Deck 33: Accounting for Equity Investments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/67

العب

ملء الشاشة (f)

Deck 33: Accounting for Equity Investments

1

When an investment ceases to be an associate,the fair value of the investment at the date when it ceases to be an associate shall be regarded as its fair value on initial recognition as a financial asset in accordance with AASB 139 "Financial Instruments: Recognition and Measurement".

True

2

Where an entity holds a controlling equity interest in another entity it may choose to account for that interest using the equity method of accounting:

False

3

'Significant influence' normally stems from the investor's voting power in the investee:

True

4

Examples of marketable securities are debentures,shares,options or bonds that can be readily sold at reasonably short notice:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

5

AASB 128 defines an 'investee' as an entity in which an investor has a controlling interest:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

6

Opponents of equity accounting argue that it breaches the principle relating to 'realisation',which tends to be linked to the traditional notion of conservatism:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

7

An equity investment that is expected to be held for longer than six (6)months after reporting date is considered a non-current asset:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

8

To account for financial instruments,there are three relevant accounting standards: AASB 7; AASB 132 and AASB 139:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

9

Investments in associates held by mutual funds are within the scope of AASB 121 "Investments in Associates".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

10

Investments are commonly classified into seven different categories:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

11

In accordance with AASB 137 "Provisions,Contingent Liabilities and Contingent Assets",the investor shall disclose the contingent liabilities of its associates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

12

The treatment of an entity's equity investments in other entities depends on a number of factors,one of which is the nature of the investor's operations:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

13

The net realisable value of a listed share would be its listed price at reporting date less any brokerage fees,stamp duties or taxes payable on the sale of the security:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

14

How equity accounting is implemented is directly influenced by whether or not the investee prepares consolidated financial statements:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

15

An equity investment is deemed to exist where the investor has acquired an equity instrument,which can be defined as any contract that evidences a residual interest in the assets of an entity after deducting all its liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

16

Where an investor company holds 20 per cent or more of the voting power of an investee it is required that the investor equity account for the investment:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the investor is required to prepare consolidated financial statements,it recognises its investment in an associate by applying the equity method of accounting in its consolidated financial statements,and by applying the cost method in its separate financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

18

One reason for holding equity investments in the form of marketable securities is that they generally earn a higher return than cash on deposit at a bank:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

19

If an associate uses accounting policies other than those of the investor for like transactions and events in similar circumstances,adjustments shall be made to conform the investor's accounting policies to those of the associate's financial statements before applying the equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

20

An associate is an investee over which the investor has control:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

21

Where an investor has significant influence over an investee and is not a parent entity itself,AASB 128 requires that the equity accounted investment be:

A) Reported as a note disclosure in the investor entity's own legal books.

B) Presented as part of group accounts prepared for the purpose of reporting the impact of associated companies on the financial performance and position of the investor entity.

C) Included in the financial statements of the investor entity itself.

D) Provided as an additional statement separately from the legal entity's own accounts and identified as a report of the impact of associate entities and not as group accounts.

E) None of the given answers.

A) Reported as a note disclosure in the investor entity's own legal books.

B) Presented as part of group accounts prepared for the purpose of reporting the impact of associated companies on the financial performance and position of the investor entity.

C) Included in the financial statements of the investor entity itself.

D) Provided as an additional statement separately from the legal entity's own accounts and identified as a report of the impact of associate entities and not as group accounts.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

22

Examples of bonds include:

A) Debentures.

B) Options.

C) Preference shares.

D) Accounts payable.

E) All of the given answers.

A) Debentures.

B) Options.

C) Preference shares.

D) Accounts payable.

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

23

Key difference(s)between the cost method and the equity method of accounting for investments include that under the equity methoD.

A) The investment is not initially recorded at cost in the investor's accounts.

B) Dividends from pre-acquisition profits are treated as revenue in the investor's accounts.

C) The investment is retained at cost in the consolidated accounts.

D) Changes in the fair value of the investment are recognised and deferred to an asset revaluation reserve.

E) None of the given answers.

A) The investment is not initially recorded at cost in the investor's accounts.

B) Dividends from pre-acquisition profits are treated as revenue in the investor's accounts.

C) The investment is retained at cost in the consolidated accounts.

D) Changes in the fair value of the investment are recognised and deferred to an asset revaluation reserve.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

24

An equity instrument is defined as:

A) An agreement to exchange rights in an entity at an agreed price by a willing buyer and a willing seller in an arm's length transaction.

B) An arrangement in writing to transfer the risks and rights of ownership to the holder of the script in exchange for consideration in the form of payment in cash or kind.

C) Any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities.

D) An arrangement to ultimately settle in cash or by transferring a right to another financial asset to the holder within a specified time and at a specified value.

E) None of the given answers.

A) An agreement to exchange rights in an entity at an agreed price by a willing buyer and a willing seller in an arm's length transaction.

B) An arrangement in writing to transfer the risks and rights of ownership to the holder of the script in exchange for consideration in the form of payment in cash or kind.

C) Any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities.

D) An arrangement to ultimately settle in cash or by transferring a right to another financial asset to the holder within a specified time and at a specified value.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

25

AASB 128 specifically addresses the accounting for the elimination of intragroup transaction between two different associates of an investor:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

26

AASB 128 requires that where an investor company does significantly influence an investee:

A) The investee company must revalue its assets to fair value and disclose all related party transactions.

B) The investor company must mark the shares to market.

C) The investee company must provide the investor company with details regarding profits made on inter-company transactions so that they may be eliminated from the group accounts.

D) The investor company must adopt the equity method of accounting for the investment.

E) None of the given answers.

A) The investee company must revalue its assets to fair value and disclose all related party transactions.

B) The investor company must mark the shares to market.

C) The investee company must provide the investor company with details regarding profits made on inter-company transactions so that they may be eliminated from the group accounts.

D) The investor company must adopt the equity method of accounting for the investment.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

27

Factors that should be considered in determining the existence of significant influence include:

A) The economic dependency of the investor in the investee.

B) The investor's participation in decisions about the distribution or retention of the investee's profits.

C) The ability of the investor to gain technical information from the investee.

D) The representation of the investee on the board of directors of the investor.

E) None of the given answers.

A) The economic dependency of the investor in the investee.

B) The investor's participation in decisions about the distribution or retention of the investee's profits.

C) The ability of the investor to gain technical information from the investee.

D) The representation of the investee on the board of directors of the investor.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

28

Equity accounting is argued to provide:

A) A more accurate measure of value of the associate than the market value of the shares.

B) An easier to understand measure of value than the lower of cost and net realisable value method.

C) A better reflection of the performance and value of the associate company than the cost method.

D) A theoretically consistent approach that is in line with the conceptual framework.

E) None of the given answers.

A) A more accurate measure of value of the associate than the market value of the shares.

B) An easier to understand measure of value than the lower of cost and net realisable value method.

C) A better reflection of the performance and value of the associate company than the cost method.

D) A theoretically consistent approach that is in line with the conceptual framework.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

29

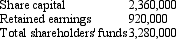

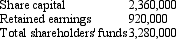

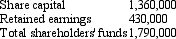

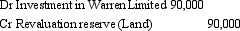

Hip Hop Ltd acquired a 30 per cent interest in Rock Ltd on 1 July 2004 for a cash consideration of $984,000.Rock Ltd's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows:  Additional information relating to the period ended 30 June 2006:

Additional information relating to the period ended 30 June 2006:

The opening balance of Rock's retained earnings was $1,100,000.Rock Ltd had paid a dividend out of pre-acquisition profits of $80,000 during the 2003/2004 period.

Rock Ltd had an after-tax profit of $260,000 for the 2004/2005 period.

Rock Ltd declared an $80,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Hip Hop Ltd accrues the dividends of associates as revenue when they are proposed.What is the amount of the investment in Rock Ltd and the income that will be recorded in the books of Hip Hop Ltd as at 30 June 2006 under (i)the cost method and (ii)the equity method?

A) (i) Investment: $960,000; IncomE. $24,000 (ii) Investment: $1,092,000; IncomE. $78,000

B) (i) Investment: $960,000; IncomE. $24,000 (ii) Investment: $1,068,000; IncomE. $78,000

C) (i) Investment: $984,000; IncomE. $0 (ii) Investment: $1,068,000; IncomE. $24,000

D) (i) Investment: $936,000; IncomE. $48,000 (ii) Investment: $1,014,000; IncomE. $78,000

E) None of the given answers.

Additional information relating to the period ended 30 June 2006:

Additional information relating to the period ended 30 June 2006:The opening balance of Rock's retained earnings was $1,100,000.Rock Ltd had paid a dividend out of pre-acquisition profits of $80,000 during the 2003/2004 period.

Rock Ltd had an after-tax profit of $260,000 for the 2004/2005 period.

Rock Ltd declared an $80,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Hip Hop Ltd accrues the dividends of associates as revenue when they are proposed.What is the amount of the investment in Rock Ltd and the income that will be recorded in the books of Hip Hop Ltd as at 30 June 2006 under (i)the cost method and (ii)the equity method?

A) (i) Investment: $960,000; IncomE. $24,000 (ii) Investment: $1,092,000; IncomE. $78,000

B) (i) Investment: $960,000; IncomE. $24,000 (ii) Investment: $1,068,000; IncomE. $78,000

C) (i) Investment: $984,000; IncomE. $0 (ii) Investment: $1,068,000; IncomE. $24,000

D) (i) Investment: $936,000; IncomE. $48,000 (ii) Investment: $1,014,000; IncomE. $78,000

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

30

Under the equity method of accounting,the amount recorded in the consolidated accounts as the investment in an associate is:

A) A market valuation.

B) A cost measure.

C) A present value calculation.

D) An independent valuation.

E) None of the given answers.

A) A market valuation.

B) A cost measure.

C) A present value calculation.

D) An independent valuation.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

31

The treatment of equity investments depends on a number of factors,including:

A) The date of purchase.

B) Whether the investee entity is in the life or general insurance industry.

C) Whether or not the investor has significant influence over the investee.

D) Whether the investee entity is in the life or general insurance industry and whether or not the investor has significant influence over the investee.

E) All of the given answers.

A) The date of purchase.

B) Whether the investee entity is in the life or general insurance industry.

C) Whether or not the investor has significant influence over the investee.

D) Whether the investee entity is in the life or general insurance industry and whether or not the investor has significant influence over the investee.

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

32

Businesses invest in the marketable securities of other entities for the short-term because:

A) Using cash to purchase marketable securities improves the current ratio, loosening debt covenant restrictions.

B) It is an effective way to manage cash surpluses so that the investment may be turned into cash at short notice.

C) A diversified portfolio of marketable securities is less risky than having cash on deposit.

D) Using cash to purchase marketable securities improves the current ratio, loosening debt covenant restrictions and it is an effective way to manage cash surpluses so that the investment may be turned into cash at short notice.

E) All of the given answers.

A) Using cash to purchase marketable securities improves the current ratio, loosening debt covenant restrictions.

B) It is an effective way to manage cash surpluses so that the investment may be turned into cash at short notice.

C) A diversified portfolio of marketable securities is less risky than having cash on deposit.

D) Using cash to purchase marketable securities improves the current ratio, loosening debt covenant restrictions and it is an effective way to manage cash surpluses so that the investment may be turned into cash at short notice.

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following are categories that are commonly used to classify investments?

A) Equity investments and property investments.

B) Electronic investments and bonds.

C) International investments and cash investments.

D) Electronic investments and bonds and international investments and cash investments.

E) None of the given answers.

A) Equity investments and property investments.

B) Electronic investments and bonds.

C) International investments and cash investments.

D) Electronic investments and bonds and international investments and cash investments.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

34

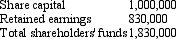

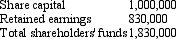

Dixie Ltd acquired a 20 per cent interest in Jazz Ltd on 1 July 2003 for a cash consideration of $366,000.It has a sufficient balance of voting rights in Jazz Ltd to give it significant influence in its operating and financing decisions.Jazz's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows:  During the period ended 30 June 2004 the following events occurreD.

During the period ended 30 June 2004 the following events occurreD.

Jazz had an after-tax profit of $348,000.

Jazz proposed a dividend out of pre-acquisition profits of $25,000.

Later in the period Jazz paid the $25,000 dividend and declared a further $25,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Dixie Ltd accrues the dividends of associates as revenue when they are proposed.What is the amount of the investment in Jazz Ltd and income that will be recorded in the books of Dixie Ltd as at 30 June 2004 under (i)the cost method and (ii)the equity method?

A) (i) Investment in Jazz LtD. $366,000; IncomE. $5,000 (ii) Investment in Jazz LtD. $385,600; IncomE. $69,600

B) (i) Investment in Jazz LtD. $366,000; IncomE. $10,000 (ii) Investment in Jazz LtD. $306,400; IncomE. $10,000

C) (i) Investment in Jazz LtD. $366,000; IncomE. $10,000 (ii) Investment in Jazz LtD. $435,600; IncomE. $79,600

D) (i) Investment in Jazz LtD. $361,000; IncomE. $5,000 (ii) Investment in Jazz LtD. $425,600; IncomE. $69,600

E) None of the given answers.

During the period ended 30 June 2004 the following events occurreD.

During the period ended 30 June 2004 the following events occurreD.Jazz had an after-tax profit of $348,000.

Jazz proposed a dividend out of pre-acquisition profits of $25,000.

Later in the period Jazz paid the $25,000 dividend and declared a further $25,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Dixie Ltd accrues the dividends of associates as revenue when they are proposed.What is the amount of the investment in Jazz Ltd and income that will be recorded in the books of Dixie Ltd as at 30 June 2004 under (i)the cost method and (ii)the equity method?

A) (i) Investment in Jazz LtD. $366,000; IncomE. $5,000 (ii) Investment in Jazz LtD. $385,600; IncomE. $69,600

B) (i) Investment in Jazz LtD. $366,000; IncomE. $10,000 (ii) Investment in Jazz LtD. $306,400; IncomE. $10,000

C) (i) Investment in Jazz LtD. $366,000; IncomE. $10,000 (ii) Investment in Jazz LtD. $435,600; IncomE. $79,600

D) (i) Investment in Jazz LtD. $361,000; IncomE. $5,000 (ii) Investment in Jazz LtD. $425,600; IncomE. $69,600

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

35

The requirements of AASB 128 relating to the equity method of accounting for investments in associates include:

A) Adjustments for impairment losses recognised by the associate.

B) The notional adjustment of the carrying amounts of the identifiable assets, liabilities and contingent liabilities of the associate to fair value.

C) The calculation of a notional goodwill or excess on acquisition that is not required to be separately disclosed.

D) The revision of depreciation expense based on the notional fair value of the identifiable assets at the time of acquisition.

E) All of the given answers.

A) Adjustments for impairment losses recognised by the associate.

B) The notional adjustment of the carrying amounts of the identifiable assets, liabilities and contingent liabilities of the associate to fair value.

C) The calculation of a notional goodwill or excess on acquisition that is not required to be separately disclosed.

D) The revision of depreciation expense based on the notional fair value of the identifiable assets at the time of acquisition.

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

36

Significant influence is defined in AASB 128 as:

A) The demonstrated ability of an entity to impact substantially both the financial and operating policies of another entity.

B) The power of an entity to participate in the financial and operating policies of the investee, but it is not control or joint control.

C) The demonstrated ability of an entity to affect substantially or control either the financial or operating policies of another entity.

D) The capacity or demonstrated ability of an entity to impact substantially or control the operations of another entity.

E) None of the given answers.

A) The demonstrated ability of an entity to impact substantially both the financial and operating policies of another entity.

B) The power of an entity to participate in the financial and operating policies of the investee, but it is not control or joint control.

C) The demonstrated ability of an entity to affect substantially or control either the financial or operating policies of another entity.

D) The capacity or demonstrated ability of an entity to impact substantially or control the operations of another entity.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

37

Under the cost method of accounting for equity investments the investment is initially recognised at its cost of acquisition anD.

A) Profits earned and dividends declared are treated as an adjustment to the amount invested.

B) Gains and losses on holding the shares are recognised at each reporting date.

C) Dividends declared from pre-acquisition profits are deducted from the carrying amount of the investment.

D) Revalued to net realisable value at the determination of the directors.

E) None of the given answers.

A) Profits earned and dividends declared are treated as an adjustment to the amount invested.

B) Gains and losses on holding the shares are recognised at each reporting date.

C) Dividends declared from pre-acquisition profits are deducted from the carrying amount of the investment.

D) Revalued to net realisable value at the determination of the directors.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

38

In the case of non-current investments in equity instruments,one factor to consider in deciding the appropriate accounting treatment is the level of influence the investor can exert over the investee.These levels include:

A) The power to govern decision-making in relation to the financial and operating policies of the investee.

B) The power to participate in the investee's financial and operating policies.

C) A minimal ability to influence the investee's financial and operating policies.

D) The power to govern decision-making in relation to the financial and operating policies of the investee and the power to participate in the investee's financial and operating policies.

E) All of the given answers.

A) The power to govern decision-making in relation to the financial and operating policies of the investee.

B) The power to participate in the investee's financial and operating policies.

C) A minimal ability to influence the investee's financial and operating policies.

D) The power to govern decision-making in relation to the financial and operating policies of the investee and the power to participate in the investee's financial and operating policies.

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

39

Equity investments include:

A) Unsecured notes.

B) Trust units.

C) Shares in corporations.

D) Trust units and shares in corporations.

E) All of the given answers.

A) Unsecured notes.

B) Trust units.

C) Shares in corporations.

D) Trust units and shares in corporations.

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

40

Firms may make long-term investments in the equity instruments of other entities because:

A) It may ultimately form the basis for a takeover bid.

B) Holding a diversified portfolio of shares can reduce the level of risk of the entity.

C) The investment is expected to yield a return in the form of capital gains and dividends.

D) A significant holding may allow the investor company to have a representative on the board of directors of the investee and therefore to influence the decisions of that entity.

E) All of the given answers.

A) It may ultimately form the basis for a takeover bid.

B) Holding a diversified portfolio of shares can reduce the level of risk of the entity.

C) The investment is expected to yield a return in the form of capital gains and dividends.

D) A significant holding may allow the investor company to have a representative on the board of directors of the investee and therefore to influence the decisions of that entity.

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

41

AASB 132 includes in its definition of financial assets,an asset that is:

A) a contractual right to pay cash or another financial asset to another entity.

B) an equity instrument of another entity.

C) cash.

D) All of the given answers.

E) an equity instrument of another entity and cash.

A) a contractual right to pay cash or another financial asset to another entity.

B) an equity instrument of another entity.

C) cash.

D) All of the given answers.

E) an equity instrument of another entity and cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

42

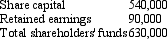

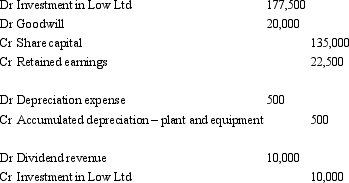

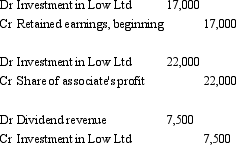

Jay Ltd acquired a 25 per cent interest in Low Ltd on 1 July 2003 for a cash consideration of $177,500.Low Ltd's equity at the time of purchase was as follows:  Additional information:

Additional information:

On 1 July 2003 Low's plant and equipment had a carrying value of $120,000 but a fair value of $140,000.The remaining expected useful life of the plant and equipment at this date was 10 years.Low did not revalue the plant and equipment in its books.

For the period ending 30 June 2004 Low Ltd recorded an after-tax profit of $70,000 out of which dividends of $30,000 were proposed in the 2003/2004 period and paid in the 2004/2005 period.

For the year ended 30 June 2005 Low Ltd had an after-tax profit of $90,000 out of which it provided for a dividend of $40,000,which has not been paid.

Jay Ltd does not accrue the dividends of associates as revenue when they are proposed.The investment has been recorded in Jay's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

Additional information:

Additional information:On 1 July 2003 Low's plant and equipment had a carrying value of $120,000 but a fair value of $140,000.The remaining expected useful life of the plant and equipment at this date was 10 years.Low did not revalue the plant and equipment in its books.

For the period ending 30 June 2004 Low Ltd recorded an after-tax profit of $70,000 out of which dividends of $30,000 were proposed in the 2003/2004 period and paid in the 2004/2005 period.

For the year ended 30 June 2005 Low Ltd had an after-tax profit of $90,000 out of which it provided for a dividend of $40,000,which has not been paid.

Jay Ltd does not accrue the dividends of associates as revenue when they are proposed.The investment has been recorded in Jay's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

43

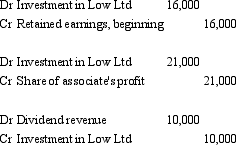

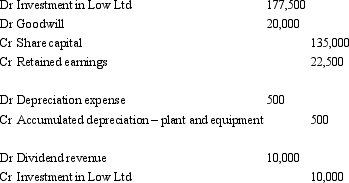

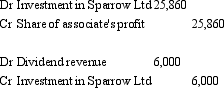

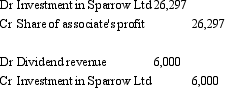

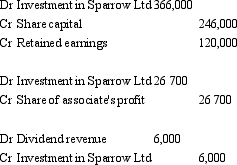

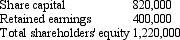

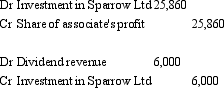

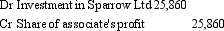

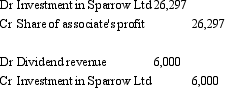

Eagle Ltd is the ultimate parent entity in a group of companies.On 1 July 2003 Eagle Ltd acquired 30 per cent of the issued capital of Sparrow Ltd for a cash consideration of $366,000.At the date of acquisition the net assets of Sparrow Ltd are recorded at fair value and are represented by equity as follows:  Additional information:

Additional information:

During the financial year ending 30 June 2004 Sparrow Ltd makes a profit before tax of $140,000,and an after-tax profit of $89,000.

Sparrow Ltd proposed a dividend of $20,000 for the 2003/2004 period that will be paid early in the next period.

Eagle Ltd does not recognise dividends proposed by associates until they are paid.

During the year ended 30 June 2004 Sparrow made intragroup sales to members of Eagle's economic group.These include:

Sparrow sold inventory to Peregrin Ltd,an 80 per cent owned subsidiary of Eagle Ltd.The inventory cost Sparrow $8,000 and was sold to Peregrin for $12,000.Half of that inventory is still on hand in Peregrin at the end of the period.

Sparrow sold inventory to Seagull Ltd,a 25 per cent owned associate of Eagle's.The inventory cost Sparrow $10,000 and was sold to Seagull for $15,000.Forty per cent of this inventory is still on hand in Seagull at the end of the period.

The tax rate is 30 per cent.

What consolidated journal entry/ies is/are required to equity account for Eagle's interest in Sparrow Ltd for the period ended 30 June 2004?

A)

B)

C)

D)

E) None of the given answers.

Additional information:

Additional information:During the financial year ending 30 June 2004 Sparrow Ltd makes a profit before tax of $140,000,and an after-tax profit of $89,000.

Sparrow Ltd proposed a dividend of $20,000 for the 2003/2004 period that will be paid early in the next period.

Eagle Ltd does not recognise dividends proposed by associates until they are paid.

During the year ended 30 June 2004 Sparrow made intragroup sales to members of Eagle's economic group.These include:

Sparrow sold inventory to Peregrin Ltd,an 80 per cent owned subsidiary of Eagle Ltd.The inventory cost Sparrow $8,000 and was sold to Peregrin for $12,000.Half of that inventory is still on hand in Peregrin at the end of the period.

Sparrow sold inventory to Seagull Ltd,a 25 per cent owned associate of Eagle's.The inventory cost Sparrow $10,000 and was sold to Seagull for $15,000.Forty per cent of this inventory is still on hand in Seagull at the end of the period.

The tax rate is 30 per cent.

What consolidated journal entry/ies is/are required to equity account for Eagle's interest in Sparrow Ltd for the period ended 30 June 2004?

A)

B)

C)

D)

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

44

When equity accounting is applied,how is the account balance of the investment in the associate measured?

A) At cost.

B) At fair value.

C) At cost initially, and thereafter at fir value.

D) At cost plus adjustments for post-acquisition movements of profits and reserves.

E) At fair value plus adjustments for post-acquisition movements of profits and reserves.

A) At cost.

B) At fair value.

C) At cost initially, and thereafter at fir value.

D) At cost plus adjustments for post-acquisition movements of profits and reserves.

E) At fair value plus adjustments for post-acquisition movements of profits and reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

45

Derivative instruments are instruments that:

A) derive their value from stock exchanges and futures markets.

B) derive their value from some other underlying expenditure.

C) derive their value from some other underlying derivative.

D) derive their value from some other underlying assets.

E) None of the given answers.

A) derive their value from stock exchanges and futures markets.

B) derive their value from some other underlying expenditure.

C) derive their value from some other underlying derivative.

D) derive their value from some other underlying assets.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

46

Quartermain Limited has the following investments: Christian Limited - a 100 per cent owned subsidiary

Hudson Limited - a 75 per cent owned subsidiary

Lane Limited - a 40 per cent owned associate

Daicos Limited - a 25 per cent owned associate

Lane Limited sells inventory,which cost Lane Limited $40,000 to acquire,to Christian Limited,at a mark up of 50 per cent.25 per cent of the inventory remains on hand at the end of the period.What is the amount to be eliminated in the consolidated accounts of Quartermain Group Limited?

A) $4,000.

B) $2,500.

C) $2,000.

D) $5,000.

E) $10,000.

Hudson Limited - a 75 per cent owned subsidiary

Lane Limited - a 40 per cent owned associate

Daicos Limited - a 25 per cent owned associate

Lane Limited sells inventory,which cost Lane Limited $40,000 to acquire,to Christian Limited,at a mark up of 50 per cent.25 per cent of the inventory remains on hand at the end of the period.What is the amount to be eliminated in the consolidated accounts of Quartermain Group Limited?

A) $4,000.

B) $2,500.

C) $2,000.

D) $5,000.

E) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

47

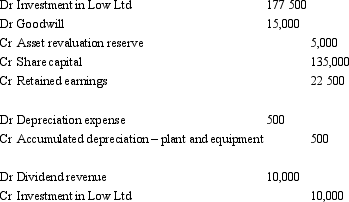

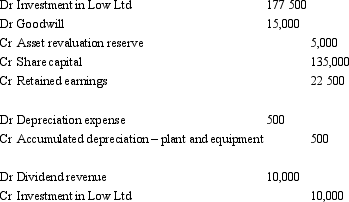

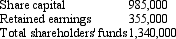

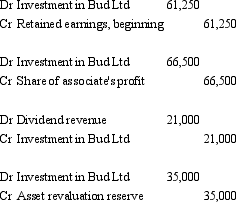

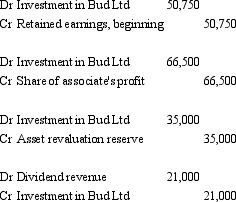

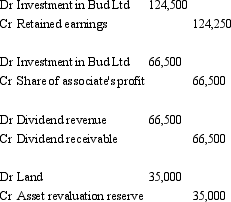

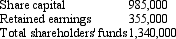

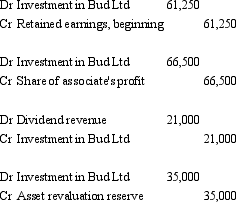

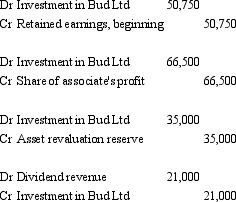

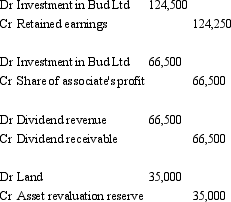

Flower Ltd acquired a 35 per cent interest in Bud Ltd on 1 July 2003 for a cash consideration of $469,000.Bud Ltd's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows:  Additional information relating to the period ended 30 June 2005:

Additional information relating to the period ended 30 June 2005:

The opening balance of Bud's retained earnings was $500,000.Bud Ltd had paid a dividend out of pre-acquisition profits of $30,000 during the 2003/2004 period.

Bud Ltd had an after-tax profit of $190,000 for the 2004/2005 period.

Bud Ltd revalued land during the period,creating an asset revaluation reserve of $100,000.

Bud Ltd declared a $60,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Flower Ltd accrues the dividends of associates as revenue when they are proposed.The investment has been recorded in Flower's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

Additional information relating to the period ended 30 June 2005:

Additional information relating to the period ended 30 June 2005:The opening balance of Bud's retained earnings was $500,000.Bud Ltd had paid a dividend out of pre-acquisition profits of $30,000 during the 2003/2004 period.

Bud Ltd had an after-tax profit of $190,000 for the 2004/2005 period.

Bud Ltd revalued land during the period,creating an asset revaluation reserve of $100,000.

Bud Ltd declared a $60,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Flower Ltd accrues the dividends of associates as revenue when they are proposed.The investment has been recorded in Flower's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

48

AASB 128 notes that in the absence of evidence to the contrary,significant influence would normally exist where an investor holds:

A) directly 20 per cent or more of the shares of another entity.

B) directly 20 per cent or less of the voting power of another entity.

C) directly 20 per cent or more of the total equity and debt on issue of another entity.

D) directly, or indirectly, 20 per cent or more of the shares of another entity.

E) None of the given answers.

A) directly 20 per cent or more of the shares of another entity.

B) directly 20 per cent or less of the voting power of another entity.

C) directly 20 per cent or more of the total equity and debt on issue of another entity.

D) directly, or indirectly, 20 per cent or more of the shares of another entity.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

49

In applying equity accounting,dividends received from an investee:

A) are treated as income.

B) are capitalised and amortised over the period in which the investment is held by the investor.

C) reduce the carrying amount of the investment.

D) increase the carrying amount of the investment.

E) are passed to the 'retained earnings' of the investor.

A) are treated as income.

B) are capitalised and amortised over the period in which the investment is held by the investor.

C) reduce the carrying amount of the investment.

D) increase the carrying amount of the investment.

E) are passed to the 'retained earnings' of the investor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

50

AASB 128 requires that the investor's share of the post-acquisition profit or loss of its associates be adjusted for certain intragroup transactions including:

A) The associate's transactions with its own associates.

B) Any transactions between the associate and a controlled entity of the investor.

C) Any transactions between the associate and any other associates of the investor.

D) Any transactions between the associate and a controlled entity of the investor and any transactions between the associate and any other associates of the investor

E) All of the given answers.

A) The associate's transactions with its own associates.

B) Any transactions between the associate and a controlled entity of the investor.

C) Any transactions between the associate and any other associates of the investor.

D) Any transactions between the associate and a controlled entity of the investor and any transactions between the associate and any other associates of the investor

E) All of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

51

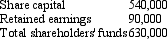

Bee Ltd acquired a 40 per cent interest in Bop Ltd on 1 July 2004 for a cash consideration of $772,000.Bop Ltd's equity at the time of purchase was as follows:  Additional information:

Additional information:

On 1 July 2004 Bop's plant and equipment had a carrying value of $600,000 but a fair value of $650,000.The carrying value of land was $560,000 while the fair value was $600,000.The remaining expected useful life of the plant and equipment at 1 July 2004 was 8 years.Bop did not revalue either asset in its books.

For the period ending 30 June 2004 Bop Ltd recorded an after-tax profit of $470,000 out of which dividends of $60,000 were proposed in the 2004/2005 period and paid in the 2005/2006 period.

For the year ended 30 June 2006 Bop Ltd had an after-tax loss of $60,000.Bop Ltd proposed a dividend of $120,000,which has not been paid this period.

Also during the year ended 30 June 2006,Bop Ltd revalued the land to $610,000.

Bee Ltd accrues dividends of associates as revenue when they are proposed.The investment has been recorded in Bee Ltd's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2006?

A)

B)

C)

D)

E) None of the given answers.

Additional information:

Additional information:On 1 July 2004 Bop's plant and equipment had a carrying value of $600,000 but a fair value of $650,000.The carrying value of land was $560,000 while the fair value was $600,000.The remaining expected useful life of the plant and equipment at 1 July 2004 was 8 years.Bop did not revalue either asset in its books.

For the period ending 30 June 2004 Bop Ltd recorded an after-tax profit of $470,000 out of which dividends of $60,000 were proposed in the 2004/2005 period and paid in the 2005/2006 period.

For the year ended 30 June 2006 Bop Ltd had an after-tax loss of $60,000.Bop Ltd proposed a dividend of $120,000,which has not been paid this period.

Also during the year ended 30 June 2006,Bop Ltd revalued the land to $610,000.

Bee Ltd accrues dividends of associates as revenue when they are proposed.The investment has been recorded in Bee Ltd's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2006?

A)

B)

C)

D)

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

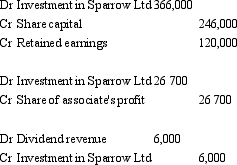

k this deck

52

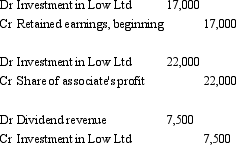

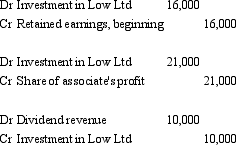

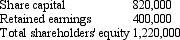

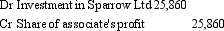

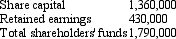

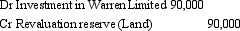

Two years after Voss Limited acquired a 30 per cent holding in its associate Warren Limited,the following journal entry appeared in the consolidated accounts of Voss Limited at the end of 20X7/20X8.  Which of the following statements are correct?

Which of the following statements are correct?

A) Voss Limited is a parent entity.

B) Warren Limited revalued its Land upwards by $90,000 in 20X7-20X8.

C) This entry will be passed only in this current year if there are no future revaluations made by Warren Limited.

D) Voss Limited is a parent entity and Warren Limited revalued its Land upwards by $90,000 in 20X7-20X8.

E) Voss Limited is a parent entity and this entry will be passed only in this current year if there are no future revaluations made by Warren Limited.

Which of the following statements are correct?

Which of the following statements are correct?A) Voss Limited is a parent entity.

B) Warren Limited revalued its Land upwards by $90,000 in 20X7-20X8.

C) This entry will be passed only in this current year if there are no future revaluations made by Warren Limited.

D) Voss Limited is a parent entity and Warren Limited revalued its Land upwards by $90,000 in 20X7-20X8.

E) Voss Limited is a parent entity and this entry will be passed only in this current year if there are no future revaluations made by Warren Limited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is(are)not a financial instrument(s)according to AASB 139?

A) Financial assets at fair value through profit and loss.

B) Financial liabilities at fair value through profit and loss.

C) Available-for-sale financial assets.

D) Available-for-sale financial liabilities.

E) Held-to-maturity investments.

A) Financial assets at fair value through profit and loss.

B) Financial liabilities at fair value through profit and loss.

C) Available-for-sale financial assets.

D) Available-for-sale financial liabilities.

E) Held-to-maturity investments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

54

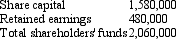

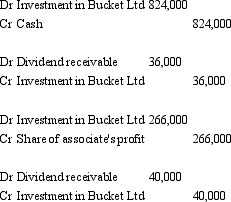

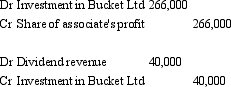

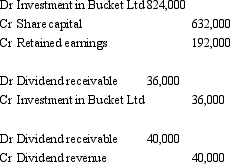

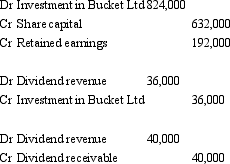

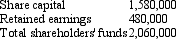

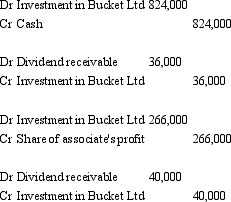

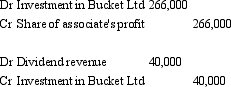

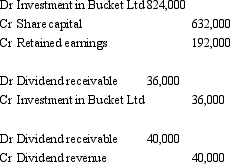

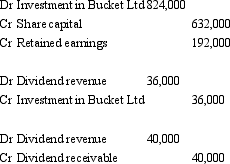

Mop Ltd acquired a 40 per cent interest in Bucket Ltd on 1 July 2004 for a cash consideration of $824,000.Bucket Ltd's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows:  Additional information relating to the period ended 30 June 2005:

Additional information relating to the period ended 30 June 2005:

Bucket Ltd had an after-tax profit of $665,000.

Bucket Ltd proposed a dividend out of pre-acquisition profits of $90,000.

Later in the period Bucket Ltd paid the $90,000 dividend and declared a further $100,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Mop Ltd accrues the dividends of associates as revenue when they are proposed.The investment has been recorded in Mop's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

Additional information relating to the period ended 30 June 2005:

Additional information relating to the period ended 30 June 2005:Bucket Ltd had an after-tax profit of $665,000.

Bucket Ltd proposed a dividend out of pre-acquisition profits of $90,000.

Later in the period Bucket Ltd paid the $90,000 dividend and declared a further $100,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Mop Ltd accrues the dividends of associates as revenue when they are proposed.The investment has been recorded in Mop's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

55

Quartermain Limited has the following investments: Christian Limited - a 100 per cent owned subsidiary

Hudson Limited - a 75 per cent owned subsidiary

Lane Limited - a 40 per cent owned associate

Daicos Limited - a 25 per cent owned associate

Lane Limited sells inventory,which cost Lane Limited $50,000 to acquire,to Daicos Limited,at a mark up of 40 per cent.Three-quarters of the inventory was sold by the end of the period.What is the amount to be eliminated in the consolidated accounts of Quartermain Group Limited?

A) $500.

B) $1,500.

C) $2,000.

D) $2,500.

E) $5,000.

Hudson Limited - a 75 per cent owned subsidiary

Lane Limited - a 40 per cent owned associate

Daicos Limited - a 25 per cent owned associate

Lane Limited sells inventory,which cost Lane Limited $50,000 to acquire,to Daicos Limited,at a mark up of 40 per cent.Three-quarters of the inventory was sold by the end of the period.What is the amount to be eliminated in the consolidated accounts of Quartermain Group Limited?

A) $500.

B) $1,500.

C) $2,000.

D) $2,500.

E) $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is not a factor that should be considered in determining the existence of significant influence?

A) The similarity of the industry within which the investee operates to that in which the investor operates.

B) The interchange of managerial personnel.

C) Representation on the governing body of the investee.

D) provision of essential technical advice.

E) Material transactions between the investor and the investee.

A) The similarity of the industry within which the investee operates to that in which the investor operates.

B) The interchange of managerial personnel.

C) Representation on the governing body of the investee.

D) provision of essential technical advice.

E) Material transactions between the investor and the investee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

57

Investments are commonly classified into the following four categories:

A) Government securities; Bonds; Debentures; Compound instruments.

B) Property investments; Cash investments; Equity investments; Bonds.

C) Government securities; Bonds; Cash investments; Equity investments.

D) Property investments; Cash investments; Debentures; Compound instruments.

E) Treasury notes; Treasury bonds; Treasury bills; Promissory notes.

A) Government securities; Bonds; Debentures; Compound instruments.

B) Property investments; Cash investments; Equity investments; Bonds.

C) Government securities; Bonds; Cash investments; Equity investments.

D) Property investments; Cash investments; Debentures; Compound instruments.

E) Treasury notes; Treasury bonds; Treasury bills; Promissory notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

58

In determining the existence of 'significant influence',and considering voting power,consideration must be given to:

A) the voting power directly related to the voting rights attaching to the equity interests.

B) the distribution of the balance of the voting power.

C) excluding voting power that applies only in contingent circumstances.

D) the voting power directly related to the voting rights attaching to the equity interests and excluding voting power that applies only in contingent circumstances.

E) the voting power directly related to the voting rights attaching to the equity interests; the distribution of the balance of the voting power; and excluding voting power that applies only in contingent circumstances.

A) the voting power directly related to the voting rights attaching to the equity interests.

B) the distribution of the balance of the voting power.

C) excluding voting power that applies only in contingent circumstances.

D) the voting power directly related to the voting rights attaching to the equity interests and excluding voting power that applies only in contingent circumstances.

E) the voting power directly related to the voting rights attaching to the equity interests; the distribution of the balance of the voting power; and excluding voting power that applies only in contingent circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

59

Quartermain Limited has the following investments: Christian Limited - a 100 per cent owned subsidiary

Hudson Limited - a 75 per cent owned subsidiary

Lane Limited - a 40 per cent owned associate

Daicos Limited - a 25 per cent owned associate

Lane Limited sells inventory,which cost Lane Limited $80,000 to acquire,to Hudson Limited,at a mark up of 25 per cent.A quarter of the inventory remains on hand at the end of the period.What is the amount to be eliminated in the consolidated accounts of Quartermain Group Limited?

A) $4,000.

B) $2,500.

C) $2,000.

D) $5,000.

E) $10,000.

Hudson Limited - a 75 per cent owned subsidiary

Lane Limited - a 40 per cent owned associate

Daicos Limited - a 25 per cent owned associate

Lane Limited sells inventory,which cost Lane Limited $80,000 to acquire,to Hudson Limited,at a mark up of 25 per cent.A quarter of the inventory remains on hand at the end of the period.What is the amount to be eliminated in the consolidated accounts of Quartermain Group Limited?

A) $4,000.

B) $2,500.

C) $2,000.

D) $5,000.

E) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

60

According to AASB 139,an equity investment:

A) must be measured at cost, less any impairment losses.

B) must be measured at fair value through profit and loss.

C) must not be measured at fair value through profit and loss if it does not have a quoted market price.

D) must not be measured at cost if it is deemed to be a financial asset.

E) None of the given answers.

A) must be measured at cost, less any impairment losses.

B) must be measured at fair value through profit and loss.

C) must not be measured at fair value through profit and loss if it does not have a quoted market price.

D) must not be measured at cost if it is deemed to be a financial asset.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

61

On acquisition of the investment in associate,any excess between the cost of the investment and the investor's share of the net fair value of the associate's identifiable assets and liabilities is accounted for as:

A) goodwill relating to an associate and amortised over the period of economic benefits.

B) goodwill relating to an associate included in the carrying amount of the investment and amortisation is not permitted.

C) income in the determination of the investor's share of the associate's profit or loss in the period in which the investment is acquired.

D) expense in the determination of the investor's share of the associate's profit or loss in the period in which the investment is acquired.

E) None of the given answers.

A) goodwill relating to an associate and amortised over the period of economic benefits.

B) goodwill relating to an associate included in the carrying amount of the investment and amortisation is not permitted.

C) income in the determination of the investor's share of the associate's profit or loss in the period in which the investment is acquired.

D) expense in the determination of the investor's share of the associate's profit or loss in the period in which the investment is acquired.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements is not in accordance with AASB 121 "Investments in Associates"?

A) The equity method of accounting is discontinued when the effect of equity accounting losses or revaluation decrements causes the carrying amount of the investment to fall below zero.

B) Profits and losses resulting from upstream and downstream transactions between an investor and an associate are recognised in the investor's financial reports only to the extent of unrelated investors' interests in the associate.

C) On acquisition of the investment, any difference between the cost of the investment and the investor's share of the net fair value of the associate's identifiable assets and liabilities is included in the determination of the investor's share of the associate's profit or loss.

D) After application of the equity method, it is still necessary to recognise any impairment loss with respect to the investor's net investment in the associate as required in AASB 139 "Financial Instruments: Recognition and Measurement".

E) None of the given answers.

A) The equity method of accounting is discontinued when the effect of equity accounting losses or revaluation decrements causes the carrying amount of the investment to fall below zero.

B) Profits and losses resulting from upstream and downstream transactions between an investor and an associate are recognised in the investor's financial reports only to the extent of unrelated investors' interests in the associate.

C) On acquisition of the investment, any difference between the cost of the investment and the investor's share of the net fair value of the associate's identifiable assets and liabilities is included in the determination of the investor's share of the associate's profit or loss.

D) After application of the equity method, it is still necessary to recognise any impairment loss with respect to the investor's net investment in the associate as required in AASB 139 "Financial Instruments: Recognition and Measurement".

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

63

On acquisition of the investment in associate,any excess of the investor's share of the net fair value of the associate's identifiable assets and liabilities over the cost of the investment is accounted for as.....

A) goodwill relating to an associate and amortised over the period of economic benefits.

B) goodwill relating to an associate included in the carrying amount of the investment and amortisation is not permitted.

C) income in the determination of the investor's share of the associate's profit or loss in the period in which the investment is acquired.

D) expense in the determination of the investor's share of the associate's profit or loss in the period in which the investment is acquired.

E) None of the given answers.

A) goodwill relating to an associate and amortised over the period of economic benefits.

B) goodwill relating to an associate included in the carrying amount of the investment and amortisation is not permitted.

C) income in the determination of the investor's share of the associate's profit or loss in the period in which the investment is acquired.

D) expense in the determination of the investor's share of the associate's profit or loss in the period in which the investment is acquired.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

64

Investor Ltd owns 30% of Investee Ltd.During the year,Investee Ltd had reported a net profit of $500,000 and paid dividends of $50,000.The bookkeeper of Investor Ltd mistakenly used the cost method to account for investments in Investee Ltd.Ignoring tax effect,what is the net effect of this error in the statement of financial position and statement of comprehensive income,respectively?

A) overstate by $150,000; overstate by $150,000;

B) understate by $150,000; understate by $150,000;

C) overstate by $135,000; overstate by $135,000;

D) understate by $135,000; understate by $135,000;

E) None of the given answers.

A) overstate by $150,000; overstate by $150,000;

B) understate by $150,000; understate by $150,000;

C) overstate by $135,000; overstate by $135,000;

D) understate by $135,000; understate by $135,000;

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

65

After an investor has reduced its investment in an associate to zero following losses made by the associate,any additional losses incurred by the associate:

A) shall be taken directly to profit or loss.

B) are capitalised and amortised over the life of the investment.

C) retained by the investor in an equity reserve account entitled 'Losses of Associates'.

D) are provided for, and a liability recognised by the investor, only to the extent that the investor has incurred legal or constructive obligations to make payments on behalf of the associate.

E) must be recognised as a liability by the investor.

A) shall be taken directly to profit or loss.

B) are capitalised and amortised over the life of the investment.

C) retained by the investor in an equity reserve account entitled 'Losses of Associates'.

D) are provided for, and a liability recognised by the investor, only to the extent that the investor has incurred legal or constructive obligations to make payments on behalf of the associate.

E) must be recognised as a liability by the investor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following statements is not in accordance with AASB 121 "Investments in Associates"?

A) An investor applies the requirements of AASB 139 to determine whether any additional impairment loss is recognised with respect to the investor's interest in the associate.

B) Goodwill that forms part of the carrying amount of an investment in an associate is not separately recognised and therefore not tested for impairment separately.

C) The investor's financial statements are prepared using uniform accounting policies for like transactions and events in similar circumstances.

D) If the reporting period of the investor is different from that of the associate, the associate prepares, for the use of the investor, financial statements as of the same date as the financial statements of the investor unless it is impracticable to do so.

E) None of the given answers.

A) An investor applies the requirements of AASB 139 to determine whether any additional impairment loss is recognised with respect to the investor's interest in the associate.

B) Goodwill that forms part of the carrying amount of an investment in an associate is not separately recognised and therefore not tested for impairment separately.

C) The investor's financial statements are prepared using uniform accounting policies for like transactions and events in similar circumstances.

D) If the reporting period of the investor is different from that of the associate, the associate prepares, for the use of the investor, financial statements as of the same date as the financial statements of the investor unless it is impracticable to do so.

E) None of the given answers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

67

Investor Ltd owns 30% of Investee Ltd.During the year,Investee Ltd had reported a net profit of $100000 and paid no dividends for the year.Which of the following statements best describes the impact of the investment in Investee Ltd to Investor Ltd's financial ratios?

A) Current ratio will improve;

B) Quick asset ratio will deteriorate;

C) Sales turnover will improve;

D) Inventory turnover will deteriorate;

E) Earnings per share will improve.

A) Current ratio will improve;

B) Quick asset ratio will deteriorate;

C) Sales turnover will improve;

D) Inventory turnover will deteriorate;

E) Earnings per share will improve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck