Deck 17: Capital Budgeting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 17: Capital Budgeting

1

The discount rate that equates present value of cash inflows and outflows is called the:

A) component cost of capital.

B) weighted average cost of capital.

C) after-tax weighted average cost of capital.

D) IRR.

A) component cost of capital.

B) weighted average cost of capital.

C) after-tax weighted average cost of capital.

D) IRR.

D

2

The internal rate of return can be calculated by solving for ki after setting net present value equal to:

A) zero.

B) the initial investment cost or outlay.

C) the cost of capital.

D) expected cash flows.

A) zero.

B) the initial investment cost or outlay.

C) the cost of capital.

D) expected cash flows.

A

3

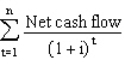

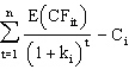

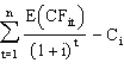

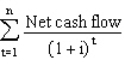

Net present value equals:

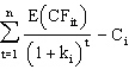

A)

B)

C)

D)

A)

B)

C)

D)

B

4

Capital budgeting is the process of planning investment expenditures when returns are expected to:

A) be earned at any time in the future.

B) be earned within one year.

C) extend beyond one generation.

D) extend beyond one year.

A) be earned at any time in the future.

B) be earned within one year.

C) extend beyond one generation.

D) extend beyond one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

Generally, a firm's estimated component cost of debt:

A) accurately estimates the firm's true opportunity cost of debt.

B) equals the firm's weighted cost of capital.

C) underestimates the firm's true opportunity cost of debt.

D) overestimates the firm's true opportunity cost of debt.

A) accurately estimates the firm's true opportunity cost of debt.

B) equals the firm's weighted cost of capital.

C) underestimates the firm's true opportunity cost of debt.

D) overestimates the firm's true opportunity cost of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

Firms should finance a project if its:

A) expected cash flow is positive.

B) net cash flow is positive.

C) internal rate of return is positive.

D) net present value is positive.

A) expected cash flow is positive.

B) net cash flow is positive.

C) internal rate of return is positive.

D) net present value is positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

The change in net cash flows due to an investment project is called:

A) marginal profit.

B) marginal revenue.

C) incremental cash flow.

D) marginal cash flow.

A) marginal profit.

B) marginal revenue.

C) incremental cash flow.

D) marginal cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

A firm must choose between two projects, X and Y. Project X has the highest net present value, but project Y has the highest profitability index. The firm should choose project Y if:

A) the firm is a risk seeker.

B) the firm is risk averse.

C) the firm has substantial investment resources.

D) the firm has limited investment resources.

A) the firm is a risk seeker.

B) the firm is risk averse.

C) the firm has substantial investment resources.

D) the firm has limited investment resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

Acceptance of investment projects where IRR > MCC:

A) will increase the value of the firm.

B) will decrease the value of the firm.

C) have no impact on the value of the firm.

D) none of these.

A) will increase the value of the firm.

B) will decrease the value of the firm.

C) have no impact on the value of the firm.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

Examples of mandatory nonrevenue-producing investments are provided by:

A) cost reduction projects.

B) expansion projects.

C) replacement projects.

D) safety and environmental projects.

A) cost reduction projects.

B) expansion projects.

C) replacement projects.

D) safety and environmental projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

Cash flows include depreciation:

A) to account for taxes effects.

B) as a cash expense.

C) if accelerated depreciation is chosen.

D) to reduce projected cash flows.

A) to account for taxes effects.

B) as a cash expense.

C) if accelerated depreciation is chosen.

D) to reduce projected cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

The pattern of returns for all potential investment projects is the:

A) investment opportunity schedule.

B) marginal cost of capital.

C) optimal capital budget.

D) optimal capital structure.

A) investment opportunity schedule.

B) marginal cost of capital.

C) optimal capital budget.

D) optimal capital structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

When net present value is positive:

A) the internal rate of return equals the cost of capital.

B) the internal rate of return exceeds the cost of capital.

C) the internal rate of return is less than the cost of capital.

D) the internal rate of return equals zero.

A) the internal rate of return equals the cost of capital.

B) the internal rate of return exceeds the cost of capital.

C) the internal rate of return is less than the cost of capital.

D) the internal rate of return equals zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

Net present value is the:

A) current-dollar difference between marginal revenues and marginal costs.

B) change in net cash flows due to an investment project.

C) change in before-tax cash flows due to an investment project.

D) change in net after-tax cash flows due to an investment project.

A) current-dollar difference between marginal revenues and marginal costs.

B) change in net cash flows due to an investment project.

C) change in before-tax cash flows due to an investment project.

D) change in net after-tax cash flows due to an investment project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

The first step in most capital budgeting decisions is:

A) estimating future demand.

B) determining the operating cost function.

C) estimating the cost of capital.

D) determining the optimal level of output and the expected annual cash flows resulting from operation at this level.

A) estimating future demand.

B) determining the operating cost function.

C) estimating the cost of capital.

D) determining the optimal level of output and the expected annual cash flows resulting from operation at this level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

Holding all else equal, the profitability index will fall following an increase in the:

A) cost of capital.

B) benefit-cost ratio.

C) IRR.

D) NPV.

A) cost of capital.

B) benefit-cost ratio.

C) IRR.

D) NPV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the tax rate is 25% and the prevailing interest rate is 12%, the after tax cost of debt is:

A) 3%.

B) 9%.

C) 16%.

D) 37%.

A) 3%.

B) 9%.

C) 16%.

D) 37%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

An estimate of the firm's cost of equity capital is:

A) the market return on common stocks.

B) the market return on common stocks multiplied by beta, the firm's risk index.

C) expected dividend yield plus projected growth.

D) expected dividend yield.

A) the market return on common stocks.

B) the market return on common stocks multiplied by beta, the firm's risk index.

C) expected dividend yield plus projected growth.

D) expected dividend yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

The most difficult step in capital expenditure analysis is estimating:

A) the internal rate of return.

B) the cost of capital.

C) the cost of investment.

D) project cash flows.

A) the internal rate of return.

B) the cost of capital.

C) the cost of investment.

D) project cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

Acceptance of new investment projects will increase the value of the firm provided that:

A) IRR > ROE.

B) ROE < IRR.

C) ROE = IRR.

D) none of these.

A) IRR > ROE.

B) ROE < IRR.

C) ROE = IRR.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

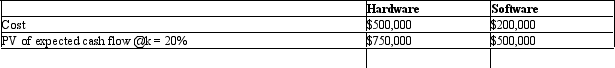

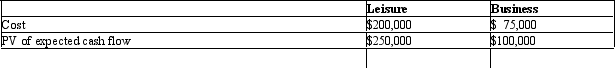

NPV Analysis. Paralegal Services, Inc., is contemplating purchase of additional computer hardware equipment and software programming. Financial analysis resulted in the following projections for a three-year planning horizon:

A. Calculate the net present value for each. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each. Which is more desirable according to the NPV criterion?

B. Calculate the profitability index for each. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both investments be undertaken?

A. Calculate the net present value for each. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each. Which is more desirable according to the NPV criterion?B. Calculate the profitability index for each. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both investments be undertaken?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

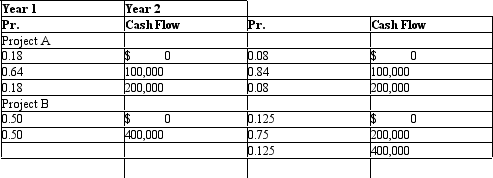

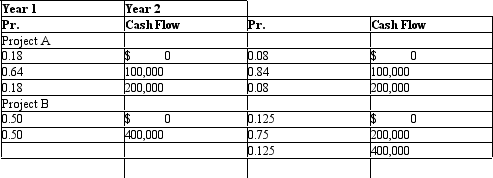

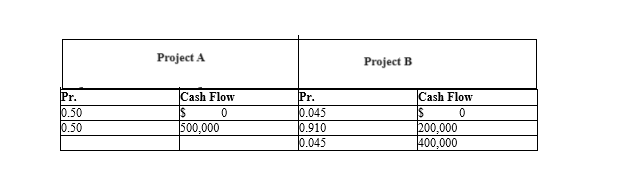

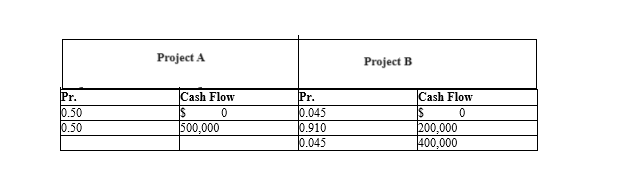

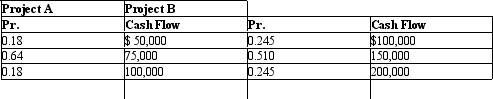

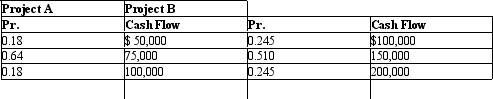

Expected Return. Pediatric Medicine, Ltd., is considering two alternative capital budgeting projects. Project A is an investment of $300,000 to renovate office facilities. Project B is an investment of $600,000 to expand diagnostic capabilities. Relevant cash flow data for the two projects over their expected two-year lives are as follows:

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

B. Calculate the risk-adjusted NPV for each project, using a 12% cost of capital for the more risky project and 10% for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank them according to their PIs.

D. Calculate the IRR for each project, and rank them according to their IRRs.

E. Compare your answers to parts B, C, and D, and discuss any differences.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.B. Calculate the risk-adjusted NPV for each project, using a 12% cost of capital for the more risky project and 10% for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank them according to their PIs.

D. Calculate the IRR for each project, and rank them according to their IRRs.

E. Compare your answers to parts B, C, and D, and discuss any differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

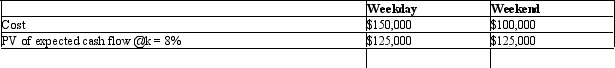

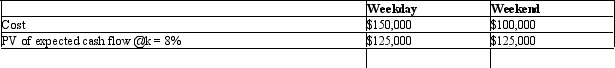

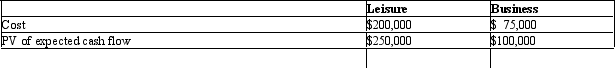

NPV Analysis. The Health Maintenance Organization, Ltd., is considering offering extended service hours during weekday and weekend periods. The company has the following projections for a two-year planning horizon:

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

B. Calculate the profitability index for each service. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the services be undertaken?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?B. Calculate the profitability index for each service. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the services be undertaken?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

The beta coefficient is:

A) a relative measure of stock-price variability.

B) an absolute measure of stock-price variability.

C) equal to the standard deviation divided by covariance.

D) none of these.

A) a relative measure of stock-price variability.

B) an absolute measure of stock-price variability.

C) equal to the standard deviation divided by covariance.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

Expected Return. Dr. Kevin Lenahan & Associates is a local optometrist considering two alternative capital budgeting projects. Project A is an investment of $800,000 in a new office addition to showcase an expanded selection of designer frames and contact lenses. Project B is an investment of $750,000 to upgrade existing testing facilities. Relevant annual cash flow data for the two projects over their expected seven-year lives are as follows:

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

B. Calculate the risk-adjusted NPV for each project, using a 20% cost of capital for the more risky project and 15% for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank them according to their PIs.

D. Calculate the IRR for each project, and rank them according to their IRRs.

E. Compare your answers to parts B, C, and D, and discuss any differences.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.B. Calculate the risk-adjusted NPV for each project, using a 20% cost of capital for the more risky project and 15% for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank them according to their PIs.

D. Calculate the IRR for each project, and rank them according to their IRRs.

E. Compare your answers to parts B, C, and D, and discuss any differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

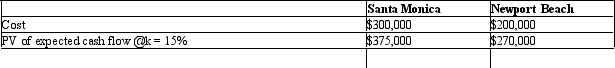

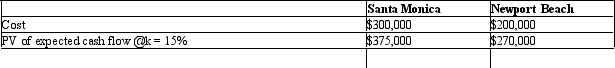

NPV Analysis. The Santa Catalina Passenger Ferry Company is contemplating leasing an additional ferryboat to expand service to Santa Monica or Newport Beach. Financial analysis resulted in the following projections for a 5-year planning horizon:

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

B. Calculate the profitability index for each service. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the services be undertaken?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?B. Calculate the profitability index for each service. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the services be undertaken?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

27

NPV Analysis. The net present value (NPV), profitability index (PI), and internal rate of return (IRR) methods are often employed in project valuation. Indicate whether each of the following statements is true or false and explain why.

A. A PI < 1 describes a project with IRR < k.

B. Selection solely according to the PI criterion will tend to favor smaller as opposed to larger investment projects.

C. Use of the NPV criterion is especially appropriate for larger firms with easy access to capital markets.

D. The IRR method can tend to overstate the relative attractiveness of investment projects when the opportunity cost of cash flows is below the IRR.

E. When NPV > 0, the IRR exceeds the cost of capital.

A. A PI < 1 describes a project with IRR < k.

B. Selection solely according to the PI criterion will tend to favor smaller as opposed to larger investment projects.

C. Use of the NPV criterion is especially appropriate for larger firms with easy access to capital markets.

D. The IRR method can tend to overstate the relative attractiveness of investment projects when the opportunity cost of cash flows is below the IRR.

E. When NPV > 0, the IRR exceeds the cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

The crossover discount rate only equates the:

A) NPV for two or more investments.

B) IRR for two or more investments.

C) present value payback period for two or more investments.

D) all of these.

A) NPV for two or more investments.

B) IRR for two or more investments.

C) present value payback period for two or more investments.

D) all of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

Cost of Capital. Indicate whether each of the following statements is true or false. Explain why.

A. In practice, the component costs of debt and equity are independently, determined.

B. The marginal cost of capital will be more elastic for larger as opposed to smaller firms.

C. Information costs both increase the marginal cost of capital and reduce the internal rate of return on investment projects.

D. Investments necessary to replace worn-out or damaged equipment tend to have high levels of risk.

E. Depreciation expenses that involve no direct cash outlay must be incorporated in investment project evaluation.

A. In practice, the component costs of debt and equity are independently, determined.

B. The marginal cost of capital will be more elastic for larger as opposed to smaller firms.

C. Information costs both increase the marginal cost of capital and reduce the internal rate of return on investment projects.

D. Investments necessary to replace worn-out or damaged equipment tend to have high levels of risk.

E. Depreciation expenses that involve no direct cash outlay must be incorporated in investment project evaluation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

The cost of capital is the:

A) component cost of debt.

B)

B) component cost of equity.

C) both A and

D) discount rate.

A) component cost of debt.

B)

B) component cost of equity.

C) both A and

D) discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

31

The risk-free rate of return is the investor reward for:

A) risk-taking.

B) postponing consumption.

C) relative stock-price variability.

D) absolute stock-price variability.

A) risk-taking.

B) postponing consumption.

C) relative stock-price variability.

D) absolute stock-price variability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

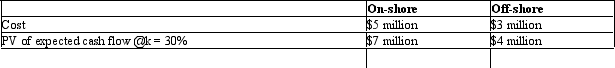

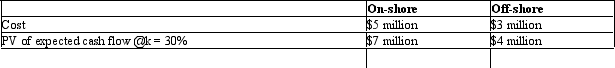

NPV Analysis. QED Exploration, Ltd., is contemplating on-shore and off-shore oil and gas exploration projects. Financial analysis resulted in the following projections for a ten-year planning horizon:

A. Calculate the net present value for each investment. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each investment. Which is more desirable according to the NPV criterion?

B. Calculate the profitability index for each investment. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both investments be undertaken?

A. Calculate the net present value for each investment. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each investment. Which is more desirable according to the NPV criterion?B. Calculate the profitability index for each investment. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both investments be undertaken?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

Expected Return. Manhattan Transfer, Inc., is considering two alternative capital budgeting projects. Project A is an investment of $225,000 to renovate warehouse facilities. Project B is an investment of $450,000 to expand distribution facilities. Relevant annual cash flow data for the two projects over their expected five-year lives are as follows:

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

B. Calculate the risk-adjusted NPV for each project, using a 15% cost of capital for the more risky project and 12% for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank them according to their PIs.

D. Calculate the IRR for each project, and rank them according to their IRRs.

E. Compare your answers to parts B, C, and D, and discuss any differences.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.

A. Calculate the expected value, standard deviation, and coefficient of variation of cash flows for each project.B. Calculate the risk-adjusted NPV for each project, using a 15% cost of capital for the more risky project and 12% for the less risky one. Which project is preferred using the NPV criterion?

C. Calculate the PI for each project, and rank them according to their PIs.

D. Calculate the IRR for each project, and rank them according to their IRRs.

E. Compare your answers to parts B, C, and D, and discuss any differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

Cost of Capital. Determine whether each of the following would increase or decrease the firm's cost of capital for investment project evaluation. Explain.

A. The company's stock price suffers a sharp decline, but no decline in the company's earnings potential is perceived.

B. A merger with a leading competitor increases the company's stock price substantially.

C. The company's home state increases the corporate state income tax.

D. In an effort to spur business activity, Congress cuts corporate income taxes.

A. The company's stock price suffers a sharp decline, but no decline in the company's earnings potential is perceived.

B. A merger with a leading competitor increases the company's stock price substantially.

C. The company's home state increases the corporate state income tax.

D. In an effort to spur business activity, Congress cuts corporate income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

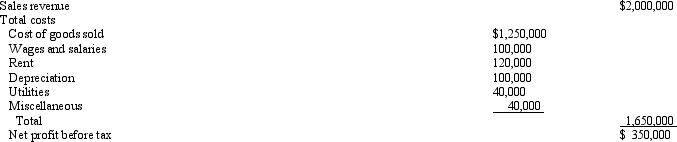

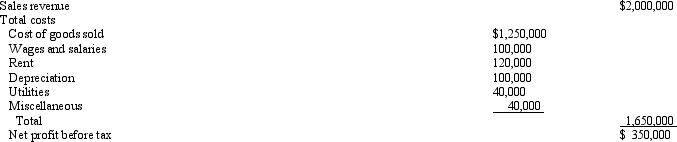

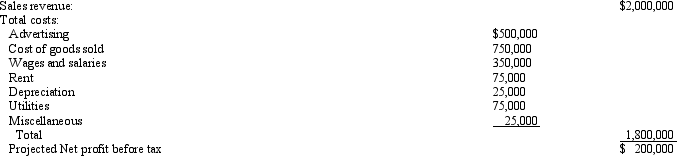

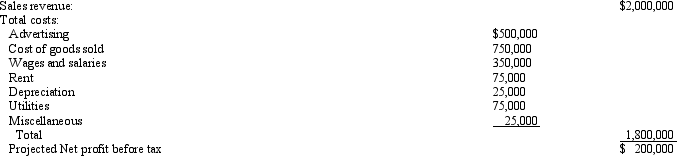

Incremental Analysis. Cunningham's Drug Store, a medium-sized drug store located in Milwaukee, Wisconsin, is owned and operated by Richard Cunningham. Cunningham's sells pharmaceuticals, cosmetics, toiletries, magazines, and various novelties. Cunningham's most recent annual net income statement is as follows:

Cunningham's sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Cunningham is considering using some floor space for a small soda fountain. Cunningham would operate the soda fountain for an initial five-year period, and then reevaluate its profitability. The soda fountain requires an incremental investment of $25,000 to lease furniture, equipment, utensils, and so on. This is the only capital investment required during the initial five-year period. At the end of that time, additional capital would be required to continue operating the soda fountain and no capital would be recovered if it were dropped. The soda fountain is expected to have sales of $125,000 and food and materials expenses of $30,000 per year. The soda fountain is also expected to increase wage and salary expenses by 8% and utility expenses by 5%. Because the soda fountain will reduce the floor space available for display of other merchandise, sales of nonsoda fountain items are expected to decline by 10%.

Cunningham's sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Cunningham is considering using some floor space for a small soda fountain. Cunningham would operate the soda fountain for an initial five-year period, and then reevaluate its profitability. The soda fountain requires an incremental investment of $25,000 to lease furniture, equipment, utensils, and so on. This is the only capital investment required during the initial five-year period. At the end of that time, additional capital would be required to continue operating the soda fountain and no capital would be recovered if it were dropped. The soda fountain is expected to have sales of $125,000 and food and materials expenses of $30,000 per year. The soda fountain is also expected to increase wage and salary expenses by 8% and utility expenses by 5%. Because the soda fountain will reduce the floor space available for display of other merchandise, sales of nonsoda fountain items are expected to decline by 10%.

A. Calculate net incremental cash flows for the soda fountain.

B. Assume that Cunningham has the capital necessary to install the soda fountain and places a 12% before-tax opportunity cost on those funds. Should the soda fountain be installed? Why or why not?

Cunningham's sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Cunningham is considering using some floor space for a small soda fountain. Cunningham would operate the soda fountain for an initial five-year period, and then reevaluate its profitability. The soda fountain requires an incremental investment of $25,000 to lease furniture, equipment, utensils, and so on. This is the only capital investment required during the initial five-year period. At the end of that time, additional capital would be required to continue operating the soda fountain and no capital would be recovered if it were dropped. The soda fountain is expected to have sales of $125,000 and food and materials expenses of $30,000 per year. The soda fountain is also expected to increase wage and salary expenses by 8% and utility expenses by 5%. Because the soda fountain will reduce the floor space available for display of other merchandise, sales of nonsoda fountain items are expected to decline by 10%.

Cunningham's sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Cunningham is considering using some floor space for a small soda fountain. Cunningham would operate the soda fountain for an initial five-year period, and then reevaluate its profitability. The soda fountain requires an incremental investment of $25,000 to lease furniture, equipment, utensils, and so on. This is the only capital investment required during the initial five-year period. At the end of that time, additional capital would be required to continue operating the soda fountain and no capital would be recovered if it were dropped. The soda fountain is expected to have sales of $125,000 and food and materials expenses of $30,000 per year. The soda fountain is also expected to increase wage and salary expenses by 8% and utility expenses by 5%. Because the soda fountain will reduce the floor space available for display of other merchandise, sales of nonsoda fountain items are expected to decline by 10%.A. Calculate net incremental cash flows for the soda fountain.

B. Assume that Cunningham has the capital necessary to install the soda fountain and places a 12% before-tax opportunity cost on those funds. Should the soda fountain be installed? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

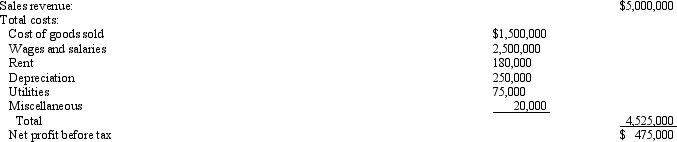

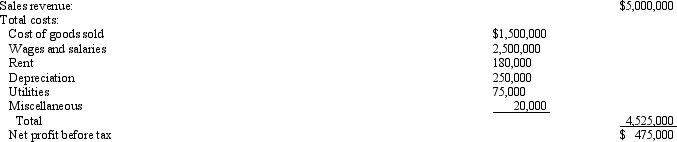

Incremental Analysis. Warren Buffet is a medium-sized restaurant located in Omaha, Nebraska. Warren Buffet currently offers elegant dining to luncheon and dining customers. The restaurant's most recent annual net income statement is as follows:

Luncheon and dining customer sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Warren Buffet is considering offering a new Sunday buffet brunch service. Warren Buffet would offer Sunday brunch for an initial two-year period, and then reevaluate its profitability. Offering a Sunday brunch would require an initial outlay of $10,000 to cover new buffet equipment and utensils. This is the only capital investment required during the initial two-year period. At the end of that time, additional capital would be required to continue operation, and no capital would be recovered if the buffet were dropped. Buffet sales of $300,000 are anticipated, and the share of revenues devoted to cost of goods sold expenses are expected to represent the same as previously. Wage and salary expenses are expected to increase by 8% and utility expenses by 5%. No other incremental costs are expected.

Luncheon and dining customer sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Warren Buffet is considering offering a new Sunday buffet brunch service. Warren Buffet would offer Sunday brunch for an initial two-year period, and then reevaluate its profitability. Offering a Sunday brunch would require an initial outlay of $10,000 to cover new buffet equipment and utensils. This is the only capital investment required during the initial two-year period. At the end of that time, additional capital would be required to continue operation, and no capital would be recovered if the buffet were dropped. Buffet sales of $300,000 are anticipated, and the share of revenues devoted to cost of goods sold expenses are expected to represent the same as previously. Wage and salary expenses are expected to increase by 8% and utility expenses by 5%. No other incremental costs are expected.

A. Calculate net incremental cash flows for the Sunday buffet.

B. Assume that Warren Buffet's has the necessary capital and places a 20% before-tax opportunity cost on those funds. Should the buffet service be offered? Why or why not?

Luncheon and dining customer sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Warren Buffet is considering offering a new Sunday buffet brunch service. Warren Buffet would offer Sunday brunch for an initial two-year period, and then reevaluate its profitability. Offering a Sunday brunch would require an initial outlay of $10,000 to cover new buffet equipment and utensils. This is the only capital investment required during the initial two-year period. At the end of that time, additional capital would be required to continue operation, and no capital would be recovered if the buffet were dropped. Buffet sales of $300,000 are anticipated, and the share of revenues devoted to cost of goods sold expenses are expected to represent the same as previously. Wage and salary expenses are expected to increase by 8% and utility expenses by 5%. No other incremental costs are expected.

Luncheon and dining customer sales and expenses have remained relatively constant in the past few years and are expected to continue unchanged in the near future. To increase sales, Warren Buffet is considering offering a new Sunday buffet brunch service. Warren Buffet would offer Sunday brunch for an initial two-year period, and then reevaluate its profitability. Offering a Sunday brunch would require an initial outlay of $10,000 to cover new buffet equipment and utensils. This is the only capital investment required during the initial two-year period. At the end of that time, additional capital would be required to continue operation, and no capital would be recovered if the buffet were dropped. Buffet sales of $300,000 are anticipated, and the share of revenues devoted to cost of goods sold expenses are expected to represent the same as previously. Wage and salary expenses are expected to increase by 8% and utility expenses by 5%. No other incremental costs are expected.A. Calculate net incremental cash flows for the Sunday buffet.

B. Assume that Warren Buffet's has the necessary capital and places a 20% before-tax opportunity cost on those funds. Should the buffet service be offered? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

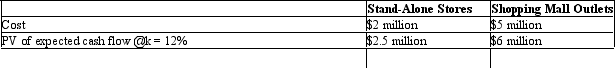

NPV Analysis. Travel Services, Inc., is contemplating purchase of a number of seats on regularly scheduled airlines for resale to leisure and business customers. The company projects the following costs and revenues for each type of service:

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

B. Calculate the profitability index for each service. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the services be undertaken?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each service. Which is more desirable according to the NPV criterion?B. Calculate the profitability index for each service. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the services be undertaken?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

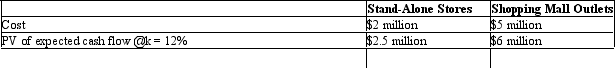

NPV Analysis. Nocando Retailing, Ltd. is contemplating leasing additional retail space to expand its distribution network in northeastern markets. Financial analysis resulted in the following projections for a five-year planning horizon:

A. Calculate the net present value for each type of retail space. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each type of retail space. Which is more desirable according to the NPV criterion?

B. Calculate the profitability index for each. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the leasing options be undertaken?

A. Calculate the net present value for each type of retail space. Which is more desirable according to the NPV criterion?

A. Calculate the net present value for each type of retail space. Which is more desirable according to the NPV criterion?B. Calculate the profitability index for each. Which is more desirable according to the PI criterion?

C. Under what conditions would either or both of the leasing options be undertaken?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

When NPV is positive, the IRR:

A) is less than the cost of capital.

B) equals the cost of capital.

C) exceeds the cost of capital.

D) none of these.

A) is less than the cost of capital.

B) equals the cost of capital.

C) exceeds the cost of capital.

D) none of these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

Rate-of-Return Analysis. New York City licenses taxicabs in two classes: (1) for operation by companies with fleets, and (2) for operation by independent driver-owners who have only one cab. It also fixes the rates that taxis charge. For many years, no new licenses have been issued in either class. In the unofficial market for licenses (medallions), their market value is currently roughly $250,000.

A. Does the $250,000 medallion price indicate that operators of New York taxicabs are earning only normal profits?

B. What factors would determine whether a change in the fare fixed by the city would raise or lower the value of a license?

C. Cab drivers, whether hired by companies or as owners of their own cabs, seem unanimous in opposing any increase in the number of cabs licensed. They argue that an increase in the number of cabs would increase competition for customers, and drive down what they regard as an already unduly low return to drivers. Is their economic analysis correct? Who would benefit and who would lose from an expansion in the number of licenses issued at a nominal fee?

A. Does the $250,000 medallion price indicate that operators of New York taxicabs are earning only normal profits?

B. What factors would determine whether a change in the fare fixed by the city would raise or lower the value of a license?

C. Cab drivers, whether hired by companies or as owners of their own cabs, seem unanimous in opposing any increase in the number of cabs licensed. They argue that an increase in the number of cabs would increase competition for customers, and drive down what they regard as an already unduly low return to drivers. Is their economic analysis correct? Who would benefit and who would lose from an expansion in the number of licenses issued at a nominal fee?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

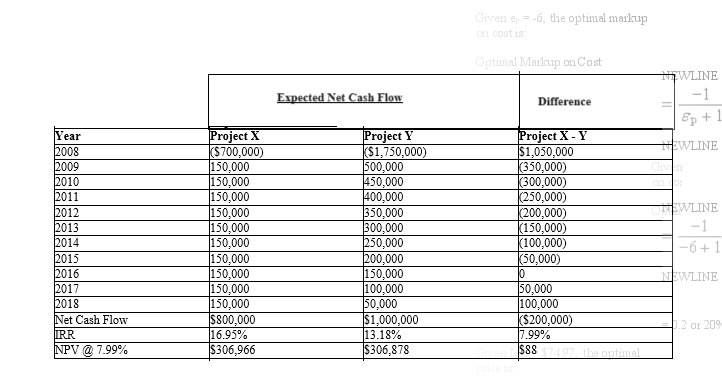

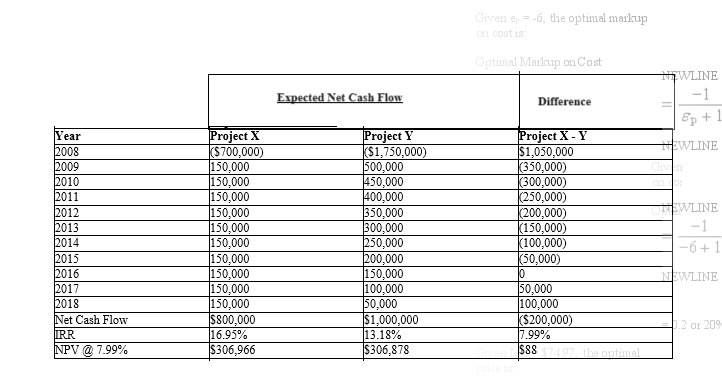

Crossover Discount Rates. Sally Rogers is the chief financial officer for Popular Productions, Inc., producers of The Allan Brady Show, a hit comedy series. Rogers is considering the desirability of purchasing one of two alternative forms of post-production equipment used in the tape editing process. Rogers has discovered that a serious problem can arise when using the NPV method of project valuation because projects sometimes differ significantly in terms of the magnitude and timing of cash flows. When the size or pattern of alternative project cash flows differs greatly, each project's NPV can react quite differently to changes in the discount rate. Changes in the appropriate discount rate can sometimes lead to reversals in project rankings. Rogers discovered this problem when considering the following before-tax cash flow data:

A. Conceptually describe how ranking reversals can occur at the crossover discount rate.

A. Conceptually describe how ranking reversals can occur at the crossover discount rate.

B. Which investment project is preferred at a relevant cost of capital that is below the crossover discount rate? Why?

C. Which investment project is preferred at a relevant cost of capital that is above the crossover discount rate? Why?

A. Conceptually describe how ranking reversals can occur at the crossover discount rate.

A. Conceptually describe how ranking reversals can occur at the crossover discount rate.B. Which investment project is preferred at a relevant cost of capital that is below the crossover discount rate? Why?

C. Which investment project is preferred at a relevant cost of capital that is above the crossover discount rate? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

Cost of Capital. Northwest Bankshares, Inc., is a rapidly growing chain of commercial banks in north central states. A security analyst's report issued by a national brokerage firm indicates that debt yielding 15%, comprises 25% of Northwest's overall capital structure. Furthermore, both earnings and dividends are expected to grow at a rate of 25% per year.

Currently, common stock in the company is priced at $25, and is not expected to pay dividends during the coming year. This yield compares favorably with the 10% return currently available on risk-free securities and the 16% average for all common stocks, given the company's estimated beta of 2.5.

A. Calculate Northwest's component cost of equity using both the capital asset pricing model and the dividend yield plus expected growth model.

B. Assuming a 40% marginal federal plus state income tax rate, calculate Northwest's weighted average cost of capital.

Currently, common stock in the company is priced at $25, and is not expected to pay dividends during the coming year. This yield compares favorably with the 10% return currently available on risk-free securities and the 16% average for all common stocks, given the company's estimated beta of 2.5.

A. Calculate Northwest's component cost of equity using both the capital asset pricing model and the dividend yield plus expected growth model.

B. Assuming a 40% marginal federal plus state income tax rate, calculate Northwest's weighted average cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

Cost of Capital. Dartmouth Systems, Inc., is a leading supplier of sorters and collators to the copier and computer printer market. A security analyst's report issued by a national brokerage firm indicates that debt yielding 8%, comprises 50% of Dartmouth's overall capital structure. Furthermore, both earnings and dividends are not expected to grow during coming years.

Currently, common stock in the company is priced at $75, and it should pay $7.50 per share in dividends during the coming year. This yield compares favorably with the 7% return currently available on risk-free securities and the 13% average for all common stocks, given the company's estimated beta of 0.5.

A. Calculate Dartmouth's component cost of equity using both the capital asset pricing model and the dividend yields plus expected growth model.

B. Assuming a 40% marginal federal plus state income tax rate, calculate Dartmouth's weighted average cost of capital.

Currently, common stock in the company is priced at $75, and it should pay $7.50 per share in dividends during the coming year. This yield compares favorably with the 7% return currently available on risk-free securities and the 13% average for all common stocks, given the company's estimated beta of 0.5.

A. Calculate Dartmouth's component cost of equity using both the capital asset pricing model and the dividend yields plus expected growth model.

B. Assuming a 40% marginal federal plus state income tax rate, calculate Dartmouth's weighted average cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

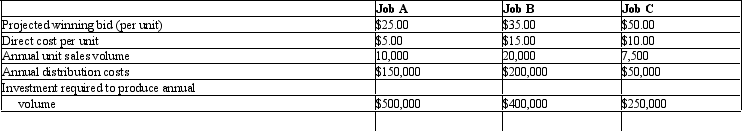

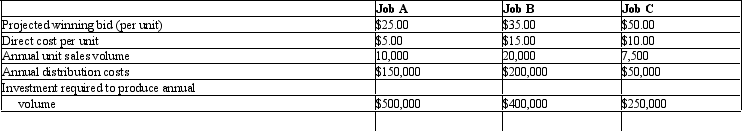

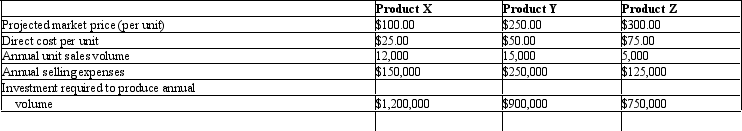

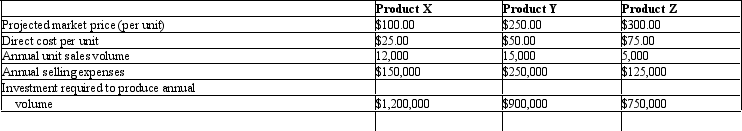

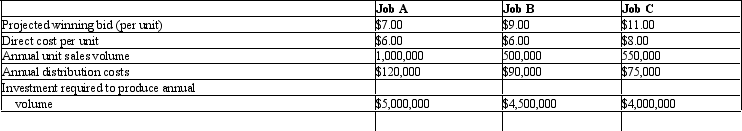

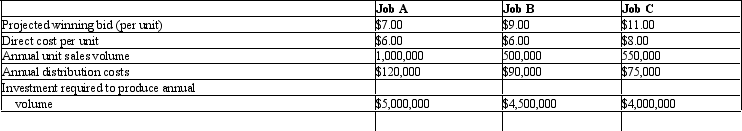

Cash Flow Analysis. The Printing Press, Inc., (PPI) is analyzing the potential profitability of three printing jobs put up for bid by a national textbook publisher:

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 35%, (2) each job is expected to have a five-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 15%, (5) the jobs have the same risks as the firm's other business, and (6) the company has already spent $10,000 on developing the preceding data. This $10,000 has been capitalized and will be amortized over the life of the job chosen, if any.

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 35%, (2) each job is expected to have a five-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 15%, (5) the jobs have the same risks as the firm's other business, and (6) the company has already spent $10,000 on developing the preceding data. This $10,000 has been capitalized and will be amortized over the life of the job chosen, if any.

A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each job? On which job, if any, should PPI bid?

C. Suppose that PPI's primary business is quite cyclical, improving and declining with the economy, which job B is expected to be counter cyclical. Might this have any bearing on your decision?

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 35%, (2) each job is expected to have a five-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 15%, (5) the jobs have the same risks as the firm's other business, and (6) the company has already spent $10,000 on developing the preceding data. This $10,000 has been capitalized and will be amortized over the life of the job chosen, if any.

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 35%, (2) each job is expected to have a five-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 15%, (5) the jobs have the same risks as the firm's other business, and (6) the company has already spent $10,000 on developing the preceding data. This $10,000 has been capitalized and will be amortized over the life of the job chosen, if any.A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each job? On which job, if any, should PPI bid?

C. Suppose that PPI's primary business is quite cyclical, improving and declining with the economy, which job B is expected to be counter cyclical. Might this have any bearing on your decision?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

Cash Flow Analysis. Biometric Devices, Inc., is analyzing the potential profitability of three potential new testing devices:

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 40%, (2) each product is expected to have a three-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 20%, (5) the products have the same risks as the firm's other business, and (6) the company has already spent $25,000 on research and development (R&D) for these products. This $250,000 has been capitalized and will be amortized over the life of the product chosen, if any.

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 40%, (2) each product is expected to have a three-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 20%, (5) the products have the same risks as the firm's other business, and (6) the company has already spent $25,000 on research and development (R&D) for these products. This $250,000 has been capitalized and will be amortized over the life of the product chosen, if any.

A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each product? Which product, if any, should BDI introduce?

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 40%, (2) each product is expected to have a three-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 20%, (5) the products have the same risks as the firm's other business, and (6) the company has already spent $25,000 on research and development (R&D) for these products. This $250,000 has been capitalized and will be amortized over the life of the product chosen, if any.

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 40%, (2) each product is expected to have a three-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 20%, (5) the products have the same risks as the firm's other business, and (6) the company has already spent $25,000 on research and development (R&D) for these products. This $250,000 has been capitalized and will be amortized over the life of the product chosen, if any.A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each product? Which product, if any, should BDI introduce?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

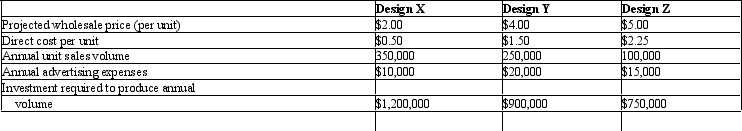

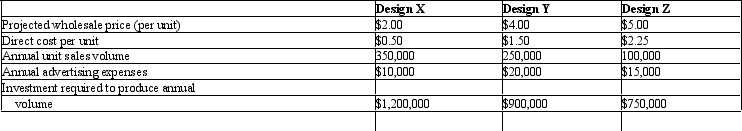

Cash Flow Analysis. Dick Tracy has acquired a franchise to sell one of three designs of a novelty watch in the Gotham City Market:

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 50%, (2) each product is expected to have a four-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 12%, (5) the products have the same risk as the firm's other business, and (6) the company has already spent $250,000 on franchise acquisition costs. This $250,000 has been capitalized and will be amortized over the life of the design chosen.

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 50%, (2) each product is expected to have a four-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 12%, (5) the products have the same risk as the firm's other business, and (6) the company has already spent $250,000 on franchise acquisition costs. This $250,000 has been capitalized and will be amortized over the life of the design chosen.

A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each product? Which design, if any, should Tracy sell?

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 50%, (2) each product is expected to have a four-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 12%, (5) the products have the same risk as the firm's other business, and (6) the company has already spent $250,000 on franchise acquisition costs. This $250,000 has been capitalized and will be amortized over the life of the design chosen.

Assume that: (1) The company's marginal city-plus-state-plus-federal tax rate is 50%, (2) each product is expected to have a four-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 12%, (5) the products have the same risk as the firm's other business, and (6) the company has already spent $250,000 on franchise acquisition costs. This $250,000 has been capitalized and will be amortized over the life of the design chosen.A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each product? Which design, if any, should Tracy sell?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

Incremental Analysis. Grey's Anatomy, Ltd., is contemplating opening a new retail outlet in a suburban shopping mall. Projections for an initial 10-year period for the potential outlet are:

A. Calculate the NPV for the proposed outlet assuming that an initial investment of $750,000 is required and the cost of capital is k=20%.

A. Calculate the NPV for the proposed outlet assuming that an initial investment of $750,000 is required and the cost of capital is k=20%.

B. Given the proposed outlet's projected net profit before tax, calculate the maximum initial investment that could be justified when k=20%.

A. Calculate the NPV for the proposed outlet assuming that an initial investment of $750,000 is required and the cost of capital is k=20%.

A. Calculate the NPV for the proposed outlet assuming that an initial investment of $750,000 is required and the cost of capital is k=20%.B. Given the proposed outlet's projected net profit before tax, calculate the maximum initial investment that could be justified when k=20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

Cost of Capital. Marine Transport, Ltd., operates a fleet of oil and chemical tankers. A security analyst's report issued by a national brokerage firm indicates that debt yielding 13%, comprises 50% of Marine's overall capital structure. Furthermore, both earnings and dividends are expected to grow at a rate of 10% per year.

Currently, common stock in the company is priced at $40, and it should pay $2 per share in dividends during the coming year. This yield compares favorably with the 10% return currently available on risk-free securities and the 15% average for all common stocks, given the company's estimated beta of 1.

A. Calculate Marine's component cost of equity using both the capital asset pricing model and the dividend yield plus expected growth model.

B. Assuming a 50% marginal federal plus state income tax rate, calculate Marine's weighted average cost of capital.

Currently, common stock in the company is priced at $40, and it should pay $2 per share in dividends during the coming year. This yield compares favorably with the 10% return currently available on risk-free securities and the 15% average for all common stocks, given the company's estimated beta of 1.

A. Calculate Marine's component cost of equity using both the capital asset pricing model and the dividend yield plus expected growth model.

B. Assuming a 50% marginal federal plus state income tax rate, calculate Marine's weighted average cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

Cash Flow Analysis. The Gulf States Press, Inc., is analyzing the potential profitability of three printing jobs put up for bid by the State Department of Transportation:

Assume that: (1) The company's marginal state plus federal tax rate is 40%, (2) each job is expected to have a ten-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 10%, (5) the jobs have the same risks as the firm's other business, and (6) the company has already spent $100,000 on developing the preceding data. This $100,000 has been capitalized and will be amortized over the life of the job chosen, if any.

Assume that: (1) The company's marginal state plus federal tax rate is 40%, (2) each job is expected to have a ten-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 10%, (5) the jobs have the same risks as the firm's other business, and (6) the company has already spent $100,000 on developing the preceding data. This $100,000 has been capitalized and will be amortized over the life of the job chosen, if any.

A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each job? On which job, if any, should Gulf States bid?

C. Suppose that Gulf States' primary business is quite cyclical, improving and declining with the economy, which Job B is expected to be counter cyclical. Might this have any bearing on your decision?

Assume that: (1) The company's marginal state plus federal tax rate is 40%, (2) each job is expected to have a ten-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 10%, (5) the jobs have the same risks as the firm's other business, and (6) the company has already spent $100,000 on developing the preceding data. This $100,000 has been capitalized and will be amortized over the life of the job chosen, if any.

Assume that: (1) The company's marginal state plus federal tax rate is 40%, (2) each job is expected to have a ten-year life, (3) the firm uses straight-line depreciation, (4) the average cost of capital is 10%, (5) the jobs have the same risks as the firm's other business, and (6) the company has already spent $100,000 on developing the preceding data. This $100,000 has been capitalized and will be amortized over the life of the job chosen, if any.A. What is the expected net cash flow each year? (Hint: Cash flow equals net profit after taxes plus depreciation and amortization charges.)

B. What is the net present value of each job? On which job, if any, should Gulf States bid?

C. Suppose that Gulf States' primary business is quite cyclical, improving and declining with the economy, which Job B is expected to be counter cyclical. Might this have any bearing on your decision?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

Cost of Capital. Chock Full O'Coffee, Inc., processes and markets a leading brand of coffee. A security analyst's report issued by a national brokerage firm indicates that debt yielding 9%, comprises 60% of the company's overall capital structure. Furthermore, both earnings and dividends are expected to grow at a rate of 4% per year.

Currently, common stock in the company is priced at $20, and it should pay $1.40 per share in dividends during the coming year. This yield compares favorably with the 8% return currently available on risk-free securities and the 14% average for all common stocks, given the company's estimated beta of 0.5.

A. Calculate the component cost of equity using both the capital asset pricing model and the dividend yield plus expected growth model.

B. Assuming a 50% marginal federal plus state income tax rate, calculate the company's weighted average cost of capital.

Currently, common stock in the company is priced at $20, and it should pay $1.40 per share in dividends during the coming year. This yield compares favorably with the 8% return currently available on risk-free securities and the 14% average for all common stocks, given the company's estimated beta of 0.5.

A. Calculate the component cost of equity using both the capital asset pricing model and the dividend yield plus expected growth model.

B. Assuming a 50% marginal federal plus state income tax rate, calculate the company's weighted average cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck