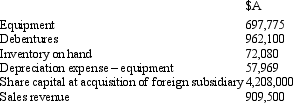

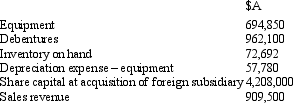

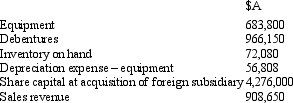

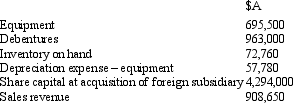

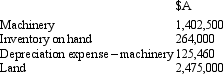

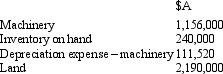

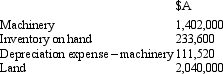

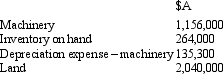

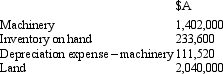

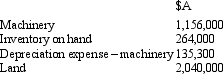

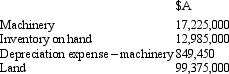

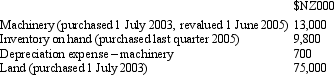

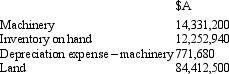

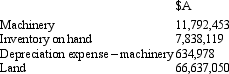

Emu Co Ltd purchased a foreign operation based in Singapore on 1 July 2002.The following information was extracted from the foreign operation's accounts for the period ended 30 June 2004:  Exchange rate information is:

Exchange rate information is:

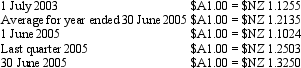

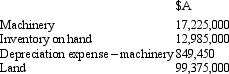

What is the amount at which each item will be translated (rounded to the nearest $A)?

What is the amount at which each item will be translated (rounded to the nearest $A)?

A)

B)

C)

D)

E) None of the given answers.

Exchange rate information is:

Exchange rate information is: What is the amount at which each item will be translated (rounded to the nearest $A)?

What is the amount at which each item will be translated (rounded to the nearest $A)?A)

B)

C)

D)

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

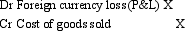

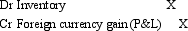

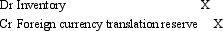

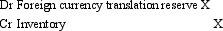

30

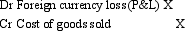

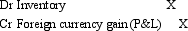

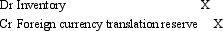

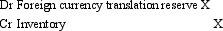

In the process of consolidating the translated financial accounts of a foreign operation,what will be the form of the journal entry required to eliminate the foreign currency effect of a purchase of inventory by the subsidiary from the parent entity? Assume that the value of the foreign currency of the foreign operation has increased relative to the reporting currency.

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

31

As prescribed in AASB 121,when re-measuring financial statements of foreign operations to presentation currency,which of the following identifies all items to be re-measured at historic rates?

A) Cash, accounts receivable and accounts payable;

B) Inventory, goodwill, property plant and equipment;

C) Accounts payable, unearned revenue and note payable;

D) Gain on sale of non-current assets, dividend revenue and dividends paid;

E) None of the given answers.

A) Cash, accounts receivable and accounts payable;

B) Inventory, goodwill, property plant and equipment;

C) Accounts payable, unearned revenue and note payable;

D) Gain on sale of non-current assets, dividend revenue and dividends paid;

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

32

Yarra Manufacturing Ltd is an Australian registered entity that has a branch in Singapore,Kew Ltd.Kew Ltd has a foreign operation in China.The foreign operation maintains its accounting records in Chinese Yuan.The functional currency of the Chinese operation is Singapore dollar.The presentation currency of Kew Ltd is Australian dollar. At reporting date,the translation of the financial statements of the Chinese foreign operation resulted to a loss of S$6 500 and the translation of the financial statements of Kew Ltd to its presentation currency resulted to a gain of A$4 500.

Which of the following results is consistent with AASB 121 with respect to Yarra Manufacturing Ltd?

A) Loss of S$6 500 should be recognised in profit and loss.

B) Loss of S$6 500 should be recognised in comprehensive income.

C) Gain of A$4 500 should be recognised in profit and loss.

D) Gain of A$4 500 should be recognised in comprehensive income.

E) None of the given answers.

Which of the following results is consistent with AASB 121 with respect to Yarra Manufacturing Ltd?

A) Loss of S$6 500 should be recognised in profit and loss.

B) Loss of S$6 500 should be recognised in comprehensive income.

C) Gain of A$4 500 should be recognised in profit and loss.

D) Gain of A$4 500 should be recognised in comprehensive income.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

33

In the process of consolidating the translated financial accounts of a foreign operation,the elimination entry to record goodwill will be affected by the translation process in what way?

A) The elimination of the investment against the pre-acquisition capital and reserves and the calculation of goodwill will vary each year depending on the exchange rates at the end of the period that are used to calculate the foreign exchange gain or loss.

B) The elimination of the investment against the pre-acquisition capital and reserves and the calculation of goodwill will be the same unless inter-company transactions have to be eliminated, in which case the entry will have to be adjusted for the exchange rate differences on the inter-company transactions.

C) The elimination of the investment against the pre-acquisition capital and reserves and the calculation of goodwill will be the same each year the elimination entry is made.

D) The elimination of the investment against the pre-acquisition capital and reserves and the calculation of goodwill will be affected by any subsequent transfers between equity items that may arise as a result of bonus issues or transfers between reserves.

E) None of the given answers.

A) The elimination of the investment against the pre-acquisition capital and reserves and the calculation of goodwill will vary each year depending on the exchange rates at the end of the period that are used to calculate the foreign exchange gain or loss.

B) The elimination of the investment against the pre-acquisition capital and reserves and the calculation of goodwill will be the same unless inter-company transactions have to be eliminated, in which case the entry will have to be adjusted for the exchange rate differences on the inter-company transactions.

C) The elimination of the investment against the pre-acquisition capital and reserves and the calculation of goodwill will be the same each year the elimination entry is made.

D) The elimination of the investment against the pre-acquisition capital and reserves and the calculation of goodwill will be affected by any subsequent transfers between equity items that may arise as a result of bonus issues or transfers between reserves.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

34

Under the translation method required by AASB 121,the approach to translating a foreign operation's accounts includes:

A) Non-monetary items included in the balance sheet are translated at the rate current at reporting date.

B) Equity at the date of investment is translated at the rate for the when the investment was acquired.

C) Revenue and expense items are translated at the exchange rates current at the applicable transaction dates.

D) Monetary items included in the balance sheet are translated at the exchange rate current at the reporting date.

E) All of the given answers.

A) Non-monetary items included in the balance sheet are translated at the rate current at reporting date.

B) Equity at the date of investment is translated at the rate for the when the investment was acquired.

C) Revenue and expense items are translated at the exchange rates current at the applicable transaction dates.

D) Monetary items included in the balance sheet are translated at the exchange rate current at the reporting date.

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

35

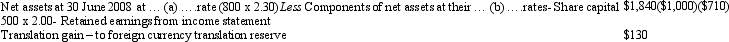

The following is an extract from the 'Notes to the Accounts' explaining the foreign currency translation reserve.  What are the rates represented by (a)and (b)?

What are the rates represented by (a)and (b)?

A) (a) Current; (b) Spot.

B) (a) Historical; (b) Current.

C) (a) Current; (b) Historical.

D) (a) Spot; (b) Current.

E) (a) Forward; (b) Historical.

What are the rates represented by (a)and (b)?

What are the rates represented by (a)and (b)?A) (a) Current; (b) Spot.

B) (a) Historical; (b) Current.

C) (a) Current; (b) Historical.

D) (a) Spot; (b) Current.

E) (a) Forward; (b) Historical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

36

If the assets of a foreign operation exceed its liabilities,and the value of the Australian dollar falls relative to the currency of the foreign operations,there will be:

A) A credit to the 'Foreign Currency Translation Reserve' in the consolidated accounts.

B) A debit to the 'Foreign Currency Translation Reserve' in the consolidated accounts.

C) A credit to 'Foreign Currency Translation Revenue in the consolidated accounts.

D) A debit to the 'Foreign Currency Translation Expense in the consolidated accounts.

E) No impact on the consolidated accounts

A) A credit to the 'Foreign Currency Translation Reserve' in the consolidated accounts.

B) A debit to the 'Foreign Currency Translation Reserve' in the consolidated accounts.

C) A credit to 'Foreign Currency Translation Revenue in the consolidated accounts.

D) A debit to the 'Foreign Currency Translation Expense in the consolidated accounts.

E) No impact on the consolidated accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

37

Distributions from retained profits are translated at

A) The 'spot rate'.

B) The rates current at the reporting date.

C) The rates current at the dates when the retained profits were created.

D) The rates current at the dates when the distributions were first proposed.

E) The rates current at the dates when the distributions were made.

A) The 'spot rate'.

B) The rates current at the reporting date.

C) The rates current at the dates when the retained profits were created.

D) The rates current at the dates when the distributions were first proposed.

E) The rates current at the dates when the distributions were made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

38

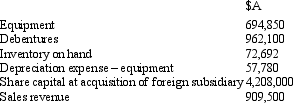

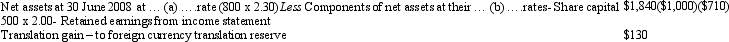

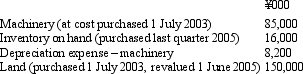

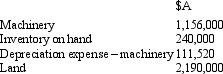

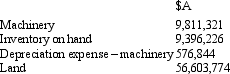

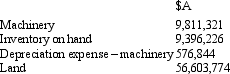

Aus Co Ltd has a foreign operation based in Japan.The following information was extracted from the foreign operation's accounts for the period ended 30 June 2005:  Exchange rate information is:

Exchange rate information is:

What is the amount at which each item would be translated (rounded to the nearest $A)?

What is the amount at which each item would be translated (rounded to the nearest $A)?

A)

B)

C)

D)

E) None of the given answers.

Exchange rate information is:

Exchange rate information is: What is the amount at which each item would be translated (rounded to the nearest $A)?

What is the amount at which each item would be translated (rounded to the nearest $A)?A)

B)

C)

D)

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

39

As prescribed in AASB 121,when re-measuring financial statements of foreign operations to functional currency,which of the following identifies all items to be re-measured at historic rates?

A) Cash, inventory and accounts receivable;

B) Payables, long-term loan and unearned revenue;

C) Inventory, goodwill, property plant and equipment;

D) Accounts receivable, accounts payable and accrued expenses;

E) None of the given answers

A) Cash, inventory and accounts receivable;

B) Payables, long-term loan and unearned revenue;

C) Inventory, goodwill, property plant and equipment;

D) Accounts receivable, accounts payable and accrued expenses;

E) None of the given answers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

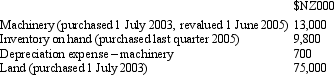

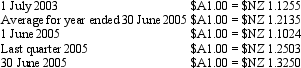

40

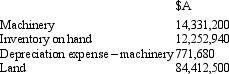

Aus Co Ltd has a foreign operation based in New Zealand.The following information was extracted from the foreign operation's accounts for the period ended 30 June 2005:  Exchange rate information is:

Exchange rate information is:

What is the amount at which each item will be translated (rounded to the nearest $A)?

What is the amount at which each item will be translated (rounded to the nearest $A)?

A)

B)

C)

D)

E) None of the given answers.

Exchange rate information is:

Exchange rate information is: What is the amount at which each item will be translated (rounded to the nearest $A)?

What is the amount at which each item will be translated (rounded to the nearest $A)?A)

B)

C)

D)

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

41

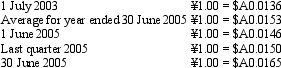

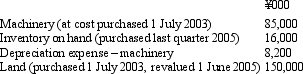

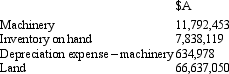

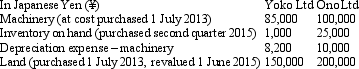

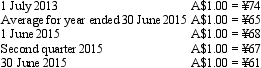

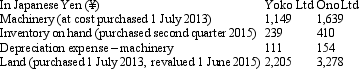

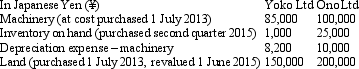

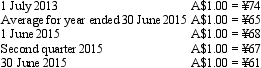

Lennon Ltd has two foreign operations based in Japan.The following information was extracted from the foreign operation's accounts for the period ended 30 June 2015:  Exchange rate information is:

Exchange rate information is:

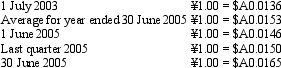

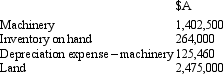

The translation from Japanese Yen to Australian dollars resulted to the following balances (rounded to the nearest ¥000):

The translation from Japanese Yen to Australian dollars resulted to the following balances (rounded to the nearest ¥000):

Which of the following translation processes were applied to Yoko Ltd and Ono Ltd,respectively,for the year ended 30 June 2015?

Which of the following translation processes were applied to Yoko Ltd and Ono Ltd,respectively,for the year ended 30 June 2015?

A) Functional currency; Presentation currency;

B) Functional currency; Functional currency;

C) Presentation currency; Functional currency;

D) Presentation currency; Presentation currency;

E) None of the given answers.

Exchange rate information is:

Exchange rate information is: The translation from Japanese Yen to Australian dollars resulted to the following balances (rounded to the nearest ¥000):

The translation from Japanese Yen to Australian dollars resulted to the following balances (rounded to the nearest ¥000): Which of the following translation processes were applied to Yoko Ltd and Ono Ltd,respectively,for the year ended 30 June 2015?

Which of the following translation processes were applied to Yoko Ltd and Ono Ltd,respectively,for the year ended 30 June 2015?A) Functional currency; Presentation currency;

B) Functional currency; Functional currency;

C) Presentation currency; Functional currency;

D) Presentation currency; Presentation currency;

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck