Deck 14: Exempt Entities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/159

العب

ملء الشاشة (f)

Deck 14: Exempt Entities

1

Certain § 501(c)(3)exempt organizations are permitted to engage in lobbying activities in the same manner as taxable organizations.

False

Certain § 501(c)(3)exempt organizations which elect under § 501(h)are permitted to engage in lobbying activities on a limited basis.

Certain § 501(c)(3)exempt organizations which elect under § 501(h)are permitted to engage in lobbying activities on a limited basis.

2

An exempt educational organization is permitted to make lobbying expenditures if the payments relate to education or charity and do not exceed $25,000.

False

There is no statutory provision permitting educational organizations or charitable organizations to make lobbying expenditures as specified.

There is no statutory provision permitting educational organizations or charitable organizations to make lobbying expenditures as specified.

3

A feeder organization is exempt from Federal income taxation because it carries on a trade or business for the benefit of an exempt organization and remits its profits to the exempt entity.

False

While this is the appropriate definition of a feeder organization,it is subject to Federal income taxation.

While this is the appropriate definition of a feeder organization,it is subject to Federal income taxation.

4

Intermediate sanctions enable the IRS to revoke the exempt status of an exempt organization for a negotiated time period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

5

Theater,Inc.,an exempt organization,owns a printing company,Printers,Inc.,which remits 80% of its profits to Theater,Inc.Since Printers remits at least 80% of its profits to Theater,neither Theater,Inc.,nor Printers,Inc.,must pay income tax on this $80,000 ($100,000 *80%).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

6

Qualified state tuition programs are exempt from Federal income tax under § 501(c)(3).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

7

While engaging in a prohibited transaction can result in an exempt organization being subject to tax,it will not result in an exempt organization losing its exempt status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

8

To be classified as a private foundation,the exempt status of an organization can be provided under either § 501(c)(1)or § 501(c)(3).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

9

The tax consequences to a donor of making a charitable contribution to an exempt organization classified as a private foundation are the same as the tax consequences to a donor of making a charitable contribution to an exempt organization that is not classified as a private foundation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

10

The only purpose of the Federal income tax law is to raise revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

11

A general requirement for exempt status is that the net earnings of the organization not be used for the benefit of the members of the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

12

An exempt organization in certain circumstances is subject to the Federal income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

13

If an organization qualifies for exempt status for Federal income tax purposes,it is exempt from all Federal income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

14

A feeder organization is subject to Federal income tax using the highest corporate tax rate (35%).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

15

The excise taxes such as the tax on self-dealing and the tax on excess business holdings are imposed only on exempt organizations classified as private foundations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

16

One reason for granting an exemption from Federal income tax to certain organizations is the belief that such organizations can perform certain government-like functions,and thereby reduce the financial burden that would otherwise fall on the Federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

17

Private foundations are not permitted to engage in lobbying activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

18

The League of Women Voters is a § 501(c)(3)organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

19

Receiving too little of its support from gross investment income and unrelated business taxable income can result in an exempt organization being classified as a private foundation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

20

Public charities receive more favorable tax treatment than do exempt organizations which are classified as private foundations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

21

If an exempt organization conducts a trade or business that consists of either exchanging or renting to other exempt organizations the organization's donor or membership list,such trade or business is an unrelated trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

22

The excise tax imposed on a private foundation's investment income can be imposed both as an initial (first-level)tax and an additional (second-level)tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

23

Federal agencies exempt from Federal income tax under § 501(c)(1)are not subject to the unrelated business income tax (UBIT).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

24

An exempt organization will not have any tax liability associated with the unrelated business income tax if the unrelated business income is $25,000 or less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

25

A profit-related activity of an exempt organization avoids the unrelated business income tax if at least 80% of the merchandise sold had been received as a contribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

26

The purpose of the excise tax imposed on a private foundation for failure to distribute sufficient levels of income is to motivate the foundation to distribute more of its income for application to exempt purposes and thus be classified as a feeder organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

27

The excise tax imposed on a private foundation's excess business holdings is in effect an audit fee to defray IRS expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

28

The excise tax that is imposed on private foundations for making jeopardizing investments is imposed because the foundation has made speculative investments that put the foundation's income at risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

29

The unrelated business income tax (UBIT)is calculated by multiplying unrelated business taxable income by the highest corporate tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

30

For an activity to be considered as regularly carried on for purposes of the unrelated business income tax,the activity must be conducted during the work week (i.e.,activities performed on the weekend are not considered in determining if the activity is regularly carried on).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

31

An exempt organization is located in the state of Nevada.Gambling in Nevada is legal.Therefore,bingo games are conducted by both taxable and tax-exempt organizations.If the net earnings from the bingo games are less than $25,000,the exempt organization is not subject to the unrelated business income tax (UBIT).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

32

A corporate sponsorship payment that is contingent on attendance at a sporting event increases the amount of unrelated business income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

33

The income from a bingo game conducted by an exempt organization may be unrelated business income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

34

An activity is not an unrelated trade or business for purposes of the unrelated business income tax (UBIT)unless it is profitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

35

Even though substantially all the work of an unrelated trade or business is performed by volunteers,it can be subject to the unrelated business income tax (UBIT).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

36

In calculating unrelated business taxable income,the exempt organization is permitted to deduct only the charitable contributions associated with the unrelated trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

37

The key factor in determining whether an exempt entity's income from a bingo game is unrelated trade or business income is whether substantially all the work is performed by volunteers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

38

For purposes of the unrelated business income tax (UBIT),a trade or business consists of any activity conducted for the production of income through the sale of merchandise or the performance of services for which profits have been earned during at least two of the five previous years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

39

The excise tax imposed on private foundations for excess business holdings is imposed on investments that enable the private foundation to control publicly-held rather than privately-held businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

40

Revenue generated by an exempt organization from the distribution of low-cost items is not income from an unrelated trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

41

An exempt organization which is subject to any of the excise taxes imposed on private foundations must file Form 4720 (Return of Certain Excise Taxes on Charities and Other Persons).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following attributes are associated with exempt organizations?

A)Organization serves some type of common good.

B)Organization is not a for profit entity.

C)Net earnings do not benefit the members of the organization.

D)Organization does not exert political influence.

E)All of the statements are true.

A)Organization serves some type of common good.

B)Organization is not a for profit entity.

C)Net earnings do not benefit the members of the organization.

D)Organization does not exert political influence.

E)All of the statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following are exempt organizations?

A)National Collegiate Athletic Association (NCAA).

B)American Bankers Association (ABA).

C)Professional Golfers Association (PGA).

D)Only a.and c.

E)a.,b.,and c.

A)National Collegiate Athletic Association (NCAA).

B)American Bankers Association (ABA).

C)Professional Golfers Association (PGA).

D)Only a.and c.

E)a.,b.,and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

44

Hotel,Inc.,is a feeder organization for Museum,Inc.,an exempt organization.Hotel,Inc.,provides approximately 25% of the support needed by Museum,Inc.,to carry out its tax-exempt mission.Which of the following statements is correct?

A)Only Museum, Inc., is subject to Federal income taxation.

B)Both Museum, Inc., and Hotel, Inc., are subject to Federal income taxation.

C)Hotel, Inc., is subject to Federal income taxation on all of its income and Museum, Inc., is subject to Federal income taxation on 25% of its income.

D)Only Hotel, Inc., is subject to Federal income taxation.

E)None of the statements is correct.

A)Only Museum, Inc., is subject to Federal income taxation.

B)Both Museum, Inc., and Hotel, Inc., are subject to Federal income taxation.

C)Hotel, Inc., is subject to Federal income taxation on all of its income and Museum, Inc., is subject to Federal income taxation on 25% of its income.

D)Only Hotel, Inc., is subject to Federal income taxation.

E)None of the statements is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

45

Garden,Inc.,a qualifying § 501(c)(3)organization,incurs lobbying expenditures of $210,000 during the taxable year.Exempt purpose expenditures are $900,000.If Garden makes the election under § 501(h)to make lobbying expenditures on a limited basis,its tax liability resulting from the lobbying expenditures is:

A)$0.

B)$12,500.

C)$50,000.

D)$60,000.

E)None of the above.

A)$0.

B)$12,500.

C)$50,000.

D)$60,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

46

Debt-financed property consists of all real property of a tax-exempt organization on which there is a mortgage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

47

Unless the "widely available" provision is satisfied,a § 501(c)(3)exempt organization (excluding churches and private foundations)must make copies of the following available to the general public: Form 990 (Return of Organization Exempt from Income Tax)and Form 1023 [Application for Recognition of Exemption under § 501(c)(3)] or Form 1024 [Application for Recognition of Exemption under § 501(a)].

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

48

Exempt organizations which are required to file an annual information return,except for Private Foundations,use Form 990 (Return of Organization Exempt from Income Tax).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

49

If the unrelated business income of an exempt organization is $25,000 or less,the unrelated business income tax (UBIT)will be $0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

50

All exempt organizations must obtain IRS approval to obtain exempt status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following § 501(c)(3)exempt organizations is appropriately classified as a private foundation?

A)Cincinnati Memorial Hospital.

B)University of Arizona.

C)Bill and Melinda Gates Foundation.

D)United Fund.

E)All of the above.

A)Cincinnati Memorial Hospital.

B)University of Arizona.

C)Bill and Melinda Gates Foundation.

D)United Fund.

E)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is not an example of an exempt organization?

A)Religious, charitable, or educational organization.

B)Voluntary employees' beneficiary association.

C)Labor, agricultural, or horticultural organization.

D)Stock exchange.

E)All of the above can be exempt from tax.

A)Religious, charitable, or educational organization.

B)Voluntary employees' beneficiary association.

C)Labor, agricultural, or horticultural organization.

D)Stock exchange.

E)All of the above can be exempt from tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

53

If personal property is leased with real property and more than 50% of the rent income under the lease is from personal property,all of the rent income is subject to the unrelated business income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

54

Personal property rental income is subject to and real property rental income is not subject to the unrelated business income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following statements is correct?

A)Exempt organizations cannot engage in significant levels of lobbying activities.

B)Certain exempt organizations can elect to engage in lobbying activities on a limited basis.

C)Churches can engage in lobbying activities on an unlimited basis because of the separation of church and state provision.

D)Only a.and b.are correct.

E)Only a.and c.are correct.

A)Exempt organizations cannot engage in significant levels of lobbying activities.

B)Certain exempt organizations can elect to engage in lobbying activities on a limited basis.

C)Churches can engage in lobbying activities on an unlimited basis because of the separation of church and state provision.

D)Only a.and b.are correct.

E)Only a.and c.are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following qualify as exempt organizations?

A)Federal and related agencies.

B)Religious, charitable, and educational organizations.

C)Civic leagues.

D)Social clubs.

E)All of the above can be exempt from tax.

A)Federal and related agencies.

B)Religious, charitable, and educational organizations.

C)Civic leagues.

D)Social clubs.

E)All of the above can be exempt from tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

57

The due date for both Form 990 (Return of Organization Exempt from Income Tax)and Form 990-PF (Return of Private Foundation)is the fifteenth day of the fifth month after the end of the taxable year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following are available options for the IRS in dealing with an exempt organization entering into prohibited transactions?

A)Attempt to subject all or part of the organization's income to Federal income tax.

B)Revoke the exempt status of the organization.

C)Impose intermediate sanctions in the form of excise taxes.

D)Only a.and b.

E)a.,b.,and c.

A)Attempt to subject all or part of the organization's income to Federal income tax.

B)Revoke the exempt status of the organization.

C)Impose intermediate sanctions in the form of excise taxes.

D)Only a.and b.

E)a.,b.,and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

59

Unrelated debt-financed income,net of the unrelated debt-financed deductions,is subject to the unrelated business income tax only if the exempt organization is a private foundation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following statements regarding intermediate sanctions is correct?

A)Intermediate sanctions are self-assessing (i.e., calculated and paid by the taxpayer rather than being imposed by the IRS).

B)The tax is imposed on the exempt organization.

C)Both a first-level tax and a second-level tax may apply.

D)The corporate tax rates apply in calculating the amount of the tax liability.

E)None of the above is correct.

A)Intermediate sanctions are self-assessing (i.e., calculated and paid by the taxpayer rather than being imposed by the IRS).

B)The tax is imposed on the exempt organization.

C)Both a first-level tax and a second-level tax may apply.

D)The corporate tax rates apply in calculating the amount of the tax liability.

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following are consequences of tax-exempt status?

A)Not necessary to file a Federal income tax return.

B)Generally exempt from Federal income tax.

C)Contributions to the exempt organization always are deductible by the donor.

D)Only a.and b.

E)a.,b.,and c.

A)Not necessary to file a Federal income tax return.

B)Generally exempt from Federal income tax.

C)Contributions to the exempt organization always are deductible by the donor.

D)Only a.and b.

E)a.,b.,and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements is correct?

A)The unrelated business income tax (UBIT)does not apply to exempt organizations that receive broad public support.

B)The unrelated business income tax (UBIT)treats the tax-exempt entity as if it were subject to the corporate income tax on its unrelated business income.

C)Unrelated business income is income derived from activities not related to the exempt purpose of the exempt organization.

D)Only b.and c.are correct.

E)a.,b.,and c.are correct

A)The unrelated business income tax (UBIT)does not apply to exempt organizations that receive broad public support.

B)The unrelated business income tax (UBIT)treats the tax-exempt entity as if it were subject to the corporate income tax on its unrelated business income.

C)Unrelated business income is income derived from activities not related to the exempt purpose of the exempt organization.

D)Only b.and c.are correct.

E)a.,b.,and c.are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

63

Third Church operates a gift shop in its parish house.The total income of the church is $800,000.Of this amount,$300,000 comes from offerings and $500,000 comes from the net income of the gift shop.The gift shop operations are conducted by five full-time employees.Which of the following statements is correct?

A)The $800,000 is unrelated business income.

B)The $500,000 of gift shop net income is unrelated business income.

C)The $300,000 is unrelated business income because the gift shop is a feeder organization.

D)None of the $800,000 is unrelated business income.

E)The unrelated business income tax does not apply to churches.

A)The $800,000 is unrelated business income.

B)The $500,000 of gift shop net income is unrelated business income.

C)The $300,000 is unrelated business income because the gift shop is a feeder organization.

D)None of the $800,000 is unrelated business income.

E)The unrelated business income tax does not apply to churches.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements is correct?

A)A private foundation is,in general,exempt from Federal income tax.

B)A private foundation may be subject to certain types of Federal income tax.

C)If a broad public support test is satisfied,an exempt organization that otherwise would be classified as a private foundation is not classified as a private foundation.

D)Only b.and c.are correct.

E)a.,b.,and c.are correct.

A)A private foundation is,in general,exempt from Federal income tax.

B)A private foundation may be subject to certain types of Federal income tax.

C)If a broad public support test is satisfied,an exempt organization that otherwise would be classified as a private foundation is not classified as a private foundation.

D)Only b.and c.are correct.

E)a.,b.,and c.are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

65

A § 501(c)(3)organization that otherwise would be classified as a private foundation can avoid such classification if it satisfies:

A)Only an external support test.

B)Only an internal support test.

C)Both an external support test and an internal support test.

D)An external support test, an internal support test, and good faith test.

E)None of the above.

A)Only an external support test.

B)Only an internal support test.

C)Both an external support test and an internal support test.

D)An external support test, an internal support test, and good faith test.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following excise taxes are imposed on the private foundation because it engages in prohibited transactions?

A)Tax on investment income.

B)Tax on self-dealing.

C)Tax on failure to distribute income.

D)Only b.and c.

E)a.,b.,and c.

A)Tax on investment income.

B)Tax on self-dealing.

C)Tax on failure to distribute income.

D)Only b.and c.

E)a.,b.,and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following exempt organizations are required to file Form 990 (Return of Organization Exempt from Income Tax)?

A)Federal agencies.

B)Churches.

C)Exempt organizations whose annual gross receipts do not exceed $25,000.

D)Private foundations.

E)None of these entities must file Form 990.

A)Federal agencies.

B)Churches.

C)Exempt organizations whose annual gross receipts do not exceed $25,000.

D)Private foundations.

E)None of these entities must file Form 990.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following statements regarding the unrelated business income tax is correct?

A)Private foundations are not subject to the unrelated business income tax.

B)Bingo games are not subject to the unrelated business income tax if they are conducted by an exempt organization.

C)The exchange or rental of membership lists with other exempt and nonexempt organizations is not an unrelated trade or business.

D)Only a.and c.are correct.

E)None of the statements is correct.

A)Private foundations are not subject to the unrelated business income tax.

B)Bingo games are not subject to the unrelated business income tax if they are conducted by an exempt organization.

C)The exchange or rental of membership lists with other exempt and nonexempt organizations is not an unrelated trade or business.

D)Only a.and c.are correct.

E)None of the statements is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

69

For purposes of the unrelated business income tax (UBIT),land that is acquired by the exempt organization for later exempt-use is excluded from the definition of debt-financed property if certain requirements are satisfied.Which of the following is not included in the requirements?

A)The principal purpose of acquiring the land is for use (substantially all) in achieving the organization's exempt purpose.

B)The fair market value of the land is not over 50% of the fair market value of land presently owned by the exempt organization.

C)The use of the land by the exempt organization will begin within ten years of the acquisition date.

D)At the date the land is acquired, it is located in the neighborhood of other property of the organization for which substantially all the use is for achieving the organization's exempt purpose.

E)All of the above are requirements.

A)The principal purpose of acquiring the land is for use (substantially all) in achieving the organization's exempt purpose.

B)The fair market value of the land is not over 50% of the fair market value of land presently owned by the exempt organization.

C)The use of the land by the exempt organization will begin within ten years of the acquisition date.

D)At the date the land is acquired, it is located in the neighborhood of other property of the organization for which substantially all the use is for achieving the organization's exempt purpose.

E)All of the above are requirements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following statements are correct with respect to the unrelated business income tax?

A)Under certain circumstances,a corporate sponsorship payment can be classified as not being an unrelated trade or business.

B)Under certain circumstances,a casino game can be classified as not being an unrelated trade or business.

C)Under certain circumstances,the distribution of low-cost articles can be classified as not being an unrelated trade or business.

D)Only a.and c.are correct.

E)a.,b.,and c.all are correct.

A)Under certain circumstances,a corporate sponsorship payment can be classified as not being an unrelated trade or business.

B)Under certain circumstances,a casino game can be classified as not being an unrelated trade or business.

C)Under certain circumstances,the distribution of low-cost articles can be classified as not being an unrelated trade or business.

D)Only a.and c.are correct.

E)a.,b.,and c.all are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following taxes may be imposed on a private foundation?

A)Tax on self-dealing.

B)Tax on failure to distribute income.

C)Tax on excess business holdings.

D)Tax on taxable expenditures.

E)A private foundation can be subject to all of these taxes.

A)Tax on self-dealing.

B)Tax on failure to distribute income.

C)Tax on excess business holdings.

D)Tax on taxable expenditures.

E)A private foundation can be subject to all of these taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

72

Maroon,Inc.,a tax-exempt organization,leases a building and machinery to Brown Partnership.The rental income from the building is $100,000,with related expenses of $40,000.The rental income from the machinery is $9,000,with related expenses of $4,000.What adjustment must be made to net unrelated business income?

A)$0.

B)($60,000).

C)($65,000).

D)($109,000).

E)Some other amount.

A)$0.

B)($60,000).

C)($65,000).

D)($109,000).

E)Some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

73

For the unrelated business income tax to be imposed on an exempt organization,which of the following is not a factor that must be present?

A)The trade or business is not substantially related to the exempt purpose of the organization.

B)The organization is a private foundation.

C)The trade or business is regularly carried on by the organization.

D)The organization conducts a trade or business.

E)All of the factors must be present for the tax to be imposed.

A)The trade or business is not substantially related to the exempt purpose of the organization.

B)The organization is a private foundation.

C)The trade or business is regularly carried on by the organization.

D)The organization conducts a trade or business.

E)All of the factors must be present for the tax to be imposed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following statements are correct?

A)If an exempt organization has annual gross receipts of less than $25,000,it need not file Form 990 (Return of Organization Exempt from Federal Income Tax).

B)Private foundations must file Form 990-PF (Return of Private Foundation).

C)If the gross income from an unrelated trade or business is less than $1,000,it is not necessary to file a return associated with the unrelated business income tax.

D)Only a.and c.are correct.

E)a.,b.,and c.are all correct.

A)If an exempt organization has annual gross receipts of less than $25,000,it need not file Form 990 (Return of Organization Exempt from Federal Income Tax).

B)Private foundations must file Form 990-PF (Return of Private Foundation).

C)If the gross income from an unrelated trade or business is less than $1,000,it is not necessary to file a return associated with the unrelated business income tax.

D)Only a.and c.are correct.

E)a.,b.,and c.are all correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

75

Teal,Inc.,is a private foundation which failed to distribute an adequate amount of income for the exempt purpose of Teal.Which of the following statements is correct?

A)An excise tax in the form of an initial tax at the rate of 5% may be imposed on Teal.

B)An excise tax in the form of an initial tax at the rate of 2.5% may be imposed on the foundation manager.

C)An excise tax in the form of an additional tax at the rate of 100% may be imposed on Teal.

D)An excise tax in the form of an additional tax at the rate of 50% may be imposed on the foundation manager.

E)None of the statements is correct.

A)An excise tax in the form of an initial tax at the rate of 5% may be imposed on Teal.

B)An excise tax in the form of an initial tax at the rate of 2.5% may be imposed on the foundation manager.

C)An excise tax in the form of an additional tax at the rate of 100% may be imposed on Teal.

D)An excise tax in the form of an additional tax at the rate of 50% may be imposed on the foundation manager.

E)None of the statements is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

76

Tan,Inc.,a tax-exempt organization,has $65,000 of net unrelated business income.Total charitable contributions (all associated with the unrelated trade or business)are $7,500.Assuming that the $7,500 was deducted in calculating net unrelated business income,what is Tan's unrelated business taxable income?

A)$57,500.

B)$65,250.

C)$66,000.

D)$72,500.

E)Some other amount.

A)$57,500.

B)$65,250.

C)$66,000.

D)$72,500.

E)Some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following statements related to unrelated debt-financed income are not correct?

A)Debt-financed income is the gross income generated from debt-financed property by an exempt organization.

B)Debt-financed property does not include property of the exempt organization on which there is acquisition indebtedness, if substantially all the use of the property is for the achievement of the exempt purpose of the exempt organization.

C)Property of an exempt organization will not be treated as debt-financed property unless there is acquisition indebtedness on the property.

D)All of the statements are correct.

E)None of the statements are correct.

A)Debt-financed income is the gross income generated from debt-financed property by an exempt organization.

B)Debt-financed property does not include property of the exempt organization on which there is acquisition indebtedness, if substantially all the use of the property is for the achievement of the exempt purpose of the exempt organization.

C)Property of an exempt organization will not be treated as debt-financed property unless there is acquisition indebtedness on the property.

D)All of the statements are correct.

E)None of the statements are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

78

Acquisition indebtedness consists of the unpaid amounts of which of the following for debt-financed property?

A)Debt incurred in acquiring or improving the property.

B)Debt incurred to enable the organization to carry out its exempt purpose.

C)Debt incurred to enable the exempt organization to acquire a feeder organization.

D)Only a.and b.

E)a.,b.,and c.

A)Debt incurred in acquiring or improving the property.

B)Debt incurred to enable the organization to carry out its exempt purpose.

C)Debt incurred to enable the exempt organization to acquire a feeder organization.

D)Only a.and b.

E)a.,b.,and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

79

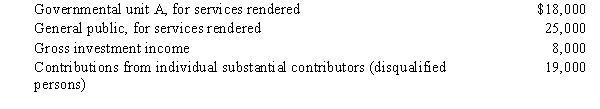

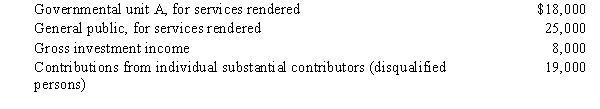

Blue,Inc.,receives its support from the following sources.

Which of the following statements is correct?

A)Blue, Inc., is a private foundation because it satisfies the external support test and fails the internal support test.

B)Blue, Inc., is not a private foundation because it fails both the internal and external support tests.

C)Blue, Inc., is a private foundation because it satisfies both the external support test and the internal support test.

D)Blue, Inc., is not a private foundation because it satisfies both the external support test and the internal support test.

E)None of the statements is true.

Which of the following statements is correct?

A)Blue, Inc., is a private foundation because it satisfies the external support test and fails the internal support test.

B)Blue, Inc., is not a private foundation because it fails both the internal and external support tests.

C)Blue, Inc., is a private foundation because it satisfies both the external support test and the internal support test.

D)Blue, Inc., is not a private foundation because it satisfies both the external support test and the internal support test.

E)None of the statements is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is not an excise tax that may be imposed on a private foundation?

A)Tax on jeopardizing investments.

B)Tax on self-dealing.

C)Tax on excessive foundation manager compensation.

D)Tax on excess business holdings.

E)All of these taxes may be imposed on a private foundation.

A)Tax on jeopardizing investments.

B)Tax on self-dealing.

C)Tax on excessive foundation manager compensation.

D)Tax on excess business holdings.

E)All of these taxes may be imposed on a private foundation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 159 في هذه المجموعة.

فتح الحزمة

k this deck