Deck 1: Fundamentals of Financial Accounting Theory

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/33

العب

ملء الشاشة (f)

Deck 1: Fundamentals of Financial Accounting Theory

1

Explain the difference between moral hazard and adverse selection.

•Moral hazard involves information about one party's actions that is not available to the other party. For this reason, moral hazard is succinctly summed up as hidden actions. As actions are involved, moral hazard involves information about what happens in the future.

•Adverse selection concerns no actions other than whether the parties choose to reveal information that they possess. Consequently, adverse selection involves hidden information from the past and present (although such information could have ramifications for the future).

•Adverse selection concerns no actions other than whether the parties choose to reveal information that they possess. Consequently, adverse selection involves hidden information from the past and present (although such information could have ramifications for the future).

2

Explain the meaning of adverse selection and moral hazard. Give an example of each.

Adverse selection: A type of information asymmetry whereby one party to a contract has an information advantage over another party. Examples: buying a resale home; buying a used car; buying shares in a company, etc.

Moral hazard: A type of information asymmetry whereby one party to a contract cannot observe some actions relating to the fulfilment of the contractual terms by the other party. Examples: renting an apartment to a tenant; car insurance; hiring an executive - separation of ownership and management or the principal-agent problem; lending money to a company, etc.

Moral hazard: A type of information asymmetry whereby one party to a contract cannot observe some actions relating to the fulfilment of the contractual terms by the other party. Examples: renting an apartment to a tenant; car insurance; hiring an executive - separation of ownership and management or the principal-agent problem; lending money to a company, etc.

3

Which statement best explains "information asymmetry"?

A)Information asymmetry means that there is uncertainty about the future.

B)Information asymmetry means that some people have more information than others.

C)Information asymmetry means that external parties need financial information.

D)Information asymmetry means information is material to a decision maker.

A)Information asymmetry means that there is uncertainty about the future.

B)Information asymmetry means that some people have more information than others.

C)Information asymmetry means that external parties need financial information.

D)Information asymmetry means information is material to a decision maker.

B

4

Explain what accounting is and why financial reporting exists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

5

Explain the meaning of financial accounting, managerial accounting and tax accounting. How are these accounting activities related to each other?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which statement is correct?

A)Financial reporting is the process of preparing information for internal parties.

B)Financial reporting involves issuing financial statements to external parties.

C)Financial reporting provides the same information as management accounting.

D)Financial reporting is based on rules issued by the CICA or IASB.

A)Financial reporting is the process of preparing information for internal parties.

B)Financial reporting involves issuing financial statements to external parties.

C)Financial reporting provides the same information as management accounting.

D)Financial reporting is based on rules issued by the CICA or IASB.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which statement best explains "moral hazard"?

A)The term refers to a situation where one party has an information advantage over another.

B)The term refers to the need external parties have for financial information.

C)The term refers to the fact that some people have more information than others.

D)The term refers to a situation where one party cannot observe the actions of another party.

A)The term refers to a situation where one party has an information advantage over another.

B)The term refers to the need external parties have for financial information.

C)The term refers to the fact that some people have more information than others.

D)The term refers to a situation where one party cannot observe the actions of another party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

8

How does an accountant decide on the appropriate method of accounting for a business transaction?

A)Evaluating if the particular method is consistent with the conceptual framework.

B)Ensuring that the accounting method agrees with that selected by other companies.

C)Evaluating whether the selected method differs from the underlying economics.

D)Testing the selected method for numerical accuracy and consistency.

A)Evaluating if the particular method is consistent with the conceptual framework.

B)Ensuring that the accounting method agrees with that selected by other companies.

C)Evaluating whether the selected method differs from the underlying economics.

D)Testing the selected method for numerical accuracy and consistency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

9

Why is financial information required?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which statement is not correct?

A)Financial accounting is the process of providing information to external parties.

B)Accounting is about the communication of financial information.

C)Accounting is the production of information about an enterprise and the transmission of that information to those who need the information.

D)Financial accounting is the process of providing information to internal parties.

A)Financial accounting is the process of providing information to external parties.

B)Accounting is about the communication of financial information.

C)Accounting is the production of information about an enterprise and the transmission of that information to those who need the information.

D)Financial accounting is the process of providing information to internal parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

11

Explain the process an accountant uses to determine the appropriate accounting method for a business transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following statements is correct about financial information?

A)All users require the same kind of information.

B)Forward looking information is useful for evaluating management stewardship.

C)Trade offs are necessary in accounting.

D)Historical cost information is useful for pricing the value of a company's shares.

A)All users require the same kind of information.

B)Forward looking information is useful for evaluating management stewardship.

C)Trade offs are necessary in accounting.

D)Historical cost information is useful for pricing the value of a company's shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

13

Discuss two ways in which a shareholder can mitigate the problem of moral hazard when investing in a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

14

Having an audit performed on the company's financial statements best illustrates which of the following?

A)Cheap talk.

B)Signalling.

C)Moral hazard.

D)Information.

A)Cheap talk.

B)Signalling.

C)Moral hazard.

D)Information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

15

Explain the meaning of information and information asymmetry. Give an example of each

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

16

Discuss two ways in which a bank can mitigate the problem of moral hazard when lending money to a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which statement best explains "adverse selection"?

A)The term refers to a situation where one party has an information advantage over another.

B)The term refers to the need external parties have for financial information.

C)The term refers to the fact that some people have more information than others.

D)The term refers to a situation where one party cannot observe the actions of another party.

A)The term refers to a situation where one party has an information advantage over another.

B)The term refers to the need external parties have for financial information.

C)The term refers to the fact that some people have more information than others.

D)The term refers to a situation where one party cannot observe the actions of another party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

18

Explain the meaning of generally accepted accounting principles (GAAP).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

19

Discuss three reasons why it is important to understand accounting theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which is not a question that financial accounting theory can answer?

A)Why do companies provide financial information to external parties?

B)Why do all companies use the same accounting policies?

C)Why is certain disclosure mandatory in financial reporting?

D)What is the role of financial accounting and reporting?

A)Why do companies provide financial information to external parties?

B)Why do all companies use the same accounting policies?

C)Why is certain disclosure mandatory in financial reporting?

D)What is the role of financial accounting and reporting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which statement best explains the relationship between the efficient securities market hypothesis and accounting?

A)Security prices adjust slowly when accounting reports are publicly released.

B)The timeliness of accounting information is irrelevant to securities markets.

C)Accounting information competes with other sources of information.

D)Security prices are unaffected when accounting reports are publicly released.

A)Security prices adjust slowly when accounting reports are publicly released.

B)The timeliness of accounting information is irrelevant to securities markets.

C)Accounting information competes with other sources of information.

D)Security prices are unaffected when accounting reports are publicly released.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

22

Explain how adverse selection and moral hazard affect the qualitative characteristics of accounting information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

23

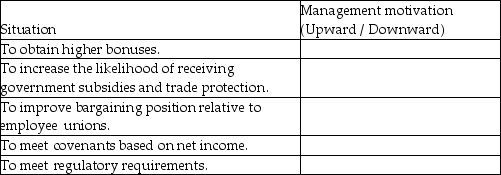

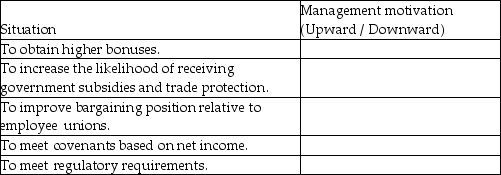

For the situations described below, explain whether managers would be motivated to manage earnings, assets, and equity upward and liabilities downward, or alternatively, managers may be motivated to manage earnings, assets, and equity downward and liabilities upward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

24

Explain how earnings management may arise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

25

Explain the meaning of publicly accountable enterprises, efficient securities market (semi-strong form), and efficient securities market (strong form).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

26

Explain the accounting implications of the following concepts about efficient securities markets:

a)Accounting information competes with other sources of information.

b)Accounting reports and standards can assume that users have a reasonable level of sophistication.

a)Accounting information competes with other sources of information.

b)Accounting reports and standards can assume that users have a reasonable level of sophistication.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

27

How does accounting information help alleviate adverse selection and moral hazard?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

28

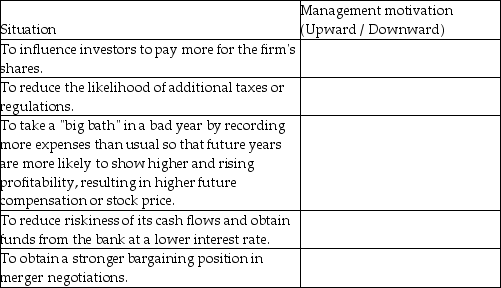

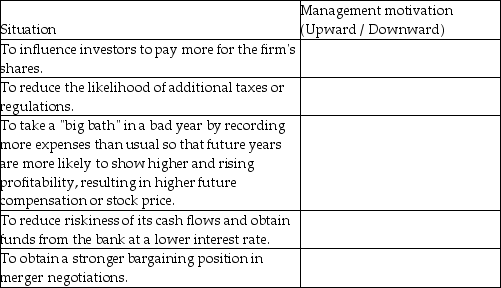

For the situations described below, explain whether managers would be motivated to manage earnings, assets, and equity upward and liabilities downward, or alternatively, managers may be motivated to manage earnings, assets, and equity downward and liabilities upward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which statement best explains the semi-strong form of the efficient securities market hypothesis?

A)A market in which the prices of securities traded in that market at all times properly reflect all information that is publicly known about those securities.

B)A market in which the prices of securities traded in that market reflect all information, whether publicly or privately known.

C)A market in which the prices of debt securities traded in that market reflect all information that is privately known about those securities.

D)A market in which the prices of equity securities traded in that market reflect all information that is privately known about those securities.

A)A market in which the prices of securities traded in that market at all times properly reflect all information that is publicly known about those securities.

B)A market in which the prices of securities traded in that market reflect all information, whether publicly or privately known.

C)A market in which the prices of debt securities traded in that market reflect all information that is privately known about those securities.

D)A market in which the prices of equity securities traded in that market reflect all information that is privately known about those securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

30

Management motivation to increase the likelihood that the company will receive a $50,000 government rebate best illustrates which of the following?

A)Earnings management.

B)Positive accounting theory.

C)Information asymmetry.

D)Efficient securities market.

A)Earnings management.

B)Positive accounting theory.

C)Information asymmetry.

D)Efficient securities market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

31

Why is the efficient securities market hypothesis important for accounting?

A)When providing financial information, management need only consider the specifically identifiable users who they know will rely on the information.

B)Accounting standards can assume that the majority of market participants have a reasonable level of sophistication.

C)Individuals with information that is not publicly available cannot make significant profits.

D)Accounting information is the only source of financial information that markets use.

A)When providing financial information, management need only consider the specifically identifiable users who they know will rely on the information.

B)Accounting standards can assume that the majority of market participants have a reasonable level of sophistication.

C)Individuals with information that is not publicly available cannot make significant profits.

D)Accounting information is the only source of financial information that markets use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which statement appropriately explains the meaning of "publicly accountable enterprise"?

A)Firms without equity, debt or other securities traded in public markets.

B)Firms with equity, debt or other securities traded in public markets.

C)Firms with assets and liabilities that provide goods and services in public markets.

D)New firms entering the public markets to provide goods and services.

A)Firms without equity, debt or other securities traded in public markets.

B)Firms with equity, debt or other securities traded in public markets.

C)Firms with assets and liabilities that provide goods and services in public markets.

D)New firms entering the public markets to provide goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck

33

Explain how accounting information helps security markets?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 33 في هذه المجموعة.

فتح الحزمة

k this deck